Wind Turbine Grease and Lubricant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437911 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wind Turbine Grease and Lubricant Market Size

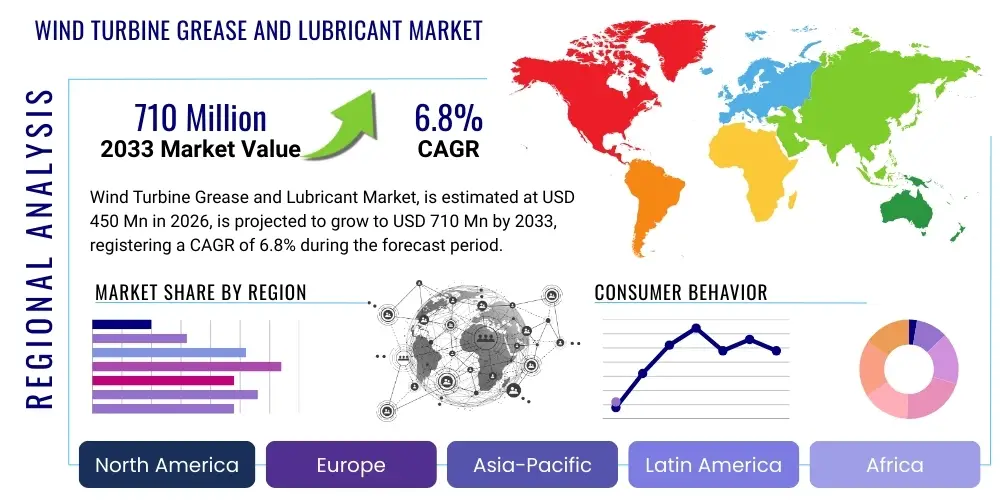

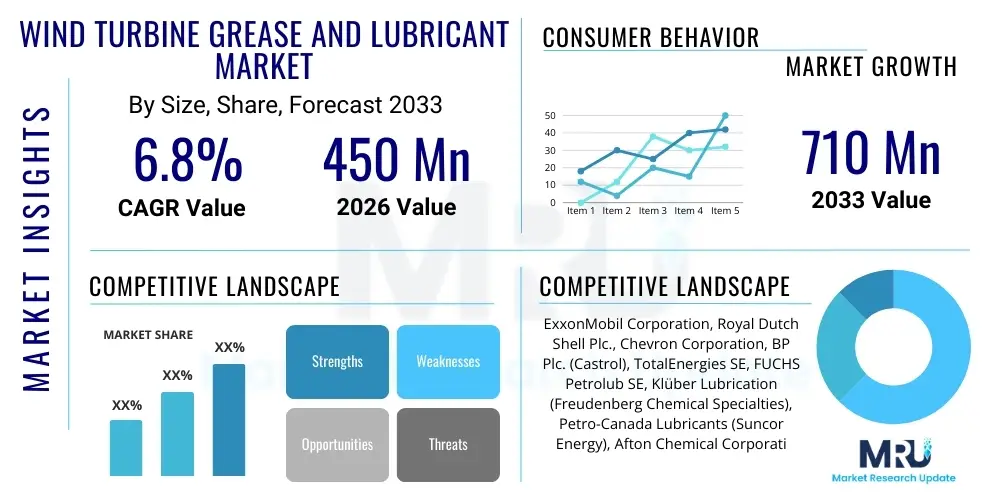

The Wind Turbine Grease and Lubricant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Wind Turbine Grease and Lubricant Market introduction

The Wind Turbine Grease and Lubricant Market encompasses specialized industrial fluids and semi-solid lubricants crucial for maintaining the operational efficiency and longevity of wind energy generation assets. These high-performance lubricants are specifically formulated to withstand the harsh and varied operating conditions characteristic of wind turbines, including extreme temperature fluctuations, high structural loads, vibrations, and moisture ingress. Key components requiring specialized lubrication include gearboxes, main bearings, pitch and yaw drives, and hydraulic systems. The rapid global deployment of both onshore and increasingly complex offshore wind farms is fundamentally accelerating demand for premium synthetic lubricants, which offer superior thermal stability and wear protection compared to traditional mineral oil-based alternatives.

The primary function of these specialized products is reducing friction and wear between moving parts, managing heat dissipation, and preventing corrosion, all of which are essential for minimizing unexpected downtime and optimizing the total cost of ownership (TCO) for wind farm operators. Applications are segmented mainly by the specific turbine component, with gearbox oils representing the largest segment due to the extreme pressure (EP) additives and anti-foaming characteristics required to protect high-speed, high-load gear meshes. The shift toward larger, multi-megawatt turbines with greater power density necessitates lubricants that can perform reliably over longer service intervals, pushing manufacturers towards advanced synthetic base stocks such as Polyalphaolefins (PAO) and esters.

Driving factors for sustained market growth include stringent government mandates promoting renewable energy adoption globally, significant investments in offshore wind infrastructure where maintenance access is challenging, and the increasing average age of the global wind turbine fleet, which requires frequent retrofitting and higher consumption of maintenance-related lubricants. The benefits derived from using high-quality wind turbine lubricants—such as extended component life, reduced energy consumption, and compliance with increasingly rigorous Original Equipment Manufacturer (OEM) specifications—are compelling operators to prioritize synthetic and bio-degradable fluid solutions. This market is highly technical, characterized by continuous innovation in additive technology aimed at improving shear stability and resistance to micropitting, especially within the critical gearbox component.

Wind Turbine Grease and Lubricant Market Executive Summary

The global Wind Turbine Grease and Lubricant Market is experiencing dynamic shifts, primarily driven by robust expansion in Asia Pacific wind installations and a technological pivot toward predictive maintenance solutions utilizing smart lubricants. Business trends indicate a consolidation among major lubricant manufacturers who are leveraging vertical integration and strategic partnerships with major turbine OEMs (Vestas, Siemens Gamesa, GE Renewable Energy) to ensure preferred supplier status and long-term service contracts. A crucial operational trend is the lengthening of lubricant drain intervals, necessitating the development of ultra-long-life synthetic fluids capable of performing for five to seven years without replacement, thereby reducing labor costs and waste disposal challenges.

Regionally, the market momentum is strongly concentrated in Asia Pacific, propelled by China’s massive domestic wind capacity additions and emerging markets like India and Vietnam. Europe remains a mature yet vital market, characterized by intense focus on offshore wind lubrication solutions and strict environmental regulations favoring bio-degradable and environmentally acceptable lubricants (EALs). North America, particularly the United States, is seeing increased maintenance demand due to an aging fleet combined with new installations benefiting from federal production tax credits (PTC) and investment tax credits (ITC), driving stable consumption across all major product segments.

Segment trends reveal that synthetic oils dominate the market value due to their superior performance characteristics necessary for maximizing asset uptime in demanding environments. Specifically, PAO-based lubricants are gaining traction over traditional mineral oils, particularly in high-stress gearbox and bearing applications. Furthermore, the grease segment is witnessing substantial growth, driven by specialized semi-fluid greases used in pitch and yaw systems that require high tackiness and excellent water resistance. The services segment, encompassing lubricant analysis, condition monitoring, and fluid management programs, is poised for rapid expansion as operators increasingly adopt data-driven maintenance protocols to optimize the operational expenditure (OPEX) of their wind assets.

AI Impact Analysis on Wind Turbine Grease and Lubricant Market

Common user questions regarding AI’s impact on the Wind Turbine Grease and Lubricant Market center on how artificial intelligence can extend component life, optimize lubrication schedules, and potentially reduce lubricant consumption. Users frequently inquire about the reliability of AI-driven Condition Monitoring Systems (CMS) in detecting early-stage lubricant degradation, predicting component failures (such as bearing wear or micropitting), and integrating these predictions directly into automated maintenance planning. Key themes include the implementation of digital twins for simulating lubricant performance under various load profiles and the use of machine learning algorithms to process complex oil analysis data, thereby shifting the industry decisively from reactive or time-based maintenance to highly precise, predictive lubrication practices.

AI’s influence is profound, primarily transforming lubricant management from a scheduled procedure into a highly optimized, condition-based endeavor. By analyzing vast datasets—including real-time vibration data, oil particle counts, temperature sensors, and historical maintenance logs—AI algorithms can precisely determine the optimal timing for lubricant replenishment or change-out, often extending drain intervals far beyond standard recommendations. This optimization leads to reduced waste, lower operational costs, and higher asset availability. Furthermore, AI tools are enhancing the formulation process itself by simulating the interaction of base oils and additives under extreme operating conditions, accelerating the development of next-generation, ultra-durable lubricants tailored for specific turbine models and geographical conditions.

The integration of AI also significantly impacts the supply chain and logistics side of the market. Predictive analytics minimize the risk of lubricant stockouts by forecasting demand based on fleet condition and operational forecasts. For lubricant suppliers, this means offering value-added services incorporating AI-powered condition monitoring alongside their physical products, creating a more sophisticated, service-oriented business model. The future of the market will see specialized smart lubricants embedded with nano-sensors feeding data directly to AI platforms, offering unprecedented visibility into the health and performance of the critical wind turbine components they protect.

- AI-driven Condition Monitoring Systems (CMS) optimize lubricant replacement intervals, shifting from fixed schedules to condition-based maintenance.

- Machine Learning algorithms enhance oil analysis, accurately predicting lubricant degradation (oxidation, contamination) and impending component failure (micropitting).

- Predictive analytics minimize unplanned downtime by forecasting lubrication needs, improving asset utilization rates.

- AI assists in formulating new synthetic lubricants by simulating performance under extreme pressures and temperatures, accelerating R&D cycles.

- Digital twins utilize AI to model the thermal and mechanical stress on gearboxes and bearings, ensuring the appropriate lubricant specification is maintained.

- Supply chain optimization through AI forecasts reduces inventory costs and improves the logistical efficiency of lubricant delivery to remote wind farms.

DRO & Impact Forces Of Wind Turbine Grease and Lubricant Market

The Wind Turbine Grease and Lubricant Market is propelled by strong Drivers such as global commitments to decarbonization and the associated exponential growth in installed wind capacity, especially offshore. However, it faces Restraints including the high initial cost of synthetic lubricants compared to mineral alternatives and the technical challenge of ensuring 100% biodegradability without compromising performance. Opportunities are abundant, specifically in the development of specialized lubricants for harsh offshore environments and the expansion of lubrication services leveraging AI and sensor technology. The cumulative Impact Forces emphasize the necessity for innovation in extended-life, environmentally friendly lubricants to meet the demands of large, remote, and highly expensive wind energy assets.

Key drivers include the imperative to achieve energy independence and the significant financial incentives provided by various governments globally for renewable energy projects. This ensures continuous new turbine installations, which immediately generate demand for fill-for-life lubricants. Furthermore, the intense performance requirements of modern multi-megawatt turbines demand premium synthetic fluids that can maintain viscosity and protective capabilities under extreme load and temperature cycles, directly fueling the high-value segment of the market. The mandatory shift towards predictive maintenance protocols, often stipulated by turbine warranties, also drives the consumption of advanced, sensor-compatible fluids.

The primary restraints involve complex regulatory frameworks, particularly concerning disposal and environmental impact, which can increase compliance costs for operators. Another significant barrier is the technological challenge posed by extreme operating conditions; wind turbine gearboxes are prone to micropitting and white etching cracks (WEC), requiring continuous, costly R&D efforts in additive chemistry. Opportunities lie in developing specialized EALs (Environmentally Acceptable Lubricants) that meet stringent EU regulations while providing comparable or superior performance to standard synthetic lubricants. Additionally, the increasing focus on repowering older wind farms presents a sustained aftermarket opportunity for lubricant suppliers providing high-performance retrofit solutions.

Impact forces are heavily weighted toward technological evolution and environmental sustainability. The need for Extended Drain Intervals (EDI) pushes manufacturers to invest heavily in Group IV (PAO) and Group V (Ester) base oils, along with sophisticated additive packages that resist shear and oxidation. The rising complexity and remoteness of offshore projects amplify the impact of maintenance efficiency; a single component failure offshore is significantly more costly than onshore, thereby increasing the emphasis on using the highest quality lubricants as a form of proactive insurance against catastrophic failure. This continuous pressure from OEMs and operators for maximum uptime dictates market standards and drives pricing power for high-performance lubricant providers.

Segmentation Analysis

The Wind Turbine Grease and Lubricant Market is extensively segmented based on the product type (Grease, Oil), the type of base oil used (Synthetic, Mineral, Semi-Synthetic), the application component (Gearbox, Bearings, Hydraulics, Pitch and Yaw systems), and the operating environment (Onshore, Offshore). This detailed segmentation provides granular insights into market dynamics, highlighting the dominance of synthetic oils in the value chain due to their necessity in high-stress components like gearboxes and main bearings. The segmentation also underscores the rapid growth of the offshore segment, which demands ultra-high-performance and often biodegradable lubricants capable of surviving the severe corrosive and humid marine environment.

Synthetic lubricants, particularly those based on PAO and ester technology, maintain the largest market share in terms of value, driven by their superior temperature stability and extended service life. The oil segment (including gearbox oils and hydraulic fluids) holds the majority of the revenue, reflecting the large volume required for critical power train components. Conversely, the grease segment, though smaller by volume, is vital for high-maintenance points like pitch and yaw mechanisms and blade roots, where semi-fluid or lithium-complex greases are applied to ensure smooth, reliable angular movement against high radial loads and varying wind directions.

The application segmentation reveals that gearbox lubrication is the single most critical and high-value segment, as gearbox failures account for a significant portion of turbine downtime and repair expenses. Lubricants in this application require specialized Extreme Pressure (EP) and anti-micropitting additives to manage the intense contact stresses within the gears. The expanding fleet of older turbines also ensures robust demand in the aftermarket segment, where replacement fluids and specialized retrofitting greases are consistently required. Geographically, the segmentation confirms Asia Pacific as the primary volume driver, while Europe leads in the adoption of premium, environmentally certified lubricants.

- By Product Type:

- Lubricating Oil (Gearbox Oil, Hydraulic Fluid)

- Grease (Pitch and Yaw Systems Grease, Bearing Grease)

- By Base Oil:

- Synthetic Oil (PAO, Esters, Polyglycols)

- Mineral Oil

- Semi-Synthetic Oil

- Bio-based/EAL (Environmentally Acceptable Lubricants)

- By Application:

- Gearbox

- Main Bearings

- Pitch and Yaw Systems

- Generator

- Hydraulics

- Others (Chains, Ropes)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

- By Operating Environment:

- Onshore Wind Turbines

- Offshore Wind Turbines

Value Chain Analysis For Wind Turbine Grease and Lubricant Market

The value chain for the Wind Turbine Grease and Lubricant Market begins with upstream activities involving the sourcing and refinement of base oils (crude oil derivatives for mineral oils, specialized chemical synthesis for synthetic PAOs and esters) and the manufacturing of performance-enhancing additives (antioxidants, EP agents, corrosion inhibitors). Key component manufacturers in the upstream segment specialize in high-quality Group III, IV, and V base stocks, which are critical determinants of the final lubricant's performance characteristics. The ability to secure stable, high-purity feedstocks is a significant competitive advantage, leading many major lubricant companies to engage in backward integration or long-term supply agreements with specialized chemical suppliers.

Midstream activities involve the crucial blending and formulation phase, where lubricant manufacturers combine the base oils and additive packages according to precise OEM specifications and industry standards (e.g., ISO VG classifications). This stage requires specialized blending facilities, rigorous quality control testing (viscosity index, flash point, thermal stability), and detailed certification processes. Downstream activities involve distribution channels, which are highly specialized due to the technical nature of the product. Distribution often occurs directly to major wind farm operators, through exclusive contracts with large turbine OEMs for factory fill and warranty service, or via specialized industrial distributors who provide technical support and fluid analysis services.

Distribution channels are categorized into direct and indirect methods. Direct sales are predominant for large-volume contracts, especially with Tier 1 wind farm developers and independent power producers (IPPs), where long-term supply agreements are negotiated based on performance guarantees and life-cycle cost analysis. Indirect channels, utilizing regional or national industrial distributors, are essential for serving smaller, independent maintenance providers and older wind farm retrofits. The service component, including oil analysis laboratories and technical consultancy, plays an increasingly significant role in the downstream value chain, as operators rely on these services to extend component life and validate lubricant performance, making technical service expertise a critical differentiator in this specialized market.

Wind Turbine Grease and Lubricant Market Potential Customers

The primary consumers and end-users of specialized wind turbine grease and lubricants are entities responsible for the construction, operation, and maintenance (O&M) of wind energy assets globally. This encompasses a broad spectrum of stakeholders, including major Original Equipment Manufacturers (OEMs) who utilize these lubricants for factory fills and subsequent warranty services, large Independent Power Producers (IPPs) who own and operate vast fleets of turbines, and specialized third-party maintenance contractors (3rd Party O&M Providers) tasked with ensuring the operational efficiency of the assets under management.

OEMs such as Vestas, Siemens Gamesa Renewable Energy, and Goldwind are critical customers, as they often standardize lubricant usage across their fleets and may require proprietary or highly customized formulations to meet their specific component design needs, particularly for innovative, direct-drive turbine architectures. These relationships are foundational, as OEM approval significantly validates the quality and performance of a lubricant product within the entire industry. IPPs, including utilities and large energy investment firms, represent the largest volume consumers in the aftermarket, procuring lubricants for routine maintenance, condition-based change-outs, and emergency repairs across their geographically dispersed portfolios.

Furthermore, smaller, independent wind farm owners and maintenance service providers constitute a growing customer base, often relying on specialized lubricant distributors for technical advice and smaller volume purchases. The expansion of offshore wind development introduces large-scale utility customers requiring premium, often biodegradable, lubricants capable of extended service life in extremely demanding marine conditions. Consequently, lubricant manufacturers must maintain distinct marketing and technical support strategies targeting each customer type—OEMs require R&D partnership and specification alignment, while IPPs seek robust performance data, extended warranty backing, and competitive pricing on volume contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil Corporation, Royal Dutch Shell Plc., Chevron Corporation, BP Plc. (Castrol), TotalEnergies SE, FUCHS Petrolub SE, Klüber Lubrication (Freudenberg Chemical Specialties), Petro-Canada Lubricants (Suncor Energy), Afton Chemical Corporation, Lubrizol Corporation, Houghton International (Yushiro), Valvoline Inc., SKF Group, LUKOIL Lubricants Company, Gulf Oil International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Turbine Grease and Lubricant Market Key Technology Landscape

The technology landscape of the Wind Turbine Grease and Lubricant Market is dominated by advancements in synthetic base oil chemistry and sophisticated additive packages designed for extreme performance. A primary technological focus is on Polyalphaolefin (PAO) and ester-based synthetic lubricants (Group IV and V base stocks), which offer superior thermal oxidation stability, high viscosity index, and excellent low-temperature fluidity essential for turbines operating in diverse climatic zones. These base oils provide the foundational performance required for extended drain intervals (EDI), significantly reducing the frequency of costly turbine shutdowns for fluid changes. Furthermore, the industry is heavily investing in specialized polymers and thickeners for greases used in pitch and yaw systems, ensuring mechanical stability and resistance to water washout in aggressive environments, particularly offshore installations.

Additive technology represents the cutting edge of innovation, focusing on three critical areas: anti-micropitting agents, white etching crack (WEC) mitigating additives, and advanced anti-corrosion packages. Micropitting—a fatigue wear mechanism in highly loaded gears—is a pervasive problem, leading lubricant developers to formulate specialized sulfur-phosphorus EP additives that form protective films without being overly aggressive. Research into WEC, a major cause of premature bearing failure, is driving the adoption of non-metallic, ashless additive systems that counteract hydrogen embrittlement. Simultaneously, nanotechnology is emerging, with solid lubricants and nanoparticles (such as carbon nanotubes or specialized ceramics) being suspended in fluid to provide enhanced boundary lubrication and repair minor surface damage in high-wear zones.

Beyond the chemistry itself, digital technology is fundamentally transforming lubrication practices. The widespread adoption of Condition Monitoring Systems (CMS), coupled with remote oil analysis and embedded sensors, is generating massive amounts of data. This technology allows for the precise measurement of particle counts, moisture content, and chemical degradation in real-time, enabling operators to manage assets based on actual condition rather than elapsed time. The future technology trajectory includes developing "smart lubricants" that change physical properties or chemical signals upon reaching a critical degradation point, feeding back critical information directly to the turbine's control system, and further integrating lubrication management into overall operational asset performance management (APM) platforms.

Regional Highlights

The global distribution of the Wind Turbine Grease and Lubricant Market is highly correlated with regional wind energy capacity, maintenance requirements, and regulatory environments. Asia Pacific (APAC) currently holds the dominant position both in terms of volume and new installation growth, largely driven by aggressive national renewable energy targets in China, India, and emerging economies across Southeast Asia. China, with its massive build-out of onshore and offshore wind farms, is the single largest consumer, although this market often favors locally produced, cost-competitive lubrication solutions, while also adopting high-end synthetics for newer, larger turbine classes. The sustained expansion of the APAC market ensures that it will remain the central engine for volume growth throughout the forecast period.

Europe represents the most mature market, characterized by technological leadership, high consumption of premium synthetic lubricants, and strict adherence to environmental mandates. The intense focus on offshore wind development in the North and Baltic Seas compels operators to use the highest quality lubricants (often Group IV and V base stocks) with extended service life to minimize complex and costly maintenance interventions. Furthermore, Europe's stringent REACH regulations and the proliferation of eco-labels drive strong demand for Environmentally Acceptable Lubricants (EALs), particularly in marine applications, establishing the region as the benchmark for high-specification, sustainable lubrication solutions.

North America, particularly the United States, represents a robust and stable market. The U.S. market dynamic is unique, balancing new installations (often in the competitive Midwest wind belt) with significant maintenance demand from a large aging fleet installed between 2000 and 2015. This duality creates simultaneous demand for both high-end factory-fill synthetics and a strong aftermarket for replacement and retrofit products. The region also exhibits high adoption rates for advanced fluid analysis and condition monitoring services, as operators focus intensely on maximizing the operational lifespan and efficiency of their existing assets under challenging weather conditions.

- Asia Pacific (APAC): Dominant market share due to unparalleled new capacity additions, led by China and India. Rapid transition towards large-scale offshore projects drives synthetic lubricant demand.

- Europe: High-value market focused on offshore wind, driving demand for premium, ultra-long-life, and certified Environmentally Acceptable Lubricants (EALs). Strict regulatory environment dictates lubricant formulation standards.

- North America: Stable growth driven by both new installations and extensive maintenance requirements for a large, aging turbine fleet. High adoption of predictive maintenance technologies and fluid analysis services.

- Latin America (LATAM): Emerging market characterized by significant wind projects in Brazil, Mexico, and Chile. Demand is volatile but growing, with a focus on cost-effective, high-performance fluids suitable for remote, high-temperature environments.

- Middle East and Africa (MEA): Smallest current market size, but poised for growth driven by ambitious national energy diversification strategies, particularly in the UAE and South Africa, focusing on desert-specific, temperature-resistant lubrication solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Turbine Grease and Lubricant Market.- ExxonMobil Corporation

- Royal Dutch Shell Plc.

- Chevron Corporation

- BP Plc. (Castrol)

- TotalEnergies SE

- FUCHS Petrolub SE

- Klüber Lubrication (Freudenberg Chemical Specialties)

- Petro-Canada Lubricants (Suncor Energy)

- Afton Chemical Corporation (Additive Supplier)

- Lubrizol Corporation (Additive Supplier)

- Houghton International (Yushiro)

- Valvoline Inc.

- SKF Group (Focus on bearing greases and systems)

- LUKOIL Lubricants Company

- Gulf Oil International

- Eni S.p.A.

- Vitol Group

- Phillips 66 Company

- Idemitsu Kosan Co., Ltd.

- MOL Group

Frequently Asked Questions

Analyze common user questions about the Wind Turbine Grease and Lubricant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic and mineral lubricants for wind turbines?

Synthetic lubricants, typically derived from Polyalphaolefins (PAO) or esters, offer superior thermal and oxidation stability, higher viscosity indices, and longer service life compared to mineral oils. This high performance is crucial for the extreme load and temperature conditions in modern turbine gearboxes, enabling extended drain intervals and reducing maintenance frequency.

Why are specialized anti-micropitting additives essential for wind turbine gearbox oils?

Wind turbine gearboxes operate under intensely high contact pressures, which frequently causes surface fatigue known as micropitting. Anti-micropitting additives, often specialized Extreme Pressure (EP) agents, are crucial for forming a protective film on gear teeth, preventing this fatigue wear and significantly extending the lifespan of the gearbox components.

How do environmental regulations impact the demand for wind turbine lubricants, especially offshore?

Strict environmental regulations, particularly in Europe (like the Vessel General Permit in the US and various EU directives), mandate the use of Environmentally Acceptable Lubricants (EALs) in components where leakage is possible, especially offshore. This drives high demand for readily biodegradable synthetic esters and polyglycols in hydraulic and pitch/yaw systems.

Which component application segment holds the highest value share in the wind turbine lubricant market?

The gearbox application segment commands the highest value share. This is attributed to the large volume of high-specification, costly synthetic oil required to protect the gearbox and the extreme importance of this component to overall turbine reliability and uptime, necessitating premium, long-life fluid formulations.

What role does Condition Monitoring play in optimizing lubricant usage in wind farms?

Condition Monitoring Systems (CMS) and fluid analysis utilize sensors and laboratory testing to track the real-time health of the lubricant and components. This allows operators to transition from costly time-based lubrication schedules to precise, condition-based maintenance, maximizing the lubricant's lifespan and proactively preventing catastrophic component failure.

What is the current growth trajectory for the offshore wind lubricant market compared to onshore?

The offshore segment is exhibiting a faster growth trajectory than the mature onshore market, driven by massive infrastructure investments globally. Offshore projects demand more specialized, ultra-high-performance synthetic and EAL fluids with exceptionally long service lives to counteract the high operational costs associated with remote marine maintenance.

How is lubricant technology addressing the challenge of White Etching Cracks (WEC) in bearings?

Manufacturers are developing ashless and non-metallic additive packages to mitigate WEC. These advanced chemistries aim to reduce electrical potential and hydrogen ingress into the steel components, which are primary causes of premature bearing failure, thereby extending the operational reliability of main and auxiliary bearings.

What key characteristics are sought in greases designed for pitch and yaw systems?

Greases for pitch and yaw systems must exhibit superior tackiness, excellent mechanical stability, resistance to water washout, and reliable low-temperature performance. Lithium complex or polyurea-based thickeners, combined with heavy base oils, are commonly used to ensure smooth movement and protection against high static loads and vibration.

What are the implications of lubricant consolidation and OEM partnerships on market competition?

Consolidation leads to a highly competitive, yet technically demanding, environment. Strategic partnerships between major lubricant suppliers and leading turbine OEMs (Original Equipment Manufacturers) create significant barriers to entry for smaller players, as OEM approval and standardized factory-fill contracts secure long-term revenue streams for the established market leaders.

Which geographical region is currently the largest consumer of wind turbine lubricants by volume?

Asia Pacific (APAC), primarily led by China, is the largest consumer of wind turbine lubricants by volume due to its unparalleled scale of installed wind capacity and ongoing construction of new mega-wind farms, driving immense demand for both initial fill and maintenance fluid consumption.

Why is the viscosity index (VI) a critical metric for wind turbine gearbox oil performance?

The viscosity index (VI) measures how much a lubricant's viscosity changes with temperature. A high VI, characteristic of synthetic oils, is essential for wind turbines, which often operate in extreme temperature ranges (sub-zero to high heat), ensuring the oil maintains adequate film thickness for protection without becoming too viscous at cold startups.

How is nanotechnology being applied in advanced wind turbine lubricants?

Nanotechnology involves suspending microscopic solid lubricants (such as specialized metal or ceramic particles) within the fluid. These nanoparticles provide enhanced boundary lubrication, reducing friction and wear under extreme load conditions and potentially offering self-healing properties for minor surface imperfections on gear teeth and bearings.

What is the expected average drain interval for high-performance synthetic gearbox oils in modern turbines?

High-performance synthetic PAO and ester-based gearbox oils are engineered to achieve Extended Drain Intervals (EDI), typically ranging from 5 to 7 years, dependent on operational conditions and constant monitoring via fluid analysis. This significantly reduces maintenance complexity and downtime compared to older, mineral-based fluids.

What is the significance of the shift from mineral oil Group I/II to synthetic Group IV/V base oils?

The shift signifies a move toward enhanced performance and longevity. Group IV (PAO) and Group V (Esters) synthetic base oils possess chemically uniform molecular structures, offering superior resistance to thermal breakdown, better cold flow characteristics, and higher inherent shear stability, which are non-negotiable for protecting multi-megawatt turbine components.

What are the main concerns regarding lubricant contamination in wind turbine operations?

The main concerns are contamination by water and particulate matter. Water ingress, common in humid or offshore environments, accelerates oxidation and reduces film strength, leading to corrosion and pitting. Particulate contamination (wear debris) causes abrasive wear. Both require specialized filtration and vigilant condition monitoring.

How does the total cost of ownership (TCO) calculation influence the choice between mineral and synthetic lubricants?

Although synthetic lubricants have a higher initial purchasing price, their ability to extend component life, reduce unscheduled downtime, and permit longer drain intervals results in a lower overall Total Cost of Ownership (TCO) over the asset's lifespan, making them the economically preferred choice despite the higher upfront investment.

What role do independent lubricant blending companies play in this highly specialized market?

Independent blending companies often focus on niche, high-performance applications, offering customized formulations that meet specific OEM requirements or addressing unique regional operational challenges. They compete by offering technical agility and specialized customer service, complementing the larger, global offerings from integrated oil majors.

How does the demand for hydraulic fluids in wind turbines evolve with turbine size?

As turbine size increases, the complexity and power requirements of hydraulic systems (used primarily for braking, pitch control, and yaw mechanisms) also grow. This necessitates higher volumes of specialized, high-pressure hydraulic fluids, often synthetic or EAL-certified, that ensure rapid response and reliable function in safety-critical systems.

What is the expected long-term impact of digitalization on lubricant consumption volumes?

Digitalization, through AI-driven predictive maintenance, is expected to slightly reduce the overall frequency of lubricant change-outs by maximizing drain intervals. However, this is counterbalanced by the growing global fleet size and the shift toward higher-value synthetic products, meaning the market value continues to grow even if volume growth slows down.

What specific challenges do lubricants face in extremely cold climates, and what formulations address these?

In extremely cold climates, lubricants face high resistance to flow (viscosity increase) during startup, potentially leading to component starvation and increased power consumption. Formulations with very low pour points and high Viscosity Indices, primarily based on PAO or specialty esters, are engineered to ensure fluidity and protection even below -40°C.

How do lubricant suppliers ensure product compatibility with various OEM specifications?

Suppliers must undergo rigorous and lengthy testing and certification processes dictated by each major OEM (e.g., Siemens Gamesa, Vestas, GE). Achieving OEM approval ensures the lubricant meets the specific material compatibility, load-bearing capacity, and service life requirements of that turbine model, which is essential for market penetration and warranty adherence.

What are the key drivers for the aftermarket segment of wind turbine lubricants?

The key drivers for the aftermarket include routine servicing, the replacement cycle for high-volume gearbox oil, and the maintenance needs of the large, established fleet of aging turbines globally. Furthermore, retrofitting older turbines with modern, synthetic lubricants to extend their operational life substantially boosts aftermarket demand.

What are the most commonly used thickeners in wind turbine bearing greases?

Lithium complex and polyurea thickeners are the most common due to their excellent mechanical stability, high dropping points, and superior resistance to water and corrosion. Polyurea greases are frequently preferred for generator and main bearings due to their exceptional high-temperature performance and shear stability.

How do turbine maintenance schedules differentiate between onshore and offshore lubrication practices?

Offshore turbines mandate significantly extended maintenance intervals (often favoring 7+ year drain intervals) due to difficult access and high intervention costs. This necessitates ultra-premium, ultra-long-life synthetic lubricants and comprehensive remote condition monitoring. Onshore maintenance tends to be more accessible, allowing for slightly shorter, though still optimized, schedules.

What impact does the trend toward larger, direct-drive turbines have on lubricant requirements?

Direct-drive turbines eliminate the gearbox, simplifying lubrication needs but increasing the demand for high-performance generator and main bearing greases, as these components now bear higher loads and require extreme thermal management and electrical resistivity properties in their lubricants.

Describe the primary function of anti-oxidation additives in wind turbine oils.

Anti-oxidation additives retard the chemical reaction between the lubricant and oxygen, which is accelerated by high operating temperatures and contaminants. By preventing premature oxidation, these additives maintain the lubricant's crucial performance properties, extending its useful life and preventing sludge formation and corrosive acid buildup.

How do lubricant manufacturers address the logistical challenge of supplying remote wind farms globally?

Logistical efficiency is achieved through establishing strong regional distribution networks, using localized blending facilities to reduce shipping costs, and implementing robust supply chain forecasting (often AI-assisted) based on customer fleet size and predicted consumption rates to ensure timely delivery to geographically dispersed, sometimes challenging, locations.

What is the significance of the FAG FE8 test standard in wind turbine lubrication?

The FAG FE8 test is a critical laboratory procedure used to assess the lubricating properties and mechanical stability of greases under typical rolling bearing loads and high temperatures. Successful performance in the FE8 test is often a requirement for greases intended for highly stressed main and generator bearings in wind turbines.

What specific challenges does the high altitude or mountain environment pose for lubricants?

Turbines at high altitudes often experience significant temperature extremes (both very low overnight temperatures and high diurnal swings) and reduced air density. Lubricants must exhibit superior low-temperature fluidity for reliable startup and high thermal stability to manage the heat generated under full load in thin air conditions.

How does the growth of Repowering (turbine replacement) influence lubricant demand?

Repowering, where older, smaller turbines are replaced by newer, larger multi-megawatt units, creates a dual demand: immediate high-volume demand for initial fill of premium synthetic lubricants for the new machines, followed by ongoing increased maintenance demand tailored to the new, more demanding operational specifications of the modernized fleet.

What specific advantages do ester base oils offer over PAOs in certain wind turbine applications?

Ester base oils (Group V) often offer better solvency (which helps keep deposits suspended), improved additive response, and natural biodegradability compared to PAOs (Group IV). They are frequently preferred for hydraulic fluids and in EAL formulations for offshore applications where environmental certification is paramount.

How are lubricant manufacturers utilizing digital twins in product development?

Digital twins allow manufacturers to create virtual models of wind turbine components (like gearboxes or bearings). By simulating real-world operational stresses, temperatures, and loads, they can test new lubricant formulations digitally before physical production, significantly accelerating R&D cycles and optimizing additive packages for specific conditions.

What is the function of demulsibility in wind turbine hydraulic fluids?

Demulsibility is the ability of a hydraulic fluid to rapidly separate from water. This is crucial in wind turbines, especially in humid or offshore environments, as poor demulsibility leads to fluid degradation, corrosion, and reduced system efficiency. High-quality hydraulic fluids must readily release any ingested moisture.

How does the increasing size of turbine rotors affect the required performance characteristics of pitch system greases?

Larger rotors mean increased blade weight and higher rotational inertia, translating to significantly higher static and dynamic loads on the pitch bearings. This demands pitch greases with exceptional load-carrying capacity (high Four-Ball Weld Load scores), extreme tackiness, and enhanced structural stability to prevent squeeze-out and false brinelling.

What is the market dynamic concerning price sensitivity for wind turbine lubricants?

While the market is sensitive to cost, price is often secondary to performance guarantee and OEM approval. Operators prioritize premium synthetic lubricants due to the catastrophic cost of component failure (e.g., a gearbox replacement costing millions). Therefore, the market favors performance-based procurement over pure cost minimization.

What percentage of turbine failures are typically attributed directly or indirectly to lubrication issues?

Industry data often indicates that approximately 60% to 80% of all mechanical failures in rotating equipment, including wind turbine components like gearboxes and bearings, are directly or indirectly attributable to improper lubrication (e.g., incorrect lubricant, contamination, or failure to change the fluid).

What are the key technical specifications that define a high-performance wind turbine gearbox oil?

Key technical specifications include a high Viscosity Index (VI), exceptional thermal and oxidation stability (TOST), superior demulsibility, low foaming characteristics, and crucially, excellent performance in the FZG micropitting test, ensuring robust protection against gear wear under high loads and shock conditions.

How do regulatory bodies enforce lubricant compliance in offshore installations?

Regulatory bodies such as the US EPA (VGP) and European maritime agencies enforce compliance by requiring operators to demonstrate that lubricants used in specific stern tube, thruster, or hydraulic systems are classified as Environmentally Acceptable Lubricants (EALs), meaning they are non-toxic, biodegradable, and non-bioaccumulative, supported by documentation and testing.

Which segment, oil or grease, is projected to exhibit faster volume growth in the forecast period?

While the oil segment (gearbox and hydraulic) constitutes the majority of the total volume, the specialized grease segment (pitch and yaw systems, main bearings) is projected to exhibit slightly faster volume and value growth, driven by the increasing size and complexity of large-scale offshore and multi-megawatt onshore turbines requiring high-performance, long-life greases.

What is the primary role of corrosion inhibitors in wind turbine lubricants, particularly for bearings?

Corrosion inhibitors form a chemical barrier on metal surfaces, protecting internal components like bearing races and gear teeth from corrosive attack caused by moisture, acid buildup from oxidation, or contaminants. This protection is vital for extending the lifespan of extremely expensive and hard-to-replace components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager