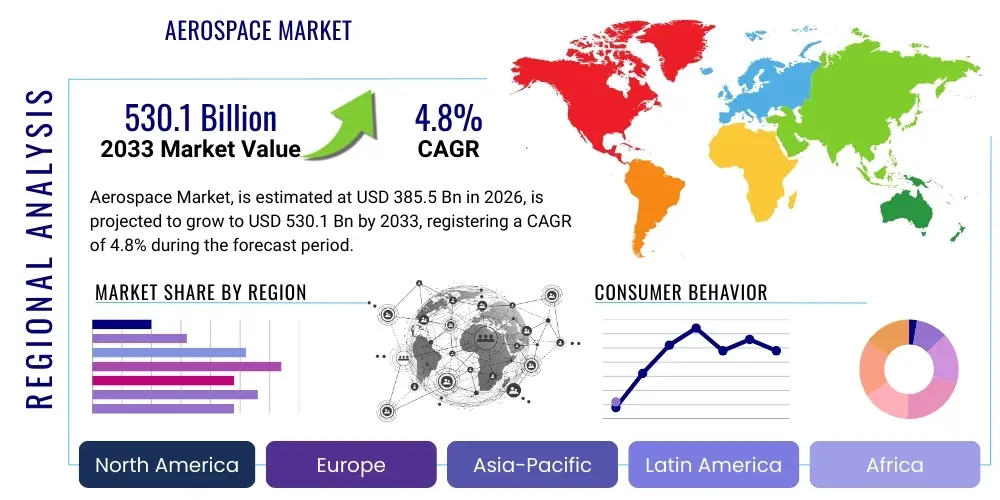

Aerospace Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437090 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aerospace Market Size

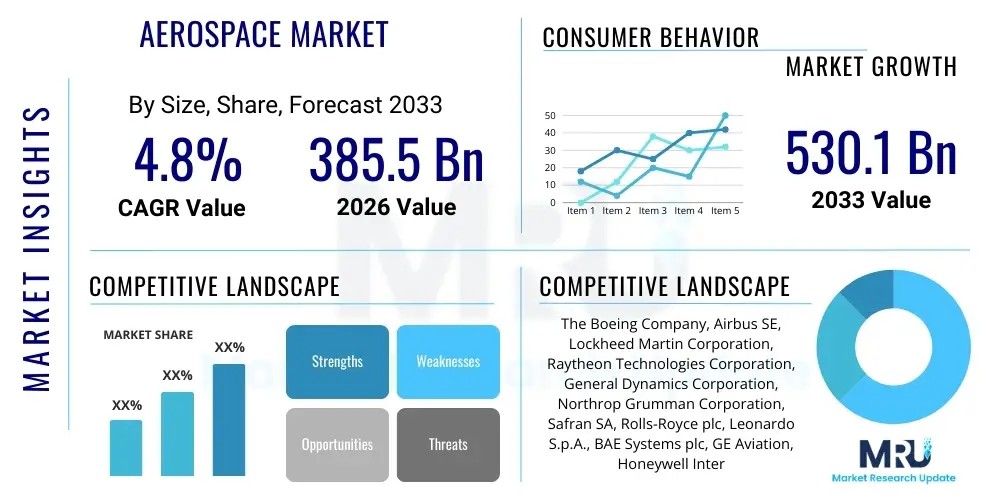

The Aerospace Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $385.5 Billion in 2026 and is projected to reach $530.1 Billion by the end of the forecast period in 2033. The continuous expansion is primarily fueled by rising global demand for commercial air travel, accelerated defense spending across major economies, and the rapid pace of technological advancements in spacecraft and satellite systems. This robust growth trajectory underscores the critical strategic importance of the aerospace sector in both global economic development and national security agendas.

Aerospace Market introduction

The Aerospace Market encompasses the research, development, manufacturing, operation, and maintenance of aircraft, spacecraft, missiles, and related equipment. It is fundamentally segmented into commercial aerospace (civil aviation), defense aerospace (military aircraft and systems), and space exploration (satellites, launch vehicles, and deep space missions). Products range from large-scale commercial airliners and fighter jets to highly complex communication satellites and advanced unmanned aerial vehicles (UAVs). The integration of lightweight materials, digital manufacturing techniques, and sophisticated avionics systems defines the modern product landscape within this industry, emphasizing efficiency, safety, and operational capability.

Major applications of aerospace technology span global transportation, military surveillance and combat, telecommunications, weather forecasting, and scientific research. Benefits derived from this market include improved global connectivity through reliable air travel, enhanced national security through advanced defense systems, and revolutionary breakthroughs in data transmission and remote sensing via space technologies. The high barriers to entry, demanding regulatory environments, and the need for significant capital investment characterize the operational structure of key industry participants. Continuous innovation in areas such as propulsion technology and sustainable aviation fuels is increasingly becoming a strategic imperative.

The primary driving factors sustaining market expansion include the increasing demand for next-generation, fuel-efficient aircraft to replace aging fleets, particularly in emerging Asian economies. Furthermore, geopolitical instability continues to stimulate government investment in defense modernization programs, focusing on advanced military aircraft and missile defense systems. The burgeoning private space industry, characterized by lower launch costs and the rapid deployment of mega-constellations of satellites for global internet coverage, also contributes substantially to the overall market momentum, pushing the boundaries of traditional aerospace domains.

Aerospace Market Executive Summary

The Aerospace Market is experiencing dynamic business trends characterized by a shift towards digital thread integration, resulting in streamlined design, production, and maintenance processes. Key industry players are increasingly engaging in strategic mergers, acquisitions, and joint ventures to consolidate technological capabilities, particularly in areas like additive manufacturing and cybersecurity solutions for airborne platforms. Supply chain resilience remains a critical focus area, driven by recent global disruptions, prompting deeper collaboration between OEMs and Tier 1 suppliers to ensure timely delivery of essential components and systems. Sustainability mandates, specifically the drive toward net-zero carbon emissions, are fundamentally reshaping R&D efforts towards Sustainable Aviation Fuels (SAFs) and hybrid-electric propulsion systems, influencing long-term investment strategies.

Regionally, North America maintains its dominance due to high defense spending, the presence of major aerospace OEMs, and robust R&D infrastructure, particularly supporting commercial and military upgrades. The Asia Pacific region, led by China and India, represents the fastest-growing segment, propelled by explosive growth in middle-class air travel, necessitating massive fleet expansion and associated maintenance, repair, and overhaul (MRO) activities. Europe is focusing heavily on collaborative programs such as the Future Combat Air System (FCAS) and adhering to strict environmental regulations, driving innovation in efficient aircraft designs. Emerging markets in the Middle East and Latin America are primarily driven by significant investments in commercial hubs and defense acquisitions.

Segmentation trends indicate strong growth in the components segment, particularly advanced composites and avionics, essential for next-generation aircraft performance. The Services segment, encompassing maintenance, repair, and overhaul (MRO), training, and data analytics, is expanding rapidly as operators seek to maximize asset utilization and minimize downtime using predictive maintenance technologies. Within the end-user segments, the commercial aircraft category is poised for long-term recovery, while the military aircraft segment remains stable, driven by ongoing modernization cycles. The space segment, particularly small satellites and dedicated launch services, is witnessing transformative growth catalyzed by private sector funding and governmental prioritization of space-based connectivity and surveillance.

AI Impact Analysis on Aerospace Market

User inquiries about the impact of Artificial Intelligence (AI) on the Aerospace Market frequently center on themes of operational efficiency, autonomous flight safety, predictive maintenance capability, and the future of military systems. Users are keen to understand how AI algorithms enhance aircraft design optimization, reduce fuel consumption, and manage complex air traffic control scenarios. Significant concerns revolve around certification standards for autonomous systems, ensuring data security in interconnected cockpits, and the ethical implications of AI deployment in unmanned combat aerial vehicles (UCAVs). The overall expectation is that AI will move beyond optimization tools to become an integral, mission-critical element of both commercial and defense aerospace systems, fundamentally redefining human-machine collaboration.

- AI optimizes aircraft design processes, reducing development timelines and material waste.

- Predictive maintenance driven by machine learning algorithms drastically lowers MRO costs and increases asset uptime.

- AI enhances flight safety and efficiency through advanced route optimization and weather prediction models.

- Autonomous systems and UCAVs utilize AI for complex decision-making, navigation, and mission execution.

- AI improves air traffic management (ATM) efficiency, reducing delays and enhancing airspace capacity.

- Supply chain management benefits from AI-powered forecasting, inventory optimization, and risk assessment.

- Simulation and training environments leverage AI for highly realistic, adaptive pilot and crew training programs.

DRO & Impact Forces Of Aerospace Market

The aerospace market’s trajectory is heavily influenced by a confluence of powerful drivers, structural restraints, and emerging opportunities, which collectively shape the competitive landscape and technological roadmap. Key drivers include robust global air passenger traffic growth, which necessitates continuous fleet expansion, and increased government defense budgets aimed at military modernization and geopolitical risk mitigation. These drivers are bolstered by technological leaps in materials science and digitalization, which enable the development of lighter, more efficient, and more capable aircraft and space vehicles. The foundational impact force in this market is the inherent capital intensity and the stringent regulatory oversight imposed by global aviation authorities, making market entry and sustained innovation challenging but essential for safety.

Restraints, however, pose significant challenges to sustained growth. These include prolonged aircraft certification cycles, which delay market introduction of new technologies, and persistent, complex supply chain disruptions leading to production bottlenecks and escalated component costs. Furthermore, the industry faces mounting pressure to address environmental concerns, particularly carbon emissions, which requires massive investment in potentially unproven sustainable technologies like SAFs and hydrogen propulsion. The cyclical nature of the commercial aviation segment, highly susceptible to economic downturns and global health crises, also acts as a dampening factor on long-term capital planning.

Opportunities for exponential growth are concentrated in several key areas: the rapid expansion of the low-Earth orbit (LEO) satellite constellation market, creating immense demand for small launch vehicles and payload capacity. Another critical opportunity lies in the development and integration of Urban Air Mobility (UAM) solutions, including electric vertical takeoff and landing (eVTOL) aircraft, which promise to revolutionize intra-city transport. Finally, the massive backlog of commercial aircraft orders ensures manufacturing sustained revenue streams for decades, provided production challenges are overcome. The overall impact forces compel continuous investment in R&D to maintain competitive advantage and meet evolving customer and regulatory demands for sustainability and performance.

Segmentation Analysis

The Aerospace Market is comprehensively segmented based on three primary dimensions: End-User (Commercial, Military, Space), Component (Aero Structure, Engines, Avionics, Interiors), and Platform (Fixed Wing, Rotary Wing, Satellites, Launch Vehicles). This granular segmentation helps stakeholders understand specific market dynamics, investment flows, and technological preferences within highly specialized sub-sectors. For instance, the commercial end-user segment is highly sensitive to fuel price fluctuations and global GDP, while the military segment is driven by long-term procurement cycles and government expenditure policies. The component segmentation highlights the increasing value contribution of complex avionics and next-generation composite aerostructures in modern aircraft manufacturing.

- By End-User:

- Commercial Aviation

- Military Aviation

- Space Exploration

- By Component:

- Aero Structures

- Aircraft Engines

- Avionics Systems

- Landing Gear Systems

- Cabin Interiors

- Actuation and Control Systems

- By Platform:

- Fixed Wing Aircraft (Narrow-body, Wide-body, Regional Jets)

- Rotary Wing Aircraft (Civil Helicopters, Military Helicopters)

- Unmanned Aerial Vehicles (UAVs)

- Satellites (GEO, MEO, LEO, HEO)

- Launch Vehicles (Heavy Lift, Medium Lift, Small Sat Launchers)

- Missile Systems

Value Chain Analysis For Aerospace Market

The aerospace value chain is exceptionally long, intricate, and hierarchical, starting with raw material providers and extending through complex multi-tier manufacturing networks to final assembly and sustained operations. Upstream activities involve specialized producers of advanced materials (e.g., carbon fiber composites, titanium alloys) and Tier 2/3 component suppliers who deliver critical sub-systems like fasteners, hydraulics, and specialized electronics. This upstream phase is characterized by strict quality control, high engineering expertise, and limited suppliers due to rigorous certification requirements. The integration of digital tools, such as Model-Based Systems Engineering (MBSE), is vital in connecting the design specifications of OEMs with the manufacturing capabilities of upstream suppliers, ensuring traceability and precision.

Midstream activities are dominated by major original equipment manufacturers (OEMs) like Boeing and Airbus, who are responsible for final integration, airframe manufacturing, and engine sourcing (often Tier 1 components). These OEMs manage vast global supply chains and bear the primary responsibility for obtaining airworthiness certifications from regulatory bodies such as the FAA and EASA. Their primary focus is lean manufacturing, minimizing assembly time, and managing extensive order backlogs. Strategic outsourcing of large assemblies to key Tier 1 partners (e.g., Spirit AeroSystems, Safran) is common practice to leverage specialized expertise and geographic advantages.

Downstream activities involve direct sales (e.g., military contracts or commercial airline purchases) and a robust aftermarket segment. Distribution channels for new aircraft are overwhelmingly direct, involving complex negotiations between OEMs, airlines, and government procurement agencies. The aftermarket, which includes MRO, spare parts logistics, crew training, and component repair, utilizes both direct OEM service centers and a network of independent MRO providers. The growing reliance on data analytics and connectivity (IoT) in aircraft ensures that the distribution of services is increasingly centralized and supported by digital platforms, maximizing uptime for end-users.

Aerospace Market Potential Customers

Potential customers for the Aerospace Market are diverse, ranging from governmental entities seeking defense capabilities and space infrastructure to private enterprises requiring transportation or data services. The largest single segment of potential customers comprises global commercial airlines (both mainline carriers and low-cost carriers) needing to refresh and expand their fleets to meet increasing passenger demand while adhering to modern efficiency and environmental standards. These buyers prioritize operational economics, fuel efficiency, and established reliability when making purchasing decisions that typically span decades.

Governmental customers are another critical segment, including national defense agencies, air forces, space agencies (like NASA and ESA), and national security bodies. These buyers focus on mission capability, technological superiority, system integration, and long-term logistical support, often procuring fighter jets, surveillance platforms, military transport aircraft, missile systems, and launch services for strategic assets. Defense procurement cycles are lengthy, highly regulated, and heavily influenced by geopolitical considerations and domestic industrial base requirements.

Emerging buyers include private space companies (e.g., satellite operators, launch brokers), logistics firms investing in specialized cargo aircraft, and technology companies exploring Urban Air Mobility (UAM) applications, seeking eVTOL solutions for future transport networks. Additionally, the MRO segment targets existing aircraft operators globally, offering scheduled and unscheduled maintenance services to prolong asset life and ensure continuous airworthiness, representing a stable and recurring revenue stream.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385.5 Billion |

| Market Forecast in 2033 | $530.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Boeing Company, Airbus SE, Lockheed Martin Corporation, Raytheon Technologies Corporation, General Dynamics Corporation, Northrop Grumman Corporation, Safran SA, Rolls-Royce plc, Leonardo S.p.A., BAE Systems plc, GE Aviation, Honeywell International Inc., Thales Group, Mitsubishi Heavy Industries, Embraer SA, Bombardier Inc., Dassault Aviation, Sierra Nevada Corporation, SpaceX, Viasat, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Market Key Technology Landscape

The aerospace technology landscape is rapidly evolving, driven by the imperatives of efficiency, autonomy, and connectivity. A crucial focus is on advanced materials technology, specifically the increased adoption of carbon fiber reinforced polymers (CFRPs) and advanced metallic alloys (like titanium and aluminum-lithium) to reduce airframe weight, enhance fuel economy, and improve structural resilience. This materials revolution is coupled with sophisticated manufacturing techniques such as Additive Manufacturing (3D Printing), which allows for the rapid production of complex, lightweight components with reduced waste and tailored performance characteristics, particularly in engine parts and structural brackets. These technological strides are fundamentally redefining how aircraft are designed and built.

Digitalization forms the backbone of modern aerospace operations, encompassing sophisticated avionics systems, fly-by-wire technology, and the integrated Digital Thread concept. This digital ecosystem connects design simulations, manufacturing data, and in-service performance monitoring, enabling real-time diagnostics and predictive maintenance (Condition-Based Monitoring). Connectivity solutions, including satellite-based broadband for in-flight services and secure communication links for air traffic management, are paramount. Furthermore, the development of integrated modular avionics (IMA) platforms streamlines hardware and software integration, making systems lighter, more adaptable, and easier to upgrade throughout the aircraft lifecycle.

Propulsion technology is undergoing transformative change due to environmental pressures. Current R&D efforts are heavily concentrated on high bypass ratio turbofan engines for maximizing efficiency, alongside emerging sustainable solutions. This includes the maturation of Sustainable Aviation Fuels (SAFs) as a drop-in replacement for traditional jet fuel, as well as the long-term exploration of electric and hybrid-electric propulsion systems for smaller, regional, and UAM platforms. In the space domain, advancements in reusable rocket technology and electric propulsion systems for satellites are drastically lowering launch costs and extending mission life, thereby accelerating the commercialization of space.

Regional Highlights

- North America: This region dominates the global aerospace market, characterized by the presence of major OEMs, extensive R&D facilities, and consistently high defense budgets. The US market drives innovation in next-generation fighter programs, advanced missile defense, and the burgeoning commercial space sector (SpaceX, Blue Origin). Strong MRO and aftermarket services are sustained by a large active fleet. North America is the primary early adopter of AI and digital manufacturing techniques in aerospace production.

- Europe: Europe is a major global manufacturing hub, led by Airbus, and focuses on collaborative multinational programs (e.g., FCAS, Eurofighter). The region emphasizes environmental compliance, driving leadership in SAF development and the adoption of more fuel-efficient aircraft designs. Key markets include the UK, France, and Germany, which maintain significant defense capabilities and prioritize intra-regional supply chain integration.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by expanding air travel demand, rapid urbanization, and rising middle-class disposable incomes, particularly in China and India. The demand is centered on new commercial aircraft procurement (narrow-body jets) and corresponding MRO infrastructure development. Regional defense modernization programs, especially in countries bordering geopolitical hotspots, also contribute significantly to the military segment growth.

- Latin America: This region's market growth is driven primarily by commercial fleet modernization and regional defense procurement focused on surveillance and border security. Brazil, hosting major OEM Embraer, is the market leader. Investment stability is often contingent on regional economic health and commodity price volatility, leading to measured, but strategic, defense and civil aviation upgrades.

- Middle East and Africa (MEA): The Middle East is a significant commercial aviation market, characterized by major hub airports and large, state-owned carriers investing heavily in wide-body aircraft for international long-haul routes. Investment in defense capabilities remains robust due to geopolitical tensions. Africa’s growth is nascent, focusing mainly on commercial fleet replacement and infrastructure development, supported by international aid and financing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Market.- The Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Northrop Grumman Corporation

- Safran SA

- Rolls-Royce plc

- Leonardo S.p.A.

- BAE Systems plc

- GE Aviation (Aviation segment of GE)

- Honeywell International Inc.

- Thales Group

- Mitsubishi Heavy Industries

- Embraer SA

- Bombardier Inc.

- Dassault Aviation

- Sierra Nevada Corporation

- SpaceX

- Viasat, Inc.

Frequently Asked Questions

Analyze common user questions about the Aerospace market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the commercial aerospace segment?

The primary drivers are the consistent growth in global air passenger traffic, particularly in the Asia Pacific region, and the mandatory need for major airlines to replace aging, less fuel-efficient aircraft with modern, next-generation models to meet both economic and environmental objectives.

How is sustainability impacting aerospace manufacturing and operations?

Sustainability is profoundly shifting R&D priorities towards Sustainable Aviation Fuels (SAFs), lighter composite materials, and electric/hybrid propulsion systems. Manufacturers are redesigning aircraft components and optimizing flight paths to meet increasingly stringent global carbon emission reduction targets and regulations.

Which technological trends are most disruptive to the aerospace industry?

The most disruptive trends include the widespread integration of Artificial Intelligence (AI) for autonomy and predictive maintenance, advanced Additive Manufacturing (3D printing) for component fabrication, and the rapid deployment of mega-constellations in Low Earth Orbit (LEO) for global satellite connectivity.

What are the primary challenges in the aerospace supply chain currently?

The primary challenges involve persistent bottlenecks in the supply of critical components (e.g., specialized electronics, forgings, castings), difficulties in securing highly specialized skilled labor, and inflationary pressures leading to increased raw material and logistics costs across the global tier network.

What role does government spending play in the overall market structure?

Government spending is crucial, particularly in the defense and space segments. Defense budgets drive the development and procurement of high-value military aircraft and surveillance systems, while government space agencies finance foundational research and major exploration and connectivity projects.

The Aerospace Market report delves deeply into the intricacies of this highly strategic sector, providing stakeholders with quantitative forecasts and qualitative insights necessary for informed decision-making. The commercial aviation segment, while historically cyclical, demonstrates powerful underlying demand fundamentals, suggesting a decade of sustained growth driven by fleet modernization requirements globally. The intersection of defense modernization programs, focusing on fifth and sixth-generation aerial platforms, and the explosive commercialization of the space sector ensures technological acceleration across the board. Companies are investing heavily in digital twins, predictive analytics, and automated assembly lines to mitigate production risks and enhance output efficiency, which are critical competitive advantages in securing long-term OEM contracts.

Further analysis of the regulatory environment reveals that noise reduction standards and pollution mitigation requirements, particularly in Europe, are placing substantial pressure on engine manufacturers to innovate rapidly. The reliance on complex global supply chains means that geo-political stability directly influences operational costs and timelines. Consequently, the concept of regional resilience in sourcing critical materials and components is gaining traction among major OEMs as a risk management strategy. The shift toward service-based contracts (Power-by-the-Hour models) in MRO is also altering financial risk distribution between manufacturers and operators, creating stable recurring revenue streams for service providers.

Examining the sub-segments within components, avionics systems, which include integrated flight controls, navigation systems, and advanced communications hardware, are exhibiting the highest innovation rate. The move toward open architecture systems allows for easier software upgrades and integration of third-party technologies, crucial for adapting to rapid technological obsolescence. Aero structure manufacturers, meanwhile, are competing based on their ability to handle complex composites at high volumes while maintaining stringent quality control, driven by the structural demands of new, lighter airframes intended for enhanced fuel efficiency.

The space segment is transforming from a government-centric domain to a heavily commercialized one. Low Earth Orbit (LEO) satellite deployment for broadband internet access (e.g., Starlink, OneWeb) necessitates new manufacturing approaches for small satellites and creates an unprecedented demand for reliable, cost-effective launch services. This has spurred intense competition and rapid technological development among private launch providers, focusing on reusability and higher launch frequencies. This democratization of space access is opening up new avenues for applications in remote sensing, agriculture, and global logistics, fundamentally reshaping the business models of satellite operators.

Geographically, while North America and Europe continue to lead in defense R&D and advanced manufacturing capability, the strategic importance of the APAC region cannot be overstated. APAC's rapid expansion provides the key demand volume needed to sustain global production lines. Companies are establishing localized MRO facilities and manufacturing joint ventures within APAC countries to better serve regional carriers and comply with local content regulations. This geographical segmentation highlights a dual market structure: high-value, technology-intensive activities concentrated in mature markets, and high-volume demand and service expansion centered in emerging economies.

The defense market is characterized by long-term strategic investments in advanced capabilities such as Hypersonic Weapons Systems and enhanced Intelligence, Surveillance, and Reconnaissance (ISR) platforms. Budget allocations are increasingly favoring digital modernization, including cyber resilience for mission-critical systems and the integration of networked battle management capabilities. This requires close collaboration between defense contractors and specialized IT/cybersecurity firms, reflecting a convergence of traditional aerospace expertise with digital technology capabilities. The necessity for system interoperability among allied nations also drives significant portions of defense R&D spending.

Addressing the workforce challenge is also paramount. The aerospace industry faces a substantial retirement wave among experienced engineers and technicians, creating a significant skills gap. Companies are investing in digital tools, Augmented Reality (AR) for assembly, and advanced technical training programs to transfer institutional knowledge and attract younger talent. The complexity of modern aerospace manufacturing demands a highly specialized and technically proficient workforce, making talent acquisition and retention a key non-financial risk factor across the industry.

In summary, the Aerospace Market remains a high-growth, high-value industry underpinned by non-discretionary defense spending and essential global transportation needs. While macroeconomic headwinds, supply chain constraints, and environmental pressures introduce volatility, the long-term outlook is exceptionally strong, driven by technological breakthroughs in autonomy, propulsion, and space commercialization. Strategic focus areas for market participants must include deepening digitalization efforts, securing critical supply chain components, and achieving leadership in sustainable aviation solutions to maintain competitive relevance over the forecast period.

The transition toward more sustainable practices is not merely regulatory compliance but is becoming a significant competitive differentiator. Airlines are increasingly evaluating new aircraft purchases based on fuel efficiency and the ability to operate on higher blends of SAFs. This demand signal is forcing engine OEMs and airframe designers to optimize every aspect of the aircraft, from aerodynamic profiles to engine thermal efficiency. The development of next-generation single-aisle aircraft is particularly focused on achieving substantial reductions in emissions and noise footprint, serving as a proving ground for commercial viability of new technologies.

Furthermore, the maintenance, repair, and overhaul (MRO) segment is benefiting tremendously from data integration and predictive analytics. Modern aircraft generate terabytes of operational data, which, when analyzed by AI algorithms, allows MRO providers to predict component failure with high accuracy. This shift from reactive or scheduled maintenance to condition-based maintenance minimizes aircraft downtime, reduces inventory holding costs for spare parts, and maximizes the operational life of expensive assets. This technological leap is driving MRO market growth faster than traditional manufacturing segments.

The role of small and medium enterprises (SMEs) within the value chain is also evolving. While OEMs dominate final assembly, SMEs often provide highly specialized, technologically niche components or services, particularly in areas like advanced materials processing, software development for avionics, or specialized tooling for maintenance. Government initiatives aimed at strengthening the domestic industrial base often include programs to support and integrate these SMEs into the global supply chain, fostering localized innovation and reducing dependency on monolithic suppliers.

The geopolitical landscape significantly influences the defense sub-segment. Ongoing tensions between major global powers stimulate continuous investment in missile defense, advanced surveillance capabilities, and rapid reaction forces. The market for unmanned aerial systems (UAS), ranging from tactical drones to large reconnaissance platforms, is expanding rapidly as militaries seek cost-effective, persistent presence capabilities. These platforms are becoming increasingly sophisticated, incorporating advanced sensor fusion and edge computing capabilities powered by artificial intelligence to operate effectively in contested environments.

In the financial dimension, the aerospace market is heavily reliant on export credit agencies and specialized aircraft leasing companies, particularly in commercial aviation. Leasing companies play a crucial role in managing the financial risks associated with large capital expenditures for airlines, allowing them greater flexibility in fleet planning. The robustness of financial markets and the availability of affordable long-term debt are therefore critical external factors affecting overall market transaction volumes and growth rates, particularly for new aircraft deliveries.

The evolution of space technology is particularly exciting, driven by the vision of multi-domain operations and the utilization of space for commercial benefit. Beyond communication satellites, the market for Earth observation and remote sensing satellites is growing, providing high-resolution data for climate monitoring, urban planning, and resource management. The increasing density of objects in space (orbital debris) necessitates significant technological advances in space traffic management and on-orbit servicing, creating a new market segment focused on debris removal and satellite life extension services.

The challenge of integrating new technologies like UAM (Urban Air Mobility) into existing regulated airspace is substantial. Regulatory bodies must develop new certification pathways for eVTOL aircraft that meet stringent safety standards while allowing innovation to flourish. The success of UAM is contingent not only on the technological maturity of the aircraft but also on the development of integrated digital infrastructure—known as Unmanned Aircraft System Traffic Management (UTM)—to ensure safe, high-density operations in urban environments.

In conclusion, the Aerospace Market exhibits high resilience and long-term potential. Its complexity necessitates constant adaptation to technological change, stringent safety regulations, and global economic shifts. The coming years will be defined by the successful integration of digital platforms, the realization of sustainable flight technologies, and the continued commercialization of space, ensuring the sector remains at the forefront of global industrial and technological development.

The rigorous requirements for materials traceability and component lifespan within aerospace mean that manufacturers are increasingly adopting blockchain technology. While nascent, blockchain offers a potential solution for creating immutable records of part origin, maintenance history, and compliance certifications, thereby enhancing supply chain transparency and reducing the incidence of counterfeit parts, a long-standing industry concern. This digital ledger technology is poised to standardize quality documentation and regulatory auditing across complex international borders.

Furthermore, the competitive dynamic among key players is not limited to airframe or engine technology but extends significantly into software and data services. Companies like Airbus and Boeing are positioning themselves as comprehensive service providers, offering data analytics packages, digital flight deck solutions, and customized crew training simulators alongside their hardware sales. This strategy locks in customers long-term and provides a continuous revenue stream from the operational phase of the aircraft lifecycle, moving the industry further towards a total lifecycle management model.

The military procurement environment is also shifting towards ‘open architecture’ systems to prevent vendor lock-in and accelerate technology refresh cycles. This mandate allows different contractors to develop interchangeable software and hardware components for platforms like fighter jets and command-and-control systems, encouraging competition and innovation, especially in AI and electronic warfare capabilities. This shift contrasts sharply with proprietary legacy systems and is fundamentally changing the defense industrial base structure.

In terms of workforce development, the specific skills in highest demand relate to coding for embedded systems, data science for predictive maintenance, and composite materials engineering. Educational institutions and industry partnerships are being leveraged globally to create specialized training curricula designed to meet these future needs. Addressing this human capital constraint is as vital as technological investment for the sustained operational capacity and innovation pipeline of the aerospace sector.

Finally, emerging market entrants, particularly from nations seeking to establish an indigenous aerospace industry (e.g., Turkey, South Korea), are introducing new competitive pressures. These entrants often target specific niche segments, such as regional jets or specialized military trainers, aiming to undercut established Western OEMs through government subsidies or localized content mandates. While these players currently hold small market shares, their long-term potential contributes to the overall global competitive complexity of the Aerospace Market.

The substantial investment required for aerospace R&D necessitates significant government partnership, particularly for disruptive technologies like hypersonic flight or large-scale hydrogen propulsion systems. Public-private partnerships (PPPs) de-risk the initial high capital outlay and share the burden of certification and testing. This collaborative model is essential for bringing radical innovations, which often take decades to mature, to commercial viability while meeting exceptionally high safety standards dictated by aviation authorities worldwide.

The rise of cyber threats specifically targeting avionics systems, air traffic control networks, and intellectual property repositories has made cybersecurity an existential priority. Manufacturers are designing security protocols into systems from the ground up, known as 'security by design,' rather than relying on reactive measures. Certification processes now include rigorous testing for cyber resilience, particularly for interconnected cockpit environments and communication links, adding complexity and cost to the development cycle.

Within the space launch services market, the shift towards reusable launch vehicles (RLVs) is rapidly decreasing the effective cost per kilogram to orbit. This cost reduction is the single most important factor enabling the proliferation of large satellite constellations and scientific missions. Established players are either adopting reusability concepts or focusing on highly specialized, responsive launch capabilities for small satellites, optimizing their strategies around distinct market segments defined by payload mass and orbital destination.

The growing demand for sophisticated training solutions includes full flight simulators (FFSs) integrated with virtual reality (VR) and augmented reality (AR) technologies. These tools provide realistic and complex training scenarios, reducing the need for costly actual flight hours while preparing pilots and technicians for the increasingly digitized and automated aircraft cockpits and systems they will encounter. The training and simulation segment is growing steadily, reflecting the complexity and scale of new aircraft deliveries and fleet upgrades globally.

Overall, the resilience of the aerospace market, despite significant global disruptions such as the recent pandemic, underscores its fundamental importance to global commerce and national security. The future growth will be characterized by intense focus on efficiency gains through digitization and a transformative shift towards ecologically sustainable operations, ensuring the sector remains dynamic and strategically critical for the foreseeable future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aerospace Raw Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aerospace Special Metal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aerospace Helmet Mounted Display Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aerospace Microwave Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aerospace Wire Harnesses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager