Wind Turbine Grease and Lubricant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439729 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Wind Turbine Grease and Lubricant Market Size

The Wind Turbine Grease and Lubricant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Wind Turbine Grease and Lubricant Market introduction

The wind turbine grease and lubricant market plays a pivotal role in the sustainable operation and longevity of wind energy infrastructure globally. These specialized lubricants are engineered to meet the stringent demands of wind turbine components, including gearboxes, main bearings, pitch and yaw drives, and generators. The market encompasses a diverse range of products, from mineral oil-based solutions to high-performance synthetic and environmentally acceptable bio-based lubricants, each designed to withstand extreme temperatures, heavy loads, and abrasive conditions inherent in wind turbine environments.

The primary function of these greases and lubricants is to reduce friction and wear, prevent corrosion, dissipate heat, and seal components against contaminants, thereby extending the operational lifespan of critical turbine parts. This in turn minimizes downtime and reduces maintenance costs, which are significant factors in the overall economics of wind power generation. Major applications span both onshore and increasingly complex offshore wind farms, where operational reliability is paramount due to harsh conditions and difficult accessibility.

The benefits derived from high-quality wind turbine lubricants are manifold, including enhanced energy efficiency, reduced unscheduled maintenance, compliance with environmental regulations, and improved return on investment for wind farm operators. The market's growth is predominantly driven by the escalating global demand for renewable energy, aggressive governmental targets for decarbonization, and continuous technological advancements in wind turbine design that necessitate more sophisticated lubrication solutions. Furthermore, the aging global fleet of wind turbines increasingly requires advanced lubricants to maintain peak performance and extend asset life, fueling consistent market demand.

Wind Turbine Grease and Lubricant Market Executive Summary

The Wind Turbine Grease and Lubricant Market is experiencing robust growth, driven by an accelerating global transition to renewable energy and the expansion of wind power capacity worldwide. Business trends indicate a strong emphasis on product innovation, with manufacturers investing heavily in developing high-performance synthetic and bio-based lubricants that offer extended service intervals, improved component protection, and enhanced environmental compatibility. Consolidations and strategic partnerships are becoming common as companies seek to expand their geographical reach and integrate advanced material science into their product portfolios. Demand for specialized maintenance services and condition monitoring solutions, often bundled with lubricant offerings, is also on the rise, reflecting a broader shift towards comprehensive asset management in the wind energy sector.

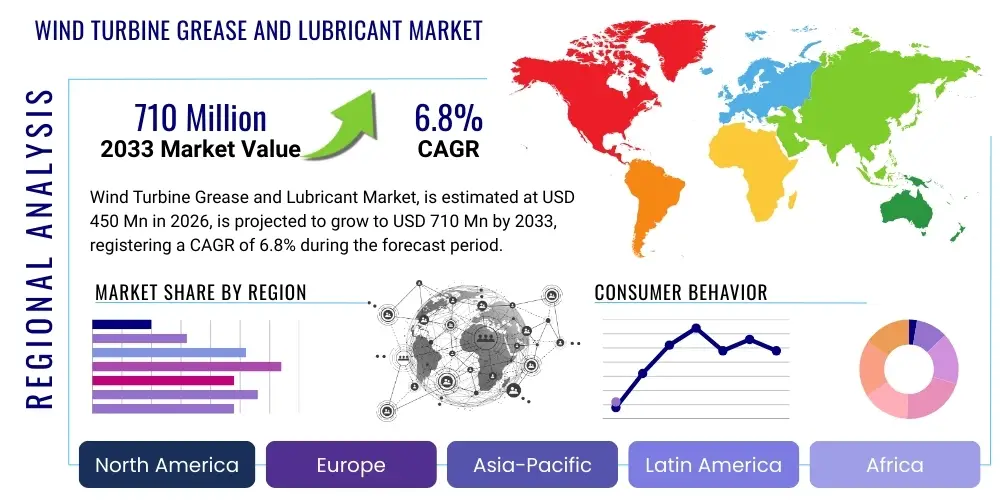

Regional trends highlight Asia Pacific as the fastest-growing market, primarily due to ambitious wind power installation targets in China, India, and other emerging economies, coupled with significant governmental support and investment. Europe, a mature wind energy market, continues to drive demand through the expansion of offshore wind projects and the maintenance needs of its extensive existing fleet. North America is also witnessing substantial growth, propelled by favorable regulatory policies, investment tax credits, and the increasing competitiveness of wind energy as a power source. Latin America, the Middle East, and Africa are showing nascent but promising growth, influenced by evolving energy policies and the potential for large-scale wind farm developments.

Segmentation trends reveal a clear shift towards synthetic oil-based and bio-based lubricants due to their superior performance characteristics and environmental benefits, especially in critical applications like gearboxes and main bearings. The demand for lubricants tailored for offshore wind turbines is escalating, given the extreme operational conditions and the premium on reliability in marine environments. Furthermore, a growing preference for longer-lasting lubricants that reduce the frequency of lubrication, thereby minimizing operational interruptions and human intervention, is reshaping product development strategies across the industry. This focus on durability and efficiency is directly linked to the overarching goal of reducing the levelized cost of energy (LCOE) for wind power.

AI Impact Analysis on Wind Turbine Grease and Lubricant Market

Users frequently inquire about how artificial intelligence can revolutionize the maintenance and performance of wind turbines, specifically concerning lubrication strategies. Key themes revolve around the potential for AI to optimize lubrication schedules, predict component failures more accurately, and reduce manual intervention, leading to significant operational cost savings and increased turbine uptime. Concerns often touch upon data privacy, the complexity of implementing AI systems, and the need for skilled personnel to manage these advanced technologies. Expectations are high for AI to enable more proactive and adaptive lubrication, moving beyond time-based or reactive maintenance to a truly condition-based approach that is both efficient and environmentally conscious.

- AI-driven predictive maintenance platforms optimize lubrication intervals by analyzing real-time sensor data, operational history, and environmental conditions.

- Machine learning algorithms enhance fault detection in critical components like gearboxes and bearings, enabling timely lubricant replacement or adjustment before catastrophic failure.

- AI-powered analytics facilitate selection of the most suitable lubricant type for specific turbine models and operating environments, improving efficiency and extending component life.

- Robotics and autonomous systems, integrated with AI, can automate lubrication tasks in hard-to-reach or hazardous areas of wind turbines, improving safety and consistency.

- Data from smart lubricants with embedded sensors can be processed by AI to monitor lubricant degradation, contamination levels, and performance in real-time, providing actionable insights.

- AI assists in inventory management and supply chain optimization for lubricants, ensuring availability while minimizing waste and storage costs across large wind farm portfolios.

- Advanced AI models contribute to the design and formulation of next-generation lubricants by simulating performance under various stress conditions, accelerating R&D cycles.

DRO & Impact Forces Of Wind Turbine Grease and Lubricant Market

The Wind Turbine Grease and Lubricant Market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the global surge in wind power installations, propelled by urgent climate change mitigation efforts and government incentives for renewable energy. The increasing focus on operational efficiency and extending the service life of expensive turbine components also significantly boosts demand for high-performance lubricants. Advancements in lubricant technology, including the development of synthetic and bio-based options that offer superior protection and longer drain intervals, further fuel market expansion. Another critical driver is the need for specialized lubricants capable of withstanding the harsh and variable conditions of both onshore and offshore wind environments, ensuring reliable energy generation.

However, the market faces several notable restraints. The relatively high initial cost of specialized wind turbine greases and lubricants compared to general-purpose industrial lubricants can be a barrier for some operators, especially in price-sensitive markets. Environmental concerns surrounding the disposal and potential leakage of petroleum-based lubricants drive demand for more expensive but sustainable alternatives, presenting a cost challenge. Furthermore, the fluctuating prices of raw materials, such as base oils and additives, can impact manufacturing costs and product pricing, creating market volatility. Supply chain complexities and the need for intricate technical support also add to the operational hurdles within the industry.

Opportunities for growth are abundant, particularly in the ongoing development and widespread adoption of bio-based and fully biodegradable lubricants, aligning with stricter environmental regulations and corporate sustainability goals. The significant expansion into offshore wind farms, which require highly robust and durable lubrication solutions due to extreme environmental exposure and difficult maintenance access, presents a substantial growth avenue. The integration of smart lubrication systems, enabled by IoT and AI for real-time monitoring and predictive maintenance, offers a pathway to increased efficiency and a competitive edge. Moreover, the demand for retrofitting and upgrading lubricants in the aging global fleet of wind turbines provides a steady aftermarket opportunity for innovative products.

External impact forces significantly influence the market trajectory. Stringent environmental regulations, particularly in regions like Europe and North America, mandate the use of environmentally acceptable lubricants (EALs), pushing manufacturers towards sustainable formulations. Rapid technological advancements in wind turbine design, leading to larger, more powerful, and more complex turbines, continuously demand lubricants with enhanced performance characteristics. Economic incentives and subsidies for renewable energy projects directly stimulate investment in wind power, thereby increasing the market for associated lubricants. Geopolitical factors affecting energy policies and international trade agreements also play a role, influencing investment flows and supply chain dynamics within the global wind energy sector.

Segmentation Analysis

The Wind Turbine Grease and Lubricant Market is comprehensively segmented to provide granular insights into its diverse components and dynamics. This segmentation facilitates a deeper understanding of market drivers, restraints, opportunities, and competitive landscapes across various product types, applications, and end-user categories. The market is primarily analyzed based on the chemical composition and performance characteristics of the lubricants, their specific function within the wind turbine mechanism, and the operational environment of the turbines themselves. This structured approach allows stakeholders to identify niche markets, assess growth potential, and tailor product development strategies to meet evolving industry demands, ensuring optimal performance and sustainability across the wind energy value chain.

- By Type:

- Mineral Oil-Based Lubricants: Traditional lubricants offering cost-effectiveness and proven performance in less demanding applications or older turbines.

- Synthetic Oil-Based Lubricants: High-performance lubricants providing superior thermal stability, oxidation resistance, and extended service life, crucial for modern, high-power turbines.

- Bio-Based Lubricants (Environmentally Acceptable Lubricants - EALs): Formulations derived from renewable resources, offering biodegradability and reduced environmental impact, increasingly preferred in sensitive ecosystems and offshore applications.

- By Application:

- Gearbox: The largest application segment, requiring high-performance gear oils to protect against extreme pressure, wear, and fatigue in high-load, continuous operation.

- Bearings (Main, Generator, Pitch, Yaw): Demands specialized greases and oils for heavy loads, slow speeds, and oscillating movements, ensuring smooth operation and preventing premature failure.

- Hydraulic Systems: Hydraulic fluids for pitch control and braking systems, requiring stable viscosity and excellent anti-wear properties under varying temperatures.

- Pitch & Yaw Drives: Greases and oils for the mechanisms that orient the rotor blades and the nacelle, ensuring precise control and protection against corrosion.

- Generator: Lubricants for generator bearings and other moving parts, designed to withstand high speeds and temperatures while maintaining electrical insulation properties.

- Other Applications: Includes lubricants for couplings, shafts, and various auxiliary components within the turbine structure.

- By End-User:

- Onshore Wind Turbines: Lubricants for turbines located on land, often subject to varying climates and requiring robust protection against environmental factors.

- Offshore Wind Turbines: High-performance and environmentally acceptable lubricants specifically designed for the corrosive, harsh, and often remote conditions of marine environments, prioritizing extended service intervals.

Value Chain Analysis For Wind Turbine Grease and Lubricant Market

The value chain for the Wind Turbine Grease and Lubricant Market begins with the upstream analysis, involving the extraction and processing of raw materials. This segment primarily consists of crude oil refiners for mineral oil-based lubricants, chemical companies providing synthetic base stocks and performance additives, and agricultural or biotechnology firms supplying renewable feedstocks for bio-based lubricants. Key raw materials include various types of base oils (mineral, PAO, esters, glycols), thickeners (lithium, calcium sulfonates), and a sophisticated blend of additives (anti-wear, antioxidants, rust inhibitors, friction modifiers). The quality and availability of these raw materials directly impact the cost, performance, and environmental profile of the final lubricant products, making this a critical foundational stage.

Moving through the midstream, lubricant manufacturers are central to the value chain, blending base oils with proprietary additive packages to formulate specialized greases and lubricants for wind turbine applications. These manufacturers invest heavily in research and development to create products that meet stringent industry standards and OEM specifications, such as those from Vestas, Siemens Gamesa, GE Renewable Energy, and Goldwind. Manufacturing processes involve strict quality control, testing, and packaging to ensure product integrity and performance. The distribution channel then plays a crucial role in delivering these products to end-users. This typically involves a mix of direct sales channels, where manufacturers engage directly with large wind farm operators and turbine OEMs, and indirect channels, utilizing a network of distributors, wholesalers, and specialized industrial suppliers who provide regional access and technical support.

The downstream analysis focuses on the end-users and the service life of the lubricants. Wind turbine manufacturers often factory-fill turbines with specific lubricants, creating an initial demand. Subsequently, wind farm operators and independent service providers (ISPs) are the primary consumers, purchasing lubricants for ongoing maintenance, refilling, and component replacement. The emphasis at this stage is on product availability, technical support, and comprehensive lubrication management services that can extend component life and optimize turbine uptime. Recycling and disposal services for used lubricants form the final part of the value chain, addressing environmental regulations and promoting circular economy principles. The efficient functioning of this entire chain, from raw material sourcing to end-use and disposal, is vital for the sustainable growth of the wind energy sector.

Wind Turbine Grease and Lubricant Market Potential Customers

The primary potential customers for wind turbine greases and lubricants are entities involved in the operation, maintenance, and manufacturing of wind energy assets. Wind farm operators constitute the largest segment of end-users, requiring a continuous supply of specialized lubricants for their existing fleet of turbines. These operators, ranging from large utility companies and independent power producers (IPPs) to smaller community-owned projects, prioritize lubricants that offer extended service intervals, enhance turbine reliability, and contribute to reducing their overall operational expenditures (OpEx). Their purchasing decisions are heavily influenced by total cost of ownership, lubricant performance in specific turbine models, and compliance with environmental regulations, particularly for offshore installations.

Another significant customer group includes original equipment manufacturers (OEMs) of wind turbines. Companies like Vestas, Siemens Gamesa, GE Renewable Energy, and Goldwind procure lubricants for the initial factory fill of newly manufactured turbines and often specify preferred lubricants for their equipment during its operational lifetime. OEMs also offer long-term service agreements (LTSAs) that include lubrication services, thus becoming direct purchasers of these products. Their demand is driven by the need for lubricants that meet stringent engineering specifications, contribute to warranty compliance, and align with their design philosophies for maximizing turbine performance and longevity.

Independent service providers (ISPs) and third-party maintenance contractors also represent a substantial customer base. These companies specialize in the maintenance, repair, and overhaul (MRO) of wind turbines, serving a diverse range of wind farm owners. ISPs require a broad portfolio of lubricants to service different turbine models and components, often seeking flexible supply chains and competitive pricing. Their purchasing decisions are influenced by product availability, technical support from lubricant manufacturers, and the ability to provide cost-effective solutions to their clients while maintaining high service standards. As the global wind fleet ages, the role of ISPs in aftermarket lubrication services is expected to grow, further solidifying their position as key customers in this market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Castrol, Shell, ExxonMobil, TotalEnergies, Chevron, Kluber Lubrication, FUCHS, SKF, Quaker Houghton, LEUBERS, Lubrication Engineers, Petro-Canada Lubricants, Lukoil, Valvoline, Idemitsu, Phillips 66, BP, Lubrizol, Whitmore, Sinopec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Turbine Grease and Lubricant Market Key Technology Landscape

The Wind Turbine Grease and Lubricant Market is continuously evolving, driven by the imperative to enhance turbine performance, extend operational life, and minimize environmental impact. A key technological advancement lies in the formulation of high-performance synthetic lubricants. These products utilize advanced base oils, such as polyalphaolefins (PAOs) and synthetic esters, which offer superior thermal stability, oxidation resistance, and low-temperature fluidity compared to traditional mineral oils. This allows lubricants to maintain their properties over longer service intervals and under more extreme operating conditions, directly contributing to reduced maintenance frequency and improved overall turbine reliability. The continuous development of specialized additive packages, including extreme pressure (EP) agents, anti-wear components, corrosion inhibitors, and anti-foaming agents, is critical in tailoring lubricants to the specific demands of gearbox, bearing, and hydraulic systems within modern wind turbines, preventing premature failure and maximizing efficiency.

Another significant area of technological focus is the development of environmentally acceptable lubricants (EALs), particularly bio-based formulations. Driven by increasing environmental regulations and a growing industry commitment to sustainability, manufacturers are innovating with renewable resources, such as natural esters derived from vegetable oils. These EALs are designed to offer comparable performance to conventional lubricants while boasting enhanced biodegradability and reduced toxicity, making them ideal for ecologically sensitive areas, especially offshore wind farms where leakage poses a significant environmental risk. Advancements in bio-based technology are addressing historical limitations related to oxidative stability and low-temperature performance, making these options increasingly viable for demanding wind turbine applications.

The integration of digital technologies, particularly condition monitoring and smart lubrication systems, is transforming how lubricants are managed and applied in wind turbines. This involves the use of advanced sensors embedded within turbines or lubricants themselves, which collect real-time data on lubricant quality, viscosity, temperature, and contaminant levels. This data is then analyzed using sophisticated algorithms and, increasingly, artificial intelligence (AI) and machine learning (ML) to provide predictive insights into lubricant degradation and component health. This shift from time-based to condition-based lubrication enables optimized lubrication schedules, prevents unnecessary lubricant changes, and allows for proactive maintenance, thereby minimizing downtime and extending the effective life of both the lubricant and the turbine components. This technological convergence represents a paradigm shift towards intelligent lubrication management, maximizing efficiency and operational longevity.

Regional Highlights

- Asia Pacific: Emerging as the dominant and fastest-growing region, propelled by aggressive renewable energy targets, particularly in China and India. Massive onshore wind farm developments and increasing investment in offshore projects drive substantial demand for wind turbine greases and lubricants. Government policies supporting wind power expansion, coupled with a robust manufacturing base, position APAC as a key market leader.

- Europe: A mature market with a high concentration of installed wind capacity, especially in countries like Germany, Spain, and the UK. Europe leads in offshore wind development, necessitating high-performance and environmentally acceptable lubricants due to stringent regulations and harsh marine conditions. The region's focus on maintaining an aging fleet and continuous innovation in turbine technology sustains steady demand.

- North America: Experiencing significant growth, driven by favorable government policies, tax incentives, and increasing investment in wind energy across the United States and Canada. The expansion of both onshore and emerging offshore wind projects contributes to a strong market for lubricants, with an emphasis on performance and extended service life to optimize operational costs.

- Latin America: Showing promising growth, particularly in countries like Brazil, Mexico, and Chile, which are investing in wind energy to diversify their power grids. While still developing, the region presents long-term growth opportunities for lubricant suppliers as wind power infrastructure continues to expand, driven by national energy policies and abundant wind resources.

- Middle East and Africa (MEA): A nascent but high-potential market, with increasing interest in wind energy projects as part of broader diversification strategies away from fossil fuels. Countries like South Africa, Egypt, and Morocco are initiating significant wind power developments, gradually increasing the demand for specialized lubricants, especially as project scales grow.

Top Key Players

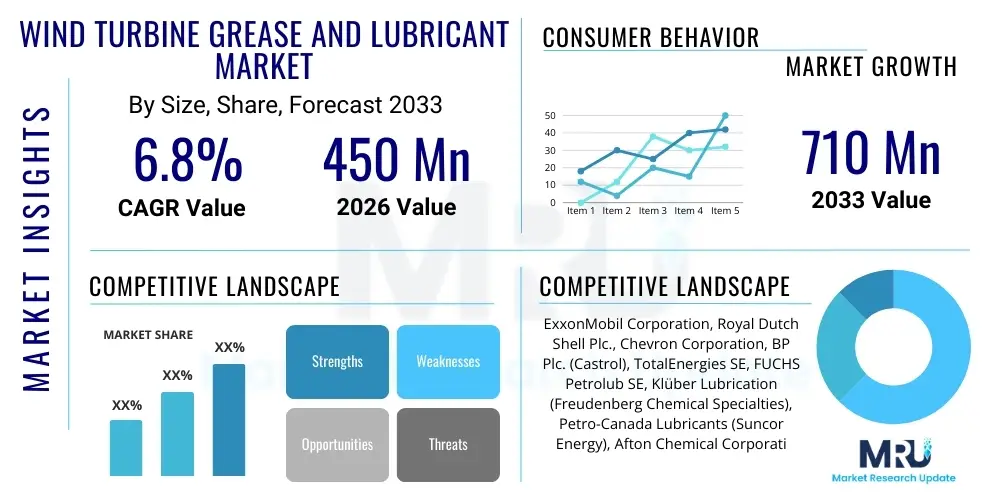

The market research report includes a detailed profile of leading stakeholders in the Wind Turbine Grease and Lubricant Market.- Castrol (A BP Company)

- Shell plc

- ExxonMobil Corporation

- TotalEnergies SE

- Chevron Corporation

- Kluber Lubrication (Freudenberg Group)

- FUCHS Petrolub SE

- SKF Group

- Quaker Houghton

- LEUBERS (Petrofer GmbH & Co. KG)

- Lubrication Engineers, Inc.

- Petro-Canada Lubricants Inc. (HollyFrontier)

- Lukoil

- Valvoline Inc.

- Idemitsu Kosan Co., Ltd.

- Phillips 66

- BP plc

- Lubrizol Corporation (A Berkshire Hathaway Company)

- Whitmore Manufacturing Company (CSW Industrials)

- Sinopec Group

Frequently Asked Questions

What types of lubricants are primarily used in wind turbines?

Wind turbines predominantly use three main types of lubricants: mineral oil-based, synthetic oil-based, and bio-based lubricants. Synthetic lubricants, such as those made from polyalphaolefins (PAOs) and synthetic esters, are increasingly preferred for their superior performance, extended service life, and ability to withstand extreme operating conditions in critical components like gearboxes and main bearings. Bio-based lubricants are gaining traction due to their environmental benefits and biodegradability, especially in offshore applications.

How do specialized lubricants contribute to the operational efficiency and lifespan of wind turbines?

Specialized wind turbine lubricants are engineered to reduce friction and wear, prevent corrosion, dissipate heat, and seal components against contaminants effectively. By performing these functions optimally, they significantly extend the operational lifespan of critical components like gearboxes, bearings, and hydraulic systems. This leads to reduced unscheduled downtime, lower maintenance costs, and improved energy production, thereby enhancing the overall operational efficiency and profitability of wind farms.

What are the key drivers for the growth of the Wind Turbine Grease and Lubricant Market?

The primary drivers for market growth include the escalating global demand for renewable energy and the rapid expansion of wind power capacity worldwide, driven by aggressive decarbonization targets and governmental incentives. Additionally, the increasing focus on maximizing turbine uptime and extending component life, coupled with continuous advancements in lubricant technology offering higher performance and longer service intervals, are significant contributing factors.

What challenges does the market for wind turbine lubricants face?

The market faces several challenges, including the relatively high initial cost of high-performance specialized lubricants compared to general industrial lubricants. Environmental concerns regarding the disposal and potential leakage of petroleum-based lubricants also necessitate investment in more expensive, sustainable alternatives. Furthermore, fluctuating raw material prices and the complexities of lubricant formulation and application in diverse turbine designs present ongoing hurdles for manufacturers and operators.

How is artificial intelligence impacting the wind turbine lubrication sector?

Artificial intelligence is transforming the lubrication sector by enabling predictive maintenance strategies. AI-driven platforms analyze real-time sensor data and operational parameters to optimize lubrication schedules, predict component failures before they occur, and recommend the most suitable lubricant for specific conditions. This leads to more efficient resource utilization, reduced maintenance costs, enhanced turbine reliability, and a shift towards condition-based monitoring, moving beyond traditional time-based lubrication practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager