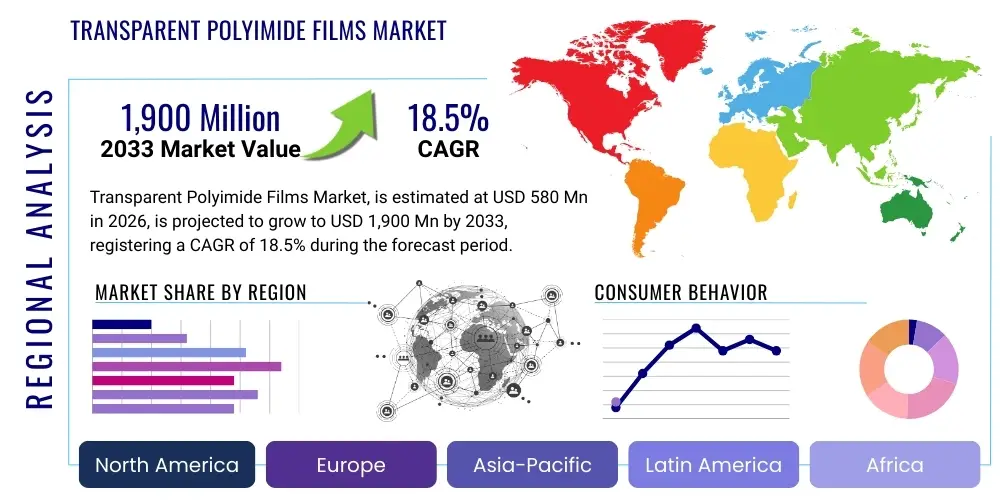

Transparent Polyimide Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438432 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Transparent Polyimide Films Market Size

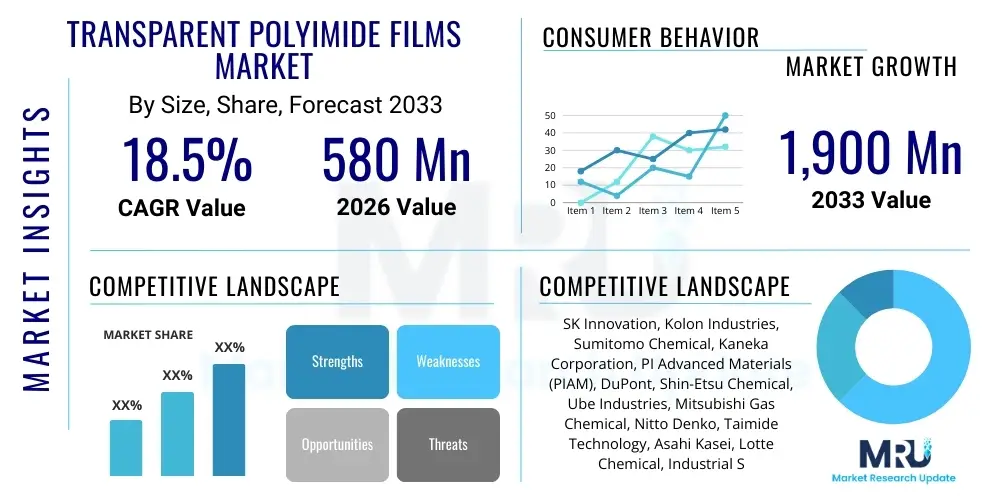

The Transparent Polyimide Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $1,900 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the relentless expansion of the flexible electronics sector, specifically the mass production and consumer adoption of foldable smartphones, rollable displays, and advanced wearable technologies. The superior thermal stability, mechanical strength, and excellent optical transparency characteristics of these films position them as indispensable materials replacing traditional glass substrates in next-generation devices. Furthermore, investment in high-throughput manufacturing processes aimed at reducing production costs and enhancing material uniformity is accelerating market penetration across diverse applications, including advanced sensor manufacturing and flexible printed circuit boards (FPCBs).

Transparent Polyimide Films Market introduction

Transparent Polyimide (TPI) films represent a class of high-performance polymer materials engineered to combine the exceptional thermal and mechanical stability inherent to traditional opaque polyimides with high optical transparency in the visible spectrum. Historically, polyimides were known for their deep yellow color, limiting their use in optical applications; however, advancements in chemical synthesis, such as the introduction of aliphatic or alicyclic diamines and fluorine substituents into the polymer backbone, have successfully disrupted the charge transfer complexes (CTCs) responsible for coloration, yielding films with clarity comparable to glass. These unique properties—high glass transition temperature (Tg), low coefficient of thermal expansion (CTE), superior dimensional stability, and light transmittance exceeding 88%—make TPI films critical enablers for innovation in display technology and advanced circuitry.

The primary applications of TPI films revolve around their use as flexible substrates and cover windows in flexible organic light-emitting diode (FOLED) displays, a segment growing rapidly due to the demand for foldable and rollable devices. Beyond displays, TPI films are essential components in flexible photovoltaic cells, high-frequency 5G antenna modules (due to their low dielectric constant and low loss tangent), and various high-reliability sensors requiring sustained performance under extreme thermal cycling. The adoption trajectory is steep, propelled by manufacturers seeking lighter, thinner, and more durable alternatives to conventional materials, satisfying the stringent performance requirements of modern consumer electronics and sophisticated industrial equipment.

Key driving factors include the proliferation of 5G networks requiring sophisticated flexible antennas, the ongoing transition from rigid to flexible displays across mobile devices and automotive interiors, and government initiatives promoting sustainable and lightweight material solutions in aerospace and defense. The inherent benefits, such as resistance to harsh chemicals, high abrasion resistance, and long-term durability, underscore their value proposition, cementing TPI films as fundamental building blocks in the evolving landscape of flexible electronic systems. Continuous research focused on further reducing CTE values and improving scalability in roll-to-roll processing remains central to future market expansion.

Transparent Polyimide Films Market Executive Summary

The Transparent Polyimide Films market is characterized by robust growth, primarily fueled by the paradigm shift toward flexible electronics. Business trends indicate aggressive capital investments in Asia Pacific, particularly in South Korea, China, and Japan, which dominate the production landscape for OLED and flexible displays. Strategic alliances and mergers between raw material suppliers (monomer producers) and film fabricators are becoming prevalent, aimed at securing consistent supply chains and controlling material specifications, especially regarding optical purity and low CTE. Furthermore, innovation competition centers on developing films capable of ultra-high optical transmission and films that can withstand extreme bending radii required for future multi-fold devices, creating a high barrier to entry for new market participants.

Regionally, Asia Pacific commands the largest market share and exhibits the highest growth potential, largely due to the massive concentration of consumer electronics manufacturing and display fabrication facilities (fabs). North America and Europe, while smaller in volume, represent critical markets for high-value applications, including aerospace, specialized medical devices, and high-performance military electronics, driving demand for premium, custom-engineered TPI film grades. The maturity of the 5G infrastructure rollout in these Western regions is also catalyzing demand for TPI substrates in advanced antenna and radio frequency (RF) modules.

Segment-wise, the Application segment led by flexible displays (including foldable and rollable smartphones and TVs) is the primary revenue generator and growth driver. By type, the colorless polyimide (CPI) sub-segment is rapidly outpacing conventional TPI films, offering superior optical clarity and reduced processing complexity. Key market players are prioritizing expansion in continuous manufacturing technologies, such as advanced solution casting and specialized curing techniques, to meet escalating volume requirements while maintaining stringent quality control over thickness uniformity and surface defect minimization, crucial for display substrates.

AI Impact Analysis on Transparent Polyimide Films Market

Common user questions regarding AI's influence on the Transparent Polyimide Films Market frequently revolve around material discovery, process efficiency, and quality control. Users are keen to understand if AI can accelerate the identification of novel TPI chemical structures that possess enhanced thermal stability and lower CTE without sacrificing transparency. Furthermore, significant interest exists in how AI-driven predictive modeling can optimize complex manufacturing processes, such as continuous solution casting and high-temperature curing, to minimize defects and reduce waste. The overarching theme is the expectation that AI will revolutionize the R&D cycle for TPI, enabling faster iteration and superior product quality necessary for next-generation flexible devices, thereby lowering overall production costs and increasing market accessibility.

The integration of AI and machine learning (ML) algorithms is set to significantly impact the TPI films industry, transforming both the upstream material design and the downstream manufacturing phases. In R&D, AI algorithms can process vast datasets of polymerization reactions, predicting the properties (optical, mechanical, thermal) of hundreds of potential new polyimide chemical structures simultaneously. This speeds up the discovery of novel colorless polyimide chemistries that meet the stringent requirements of foldable displays, dramatically shortening the time-to-market for advanced materials. By simulating molecular interactions and predicting performance under stress, AI minimizes the need for costly and time-consuming physical laboratory experiments, focusing resources only on the most promising candidates.

In manufacturing, AI-powered predictive maintenance and quality assurance systems are critical. Continuous monitoring of parameters in roll-to-roll processes, such as solvent evaporation rates, film thickness uniformity, and curing temperature profiles, allows AI to detect subtle deviations in real-time. This enables automated process adjustments before defects occur, resulting in higher yield rates, reduced material waste, and improved product consistency—all vital for maintaining competitiveness in the high-volume display substrate market. Ultimately, AI integration drives operational efficiency, lowers the effective cost of TPI film production, and ensures the materials meet the ultra-high precision standards demanded by flexible electronics manufacturers.

- AI accelerates the discovery and design of novel colorless polyimide (CPI) chemistries with optimal CTE and transparency.

- Predictive modeling minimizes defects in large-scale manufacturing (solution casting) by optimizing complex thermal and chemical processes.

- Machine learning enhances quality control through real-time, non-destructive monitoring of film uniformity and surface defects.

- AI-driven supply chain optimization improves inventory management of expensive monomers and reduces lead times for specialized TPI grades.

- Automation facilitated by AI integration lowers operational expenditure (OPEX) and labor costs in advanced fabrication facilities.

DRO & Impact Forces Of Transparent Polyimide Films Market

The Transparent Polyimide Films market is driven by the explosive demand from flexible and foldable display technologies (Driver), while constrained by the complexity and high cost associated with synthesizing high-purity, colorless monomers and the rigorous manufacturing standards required for optical-grade films (Restraint). Opportunities lie in the rapidly expanding 5G telecommunications infrastructure, requiring high-frequency circuit substrates that TPI films are uniquely positioned to serve, and the development of cost-effective, continuous processing techniques (Opportunity). These factors collectively exert significant Impact Forces on the market structure, necessitating continuous technological innovation and substantial capital investment to overcome restraints and fully capitalize on the widespread applications in high-performance electronics.

The primary impact force driving market expansion is the technological necessity for flexible, durable, and thermally stable substrates in modern consumer electronics. As devices move beyond simple rigidity, materials must endure tight bending radii, high operational temperatures, and long-term mechanical stress. TPI films, offering unparalleled thermal resilience (up to 400°C) coupled with optical clarity, are the material of choice for cover windows and base substrates in OLEDs, providing a crucial competitive edge over materials like PEN or specialized glasses that lack flexibility. This pervasive need across smartphones, tablets, and advanced wearables creates sustained high demand, influencing pricing strategies and production capacity planning among major market players.

Conversely, the stringent quality requirements and high capital expenditure for establishing cleanroom facilities capable of producing optical-grade films act as a strong restraining force, slowing down rapid market entry and diffusion. Achieving ultra-low CTE and maintaining zero defects across large-area films is technically challenging and requires specialized polymerization and purification techniques. However, the opportunity provided by non-display applications, such as flexible solar cells, specialized aerospace components (satellites and drones), and high-reliability sensors used in automotive advanced driver-assistance systems (ADAS), provides substantial diversification potential, mitigating the risk associated with reliance solely on the volatile consumer electronics display segment. The combined impact of these forces fosters an environment where innovation in cost reduction and process scaling is paramount for achieving market leadership and widespread material adoption.

Segmentation Analysis

The Transparent Polyimide Films Market is comprehensively segmented based on Type, Application, and Geography, providing a granular view of market dynamics and revenue streams. Segmentation by Type differentiates between various chemical compositions, primarily focusing on the evolution from traditional, slightly yellow-tinted TPI to advanced Colorless Polyimide (CPI) films, which offer superior transmittance properties. The Application segmentation is crucial, highlighting the dominance of the flexible display industry but also recognizing high-growth non-display sectors like advanced circuit boards and specialized flexible solar panels. Geographical analysis emphasizes the critical role of manufacturing hubs in Asia Pacific versus high-value application markets in North America and Europe.

- By Type:

- Colorless Polyimide (CPI) Films

- Light Yellow Transparent Polyimide Films

- Others (e.g., highly functionalized TPI with low dielectric constants)

- By Application:

- Flexible Displays (OLED, microLED, foldable devices)

- Flexible Printed Circuit Boards (FPCBs) and Substrates

- Flexible Solar Cells and Photovoltaics

- 5G Antennas and RF Modules

- Lighting & Optoelectronics (LED substrates)

- Touch Sensors and Wearables

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Energy

- Medical

Value Chain Analysis For Transparent Polyimide Films Market

The value chain for Transparent Polyimide Films is complex and highly specialized, beginning with the upstream supply of purified chemical monomers. Upstream activities involve the synthesis and purification of high-purity diamines and dianhydrides, which are essential precursors for TPI polymerization. Achieving optical clarity demands extremely pure monomers, often proprietary to specialized chemical manufacturers, giving this stage significant control over material cost and final film quality. Suppliers in this segment focus intensely on reducing impurities and managing batch consistency, as even minor variations can drastically impact the final film's transparency and physical properties, such as the coefficient of thermal expansion (CTE).

The midstream focuses on polymerization and film fabrication, typically through advanced solution casting or spin coating techniques. Film fabricators receive the purified monomers and perform polycondensation to form the polyamic acid (PAA) intermediate solution, followed by meticulous casting onto specialized belts or substrates. This step requires extremely controlled environments (cleanrooms) and precise thermal curing processes to convert PAA into the finished transparent polyimide film. Efficiency in this stage, particularly minimizing solvent use and achieving consistent film thickness, directly influences manufacturing cost and yield. Direct distribution often occurs from these film fabricators to major tier-one electronics manufacturers.

The downstream segment involves converting the raw TPI film into final components and subsequent distribution channels. Converters utilize specialized processes like laser cutting, lamination, and surface treatment to integrate the film into flexible displays, FPCBs, or sensor assemblies. Distribution channels are predominantly direct, involving large-volume transactions between the film manufacturers/converters and Original Equipment Manufacturers (OEMs) in the consumer electronics or automotive sectors. Indirect channels, involving regional distributors or specialized material brokers, handle smaller or custom-order volumes for niche applications like medical devices or research institutions. The high-value, highly customized nature of TPI films necessitates close collaboration across the entire chain to ensure performance specifications are met.

Transparent Polyimide Films Market Potential Customers

The primary potential customers and end-users of Transparent Polyimide Films are large-scale Original Equipment Manufacturers (OEMs) and Tier 1 suppliers within the consumer electronics and automotive industries. These buyers require materials that offer a superior combination of optical clarity, flexibility, and thermal endurance, which TPI films uniquely provide. Specifically, display panel manufacturers (for OLED and microLED) and flexible circuit board fabricators are the most significant volume purchasers, driving demand for high-performance, cost-effective films capable of continuous, mass-production yields. The purchasing decisions of these entities are heavily influenced by the film's CTE match with other materials in the stack and its ability to withstand demanding processing steps like high-temperature lamination.

A secondary, yet rapidly expanding, customer segment includes manufacturers involved in advanced connectivity solutions, specifically 5G infrastructure and high-frequency communication devices. These customers leverage TPI films for their excellent dielectric properties (low Df and Dk) at high frequencies, making them ideal substrates for flexible antennas, radar components, and specialized RF circuit packaging. Furthermore, companies in the aerospace and defense sectors constitute high-value customers, often requiring small quantities of highly customized, ultra-reliable TPI films for lightweight, thermally stable components in avionics, space exploration hardware, and military communication systems where material failure is unacceptable under extreme conditions.

In addition to these major industrial buyers, specialized manufacturers in the medical device sector (e.g., flexible sensor patches, surgical instruments) and the renewable energy industry (flexible solar panels, energy storage systems) represent promising niche customer bases. These users prioritize TPI films for their biocompatibility, lightweight nature, and long-term durability in critical applications. Marketing efforts must therefore be highly segmented, addressing volume cost-efficiency for electronics OEMs and reliability/customization for aerospace and medical purchasers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $1,900 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SK Innovation, Kolon Industries, Sumitomo Chemical, Kaneka Corporation, PI Advanced Materials (PIAM), DuPont, Shin-Etsu Chemical, Ube Industries, Mitsubishi Gas Chemical, Nitto Denko, Taimide Technology, Asahi Kasei, Lotte Chemical, Industrial Summit Technology (IST), Wuhan Imide New Materials, Flexpoly, Raychung Chemical, Arakawa Chemical Industries, Daicel Corporation, Toray Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transparent Polyimide Films Market Key Technology Landscape

The technological landscape of the Transparent Polyimide Films market is dominated by advancements in polymerization chemistry and precision manufacturing techniques aimed at maximizing optical transparency while maintaining the intrinsic thermal and mechanical robustness of polyimides. The shift from conventional polyimides, which suffered from inherent color due to charge transfer complexes (CTCs) between adjacent polymer chains, to Colorless Polyimide (CPI) technology is the most significant development. CPI is typically achieved by incorporating bulky alicyclic or fluorinated groups into the polymer backbone, which sterically hinder the formation of CTCs, resulting in films with light transmittance values often exceeding 90% in the visible light spectrum (400–800 nm). The development focus is currently centered on optimizing the thermal imidization process to ensure high yield without compromising clarity.

Manufacturing technology primarily utilizes advanced solution casting methods, where the polyamic acid precursor solution is precisely cast onto a large-area substrate, followed by controlled solvent removal and high-temperature thermal curing. Key innovation here involves large-scale, continuous roll-to-roll (R2R) processing, which is essential for meeting the volume demands of the display industry. R2R allows for uniform deposition across vast areas, but requires extremely sophisticated tension control, temperature uniformity across the curing oven, and contaminant exclusion (AEO focus: cleanroom standards) to prevent pinholes or thickness variations that could render the film unusable for OLED displays. Companies invest heavily in specialized curing units that minimize film shrinkage and distortion.

Furthermore, critical technological requirements include achieving an ultra-low Coefficient of Thermal Expansion (CTE), ideally matching that of glass or silicon components (below 5 ppm/°C). A mismatch in CTE leads to stress and delamination during thermal cycling, particularly during display panel manufacturing. Researchers are employing molecular design techniques and adding specific inorganic fillers (nanoparticles) to the polymer matrix to fine-tune the CTE, leading to the development of Composite Transparent Polyimide Films. Other advancements include surface functionalization techniques to improve adhesion to barrier layers and conductive materials, necessary for integrating TPI films into flexible electronic systems seamlessly and ensuring long-term reliability under mechanical stress.

Regional Highlights

- Asia Pacific (APAC): Dominates the global TPI Films market both in terms of production capacity and consumption, primarily driven by China, South Korea, and Japan. South Korea remains the epicenter for flexible and foldable display manufacturing (Samsung Display, LG Display), creating immense demand for high-quality CPI films. China's rapid expansion in domestic electronics production and 5G infrastructure development ensures continuous, steep growth in consumption across display, FPCB, and antenna segments. APAC benefits from robust government support for advanced material science and proximity to the entire electronics supply chain.

- North America: Represents a high-value market focused on specialized, high-reliability applications rather than mass volume consumer electronics manufacturing. Key demand drivers include the aerospace and defense sector (requiring high-temperature, low-outgassing films), specialized medical devices, and the early adoption of next-generation high-frequency 5G components. The region is also a hub for fundamental R&D in novel TPI chemistry and advanced processing technologies.

- Europe: Characterized by strong demand from the premium automotive industry for flexible displays, lighting solutions, and sophisticated sensors used in electric and autonomous vehicles. Europe also possesses a mature market for specialized industrial electronics and demanding medical equipment. Regulatory frameworks favoring energy efficiency and reduced material weight further support the adoption of lightweight TPI films over traditional materials.

- Latin America & Middle East and Africa (LAMEA): Currently smaller markets, primarily driven by imported finished electronic goods. However, localized infrastructure development, particularly in telecommunications (5G rollout) and renewable energy (flexible solar farms), is expected to accelerate the demand for TPI films in FPCB and photovoltaic applications during the latter half of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transparent Polyimide Films Market.- SK Innovation

- Kolon Industries

- Sumitomo Chemical

- Kaneka Corporation

- PI Advanced Materials (PIAM)

- DuPont

- Shin-Etsu Chemical

- Ube Industries

- Mitsubishi Gas Chemical

- Nitto Denko

- Taimide Technology

- Asahi Kasei

- Lotte Chemical

- Industrial Summit Technology (IST)

- Wuhan Imide New Materials

- Flexpoly

- Raychung Chemical

- Arakawa Chemical Industries

- Daicel Corporation

- Toray Industries

Frequently Asked Questions

Analyze common user questions about the Transparent Polyimide Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard PI and Transparent PI (TPI) Films?

Standard polyimide (PI) is opaque and typically yellowish-brown due to charge transfer complexes (CTCs) in its structure, limiting light transmission. Transparent Polyimide (TPI), particularly Colorless Polyimide (CPI), utilizes altered chemical structures (often containing fluorinated or alicyclic components) that disrupt these CTCs, resulting in films that offer high thermal stability (up to 400°C) combined with high optical clarity, making them suitable for flexible displays and optical components.

Which application segment drives the highest demand for Transparent Polyimide Films?

The Flexible Displays segment, particularly the manufacturing of flexible organic light-emitting diode (FOLED) displays for foldable smartphones, smartwatches, and rollable televisions, is the largest and fastest-growing application. TPI films serve as both the substrate material for the display panel and the durable, flexible cover window layer, replacing traditional glass due to superior bending capabilities and heat resistance.

What technical challenges are currently restraining the growth of the TPI market?

The main restraints involve the high manufacturing cost associated with producing optical-grade films, the complexity of scaling continuous roll-to-roll (R2R) production while maintaining zero defects, and the technical difficulty in achieving an ultra-low Coefficient of Thermal Expansion (CTE). Matching the CTE of silicon or glass is crucial to prevent warping and delamination during high-temperature display fabrication processes.

How are Transparent Polyimide Films utilized in 5G technology?

TPI films are critical enablers for 5G antenna modules and high-frequency printed circuit boards (FPCBs) due to their low dielectric constant (Dk) and low dissipation factor (Df). These properties minimize signal loss and maximize data transmission speeds at the high frequencies utilized by 5G networks, offering a significant performance advantage over conventional materials like PET or standard epoxy laminates.

Which geographical region dominates the production and consumption of Transparent Polyimide Films?

The Asia Pacific (APAC) region, spearheaded by South Korea, China, and Japan, dominates both the production capacity and the consumption market for TPI films. This is directly attributable to the large concentration of global consumer electronics manufacturers and the established supply chain for flexible display panels within these countries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Optically Transparent Polyimide Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Optically Transparent Polyimide Films Market Statistics 2025 Analysis By Application (.), By Type (Thickness>25 m, 15 m), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Transparent Polyimide Films Market Statistics 2025 Analysis By Application (.), By Type (Thickness>25 m, 15 m), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Optically Transparent Polyimide Films Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thickness>25μm, 15μm

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager