Tetrabromobisphenol A Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435154 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Tetrabromobisphenol A Market Size

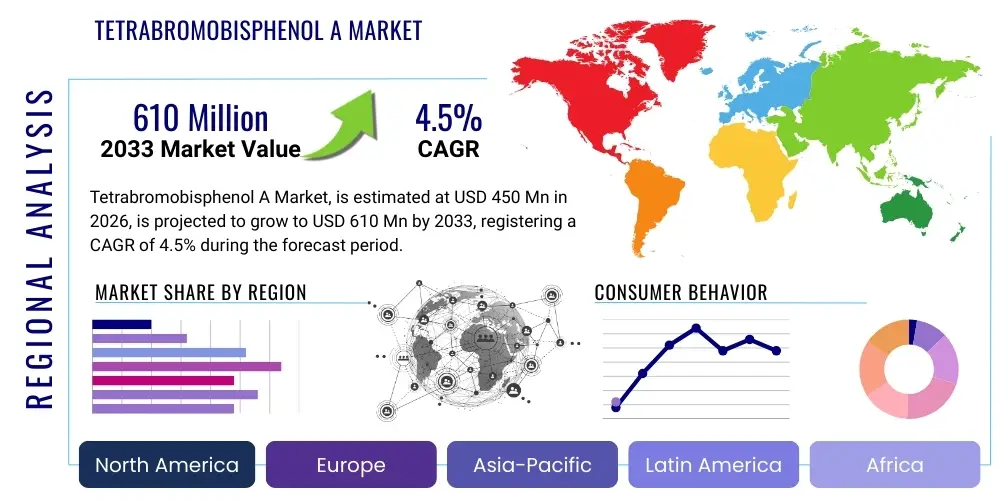

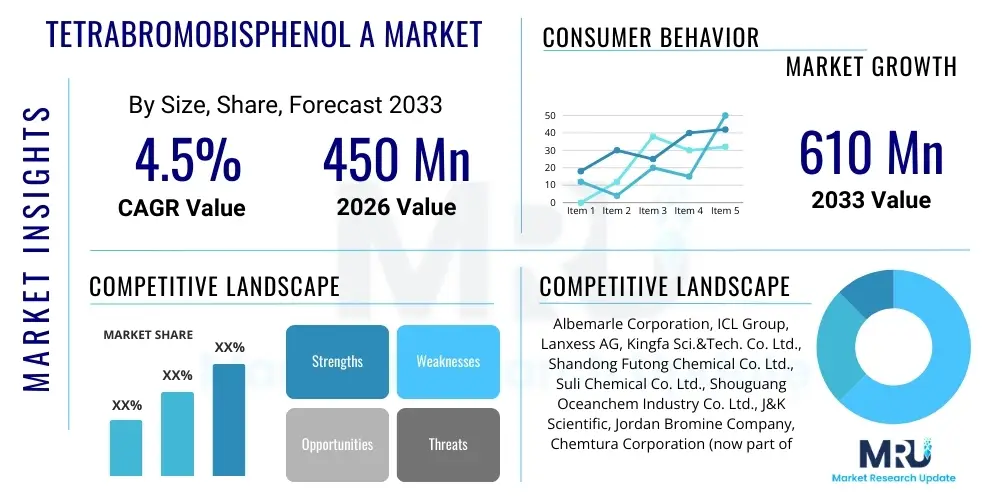

The Tetrabromobisphenol A Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 610 Million by the end of the forecast period in 2033.

Tetrabromobisphenol A Market introduction

Tetrabromobisphenol A (TBBPA) is a crucial chemical compound primarily used as a flame retardant in electronic equipment, electrical insulation materials, and construction products. It is the most highly consumed brominated flame retardant globally, integral to enhancing safety and meeting strict fire safety standards across various industries. TBBPA functions by interrupting the chemical process of combustion, thereby preventing or significantly slowing the spread of fire. Its effectiveness and cost-efficiency have cemented its position as a standard additive in polymers and resins, particularly in the production of epoxy resins for printed circuit boards (PCBs).

The primary applications of TBBPA are concentrated within the electronics sector, where it is incorporated into epoxy resins to manufacture flame-retardant laminates used in PCBs. Furthermore, TBBPA finds significant use in polycarbonates, acrylonitrile butadiene styrene (ABS) resins, and high-impact polystyrene (HIPS) utilized for electronics housings and automotive components. The chemical’s versatility allows it to be used either reactively, chemically bonded into the polymer matrix, or additively, blended into the material. The reactive application is particularly favored in the electronics industry as it minimizes leaching and improves the material's overall stability and lifespan.

Market growth is predominantly driven by the relentless expansion of the global consumer electronics industry, coupled with stringent fire safety regulations mandated by governmental bodies worldwide. As devices become smaller, more complex, and carry higher power loads, the demand for effective, reliable, and compliant flame retardants like TBBPA in mission-critical components escalates. However, the market navigates a complex regulatory environment, given growing concerns regarding the environmental persistence and potential toxicity associated with certain brominated compounds. Continuous innovation focusing on encapsulating or reacting TBBPA into polymers remains a key strategy to mitigate these environmental challenges while maintaining fire safety performance.

Tetrabromobisphenol A Market Executive Summary

The Tetrabromobisphenol A market is characterized by robust demand originating primarily from the Asia Pacific electronics manufacturing hub, balancing consistent growth against increasing regulatory scrutiny in Western economies. Business trends indicate a strategic shift among major manufacturers towards producing high-purity, reactive grades of TBBPA, which are preferred for advanced printed circuit board (PCB) applications, offering superior fire resistance and compliance with stricter environmental directives. Consolidation within the supply chain, particularly among raw material suppliers and large-scale producers, aims to stabilize pricing and secure long-term contracts with major electronics original equipment manufacturers (OEMs). Furthermore, there is a visible trend of backward integration to control the sourcing of bromine and Bisphenol A, critical precursors for TBBPA synthesis.

Regionally, Asia Pacific (APAC) dominates the market, largely attributed to the massive scale of electronics production in China, South Korea, Taiwan, and Southeast Asian nations. This region acts as both the largest consumer and producer of TBBPA derivatives. Europe and North America, while having slower consumption growth due to mature markets and more rigorous environmental regulations, maintain high demand for specialized, high-performance, and compliant TBBPA grades used in complex infrastructure and premium electronic applications. The enforcement of regulations like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) significantly influences product development, pushing the industry towards reactive forms of TBBPA.

Segment trends highlight the reactive TBBPA segment’s accelerated growth compared to the additive segment. Reactive TBBPA, chemically bonded into epoxy resins, is essential for high-end PCB laminates requiring superior thermal stability and durability, minimizing migration potential. Application-wise, the consumption in epoxy resins for PCBs remains the undisputed largest segment, underpinned by the global proliferation of 5G infrastructure, electric vehicles (EVs), and advanced data centers, all requiring high-performance, multilayered circuit boards. The construction sector also represents a stable segment, utilizing TBBPA in fire-retardant plastics and insulation foams, although its growth rate is moderate compared to the fast-paced electronics segment.

AI Impact Analysis on Tetrabromobisphenol A Market

User queries regarding AI's influence on the TBBPA market predominantly center on optimizing complex manufacturing processes, accelerating the discovery of sustainable TBBPA alternatives, and improving supply chain resilience against geopolitical and environmental disruptions. Users are keenly interested in how machine learning can predict fluctuations in raw material costs, particularly bromine, and how AI-driven simulation tools can rapidly test new polymer formulations containing TBBPA, reducing time-to-market for compliant, high-performance materials. Another key area of inquiry is the application of predictive maintenance models to TBBPA production facilities to ensure consistent quality and prevent costly operational downtime, which is crucial given the high-purity requirements for electronics-grade TBBPA.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is expected to revolutionize several operational facets within the TBBPA industry. In manufacturing, AI can analyze real-time sensor data from reactors to fine-tune reaction parameters, maximizing yield and purity while minimizing energy consumption and waste generation. This precision manufacturing capability is vital for maintaining the competitive edge of TBBPA producers, especially when dealing with increasingly complex synthesis routes required for specialized grades. Furthermore, predictive modeling powered by AI is already being deployed to forecast global demand fluctuations based on semiconductor industry forecasts and consumer electronics sales cycles, allowing producers to optimize inventory levels and production schedules dynamically.

From a strategic perspective, AI tools are proving invaluable in regulatory compliance and sustainable chemistry initiatives. By sifting through vast databases of toxicology and environmental impact data, AI can help researchers quickly assess the safety profile of TBBPA derivatives and potential substitutes, significantly accelerating R&D efforts focused on 'greener' flame retardant chemistries. This allows companies to proactively address regulatory concerns and investor pressure regarding ESG (Environmental, Social, and Governance) criteria. Ultimately, AI enhances the TBBPA market's ability to operate efficiently, respond swiftly to market shifts, and maintain compliance standards in a highly regulated global environment.

- AI-driven optimization of chemical reaction parameters for maximum TBBPA yield and purity.

- Predictive analytics for forecasting raw material price volatility (Bromine, Bisphenol A).

- Machine learning models for rapid screening and development of TBBPA alternatives.

- Enhanced supply chain visibility and risk assessment using AI algorithms.

- Implementation of AI in quality control for detecting minute impurities in electronics-grade TBBPA.

- Optimization of energy consumption and waste minimization in TBBPA manufacturing facilities.

DRO & Impact Forces Of Tetrabromobisphenol A Market

The Tetrabromobisphenol A market is shaped by a potent combination of increasing demand from critical high-growth sectors (Drivers), persistent environmental and regulatory scrutiny (Restraints), and the emergence of new applications requiring high thermal stability (Opportunities). The primary impact forces are regulatory policy shifts in major consuming regions (Europe, North America) and the continuous technological advancements in the electronics industry, which dictates product specifications. The balance between maintaining robust fire safety standards and meeting stringent environmental and health safety regulations forms the core dynamic of this market. Success hinges on a manufacturer's ability to innovate towards reactive TBBPA grades that mitigate environmental risk while ensuring compliance and performance.

Key drivers include the global expansion of data infrastructure, fueled by cloud computing, IoT, and 5G network deployment, which mandates the use of highly reliable and fire-safe materials for server components and network equipment. The automotive industry’s shift toward electric vehicles (EVs) is also becoming a significant driver, as TBBPA is used in battery casings and electronic control units (ECUs) where fire safety is paramount. Conversely, the market faces restraints from environmental organizations and regulatory bodies pushing for the phase-out of potentially persistent or bioaccumulative flame retardants. This pressure necessitates substantial investment in R&D for environmentally benign TBBPA analogs or alternative halogen-free systems, sometimes leading to market uncertainty and increased operational costs.

Opportunities for market expansion are visible in the development of specialized TBBPA derivatives for high-performance engineering plastics, particularly those used in extreme temperature environments, aerospace, and high-frequency communication applications. Furthermore, advancements in chemical recycling technologies for TBBPA-containing plastics present a long-term opportunity to address end-of-life concerns, enhancing the material's circular economy credentials. The major impact forces are external, dominated by regulatory policy (e.g., California’s fire safety standards, EU’s chemical directives) and the cyclical nature of the global semiconductor and electronics manufacturing industry, which directly correlates with TBBPA consumption volume and pricing stability.

Segmentation Analysis

The Tetrabromobisphenol A market is comprehensively segmented primarily by Type, Application, and End-Use Industry, providing a structured view of consumption patterns and future growth trajectories. Segmentation by Type differentiates between the reactive grade and the additive grade, reflecting their distinct incorporation mechanisms and associated environmental profiles. Reactive grades, which chemically bind TBBPA into the polymer structure, represent the fastest-growing segment due to regulatory preference for non-leaching components in electronics. Application segmentation focuses on the immediate product TBBPA is used in, such as epoxy resins, polycarbonate, and vinyl ester resins, with epoxy resins for printed circuit boards being the dominant consumer globally.

- By Type

- Reactive TBBPA

- Additive TBBPA

- By Application

- Epoxy Resins (e.g., PCB Laminates)

- Polycarbonate

- Vinyl Ester Resins

- Acrylonitrile Butadiene Styrene (ABS)

- High-Impact Polystyrene (HIPS)

- Other Polymers

- By End-Use Industry

- Electronics and Electrical

- Construction

- Automotive

- Adhesives and Sealants

- Textiles and Furniture

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Tetrabromobisphenol A Market

The TBBPA value chain begins with the upstream sourcing of critical raw materials: Bromine and Bisphenol A (BPA). Bromine sourcing is heavily concentrated geographically, primarily extracted from brines or seawater, leading to potential supply chain vulnerabilities and price volatility influenced by geopolitical factors. BPA production, synthesized from acetone and phenol, is generally more distributed but still relies on petrochemical feedstocks. Major TBBPA manufacturers often require high-purity raw materials, necessitating specialized purification processes during the initial stages. Manufacturers who are integrated with bromine production capabilities hold a significant competitive advantage in terms of cost control and supply security.

Midstream involves the chemical synthesis of TBBPA through the bromination of BPA. This process requires precise control to achieve the desired grade (reactive or additive) and purity level, especially for applications in advanced electronics. Distribution channels are highly professionalized, utilizing specialized chemical distributors and agents globally. Direct sales are common for high-volume, long-term contracts with large-scale resin manufacturers (e.g., global epoxy resin producers). Indirect channels, including local distributors, serve smaller manufacturers and specialized end-users, ensuring market penetration across diverse geographical areas, particularly in fragmented markets like construction and specialized polymers.

The downstream sector is dominated by end-use manufacturers, primarily those producing PCB laminates, molded plastics for appliance housings, and automotive components. The demand from the electronics sector is highly technical, requiring specific material performance characteristics, driving innovation back up the chain. Regulatory requirements, particularly in North America and Europe, often act as a secondary downstream force, dictating which grades of TBBPA are permissible. The efficacy and integration ease of TBBPA into the final product dictate its ultimate market acceptance, making technical support and formulation expertise a crucial part of the value proposition offered by TBBPA producers.

Tetrabromobisphenol A Market Potential Customers

The primary customers for Tetrabromobisphenol A are industrial chemical manufacturers specializing in thermoset and thermoplastic resins, who utilize TBBPA as a mandatory ingredient for fire safety compliance. Specifically, the largest segment includes manufacturers of epoxy resins used to create prepregs and laminates for Printed Circuit Boards (PCBs). These customers operate in a high-stakes environment where material failure due to inadequate fire resistance can lead to severe product recalls and safety violations. Consequently, they demand stringent quality control, consistent supply, and documentation supporting environmental compliance and purity levels.

Secondary customer groups include producers of engineering plastics such as polycarbonate, ABS, and HIPS, which are used for housing electronics, automotive interiors, and large appliances. These buyers seek TBBPA in additive form for ease of blending during polymerization or molding processes. The construction and infrastructure sector represents another stable customer base, demanding TBBPA integration into specialized foams, coatings, and sealants requiring fire resistance ratings for compliance with building codes. These customers prioritize bulk availability, competitive pricing, and certified performance data relating to material fire classification (e.g., UL 94 standards).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 610 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, ICL Group, Lanxess AG, Kingfa Sci.&Tech. Co. Ltd., Shandong Futong Chemical Co. Ltd., Suli Chemical Co. Ltd., Shouguang Oceanchem Industry Co. Ltd., J&K Scientific, Jordan Bromine Company, Chemtura Corporation (now part of Lanxess), BASF SE, Dow Chemical Company, Jiangsu Yoke Technology, Hongsheng Chemical, Zhejiang Wansheng. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tetrabromobisphenol A Market Key Technology Landscape

The core technology surrounding TBBPA production involves the highly controlled electrophilic substitution reaction between Bisphenol A and Bromine in the presence of a suitable catalyst. Recent technological advancements, however, are less focused on fundamentally altering the synthesis process and more concentrated on improving purity, optimizing isomer distribution, and enhancing environmental performance. Modern production facilities utilize continuous flow reactors and advanced process control systems to ensure consistent, high-purity material, crucial for demanding applications like high-Tg (glass transition temperature) epoxy resins used in multilayer PCBs. Achieving near-perfect stoichiometry is critical to minimize unreacted starting materials and undesirable byproducts, which could compromise the final product's electrical performance and regulatory compliance.

A significant area of technological focus is the development of encapsulated or modified TBBPA products that reduce leaching and potential bioaccumulation. This includes surface modification techniques and specialized compounding processes aimed at increasing the reactivity of TBBPA, ensuring its complete incorporation into the polymer matrix during curing. Furthermore, the industry is heavily investing in process efficiency through green chemistry principles, minimizing solvent usage, and improving energy efficiency during the synthesis and purification phases. This aligns with global sustainability goals and helps mitigate rising operational costs associated with stricter pollution controls and waste disposal.

Beyond primary production, critical adjacent technologies include the development of advanced analytical methodologies, such as high-performance liquid chromatography (HPLC) and mass spectrometry, to quickly and accurately detect trace contaminants in TBBPA. This technical rigor is necessary to meet the demanding quality specifications set by global electronics standards. Separately, nascent technologies focusing on the chemical recycling of TBBPA-containing waste streams, utilizing techniques like pyrolysis or solvolysis, are gaining traction. While challenging due to the stability of the C-Br bond, successful scaling of these recycling technologies would significantly alter the material’s lifecycle assessment and future market viability.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global TBBPA market, commanding the largest market share in terms of both consumption and production volume. This dominance is intrinsically linked to the region’s status as the world’s primary manufacturing hub for consumer electronics, automotive components, and data center infrastructure. Countries such as China, South Korea, Taiwan, and Japan house the major PCB laminate manufacturers (epoxy resin converters) that consume TBBPA. Regulatory frameworks in this region, while evolving, historically favored cost-effective brominated flame retardants, leading to high production capacity. Future growth in APAC will be fueled by 5G deployment, EV expansion, and smart factory development, creating sustained demand for reactive TBBPA grades.

- North America: The North American market is characterized by high demand for specialized, high-specification TBBPA primarily in the aerospace, advanced server, and high-performance material segments. Strict governmental regulations and robust environmental concerns drive the preference for reactive TBBPA over additive forms, mitigating end-of-life environmental risks. The market is mature but highly focused on quality, consistency, and compliance. Growth is steady, propelled by military electronics, data center expansions, and stringent fire codes for commercial construction, requiring premium TBBPA derivatives.

- Europe: The European TBBPA market is heavily influenced by EU regulations such as REACH and RoHS, which impose strict limitations on the use of chemical substances. Consequently, demand is strongly skewed towards reactive TBBPA, which is deemed less hazardous due to its stable chemical incorporation into the polymer matrix. Europe is a significant consumer for specialized applications in the automotive sector (especially EV components subject to ECE R100 safety standards) and high-end industrial machinery. Innovation often centers around compliance, driving demand for technical expertise and certified products.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets for TBBPA. LATAM growth is tied to local electronics assembly and increasing construction activities, particularly in Brazil and Mexico. MEA’s demand is driven by infrastructure projects, oil and gas industry requirements (requiring specialized fire-retardant coatings), and urbanization leading to greater adoption of formal fire safety standards in building materials. Consumption in these regions remains relatively low but is expected to accelerate with industrialization and the adoption of global safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tetrabromobisphenol A Market.- Albemarle Corporation

- ICL Group

- Lanxess AG

- Kingfa Sci.&Tech. Co. Ltd.

- Shandong Futong Chemical Co. Ltd.

- Suli Chemical Co. Ltd.

- Shouguang Oceanchem Industry Co. Ltd.

- J&K Scientific

- Jordan Bromine Company

- Chemtura Corporation (now part of Lanxess)

- BASF SE

- Dow Chemical Company

- Jiangsu Yoke Technology

- Hongsheng Chemical

- Zhejiang Wansheng

- Taminco (part of Eastman Chemical Company)

- ADEKA Corporation

- Great Lakes Solutions (acquired by Lanxess)

Frequently Asked Questions

Analyze common user questions about the Tetrabromobisphenol A market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand for Tetrabromobisphenol A (TBBPA)?

The main driver is the sustained, high-volume growth in the global electronics and electrical industry, particularly the mandatory requirement for TBBPA (specifically reactive grades) in epoxy resins used for flame-retardant Printed Circuit Boards (PCBs) across consumer electronics, data centers, and 5G infrastructure.

What is the difference between Reactive and Additive TBBPA grades?

Reactive TBBPA is chemically bonded into the polymer matrix during processing, preventing it from leaching out and improving its long-term stability and environmental profile. Additive TBBPA is simply blended into the material and is used primarily in thermoplastics (e.g., ABS, HIPS) where leaching potential is a greater regulatory concern.

How do regulatory changes, such as REACH and RoHS, impact the TBBPA market?

Regulations like REACH and RoHS impose stringent restrictions on potentially hazardous substances, strongly favoring the use of reactive TBBPA over additive grades due to its lower migration risk. This drives innovation towards higher purity and better integrated chemical formulations to maintain regulatory compliance, especially in Europe.

Which geographic region dominates the global TBBPA consumption?

Asia Pacific (APAC), particularly nations like China, South Korea, and Taiwan, dominates the TBBPA consumption landscape. This is directly correlated with the region's massive output capacity for electronics manufacturing and PCB production, making it the largest market hub.

Are there viable halogen-free alternatives to TBBPA being adopted in the market?

Yes, the market is actively exploring halogen-free alternatives, such as phosphorus-based flame retardants, especially for certain end-uses where environmental regulations are highly restrictive. However, TBBPA retains dominance in high-performance PCB laminates due to its superior cost-effectiveness, high thermal stability, and specific required electrical properties that alternatives often struggle to match completely.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager