Used Car Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432897 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Used Car Market Size

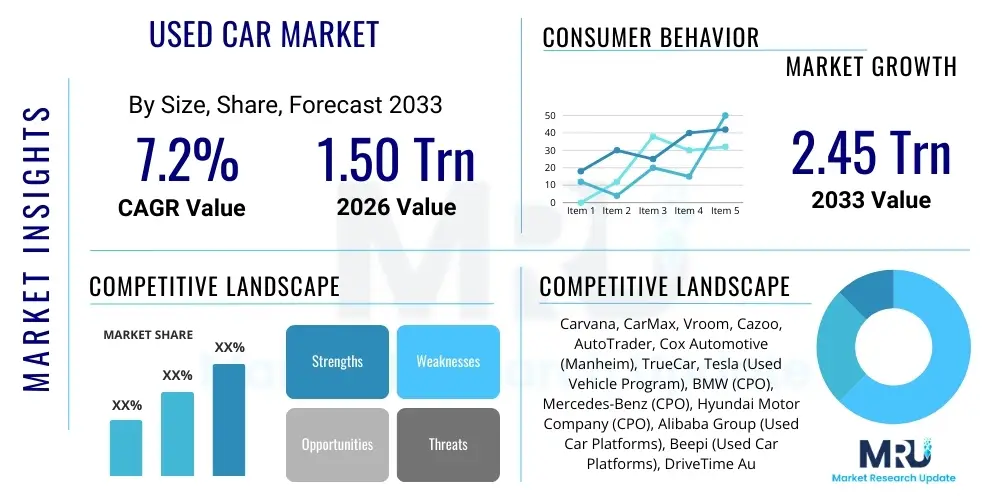

The Used Car Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 1.50 Trillion in 2026 and is projected to reach USD 2.45 Trillion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing affordability of pre-owned vehicles compared to new counterparts, coupled with evolving consumer preferences leaning towards cost-effective personal transportation solutions, especially in emerging economies.

The resilience of the used car sector post-economic fluctuations highlights its crucial role in the global automotive landscape. Factors such as prolonged vehicle lifespans due to manufacturing quality improvements, coupled with sophisticated digital platforms simplifying the transaction process, are significantly contributing to market value enhancement. Furthermore, the global semiconductor shortage impacting new vehicle production has consistently channeled consumer demand toward high-quality used inventory, pushing up average transaction prices and overall market valuation.

Used Car Market introduction

The Used Car Market encompasses the trade of pre-owned vehicles, including passenger cars, light commercial vehicles, and heavy trucks, facilitated through organized dealers, independent sellers, and online platforms. The market scope covers various vehicle types segmented by age, fuel type, and body style. A primary driver for this market is the inherent value proposition: used cars offer immediate availability and lower depreciation rates compared to new vehicles, making them highly attractive to first-time buyers and budget-conscious consumers globally. The recent proliferation of certified pre-owned (CPO) programs, backed by Original Equipment Manufacturers (OEMs), has introduced a higher level of trust and quality assurance, bolstering consumer confidence and standardizing market practices.

Major applications for used vehicles span personal mobility, fleet operations, ride-sharing services, and last-mile logistics. Benefits of engaging with the used car market include significant cost savings, lower insurance premiums in some regions, and access to luxury or higher-spec models that might be financially prohibitive when purchased new. Key driving factors accelerating market expansion include rapid urbanization in Asia Pacific, the increasing disposable income of middle-class populations, favorable financing options specifically tailored for pre-owned vehicles, and regulatory support encouraging the scrapping of older, polluting vehicles, thereby replenishing the supply of slightly used cars.

The digital transformation has revolutionized the used car ecosystem. Online platforms provide detailed vehicle history reports, 360-degree virtual tours, and seamless transaction capabilities, reducing information asymmetry that historically plagued the market. This transparency has fostered cross-regional sales and introduced specialized services such as subscription models for pre-owned vehicles. As the global supply chain stabilizes, the balance between new and used vehicle inventory is expected to normalize, but the established trust in certified used channels ensures continued market vibrancy and steady growth throughout the forecast period.

Used Car Market Executive Summary

The Used Car Market is experiencing robust business trends characterized by digitalization, consolidation, and the increasing influence of certified pre-owned programs. Key business trends involve aggressive investment by venture capitalists into used car marketplaces (e.g., Carvana, Cazoo, Vroom), focusing on enhancing the end-to-end digital purchasing experience, including financing and delivery. This shift from physical auctions to transparent online retail models is driving market efficiency and expanding geographical reach. Furthermore, OEMs are increasingly recognizing the value of the used car sector, integrating trade-in processes directly into their sales funnel to manage residual values and secure future customers.

Regionally, the market dynamics vary significantly. North America and Europe possess mature markets dominated by organized retail, stringent CPO standards, and high consumer turnover rates, often driven by cyclical trade-ins every three to five years. Conversely, Asia Pacific represents the fastest-growing region, fueled by rapid motorization, limited public transport infrastructure in secondary cities, and a large population base entering the vehicle ownership cycle, frequently starting with pre-owned vehicles. Latin America and MEA are focused on importing low-cost used vehicles and developing localized financing mechanisms to cater to nascent but rapidly expanding consumer bases.

Segment trends indicate strong preference growth for used SUVs and trucks, mirroring new car market trends. The fuel type segmentation highlights sustained demand for used gasoline and diesel vehicles due to their affordability, although electric vehicle (EV) residuals are becoming a critical factor. The emerging segment of used EVs, while currently small, is poised for explosive growth as leasing cycles mature and initial high ownership costs of new EVs make the used models highly desirable. Organizationally, the transition from unorganized, individual sellers toward large, multi-brand dealerships and high-tech online retailers is the most defining segment trend, guaranteeing reliability and standardization for consumers.

AI Impact Analysis on Used Car Market

Common user questions regarding AI in the Used Car Market typically center on how technology can guarantee fair pricing, prevent fraudulent transactions, improve the financing process, and personalize the buying journey. Users are primarily concerned with whether AI algorithms can accurately predict vehicle depreciation, determine the optimal time to sell or buy, and seamlessly integrate vehicle history checks (like VIN data analysis) to ensure transparency. The collective expectations revolve around achieving maximum price efficiency, minimizing human error in inspection and valuation, and speeding up the often cumbersome underwriting process for used vehicle loans. There is significant interest in AI’s role in automating inventory management and optimizing logistics for last-mile delivery of purchased vehicles.

AI's influence is profound, transforming the market from a traditional, negotiation-heavy process into a data-driven, precise retail operation. AI algorithms are instrumental in real-time pricing adjustments based on thousands of variables, including local demand, economic indicators, weather patterns, and competitive pricing data. This dynamic pricing model ensures that sellers maximize returns while buyers receive competitive, transparent offers, thus reducing the negotiation time and enhancing buyer trust. Furthermore, AI-powered predictive maintenance diagnostics, integrated into modern vehicle sensors, are increasingly utilized to assess the true condition and remaining lifespan of critical components in used vehicles, moving beyond simple visual inspections.

In customer service and marketing, AI drives sophisticated personalization. Chatbots and virtual assistants handle initial inquiries, streamlining lead qualification and providing immediate information availability 24/7. Machine learning models analyze buyer behavioral data, suggesting vehicles that match not just budget, but also lifestyle and historical preferences, significantly increasing conversion rates for online retailers. Crucially, AI is rapidly being deployed in fraud detection and risk assessment during the financing application phase, cross-referencing identity documentation and financial histories far faster and more accurately than traditional methods, thereby accelerating loan approvals and mitigating financial risks for lenders.

- AI-driven Dynamic Pricing: Utilizes machine learning to optimize vehicle valuation based on real-time market fluctuations, condition reports, and regional demand, ensuring fair transaction prices.

- Predictive Maintenance Analysis: AI processes telematics and sensor data to predict component failure in used vehicles, enabling more accurate condition reporting and extended warranty offerings.

- Enhanced Fraud Detection: Sophisticated algorithms scrutinize financing applications and vehicle history reports to quickly identify and flag fraudulent activities, improving trust and security.

- Personalized Customer Experience: AI chatbots and recommendation engines tailor inventory suggestions and communication based on individual browsing and purchasing history, optimizing the sales funnel.

- Automated Inventory Management: Machine learning optimizes logistics, warehousing, and refurbishment scheduling, minimizing holding costs and accelerating time-to-market for acquired vehicles.

DRO & Impact Forces Of Used Car Market

The Used Car Market is propelled by powerful drivers centered on economic affordability and digital convenience, notably the lower entry barrier for vehicle ownership and the transparency afforded by online platforms. Restraints primarily involve persistent consumer skepticism regarding vehicle quality, the fragmentation of the supply chain in developing regions, and the risk associated with non-standardized private sales. Opportunities abound in the burgeoning electrification trend, where the used EV market is set to accelerate, and in the adoption of subscription models offering flexible ownership without long-term commitment. These forces combine to create a dynamic environment where economic necessity meets technological innovation, shaping investment patterns and regulatory responses.

Key drivers include the global trend of diminishing vehicle depreciation rates for high-demand models, the expansion of dealer-certified programs guaranteeing quality, and the increasing availability of dedicated used car financing options with competitive interest rates. Conversely, a significant restraint is the varying regulatory landscape concerning vehicle emissions and age limits across countries, which can suddenly render large segments of used inventory non-compliant or prohibitively expensive to maintain. Additionally, the lack of standardized global vehicle history reporting makes cross-border transactions complex and risky, occasionally dampening international trade flows in pre-owned vehicles.

The primary opportunity lies in integrating advanced diagnostics and blockchain technology for immutable vehicle history records, which will further minimize fraud and enhance consumer trust, particularly beneficial for high-value segments. The increasing lifespan of vehicles due to enhanced manufacturing quality also provides a long-term supply of used vehicles that are economically viable to refurbish. Impact forces driving market evolution include socio-economic shifts like rising fuel costs pushing demand toward smaller, more efficient used cars, and rapid technological diffusion compelling traditional dealerships to adopt omnichannel strategies or face obsolescence. The transition towards CPO and high-quality inventory is a critical mitigating force against historical quality concerns.

Segmentation Analysis

The Used Car Market is segmented based on vehicle type, organization, fuel type, age of vehicle, and sales channel, providing a granular view of consumer preferences and market structure. This multi-dimensional segmentation is crucial for stakeholders to tailor their inventory acquisition, pricing strategies, and marketing efforts. The segmentation by organization—organized vs. unorganized sectors—is especially important in identifying growth pockets, as the shift from independent, often informal transactions (unorganized) to certified, professional dealerships (organized) dictates reliability and scale within the market.

The analysis reveals that the passenger vehicle segment holds the largest market share globally due to universal demand for personal mobility. Within this, the SUV/MUV category exhibits the fastest growth trajectory, consistent with new car purchasing trends. Fuel type segmentation shows a gradual but significant movement toward used hybrid and electric vehicles, although internal combustion engine (ICE) vehicles, particularly gasoline models, dominate the volume segment due to historical installed base and lower initial purchase prices. Furthermore, the segmentation by vehicle age highlights strong demand for vehicles aged between 3 and 5 years, which typically offer the best balance between lower prices and remaining warranty or reliability.

The sales channel segmentation is currently undergoing the most disruptive change, with the online/e-commerce channel rapidly capturing market share from traditional physical dealerships and C2C sales. Digital platforms offer convenience, competitive financing, and standardized inspection processes, appealing to digitally native consumers. Understanding these segment dynamics allows OEMs to better manage residual values for their new models and enables specialized retailers to focus on high-margin niches, such as luxury used cars or specialty commercial vehicles, thus maximizing profit margins within the competitive landscape.

- By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- By Fuel Type:

- Gasoline

- Diesel

- Electric (EV)

- Hybrid

- By Organization:

- Organized Sector (Dealerships, Certified Programs, Online Retailers)

- Unorganized Sector (Independent Dealers, C2C Sales)

- By Vehicle Age:

- Less than 3 Years

- 3 to 5 Years

- 5 to 8 Years

- Above 8 Years

- By Sales Channel:

- Dealerships (Physical Stores)

- Online Platforms/E-commerce

- Auctions (Physical & Digital)

Value Chain Analysis For Used Car Market

The Used Car Market value chain is complex, starting with vehicle sourcing (upstream activities) and concluding with the sale and post-sale services (downstream activities). Upstream activities involve acquiring inventory from various sources, including direct consumer trade-ins, corporate fleet disposals, rental agency fleet retirement, and wholesale auctions. The efficiency of this sourcing phase dictates the quality and volume of inventory available. Key focus areas upstream include accurate initial vehicle assessment, securing favorable acquisition prices, and efficient logistical retrieval of the assets. The introduction of digital auction platforms has significantly streamlined this sourcing, reducing geographical limitations for buyers.

Midstream processes center on inspection, reconditioning, and certification. This includes mechanical repairs, bodywork, detailing, and passing stringent quality checks, particularly for Certified Pre-Owned (CPO) programs. This stage adds significant value by mitigating perceived risk and improving vehicle presentation. Downstream activities involve marketing, sales, financing, insurance provision, and vehicle delivery. Sales channels are predominantly direct (dealerships, online retailers selling directly to consumers) and indirect (brokers, smaller independent lots relying on wholesale). The modern trend heavily favors direct digital sales channels, which bypass intermediate steps, offering greater transparency and control over the customer experience.

Distribution channels are evolving rapidly. Traditional distribution relied heavily on physical lots and regional boundaries. However, the rise of e-commerce giants allows for national or even international distribution, where vehicles are purchased sight-unseen and delivered directly to the consumer's doorstep. This requires sophisticated logistics networks and standardized digital documentation. Successful value chain management hinges on leveraging technology to enhance transparency at every step—from using AI for initial valuation to integrating blockchain for vehicle history—thereby minimizing friction and maximizing the residual value retained through the refurbishment process.

Used Car Market Potential Customers

The Used Car Market caters to an extremely broad and diverse customer base, categorized primarily by financial capability, transportation needs, and propensity for risk. Potential customers include first-time vehicle owners, who often seek reliable, low-cost transportation to fulfill basic mobility needs; these buyers are highly price-sensitive and frequently rely on installment loans for financing. Another significant group comprises budget-conscious families looking for larger, higher-specification vehicles (like SUVs or minivans) that would be financially out of reach if purchased new, prioritizing space and features over the latest model year.

A third major customer segment consists of businesses and fleet operators. Small and medium-sized enterprises (SMEs) often procure light commercial vehicles (LCVs) or company cars from the used market to minimize capital expenditure and benefit from quicker depreciation cycles for tax purposes. These buyers prioritize total cost of ownership (TCO) and durability. High-net-worth individuals also engage in the used market, typically seeking certified pre-owned luxury or specialty vehicles where the steep initial depreciation has already occurred, offering substantial savings on premium brands.

Furthermore, the emerging segments include ride-sharing drivers who require affordable, robust, and fuel-efficient vehicles for high-mileage use, and consumers increasingly interested in used electric vehicles (EVs) as a more affordable way to transition to sustainable transportation. Understanding the financial profile and usage requirements of these diverse groups allows market players to specialize in CPO programs, flexible financing, or niche vehicle types, ensuring that supply meets the complex spectrum of global used vehicle demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.50 Trillion |

| Market Forecast in 2033 | USD 2.45 Trillion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carvana, CarMax, Vroom, Cazoo, AutoTrader, Cox Automotive (Manheim), TrueCar, Tesla (Used Vehicle Program), BMW (CPO), Mercedes-Benz (CPO), Hyundai Motor Company (CPO), Alibaba Group (Used Car Platforms), Beepi (Used Car Platforms), DriveTime Automotive Group, Lithia Motors, Penske Automotive Group, Hendrick Automotive Group, ACV Auctions, Copart, eBay Motors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Car Market Key Technology Landscape

The technological landscape of the Used Car Market is rapidly shifting towards digitization and automation, with a strong emphasis on generating trust and efficiency. A critical technology is the development and deployment of sophisticated Vehicle Inspection Apps and Diagnostic Tools, often leveraging computer vision and AI to quickly assess cosmetic damage and mechanical health. These tools standardize the condition reporting process, which is essential for facilitating online, sight-unseen purchases. Furthermore, advanced data analytics platforms integrate vast datasets on vehicle history, insurance claims, recall data, and market pricing to provide accurate, real-time valuation models, replacing subjective human appraisal processes.

Blockchain technology is emerging as a powerful tool to address the core industry challenge of trust and transparency. By recording the immutable history of maintenance, ownership changes, and major accidents onto a decentralized ledger, blockchain minimizes the risk of odometer rollback and fraudulent vehicle history reports, providing genuine transparency to potential buyers. Parallel to this, the adoption of robust Customer Relationship Management (CRM) systems and Enterprise Resource Planning (ERP) platforms is enabling large organized players to manage complex inventory across multiple locations, streamline financing workflows, and execute highly targeted marketing campaigns based on detailed customer profiles.

Additionally, the optimization of the logistical chain through smart routing algorithms and specialized vehicle transport technology is crucial for the success of e-commerce used car retailers, ensuring timely and damage-free delivery. The integration of augmented reality (AR) and virtual reality (VR) technologies allows potential buyers to conduct highly detailed virtual inspections of vehicles remotely, enhancing the immersive online shopping experience. This suite of technologies—from AI-powered diagnostics and valuation to blockchain ledgering and sophisticated logistics—is foundational to establishing the next generation of organized used car retail.

Regional Highlights

Regional dynamics play a significant role in shaping the Used Car Market, influenced by economic maturity, consumer behavior, and regulatory frameworks. North America, encompassing the United States and Canada, represents one of the most mature and valuable markets. This region is characterized by high vehicle turnover, strong organized dealership networks (both OEM-affiliated CPO and independent mega-dealers like CarMax), and exceptionally high penetration of digital retail platforms. Consumers here often seek convenience, standardized warranties, and strong trade-in values. The US market specifically benefits from extensive vehicle history reporting services, further underpinning consumer confidence and supporting higher average transaction prices.

Europe’s market is highly fragmented, driven by varying national regulations regarding emissions and vehicle taxation, which leads to significant cross-border trade, particularly for luxury and low-emission vehicles. Western European countries, such as Germany and the UK, exhibit strong demand for CPO programs and vehicles aged under five years, reflecting higher consumer standards and disposable income. Conversely, Eastern European markets show greater price sensitivity, driving demand for older, more affordable inventory. The regulatory push towards sustainability is beginning to stimulate the secondary market for used EVs, though infrastructure and battery residual value concerns remain a regional challenge.

Asia Pacific (APAC) is the engine of future growth, primarily driven by China, India, and Southeast Asian nations. While the market in APAC is historically dominated by the unorganized sector, rapid motorization, increasing urbanization, and rising middle-class income levels are rapidly transitioning consumers toward organized retail. China, despite strict regulatory controls on used imports, boasts a massive domestic used car sales volume, with platforms like Alibaba investing heavily in digital infrastructure. India's market is highly price-sensitive, emphasizing vehicles under $10,000, and is experiencing a boom in transactional platforms that streamline ownership transfer and financing for first-time buyers. Latin America and MEA markets are constrained by economic volatility and reliance on imported inventory, yet they offer substantial long-term growth potential through the establishment of modern financing and vehicle certification structures.

- North America: Highly organized, significant penetration of online retail (e.g., Carvana, Vroom), high consumer confidence supported by robust vehicle history reports, and high demand for used trucks and SUVs.

- Europe: Fragmented by national regulations, strong cross-border trade, growing acceptance of CPO programs, and emerging secondary market for used electric vehicles, particularly in Norway and Germany.

- Asia Pacific (APAC): Fastest-growing region, driven by first-time buyers in China and India, rapid shift from unorganized to organized retail, and intense competition among large digital marketplaces.

- Latin America: Characterized by economic sensitivity, reliance on low-cost imports, and infrastructural challenges in logistics and formal financing, but significant long-term potential in metropolitan areas.

- Middle East and Africa (MEA): Growth driven by vehicle imports, high demand for reliable, durable older models, and increasing adoption of digital platforms for transparent pricing and verification, especially in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Car Market.- Carvana Co.

- CarMax Inc.

- Vroom Inc.

- Cazoo Ltd.

- AutoTrader Group plc

- Cox Automotive Inc. (Manheim, Kelley Blue Book)

- TrueCar Inc.

- Alibaba Group (Used Car Platforms)

- DriveTime Automotive Group Inc.

- Lithia Motors Inc.

- Penske Automotive Group Inc.

- Hendrick Automotive Group

- Saks Fifth Avenue (Used Luxury)

- BMW Group (CPO Programs)

- Mercedes-Benz Group AG (CPO Programs)

- Tesla Inc. (Used Vehicle Program)

- Hyundai Motor Company (CPO Programs)

- ACV Auctions Inc.

- Copart Inc.

- eBay Motors

Frequently Asked Questions

Analyze common user questions about the Used Car market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Organized Used Car Market sector?

The growth is primarily driven by technological advancements, specifically digital platforms offering enhanced transparency, standardized inspection processes (often 150-point checks), certified pre-owned (CPO) programs offering warranties, and the increasing availability of dedicated, competitive financing options for pre-owned vehicles. This structure provides trust and convenience, minimizing the risks associated with private sales.

How is Artificial Intelligence (AI) influencing used car valuation and pricing?

AI utilizes machine learning algorithms to analyze massive datasets, including real-time market supply, demand patterns, seasonal variations, economic indicators, and detailed vehicle condition reports. This enables dynamic pricing, ensuring vehicles are valued accurately and competitively, thereby reducing price asymmetry and negotiation time for both buyers and sellers.

What is the market outlook for used electric vehicles (EVs)?

The market outlook for used EVs is extremely positive and accelerating. As initial leasing periods of new EVs mature, the supply of used models is rapidly increasing. The lower entry price point makes used EVs attractive to budget-conscious and environmentally aware consumers, provided that battery health verification methods and robust warranties are standardized, which is becoming a key technological focus.

Which regions demonstrate the fastest growth potential in used car sales?

The Asia Pacific (APAC) region, particularly emerging economies like India and China, demonstrates the fastest growth potential. This growth is fueled by a rapidly expanding middle class, high rates of urbanization driving the need for personal transport, and the swift adoption of digital marketplaces that facilitate trustworthy and structured transactions in previously unorganized markets.

What are the primary challenges restraining the global Used Car Market expansion?

Key restraints include consumer skepticism regarding vehicle history and true condition (though mitigated by CPO programs), regulatory hurdles related to age and emissions standards across different jurisdictions, and persistent supply chain fragmentation, especially in developing markets where vehicle history data is often unreliable or difficult to verify without centralized systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager