TOPCon Solar Cell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433327 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

TOPCon Solar Cell Market Size

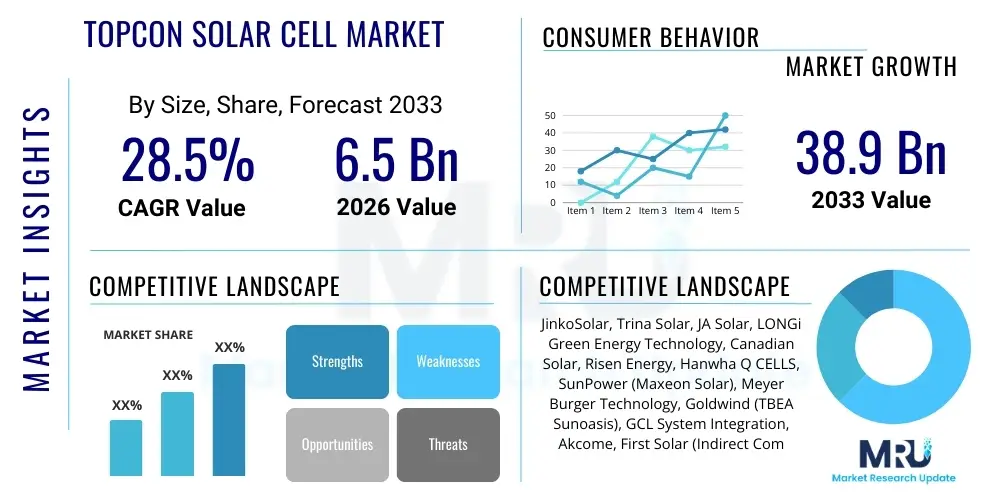

The TOPCon Solar Cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 38.9 Billion by the end of the forecast period in 2033.

TOPCon Solar Cell Market introduction

The Tunnel Oxide Passivated Contact (TOPCon) solar cell represents a paradigm shift in photovoltaic technology, moving beyond conventional P-type PERC (Passivated Emitter Rear Cell) architecture. This advanced N-type technology leverages a thin layer of silicon dioxide (tunnel oxide) combined with a highly doped polycrystalline silicon layer to significantly enhance passivation quality and reduce surface recombination losses. The core advantage of TOPCon lies in its ability to achieve substantially higher energy conversion efficiencies—often exceeding 25% in mass production environments—while maintaining excellent long-term stability and reliability. This high efficiency translates directly into lower Levelized Cost of Electricity (LCOE) for utility-scale solar farms and commercial installations, making it highly attractive to global energy developers seeking performance optimization. The market expansion is intrinsically linked to the global energy transition mandate and the increasing demand for sustainable, high-yield renewable power solutions.

Major applications of TOPCon solar cells span across utility-scale power generation, commercial and industrial (C&I) rooftop installations, and specialized residential segments where space constraints necessitate maximum energy density per unit area. Benefits include superior performance under low-light conditions, negligible Light Induced Degradation (LID) and Potential Induced Degradation (PID), and high bifaciality factors, which significantly increase the energy harvest, especially in ground-mounted systems. Driving factors include aggressive national renewable energy targets, falling manufacturing costs due to scale-up and process refinement, and technological maturity positioning TOPCon as the direct successor to PERC technology. Furthermore, the compatibility of TOPCon with existing manufacturing lines (PERC compatibility) accelerates its adoption rate globally, minimizing initial capital expenditure for manufacturers transitioning their production facilities.

TOPCon Solar Cell Market Executive Summary

The TOPCon Solar Cell Market is experiencing rapid structural growth, driven primarily by the global race for high-efficiency photovoltaic solutions necessary for meeting ambitious decarbonization targets. Business trends indicate a massive shift in capital expenditure from P-type to N-type production lines, with major Chinese manufacturers leading the capacity expansion, which is creating a highly competitive pricing environment and accelerating global deployment. Technological maturity, specifically improvements in the deposition techniques for the tunnel oxide layer and silicon doping processes, has been central to maintaining this competitive edge, allowing manufacturers to consistently push module power output boundaries. This strong supply-side push, coupled with sustained demand from utility-scale project developers, is defining the current market dynamics, characterized by significant overcapacity planning and a strategic focus on cost parity with conventional, less efficient modules.

Regional trends highlight Asia Pacific (APAC), particularly China, as the dominant production and consumption hub, owing to massive domestic solar deployment initiatives and global export capabilities. Europe and North America are characterized by robust demand for premium, high-efficiency modules, driven by strict regulatory requirements and high electricity prices, fostering increased local manufacturing attempts aimed at securing supply chains. Segment trends show that the 182mm and 210mm wafer sizes dominate the utility and C&I sectors due to optimization for lower balance-of-system (BoS) costs, while the bifacial module segment is rapidly gaining market share, capitalizing on the inherent advantages of the N-type structure to boost energy yield in ground-mounted applications. The residential segment is increasingly adopting modules exceeding 450W, prioritizing aesthetics and energy density, further cementing the premium positioning of TOPCon technology.

AI Impact Analysis on TOPCon Solar Cell Market

User queries regarding the intersection of Artificial Intelligence (AI) and the TOPCon Solar Cell Market frequently revolve around optimizing manufacturing yields, predicting long-term module performance under variable climates, and accelerating material discovery. Key user concerns focus on how AI can reduce the highly complex and sensitive manufacturing steps, such as chemical vapor deposition (CVD) and thermal processes involved in forming the tunnel oxide layer, which are critical for achieving peak efficiency. Users also express expectations that AI-driven predictive maintenance and digital twins will enhance operational efficiency in utility-scale solar farms powered by TOPCon modules, minimizing downtime and optimizing energy output, thereby maximizing return on investment (ROI). The core thematic takeaway is the desire for AI to bridge the gap between laboratory-level efficiencies and mass production consistency while significantly improving the asset management lifecycle of deployed solar infrastructure.

The application of AI extends beyond simple process control into advanced simulation and quality assurance. Machine learning algorithms are being trained on vast datasets encompassing material properties, process parameters, and cell performance metrics to identify optimal manufacturing recipes that reduce defects (e.g., microcracks or shunt resistance issues) specific to N-type architectures. Furthermore, AI-powered image recognition systems are essential for high-throughput, non-destructive quality inspection during cell sorting and module assembly, ensuring that only cells meeting stringent efficiency benchmarks proceed to final integration. This intelligent automation minimizes waste, improves resource utilization, and is pivotal for maintaining the high-volume, low-margin environment characteristic of modern solar manufacturing.

In the downstream sector, AI is crucial for optimizing the placement and orientation of TOPCon bifacial modules, using geospatial data and real-time atmospheric modeling to predict energy generation profiles with high fidelity. For large solar asset managers, AI algorithms manage energy storage integration and grid interactions, ensuring the seamless dispatch of solar energy. As TOPCon technology allows for higher power density in smaller physical spaces, AI planning tools are essential for complex site layouts, maximizing the utilization of constrained land areas and further driving down the overall LCOE for renewable energy projects globally. This synergistic relationship confirms AI as a crucial enabling technology for the sustainable scaling of advanced solar cell production and deployment.

- AI-driven optimization of Tunnelling Oxide deposition for defect reduction and efficiency maximization.

- Predictive maintenance models for large-scale TOPCon solar farms, enhancing asset performance and lifespan.

- Machine learning algorithms accelerating the discovery of new passivation materials and dopants.

- Automated visual inspection (AVI) systems using deep learning for high-speed quality control in cell manufacturing.

- AI modeling for optimized bifacial gain calculation based on ground albedo and module geometry.

- Enhanced supply chain forecasting and inventory management specific to N-type silicon wafers and specialized chemicals.

DRO & Impact Forces Of TOPCon Solar Cell Market

The dynamic forces shaping the TOPCon Solar Cell Market are characterized by a powerful confluence of drivers related to technological superiority and restraints imposed by complex manufacturing requirements and fierce market competition. The primary driver is the undeniable efficiency advantage of TOPCon over legacy technologies, positioning it as the standard for achieving grid parity without subsidies in diverse global regions. Restraints, however, include the higher complexity of the N-type silicon wafer preparation and the extremely precise control required during the diffusion and tunneling oxide formation steps, leading to initial yield challenges and capital expenditure intensity. Opportunities are abundant, specifically in emerging markets and large-scale green hydrogen projects that demand the absolute lowest LCOE, which TOPCon is uniquely equipped to provide. The primary impact force accelerating this market is the swift decline in manufacturing costs due to rapid scaling, which overcomes initial capital barriers and establishes TOPCon as the cost-effective high-performance solution.

Specific market drivers include supportive governmental policies such as tax credits, feed-in tariffs, and decarbonization mandates across North America, Europe, and Asia, which necessitate rapid deployment of high-efficiency renewable capacity. Furthermore, the inherent low-temperature coefficient and low degradation rates of TOPCon cells make them ideal for deployment in harsh environmental conditions, expanding their addressable market significantly compared to P-type cells. Conversely, restraints involve intellectual property disputes, which occasionally slow down technology transfer and global market penetration, alongside the ongoing challenge of securing adequate supplies of high-quality N-type silicon wafers, which currently command a premium over standard P-type material. The continuous advancement of competing technologies, such as Heterojunction Technology (HJT) and potential perovskite tandem cells, acts as a long-term restraint, pressuring TOPCon manufacturers to maintain a rapid pace of innovation.

The key opportunities lie in the integration of TOPCon technology into building-integrated photovoltaics (BIPV) due to its aesthetic qualities and high-power density, as well as its strategic deployment in floating solar (FPV) installations where its excellent humidity resistance is beneficial. The long-term impact forces are dominated by the push toward full automation and digitalization in solar production, which aims to further reduce labor costs and variability. The combination of mandatory efficiency standards set by major utilities and procurement bodies, alongside the increasing consumer preference for highly reliable and sustainable energy sources, ensures that TOPCon technology will remain the central focus of solar infrastructure development throughout the forecast period, necessitating continuous capital investment into capacity upgrades and technological iteration.

- Drivers: Superior energy conversion efficiency (25%+), high bifacial factor, low degradation (LID/PID free), supportive government policies for high-efficiency solar.

- Restraints: High initial capital expenditure for N-type fabrication lines, complexity of tunneling oxide layer manufacturing control, dependence on high-quality N-type silicon wafers.

- Opportunities: Integration into emerging markets, growth in Floating PV (FPV) and BIPV, potential for tandem cell integration, reduction in LCOE for green hydrogen production.

- Impact Forces: Rapid scaling and cost reduction driven by Chinese manufacturers, mandatory national efficiency standards, intense competition leading to accelerated innovation cycles.

Segmentation Analysis

The TOPCon Solar Cell Market is segmented based on critical factors including cell structure, module type, application, and end-user, each reflecting distinct market demands and technological preferences. Segmentation by cell structure primarily differentiates between the established Passivated Emitter and Rear Contact (PERC) retrofitted lines and newly built, dedicated N-type production lines, which often achieve higher efficiencies due to optimized process flows. Module type segmentation focuses heavily on monocrystalline versus polycrystalline structures, with monocrystalline silicon dominating due to the inherent benefits of N-type technology. The most impactful segmentation for deployment is module design, splitting the market between traditional monofacial modules and high-gain bifacial modules, catering to different installation environments.

Application-wise, the market is broadly divided into utility-scale projects (large solar farms), commercial and industrial (C&I) installations (rooftops of factories and large offices), and residential installations. Utility-scale remains the largest consumer segment due to the vast volumes required and the prioritization of maximum efficiency per acre. Within the end-user segment, Independent Power Producers (IPPs) and solar project developers constitute the largest buying group, valuing the long-term yield and reliability offered by TOPCon cells. Furthermore, technology segmentation by wafer size—166mm, 182mm, and 210mm—reflects the continuous industry trend toward larger formats designed to reduce Balance of System (BoS) costs and enhance power output per module.

Understanding these segmentations is crucial for manufacturers to tailor their product offerings and strategic investments. For instance, the C&I sector often prioritizes high aesthetics and slightly smaller formats, whereas the utility sector demands the highest wattage output from 210mm bifacial modules. The consistent efficiency improvements across all these segments reinforce the market’s transition away from lower-performing P-type products. This granular analysis provides stakeholders with the necessary insight to navigate the competitive landscape and identify underserved niches, such as specialized BIPV or portable power applications that benefit from TOPCon’s superior performance characteristics.

- By Structure: Monofacial, Bifacial

- By Wafer Size: 166mm, 182mm, 210mm

- By Application: Utility-Scale Solar Power Plants, Commercial & Industrial (C&I), Residential

- By Technology Generation: TOPCon 1.0 (Retrofit), TOPCon 2.0 (Dedicated High-Efficiency Lines)

- By End-User: Independent Power Producers (IPPs), Government & Energy Agencies, Residential Consumers

Value Chain Analysis For TOPCon Solar Cell Market

The value chain of the TOPCon Solar Cell Market begins in the upstream segment with the production of specialized N-type polycrystalline silicon ingots, followed by slicing into high-purity N-type wafers. This upstream phase is highly capital-intensive and dominated by a few specialized polysilicon producers and wafer manufacturers, often requiring specific purification processes to ensure the low oxygen and carbon content essential for N-type cell quality. Securing reliable, high-volume supply of these specialized wafers is critical, as any bottlenecks in this stage directly impact the subsequent cell and module production output. The subsequent midstream manufacturing involves the highly technical processes of cell fabrication, including texturing, diffusion, tunnel oxide deposition (typically using Low-Pressure Chemical Vapor Deposition, LPCVD, or Plasma-Enhanced Chemical Vapor Deposition, PECVD), metallization, and interconnection, all of which are optimized to achieve maximum passivation and efficiency.

The midstream cell manufacturing segues into module assembly, where cells are interconnected, laminated, framed, and tested to meet industry standards. This stage involves significant automation and quality control, leveraging materials such as specialized encapsulants (e.g., polyolefin elastomer, POE, for improved moisture protection) and high-transparency glass, especially for bifacial modules. The downstream analysis focuses on the distribution channels and final deployment. Distribution is segmented into direct sales from manufacturers to large Independent Power Producers (IPPs) for utility projects, indirect sales through authorized distributors and wholesalers catering to smaller C&I and residential installers, and EPC (Engineering, Procurement, and Construction) companies that integrate the modules into turnkey solutions.

Direct channels are preferred for massive utility-scale deals where high volumes enable direct negotiation and tailored logistics, minimizing intermediary costs. Indirect channels, conversely, provide geographical reach and inventory flexibility essential for the fragmented residential and small C&I markets. The effectiveness of the downstream segment is highly dependent on local regulations, financing availability, and the efficiency of the installation ecosystem. Optimization of the entire value chain—from ensuring the quality of the N-type wafer upstream to accelerating final project commissioning downstream—is critical for reducing the overall Levelized Cost of Electricity (LCOE) and maintaining the competitive advantage of TOPCon technology over alternatives.

TOPCon Solar Cell Market Potential Customers

The primary consumers and end-users of TOPCon solar cells are organizations and entities with a strategic mandate to minimize electricity generation costs and maximize energy yield over a 25-30 year project lifetime. Independent Power Producers (IPPs) and global utility companies represent the largest procurement base, as they require massive volumes of modules offering the highest possible output (measured in Watts) and the best long-term degradation performance for their large-scale solar farms. Their purchasing decisions are heavily influenced by the technology's long-term reliability reports and the manufacturer’s financial stability and warranty commitments, making TOPCon’s low degradation rates a compelling factor. These users are typically procuring large format, high-wattage, bifacial modules to optimize land use and BoS costs in remote locations.

The second major category encompasses Commercial and Industrial (C&I) enterprises, including large retail chains, manufacturing facilities, and logistics hubs seeking to achieve energy independence and reduce operational expenses through rooftop installations. For C&I customers, the high power density of TOPCon is paramount, allowing them to install significant generation capacity within limited roof space. These customers often utilize specialized EPC contractors and solar service providers who act as indirect buyers. Furthermore, government agencies and municipal authorities involved in public works, infrastructure development, and defense installations are increasingly specifying high-efficiency modules like TOPCon to meet public sector sustainability goals and mandated renewable energy targets.

Lastly, the residential sector represents a rapidly growing segment, particularly in high-tariff regions such as Europe and North America. Homeowners and small-scale developers prioritize aesthetics, high power output (critical for maximizing feed-in tariffs or offsetting high retail rates), and reliable performance. While volumes are smaller per transaction, the total accumulated demand from the residential segment contributes significantly to market growth, often focusing on visually appealing, all-black or frameless TOPCon modules that integrate smoothly into building architecture, reinforcing the product’s premium market positioning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 38.9 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JinkoSolar, Trina Solar, JA Solar, LONGi Green Energy Technology, Canadian Solar, Risen Energy, Hanwha Q CELLS, SunPower (Maxeon Solar), Meyer Burger Technology, Goldwind (TBEA Sunoasis), GCL System Integration, Akcome, First Solar (Indirect Competition/CdTe comparison), Waaree Energies, Boviet Solar, Solargiga Energy, Astronergy, Eging PV, Shunfeng International Clean Energy, REC Solar. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TOPCon Solar Cell Market Key Technology Landscape

The core technology underpinning the TOPCon solar cell is the N-type silicon wafer, which replaces the traditionally used P-type wafer, offering superior tolerance to impurities and negligible boron-oxygen related degradation. The critical innovation is the Tunnel Oxide Passivated Contact (TOPCon) structure itself, which involves the formation of an ultra-thin (approx. 1-2 nm) layer of silicon dioxide (SiO2), the tunnel oxide, deposited on the rear surface of the N-type silicon wafer. This layer is thin enough to allow quantum mechanical tunneling of charge carriers, minimizing resistance, yet thick enough to effectively block minority carriers, drastically reducing recombination losses at the metal-silicon interface. This superior passivation mechanism is the primary reason TOPCon cells achieve such high open-circuit voltages (Voc) and overall conversion efficiencies, positioning them significantly ahead of PERC cells.

Manufacturing advancements in the technology landscape revolve heavily around deposition techniques and cell structure optimization. Low-Pressure Chemical Vapor Deposition (LPCVD) and Plasma-Enhanced Chemical Vapor Deposition (PECVD) are the two leading methods employed for depositing the polysilicon layer over the tunnel oxide. LPCVD typically offers better uniformity and purity, which is crucial for achieving high efficiencies, but it requires higher processing temperatures. Modern TOPCon 2.0 architectures also incorporate advanced features such as multi-busbar (MBB) technology, which utilizes thin, numerous wires instead of thick busbars to reduce shadowing and enhance current collection efficiency, and half-cut or shingled cell formats, which reduce internal resistance losses at the module level, optimizing performance under partial shading conditions.

Future technological iterations focus on process simplification and cost reduction, specifically exploring alternatives to high-vacuum LPCVD, such as atmospheric pressure processes or advanced doping techniques to simplify the rear-side formation. Furthermore, the integration of TOPCon cells into tandem structures, particularly with perovskite cells, represents the next frontier in photovoltaic research. By stacking a perovskite top cell (optimized for high-energy blue light) onto a silicon TOPCon bottom cell (optimized for low-energy red light), theoretical efficiencies exceeding 30% are achievable. This research direction reinforces the long-term relevance of the high-performance TOPCon base structure within the advanced solar ecosystem.

Regional Highlights

- Asia Pacific (APAC): Dominates both the production and consumption segments. China is the undisputed global manufacturing powerhouse, controlling over 90% of the world's N-type capacity pipeline, driving down costs through rapid scale. India, Vietnam, and Southeast Asia are significant growth markets, fueled by large-scale government procurement tenders prioritizing high-efficiency modules to maximize energy yields on constrained land areas. APAC’s market is characterized by intense price competition and technology leadership.

- Europe: Characterized by high electricity prices and stringent environmental regulations, Europe is a premium market for TOPCon cells. Demand is robust, driven by the need for low-carbon energy sources and high-yield residential/C&I rooftop installations where space is costly. The region is actively investing in domestic TOPCon manufacturing (e.g., in Germany and Central Europe) to enhance energy independence and reduce reliance on Asian supply chains, often supported by regulatory mechanisms like the Net-Zero Industry Act.

- North America: Experiencing explosive growth, heavily incentivized by the U.S. Inflation Reduction Act (IRA). The IRA provides substantial manufacturing tax credits for domestically produced solar components, leading to massive planned investments in TOPCon cell and module production capacity across the U.S. and Mexico. This region demands high-reliability modules, especially bifacial versions for utility-scale deployment in varied climate zones. Canada also contributes strong residential demand due to high performance in cold environments.

- Latin America (LATAM): A rapidly emerging market focused on utility-scale projects, particularly in Brazil, Chile, and Mexico, due to excellent solar irradiation levels. LCOE is the primary decision driver, making the high efficiency and low maintenance demands of TOPCon cells particularly attractive. The market relies heavily on imports from APAC, necessitating robust logistics chains and large-volume purchasing agreements.

- Middle East and Africa (MEA): This region is crucial for the deployment of ultra-large, giga-scale solar projects, especially in the UAE and Saudi Arabia. The extreme heat and high irradiation conditions necessitate modules with low-temperature coefficients and robust durability, properties inherent to N-type TOPCon technology. Investment is often state-backed, focusing on long-term energy diversification and massive power generation capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TOPCon Solar Cell Market.- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- JA Solar Technology Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Canadian Solar Inc.

- Risen Energy Co., Ltd.

- Hanwha Q CELLS Co., Ltd.

- Astronergy Co., Ltd.

- GCL System Integration Technology Co., Ltd.

- TCL Zhonghuan Renewable Energy Technology Co., Ltd.

- Aiko Solar Energy Co., Ltd.

- Shunfeng International Clean Energy Limited

- Eging PV Co., Ltd.

- SunPower Corporation (Maxeon Solar Technologies)

- Meyer Burger Technology AG

- Waaree Energies Ltd.

- Boviet Solar Technology Co., Ltd.

- Akcome Technologies Inc.

- REC Solar Holdings AS

- Solargiga Energy Holdings Limited

Frequently Asked Questions

Analyze common user questions about the TOPCon Solar Cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between TOPCon and PERC solar technology?

The core difference lies in the rear passivation structure. PERC uses a dielectric passivation film, while TOPCon utilizes a Tunnel Oxide Passivated Contact (N-type structure with an ultra-thin silicon dioxide layer and doped polysilicon). This N-type structure significantly reduces surface recombination losses, resulting in higher efficiency (typically 25%+ vs. 23% for PERC), superior bifacial performance, and negligible Light Induced Degradation (LID).

Why are N-type TOPCon solar cells considered more reliable than P-type cells?

TOPCon cells are built on N-type silicon wafers, which use phosphorus doping instead of boron. This composition inherently avoids the boron-oxygen complex that causes Light Induced Degradation (LID) in P-type cells, ensuring stable power output and better long-term performance guarantees, particularly under operational stress, contributing to a lower Levelized Cost of Electricity (LCOE).

Which regions are leading the production capacity expansion for TOPCon technology?

Asia Pacific (APAC), primarily China, dominates the global TOPCon production landscape. Major manufacturers are rapidly converting P-type lines and building dedicated N-type facilities, driven by low manufacturing costs and global export demand. North America and Europe are also seeing planned domestic capacity additions, heavily supported by government industrial policies like the US IRA and European Green Deal initiatives.

How does TOPCon technology impact Balance of System (BoS) costs for solar projects?

By achieving significantly higher power output per module (up to 700W+), TOPCon technology allows developers to install the same total capacity using fewer physical modules. This reduction directly lowers BoS costs related to racking, cabling, land utilization, and labor, making large-scale projects more economically viable and enhancing the overall financial return on investment.

What are the main technical challenges currently facing TOPCon mass production?

Key challenges include optimizing the deposition process for the ultra-thin tunnel oxide layer (critical for efficiency and yield), managing the higher initial capital expenditure required for N-type lines, and maintaining a consistent supply of specialized, high-purity N-type silicon wafers. Manufacturers are focusing heavily on process control and moving toward advanced deposition techniques like PECVD to overcome these yield hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager