Wood Chips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432921 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wood Chips Market Size

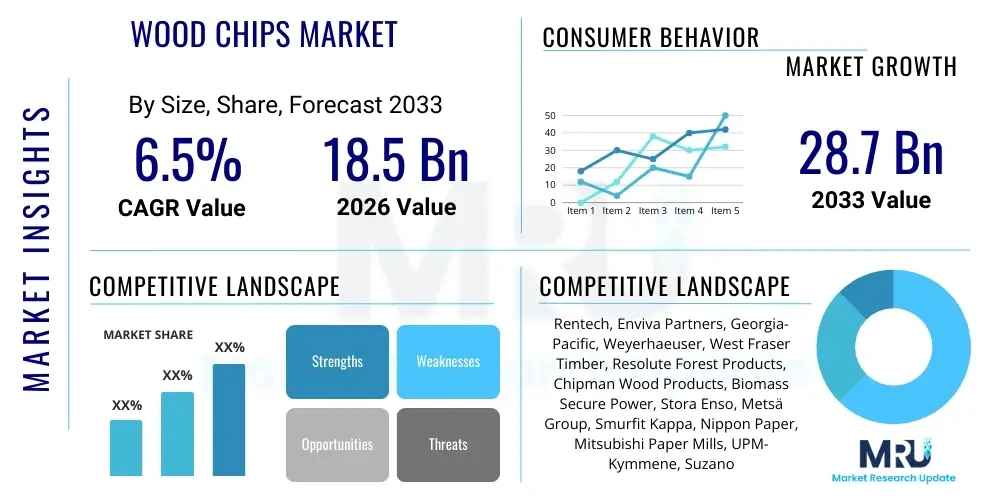

The Wood Chips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 28.7 Billion by the end of the forecast period in 2033.

Wood Chips Market introduction

The Wood Chips Market encompasses the production, distribution, and consumption of small to medium-sized pieces of wood formed by cutting or chipping larger pieces of wood, such as trees, branches, or timber processing residue. These chips serve as a foundational industrial commodity, primarily categorized by the wood species (hardwood or softwood), intended use, and moisture content. The product description highlights the varying specifications required by end-use industries; for instance, chips used in the pulp and paper industry demand highly uniform size and low bark content, while those destined for energy production (biofuel) can accommodate a wider range of quality and moisture levels, often capitalizing on forest residues and waste wood that would otherwise be discarded.

Major applications for wood chips are broadly segmented into energy generation, material production (pulp and paper, composite boards), and landscaping. In energy applications, wood chips are a critical source of renewable biomass fuel, used directly in boilers for heat and power generation or processed into higher-density fuels like pellets. Their utilization as biofuel is significantly supported by global mandates aimed at reducing carbon emissions and transitioning away from fossil fuels. Conversely, the pulp and paper sector relies heavily on wood chips as the primary raw material for cellulose extraction, dictating strict quality standards to ensure consistency in the finished paper product. The sustained demand from these large-scale industrial consumers underscores the market's stability and strategic importance in both environmental and manufacturing supply chains.

The core benefits driving market expansion include the cost-effectiveness of wood chips compared to fossil fuels, their status as a renewable resource, and the efficient utilization of forest biomass, which aids in sustainable forest management by leveraging residues from logging and milling operations. Furthermore, governmental incentives, such as carbon credits and renewable energy targets, particularly in Europe and Asia Pacific, significantly propel the adoption of wood chips for bioenergy projects. The primary driving factors are the stringent global climate policies, the rising cost volatility of conventional fuels, and technological advancements in chipping and densification processes, making wood chips a more accessible and efficient energy and material input.

Wood Chips Market Executive Summary

The Wood Chips Market Executive Summary highlights robust growth trajectory primarily fueled by the accelerating global shift towards sustainable energy sources and the sustained demand from the construction and packaging industries. Business trends indicate a move towards large-scale, integrated biomass supply chain management, where key players are investing heavily in optimizing harvesting logistics, chipping technology, and port infrastructure to secure long-term contracts with major power generation utilities and multinational pulp producers. Consolidation among suppliers is increasing, aiming to achieve economies of scale and better manage fluctuating timber prices and supply risks. Furthermore, there is a growing trend in the utilization of recycled and urban waste wood chips, driven by circular economy principles and resource scarcity concerns in traditional logging regions, necessitating innovations in contamination detection and sorting technologies.

Regionally, the market dynamics are highly differentiated. Europe, particularly the Nordic countries and the UK, remains the dominant consumption hub due to proactive renewable energy policies, leading to substantial imports, often from North America and emerging supplier regions like Southeast Asia. Asia Pacific is emerging as the fastest-growing market, driven by rapidly expanding paper and packaging industries in China and India, alongside Japan and South Korea's commitments to biomass co-firing in coal power plants. North America serves as a major net exporter, benefiting from vast forest resources and advanced forestry practices, although internal consumption for residential heating and panel board manufacturing also remains significant. Regional trends are heavily influenced by trade policies, sustainable forestry certifications (e.g., FSC, PEFC), and the logistical costs associated with maritime transport of biomass.

Segmentation trends confirm that the Energy/Biofuel application segment is the largest and fastest-expanding segment, particularly within the industrial heating and electricity generation sectors, reflecting global decarbonization efforts. Within wood type segmentation, softwood chips dominate trade flows due to their suitability for pulp production and specific bioenergy processes, though hardwood utilization is expanding, especially in regions focusing on particle board and MDF manufacturing. Key segment drivers include the regulatory environment surrounding coal phase-outs and the development of sophisticated combustion technologies optimized for high-moisture biomass. The market is also seeing increased differentiation in chip specifications, moving towards standardized quality metrics to facilitate international trade and ensure consistent performance across diverse industrial applications, thus minimizing operational disruptions for end-users.

AI Impact Analysis on Wood Chips Market

User queries regarding the impact of Artificial Intelligence (AI) on the Wood Chips Market commonly revolve around themes of supply chain efficiency, sustainable harvesting practices, and quality control automation. Users are primarily concerned with how AI can mitigate the inherent volatility in raw material sourcing (forest inventory fluctuations, weather dependency) and optimize the complex logistics network involved in transporting bulky, low-value material over long distances. Key expectations focus on predictive analytics for maximizing timber yield, automating the classification and grading of wood chips based on moisture and contamination levels, and enhancing the security and transparency of sustainable sourcing certifications through blockchain and AI-driven monitoring systems. The overarching interest lies in leveraging computational power to transform traditional, labor-intensive forestry operations into highly efficient, data-driven supply chains, ensuring compliance with increasingly strict environmental, social, and governance (ESG) standards.

The practical application of AI is primarily centered on operational optimization. Machine learning algorithms are being developed to analyze satellite imagery, LiDAR data, and drone footage to create precise, real-time inventories of forest resources, predicting optimal harvesting times and volumes, thereby reducing waste and improving resource utilization rates. Furthermore, predictive maintenance models utilize sensor data from chippers, transporters, and processing equipment to minimize downtime, maximizing the throughput of expensive machinery. This predictive capability translates directly into lower operating costs and improved reliability of supply, which is critical for continuous-operation industries like power generation and pulp manufacturing. The introduction of AI into pricing models, considering factors like moisture content, calorific value, and transport costs, is also enabling more accurate and dynamic market pricing, moving away from simple volume-based transactions.

While AI offers significant opportunities for efficiency, it also introduces challenges related to data infrastructure and workforce readiness. Users often inquire about the necessary investment in high-resolution sensor technology and cloud computing required to implement effective AI models across dispersed forest operations. Another significant concern is the ethical sourcing and transparency facilitated by these technologies; AI systems can be used to track the chain of custody from stump to stack, providing verifiable evidence of sustainable harvesting, a crucial factor for European buyers prioritizing certified wood products. Successful integration of AI is expected to lead to a highly optimized market where material quality is standardized, supply shocks are minimized, and environmental compliance is seamlessly managed through automated reporting and verification.

- AI-driven optimization of forest inventory management using satellite imagery and LiDAR for precise volume estimation.

- Predictive modeling for supply chain logistics, minimizing transportation costs for high-volume, low-density wood chips.

- Automated quality control systems utilizing computer vision to grade chips based on size, species, and contamination level.

- Implementation of AI and blockchain for verifiable, transparent tracking of sustainable forestry certifications (Chain of Custody).

- Predictive maintenance for chipping equipment, maximizing asset utilization and reducing operational downtime.

- Enhanced safety protocols in harvesting and processing through real-time risk assessment using machine learning.

DRO & Impact Forces Of Wood Chips Market

The Wood Chips Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. The primary Driver is the overwhelming global commitment to decarbonization, pushing utilities and industrial users to substitute coal and heavy oils with biomass, of which wood chips are a foundational component. Coupled with this, government subsidies and mandated renewable portfolio standards (RPS) provide a powerful economic incentive for biomass utilization. Conversely, the market faces significant Restraints, most notably the high logistical costs associated with handling and transporting bulky, moisture-sensitive raw material, and stringent regulatory scrutiny regarding forest sustainability, where non-compliance can lead to market access denial. Opportunities are vast, primarily residing in technological advancements in densification (pelletization) and Torrefaction, which improve the energy density and handling characteristics of wood chips, opening up new, more distant markets, alongside the increasing adoption of wood waste from municipal and construction sources under circular economy mandates.

Impact forces in the market are prominently weighted towards regulatory and macroeconomic factors. Regulatory pressure, particularly from the European Union's Renewable Energy Directive (RED II), mandates strict sustainability criteria for imported biomass, profoundly influencing sourcing practices across North America and South America. Geopolitical dynamics, such as trade disputes and tariffs, can quickly shift the equilibrium of global wood chip flows, particularly impacting key exporting nations like Canada and Russia. Furthermore, competition from alternative biomass sources, such as agricultural residues or energy crops, constantly pressures the pricing and market share of conventional wood chips, requiring suppliers to continually justify the environmental and economic superiority of their product.

The combined effect of these forces creates a market environment favoring integrated suppliers who can demonstrate both scale and verifiable sustainability. The rising demand for green energy acts as a strong pull factor (Driver), while the necessity of compliance with rigorous sustainability certification (Restraint) acts as a powerful barrier to entry for smaller, less-organized players. The enduring Opportunity lies in innovation—specifically, in mitigating high moisture content and improving energy conversion efficiency, which are key bottlenecks. The long-term trajectory suggests that market leaders will be those who successfully leverage technology to reduce logistics costs, manage resource volatility, and provide impeccable traceability and environmental compliance documentation.

Segmentation Analysis

The Wood Chips Market segmentation is critical for understanding varied demand patterns across end-use industries and geographic regions. The market is primarily segmented based on Wood Type (Softwood, Hardwood), Application (Energy/Biofuel, Pulp & Paper, MDF/Particle Board, Others), and Geography. This structured classification allows market participants to tailor their processing specifications and supply chain logistics to specific consumer requirements. For instance, the Pulp & Paper segment dictates specific fiber properties best met by certain species of softwood, necessitating highly precise sizing and minimal contamination, contrasting sharply with the specifications required by the Biofuel segment, which prioritizes calorific value and cost efficiency and often utilizes lower-grade forest residues.

The dominance of the Energy/Biofuel application segment is driven by global policy mandates, creating immense volume demand, particularly in regions phasing out coal power generation. This segment often involves international trade, relying on bulk carriers and deep-water ports for efficient global movement. Conversely, the demand from the Panel Board industry (MDF and Particle Board) is more localized, relying on proximity to wood processing mills and construction markets. Understanding these distinct segment requirements—from fiber quality for paper to moisture content for energy—is essential for developing effective pricing strategies and capacity planning.

- Wood Type

- Softwood Chips

- Hardwood Chips

- Application

- Energy/Biofuel (Industrial Boilers, Co-firing)

- Pulp & Paper Manufacturing

- MDF (Medium-Density Fiberboard) and Particle Board Manufacturing

- Landscaping and Mulch

- Geography

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Wood Chips Market

The Value Chain for the Wood Chips Market is extensive and resource-intensive, beginning with sustainable forestry practices (Upstream) and culminating in industrial end-use (Downstream). The Upstream segment involves forest harvesting, which includes crucial activities like timber felling, logging, and on-site chipping or transportation of whole logs to centralized processing yards. Efficiency in this stage is paramount, relying heavily on mechanized harvesting equipment and compliance with environmental regulations, particularly regarding biodiversity and reforestation. Key challenges upstream include managing seasonal fluctuations in timber availability, unpredictable weather events impacting harvesting access, and securing long-term timber rights, often dictating the overall cost of raw material supply.

The Midstream segment focuses on processing and preparation. This includes debarking, precise chipping, screening for size and contaminants, and moisture content management, which are critical determinants of the final product's market value. Transportation, a major cost component due to the low density of wood chips, involves complex multimodal logistics (trucks, rail, barges, and dedicated ocean carriers). Distribution channels are predominantly direct for high-volume industrial users, but also include intermediaries like commodity traders and specialized biomass brokers who manage cross-border transactions and quality assurance. Indirect sales channels are more common in localized markets such as landscaping or small-scale heating.

The Downstream segment consists of the major industrial consumers—power generators, pulp mills, and panel board manufacturers. These end-users typically enter into long-term supply agreements (LTAs) to ensure stable and consistent input quality, often requiring suppliers to invest in dedicated storage and handling facilities near the consuming plant. Potential customers, therefore, are highly sophisticated organizations seeking stable, certified, high-volume supply. The integration of the value chain, from sustainable forest sourcing to guaranteed delivery to the boiler or digester, is a major competitive advantage, enabling players to capture higher margins and maintain regulatory compliance across the entire supply chain.

Wood Chips Market Potential Customers

The Wood Chips Market caters to a diverse range of large-scale industrial and utility consumers whose operational needs dictate the demand and quality requirements of the product. Potential customers are primarily categorized into the Bioenergy Sector and the Material Production Sector. Within the Bioenergy sector, major electricity generation companies and industrial manufacturers operating large combined heat and power (CHP) plants constitute the largest buyer base. These customers often require high volumes of chips optimized for calorific value and low ash content, sourcing globally through long-term contracts to fuel dedicated biomass power stations or co-fire with coal, particularly in Europe and parts of Asia committed to renewable energy targets.

The Material Production Sector, dominated by the Pulp & Paper and Wood Panel industries, represents another major customer segment. Pulp mills require clean, uniform, and specifically sized wood chips (usually softwood) to efficiently extract cellulose fibers for paper and cardboard production. Manufacturers of Medium-Density Fiberboard (MDF) and Particle Board utilize both softwood and hardwood chips, emphasizing bulk consistency and specific moisture levels crucial for the gluing and pressing processes. These manufacturers often establish facilities in close proximity to dense forest resources or large port terminals to minimize inbound logistics costs, defining them as highly localized or highly integrated supply chain buyers.

A secondary, yet growing, customer base includes commercial heating systems, specialized chemical producers utilizing wood extracts, and municipal entities purchasing chips for public landscaping or erosion control. However, the dominant market volume and revenue are dictated by large utility companies (focused on energy mandates) and multinational forest product conglomerates (focused on fiber feedstock). These end-users demand rigorous quality assurance, robust logistics capabilities, and comprehensive documentation of sustainable sourcing, making supplier reliability and certification status paramount purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rentech, Enviva Partners, Georgia-Pacific, Weyerhaeuser, West Fraser Timber, Resolute Forest Products, Chipman Wood Products, Biomass Secure Power, Stora Enso, Metsä Group, Smurfit Kappa, Nippon Paper, Mitsubishi Paper Mills, UPM-Kymmene, Suzano S.A., Domtar Corporation, Canfor Corporation, Sierra Pacific Industries, Hubei Wuchuan Energy, Pinnacle Renewable Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Chips Market Key Technology Landscape

The technology landscape in the Wood Chips Market is focused primarily on improving efficiency in resource extraction, processing, and enhancing the energy density of the final product to mitigate logistical constraints. Core technological advancements are seen in large-scale mobile and stationary chipping units, which utilize advanced sensors and automation to ensure highly uniform chip size distribution and minimize contamination. Precision engineering in screen systems and material handling is crucial, particularly for high-grade pulp chips, where slight variations in size drastically affect the efficiency of the pulping process. Furthermore, technologies focusing on moisture reduction, such as advanced drying kilns and natural air-drying strategies supported by predictive atmospheric models, are key to improving the calorific value and reducing shipping weights, which directly impacts profitability in international trade.

A transformative technology gaining traction is Torrefaction, a mild form of pyrolysis that converts wood chips into "torrefied pellets" or "biocoal." This process significantly improves the energy density, water resistance, and grindability of the biomass, making it behave similarly to coal. This technological breakthrough is crucial for the co-firing segment, as torrefied biomass can be handled and stored using existing coal infrastructure without major modifications, addressing a key challenge for utilities transitioning to renewables. The adoption of torrefaction technology, while capital-intensive, provides a pathway to unlock higher-value export markets and reduce the risks associated with long-distance biomass shipping, substantially enhancing the economic viability of wood chips as a global commodity.

Beyond processing, digital technology plays an essential role in supply chain optimization. The use of Geographic Information Systems (GIS) and remote sensing technologies (drones, LiDAR) is vital for efficient forest management, providing accurate volume estimation and enabling precise planning of harvesting routes, thereby minimizing environmental impact and operational costs. Furthermore, sophisticated inventory management software, often integrated with logistics planning tools, tracks chip quality, volume, and movement in real-time. This technological integration is mandatory for meeting the stringent traceability requirements imposed by sustainable biomass certification bodies, ensuring that the entire chain of custody is digitally verifiable and auditable, which is a major purchasing determinant for European and Asian utilities.

Regional Highlights

The regional distribution of the Wood Chips Market is characterized by a few major supply regions and several dominant demand centers, often separated by vast oceanic distances, making logistics a critical factor.

- Europe: Europe is the largest consumption hub, driven overwhelmingly by ambitious renewable energy targets and the rapid phase-out of coal power plants, particularly in the UK, Denmark, and the Netherlands. Consumption is highly concentrated in industrial-scale electricity and heat generation (bioenergy). Due to limited domestic forest resources relative to demand, Europe is a major net importer, relying heavily on stable supply chains from North America and, increasingly, South America and Africa. Regulatory compliance with the EU's sustainability criteria is the defining characteristic of this market.

- North America (NA): North America, led by the US and Canada, is the largest global producer and exporter of wood chips, benefiting from extensive, sustainably managed forest resources and advanced processing infrastructure. The US supplies substantial volumes of both softwood (for pulp and paper) and hardwood (for panel boards) chips domestically, while exporting significant volumes of high-quality industrial wood pellets (derived from chips) to Europe and Asia. The market here is balanced between domestic manufacturing demand and lucrative export opportunities.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by robust demand from the paper and packaging industry (China and India) and the bioenergy sector (Japan and South Korea). Japan and South Korea utilize wood chips and pellets for biomass co-firing to meet their national emission reduction targets. This region is structurally reliant on imports, seeking affordable and long-term certified supply, making it a critical strategic target for North American and Southeast Asian exporters.

- Latin America (LATAM): LATAM is emerging as a significant supply region, particularly countries like Brazil and Chile, which possess fast-growing plantation forests (e.g., eucalyptus). These resources provide a cost-competitive source of hardwood chips primarily targeting the global pulp and paper industry and increasingly the European bioenergy sector, positioning LATAM as a key growth area for both production and export capacity.

- Middle East and Africa (MEA): The MEA region remains a relatively small consumer, mainly utilizing wood chips for localized industrial processes, such as furniture manufacturing and smaller-scale power generation. However, investments in sustainable forestry and potential export capabilities, especially in Southern and West Africa, are beginning to draw international attention for future supply security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Chips Market.- Rentech

- Enviva Partners

- Georgia-Pacific

- Weyerhaeuser

- West Fraser Timber

- Resolute Forest Products

- Chipman Wood Products

- Biomass Secure Power

- Stora Enso

- Metsä Group

- Smurfit Kappa

- Nippon Paper

- Mitsubishi Paper Mills

- UPM-Kymmene

- Suzano S.A.

- Domtar Corporation

- Canfor Corporation

- Sierra Pacific Industries

- Hubei Wuchuan Energy

- Pinnacle Renewable Energy

Frequently Asked Questions

Analyze common user questions about the Wood Chips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Wood Chips Market?

The primary driver is the accelerating global shift towards renewable energy sources, specifically the demand from industrial power generation utilities replacing coal with certified biomass fuels (wood chips and derived products like pellets) to meet stringent national and international carbon reduction mandates and Renewable Portfolio Standards (RPS).

How does sustainability certification impact the Wood Chips Market?

Sustainability certification (e.g., FSC, PEFC, SBP) is mandatory, particularly for wood chips used in European and certain Asian bioenergy markets. These certifications ensure legal and sustainable sourcing, minimize environmental damage, and guarantee traceability, acting as a crucial barrier to entry for non-certified suppliers and deeply influencing global trade flows.

Which application segment holds the largest market share for wood chips?

The Energy/Biofuel application segment currently holds the largest market share by volume and is projected to exhibit the highest growth rate. This segment includes industrial power generation, co-firing with coal, and large-scale commercial heat generation systems globally, driven by government incentives favoring biomass utilization over fossil fuels.

What major logistical challenge affects the international trade of wood chips?

The major challenge is the high transportation cost due to the low energy density and high bulk volume of wood chips, compounded by the detrimental impact of moisture content on shipping weight and fuel efficiency. Technologies like densification (pelletization) and Torrefaction are being adopted to mitigate these inherent logistical inefficiencies.

Which regions are the largest exporters and importers of wood chips?

North America (the US and Canada) and emerging LATAM countries (Brazil, Chile) are the largest global exporters due to extensive forest resources. Europe, led by the UK and Nordic countries, is the largest net importer, followed closely by rapidly growing demand centers in Asia Pacific, specifically Japan and South Korea, which rely heavily on seaborne imports for bioenergy needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager