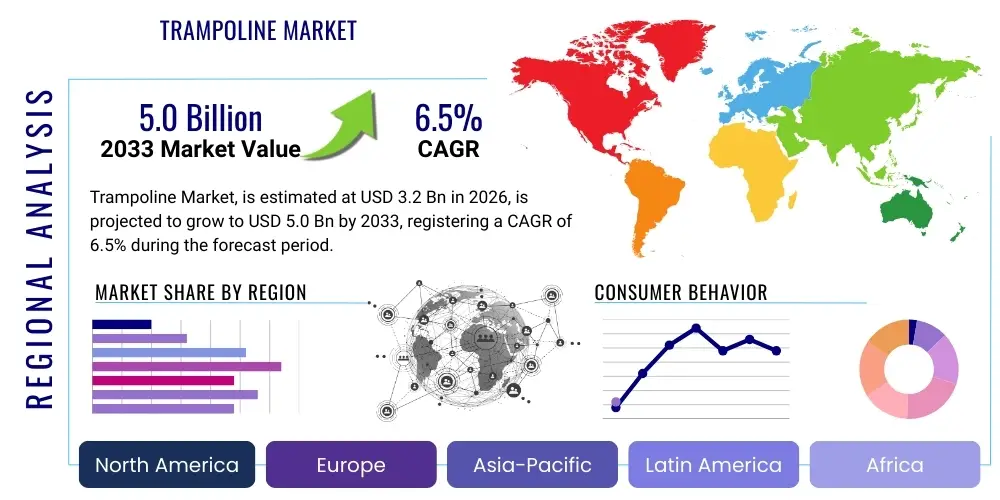

Trampoline Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437799 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Trampoline Market Size

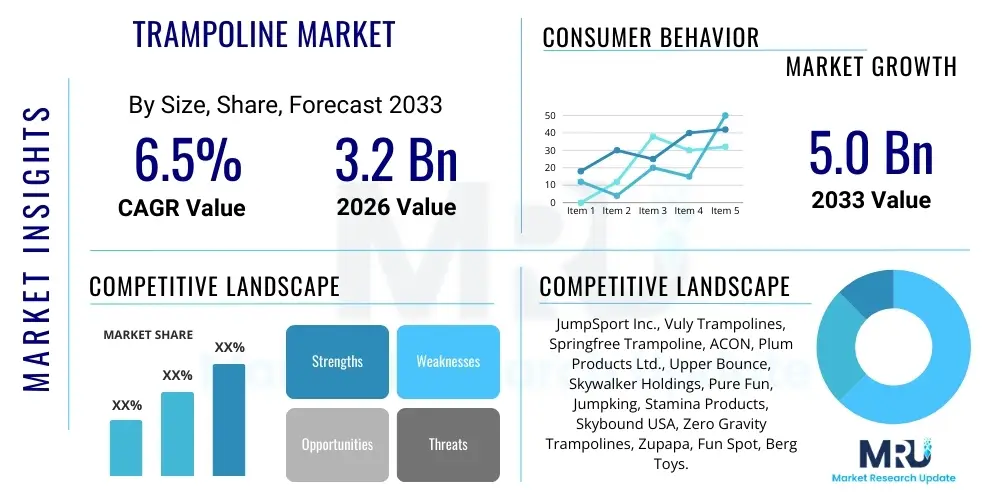

The Trampoline Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Trampoline Market introduction

The Trampoline Market encompasses the manufacturing, distribution, and sale of recreational and fitness devices designed to provide a rebounding surface for jumping. These devices range from small, personal fitness rebounders to large, backyard trampolines and commercial-grade park installations. Historically viewed primarily as recreational equipment, the product has increasingly gained traction as a cost-effective and low-impact fitness tool, driving diversification in product offerings and design innovations aimed at improving safety and user experience. The core materials typically include galvanized steel frames, weather-resistant jumping mats (polypropylene or synthetic fibers), and elastic elements such as springs or flexible rods.

Major applications of trampolines span across residential use (backyards, fitness rooms), commercial installations (amusement parks, trampoline parks, indoor playgrounds), and therapeutic/rehabilitation centers. Key benefits include improved cardiovascular health, enhanced balance and coordination, stress reduction, and overall low-impact exercise suitable for various age groups. The rise in awareness concerning the importance of physical activity, coupled with the desire for engaging outdoor and indoor recreational equipment, continues to bolster demand across suburban and urban environments globally.

The market's expansion is significantly driven by persistent product innovation, particularly the integration of safety features like enclosure nets, padding, and springless designs (utilizing composite rods). Furthermore, the trend toward specialized fitness classes centered around rebound exercise has expanded the product's application beyond mere recreation. Increased disposable income in emerging economies, combined with a robust supply chain capable of handling bulky consumer goods, establishes a strong foundation for sustained market growth throughout the forecast period, addressing both consumer leisure and fitness needs.

Trampoline Market Executive Summary

The Trampoline Market is characterized by robust consumer demand, driven primarily by the global focus on health and wellness and the sustained growth of the residential outdoor equipment sector. Business trends indicate a strong shift towards premium, safety-certified products, where manufacturers invest heavily in materials science to reduce injury risk, particularly through springless technology and integrated smart features for performance tracking. The competitive landscape is intensely focused on patenting innovative safety designs and optimizing logistics for large-volume, seasonal shipments. E-commerce channels are gaining substantial traction, offering consumers comprehensive product information, installation guidance, and direct-to-consumer advantages, thereby bypassing traditional retail limitations related to product size.

Regionally, North America remains the dominant revenue contributor, largely due to high rates of home ownership, expansive residential yards suitable for large trampolines, and a strong culture of outdoor recreation. However, the Asia Pacific region is demonstrating the highest growth velocity, spurred by rapid urbanization leading to the proliferation of commercial trampoline parks and the adoption of fitness rebounders in densely populated areas. European markets emphasize adherence to stringent safety standards (like TÜV certification) and are leaders in incorporating advanced materials and aesthetic design into residential units, catering to discerning consumers prioritizing both safety and durability.

Segment trends reveal that the Residential segment maintains the largest market share, but the Commercial segment (trampoline parks and amusement centers) is poised for accelerated expansion, especially post-pandemic as leisure activities resume globally. Furthermore, segmentation by type highlights the increasing popularity of Rectangular Trampolines among serious athletes and the continued dominance of Round Trampolines for general backyard recreational use. The rebounder segment, catering explicitly to fitness and rehabilitation applications, provides a valuable diversification stream, appealing to urban dwellers with limited space, reinforcing the market's resilience against space constraints.

AI Impact Analysis on Trampoline Market

User queries regarding AI's impact on the Trampoline Market primarily revolve around how technology can enhance safety, personalize the exercise experience, and optimize supply chain operations for seasonal demand spikes. Users frequently ask about the implementation of motion sensors and computer vision algorithms to detect unsafe jumping patterns, prevent collisions, and provide real-time coaching feedback. There is significant interest in how predictive maintenance, powered by AI, can assess the wear and tear on springs or nets, prompting timely replacement notifications, thereby mitigating accident risks. Furthermore, consumers anticipate AI-driven personalization, such as tailored workout routines provided through connected apps based on user fitness levels and goals, transforming the trampoline from a simple recreational item into a sophisticated fitness platform. Manufacturers are leveraging AI for demand forecasting, inventory management, and optimizing the complex logistics associated with bulky, seasonal products, leading to improved efficiency and reduced waste across the entire value chain.

- AI-driven Safety Monitoring: Computer vision and machine learning algorithms analyze jump trajectories and landing zones to detect hazardous behavior, alerting users or supervisors instantly, significantly lowering accident rates, and enhancing parental peace of mind.

- Personalized Fitness Coaching: Integration of AI with connected rebounders provides customized workout programs, tracks calorie expenditure, and monitors form efficiency, delivering real-time auditory or visual feedback via associated mobile applications.

- Predictive Maintenance: AI models analyze sensor data from trampoline components (spring tension, frame integrity) to predict failure points, scheduling preventative maintenance and ensuring product longevity and consistent safety performance.

- Optimized Supply Chain Logistics: Utilizing machine learning for highly accurate seasonal demand forecasting, optimizing inventory placement, and streamlining the transportation of large, bulky trampolines from manufacturing facilities to regional distribution hubs, reducing costs and lead times.

- Enhanced Customer Service: Deployment of AI-powered chatbots and virtual assistants to provide immediate, detailed assembly instructions, troubleshoot common issues, and answer technical specifications, improving the post-purchase customer experience.

DRO & Impact Forces Of Trampoline Market

The dynamics of the Trampoline Market are shaped by a complex interplay of driving forces, inherent limitations, and evolving opportunities, all contributing to the overall impact forces on market trajectory. A primary driver is the accelerating consumer adoption of home fitness equipment, especially following increased time spent indoors due to global events, promoting trampolines as a versatile, enjoyable, and effective piece of backyard or indoor exercise gear. Coupled with this is the continuous improvement in product safety standards mandated by regulatory bodies in key regions, which encourages consumers to purchase newer, safer models, thus generating replacement demand and fostering market credibility. Conversely, the market faces significant restraints, chiefly the persistent perception of high injury risk associated with older, lower-quality models, although manufacturers are diligently working to counter this through advanced safety certifications and robust design.

Impact forces are strongly influenced by urbanization trends; while dense urban living limits the size and placement of residential trampolines, it concurrently fuels the growth of commercial trampoline parks and indoor recreational centers, transforming the application scope. Opportunities abound in technological integration, such as the development of smart trampolines equipped with sophisticated sensors and gamification features, making exercise more engaging for children and adults alike. Furthermore, expansion into new demographics, particularly the senior fitness and rehabilitation markets utilizing rebounders for low-impact therapy, presents untapped revenue streams. Manufacturers must strategically navigate the balance between cost-effectiveness and premium safety features to maximize market penetration.

Overall, the market’s growth momentum is high, primarily due to safety innovations that mitigate restraints. The increasing disposable income globally allows consumers to invest in high-quality, durable recreational equipment. The greatest impact force currently lies in the synergy between the health and wellness movement and the successful deployment of stringent international safety certifications, which collectively enhance consumer confidence and drive market maturity towards professional-grade recreational and fitness devices. Strategic pricing and effective management of logistics challenges associated with large product volumes remain crucial for maintaining competitive advantages in this sector.

Segmentation Analysis

The Trampoline Market segmentation provides a critical understanding of the varying consumer needs, preferences, and utilization patterns across different product categories and end-user groups. Segmentation is typically performed based on Type, End-User, Size, and Distribution Channel, allowing market players to tailor their product development, marketing strategies, and geographic focus effectively. The dominance of residential usage necessitates a focus on safety standards and aesthetic design, while the burgeoning commercial sector demands durability, high capacity, and compliance with institutional safety regulations. The evolution of materials, particularly the transition toward composite materials in place of traditional steel springs, is a core factor influencing categorization and price points across these segments.

Analysis of the Type segment highlights the bifurcation between traditional spring-based trampolines and the increasingly popular springless designs, which command a higher average selling price due to superior safety profiles and reduced maintenance. Furthermore, the functional segmentation distinguishes recreational models (Round, Rectangular) from fitness models (Rebounders/Mini-trampolines). The Distribution Channel segment illustrates the pivotal role of online retail, which efficiently manages the complexity of delivering bulky items directly to consumers, thereby capturing significant market share from traditional brick-and-mortar sports retailers.

Understanding these segments enables targeted product portfolio management. For instance, companies targeting the North American residential market emphasize large, round, and rectangular models with premium enclosure systems, while firms focusing on the European fitness segment prioritize compact, foldable rebounders with integrated digital features. The granular view provided by robust segmentation analysis is indispensable for forecasting demand shifts and strategically positioning product offerings to maximize exposure in high-growth niches, such as the burgeoning market for specialized therapeutic rebound equipment.

- By Type:

- Round Trampolines (Dominant due to recreational popularity and safety dynamics)

- Rectangular Trampolines (Preferred for professional training and gymnastics)

- Octagonal Trampolines (Balancing surface area and spring dynamics)

- Mini-Trampolines/Rebounders (Focus on fitness, portability, and indoor use)

- Other Shapes (e.g., Square)

- By End-User:

- Residential (Backyard use, highest volume segment)

- Commercial (Trampoline parks, amusement centers, schools, leisure facilities)

- By Size:

- Small (Under 8 ft / Mini-rebounders)

- Medium (8 ft to 12 ft)

- Large (Over 12 ft, premium segment)

- By Distribution Channel:

- Online Retail (E-commerce websites, direct-to-consumer platforms)

- Offline Retail (Specialty Sports Stores, Departmental Stores, Hypermarkets)

Value Chain Analysis For Trampoline Market

The value chain of the Trampoline Market begins with the sourcing of primary raw materials, predominantly high-tensile galvanized steel for the frames and springs (or composite rods for springless models), along with specialized synthetic fabrics like polypropylene for the jumping mats and weather-resistant polyethylene for the safety netting and padding. Upstream analysis highlights the sensitivity of manufacturing costs to global steel and plastic resin prices, requiring manufacturers to implement robust hedging strategies and maintain diversified supplier networks. Quality control at this stage is paramount, as the integrity of the frame material directly impacts the safety and durability certifications essential for market acceptance. Manufacturers often integrate backwards to secure stable supplies of specialized steel tubing or develop proprietary composite rod technology to maintain intellectual property advantage and cost control.

The core manufacturing and assembly stage involves precision welding, powder coating, stitching, and final assembly, often utilizing automated processes to ensure standardized quality across various sizes and configurations. Due to the product’s bulk, manufacturing facilities are strategically located near major shipping ports or large consumer markets to mitigate freight costs, which constitute a significant portion of the final product price. Distribution is complex; trampolines are typically shipped as large, heavy, multiple-box kits. Direct and indirect channels are both heavily utilized, with direct-to-consumer (D2C) online models gaining prominence due to their efficiency in handling high-volume, seasonal sales without requiring extensive physical inventory space at retail locations.

Downstream analysis focuses on retail, installation, and post-sale service. Indirect channels involve large big-box retailers and specialized sporting goods stores that manage localized distribution and display, though online platforms provide superior scalability. Direct sales through specialized trampoline brand websites offer better margin control and allow manufacturers to capture valuable customer data for future product development and marketing efforts. After-sales support, including warranty claims management, replacement parts availability (mats, springs, nets), and online video tutorials for assembly, is a critical component of customer satisfaction and brand loyalty, particularly given the product's long lifecycle and safety requirements. The overall value chain emphasizes logistics efficiency and uncompromising safety compliance at every stage.

Trampoline Market Potential Customers

The primary customer base for the Trampoline Market is segmented across residential consumers, commercial leisure operators, and institutional buyers focused on fitness and rehabilitation. Residential customers form the largest segment, typically consisting of suburban families with children (aged 5 to 16) who possess adequate outdoor space and prioritize recreational activities and equipment that promote physical activity. These buyers are highly sensitive to safety features, often seeking models with high weight limits, integrated safety enclosures, and long-term warranties. Marketing efforts toward this group often emphasize family fun, safety certifications, and durability, primarily utilizing online visual content and seasonal promotions coinciding with warmer months.

Commercial operators, representing the high-growth segment, include owners and developers of dedicated indoor trampoline parks, family entertainment centers (FECs), and recreational facilities. These professional buyers require highly durable, modular systems designed for continuous, heavy usage and must comply rigorously with commercial safety standards and insurance requirements. Their purchasing decisions are driven by ROI, lifespan of materials, customization options, and the ability to handle high volumes of simultaneous users. The procurement cycle for commercial customers is longer, involving tenders, detailed safety audits, and significant capital investment, often leading to lucrative long-term supply contracts.

The third key segment includes fitness enthusiasts and therapeutic/medical institutions. Fitness customers purchase mini-trampolines (rebounders) for low-impact cardio, core strengthening, and home workout routines, prioritizing portability and digital integration (e.g., smart sensors). Rehabilitation centers and physical therapists utilize these rebounders for balance training and gentle physical recovery programs, focusing on stability and therapeutic efficacy. This customer group is less price-sensitive than residential buyers but highly sensitive to ergonomic design, material quality, and endorsement by fitness professionals or medical practitioners. Understanding the distinct needs of these three buyer profiles is crucial for manufacturers in designing appropriate product lines and distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JumpSport Inc., Vuly Trampolines, Springfree Trampoline, ACON, Plum Products Ltd., Upper Bounce, Skywalker Holdings, Pure Fun, Jumpking, Stamina Products, Skybound USA, Zero Gravity Trampolines, Zupapa, Fun Spot, Berg Toys. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trampoline Market Key Technology Landscape

The technological evolution within the Trampoline Market centers heavily on safety engineering and digital integration, transforming the basic recreational device into a sophisticated piece of sporting equipment. The most significant technological leap is the widespread adoption of springless technology, pioneered by companies utilizing flexible composite rods (like fiberglass or proprietary materials) instead of traditional metal springs. This design innovation moves the impact zone away from the frame edge, drastically reducing the risk of pinch injuries and falls onto the hard frame. Manufacturers are continuously refining these composite materials to improve elasticity, durability against UV rays, and overall load-bearing capacity, ensuring extended product lifecycles even under harsh outdoor conditions.

Material science also drives advancements in the jumping surface. Modern trampoline mats utilize highly durable, UV-resistant polypropylene mesh fabrics, which maintain optimal bounce characteristics over long periods and resist degradation. Furthermore, technology is being deployed in manufacturing processes, such as advanced robotic welding for frame construction, ensuring structural integrity and precision alignment crucial for safety certification. The development of modular, quick-assembly frame designs is another key technological trend, addressing consumer pain points related to complex and time-consuming installation processes, thereby enhancing the overall user experience and reducing the need for professional assembly services.

The latest technological frontier involves 'Smart Trampolines' and 'Connected Rebounders.' These products integrate sophisticated sensor technology, including accelerometers and gyroscopes embedded in the mat or frame, to measure bounce height, frequency, and landing accuracy. This data is wirelessly transmitted to companion apps, enabling gamification, fitness tracking, and performance metrics. These smart integrations appeal strongly to the millennial and Generation Z demographic, converting recreational jumping into a data-driven fitness activity. Furthermore, advanced AI and IoT frameworks are being utilized in commercial park operations for real-time occupancy tracking, preventative maintenance alerts, and automated user coaching, ensuring both safety compliance and operational efficiency at scale.

Regional Highlights

The regional analysis reveals distinct market maturity levels, safety regulation adherence, and consumer purchasing power influencing the distribution of market revenue and growth potential.

- North America (USA and Canada): North America stands as the largest and most mature market for trampolines, primarily driven by high consumer spending on backyard leisure equipment and a strong cultural affinity for outdoor activities. The USA, in particular, accounts for a significant portion of global residential sales, with a clear preference for large-sized, premium safety models, often incorporating springless technology and extensive warranties. Stringent national safety standards (e.g., ASTM) and strong liability awareness among consumers necessitate continuous innovation in enclosure systems and frame materials, maintaining a high average selling price. The region also exhibits robust growth in the commercial sector, with numerous large trampoline park chains expanding aggressively.

- Europe (Germany, UK, France): The European market is characterized by a high degree of regulation and consumer emphasis on certification. Germany and the UK are key contributors, where TÜV and CE markings are critical selling points, often prioritizing quality and environmental standards. While backyard trampolines are popular, particularly in rural and suburban areas, the market also displays significant demand for high-quality fitness rebounders due to the widespread popularity of indoor fitness classes and compact living spaces in major cities. Manufacturers focus on streamlined, aesthetically pleasing designs that fit into modern European garden aesthetics.

- Asia Pacific (China, Australia, Japan, India): APAC is projected to be the fastest-growing region, driven by rapid urbanization and the emergence of a health-conscious middle class, particularly in China and India. While residential ownership is constrained by smaller living spaces, the commercial segment, led by the proliferation of indoor trampoline parks and family entertainment centers (especially in metropolitan centers), is experiencing explosive growth. Australia and New Zealand, with similar outdoor cultures to North America, show strong residential demand. Manufacturers operating here benefit from lower production costs but must increasingly adhere to rising localized safety standards and adapt to complex distribution logistics across diverse geographical terrains.

- Latin America (Brazil, Mexico): This region represents an evolving market, currently characterized by price sensitivity but growing interest in both residential and commercial applications. Market penetration is steadily increasing, fueled by improving economic conditions and the growing availability of affordable, imported models. Focus is shifting towards establishing regional distribution hubs to reduce shipping costs and lead times, making the product more accessible to the mass market.

- Middle East and Africa (MEA): The MEA region remains a nascent market, primarily focused on high-end commercial installations (e.g., luxury resorts and large indoor malls) and recreational centers in GCC countries. Residential uptake is limited, often confined to expatriate communities or affluent households. Future growth hinges on infrastructure development and increasing investment in tourism and entertainment sectors, which drive the demand for large-scale, climate-resistant commercial trampoline installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trampoline Market.- JumpSport Inc.

- Vuly Trampolines

- Springfree Trampoline

- ACON

- Plum Products Ltd.

- Upper Bounce

- Skywalker Holdings

- Pure Fun

- Jumpking

- Stamina Products

- Skybound USA

- Zero Gravity Trampolines

- Zupapa

- Fun Spot

- Berg Toys

- ReboundAir

- Kangaroo Hoppers

- Avyna Trampolines

- Leisure Kingdom

- Oz Trampolines

Frequently Asked Questions

Analyze common user questions about the Trampoline market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Trampoline Market?

The primary drivers are the surging global interest in health and wellness activities, the sustained demand for accessible home fitness equipment, and continuous innovation in safety technology, particularly the shift toward safer springless designs that mitigate injury risks and enhance consumer confidence.

How are new safety innovations influencing consumer purchase decisions?

Safety innovations, such as advanced enclosure systems, robust padding, and especially springless technology, are critical differentiators. Consumers, particularly parents in North America and Europe, actively seek out products with proven safety certifications (e.g., ASTM, TÜV), often leading them to choose premium, higher-priced models over cheaper alternatives.

Which trampoline type holds the largest market share: Round or Rectangular?

Round trampolines currently dominate the market share by volume due to their popularity as general recreational backyard equipment, their inherent safety characteristics (naturally directing the jumper toward the center), and their competitive pricing, making them the standard choice for residential use globally.

What impact does the commercial sector, such as trampoline parks, have on market growth?

The commercial sector is a high-growth segment, especially in emerging markets (APAC). The proliferation of dedicated indoor trampoline parks drives significant demand for industrial-grade, highly durable, modular systems, fueling innovation in materials and contributing substantially to the overall market revenue and expansion rate.

Are smart trampolines and rebounders becoming standard, and what features do they offer?

Smart integration is an accelerating trend, particularly in the fitness rebounder segment. These devices integrate sensors (IoT) and AI to offer personalized workout tracking, calorie burn estimates, real-time performance feedback, and interactive gamification features via connected mobile applications, enhancing the product's value proposition beyond simple exercise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Home Workouts Trampoline Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Foldable Trampoline Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Trampoline Park Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Trampoline Park Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Trampoline Parks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mini Trampoline, Medium Trampoline, Large Trampoline), By Application (Domestic Use, Trampoline Park Use, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager