Wiper Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434902 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wiper Blade Market Size

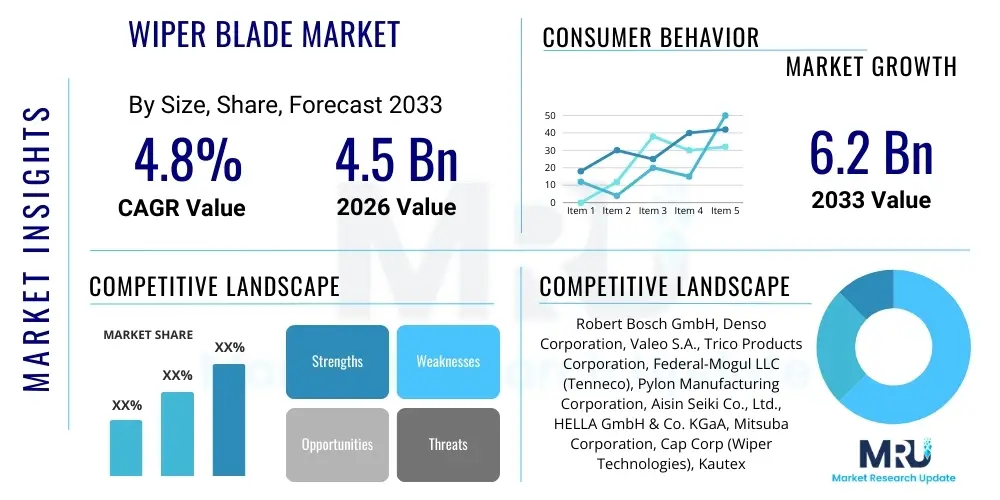

The Wiper Blade Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.2 Billion by the end of the forecast period in 2033.

Wiper Blade Market introduction

The Wiper Blade Market encompasses the global production and distribution of components essential for maintaining clear visibility through vehicle windshields and rear windows. These safety-critical devices are mandatory components across all vehicle types, designed to remove rain, snow, ice, wash fluid, and debris from the viewing surface. Modern wiper blade technology has evolved significantly from traditional conventional frames to advanced flat (beam) and hybrid designs, incorporating improved aerodynamics, sophisticated material compounds like silicone and proprietary synthetic rubbers, and integrated sensor technologies to enhance durability and wiping efficiency. Major applications span original equipment manufacturing (OEM) for new vehicles and the robust aftermarket sector, driven primarily by replacement cycles necessitated by wear and tear. Key benefits of high-performance wiper blades include enhanced driver safety, compliance with stringent regional traffic laws pertaining to visibility, and reduced aerodynamic noise, contributing to overall vehicle comfort.

The primary driving forces propelling this market expansion are the consistent growth in global vehicle production, particularly within emerging economies across Asia Pacific; the stringent regulatory standards imposed by governmental bodies regarding vehicular safety and visibility; and the increasing consumer preference for premium, durable, and aesthetically superior beam or hybrid blades. Furthermore, the mandatory periodic replacement cycle, typically recommended annually or semi-annually depending on climatic conditions and blade material, ensures a perpetual demand stream within the aftermarket. Technological advancements, such as the introduction of heated wiper elements and advanced hydrophobic coatings that integrate with the blade structure, are also contributing to higher average selling prices and market value.

Wiper Blade Market Executive Summary

The Wiper Blade Market demonstrates resilience, characterized by stable demand fueled by mandatory replacement schedules and increasing global vehicle parc. Current business trends indicate a strong shift towards advanced blade geometries, specifically hybrid and flat/beam designs, which offer superior performance and longevity compared to traditional framed blades, allowing manufacturers to command higher profit margins. Competition is intensifying in the aftermarket segment, with a growing emphasis on brand reputation, distribution efficiency, and price competitiveness, while the OEM segment is dominated by long-term supplier agreements focused on design integration and quality assurance. Regional trends underscore the dominance of Asia Pacific (APAC) in terms of sheer production volume and burgeoning vehicle ownership, positioning it as the fastest-growing market, whereas North America and Europe maintain high maturity, characterized by high-frequency replacement demand due to severe weather variability and strict maintenance standards.

Segment trends reveal that the aftermarket segment accounts for the largest share of revenue, driven by necessary consumer replacements, although the OEM segment dictates long-term design standards. By material, the use of advanced synthetic rubbers and silicone compounds is gaining traction over conventional natural rubber due to enhanced resistance to UV degradation, extreme temperatures, and chemical exposure, providing extended service life. The market structure remains highly consolidated among a few major global players—Bosch, Denso, and Valeo—who leverage vast distribution networks and intellectual property in blade design. The future outlook involves greater integration with advanced driver-assistance systems (ADAS) and autonomous vehicle technologies, potentially shifting the design paradigm toward integrated sensing and cleaning systems.

AI Impact Analysis on Wiper Blade Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Wiper Blade Market primarily revolve around predictive maintenance, quality control, and the functional role of wiper blades in the context of autonomous vehicles (AVs). Consumers and industry analysts are concerned about whether AI-driven vehicle systems, specifically those managing Advanced Driver-Assistance Systems (ADAS) and Level 3+ autonomy, will render traditional human-operated wiping mechanisms obsolete or, conversely, necessitate more precise, reliable wiping capabilities due to the critical reliance of external sensors (Lidar, cameras) on clear fields of view. Key themes emerging from these questions center on the integration of smart sensors within wiper systems to assess windshield contamination levels accurately, the application of machine learning algorithms to predict optimal replacement timing based on driving conditions and usage patterns, and the potential for AI-optimized manufacturing processes to enhance blade quality and reduce defects.

While the physical design and function of the blade itself remain essential, AI primarily acts as an enabler for optimized maintenance and performance monitoring. AI algorithms are being deployed in manufacturing for real-time defect detection and precision assembly, ensuring higher yield rates and improved product consistency, which addresses user concerns about premature failure. In the usage phase, AI contributes to predictive maintenance by analyzing data points such as force friction, motor current draw, and environmental factors to generate precise replacement alerts, moving away from simple time-based replacement schedules. Furthermore, in the context of AVs, AI dictates when and how intensely wiping occurs, crucial for maintaining the operational integrity of high-definition cameras and Lidar sensors, thus increasing the performance demands placed on wiper systems rather than eliminating them. This shift drives demand for 'smart' wipers capable of communicating real-time performance metrics to the vehicle's central processing unit.

- AI algorithms enhance predictive maintenance scheduling, reducing unplanned failures and optimizing inventory for service providers.

- AI-powered manufacturing processes improve quality control and material handling, minimizing defects in rubber and silicone compounds.

- Autonomous vehicles utilize AI to manage wiping cycles based on sensor clarity requirements (Lidar and Camera visibility), increasing demand for precision wiping.

- Machine learning aids in analyzing complex aerodynamic and hydrodynamics data to optimize future wiper blade designs for noise reduction and streak-free performance.

- AI facilitates enhanced supply chain logistics, ensuring timely delivery of replacement blades to high-demand regional markets based on weather patterns and accident data.

DRO & Impact Forces Of Wiper Blade Market

The dynamics of the Wiper Blade Market are fundamentally governed by a balance of persistent safety-driven demand and evolving technological standards, countered by cost pressures and environmental considerations. Drivers primarily center on safety regulations, which mandate functional wiping systems globally, coupled with the inherent replacement nature of the product due to material degradation from UV light, ozone, and environmental debris. Opportunities are substantial in integrating advanced materials like specialized silicone compounds and implementing active heating elements for cold-weather performance, addressing a significant consumer pain point. Conversely, the market faces restraints such as the proliferation of low-quality, inexpensive counterfeit products, which distort pricing and erode brand equity, alongside the natural constraint of relatively long product lifespan compared to fast-moving consumables, limiting repeat purchases. These forces collectively shape the competitive environment, pushing manufacturers toward innovation in durability and performance to justify premium pricing.

Impact forces in the market are particularly sensitive to economic cycles and regulatory shifts. For instance, global economic downturns can lead consumers to delay necessary maintenance, temporarily dampening aftermarket sales, though this effect is generally short-lived due to the critical safety function of the product. The rapid development of Advanced Driver-Assistance Systems (ADAS) acts as a powerful accelerating force, necessitating flawless windshield clarity for sensor operation, thereby elevating quality expectations for OEM wiper suppliers. Environmental pressures are also mounting, prompting manufacturers to explore sustainable and bio-degradable material options, particularly concerning the rubber compounds and plastic framing used in blade construction. Furthermore, the rising adoption of connected vehicles creates new avenues for service providers to track blade condition and proactively market replacements, enhancing overall market efficiency and addressing the historical restraint of consumer negligence toward timely replacement.

Segmentation Analysis

The Wiper Blade Market is broadly segmented based on core product characteristics, application context (OEM vs. Aftermarket), and the primary vehicle type served. This structured segmentation allows for a detailed analysis of consumption patterns, technological preferences, and growth trajectories across various sub-sectors. The market dynamics differ significantly between the high-volume, cost-sensitive traditional blade segment and the premium, performance-focused beam and hybrid blade segments, which are increasingly adopted by OEMs for new vehicle models. Understanding the bifurcation between Original Equipment Manufacturer (OEM) demand, which requires mass production and strict quality control standards, and Aftermarket demand, which focuses on breadth of coverage and accessible distribution, is critical for strategic market positioning. Furthermore, differentiation by material—traditional rubber versus higher-performance silicone—highlights divergent trends in durability and resilience against severe weather conditions, influencing purchasing decisions across geographic regions.

Detailed segmentation analysis further includes categorization by sales channel, differentiating between independent automotive retailers, specialized service garages, and mass merchandisers, each requiring tailored marketing and distribution strategies. The ongoing trend towards vehicle electrification (EVs) is also subtly impacting segmentation, as EV manufacturers prioritize lightweight components and enhanced aerodynamics, favoring beam and hybrid designs. This comprehensive segmentation framework reveals that while traditional blade types still hold significant volume share in older vehicles and emerging markets, the growth momentum is undeniably concentrated in the technologically advanced, higher-margin segments. This shift reflects global consumer trends favoring safety enhancements and reduced maintenance requirements, driving manufacturers to invest heavily in design patents and material science innovations. The complexity of modern vehicle parc necessitates suppliers offering an extensive portfolio covering legacy vehicles, current models, and future electric platforms.

- By Product Type

- Conventional/Frame Blades

- Flat/Beam Blades

- Hybrid Blades

- By Material

- Natural Rubber

- Synthetic Rubber

- Silicone

- By Application/Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Vehicle Type

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By End-Use Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Wiper Blade Market

The value chain for the Wiper Blade Market is characterized by a sequential flow starting with the procurement of essential raw materials and culminating in the consumer replacement cycle. The upstream segment is dominated by suppliers of rubber and silicone compounds, steel/aluminum (for frames and springs), and plastics/polymers. This phase requires rigorous material science expertise to ensure the compounds meet demanding specifications for durability, friction, and resistance to environmental elements like UV radiation and ozone. Raw material costs and availability significantly impact the overall production expense, making strategic sourcing and long-term contracts critical for major manufacturers. Quality control at the upstream level is paramount, as inconsistencies in the wiping edge material directly translate into performance failures and reduced product lifespan, severely affecting brand reputation in the highly competitive aftermarket.

The midstream involves the manufacturing and assembly process, typically performed by Tier 1 suppliers like Bosch, Valeo, and Denso. This stage includes precision cutting of the wiping element, molding of the plastic components, and sophisticated assembly of the tension springs and linkage mechanisms, particularly for complex beam and hybrid designs. Efficient manufacturing leverages automation and lean production principles to achieve economies of scale necessary for both high-volume OEM supply and competitive aftermarket pricing. Following production, the distribution channel acts as the crucial link to the end-user. Direct distribution involves supplying OEMs for new vehicle assembly lines, governed by stringent quality audits and long lead times. Indirect distribution dominates the aftermarket, utilizing a complex network involving authorized distributors, large automotive parts wholesalers, and independent retail chains, ensuring broad geographic reach and immediate availability of thousands of specific SKUs to match the diverse global vehicle parc.

The downstream segment encompasses the end-users and service providers. This includes independent garages, franchise service centers, rapid oil-change businesses, and DIY consumers who purchase replacements through retail outlets or e-commerce platforms. The aftermarket segment, which constitutes the majority of replacement volume, is highly sensitive to marketing efforts, brand trust, and ease of installation. A significant trend in the downstream market is the rising influence of e-commerce, allowing consumers to bypass traditional brick-and-mortar stores and access an expansive range of products, often prioritizing price and user reviews. This necessitates robust logistical capabilities from suppliers to handle individual B2C shipments efficiently, moving away from bulk B2B distribution models, and ensuring proper fitment guidance is provided online to mitigate returns due to incorrect product selection.

Wiper Blade Market Potential Customers

The market for wiper blades is bifurcated into institutional buyers and individual consumers, forming distinct customer segments with varying needs and purchasing criteria. Original Equipment Manufacturers (OEMs) represent the most significant institutional segment, requiring large volumes of custom-designed, highly specified blades that integrate seamlessly with vehicle design and undergo rigorous validation testing. OEMs prioritize supply reliability, zero defect tolerance, and long-term cost stability, typically establishing partnerships lasting for the entire vehicle model cycle. The second major group comprises Independent Aftermarket Retailers and Distributors, who act as intermediaries, stocking diverse inventory to meet the immediate replacement needs of mechanics and consumers. These customers prioritize product breadth (covering many vehicle models), competitive wholesale pricing, and effective merchandising support from the supplier.

Individual vehicle owners and fleet operators constitute the primary end-users, driving the massive replacement market. Individual consumers, particularly those performing Do-It-Yourself (DIY) installation, seek blades that are easy to install, provide reliable all-weather performance, and offer a clear value proposition, often choosing premium brands based on perceived quality or past positive experience. Conversely, commercial fleet operators, managing large numbers of vehicles (e.g., logistics companies, taxi services), prioritize total cost of ownership (TCO) and durability. They often opt for heavy-duty blades with enhanced lifespan to minimize vehicle downtime and maintenance frequency. This segment demands reliable, bulk supply and often relies on direct contracts with wholesalers or blade manufacturers for maintenance parts. The emergence of specialized quick service centers further fragments the customer base, as these businesses require readily available, universal-fit product lines that facilitate rapid turnover and standardized service protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Denso Corporation, Valeo S.A., Trico Products Corporation, Federal-Mogul LLC (Tenneco), Pylon Manufacturing Corporation, Aisin Seiki Co., Ltd., HELLA GmbH & Co. KGaA, Mitsuba Corporation, Cap Corp (Wiper Technologies), Kautex Textron GmbH & Co. KG, DOGA S.A., ITW Global Brands, Crown North America, and Shandong Hengke Automobile Parts Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wiper Blade Market Key Technology Landscape

The technological evolution within the Wiper Blade Market is focused primarily on material science, aerodynamic efficiency, and system integration with modern vehicle electronics. Advanced elastomer compounds, specifically high-grade synthetic rubbers and silicone, represent a core area of innovation. Silicone blades, for instance, are treated with specialized coatings that transfer to the windshield, creating a temporary hydrophobic layer that actively repels water, significantly improving visibility and extending the blade's functional lifespan compared to standard natural rubber formulations which degrade faster under UV exposure and temperature extremes. Furthermore, manufacturers are employing nano-technology in coating development to minimize friction between the blade and the glass, reducing squeaking and chatter while ensuring consistent contact pressure across the wiping surface, a critical factor for large, curved modern windshields.

Aerodynamic design constitutes another major technological pillar, particularly for high-speed vehicles and modern hybrid/beam blades. Beam blades utilize a robust spring steel structure enclosed within a slim, aerodynamic spoiler, which distributes pressure evenly along the entire length of the blade and uses vehicle speed to press the blade firmly against the glass, preventing lift-off at high velocities. Hybrid blades combine the robust structure of conventional blades with the aerodynamic housing of beam blades, providing an aesthetic and functional compromise. The development of advanced connecting systems, such as proprietary locking mechanisms and specific adaptors, is also essential, allowing the same blade SKU to fit a multitude of vehicle arm styles, streamlining inventory management for aftermarket retailers and enhancing ease of DIY installation for consumers.

Beyond the blade structure itself, integration technology is rapidly becoming central to innovation. This includes heated wiper blades or heating elements embedded within the parking area of the windshield, designed to prevent freezing and ensure immediate functionality in cold climates—a critical safety feature increasingly demanded by consumers in Northern regions. Sensor integration, though still nascent, is beginning to appear in high-end systems where capacitive or optical sensors detect moisture or contamination levels and automatically adjust wiper speed and pressure, or even detect blade wear and relay maintenance alerts to the driver via the vehicle's infotainment system. These smart systems represent the future direction of OEM specification, aligning the traditional mechanical function of the wiper with the advanced electronic framework of connected and autonomous vehicles, demanding higher levels of reliability and communication capability from the component.

Manufacturers are heavily investing in Computer-Aided Engineering (CAE) and Computational Fluid Dynamics (CFD) software to model and simulate the complex interaction between the blade, the windshield curvature, and airflow patterns at various speeds. This meticulous process aims to optimize the tension profile of the internal steel structure, ensuring uniform pressure distribution across the blade’s entire length, which is crucial for achieving a streak-free wipe. The shift towards larger and more complex windshield shapes in SUVs and modern crossovers further compounds this design challenge. Furthermore, the development of specialized rubber compounds that incorporate graphite or molybdenum coatings reduces surface tension and friction, extending the life of the wiping edge and minimizing noise generation, a factor of growing importance in the context of quieter electric vehicles where ambient noise is more noticeable.

The rapid proliferation of electric vehicles (EVs) is also influencing material technology. EVs prioritize efficiency and weight reduction. This encourages the use of lighter, high-strength plastics and composite materials for blade frames and adapters, moving away from heavy metallic components where feasible, without compromising the structural integrity required for effective wiping under adverse conditions. This technological push is symbiotic with the demand for highly efficient motors and linkages that draw minimal power, ensuring that the operation of the wiper system does not unduly burden the EV's battery life or reduce its driving range. The confluence of material science, aerodynamic engineering, and electronic integration dictates the competitive edge in securing long-term OEM contracts and establishing premium positioning in the lucrative aftermarket sector, especially as regulatory bodies worldwide continue to elevate minimum performance standards for vehicle safety components.

Regional Highlights

The Wiper Blade Market exhibits distinct regional consumption patterns and growth drivers, heavily influenced by local climate, regulatory environment, and the maturity of the automotive manufacturing sector. Asia Pacific (APAC) stands as the dominant region in terms of both production and future market growth potential. This is primarily driven by the massive automotive production hubs in China, Japan, South Korea, and India, which supply both domestic OEM demand and global exports. Additionally, the rapidly expanding vehicle parc, coupled with increasing disposable income in countries like India and Southeast Asian nations, fuels robust aftermarket demand. While the replacement frequency may be slightly lower than in Northern regions, the sheer volume of vehicles ensures APAC's leading position, with a notable shift toward affordable, yet technologically acceptable, flat and hybrid blade designs.

North America (NA) represents a mature but high-value market, characterized by stringent consumer expectations for premium performance and durability, driven by diverse and often severe climatic conditions ranging from extreme heat to heavy snow and ice. The aftermarket segment in the US and Canada is highly developed, supported by efficient distribution networks and high consumer awareness regarding the safety implications of worn blades, leading to a higher average replacement frequency compared to the global norm. NA consumers typically favor high-performance, branded hybrid and silicone-based beam blades. The regional market is also strongly influenced by OEM demands associated with the integration of complex sensor packages (Lidar, camera) in vehicles, demanding specialized, high-precision wiping systems capable of maintaining sensor visibility.

Europe, similar to North America, is a mature market distinguished by very strict regulatory requirements concerning visibility and vehicle components (Euro NCAP safety ratings). The European market demonstrates a strong preference for high-quality, aesthetically integrated flat/beam blades, especially in Germany and the Scandinavian countries, where long-term durability against rain and winter conditions is non-negotiable. Western European countries maintain high average replacement prices due to strong brand loyalty and consumer willingness to pay for certified premium products. Conversely, Eastern Europe presents an expanding market opportunity, where increasing vehicle ownership and modernization of local manufacturing facilities are slowly boosting both OEM and aftermarket sales volumes, creating fertile ground for both global and regional suppliers.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets that are highly sensitive to economic stability and local currency fluctuations. In LATAM, fluctuating vehicle production and strong reliance on imported parts complicate the supply chain, though the aftermarket remains steady due to necessity. Brazil and Mexico are the primary centers for automotive activity, driving demand. In MEA, the market dynamics are highly bifurcated: the Gulf Cooperation Council (GCC) countries demand high-performance blades resistant to extreme heat, sand, and dust, aligning with the premium segment, while the African continent is dominated by cost-sensitive, basic framed blades necessary for the predominantly older vehicle parc, focusing heavily on price point and basic functionality rather than advanced technological features. Both regions show promising long-term growth as infrastructure improves and vehicle ownership rates climb, particularly in urban centers across the African continent and the rapidly industrializing markets of the Middle East.

- Asia Pacific (APAC): Highest volume market due to major manufacturing bases (China, Japan) and rapid vehicle parc expansion; fastest growth rate projected in the aftermarket segment.

- North America (NA): High-value market with high replacement frequency driven by severe weather; strong preference for premium silicone and hybrid beam blades.

- Europe: Regulatory-driven market emphasizing quality and aerodynamic integration; strong adoption of flat/beam blades influenced by stringent safety standards and high-speed driving requirements.

- Latin America (LATAM): Growth driven by economic recovery and domestic vehicle production in Brazil and Mexico; marked by price sensitivity in the replacement segment.

- Middle East & Africa (MEA): Demand polarized between premium, heat-resistant blades (GCC) and cost-effective framed blades (Africa); future growth tied to infrastructural development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wiper Blade Market.- Robert Bosch GmbH

- Denso Corporation

- Valeo S.A.

- Trico Products Corporation

- Federal-Mogul LLC (Tenneco)

- Pylon Manufacturing Corporation

- Aisin Seiki Co., Ltd.

- HELLA GmbH & Co. KGaA

- Mitsuba Corporation

- Cap Corp (Wiper Technologies)

- Kautex Textron GmbH & Co. KG

- DOGA S.A.

- ITW Global Brands

- Crown North America

- Shandong Hengke Automobile Parts Co., Ltd.

- Amritsar Auto Corporation (AAC)

- Carcare Product (XINNUO)

- Guangzhou Botian Automotive Parts Co., Ltd.

- Pilot Automotive

- PureSight (Brand of Anco)

Frequently Asked Questions

Analyze common user questions about the Wiper Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between beam, hybrid, and conventional wiper blades?

Conventional blades use a metal frame structure and multiple pressure points. Beam (flat) blades utilize spring steel embedded in rubber for uniform pressure distribution and superior aerodynamics, lacking an external frame. Hybrid blades combine the articulated structure of conventional types with the aerodynamic shell of beam blades, balancing cost and performance. Beam blades are the industry standard for new premium vehicles.

How often should wiper blades be replaced to ensure optimal safety?

Wiper blades should generally be replaced every six to twelve months, depending on the material composition and regional climate severity. Excessive heat, intense UV exposure, and heavy use in icy or dusty conditions accelerate the degradation of the rubber or silicone element, reducing visibility and increasing the risk of streaking or skipping, necessitating more frequent replacement.

Are silicone wiper blades worth the higher investment compared to traditional rubber blades?

Yes, silicone wiper blades typically offer superior performance and significantly extended service life. Silicone is highly resistant to ozone, UV radiation, and temperature extremes, allowing them to last longer. They also often leave a water-repellent coating on the windshield, which enhances water sheeting, justifying their higher initial purchase price through improved durability and visibility.

How does the shift to electric and autonomous vehicles impact wiper blade demand?

The shift increases demand for high-precision, reliable wiping systems. Electric vehicles require lightweight, efficient components that minimize energy drain. Autonomous vehicles, relying heavily on windshield-mounted cameras and Lidar sensors, require near-perfect clarity at all times, driving OEM specifications toward advanced, sensor-integrated, and highly durable beam blade designs with improved cleaning performance.

Which regional market is projected to experience the fastest growth in the Wiper Blade segment?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven primarily by the sustained high volume of vehicle manufacturing in countries like China and India, the substantial expansion of the regional vehicle parc, and increasing consumer awareness regarding vehicle safety and maintenance in developing economies across Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Windscreen Wiper Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wiper Blade Market Size Report By Type (Boneless Wiper Blade, Bone Wiper Blade, Hybrid Wiper Blade), By Application (OEM Market, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager