Welding Helmets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431634 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Welding Helmets Market Size

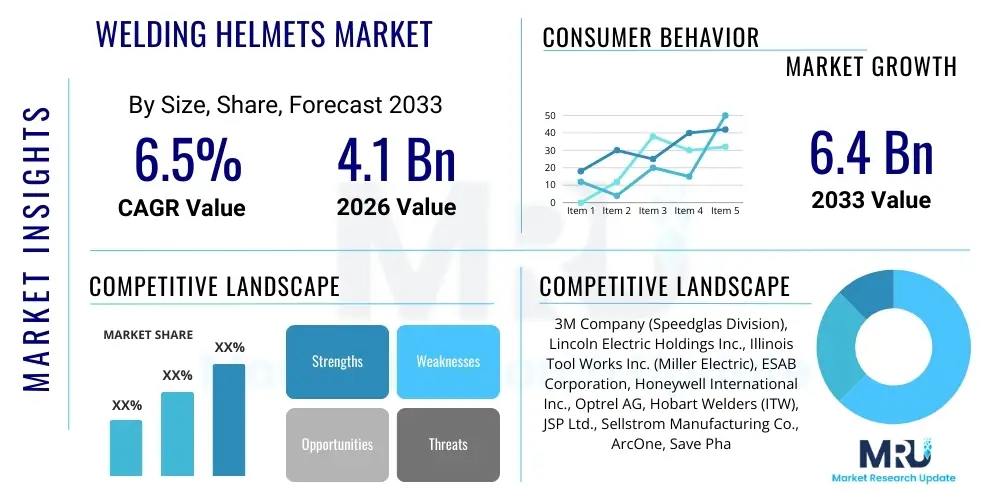

The Welding Helmets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.4 Billion by the end of the forecast period in 2033.

Welding Helmets Market introduction

The Welding Helmets Market encompasses the manufacturing, distribution, and sale of protective gear designed to shield the eyes, face, and neck from intense light, ultraviolet radiation, infrared radiation, heat, sparks, and debris generated during welding, soldering, and cutting operations. These helmets are indispensable personal protective equipment (PPE) in numerous industrial settings, including construction, automotive manufacturing, heavy machinery fabrication, shipbuilding, and infrastructure maintenance. Traditional helmets offered static shading, but modern market growth is significantly driven by advanced technologies, particularly auto-darkening filters (ADF), which automatically adjust the lens shade based on the arc intensity within milliseconds, dramatically enhancing welder efficiency and safety compliance.

Product descriptions typically categorize helmets by their core technology, covering passive welding helmets (fixed shade), variable shade auto-darkening helmets, and specialized helmets incorporating features such as external grind modes, integrated respirators (PAPR systems), and advanced optical clarity ratings (1/1/1/1 classification). The adoption of auto-darkening technology represents the primary evolutionary leap, moving the industry focus from basic protection to ergonomic design, comfort, and enhanced peripheral vision. This shift caters directly to professional welders who spend extended periods under the arc, emphasizing the necessity for reduced neck strain and improved task visibility, thereby driving premium pricing and market differentiation.

Major applications span Manual Metal Arc Welding (MMAW/Stick), Gas Metal Arc Welding (GMAW/MIG), Gas Tungsten Arc Welding (GTAW/TIG), Flux-Cored Arc Welding (FCAW), and plasma cutting. Benefits include compliance with stringent international safety standards (such as ANSI Z87.1, EN 379), prevention of serious eye injuries (arc flash, welder’s flash), and long-term protection against skin damage caused by intense UV/IR exposure. Driving factors for market expansion include escalating global industrial safety regulations, the robust resurgence of manufacturing and infrastructure projects in developing economies, and continuous innovation in battery technology and solar-powered ADF mechanisms that improve operational longevity and reliability in demanding environments. Furthermore, increasing awareness regarding chronic health risks associated with inadequate welding protection is compelling organizations to invest in high-quality protective gear, solidifying the market’s positive trajectory.

Welding Helmets Market Executive Summary

The global Welding Helmets Market demonstrates robust expansion, primarily fueled by stringent occupational safety mandates imposed across mature and emerging industrial nations and a fundamental technological shift towards auto-darkening filters (ADF) over traditional passive helmets. Business trends indicate a strong focus on strategic mergers, acquisitions, and partnerships aimed at consolidating market share, particularly among companies specializing in integrated respiratory protection (PAPR systems) and advanced optical systems. Leading manufacturers are investing heavily in R&D to improve battery life, reduce helmet weight, and achieve superior optical clarity ratings, addressing the critical needs of professional wel welders for enhanced comfort and productivity. The competitive landscape is characterized by a high degree of technological differentiation, where patented ADF algorithms and proprietary ergonomic designs act as key competitive advantages, driving premium segment growth and maintaining high average selling prices for advanced models.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, primarily due to rapid industrialization, massive investments in infrastructure development, and the burgeoning automotive and heavy fabrication sectors in countries like China and India. While North America and Europe remain mature markets, they continue to drive demand for highly specialized and high-end helmets, particularly those compliant with sophisticated ANSI and ISO standards, and models featuring connectivity or IoT capabilities for maintenance tracking. The Middle East and Africa (MEA) region is exhibiting strong growth linked to oil and gas infrastructure expansion and shipbuilding activities, compelling local industries to adopt global best practices in safety equipment procurement.

Segment trends reveal that the Auto-Darkening Helmets segment is overwhelmingly dominant by value and is expected to exhibit the highest CAGR, driven by their operational superiority across various welding techniques, particularly TIG welding where instantaneous response is crucial. Within the end-user segmentation, the Manufacturing sector, encompassing automotive and general fabrication, holds the largest market share due to the sheer volume of welding activities performed. The distribution channel dynamics show a strong preference for industrial distributors and safety equipment specialists, although e-commerce platforms are gaining traction for aftermarket sales and standardized models, allowing smaller fabrication shops and DIY enthusiasts easier access to a diverse product portfolio. Premiumization of features, such as integrated communication systems and advanced lens coatings resistant to scratching and spatter adhesion, further reinforces the structural shift toward technologically superior offerings.

AI Impact Analysis on Welding Helmets Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Welding Helmets Market primarily revolve around the integration of smart features, predictive maintenance, and enhanced real-time safety analysis. Users are keenly interested in whether AI can optimize the auto-darkening response time further, or if embedded sensors and algorithms could predict lens failure or detect unsafe welding practices instantly. Concerns frequently emerge about data privacy, the cost implications of integrating AI-powered modules, and the reliance on complex electronic systems in harsh industrial environments. Expectations are high for AI to transition the helmet from a purely protective device into a data-gathering, instructional, and diagnostic tool, capable of providing feedback on arc stability, penetration depth, and overall weld quality directly to the operator or supervisor, thereby linking safety parameters intrinsically with quality assurance protocols. The primary theme summarized is the transition towards the "Smart Welding Helmet," leveraging computational power to transcend simple optical protection and offer sophisticated, proactive operational assistance and real-time risk mitigation.

- AI-Enhanced Optical Sensing: Utilization of machine learning algorithms to analyze arc characteristics in real-time, optimizing the auto-darkening shade level with unprecedented precision, reducing eye strain, and accommodating rapid changes in ambient light conditions or reflective surfaces more effectively than traditional sensors.

- Predictive Maintenance for PPE: AI modules embedded within helmets can monitor usage patterns, battery health, filter longevity, and sensor calibration status, predicting potential failure points before they compromise safety, thereby scheduling proactive maintenance or replacement of expensive ADF cartridges.

- Ergonomics Optimization via AI: Data collected on head movement, neck posture, and operational fatigue using integrated sensors can be analyzed by AI to recommend ergonomic adjustments or future helmet designs that minimize physical strain during prolonged welding operations, linking operational data with musculoskeletal health outcomes.

- Integrated Quality Assurance Feedback: AI capable of analyzing visual data captured by a secondary, non-protective camera to assess weld bead consistency, detect porosity or spatter issues in real-time, and provide immediate audible or visual feedback to the welder, blurring the lines between safety PPE and quality control instrumentation.

- Training and Simulation Enhancement: AI-powered welding simulators utilizing helmet tracking and visual feedback mechanisms to provide personalized, objective evaluation of a trainee's technique, accelerating the learning curve for complex welding processes and ensuring faster proficiency in safety compliance.

- Compliance Monitoring Automation: AI systems can track and log helmet usage, including confirmation that the helmet was correctly deployed and functional during specific high-risk tasks, generating immutable compliance records essential for auditing and regulatory verification, mitigating organizational risk exposure.

DRO & Impact Forces Of Welding Helmets Market

The market dynamics for welding helmets are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by potent impact forces stemming from regulatory pressure and technological evolution. Key drivers include the stringent and increasingly globalized enforcement of occupational safety regulations, particularly concerning eye and face protection standards (e.g., OSHA, European Directives), which mandate the use of certified equipment in industrial environments. This regulatory push is supplemented by the accelerating adoption of advanced welding techniques in complex industries such as aerospace and offshore drilling, demanding higher reliability and performance from protective gear. Additionally, the growing awareness among end-users regarding the long-term health risks associated with welding fume exposure is driving demand for helmets integrated with powered air-purifying respirators (PAPR), significantly boosting the high-end segment's market value and technological complexity.

However, market growth is significantly restrained by the high initial cost of premium auto-darkening and PAPR helmets, particularly for small-scale workshops and independent contractors in price-sensitive developing economies, leading to the continued, albeit discouraged, use of lower-cost passive helmets or non-compliant substitutes. Furthermore, the operational durability and reliability of highly electronic ADF systems in extremely dusty, high-temperature, or high-humidity environments remain a technical challenge, requiring frequent maintenance and replacement of specialized components, increasing the total cost of ownership. The proliferation of low-quality, uncertified, and counterfeit welding helmets, particularly through unauthorized online channels, poses a substantial restraint by undercutting certified manufacturers and potentially exposing end-users to severe safety risks, complicating regulatory compliance efforts.

Opportunities for market expansion are centered on the burgeoning adoption of robotic and automated welding systems, which, counterintuitively, still require specialized maintenance and oversight tasks performed by human operators wearing high-tech helmets. The rising demand for integrated smart features, such as Bluetooth communication, heads-up displays (HUDs), and data logging capabilities, represents a significant avenue for product differentiation and premium market penetration. Furthermore, developing lightweight, comfortable, and sustainable helmet materials that improve wearer compliance and reduce environmental impact provides a crucial strategic opportunity for manufacturers seeking leadership in industrial safety innovation, capitalizing on the broader industry trend towards worker well-being and ergonomic enhancement.

Segmentation Analysis

The Welding Helmets Market is comprehensively segmented based on technology, end-user industry, and distribution channel, providing granular insights into varying demand patterns across the industrial landscape. The segmentation by technology—Passive vs. Auto-Darkening—is the most crucial differentiator, illustrating the industry’s decisive shift towards active protection systems that enhance productivity and safety simultaneously. End-user segmentation reveals where the highest volumes and specialized demands originate, with Manufacturing, Construction, and Automotive dominating procurement decisions. Geographic segmentation is vital for understanding regulatory variances and differing price sensitivities that influence regional market performance, demanding tailored distribution and marketing strategies from global suppliers. This detailed analysis allows stakeholders to target specific niches requiring high optical clarity, integrated respiratory solutions, or robust impact resistance for specialized applications.

- By Technology:

- Passive Welding Helmets (Fixed Shade)

- Auto-Darkening Welding Helmets (ADF)

- Fixed Shade ADF

- Variable Shade ADF

- High Definition (HD) ADF

- PAPR Integrated ADF Systems

- By End-User Industry:

- Manufacturing (General Fabrication, Machinery, Equipment)

- Automotive and Transportation (OEMs, Aftermarket, Repair)

- Construction and Infrastructure

- Oil and Gas, Petrochemical, and Energy Sector

- Shipbuilding and Marine

- Aerospace and Defense

- DIY and Hobbyist Use

- By Distribution Channel:

- Industrial Distributors and Safety Specialists (Direct Sales to Large Corporates)

- Online Retail and E-commerce Platforms

- Retail Stores and Hardware Outlets (Primarily DIY Segment)

- Direct Manufacturer Sales (OEM relationships)

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Welding Helmets Market

The value chain of the Welding Helmets Market begins with upstream activities focused on the procurement of specialized raw materials, primarily high-impact resistant polymers (polycarbonate, nylon) for the shell construction, sophisticated liquid crystal display (LCD) components, high-efficiency solar cells, and complex electronic circuitry required for the Auto-Darkening Filter (ADF) modules. Upstream analysis highlights that the optical clarity and response speed of ADF modules are critically dependent on specialized suppliers of liquid crystal technology, making sourcing relationships and quality control paramount. Manufacturers must maintain strict quality standards for these raw components as they directly impact the helmet's compliance with safety certifications (e.g., optical classes 1/1/1/1), which serves as a major factor in market differentiation and pricing strategy, requiring robust supplier qualification processes.

Manufacturing and assembly form the core of the value chain, involving the highly technical process of integrating the sensor array, ADF cartridge, battery pack, and control board into the ergonomic helmet shell. This stage is increasingly automated for large-scale producers but requires skilled labor for final assembly, quality checks, and customization, particularly for PAPR integrated systems. Downstream activities involve distribution, sales, and aftermarket support. The distribution channel is bifurcated into direct and indirect routes. Direct distribution typically involves large manufacturers selling specialized PAPR or high-end models directly to major industrial end-users (e.g., shipbuilding yards, automotive OEMs) who require personalized technical support, bulk ordering, and long-term service agreements.

The indirect channel relies extensively on industrial distributors, safety equipment wholesalers, and localized retail outlets. Industrial distributors are crucial as they manage inventory, provide localized logistical support, and often package helmets with other complementary PPE (gloves, safety glasses). E-commerce platforms have grown significantly, serving as an important indirect channel for the DIY segment and smaller fabrication shops seeking competitive pricing and broad product availability. The efficiency of the distribution network, coupled with rapid inventory turnover, significantly impacts the end-user price and the accessibility of the latest protective technologies, making robust channel management a critical factor for competitive success in the global welding safety market.

Welding Helmets Market Potential Customers

Potential customers and end-users of welding helmets encompass a wide spectrum of industrial professionals and hobbyists, with demand predominantly driven by sectors engaged in metal fabrication and structural construction. Primary buyers include procurement departments within large-scale manufacturing entities, such as automotive assembly plants and heavy machinery producers, where welding is integral to the production line and safety compliance is non-negotiable. These institutional buyers typically prioritize high-specification auto-darkening helmets with superior optical ratings (1/1/1/1) and integrated respiratory protection (PAPR) to mitigate long-term liability risks and maximize worker productivity in continuous welding operations. The decision-making unit often involves safety managers, procurement specialists, and operations engineers who evaluate products based on compliance, durability, ergonomic design, and total cost of ownership over an extended lifecycle.

Another significant customer segment includes small and medium-sized enterprises (SMEs) specializing in localized fabrication, maintenance, and repair services across various industries, including plumbing, electrical work, and general structural repairs. These buyers are often more price-sensitive but still require certified equipment, driving demand for mid-range variable shade ADF helmets that offer flexibility across different welding processes without the significant investment required for PAPR systems. For this segment, ease of use, interchangeable parts, and readily available consumables through local industrial supply channels are key purchasing criteria, often influencing decisions based on brand reputation for reliability rather than cutting-edge features.

Furthermore, the maintenance, repair, and overhaul (MRO) segment, covering operations in oil refineries, power generation facilities, and aging infrastructure, represents a consistently robust market, necessitating specialized helmets capable of performing in confined spaces or hazardous atmospheres. Educational institutions and vocational training centers also constitute a steady customer base, purchasing durable, standardized helmets for student training, focusing on robustness and straightforward maintenance. Finally, the growing DIY and hobbyist market, accessing products primarily through online platforms and retail hardware stores, drives demand for entry-level auto-darkening helmets that balance basic protection with affordability, although these buyers are generally less demanding regarding professional-grade specifications or specific regulatory compliance beyond general safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company (Speedglas Division), Lincoln Electric Holdings Inc., Illinois Tool Works Inc. (Miller Electric), ESAB Corporation, Honeywell International Inc., Optrel AG, Hobart Welders (ITW), JSP Ltd., Sellstrom Manufacturing Co., ArcOne, Save Phace, Inc., Jackson Safety (Kimberly-Clark Professional), Kuhtreiber s.r.o., Saf-T-Gard International, Inc., Techniweld USA, Kemppi Oy, The Black Stallion (Revco), Harbor Freight Tools (Vulcan), Antra Welding Products, and Tecmen Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Welding Helmets Market Key Technology Landscape

The technological landscape of the Welding Helmets Market is dominated by advancements in Auto-Darkening Filter (ADF) technology, which represents the critical component determining performance and market valuation. Current innovations focus heavily on improving the optical clarity rating, achieving the coveted 1/1/1/1 classification (referencing optical class, diffusion of light class, variation in luminous transmittance class, and angle dependence class, respectively), which minimizes distortion and maximizes visual comfort, especially crucial for high-precision TIG welding. This is accomplished through refined LCD panel manufacturing techniques and sophisticated layering of protective filters. Furthermore, manufacturers are aggressively pursuing faster switching speeds, pushing response times down to 1/25,000th of a second or faster, ensuring instantaneous protection against the arc flash, which significantly differentiates premium models from standard offerings.

Beyond the optical capabilities, ergonomics and integration are pivotal technological trends. The adoption of advanced, lighter composite materials, such as specialized nylons and fiber-reinforced polymers, reduces the overall helmet weight, directly addressing the primary user complaint of neck strain during long operational shifts. Integrated technologies, particularly Powered Air-Purifying Respirator (PAPR) systems, are rapidly becoming standard in high-end industrial environments. These systems utilize advanced filtration technology (HEPA filters) and forced air delivery to protect the welder from hazardous fumes and particulates, often monitored by sophisticated electronic flow sensors, significantly increasing the complexity and value of the PPE system as a whole, moving it beyond simple vision protection.

Future technological developments center around smart connectivity and enhanced power management. Solar-powered ADF systems, utilizing high-efficiency photovoltaic cells, are common, reducing reliance on disposable batteries and improving system longevity. Additionally, nascent technologies involve the integration of wireless communication modules (Bluetooth) for hands-free coordination, and the incorporation of augmented reality (AR) or Heads-Up Displays (HUD) within the lens. These HUDs can project critical information, such as welding parameters, time elapsed, or safety warnings, directly into the welder's line of sight, promising to revolutionize efficiency and safety management on the shop floor by providing actionable data without requiring the operator to lift the helmet or break concentration.

Regional Highlights

- North America: This region represents a highly mature and technologically advanced market, characterized by stringent enforcement of safety standards, particularly those set by OSHA and ANSI. Demand is robust for high-end auto-darkening helmets, especially those integrated with PAPR systems, driven by high labor costs and a strong focus on worker safety and minimizing liability. The U.S. automotive and aerospace sectors are key consumers, prioritizing optical clarity and compatibility with complex automation environments. Continuous modernization of infrastructure further sustains stable demand.

- Europe: The European market is highly regulated under CE marking and various European Standards (EN), maintaining a strong preference for certified, ergonomic, and lightweight solutions. Germany, the UK, and France are major contributors, driven by advanced manufacturing and precision engineering. There is a notable consumer shift towards sustainability, leading to increased adoption of long-lasting, rechargeable, and efficiently designed welding equipment. Nordic countries show elevated demand for specialized PAPR systems due to strict health and safety legislation pertaining to fume inhalation in confined spaces.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by explosive industrial expansion, particularly in construction, shipbuilding (South Korea, China), and heavy fabrication (India). While price sensitivity is higher in segments catering to general fabrication, the increasing foreign direct investment (FDI) in manufacturing zones compels local industries to adopt international safety standards, boosting demand for mid-to-high-range auto-darkening helmets. China and India are undergoing massive infrastructure projects, ensuring sustained high-volume procurement of welding equipment.

- Latin America: Characterized by a mix of mature industrial pockets (Brazil, Mexico) and developing manufacturing base, the market here shows significant potential, albeit tempered by economic volatility. Demand is primarily driven by the oil and gas sector and localized construction projects. Adoption of advanced ADF technology is increasing, replacing traditional passive helmets as awareness of international safety best practices spreads, often influenced by large multinational corporations operating within the region.

- Middle East and Africa (MEA): Market growth is intimately linked to the massive investments in the oil and gas infrastructure, petrochemical processing plants, and port development across the GCC countries. The extreme climate conditions necessitate robust, durable helmets with effective heat resistance and reliable electronics. While South Africa leads in industrialization within the African continent, the region as a whole is seeing growing adoption of safety standards, resulting in increasing, albeit sporadic, demand for certified welding protection gear, often imported from European or American suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Welding Helmets Market.- 3M Company (Speedglas Division)

- Lincoln Electric Holdings Inc.

- Illinois Tool Works Inc. (Miller Electric)

- ESAB Corporation

- Honeywell International Inc.

- Optrel AG

- Hobart Welders (ITW)

- JSP Ltd.

- Sellstrom Manufacturing Co.

- ArcOne

- Save Phace, Inc.

- Jackson Safety (Kimberly-Clark Professional)

- Kuhtreiber s.r.o.

- Saf-T-Gard International, Inc.

- Techniweld USA

- Kemppi Oy

- The Black Stallion (Revco)

- Harbor Freight Tools (Vulcan)

- Antra Welding Products

- Tecmen Inc.

Frequently Asked Questions

Analyze common user questions about the Welding Helmets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Auto-Darkening Filter (ADF) and how does it improve welding safety and productivity compared to passive helmets?

An Auto-Darkening Filter (ADF) is an advanced optical component utilizing liquid crystal technology and specialized sensor arrays that instantaneously detect the welding arc's ignition and darken the lens from a light shade (typically Shade 3 or 4) to a predetermined dark shade (typically Shade 9 to 13) within milliseconds (often 1/20,000th of a second or faster). This critical feature eliminates the need for the welder to nod the helmet down manually before striking an arc, significantly improving both safety, by preventing momentary exposure to intense radiation during arc ignition, and productivity, by allowing the welder to maintain consistent torch placement and reducing repetitive neck movement. ADF technology allows continuous visibility of the workpiece prior to welding, enhancing precision and minimizing errors, especially crucial in TIG welding applications that require fine manipulation. The variable shade setting capability allows a single helmet to be optimally used across different welding processes and amperage settings, offering superior versatility and reducing equipment changeover time in multi-process fabrication environments, thereby justifying the higher capital investment for professional users.

Why is the optical clarity rating, often stated as 1/1/1/1, critical for high-quality welding helmets?

The optical clarity rating, codified by European standard EN 379 and often cited as a four-digit rating (e.g., 1/1/1/1), is essential as it objectively quantifies the visual performance of the Auto-Darkening Filter (ADF) lens under active conditions. The first digit represents Optical Class, measuring distortion; the second, Diffusion of Light Class, measuring haze; the third, Variation in Luminous Transmittance Class, measuring shading consistency across the lens; and the fourth, Angle Dependence Class, measuring how clarity is maintained when viewed from different angles. A 1/1/1/1 rating signifies the highest possible level of optical perfection, indicating minimal visual distortion, excellent shade uniformity, and high clarity, which drastically reduces eye strain, improves the ability to see weld pool detail and color distinction, and ultimately ensures the welder can perform high-precision work (like crucial TIG or plasma cutting tasks) safely and accurately over extended working periods. High clarity directly correlates with reduced fatigue and enhanced quality control, making it a primary purchasing factor for professional-grade PPE, particularly in high-demand industrial sectors like aerospace and heavy machinery manufacturing.

What is the current market trend regarding PAPR integrated welding helmets and who are the primary users?

The market trend for Powered Air-Purifying Respirator (PAPR) integrated welding helmets is experiencing rapid acceleration, transitioning from a niche safety requirement to an industry-standard component of high-specification welding PPE, driven by increased regulatory scrutiny of airborne contaminants. PAPR systems draw ambient air, filter out hazardous particulates and welding fumes using high-efficiency filters (typically HEPA or specialized combination filters), and deliver clean, purified air into the helmet environment under a slight positive pressure, effectively mitigating the risk of occupational respiratory diseases associated with fume exposure, such as metal fume fever or chronic obstructive pulmonary disease. Primary users include professionals in environments with high exposure risks, such as shipbuilding, stainless steel welding, heavy manufacturing utilizing galvanized or coated materials, and operations in confined spaces like storage tanks or pressure vessels where ventilation is naturally poor. Organizations prioritize PAPR helmets due to stringent governmental regulations, liability mitigation efforts, and the direct correlation between worker health, comfort, and sustained productivity, making this segment the most technologically advanced and highest-value component of the overall welding helmet market portfolio, often necessitating specialized servicing and maintenance contracts to ensure continued compliance and filter efficacy.

How do technological advancements in battery life and solar power affect the adoption rate of ADF welding helmets?

Advancements in power management, specifically improved battery efficiency and higher-yield photovoltaic solar cells, are instrumental in driving the widespread adoption of Auto-Darkening Filter (ADF) welding helmets by significantly enhancing their reliability and reducing the long-term operational costs associated with maintenance. Modern ADF systems often utilize a combination of high-capacity lithium batteries and efficient solar panels, allowing the helmet to remain operational for hundreds or even thousands of hours on a single charge or relying solely on the arc energy and ambient shop lighting for continuous power supply. This technological reliability eliminates the critical risk of a battery failure resulting in unprotected exposure to the arc flash, a major concern for industrial safety managers regarding earlier generation models. Furthermore, the incorporation of advanced power-saving modes and simplified battery replacement procedures ensures maximized uptime and minimizes disruption on the factory floor. This enhanced durability and reduced total cost of ownership (TCO) make ADF helmets economically viable for a broader range of users, extending market penetration into SME fabrication shops and high-volume training environments where reliability and low operational overhead are paramount purchasing considerations, accelerating the displacement of passive helmets globally.

What role does ergonomic design play in the competitive landscape of the welding helmets market?

Ergonomic design has evolved from a secondary consideration to a crucial competitive differentiator, deeply influencing procurement decisions in the professional welding segment where operators wear PPE for 8 to 12 hours daily. Modern competitive helmets emphasize reduced weight through advanced material science, utilizing lightweight yet impact-resistant polymers to minimize neck and shoulder strain, a chronic occupational hazard. Key ergonomic features include multi-axis headgear adjustments, precisely balanced shell geometry, and improved padding systems that distribute weight evenly across the head, significantly enhancing wearer comfort and compliance. Manufacturers like 3M (Speedglas) and Optrel heavily market their proprietary head suspension systems, often incorporating complex ratcheting mechanisms and low-profile designs that improve fit and integration with other necessary PPE, such as ear protection and hard hats. Superior ergonomic design directly translates into reduced welder fatigue, increased operational hours, and lower incidence of musculoskeletal injuries, providing a tangible return on investment for employers and positioning manufacturers with comfortable, balanced designs at a significant advantage in securing contracts with large industrial end-users focused on comprehensive worker well-being programs and enhanced operational efficiency metrics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Auto Darkening Welding Helmets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Welding Helmets Market Size Report By Type (Passive Welding Helmet, Auto Darkening Welding Helmets), By Application (Shipbuilding, Energy, Automotive, General Industrial, Infrastructure Construction), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager