Ultra HD Television Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432698 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ultra HD Television Market Size

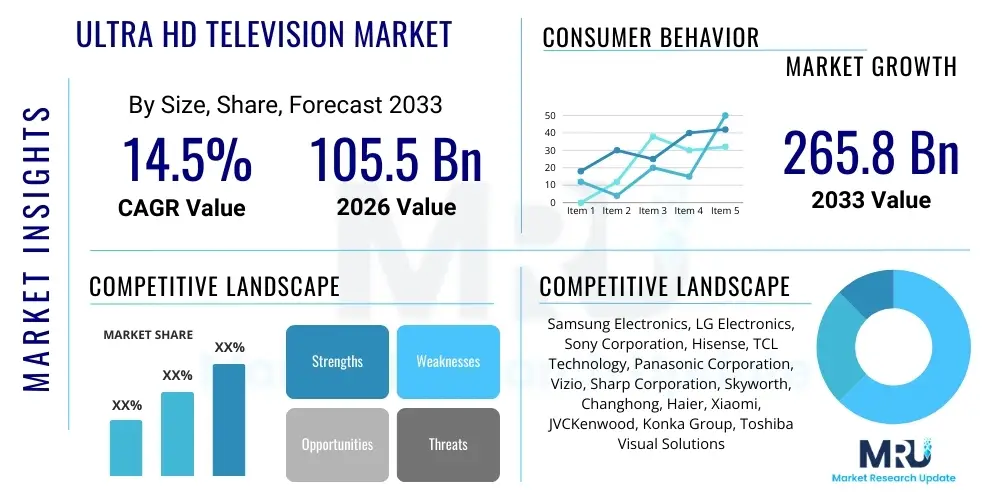

The Ultra HD Television Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $105.5 billion in 2026 and is projected to reach $265.8 billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing consumer demand for premium home entertainment systems and the rapid proliferation of high-resolution digital content across global streaming platforms. Market growth is further catalyzed by technological advancements in display panel manufacturing, including OLED and MicroLED technologies, which enhance picture quality and drive consumer upgrade cycles, particularly in developed economies seeking replacement for Full HD (FHD) units.

Ultra HD Television Market introduction

The Ultra HD Television market encompasses display devices offering resolutions significantly exceeding standard Full HD (1920x1080), predominantly focusing on 4K (3840x2160) and the emerging 8K (7680x4320) standards. These televisions deliver an immersive viewing experience characterized by superior clarity, enhanced color gamut, and improved contrast ratios, often integrating advanced High Dynamic Range (HDR) technologies such as HDR10+ and Dolby Vision. The core product description involves sophisticated display panels (LED, OLED, QLED, MicroLED) coupled with powerful processing chips capable of upscaling lower-resolution content and managing bandwidth-intensive 4K/8K streams. The inherent benefits include improved visual fidelity for movies, sports, and gaming, positioning Ultra HD TVs as central components in modern smart homes.

Major applications of Ultra HD Televisions span across residential viewing, commercial display installations, and specialized professional monitoring environments. In the residential sector, they serve as the primary platform for content consumption, driving growth through their compatibility with next-generation gaming consoles and 4K streaming services (Netflix, Amazon Prime Video, Disney+). The benefits derived from these advanced displays include increased screen size availability without sacrificing pixel density, leading to a perceptibly sharper image even on large format displays, which is highly valued by consumers globally. The market's structural evolution is consistently pushing towards larger screen sizes (65 inches and above) where the advantages of Ultra HD resolutions become most pronounced.

Key driving factors propelling the market include the continuous decline in manufacturing costs for 4K panels, making them accessible across wider price points, thereby accelerating mass market adoption. Furthermore, the increasing availability of Ultra HD content, supported by partnerships between television manufacturers and content producers, ensures a robust ecosystem for consumption. Consumer preferences are shifting rapidly towards smart, connected devices, and Ultra HD Televisions seamlessly integrate smart functionalities, voice control, and advanced connectivity protocols (HDMI 2.1, Wi-Fi 6), further cementing their indispensable role in the modern digital household ecosystem. Government initiatives in various regions promoting digital broadcasting standards also inadvertently support the transition to higher resolution displays.

Ultra HD Television Market Executive Summary

The Ultra HD Television Market is experiencing robust growth driven by converging technological advancements, favorable pricing strategies, and shifting consumer expectations for high-fidelity media consumption. Key business trends indicate an aggressive push towards integrating Artificial Intelligence (AI) for optimized picture processing, dynamic content recommendation, and enhanced user interface customization. Manufacturers are heavily investing in proprietary display technologies, particularly QLED and OLED, to differentiate their offerings based on superior contrast and color performance. Additionally, the strategic shift towards value-added services, including integrated smart home hubs and personalized advertising, is transforming Ultra HD TVs from mere display devices into comprehensive home entertainment and connectivity platforms, creating new revenue streams beyond hardware sales.

Regionally, Asia Pacific (APAC) dominates the market, primarily fueled by massive consumer bases in China and India, coupled with rapid urbanization and rising disposable incomes that enable premium product purchases. North America and Europe remain crucial markets, characterized by high replacement rates and a strong demand for large-screen formats (75 inches and above) and 8K resolution early adoption. Regional trends also highlight distinct technological preferences; for example, OLED penetration is traditionally higher in Western Europe due to brand perception and environmental standards, while QLED and LED technologies maintain strongholds in APAC due to cost-efficiency and brightness performance tailored for varied lighting conditions.

Segmentation trends reveal significant dynamism, particularly within the Technology and Screen Size segments. The transition from conventional LED-backlit LCDs to advanced OLED and QLED technologies represents the most significant shift, offering enhanced visual performance and driving premium segment growth. In terms of screen size, the 55-inch to 65-inch category currently holds the largest market share due to its balance between immersive viewing and affordability, but the fastest growth trajectory is observed in the 75-inch and above segment, reflecting the 'bigger is better' consumer mentality in developed markets. Further segmentation shows the retail distribution channel maintaining dominance, although e-commerce platforms are rapidly gaining traction due to superior pricing and convenient logistics, particularly for large, bulky items.

AI Impact Analysis on Ultra HD Television Market

Common user questions regarding AI's impact on the Ultra HD Television market often center on whether AI truly enhances picture quality, how it affects privacy regarding viewing habits, and if it justifies the increased cost of premium models. Users frequently inquire about the effectiveness of AI upscaling—the process of converting lower-resolution content to 4K or 8K—and the practical benefits of machine learning applied to optimizing sound output based on room acoustics. There is also significant user curiosity concerning how AI-driven smart features, such as personalized recommendations and seamless integration with voice assistants, will evolve and interact with other smart home devices. The key theme summarized from user concerns revolves around verifiable performance improvement and the ethical use of collected viewing data used to fuel these AI processing algorithms.

AI's influence is transforming the market from a simple display technology evolution to a complex, intelligent system optimization. Modern Ultra HD TVs utilize specialized AI processors (often branded as Neural Quantum Processors or Cognitive Processors) designed to perform real-time image analysis. These processors analyze individual frames, identifying objects, textures, and scene types (e.g., sports, cinema, news), and apply sophisticated algorithms to reduce noise, sharpen edges, and adjust color mapping dynamically, far exceeding the capabilities of traditional static processors. This capability is paramount in 8K displays where the required processing power for upscaling and handling massive pixel counts demands machine learning optimization, ensuring optimal clarity and color rendition regardless of the source content quality.

Furthermore, AI extends beyond core visual processing into personalized user experiences and operational efficiency. AI is leveraged for personalized content curation, learning viewer preferences across different services and recommending optimal viewing modes (e.g., automatically engaging 'Game Mode' when a console is detected or 'Filmmaker Mode' for cinematic content). This enhancement of the user interface (UI) drastically improves navigation and search functionality. Operationally, AI contributes to predictive maintenance, optimizing panel longevity, and fine-tuning power consumption based on ambient light and usage patterns, thereby enhancing the overall energy efficiency and longevity of the Ultra HD television sets.

- Enhanced Picture Processing: AI upscaling maximizes clarity and reduces artifacts in non-native 4K/8K content.

- Dynamic Sound Optimization: AI adapts audio output based on room geometry and content type for an immersive experience.

- Personalized Content Recommendation: Machine learning algorithms analyze viewing history to curate tailored content lists.

- Voice Control and Smart Integration: AI drives highly accurate natural language processing for seamless smart home device connectivity.

- Predictive Maintenance: Algorithms monitor panel health and operational parameters to optimize performance and longevity.

- Optimized Display Settings: Real-time sensor input allows AI to automatically adjust brightness and contrast based on ambient light conditions.

DRO & Impact Forces Of Ultra HD Television Market

The Ultra HD Television market is shaped by a confluence of accelerating drivers (D), significant restraints (R), evolving opportunities (O), and pervasive impact forces (IF). Major drivers include the increasing penetration of streaming platforms requiring high-bandwidth, high-resolution playback, and the rapid expansion of affordable large-screen TV manufacturing capabilities, making 4K accessible to the middle-income segment globally. Restraints primarily involve the high initial cost of 8K technology, the significant bandwidth required for true 4K/8K streaming, and lingering consumer confusion regarding different HDR and display standards (OLED vs. QLED vs. Mini-LED), which can delay purchase decisions. Opportunities are ripe in developing economies characterized by high rates of first-time TV purchases and the potential for integrating Ultra HD displays into specialized commercial applications like digital signage and advanced medical imaging. These factors collectively establish the dynamic equilibrium within the competitive market landscape.

Impact forces govern the speed and direction of market shifts. Technological impact forces are particularly strong, centered on the constant iteration of display panel technology (e.g., the transition from traditional LED to Mini-LED backlighting) and the aggressive deployment of advanced processing chips focused on AI optimization. Economic impact forces, such as global macroeconomic instability and fluctuating component prices (especially semiconductors and display glass), directly influence final product pricing and profit margins for manufacturers. Furthermore, regulatory impact forces related to energy consumption standards (e.g., new EU energy efficiency mandates) compel manufacturers to continuously innovate product design, forcing them to adopt more efficient panel technologies despite the higher resolution requirements.

The interplay of these factors suggests that while technology adoption remains high, especially for 4K, the widespread commercialization of 8K faces friction due to content scarcity and infrastructure limitations. The sustained pressure from component shortages (a key restraint) intermittently affects manufacturing output, impacting pricing volatility. However, the overarching opportunity presented by the integration of TVs into the Internet of Things (IoT) ecosystem—transforming them into central command units for the smart home—provides a significant long-term growth trajectory that outweighs transient economic restraints. Manufacturers must strategically balance high R&D investment in advanced display technology with efficient supply chain management to capitalize on the sustained consumer demand for larger, higher-resolution viewing experiences.

Segmentation Analysis

The Ultra HD Television Market is comprehensively segmented based on technology, screen size, resolution, and distribution channel, providing a granular view of market dynamics and consumer preferences. Segmentation by technology is crucial, differentiating between traditional Liquid Crystal Display (LCD) panels, advanced Quantum Dot (QLED) technology, and superior Organic Light Emitting Diode (OLED) displays, each catering to different consumer segments based on performance expectations and budget constraints. This segmentation reflects the core R&D expenditure focus of key market players, influencing competitive positioning and pricing strategies across regions.

Screen size segmentation highlights evolving consumer preferences, particularly the shift towards large-format displays driven by decreasing costs and the perceived value of an immersive cinematic experience at home. While resolutions are typically segmented into 4K (which holds the majority share) and 8K (the nascent, high-end segment), the analysis of screen size against resolution provides essential insights into where 8K technology is currently viable and accepted by early adopters. The distribution channel segmentation, contrasting traditional retail with explosive growth in e-commerce, dictates logistics strategies and customer engagement models for manufacturers.

- By Technology:

- LED/LCD (including Mini-LED)

- OLED

- QLED

- MicroLED (Emerging)

- By Resolution:

- 4K Ultra HD

- 8K Ultra HD

- By Screen Size:

- Below 50 inches

- 50 to 65 inches

- 65 to 75 inches

- Above 75 inches

- By Application:

- Residential

- Commercial

- By Distribution Channel:

- Offline (Retail Stores, Hypermarkets)

- Online (E-commerce Platforms)

Value Chain Analysis For Ultra HD Television Market

The Ultra HD Television market's value chain is complex and involves multiple highly specialized stages, beginning with upstream component manufacturing. Upstream analysis focuses on the supply of critical raw materials and highly sophisticated components, including specialized display panels (OLED substrates, Quantum Dots, LCD glass), semiconductor chips (AI processors, T-con boards), and backlight modules (for LED/QLED). Key suppliers in this stage wield considerable negotiating power, particularly firms specializing in OLED and high-end chipsets, as technological exclusivity and capacity constraints often dictate production costs and lead times for downstream television manufacturers. Efficient management of these specialized suppliers is paramount for maintaining competitive manufacturing costs and stable supply.

Midstream activities involve the core manufacturing, assembly, integration of smart platforms, and rigorous quality control processes undertaken by major TV brands. This stage adds significant value through industrial design, proprietary software development (e.g., Tizen, webOS, Google TV), and advanced assembly techniques necessary for large-format, high-resolution panels. Downstream analysis focuses on logistics, distribution channels, and end-user sales. The distribution channel is bifurcated into direct sales (manufacturer websites, flagship stores) and indirect sales, primarily through massive retailers, consumer electronics chains, and rapidly growing e-commerce platforms. E-commerce platforms are increasingly preferred for large, high-value purchases due to competitive pricing and tailored logistics services.

The efficiency of the distribution channel is critical due to the bulky nature of Ultra HD TVs. Indirect channels rely on strong partnerships with major retailers, which offer physical visibility and installation services, particularly important for premium models. Direct channels, while offering higher margin capture, require substantial investment in logistics infrastructure. The value chain concludes with post-sale services, including installation, technical support, and warranty provisions, which significantly influence customer satisfaction and brand loyalty. Optimization across the entire chain, from securing advanced semiconductor supply to efficient last-mile delivery, determines the final product cost and market competitiveness.

Ultra HD Television Market Potential Customers

Potential customers for Ultra HD Televisions span several demographic and psychographic groups, anchored primarily by those seeking premium entertainment experiences and early adopters of cutting-edge technology. The primary target group consists of affluent homeowners and tech-savvy individuals globally who possess high disposable income and prioritize cinematic quality viewing and immersive gaming. These buyers typically seek large-format screens (65+ inches) and are willing to pay a premium for advanced technologies such as OLED or 8K resolution, valuing features like high refresh rates, exceptional black levels, and sophisticated smart home integration capabilities. This segment drives the adoption of the highest margin products in the market.

A secondary, but highly influential, customer base includes the mass market seeking replacement cycles for aging Full HD televisions. This demographic is highly sensitive to the declining price points of 4K LCD/QLED models, particularly in the 50-65 inch range. For these customers, the primary motivator is upgrading to current industry standards and accessing native 4K content available through subscription services. They prioritize reliability, smart functionality ease of use, and overall value proposition over bleeding-edge panel technology, representing the bulk volume driver for the market, particularly in rapidly urbanizing regions of Asia and Latin America.

Finally, commercial buyers represent a growing B2B segment, including hospitality providers, corporate offices, healthcare facilities, and specialized professional users. Hospitality sectors, such as high-end hotels, utilize Ultra HD TVs for in-room entertainment and digital signage, demanding durability and seamless network integration. Professional users, such as graphic designers and medical imaging specialists, require the superior color accuracy and high pixel density offered by professional-grade Ultra HD displays. These buyers often purchase in bulk, prioritizing long-term service agreements and robust operational reliability. These end-user segments represent distinct procurement cycles and require tailored marketing and service packages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $105.5 Billion |

| Market Forecast in 2033 | $265.8 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Electronics, Sony Corporation, Hisense, TCL Technology, Panasonic Corporation, Vizio, Sharp Corporation, Skyworth, Changhong, Haier, Xiaomi, JVCKenwood, Konka Group, Toshiba Visual Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra HD Television Market Key Technology Landscape

The Ultra HD Television market is fundamentally defined by continuous innovation in display technology, focusing on achieving deeper blacks, brighter peak luminance, and wider color gamuts. The current technological landscape is dominated by the competition between OLED (Organic Light Emitting Diode) and Quantum Dot (QLED) technologies. OLED panels are self-emissive, allowing for perfect blacks and infinite contrast, preferred by cinephiles and high-end consumers. Conversely, QLED, which combines traditional LCD backlighting with a layer of quantum dots, excels in peak brightness and color volume, making it highly effective in brightly lit environments and a staple in large-format, cost-effective Ultra HD offerings.

The emerging technological front involves Mini-LED and MicroLED. Mini-LED technology utilizes thousands of tiny LEDs for backlighting, drastically improving local dimming zones and enhancing contrast and HDR performance compared to standard LED. This serves as a significant bridge technology, bolstering the competitive stance of QLED and LCD manufacturers. MicroLED represents the future goal of the industry, combining the self-emissive properties of OLED with the brightness and longevity of traditional inorganic LEDs. Although currently confined to extremely large, premium commercial installations due to prohibitively high manufacturing costs, MicroLED promises the ultimate picture quality without the risks of burn-in associated with OLED.

Beyond the display panel itself, the technological landscape includes significant advancements in processing and connectivity. The adoption of HDMI 2.1 is critical, enabling high refresh rates (120Hz or higher) at 4K and 8K resolutions, essential for next-generation gaming consoles and high-fidelity PC connections. Furthermore, the integration of dedicated AI processors for sophisticated upscaling and real-time image optimization (as discussed in the AI analysis) is a standard feature in high-end models. These processing units are responsible for ensuring seamless interaction between complex display hardware and diverse streaming software platforms, guaranteeing a fluid and optimized viewing experience across varying source inputs and network speeds.

Regional Highlights

Regional dynamics play a crucial role in shaping the Ultra HD Television market, with distinct growth drivers and technological adoption patterns observed across major geographical areas. The Asia Pacific (APAC) region stands out as the primary market driver, characterized by massive volume sales, fueled by rapidly expanding middle-class populations in China and India, and high consumer interest in technological gadgets. Manufacturing hubs located within APAC also contribute to lower product costs and faster adoption cycles. The competition is intense, with regional brands leveraging cost-efficiency and localized smart features to gain market share, often prioritizing QLED and LED technologies for affordability.

North America (NA) represents the market leader in terms of revenue per unit and the adoption of large-screen, premium technology. Consumers in NA exhibit a strong propensity for replacement cycles, prioritizing high-end features such as 8K readiness, high-refresh-rate gaming specifications, and integrated smart assistants. The market is highly saturated, leading manufacturers to focus on premiumization strategies and direct-to-consumer models for high-value items. Europe, particularly Western Europe, mirrors North America in its focus on premiumization but shows a higher sensitivity to energy efficiency regulations and environmental mandates, favoring technologies that offer superior performance with lower power consumption, such as OLED displays.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets exhibiting high growth potential, though they are currently constrained by lower average disposable incomes and infrastructure limitations (e.g., lower average internet speeds impacting 4K streaming adoption). In these regions, 4K technology is gaining rapid traction, but often in smaller screen sizes compared to NA or Europe. Growth here is primarily driven by government initiatives to improve digital broadcasting and the expansion of affordable, entry-level Ultra HD models. Strategic partnerships between manufacturers and local content providers are essential for stimulating demand in these diverse regions, adapting product features to local content ecosystems.

- North America: Focus on premium large-screen models (75"+), high 8K adoption rates, driven by high disposable income and strong gaming culture.

- Europe: Strong preference for OLED technology, high adherence to strict energy efficiency standards (AEO consideration), and high replacement demand.

- Asia Pacific (APAC): Dominant market in terms of volume, driven by high population density, rapid urbanization, and competitive local manufacturing bases in China and South Korea.

- Latin America: High growth in 4K adoption, sensitive to price points, with demand concentrated in the 50-65 inch segments.

- Middle East and Africa (MEA): Emerging market with potential due to infrastructure improvements and increasing penetration of satellite and streaming services requiring UHD displays.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra HD Television Market.- Samsung Electronics

- LG Electronics

- Sony Corporation

- Hisense

- TCL Technology

- Panasonic Corporation

- Vizio

- Sharp Corporation

- Skyworth

- Changhong

- Haier

- Xiaomi

- JVCKenwood

- Konka Group

- Toshiba Visual Solutions

- Philips (TP Vision)

- Vestel

- Sceptre

- AOC

- Funai Electric

Frequently Asked Questions

Analyze common user questions about the Ultra HD Television market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between 4K and 8K Ultra HD resolutions?

4K Ultra HD resolution features 3,840 horizontal pixels and 2,160 vertical pixels, totaling approximately 8.3 million pixels. In contrast, 8K Ultra HD resolution doubles both the horizontal and vertical pixel counts to 7,680 by 4,320, resulting in over 33 million pixels—four times the clarity of 4K. While 4K is the current industry standard, 8K is an emerging technology primarily impacting very large screen sizes (75 inches and above) where the pixel density improvement is more noticeable.

Is there enough 4K and 8K native content available to justify an upgrade?

Yes, 4K content availability is robust and growing rapidly, driven by all major streaming services (e.g., Netflix, Hulu, Disney+) and physical media (4K Blu-ray). While native 8K content is currently scarce, premium Ultra HD televisions utilize advanced AI upscaling processors to significantly improve lower-resolution content to near-8K quality, ensuring an immediate benefit from the display’s capability even without dedicated 8K source material.

Which display technology is superior: OLED or QLED?

OLED (Organic Light Emitting Diode) is generally considered superior for contrast and deep blacks because each pixel emits its own light and can be completely turned off, offering perfect black levels and superior viewing angles. QLED (Quantum Dot LED), which uses an LED backlight, excels in peak brightness and color volume, making it highly effective in bright rooms. The choice depends on the viewing environment and priority: contrast (OLED) versus brightness (QLED).

What factors are primarily driving the price decline of Ultra HD televisions?

The primary drivers for price decline are improved panel manufacturing efficiency, particularly in China and South Korea, increased competition among global brands, and the maturation of 4K technology, which shifts focus towards the next generation (8K). Economies of scale achieved by producing larger volumes of 4K components also contribute significantly to reducing the average selling price across all screen size categories.

How does the integration of AI improve the user experience on new Ultra HD models?

AI integration significantly enhances picture quality through real-time processing and upscaling, delivering optimized clarity and reduced noise across various sources. Furthermore, AI powers smarter operating systems, offering highly personalized content recommendations, seamless voice control integration with smart home ecosystems, and dynamic audio adjustments based on the viewing environment, transforming the TV into an intelligent media hub.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager