Uniform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431560 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Uniform Market Size

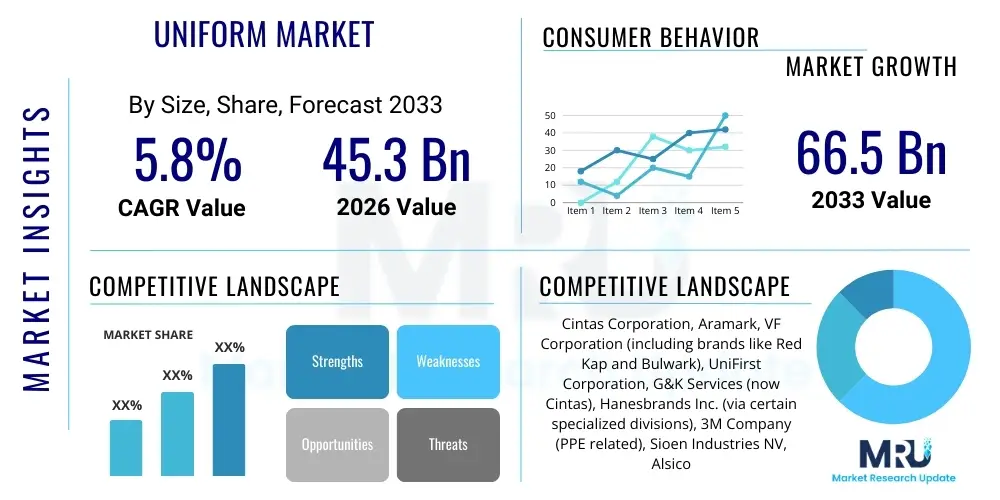

The Uniform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.3 Billion in 2026 and is projected to reach USD 66.5 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by stringent global workplace safety regulations, the consistent demand across critical sectors such as healthcare and manufacturing, and the increasing recognition of uniforms as essential elements of corporate branding and professional identity. The market's resilience, demonstrated even during economic fluctuations, highlights its foundational role in operational efficiency across various industries, necessitating continuous procurement and replacement cycles, thereby ensuring sustained revenue growth throughout the forecast period.

Market expansion is strategically driven by two key dynamics: volume growth in developing economies, particularly in Asia Pacific, which is experiencing rapid industrialization and expansion of its formal workforce, and value appreciation driven by technological advancements in developed markets. Developed regions prioritize high-performance fabrics, smart uniform integration, and sustainable sourcing, resulting in higher average selling prices (ASPs). The shift towards specialized protective clothing (e.g., fire-resistant, chemical-resistant uniforms) in heavy industries further contributes to the market's increasing valuation, as these specialized products command significant premiums due to their complex manufacturing processes and regulatory compliance requirements. Moreover, the emphasis on ergonomic design and comfort is becoming a standard feature, justifying higher investment in high-quality materials.

Uniform Market introduction

The Uniform Market encompasses the manufacturing, distribution, and sale of standardized clothing worn by members of an organization while participating in work or school activities. These specialized garments serve multiple critical functions, including ensuring safety (Personal Protective Equipment or PPE), projecting a unified corporate image, maintaining hygiene, and providing easy identification. Products range vastly, covering everything from highly technical, industry-specific protective gear used in chemical processing and firefighting to professional corporate attire utilized in the aviation, retail, and financial sectors, alongside high-volume demand from the healthcare and education industries. The foundational goal of the uniform remains consistent: to provide functional, durable, and recognizable apparel that meets specific regulatory and operational standards, enhancing organizational cohesion and external perception.

Major applications of uniforms span virtually every sector requiring a formalized dress code, including government and military agencies, hospitality (hotels, restaurants), transportation (airlines, logistics), and industrial environments (construction, manufacturing). Benefits derived from uniform implementation are multifaceted; they standardize quality and presentation, reduce internal socio-economic disparities among employees, and critically, ensure regulatory adherence, particularly regarding health and safety standards mandated by bodies like OSHA or equivalent international organizations. Functionally, modern uniforms integrate features such as moisture-wicking, antimicrobial properties, and durability optimized for repetitive industrial laundering, moving far beyond simple aesthetic requirements toward high-performance operational tools.

Driving factors propelling market growth include the rising globalization of corporate standards, which necessitates consistent branding across international operations, and increasingly stringent governmental mandates concerning employee safety in hazardous environments. Furthermore, demographic shifts, such as the expansion of the global service industry workforce and consistent investment in healthcare infrastructure globally, ensure a steady baseline demand. Innovation in material science, leading to lighter, more comfortable, and functionally superior fabrics (e.g., enhanced stretch, UV protection), also acts as a crucial driver, encouraging organizations to regularly update their uniform inventories to improve employee comfort and performance metrics.

Uniform Market Executive Summary

The Uniform Market is experiencing robust growth driven by escalating compliance mandates, evolving material technology, and a pronounced strategic shift towards uniforms as a key element of corporate identity management. Business trends indicate a movement toward integrated service models, where large market players offer full-service uniform programs encompassing design, manufacturing, inventory management, laundering, repair, and disposal, minimizing administrative burden for clients. This consolidation of services enhances customer retention and optimizes supply chain efficiency. Furthermore, there is a distinct surge in demand for sustainable uniforms, incorporating recycled or organically sourced fibers, responding to increasing corporate social responsibility (CSR) initiatives and consumer environmental awareness, fundamentally altering sourcing and manufacturing practices across the industry.

Regional trends highlight the Asia Pacific (APAC) as the epicenter of volume manufacturing and the fastest-growing consumption market, attributed to massive industrial growth, particularly in China, India, and Southeast Asian nations, where formal employment sectors are rapidly expanding. Conversely, North America and Europe remain key markets for value innovation, demonstrating high expenditure on performance-based and smart uniforms, and pioneering ethical sourcing and circular economy models for textile usage. Regulatory environments in Europe, specifically regarding labor standards and environmental impact, heavily influence purchasing decisions, leading to higher adoption rates of premium, ethically manufactured apparel compared to cost-sensitive procurement in emerging markets, thus creating a dual structure in global demand.

Segmentation trends reveal healthcare as the dominant end-user segment due to the non-negotiable demand for high-hygiene, specialized surgical, and patient care uniforms, amplified by global health crises and continuous healthcare infrastructure investment. In terms of product type, the functional apparel segment (including flame-resistant and high-visibility clothing) is outpacing general corporate wear, reflecting the increasing prioritization of worker protection in industrial settings. Technology adoption is further segmenting the market, with "smart uniforms" integrating IoT devices for monitoring health and safety metrics (e.g., temperature, posture, location tracking) emerging as a high-growth niche, primarily targeting high-risk professions like mining, construction, and specialized manufacturing operations, demanding significant capital investment in textile technology.

AI Impact Analysis on Uniform Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Uniform Market reveals predominant concerns centered on supply chain agility, personalized fit solutions, and predictive demand forecasting. Users frequently inquire about how AI can optimize inventory levels to minimize waste and stockouts, particularly for customized or seasonal uniforms. There is significant interest in AI-driven design tools that could generate functional and aesthetically compliant uniform prototypes faster, reducing the time-to-market. Furthermore, questions often focus on the ethical implications and data security associated with integrating AI-powered tracking and monitoring capabilities into smart uniforms, especially concerning employee privacy and data ownership in high-surveillance environments.

The key themes emerging from user inquiries demonstrate an expectation that AI will transition the uniform industry from a reactive, volume-driven model to a predictive, highly personalized service model. Users anticipate AI will solve complex logistical challenges inherent in managing diverse sizing matrices and varying global regulatory requirements. The concern about material wastage due to overproduction is prominent, leading to inquiries about AI-optimized cutting patterns and sustainable sourcing recommendations. Ultimately, stakeholders view AI not just as a tool for efficiency, but as a mechanism for elevating uniform standards across durability, comfort, and compliance while simultaneously tackling environmental impact challenges.

- AI-driven Demand Forecasting: Utilizes machine learning algorithms to predict future uniform needs based on seasonal trends, employee turnover rates, economic indicators, and regulatory changes, drastically reducing overstocking and obsolescence.

- Optimized Supply Chain Logistics: AI manages complex global sourcing networks, identifying optimal material routes and predicting potential delays (e.g., port congestion, geopolitical disruptions), ensuring timely delivery of contractual uniform orders.

- Mass Customization and Sizing: AI-powered body scanning and 3D modeling technologies allow for highly accurate, personalized sizing recommendations, minimizing returns and improving employee comfort and fit, crucial in minimizing uniform complaints.

- Material Science Acceleration: AI assists in simulating material performance under various conditions (e.g., friction, chemical exposure, heat), accelerating the R&D cycle for new, high-performance, and sustainable uniform fabrics, such as self-cleaning or adaptive temperature materials.

- Quality Control Automation: Machine vision and AI systems are deployed on manufacturing lines to rapidly detect minute defects in fabric consistency, stitching quality, and color compliance, ensuring adherence to rigorous industry standards before final shipment.

- Enhanced Inventory Management: Predictive maintenance planning and real-time inventory tracking, often involving RFID tags linked to AI systems, manage the lifecycle of thousands of individual uniform pieces, determining optimal replacement timing and laundry cycles.

DRO & Impact Forces Of Uniform Market

The Uniform Market's trajectory is defined by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction for stakeholders. Primary drivers include the global tightening of safety legislation, mandating specialized PPE in industries like oil and gas, healthcare, and construction, thus creating non-discretionary procurement cycles. Furthermore, the strategic adoption of uniforms as a core component of organizational culture and branding, especially within consumer-facing service industries, continues to elevate demand, as companies seek tangible ways to differentiate their employee presence. These factors are compounded by economic recovery and sustained investment in industrial and infrastructural projects globally, ensuring continuous demand for labor-intensive sector uniforms. However, the market faces significant restraints, chiefly volatility in raw material prices (cotton, polyester fibers), which impacts profitability and necessitates complex hedging strategies for manufacturers, alongside the inherent high cost and logistical complexity of managing expansive, multi-location uniform programs.

Opportunities for growth are abundant, particularly in the rapid development and commercialization of smart textiles and IoT integration, allowing uniforms to serve functional roles beyond protection and aesthetics, such as monitoring biometric data or environmental conditions. The increasing global focus on sustainability presents a major avenue for innovation, pushing manufacturers towards circular economy models, utilizing recycled fibers, and implementing advanced textile recycling programs. These opportunities align perfectly with AEO and GEO principles, catering to user inquiries about responsible sourcing and technological integration. The market's competitive structure is also subject to internal and external impact forces. Internally, differentiation through superior product durability, customization capabilities, and speed of service delivery are paramount competitive factors. Externally, geopolitical shifts affecting trade tariffs and labor costs in major manufacturing hubs (e.g., Southeast Asia) directly influence supply chain decisions and pricing strategies globally, demanding exceptional strategic agility from market leaders.

The market faces significant impact forces from substitutes, primarily the growing trend of casual corporate wear, which, while not replacing specialized industrial uniforms, can dampen growth in the traditional corporate apparel segment. However, the essential nature of most uniform applications—safety and hygiene—provides a substantial buffer against substitution risks in critical sectors. The negotiating power of buyers, especially large multinational corporations seeking multi-year, fixed-price contracts for thousands of employees, remains high, constantly pressuring manufacturers on pricing and service guarantees. This constant pressure necessitates operational excellence, leveraging economies of scale, and adopting advanced manufacturing technologies to maintain competitive margins in a high-volume, low-margin environment while simultaneously catering to premium, high-specification demands.

Segmentation Analysis

The Uniform Market is highly segmented across various dimensions, including product type, material, end-user industry, and geographical region, reflecting the diverse functional and regulatory requirements of the global workforce. This segmentation is crucial for understanding specific growth pockets and tailoring product development and marketing strategies effectively. The complexity of end-user demands, ranging from sterile environments in hospitals to high-heat exposure in metallurgy, requires manufacturers to maintain highly specialized production lines and extensive product catalogues. The most prominent segmentation variable remains the end-user application, as this dictates the necessary performance specifications, material composition, and regulatory compliance requirements for the final garment, such as anti-static properties in electronics manufacturing or fluid resistance in surgical settings. The continuous emergence of new safety standards across different jurisdictions ensures that specialization within these segments remains highly profitable.

Segmentation by material is increasingly relevant, driven by sustainability and performance demands. Traditional materials like cotton and polyester remain dominant by volume, particularly in corporate and education sectors due to cost-effectiveness and breathability. However, the high-growth segments are increasingly dominated by blended fabrics that integrate enhanced functionality, such as moisture-wicking synthetics, aramid fibers for fire resistance, or recycled polyester addressing environmental concerns. Manufacturers are actively investing in R&D to develop proprietary blends that offer optimal combinations of durability, comfort, and protection, often focusing on lightweight solutions that do not compromise safety. This material diversification provides buyers with greater choices but also introduces complexity in procurement and end-of-life management.

- By Product Type:

- Workwear (Industrial, Construction, Automotive)

- Corporate Wear (Office, Retail, Aviation)

- Service Wear (Hospitality, Catering, Cleaning)

- Protective Clothing (FR, Chemical Resistant, High Visibility)

- Healthcare/Medical Uniforms (Scrubs, Lab Coats, Patient Gowns)

- Education/School Uniforms

- Military and Public Safety Uniforms

- By Material:

- Cotton and Cotton Blends

- Polyester and Polyester Blends (Recycled and Virgin)

- Nylon and Synthetic Fibers

- Aramid Fibers (Kevlar, Nomex)

- Other Specialty Materials (e.g., Vinyl, Rayon, Wool Blends)

- By End-User Industry:

- Healthcare and Pharmaceuticals

- Manufacturing and Automotive

- Construction and Infrastructure

- Service and Hospitality

- Government and Defense

- Retail and Logistics

- Education

- By Gender:

- Male

- Female

- Unisex

Value Chain Analysis For Uniform Market

The Value Chain for the Uniform Market is multifaceted and extends from the initial sourcing of raw materials to the final end-of-life garment disposal, requiring sophisticated coordination across multiple specialized sectors. Upstream analysis focuses predominantly on the procurement of textile fibers, involving relationships with chemical companies (for synthetic fibers like polyester and nylon) and agricultural commodity suppliers (for natural fibers like cotton). Volatility in commodity pricing and ethical sourcing requirements (e.g., organic cotton, conflict-free minerals for specialty dyes) are major factors at this stage. The subsequent manufacturing phase involves spinning, weaving/knitting, dyeing, finishing (adding antimicrobial or flame-retardant properties), and cut-and-sew operations. Efficiency and compliance with labor standards are critical performance indicators in this manufacturing core, which is heavily concentrated in low-cost regions like China, Vietnam, and Bangladesh, although automation is increasing in high-wage economies to ensure supply chain resilience and quality control.

Midstream activities involve sophisticated logistics and inventory management. Unlike standard apparel, uniforms often require detailed customization (logo embroidery, specialized pockets, name tags) and rigid batch control to ensure color consistency across large orders delivered over extended periods. Direct distribution channels are highly favored, especially for large industrial contracts and healthcare systems, where manufacturers or specialized uniform service providers manage the entire lifecycle through dedicated rental or leasing programs. These providers own the inventory, manage the complex laundering cycles necessary for hygiene (e.g., sterilization in medical settings), and handle repairs, providing a seamless service package to the end-user. This B2B contract model emphasizes service reliability and long-term partnership over transactional sales, creating high barriers to entry for smaller players.

Indirect distribution primarily occurs in the small-to-medium enterprise (SME) sector, school uniform sales, and retail sales of specialized protective gear, utilizing third-party distributors, wholesalers, and increasingly, e-commerce platforms. E-commerce enables rapid global distribution of standard catalogue items and facilitates reordering, although the complexity of fitting and customization often limits its role in highly technical or regulated segments. Downstream activities are heavily focused on customer relationship management, including robust after-sales support, fitting services, and ensuring timely replacement of worn-out garments to maintain safety and corporate image consistency. The increasing emphasis on sustainable disposal and recycling protocols is also becoming a critical, high-value downstream service, particularly for companies focused on circularity and minimizing their environmental footprint, thereby adding a layer of complexity to traditional garment management.

Uniform Market Potential Customers

Potential customers for the Uniform Market encompass virtually all organizations that require a standardized appearance, ensure employee safety, or operate within regulated hygienic environments. The most substantial buyers are large, multinational corporations across the healthcare, manufacturing, and transportation sectors, purchasing in massive volumes under long-term supply and service agreements. Healthcare systems (hospitals, clinics, nursing homes) are constant high-volume buyers, driven by infection control mandates and the necessity for specific, frequently laundered items like scrubs, patient gowns, and specialized surgical drapes. These customers prioritize sterility, durability against harsh chemicals and high-temperature washing, and adherence to medical grade textile standards, often requiring stringent supplier certifications.

The second major segment includes industrial customers, specifically those in energy (oil, gas, power generation), heavy construction, and specialized manufacturing (chemicals, aerospace). These buyers require uniforms that function as critical Personal Protective Equipment (PPE), specifically demanding flame-resistant (FR), arc-flash rated, or highly visible garments compliant with local, national, and international safety standards. Procurement decisions here are heavily weighted toward certified safety features and demonstrable product reliability, often necessitating specialized training for end-users on garment care and limitations. Uniforms in this segment are viewed as safety capital expenditures rather than simple apparel costs, influencing purchasing dynamics.

Finally, the corporate and service sectors—including retail chains, airlines, logistics providers, and educational institutions—constitute substantial market volume, prioritizing brand alignment, aesthetic quality, comfort, and consistent fit across diverse employee demographics. These customers leverage uniforms as powerful marketing and cultural tools, demanding customized design options, consistent color matching, and easy scalability for rapid workforce expansion or organizational changes. For all customer types, the trend is moving away from outright purchase towards managed service contracts, where the uniform provider assumes the logistical burden of inventory, cleaning, and maintenance, simplifying the process for the end-user organization and ensuring compliance longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.3 Billion |

| Market Forecast in 2033 | USD 66.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cintas Corporation, Aramark, VF Corporation (including brands like Red Kap and Bulwark), UniFirst Corporation, G&K Services (now Cintas), Hanesbrands Inc. (via certain specialized divisions), 3M Company (PPE related), Sioen Industries NV, Alsico Group, F. Engel K/S, Dickies (Workwear), Strategic Partners, Inc., Superior Group of Companies, Inc., WESCO International, ADI Group, Lakeland Industries, Inc., Carhartt, Inc., Kimberley-Clark Professional, VF Imagewear. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Uniform Market Key Technology Landscape

The Uniform Market's technological landscape is rapidly advancing, moving far beyond basic textile manufacturing to incorporate specialized material science and digital integration. A primary focus is placed on performance fabrics designed to enhance safety, comfort, and hygiene. Innovations include advanced moisture management systems that wick sweat away more efficiently, anti-microbial treatments crucial for the healthcare and food service sectors to reduce infection transmission, and next-generation flame-resistant (FR) materials that offer superior protection while being significantly lighter and more breathable than traditional alternatives. These technological leaps are driven by the need to comply with increasingly strict occupational health and safety (OHS) standards globally, demanding continuous investment in textile finishing and treatment processes that maintain integrity over industrial laundering cycles, maximizing the return on investment for end-users.

Manufacturing efficiency is being revolutionized by the adoption of Industry 4.0 principles, including high levels of automation, robotics in cut-and-sew operations, and computerized pattern optimization to minimize material waste—a critical factor in driving down costs and improving sustainability metrics. Mass customization technology, often facilitated by 3D body scanning and computer-aided design (CAD), allows manufacturers to quickly produce customized uniforms tailored to individual employee measurements and specific departmental requirements without the cost penalties traditionally associated with bespoke tailoring. This capability is paramount for securing high-value contracts with large organizations that require precise fit and personalized embroidery across thousands of employees in diverse roles, ensuring both professional appearance and ergonomic comfort in demanding work environments.

The most transformative technology in the long term is the integration of Smart Uniforms, leveraging the Internet of Things (IoT). These uniforms embed sensors and microelectronics directly into the fabric, enabling real-time monitoring of vital signs (heart rate, body temperature), environmental exposure (toxic gases, radiation levels), and location tracking. This is particularly valuable in high-risk sectors such as mining, military, and infrastructure construction, where immediate alerts regarding worker fatigue or exposure can prevent severe accidents. While still in the early adoption phase due to cost and data privacy concerns, the potential safety benefits and operational insights offered by smart uniforms are substantial, positioning this segment for exponential growth, heavily reliant on sophisticated material science for flexible, durable, and washable electronic components.

Regional Highlights

- North America: This region represents a highly mature and high-value market, characterized by stringent safety regulations (OSHA compliance) and a strong emphasis on service-based uniform rental and leasing programs, dominated by major integrated service providers like Cintas and Aramark. Demand is heavily concentrated in the healthcare, industrial maintenance, and energy sectors, which prioritize high-performance and safety-certified uniforms (e.g., NFPA 2112 for FR apparel). The market exhibits a high propensity for adopting technological innovations, including personalized fitting and early implementation of smart uniform solutions. The stability of long-term contracts and the requirement for sophisticated laundering services contribute to the region's high average revenue per user (ARPU) compared to other global markets. The United States accounts for the bulk of the regional market, driven by its expansive service economy and robust industrial base, focusing on lifecycle management and sustainable disposal solutions to meet corporate ESG goals.

- Europe: The European Uniform Market is defined by a strong regulatory framework governing worker protection, coupled with a significant focus on ethical sourcing, transparency, and environmental sustainability (EU Green Deal implications). Countries like Germany, the UK, and France maintain substantial demand across healthcare, specialized manufacturing, and public transport sectors. European buyers often prioritize durability, high aesthetic standards, and sustainable materials (e.g., Tencel, organic cotton, recycled polyester), leading to a higher willingness to pay for premium, certified products. The labor laws in many European nations necessitate high standards of employee comfort and ergonomic design. The market is moderately fragmented, with strong regional suppliers specializing in niche areas like protective footwear integration or eco-certified textiles, alongside major multinational players offering pan-European service contracts.

- Asia Pacific (APAC): APAC is the engine of volume growth in the global Uniform Market, driven by explosive industrialization, massive workforce expansion, and increasing penetration of formal employment structures, particularly in countries like India, China, and Southeast Asia. This region serves dual roles: it is the primary global manufacturing hub for general uniform apparel due to lower labor costs and extensive textile infrastructure, and simultaneously, it is the fastest-growing consumption market. While initial adoption focuses on cost-effectiveness and durability, regulatory compliance standards, particularly for PPE in manufacturing and infrastructure projects (driven by foreign investment mandates), are rapidly strengthening, leading to rising demand for specialized, high-specification protective gear, which is beginning to shift the market towards value-based purchasing.

- Latin America: The Latin American Uniform Market is characterized by steady growth, primarily fueled by the expanding retail sector, hospitality industry, and resource extraction (mining and oil & gas). Economic volatility remains a restraint, but large multinational corporations operating within the region enforce global safety and branding standards, ensuring persistent demand for industrial and protective uniforms. Brazil and Mexico are the largest national markets, requiring localization of supply chains and distribution networks. The market often sees a mixture of imported, high-specification uniforms (especially for PPE) and locally manufactured, cost-competitive general corporate wear, reflecting the economic diversity and differing regulatory enforcement levels across various nations in the region.

- Middle East and Africa (MEA): Growth in the MEA region is strongly linked to massive infrastructure development projects, large-scale construction, and the expanding tourism and aviation sectors, particularly in the GCC countries. The Middle East demonstrates high demand for uniforms designed to withstand extreme climatic conditions (heat management, UV protection). Procurement often involves large, government-backed contracts for public services, military, and state-owned enterprises, valuing durability and high volume supply capabilities. The African market is more nascent but growing, driven by expansion in healthcare and manufacturing, presenting opportunities for affordable, functional workwear solutions adapted to local climatic and logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Uniform Market.- Cintas Corporation

- Aramark Corporation

- UniFirst Corporation

- VF Corporation (including brands like Red Kap and Bulwark)

- Superior Group of Companies, Inc.

- Alsico Group

- Sioen Industries NV

- F. Engel K/S

- Strategic Partners, Inc. (Focus on Healthcare)

- Aditya Birla Group (Textile and Manufacturing)

- WESCO International (via PPE distribution)

- Carhartt, Inc.

- Dickies (Workwear)

- Kimberley-Clark Professional

- Lakeland Industries, Inc.

- 3M Company (Specialized components and PPE)

- Honeywell International Inc. (Safety and Protective Uniforms)

- Alsco Uniforms

- Gildan Activewear Inc. (Base apparel supply)

- VF Imagewear

Frequently Asked Questions

Analyze common user questions about the Uniform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Uniform Market?

The Uniform Market is primarily driven by three core factors: stringent governmental and industry safety regulations necessitating certified Personal Protective Equipment (PPE); the increasing strategic use of uniforms for corporate branding, identity, and customer trust; and continuous growth in workforce size across global healthcare, manufacturing, and service industries, ensuring perpetual replacement demand.

How is sustainability impacting material sourcing in the Uniform industry?

Sustainability is profoundly impacting sourcing by pushing manufacturers toward circular economy models, utilizing recycled polyester from plastic bottles, incorporating organic cotton, and demanding full traceability of raw materials. This shift addresses corporate ESG mandates and minimizes textile waste, leading to a premium market segment focused entirely on eco-friendly, durable uniform options.

What role does technology play in modern uniform manufacturing and design?

Technology facilitates mass customization through 3D body scanning for optimal fit, employs AI for highly accurate demand forecasting and inventory management, and integrates material science innovations for enhanced performance fabrics (e.g., antimicrobial, flame-resistant). Furthermore, IoT technology is enabling smart uniforms for real-time employee safety and health monitoring in high-risk environments.

Which end-user segment commands the largest share of the Uniform Market?

The Healthcare and Medical segment currently commands the largest share of the market. This dominance is due to the mandatory, high-volume requirement for specialized, sterile, and frequently replaced uniforms (scrubs, gowns) necessary for infection control, coupled with consistent global investment and expansion in medical infrastructure and services.

What are the major challenges faced by uniform suppliers regarding the supply chain?

Major supply chain challenges include managing volatility in raw material commodity prices, navigating complex global trade tariffs and labor regulations across manufacturing hubs, and ensuring logistical efficiency for highly customized, multi-location contract fulfillment, often requiring rigorous quality control and extended warranty agreements to maintain service credibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- School Uniform Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Workwear and Uniform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chef Uniform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- School Uniform Market Size Report By Type (Sportswear, Suits, Traditional Uniforms, Other), By Application (Primary School, Middle/Senior High School, College), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fiber Bragg Grating (Fbg) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Uniform Fiber Bragg Grating, Non-Uniform Fiber Bragg Grating), By Application (Optical Fiber Communications, Optical Fiber Sensing, Optical Information Processing), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager