Almond Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433091 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Almond Market Size

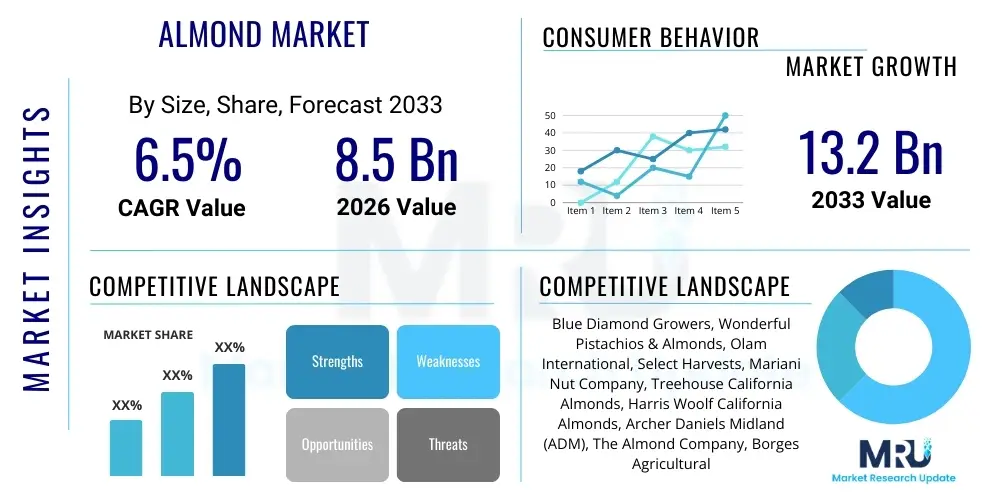

The Almond Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $13.2 Billion by the end of the forecast period in 2033.

The robust expansion of the global almond market is primarily driven by escalating consumer awareness regarding the significant nutritional benefits associated with almond consumption. Almonds, rich in healthy fats, fiber, protein, magnesium, and Vitamin E, are increasingly integrated into health-conscious diets across developed and emerging economies. This nutritional profile makes them a staple ingredient in functional foods, dietary supplements, and plant-based alternatives, directly influencing market volume growth. Furthermore, the diversification of almond products, including almond milk, butter, flour, and snack bars, has significantly broadened their accessibility and application base, moving beyond traditional snacking into mainstream food processing and beverage industries. This rapid product innovation pipeline ensures sustained consumer engagement and market dynamism.

Geographically, while North America, particularly the United States, remains the largest producer and consumer, rapid urbanization and rising disposable incomes in the Asia Pacific region, notably in countries like China and India, are fueling exponential demand growth. The shift towards Western dietary patterns and the strong demand for premium imported nuts in these regions represent a critical market expansion vector. Supply chain optimization, driven by technological advancements in farming and processing, is crucial for sustaining this growth trajectory, though it must contend with inherent challenges related to water scarcity and climate variability impacting major production zones.

Almond Market introduction

The Almond Market encompasses the global production, trade, and consumption of almonds (Prunus dulcis) and their derived products. Almonds are highly valued nuts categorized primarily into sweet and bitter varieties, with sweet almonds dominating commercial markets due to their palatability and versatility. The product description spans raw kernels, roasted and salted varieties, and value-added derivatives such as sliced, slivered, paste, flour, oil, and milk. Major applications include direct consumption as snacks, integration into confectionery and bakery items, use in processed foods and beverages (especially plant-based dairy substitutes), and application in the cosmetic and pharmaceutical industries due to almond oil's emollient and nutritional properties.

The primary driving factors propelling the market include the global health and wellness trend, which emphasizes nutrient-dense foods; the surging demand for vegan and lactose-free dairy alternatives, positioning almond milk as a leading plant-based beverage; and the increasing use of almond ingredients in gluten-free and keto-friendly formulations. Furthermore, the inherent benefits of almonds, such as supporting heart health, blood sugar control, and weight management, solidify their status as a preferred ingredient among consumers prioritizing preventative health measures. The market’s resilience is also supported by advanced packaging techniques that extend shelf life and maintain quality, crucial for global distribution.

Despite robust demand, the market introduction phase is heavily influenced by geopolitical stability, trade tariffs, and the pronounced impact of environmental factors, particularly water availability in key growing regions such as California (which accounts for over 80% of global output). Sustainable farming practices and investments in efficient irrigation technologies are becoming mandatory prerequisites for market stakeholders aiming for long-term supply stability. The competitive landscape is characterized by vertical integration among major growers and processors seeking control over quality and cost throughout the supply chain, ensuring consistent product delivery across diverse international markets.

Almond Market Executive Summary

The Almond Market exhibits sustained upward momentum, characterized by significant business trends centered on premiumization and product diversification. Key business trends include substantial investments in advanced processing capabilities to produce specialized ingredients like defatted almond flour and high-purity almond protein powders catering to the sports nutrition and functional food sectors. Furthermore, mergers and acquisitions activity is concentrating market share among large agribusinesses, streamlining global distribution and enhancing brand visibility. The emphasis on transparency and sustainability claims, particularly concerning water usage and pesticide reduction, is now a crucial competitive differentiator, driven by increasingly discerning consumer expectations and regulatory pressure across Western markets.

Regionally, the market dynamics are polarized. North America and Europe maintain dominance in terms of value consumption and advanced product formulation, acting as innovation hubs for almond-based substitutes. However, the highest growth rates are projected from the Asia Pacific (APAC) region, fueled by demographic expansion, rising middle-class consumption power, and increasing exposure to Western diets. APAC demand is heavily skewed towards raw and in-shell almonds, while Western markets favor value-added products like almond butter and beverages. This regional variance necessitates tailored marketing and supply chain strategies, focusing on efficiency and cold chain logistics for perishable goods in high-growth areas.

Segmentation trends highlight the critical role of the beverage segment, where almond milk continues to aggressively capture market share from traditional dairy, underpinned by its lower calorie count and environmental perception advantages. Simultaneously, the ingredients segment (flour, oil, paste) is experiencing accelerated growth, driven by the expansion of industrial bakery and confectionery industries seeking non-GMO, natural, and gluten-free inputs. Manufacturers are responding by focusing on varietal specificities, such as Nonpareil and Carmel types, to meet specific texture and flavor requirements for industrial application, indicating a maturing and specialized market structure.

AI Impact Analysis on Almond Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Almond Market reveals key thematic areas focusing primarily on supply chain optimization, predictive farming capabilities, and market price volatility forecasting. Users frequently inquire about how AI can mitigate climate-related crop losses, specifically asking about AI-driven irrigation scheduling and disease detection systems. Another significant area of concern revolves around optimizing global logistics; users are keen to understand how machine learning algorithms can predict peak demand periods and minimize transportation costs and spoilage across vast international supply chains. Furthermore, businesses are seeking clarity on the application of AI in consumer behavior analysis to refine product development and personalized marketing strategies for almond derivatives, moving towards a data-driven approach for market entry and expansion.

AI is fundamentally transforming almond agriculture through precision farming techniques. Satellite imagery and drone data, processed by machine learning models, allow growers to monitor tree health, nutrient uptake, and water stress at an individual plant level, moving away from generalized field management. This capability not only maximizes yield efficiency per acre but also significantly addresses critical environmental constraints, such as water usage, which is paramount in arid growing regions. The utilization of computer vision in sorting and grading facilities also enhances quality control, minimizing manual errors and accelerating processing speeds, thereby reducing operational overhead and improving overall product consistency.

In the commercial downstream sector, AI algorithms are playing a pivotal role in demand forecasting and inventory management. By analyzing complex variables, including global trade indices, weather patterns, historical sales data, and commodity price fluctuations, AI systems provide superior predictive accuracy for almond traders and large-scale buyers. This predictive intelligence allows companies to make more informed purchasing decisions, hedge against price volatility, and maintain optimal inventory levels, drastically reducing the risk of overstocking or stockouts in a rapidly fluctuating commodity market.

- AI-Powered Precision Irrigation Systems: Optimizing water usage by 15-25% in major cultivation areas.

- Predictive Yield Modeling: Using machine learning to forecast harvest volumes, improving market supply planning.

- Automated Pest and Disease Detection: Utilizing drone imagery and computer vision for early intervention in orchards.

- Supply Chain and Logistics Optimization: AI algorithms reducing transportation costs and transit times by route optimization.

- Quality Control Automation: Machine vision systems replacing manual sorting for defect and size grading in processing plants.

- Consumer Behavior Analytics: Identifying niche demand trends for specialized almond products (e.g., keto flour, high-protein paste).

DRO & Impact Forces Of Almond Market

The Almond Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. The main drivers include the overwhelming global preference for plant-based foods, the confirmed health benefits of almonds (supporting heart health and chronic disease prevention), and the innovative expansion of product applications into mainstream food and cosmetic segments. However, the market faces severe restraints, most notably the high dependence on specific climate conditions and intense water requirements for cultivation, leading to supply instability and high input costs, particularly in primary production regions like California and the Mediterranean. These restraints are further compounded by ongoing trade tensions and escalating raw material price volatility, which affect profit margins for processors and manufacturers.

Opportunities for market growth are vast and primarily reside in technological advancements and geographical diversification. Significant opportunities include the development of drought-resistant almond varieties through genetic research, offering a buffer against climate change risks. Furthermore, there is immense untapped potential in emerging markets in Southeast Asia and Africa, where growing affluence is translating into higher consumption of imported, high-value nutritional snacks. Strategic investments in vertical integration, coupled with certifications emphasizing sustainable sourcing and ethical labor practices, present opportunities for brands to command premium pricing and strengthen consumer loyalty, especially among environmentally conscious consumer segments in developed nations.

The impact forces within the market, driven by external environmental and regulatory pressures, dictate operational viability. Climate change acts as a formidable impact force, directly threatening yield stability and forcing growers to adopt advanced water-saving technologies like micro-irrigation and soil moisture sensors. Regulatory bodies globally are increasingly scrutinizing pesticide use and water footprint, compelling industry compliance and investment in cleaner farming techniques. The collective impact of these forces necessitates continuous innovation in both agricultural practices and processing efficiency to sustain market growth while simultaneously managing resource scarcity and adhering to increasingly stringent environmental governance frameworks.

Segmentation Analysis

The global almond market is segmented based on product type, application, form, and distribution channel, reflecting the diverse ways almonds are processed and utilized across various industries. This segmentation is crucial for stakeholders to identify key growth pockets and tailor their product portfolios. Product type segmentation distinguishes between shelled and unshelled almonds, with shelled varieties dominating industrial and retail consumption due to convenience and ease of processing. The application segment is dominated by direct consumption/snacking, but significant growth is being witnessed in the industrial use of almonds for dairy substitutes, baking, and confectionery, driven by the clean label movement and functional food trends.

Segmentation by form—whole, sliced, slivered, flour, and oil—indicates the level of value addition. Almond flour is rapidly gaining traction due to its gluten-free properties, making it essential in health-focused bakery products and specialty dietary foods. Similarly, almond oil, valued highly in both culinary applications for its delicate flavor and in cosmetics for its moisturizing capabilities, commands a premium price point. Analyzing these forms helps companies position themselves either as bulk commodity suppliers or as producers of specialized, high-margin ingredients necessary for formulated products.

The distribution channel segmentation highlights the importance of both B2B channels, where large volumes are supplied to food processors and manufacturers, and B2C channels (supermarkets, hypermarkets, and e-commerce). E-commerce platforms are experiencing exponential growth, especially in developed markets, providing consumers with direct access to a wide variety of domestic and imported almond products, including artisanal and organic varieties. Understanding the flow through these channels is vital for optimizing logistics, inventory management, and maximizing market penetration across different consumer demographics.

- By Product Type:

- Shelled Almonds

- In-Shell (Unshelled) Almonds

- By Application:

- Direct Consumption/Snacks

- Confectionery and Bakery

- Beverages (Almond Milk)

- Cosmetics and Personal Care

- Others (Pharmaceuticals, Processed Foods)

- By Form:

- Whole

- Flour

- Slivered/Sliced

- Diced/Chopped

- Almond Paste/Butter

- Oil

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

Value Chain Analysis For Almond Market

The value chain for the Almond Market is complex, beginning with highly concentrated upstream activities and extending through diverse downstream processing and global distribution channels. Upstream analysis focuses predominantly on cultivation, where key activities include nursery stock preparation, orchard management (irrigation, fertilization, pest control), harvesting, and primary hulling and shelling. This segment is characterized by high capital expenditure, intensive water usage, and susceptibility to climatic and biological risks. Efficiency in the upstream segment, particularly yield optimization per unit of water, is critical for cost control, largely dictating the raw material price that enters the midstream processing stage. Major producers, leveraging advanced agricultural technology and large-scale operations, maintain significant bargaining power in this phase.

The midstream sector involves secondary processing, which includes sorting, grading, blanching, roasting, slicing, and ultimately converting kernels into value-added derivatives like almond flour, paste, oil, and beverages. This phase requires substantial investment in specialized machinery and adherence to stringent food safety and quality standards (e.g., HACCP, pasteurization protocols). Companies excelling in the midstream often differentiate themselves through innovative product development and customization for industrial clients. Large processors frequently integrate vertically backward into farming or forward into specialized ingredient formulation to enhance control over quality and ensure stable supply, mitigating risks associated with commodity price volatility.

Downstream activities involve the distribution channel, which is partitioned into direct and indirect routes. Direct channels include bulk sales to large industrial customers (e.g., major food and beverage manufacturers) and increasing direct-to-consumer sales via e-commerce platforms. Indirect channels utilize brokers, distributors, and wholesalers to move product through hypermarkets, supermarkets, and international trade networks. Effective cold chain logistics and inventory management are paramount in the downstream segment to maintain product freshness and minimize spoilage across long-distance global trade routes. The choice of distribution strategy is highly dependent on the product form; commodities typically move through traditional brokerage, while niche value-added products rely more on specialized retail and digital platforms.

Almond Market Potential Customers

Potential customers for the Almond Market span a broad spectrum of industries and consumer segments, reflecting the versatility of the product across various forms. Primarily, the largest industrial end-users are food and beverage manufacturers, including major dairy companies transitioning into plant-based alternatives, confectionery giants requiring specialized ingredients for chocolate and bar formulations, and bakery enterprises utilizing almond flour for gluten-free and artisanal breads. These B2B customers prioritize stability of supply, specific quality parameters (e.g., particle size for flour, oil extraction rate), and competitive bulk pricing, often entering into long-term supply contracts with large almond processors and growers.

A rapidly expanding segment of potential customers includes specialized health and wellness companies. This incorporates manufacturers of sports nutrition products seeking high-quality, plant-based protein powders derived from almonds, dietary supplement companies formulating nutrient-rich capsules, and producers of functional food products aimed at specific dietary needs, such as ketogenic or paleo diets. These customers place a premium on certification (organic, non-GMO, allergen control) and detailed nutritional profiling, driving demand for specialized, high-pmargin almond derivatives that require advanced processing techniques.

At the consumer level (B2C), potential customers are diverse, ranging from general household shoppers purchasing snacking nuts to highly informed individuals seeking specific health outcomes. The largest consumer groups are health-conscious millennials and Gen Z, driving the demand for almond milk and convenient, portable almond snacks. Additionally, the growing demographic of individuals with lactose intolerance or Celiac disease forms a critical customer base for almond milk and almond flour. Market penetration is maximized by targeting regional dietary preferences; for instance, targeting confectionary use in Europe versus direct snacking in the Middle East and use in traditional recipes in Asia.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $13.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blue Diamond Growers, Wonderful Pistachios & Almonds, Olam International, Select Harvests, Mariani Nut Company, Treehouse California Almonds, Harris Woolf California Almonds, Archer Daniels Midland (ADM), The Almond Company, Borges Agricultural & Industrial Nuts, Panoche Creek Packing, Bel-Air Nut Company, Poindexter Nut Company, Sran Family Orchards, Continental Nut Company, Sierra Valley Almonds, Royal Nut Company, TCI Nut Group, Montz Company, Hilltop Ranch Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Almond Market Key Technology Landscape

The Almond Market's key technology landscape is defined by the integration of sophisticated agricultural technology (AgriTech) and advanced processing and packaging innovations aimed at maximizing yield efficiency and ensuring product quality and safety during global transit. In the cultivation phase, the primary technological shift involves precision agriculture tools. This includes the widespread adoption of IoT sensors for real-time monitoring of soil health, nutrient levels, and moisture content, enabling variable rate irrigation (VRI) systems. VRI technologies are crucial for minimizing water consumption, a significant environmental and operational challenge for almond growers. Furthermore, the use of GPS-guided tractors and aerial surveying via drones equipped with multispectral cameras allows for targeted pest management and nutrient application, dramatically increasing resource efficiency and reducing environmental impact.

In the processing segment, technological advancements center on food safety and product consistency. High-capacity, automated sorting and grading machines utilize advanced camera vision systems and near-infrared (NIR) spectroscopy to rapidly detect physical defects, foreign materials, and chemical contaminants with unparalleled accuracy, exceeding human capability. Mandatory pasteurization protocols, such as dry heating and propylene oxide (PPO) treatment, require specialized, high-throughput equipment to meet strict global export standards, particularly those mandated by the US Food and Drug Administration (FDA) and European Union regulations. These technologies safeguard consumer health and ensure the marketability of products across highly regulated international borders.

Packaging and storage technologies represent another vital area of innovation. Modified Atmosphere Packaging (MAP) and Vacuum Packaging systems are employed to extend the shelf life of raw and processed almonds by controlling oxygen and moisture levels, thereby mitigating rancidity and spoilage during lengthy transportation across continents. Additionally, the development of blockchain technology is beginning to impact the market by offering enhanced traceability features. This allows all stakeholders, from consumer to farmer, to track the origin and processing history of the batch, fostering greater transparency and trust, which is highly valued in the premium and organic almond segments. Investment in these technologies is essential for maintaining a competitive edge in quality and compliance.

Regional Highlights

- North America: North America, led by the United States (California), is the dominant global force in the Almond Market, accounting for the vast majority of worldwide production and holding a significant share of global consumption value. The region is characterized by highly mechanized farming operations and advanced processing infrastructure. Demand is exceptionally strong for value-added products, particularly almond milk and innovative snack formulations. The market benefits from high consumer awareness regarding nut nutrition and robust retail infrastructure, though it is simultaneously constrained by stringent environmental regulations concerning water usage and pest control.

- Europe: Europe represents the largest import market for almonds, driven by strong industrial demand from the confectionery and bakery sectors, especially in countries like Germany, Spain, and the UK. Spain is also a notable traditional grower, focusing on unique indigenous varieties. Consumer trends emphasize organic, non-GMO, and sustainably sourced almonds. Regulatory focus on food safety, including strict import controls on aflatoxins and chemical residues, drives high-quality standards among suppliers. The rising popularity of plant-based diets accelerates the adoption of almond ingredients across the region.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, driven by population growth, rapid urbanization, and significant increases in disposable income across economies like China and India. The cultural perception of nuts as a healthy, luxurious snack, especially during festive seasons, fuels demand. While currently focused primarily on raw and in-shell consumption, there is emerging demand for processed derivatives like almond milk and almond-based infant foods, suggesting a future shift towards value-added consumption patterns influenced by Westernization.

- Latin America: The market in Latin America is characterized by moderate but consistent growth, primarily concentrated in large economies such as Brazil and Mexico. Consumption is largely driven by direct snacking and limited industrial use. Trade agreements and improved logistics infrastructure are facilitating imports, expanding consumer access. Challenges include fluctuating economic stability and lower per capita consumption compared to Western counterparts, though the growing middle class represents a significant opportunity.

- Middle East and Africa (MEA): The MEA region is a key consumption area, particularly for high-quality imported almonds used in traditional baking, religious ceremonies, and premium snacking. High purchasing power in the GCC countries sustains demand for premium and imported products. Supply chain stability, influenced by geopolitical factors and reliance on sea freight, remains a key consideration for market entry and sustained operation within this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Almond Market.- Blue Diamond Growers

- Wonderful Pistachios & Almonds

- Olam International

- Select Harvests

- Mariani Nut Company

- Treehouse California Almonds

- Harris Woolf California Almonds

- Archer Daniels Midland (ADM)

- The Almond Company

- Borges Agricultural & Industrial Nuts

- Panoche Creek Packing

- Bel-Air Nut Company

- Poindexter Nut Company

- Sran Family Orchards

- Continental Nut Company

- Sierra Valley Almonds

- Royal Nut Company

- TCI Nut Group

- Montz Company

- Hilltop Ranch Inc.

Frequently Asked Questions

Analyze common user questions about the Almond market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Almond Market?

The primary drivers are the global shift towards plant-based and high-protein diets, the superior nutritional profile of almonds (rich in Vitamin E and healthy fats), and expansive product diversification, especially in the fast-growing almond milk and gluten-free flour segments.

How significant is water scarcity as a restraint on almond production?

Water scarcity is arguably the most critical operational restraint. Almond cultivation is highly water-intensive, and sustained droughts in major producing regions, particularly California, necessitate massive investment in precision irrigation technologies and threaten long-term supply stability and cost efficiency.

Which almond derivative is experiencing the fastest growth in the market?

Almond flour is currently exhibiting the fastest growth rate in the ingredients segment due to its pivotal role in the gluten-free and keto dietary trends. Concurrently, almond milk remains the volume leader in the plant-based beverage sector, securing continuous market penetration.

Where are the key geographical opportunities for almond market expansion?

The most significant market expansion opportunities are found in the Asia Pacific (APAC) region, specifically China and India, where rising disposable incomes and changing urban dietary habits are fueling explosive demand for both raw almonds and processed nutritional products.

What role does technology play in ensuring the quality and safety of globally traded almonds?

Technology is crucial for maintaining quality and safety. Advanced machine vision systems are used for accurate defect sorting, while mandatory pasteurization (e.g., dry heating) ensures microbiological safety, meeting strict international export standards and reducing health risks associated with raw nut consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Almond Drinks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Almond Butter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Almond Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Almond Drink Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Sweet Almond Oil Market Size Report By Type (Nonpareil Almond Oil, California Almond Oil, Mission Almond Oil, Others), By Application (Cosmetics, Food, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager