Wafer Bonder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440321 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Wafer Bonder Market Size

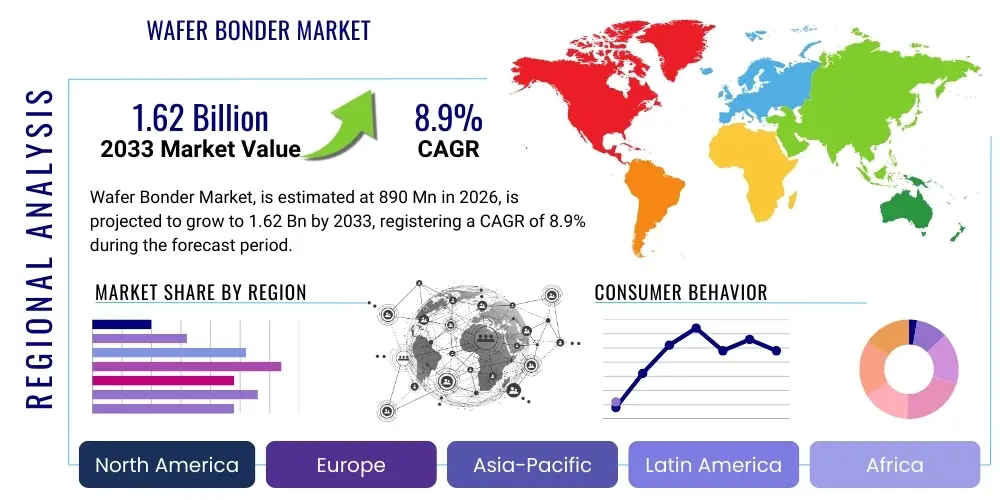

The Wafer Bonder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 890 million in 2026 and is projected to reach USD 1.62 billion by the end of the forecast period in 2033.

Wafer Bonder Market introduction

The Wafer Bonder Market encompasses specialized equipment essential for bonding two or more semiconductor wafers together, or a wafer to a substrate, forming a robust and permanent or temporary connection. This intricate process is fundamental in advanced semiconductor manufacturing, enabling the creation of complex device architectures, including 3D integrated circuits (3D-ICs), Micro-Electro-Mechanical Systems (MEMS), advanced packaging solutions, and various power devices. Wafer bonding facilitates the vertical integration of different functional layers, enhancing device performance, reducing form factors, and improving energy efficiency.

Wafer bonders are precision machines designed to achieve highly accurate alignment and intimate contact between wafers under controlled environmental conditions, often involving vacuum, elevated temperatures, and specific pressures. The primary benefit of wafer bonding lies in its ability to enable miniaturization and create heterogeneous integration, allowing for the stacking of dissimilar materials and functionalities. This capability is critical for developing next-generation electronic components that demand higher processing power, lower latency, and smaller footprints, addressing the ever-increasing demands from industries such as consumer electronics, automotive, healthcare, and telecommunications.

Key driving factors for the Wafer Bonder Market include the escalating demand for 3D packaging and advanced heterogeneous integration techniques, driven by the relentless pursuit of Moore's Law and beyond. The proliferation of the Internet of Things (IoT), artificial intelligence (AI), 5G technology, and high-performance computing (HPC) necessitates sophisticated semiconductor devices that leverage wafer bonding for enhanced functionality and efficiency. Furthermore, the growing adoption of MEMS sensors and actuators across various applications, from automotive safety systems to medical wearables, significantly contributes to the market's expansion, as these devices inherently rely on wafer bonding processes for their fabrication.

Wafer Bonder Market Executive Summary

The Wafer Bonder Market is experiencing robust growth, primarily fueled by significant advancements in semiconductor technology and the increasing adoption of 3D integration and advanced packaging solutions across a multitude of end-use industries. Business trends indicate a strong emphasis on automation, precision, and yield improvement, with leading manufacturers investing heavily in research and development to introduce next-generation bonding technologies such as hybrid bonding, which offers superior interconnect density and performance. There is also a notable trend towards strategic partnerships and collaborations among equipment providers, material suppliers, and semiconductor manufacturers to address complex integration challenges and accelerate market penetration of new technologies.

Regionally, the Asia Pacific (APAC) continues to dominate the Wafer Bonder Market, driven by its extensive and rapidly expanding semiconductor manufacturing infrastructure, particularly in countries like Taiwan, South Korea, China, and Japan. These nations host major foundries, IDMs, and OSATs that are at the forefront of advanced packaging and 3D-IC development. North America and Europe also represent significant markets, characterized by strong R&D activities, specialized MEMS production, and a growing focus on high-reliability applications, particularly in the automotive, aerospace, and defense sectors. Emerging markets in Southeast Asia are also showing promising growth as semiconductor investment diversifies.

Segmentation trends within the market highlight the increasing prominence of hybrid bonding technologies, which are gaining traction for their ability to achieve very fine pitch interconnects crucial for high-density 3D stacking. Temporary bonding solutions are also experiencing heightened demand, particularly for wafer thinning and fan-out wafer-level packaging (FOWLP) processes, enabling more advanced packaging schemes. In terms of applications, 3D-ICs and MEMS continue to be major drivers, while the growth of CMOS image sensors and power devices further solidifies the demand for reliable wafer bonding solutions. The shift towards larger wafer sizes, especially 300mm (12-inch) wafers, is another significant trend, impacting equipment design and throughput requirements.

AI Impact Analysis on Wafer Bonder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Wafer Bonder Market frequently center on how AI can enhance manufacturing efficiency, precision, and yield, as well as its role in predictive maintenance and process optimization. Common questions explore how AI algorithms can improve alignment accuracy, detect defects more effectively, and adapt bonding parameters in real-time to mitigate process variations. Users are also interested in the potential for AI to reduce operational costs, minimize human intervention, and accelerate the development of new bonding processes. Overall, the discussions reveal a strong expectation for AI to transform wafer bonding from a highly manual and empirical process to a more automated, intelligent, and data-driven operation, addressing current challenges related to throughput, reliability, and cost.

- AI algorithms enable real-time optimization of bonding parameters, such as temperature, pressure, and alignment, based on sensor data feedback, leading to improved bond quality and reduced defects.

- Predictive maintenance powered by AI analyzes equipment performance data to forecast potential failures, minimizing downtime and optimizing maintenance schedules for wafer bonders.

- Machine vision systems integrated with AI enhance automated optical inspection (AOI) capabilities, accurately identifying and classifying microscopic defects on wafers before and after bonding, surpassing human capabilities.

- AI-driven data analytics helps in identifying correlations between process parameters and yield, facilitating quicker root cause analysis for bonding issues and accelerating process development cycles.

- Robotics and automation, guided by AI, streamline wafer handling, loading, and unloading processes, improving throughput and reducing the risk of human error or contamination in advanced bonding environments.

- AI can contribute to the development of 'smart' bonders that learn from historical data to adapt to new wafer types or bonding requirements, making the equipment more versatile and intelligent.

DRO & Impact Forces Of Wafer Bonder Market

The Wafer Bonder Market is profoundly shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces that influence its trajectory. Key drivers include the ever-increasing demand for advanced semiconductor devices, particularly for applications in Artificial Intelligence (AI), 5G infrastructure, autonomous vehicles, and the Internet of Things (IoT), all of which necessitate higher levels of integration and miniaturization achievable through wafer bonding. The relentless pursuit of 3D integration and advanced packaging technologies, offering enhanced performance and reduced form factors, serves as a primary catalyst for market growth. Additionally, the expansion of the MEMS and sensor market, which heavily relies on wafer bonding for encapsulation and device fabrication, further propels demand for sophisticated bonding solutions.

However, the market also faces significant restraints. The exceptionally high cost associated with advanced wafer bonding equipment, coupled with the substantial R&D investments required for developing new processes, can be a barrier for smaller manufacturers. Technical complexities related to precise alignment, void-free bonding, and managing thermal stress across different materials pose ongoing challenges that can impact yield and throughput. Economic uncertainties and cyclical downturns in the semiconductor industry can also lead to reduced capital expenditure, temporarily slowing market expansion. Furthermore, the stringent requirements for ultra-clean environments and the highly specialized expertise needed for operation and maintenance add to the operational complexities.

Opportunities within the Wafer Bonder Market are substantial and diverse. The continuous innovation in bonding technologies, particularly the emergence of hybrid bonding for ultra-fine pitch interconnects, presents a significant growth avenue. The development of advanced temporary bonding solutions for wafer thinning and 3D stacking processes unlocks new possibilities for high-density packaging. Furthermore, the burgeoning demand for specialized devices in high-growth sectors such as medical electronics, quantum computing, and augmented/virtual reality (AR/VR) offers niche but lucrative markets. The ongoing trend towards heterogeneous integration, combining different materials and device types on a single platform, ensures a sustained demand for versatile and high-performance wafer bonding solutions, driving continuous technological evolution and market expansion.

Segmentation Analysis

The Wafer Bonder Market is extensively segmented to reflect the diverse technological approaches, application requirements, and operational scales within the semiconductor industry. These segmentations provide crucial insights into market dynamics, identifying key areas of growth, technological shifts, and competitive landscapes. Understanding these distinct segments is vital for stakeholders to tailor strategies, optimize product development, and address the specific needs of various end-users and applications, thereby maximizing market penetration and fostering innovation across the value chain.

- By Type:

- Permanent Wafer Bonders

- Temporary Wafer Bonders

- Hybrid Wafer Bonders

- By Bonding Technology:

- Fusion Bonding

- Anodic Bonding

- Thermo-compression Bonding

- Eutectic Bonding

- Adhesive Bonding

- Plasma Activated Bonding

- By Wafer Size:

- 4-inch (100mm)

- 6-inch (150mm)

- 8-inch (200mm)

- 12-inch (300mm)

- Others (e.g., small panel bonding)

- By Application:

- MEMS (Micro-Electro-Mechanical Systems)

- 3D-IC (3D Integrated Circuits)

- Advanced Packaging (e.g., Wafer Level Packaging, Fan-Out Wafer Level Packaging)

- Power Devices

- CMOS Image Sensors

- HB-LED (High Brightness LED)

- Others (e.g., Photonics, RF Devices)

- By End-User:

- IDM (Integrated Device Manufacturers)

- Foundries

- OSAT (Outsourced Semiconductor Assembly and Test)

- Research & Development Institutes

Value Chain Analysis For Wafer Bonder Market

The value chain for the Wafer Bonder Market is characterized by a complex interplay of specialized entities, from raw material suppliers to end-product manufacturers, each contributing critical components and services. At the upstream segment, the chain begins with suppliers of high-purity semiconductor-grade wafers (silicon, silicon-on-insulator, compound semiconductors), specialized bonding materials (adhesives, metals, polymers), and precision components essential for bonder construction, such as optics, motion control systems, vacuum components, and heating elements. These suppliers ensure the fundamental quality and functionality required for the advanced capabilities of wafer bonding equipment.

The midstream of the value chain involves the wafer bonder manufacturers themselves, who design, develop, and assemble these highly sophisticated machines. These companies integrate various sub-systems, develop proprietary bonding technologies, and provide comprehensive software for process control, alignment, and data acquisition. Their role is pivotal in innovating and delivering equipment that meets the stringent requirements of precision, throughput, and reliability demanded by the semiconductor industry. Furthermore, calibration, testing, and system integration services are crucial aspects at this stage, ensuring optimal performance and compliance with industry standards.

Downstream, the value chain extends to the direct and indirect distribution channels that facilitate the delivery of wafer bonders to the end-users. Direct sales involve bonder manufacturers selling directly to major semiconductor fabrication plants (fabs), research institutions, and large integrated device manufacturers (IDMs). Indirect channels include a network of specialized distributors, value-added resellers, and system integrators who provide regional sales, technical support, installation, and maintenance services, especially to smaller and geographically diverse customers. The ultimate customers are the semiconductor manufacturers (IDMs, foundries, OSATs), MEMS producers, and R&D facilities that utilize wafer bonders to produce advanced semiconductor devices, thereby completing the cycle of value creation and consumption.

Wafer Bonder Market Potential Customers

Potential customers for the Wafer Bonder Market represent a diverse spectrum of entities within the semiconductor and related high-tech industries, all driven by the need for advanced integration and miniaturization capabilities. Integrated Device Manufacturers (IDMs) such as Intel, Samsung, and Micron are prime customers, as they design, manufacture, and market their own semiconductor products, often requiring state-of-the-art bonding processes for their advanced memory, logic, and processor technologies. These companies seek bonders that offer high throughput, exceptional precision, and compatibility with their proprietary manufacturing flows to maintain a competitive edge and optimize their product portfolios.

Foundries, including industry giants like TSMC, GlobalFoundries, and UMC, constitute another critical customer segment. These companies specialize in manufacturing chips designed by other firms, making them highly dependent on versatile and robust wafer bonding solutions to cater to a broad array of customer specifications. Foundries require bonders capable of handling various wafer sizes and bonding technologies to support diverse client demands, from cutting-edge 3D-ICs to specialized MEMS devices. Their investments in wafer bonding equipment are directly tied to their capacity expansion and technological advancement plans to serve the evolving needs of fabless semiconductor companies.

Additionally, Outsourced Semiconductor Assembly and Test (OSAT) providers, such as ASE Technology Holding, Amkor Technology, and JCET, are significant end-users. OSATs focus on post-fabrication services, including packaging, assembly, and testing, where advanced wafer bonding is crucial for fan-out wafer-level packaging (FOWLP), 3D packaging, and other complex integration schemes. MEMS manufacturers, academic and industrial research and development (R&D) institutions, and specialized component manufacturers (e.g., for power devices, CMOS image sensors, or photonics) also represent substantial customer bases, seeking innovative bonding solutions for prototyping, low-volume specialized production, and fundamental research into next-generation devices and materials. These customers collectively drive demand for a wide range of wafer bonder capabilities, from high-volume manufacturing tools to flexible R&D systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 890 million |

| Market Forecast in 2033 | USD 1.62 billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EV Group (EVG), SUSS MicroTec, Ayumi Industry, AML Technologies, Ushio Inc., Shibuya Corp., Panasonic Corporation, SET Corporation, HIWIN Technologies Corp., SPP Process Technology Systems (SPP PTS), Finetech GmbH & Co. KG, Versum Materials (now part of Merck KGaA), WaferPro, Micro-Tec Inc., Dynatex International, ASMPT, F&K Delvotec, J-Micro Technology Inc., Suss MicroOptics, Tokyo Electron Limited (TEL). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Bonder Market Key Technology Landscape

The Wafer Bonder Market is characterized by a sophisticated and continuously evolving technology landscape, where innovation is paramount to addressing the increasing demands for higher precision, improved performance, and diverse application support in semiconductor manufacturing. Core bonding technologies include Fusion Bonding, which creates covalent bonds between wafers after surface activation, enabling robust and hermetic seals critical for 3D-ICs and CMOS Image Sensors. Anodic Bonding, often used for MEMS devices, involves applying voltage across glass and silicon at elevated temperatures to form a strong, permanent bond. Thermo-compression Bonding utilizes heat and pressure to bond wafers, typically with metallic interconnects, common in advanced packaging. Eutectic Bonding, another method, employs an alloy that melts at a lower temperature to form a bond, suitable for hermetic sealing.

Adhesive Bonding, involving polymer or epoxy materials, offers flexibility and lower process temperatures, making it suitable for temperature-sensitive devices or non-planar surfaces. Plasma Activated Bonding enhances surface reactivity prior to bonding, leading to stronger interfaces at lower temperatures. Among the most significant advancements is Hybrid Bonding, which combines dielectric-dielectric bonding with direct metal-metal bonding in a single process step. This technology is crucial for achieving ultra-fine pitch interconnects for high-density 3D stacking, enabling unprecedented levels of vertical integration and electrical performance in advanced logic and memory devices. Hybrid bonding demands exceptionally tight control over surface preparation and alignment, pushing the boundaries of current manufacturing capabilities.

Beyond these primary bonding methods, the technology landscape also encompasses crucial ancillary innovations that enhance bonder functionality. High-precision alignment systems, often utilizing advanced optics and sophisticated software algorithms, are essential for achieving sub-micron alignment accuracy. Vacuum bonding capabilities are vital for preventing voids and contamination during the bonding process, especially for fusion and hybrid bonding. Integrated plasma activation modules are increasingly common for surface preparation, enhancing bond strength and reliability. Furthermore, automation, robotics, and advanced process control systems (often AI-enhanced) are integral to improving throughput, reducing human error, and ensuring consistent bond quality across high-volume manufacturing environments, marking a clear trajectory towards fully autonomous wafer bonding solutions.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Wafer Bonder Market, driven by the presence of major semiconductor manufacturing hubs in Taiwan, South Korea, China, and Japan. These countries are home to leading foundries (TSMC, Samsung Foundry), IDMs (Samsung, SK Hynix), and OSATs (ASE, Amkor), which are at the forefront of 3D-IC and advanced packaging technologies. Government initiatives and significant investments in local semiconductor ecosystems further bolster market growth.

- North America: A significant market characterized by strong R&D activities, innovation in new semiconductor materials and architectures, and demand from high-performance computing, AI, and defense sectors. Companies here focus on specialized applications, advanced MEMS, and pioneering next-generation bonding techniques, contributing to technological advancements.

- Europe: Represents a mature market with a focus on specialized applications, particularly in the automotive, industrial, and medical sectors. European companies excel in MEMS, sensors, and power device manufacturing, driving demand for specific bonding solutions. Strong research institutes and collaborative projects contribute to continuous innovation in bonding technology.

- Latin America & Middle East and Africa (MEA): Emerging markets with nascent but growing semiconductor industries. While smaller in market share, these regions are showing increasing interest in local manufacturing and R&D initiatives, particularly in areas like IoT and localized electronics production, which could drive future demand for wafer bonding equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Bonder Market.- EV Group (EVG)

- SUSS MicroTec

- Ayumi Industry Co., Ltd.

- AML Technologies

- Ushio Inc.

- Shibuya Corp.

- Panasonic Corporation

- SET Corporation

- HIWIN Technologies Corp.

- SPP Process Technology Systems (SPP PTS)

- Finetech GmbH & Co. KG

- Versum Materials (now part of Merck KGaA)

- WaferPro (indirectly through materials/services)

- Micro-Tec Inc.

- Dynatex International

- ASMPT

- F&K Delvotec Bondtechnik GmbH

- J-Micro Technology Inc.

- Suss MicroOptics (part of SUSS MicroTec)

- Tokyo Electron Limited (TEL)

Frequently Asked Questions

Analyze common user questions about the Wafer Bonder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is wafer bonding and why is it important in semiconductor manufacturing?

Wafer bonding is a critical process in semiconductor manufacturing that joins two or more wafers or a wafer to a substrate. It is essential for creating advanced devices like 3D-ICs, MEMS, and advanced packaging, enabling miniaturization, enhanced performance, and new functionalities in electronics.

What are the primary types of wafer bonding technologies?

The primary types include fusion bonding (direct dielectric bonding), anodic bonding (glass to silicon), thermo-compression bonding (using heat and pressure), eutectic bonding (alloy formation), adhesive bonding (using polymers), and the advanced hybrid bonding (combining dielectric and metal bonds).

Which applications primarily drive the demand for wafer bonders?

Key applications driving demand include 3D integrated circuits (3D-ICs) for high-performance computing, Micro-Electro-Mechanical Systems (MEMS) for sensors, advanced packaging solutions (e.g., FOWLP), and the manufacturing of power devices and CMOS image sensors.

How does hybrid bonding differ from traditional bonding methods?

Hybrid bonding simultaneously creates both direct dielectric bonds and metal-to-metal interconnects at ultra-fine pitches in a single process step. This contrasts with traditional methods that typically form one type of bond or require multiple steps for electrical connections, offering superior interconnect density for 3D stacking.

What impact does AI have on the wafer bonder market?

AI significantly impacts the market by enabling enhanced process control, real-time optimization of bonding parameters, predictive maintenance for equipment, and superior automated defect inspection through machine vision, ultimately improving yield, throughput, and overall manufacturing efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager