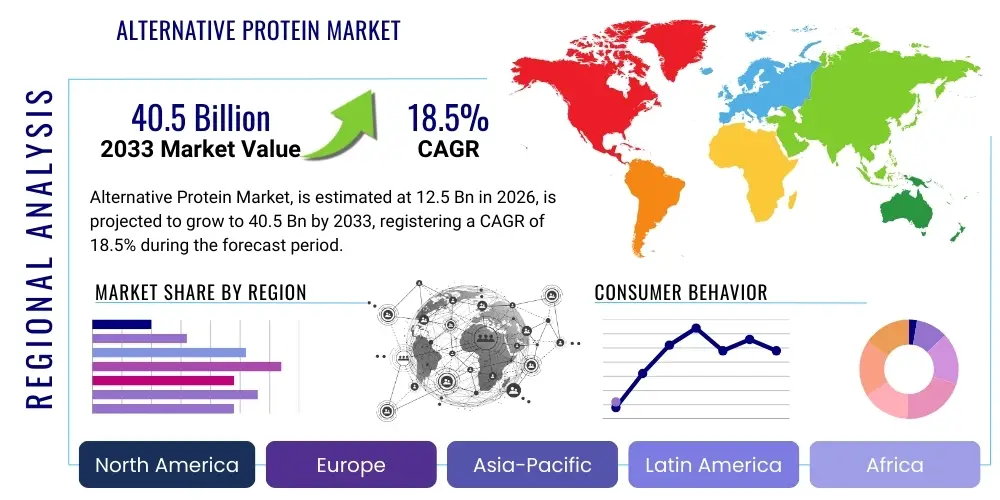

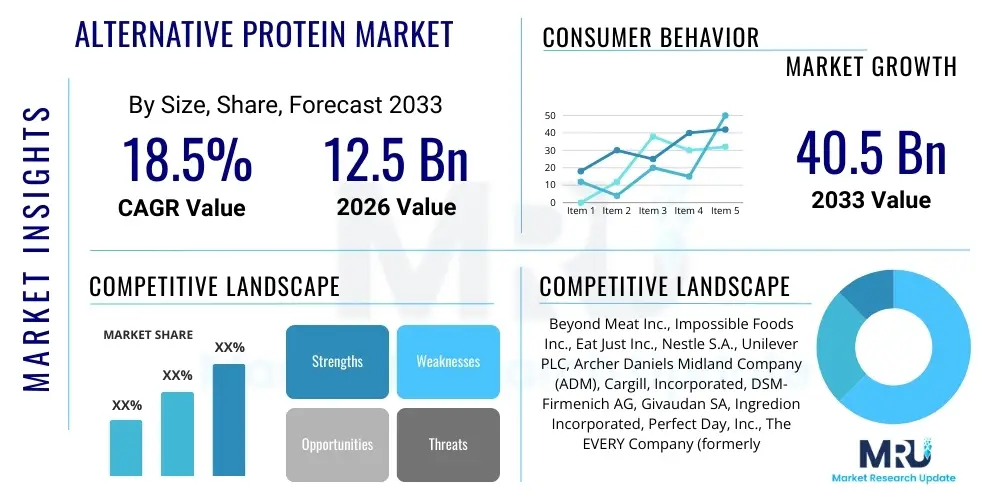

Alternative Protein Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439561 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Alternative Protein Market Size

The Alternative Protein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 40.5 Billion by the end of the forecast period in 2033.

Alternative Protein Market introduction

The alternative protein market encompasses a diverse range of protein sources designed to replace or complement traditional animal-derived proteins, driven by global megatrends in sustainability, health, and ethical consumption. This rapidly evolving sector includes plant-based proteins, microbial proteins derived from fermentation (such as fungi, algae, and bacteria), insect-based proteins, and cultivated meat, which is grown from animal cells. These products primarily target applications across food and beverages, animal feed, and nutritional supplements, offering innovative solutions to address the escalating demand for protein while mitigating the environmental footprint associated with conventional livestock farming. The market's expansion is fundamentally propelled by increasing consumer awareness regarding the ecological impact of traditional agriculture, growing health consciousness leading to the adoption of flexitarian and plant-forward diets, and significant technological advancements in food science and biotechnology that enhance the taste, texture, and nutritional profile of alternative protein products, making them more appealing to a broader consumer base.

Major applications of alternative proteins span a wide spectrum, from replicating traditional meat and dairy products to serving as functional ingredients in various food formulations. Meat alternatives, dairy-free beverages and yogurts, egg substitutes, and protein-rich snacks represent prominent segments, offering consumers diverse choices that align with their dietary preferences and ethical stances. The benefits associated with alternative proteins are multifaceted: they typically require less land and water, produce fewer greenhouse gas emissions compared to animal agriculture, and often present favorable nutritional profiles, including lower saturated fat and cholesterol. Key driving factors include a burgeoning global population necessitating sustainable food systems, increasing urbanization coupled with rising disposable incomes in developing economies, leading to diversified dietary patterns, and substantial investment from venture capitalists and established food corporations into research and development, fostering continuous innovation in product development and ingredient optimization. These elements collectively establish a dynamic environment for sustained growth within the alternative protein landscape.

Alternative Protein Market Executive Summary

The Alternative Protein Market is experiencing unprecedented growth, characterized by vigorous business trends centered on innovation, strategic partnerships, and aggressive market entry by both startups and established food giants. A key business trend involves significant venture capital funding and private equity investments pouring into cellular agriculture and precision fermentation companies, signaling confidence in their long-term scalability and market disruption potential. Furthermore, food manufacturers are increasingly reformulating existing products and launching new lines featuring alternative proteins to cater to evolving consumer preferences, leading to a proliferation of plant-based meat, dairy, and egg alternatives across retail and foodservice channels. Regional trends highlight North America and Europe as the leading markets, driven by early adoption, strong consumer awareness, and robust innovation ecosystems, while the Asia Pacific region is rapidly emerging as a critical growth hub, propelled by dietary shifts, increasing urbanization, and government initiatives promoting sustainable food security. Latin America and the Middle East & Africa are also showing nascent but growing interest, particularly in plant-based and insect protein segments, driven by both economic development and a desire for diverse protein sources.

Segmentation trends reveal plant-based proteins, especially soy, pea, and wheat, continuing to dominate due to their established supply chains, versatility, and cost-effectiveness, though microbial and cultivated protein segments are projected to exhibit the highest growth rates as their technologies mature and scale. Within applications, meat alternatives remain the largest and most dynamic segment, constantly evolving with advancements in texture, flavor, and nutritional parity with conventional meats. Dairy alternatives, including milks, cheeses, and yogurts made from nuts, oats, and microbial ferments, are also demonstrating robust expansion. The market is witnessing a diversification in product forms, with an increasing availability of solid, liquid, and powdered protein ingredients catering to both industrial food manufacturers and direct-to-consumer supplement markets. Overall, the executive summary underscores a market ripe with opportunity, characterized by a rapid pace of technological advancement, increasing consumer acceptance, and a shifting paradigm towards more sustainable and ethical food production globally, despite facing challenges related to cost parity, sensory attributes, and regulatory harmonization across diverse geographies.

AI Impact Analysis on Alternative Protein Market

The impact of Artificial Intelligence (AI) on the Alternative Protein Market is a topic of significant user interest, with common inquiries centering on how AI can accelerate product development, optimize production processes, and enhance the sensory experience of novel protein foods. Users are keen to understand AI's role in discovering new protein sources, improving ingredient functionality, and streamlining complex supply chains. Expectations revolve around AI's ability to reduce costs, enhance efficiency, and overcome current challenges such as taste and texture disparities between alternative and traditional proteins. There is also considerable interest in AI's potential to personalize nutrition and facilitate data-driven decision-making throughout the alternative protein value chain, from raw material sourcing to consumer product launch, ultimately making alternative proteins more competitive and accessible. Concerns often touch upon data privacy, the ethical implications of AI-driven food design, and the need for transparency in AI applications within food production, reflecting a broader societal dialogue around technology in daily life.

- Accelerated R&D and Novel Ingredient Discovery: AI algorithms analyze vast datasets to identify new protein sources, predict protein functionality, and optimize ingredient combinations for desired taste, texture, and nutritional profiles, significantly shortening development cycles.

- Precision Fermentation Optimization: AI and machine learning enhance bioprocesses in precision fermentation and cellular agriculture by optimizing growth conditions, media formulations, and bioreactor parameters, leading to increased yield, purity, and cost efficiency.

- Enhanced Product Formulation: AI-driven predictive modeling helps food scientists formulate alternative protein products that closely mimic the sensory attributes (flavor, mouthfeel, appearance) of conventional animal products, overcoming key consumer acceptance hurdles.

- Supply Chain Management and Sustainability: AI optimizes supply chain logistics, predicts demand, manages inventory, and identifies sustainable sourcing strategies for raw materials, reducing waste and improving overall environmental performance.

- Quality Control and Food Safety: AI-powered sensors and imaging systems monitor product quality in real-time during manufacturing, detecting contaminants, ensuring consistency, and enhancing food safety standards across alternative protein production lines.

- Personalized Nutrition and Consumer Insights: AI analyzes consumer data to identify trends, preferences, and dietary needs, enabling the development of personalized alternative protein products and tailored marketing strategies that resonate with specific demographics.

- Automated Manufacturing and Robotics: AI integrates with robotics to automate various stages of alternative protein production, from ingredient mixing and extrusion to packaging, improving efficiency, reducing labor costs, and ensuring consistent product quality.

DRO & Impact Forces Of Alternative Protein Market

The Alternative Protein Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by several Impact Forces. Key drivers include the growing global population's demand for sustainable and ethical food sources, increasing consumer awareness regarding the health benefits associated with plant-based diets, and rising concerns over the environmental footprint of conventional animal agriculture, particularly its contributions to greenhouse gas emissions, deforestation, and water usage. Furthermore, significant technological advancements in protein extraction, fermentation, and cellular agriculture have dramatically improved the sensory attributes and versatility of alternative protein products, making them more appealing to a wider consumer base. These factors collectively push innovation and investment within the sector, propelling market expansion and diversification. The confluence of these drivers creates a compelling narrative for the long-term growth and eventual mainstream adoption of alternative proteins across various global food systems.

Despite robust growth, the market faces several restraints, most notably the higher production costs of some novel alternative proteins compared to their conventional counterparts, which impacts price parity at the consumer level. Challenges related to achieving satisfactory taste, texture, and aroma profiles that fully replicate animal products remain, limiting broader consumer acceptance in certain demographics. Regulatory complexities and the absence of harmonized labeling standards across different regions also pose significant hurdles for market entry and product commercialization. Furthermore, scalability issues for emerging technologies like cultivated meat and precision fermentation, coupled with concerns regarding consumer perception and cultural resistance in some traditional markets, can slow adoption rates. Nevertheless, these restraints are actively being addressed through continuous research and development efforts, strategic industry collaborations aimed at cost reduction and sensory improvement, and advocacy for clearer, more supportive regulatory frameworks. Opportunities abound in product innovation, particularly in hybrid products that combine plant-based and cultivated ingredients, expansion into emerging markets with rapidly changing dietary preferences, and the development of alternative proteins tailored for specific nutritional needs or functional applications. The overarching impact forces include evolving consumer trends, rapid technological innovation, the global regulatory environment, increasing investment capital, and mounting environmental and sustainability pressures, all of which dynamically influence the market's trajectory and competitive landscape.

Segmentation Analysis

The Alternative Protein Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its intricate dynamics and growth trajectories. These segmentations typically include source, application, and form, each offering unique insights into market preferences, technological maturity, and consumer adoption patterns. Analyzing these segments is crucial for identifying high-growth areas, understanding competitive landscapes, and formulating effective market entry strategies for various stakeholders, from raw material suppliers to final product manufacturers. The diversity within these segments reflects the broad scope of innovation and the evolving nature of consumer demand for sustainable and health-conscious food solutions.

- By Source:

- Plant-based Proteins

- Soy Protein

- Wheat Protein

- Pea Protein

- Rice Protein

- Potato Protein

- Fava Bean Protein

- Oat Protein

- Almond Protein

- Mung Bean Protein

- Lentil Protein

- Chickpea Protein

- Sunflower Protein

- Hemp Protein

- Other Plant-based Proteins (e.g., microalgae, fungal)

- Microbial Proteins

- Fungi-based Proteins (e.g., Mycoprotein)

- Algae-based Proteins (e.g., Spirulina, Chlorella)

- Bacteria-based Proteins (e.g., Methanotrophs)

- Yeast-based Proteins

- Insect-based Proteins

- Cricket Protein

- Mealworm Protein

- Black Soldier Fly Larvae Protein

- Grasshopper Protein

- Ant Protein

- Other Insect Proteins

- Cultivated Meat

- Cultivated Beef

- Cultivated Chicken

- Cultivated Pork

- Cultivated Seafood

- Other Cultivated Meats

- Plant-based Proteins

- By Application:

- Food & Beverages

- Meat Alternatives (e.g., burgers, sausages, nuggets)

- Dairy Alternatives (e.g., milk, yogurt, cheese, ice cream)

- Egg Alternatives

- Bakery and Confectionery

- Snacks and Nutritional Bars

- Beverages

- Cereals

- Ready Meals

- Other Food Applications

- Feed

- Animal Feed (e.g., aquaculture, poultry, swine, pet food)

- Nutraceuticals & Health Supplements

- Protein Powders

- Protein Bars

- Functional Beverages

- Meal Replacements

- Food & Beverages

- By Form:

- Solid (e.g., powders, isolates, concentrates, textured proteins)

- Liquid (e.g., beverages, ready-to-drink formulations)

- Semi-Solid (e.g., pastes, gels, emulsions)

Value Chain Analysis For Alternative Protein Market

The value chain of the alternative protein market is a complex ecosystem, beginning with upstream activities focused on raw material sourcing and cutting-edge research and development. Upstream analysis involves the cultivation or fermentation of protein sources such as soybeans, peas, fungi, algae, or the intricate processes of cell line development for cultivated meat. This stage also includes the extraction and processing of proteins from these raw materials into isolates, concentrates, or textured forms, requiring specialized biotechnology and food processing equipment. Key players at this stage include agricultural suppliers, biotech firms, ingredient manufacturers, and R&D institutions that innovate new protein strains and processing technologies. The efficiency and sustainability of these upstream processes are critical for the overall market viability and cost-effectiveness of alternative protein products. Strategic partnerships between farmers, ingredient developers, and research laboratories are essential to optimize raw material quality, yield, and sustainability, while simultaneously driving down production costs and improving functional attributes.

Moving downstream, the value chain encompasses the manufacturing, formulation, and distribution of finished alternative protein products. This involves food manufacturers who utilize the processed protein ingredients to create a wide array of consumer-ready products, including plant-based meats, dairy alternatives, and protein supplements. These companies invest heavily in product development to improve taste, texture, and nutritional profiles, striving to mimic or surpass traditional animal products. Distribution channels are varied, including direct and indirect approaches. Direct channels involve manufacturers selling directly to consumers through e-commerce platforms or company-owned retail outlets, offering greater control over branding and customer experience. Indirect channels, which are more prevalent, involve sales through major retail chains (supermarkets, hypermarkets), foodservice establishments (restaurants, cafeterias), and specialized health food stores. Logistics providers, wholesalers, and distributors play a vital role in ensuring efficient product movement from manufacturing facilities to points of sale. The effectiveness of both direct and indirect distribution strategies, coupled with robust marketing and branding efforts, is paramount for securing market share and reaching diverse consumer segments, ultimately influencing the widespread adoption and commercial success of alternative protein products across global markets.

Alternative Protein Market Potential Customers

The potential customers for the alternative protein market are incredibly diverse, spanning across multiple sectors and demographics, reflecting a broad shift in global consumption patterns. At the core, end-users include individual consumers who are increasingly adopting flexitarian, vegetarian, or vegan diets due to health consciousness, ethical concerns about animal welfare, and environmental awareness. This segment comprises early adopters seeking innovative food choices, as well as a growing mainstream audience looking for healthier and more sustainable options without necessarily committing to a fully plant-based lifestyle. Beyond individual consumers, the market also serves a significant industrial clientele, including large-scale food and beverage manufacturers. These companies integrate alternative proteins into their product lines to meet consumer demand for plant-based alternatives, develop novel food products, or enhance the nutritional profiles of existing offerings. This includes manufacturers of meat alternatives, dairy-free products, bakery items, snacks, and functional beverages, all aiming to expand their market reach and cater to evolving dietary trends.

Furthermore, the foodservice industry represents a substantial potential customer segment. Restaurants, cafes, hotels, catering services, and institutional food providers (e.g., schools, hospitals) are increasingly incorporating alternative proteins into their menus to attract a broader customer base and align with corporate sustainability goals. The growing demand for plant-based options in out-of-home dining environments highlights a significant opportunity for alternative protein suppliers. The animal feed industry also stands as a crucial end-user, exploring alternative proteins such as insect meal and microbial proteins as sustainable and efficient protein sources to reduce reliance on conventional feed ingredients like soy and fishmeal, particularly in aquaculture and poultry farming. Lastly, the nutraceuticals and sports nutrition sectors are key buyers, utilizing alternative protein isolates and concentrates in protein powders, bars, and supplements to cater to athletes and health-conscious individuals seeking plant-derived or sustainable protein sources for muscle building, recovery, and overall wellness. This multi-faceted customer base underscores the pervasive influence and expansive growth potential of the alternative protein market across the entire food system.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 40.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Beyond Meat Inc., Impossible Foods Inc., Eat Just Inc., Nestle S.A., Unilever PLC, Archer Daniels Midland Company (ADM), Cargill, Incorporated, DSM-Firmenich AG, Givaudan SA, Ingredion Incorporated, Perfect Day, Inc., The EVERY Company (formerly Clara Foods), Meati Foods, Mosa Meat B.V., Upside Foods (formerly Memphis Meats), Tyson Foods, Inc., Maple Leaf Foods Inc. (Greenleaf Foods, SPC), Lightlife Foods, Inc., Quorn Foods (Monde Nissin Corporation), SavorEat. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alternative Protein Market Key Technology Landscape

The alternative protein market is underpinned by a rapidly evolving and innovative technology landscape, crucial for overcoming current sensory and cost challenges while enabling the development of novel, scalable products. Key technologies employed include advanced plant protein extraction and texturization techniques, which are vital for transforming raw plant materials into functional ingredients with desirable mouthfeel and structural integrity. High-moisture extrusion, for instance, is increasingly used to create fibrous, meat-like textures from plant proteins, significantly improving their mimicry of conventional meat products. Precision fermentation stands as a transformative technology, utilizing genetically engineered microorganisms (yeast, fungi, bacteria) to produce specific proteins, enzymes, and other complex organic molecules, such as heme or dairy proteins, without the need for animal inputs. This allows for the production of highly pure, functional ingredients that can impart authentic flavors and textures to alternative protein foods, fundamentally redefining possibilities in the dairy and egg alternative segments. Cellular agriculture, encompassing cultivated meat and cell-based seafood, represents another frontier, where animal cells are grown in bioreactors to produce real meat, fish, or dairy components, entirely eliminating the need for animal slaughter. This technology promises to deliver identical sensory and nutritional profiles to conventional products, marking a significant leap in the market's capabilities.

Beyond these primary production methods, several other technologies play a critical role. Microencapsulation and nanotechnology are being explored to enhance the stability, bioavailability, and controlled release of nutrients and flavors in alternative protein products, while also masking undesirable off-notes. AI and machine learning are increasingly integrated into research and development, optimizing everything from ingredient discovery and formulation to process parameters and quality control, thereby accelerating innovation cycles and improving efficiency. Advanced bioreactor designs and bioprocessing techniques are continuously being refined to scale up production of microbial and cultivated proteins, aiming to reduce capital and operational costs. Furthermore, sustainable sourcing technologies, including vertical farming for plant-based ingredients and valorization of agricultural side streams, contribute to the overall environmental credentials of the alternative protein industry. The synergistic application of these diverse technologies is fundamental to enhancing product quality, achieving cost parity, and ensuring the long-term sustainability and widespread adoption of alternative proteins, driving the market towards greater mainstream acceptance and competitive advantage against traditional animal protein sources.

Regional Highlights

- North America: This region stands as a dominant force in the alternative protein market, characterized by high consumer awareness, significant venture capital investment, and a robust innovation ecosystem. The U.S. and Canada lead in product development and consumer adoption, particularly for plant-based meat and dairy alternatives. Health consciousness, ethical considerations, and a strong culture of dietary experimentation drive market growth.

- Europe: Europe is another key market, propelled by stringent environmental regulations, growing consumer demand for sustainable and ethical food choices, and proactive government support for alternative protein research. Countries like the UK, Germany, and the Netherlands are at the forefront, with significant advancements in mycoprotein and cultivated meat technologies, alongside a strong market for diverse plant-based options.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by a large and rapidly urbanizing population, increasing disposable incomes, and a growing middle class shifting towards diversified and health-conscious diets. While traditional protein sources remain strong, sustainability concerns and food security issues are accelerating interest in plant-based and insect proteins, particularly in China, India, and Southeast Asian countries.

- Latin America: This region shows emerging potential, with increasing adoption of plant-based diets, particularly in countries like Brazil and Mexico. Economic development and rising awareness of health and environmental benefits are stimulating demand, though market penetration is still nascent compared to North America and Europe. Local ingredient sourcing and cultural adaptation are key for market success.

- Middle East and Africa (MEA): The MEA market is still in its early stages but offers significant growth opportunities, driven by concerns over food security, water scarcity, and a rising interest in health and wellness. While cultural preferences for traditional meats are strong, there is a growing niche for plant-based and, potentially, insect-based proteins, particularly in urban centers and among younger demographics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alternative Protein Market.- Beyond Meat Inc.

- Impossible Foods Inc.

- Eat Just Inc.

- Nestle S.A.

- Unilever PLC

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- DSM-Firmenich AG

- Givaudan SA

- Ingredion Incorporated

- Perfect Day, Inc.

- The EVERY Company (formerly Clara Foods)

- Meati Foods

- Mosa Meat B.V.

- Upside Foods (formerly Memphis Meats)

- Tyson Foods, Inc.

- Maple Leaf Foods Inc. (Greenleaf Foods, SPC)

- Lightlife Foods, Inc.

- Quorn Foods (Monde Nissin Corporation)

- SavorEat

Frequently Asked Questions

What are the primary drivers of growth in the Alternative Protein Market?

The primary drivers include increasing consumer awareness of environmental sustainability, growing health consciousness leading to plant-forward diets, advancements in food technology improving product taste and texture, and significant investments in novel protein research and development.

What are the main types of alternative proteins currently available?

The main types include plant-based proteins (e.g., soy, pea, wheat, fava bean), microbial proteins (e.g., fungi/mycoprotein, algae, yeast), insect-based proteins (e.g., cricket, mealworm), and cultivated meat (grown from animal cells).

What challenges does the Alternative Protein Market face?

Key challenges include achieving cost parity with conventional animal proteins, overcoming sensory hurdles (taste, texture, aroma) for broader consumer acceptance, navigating complex regulatory landscapes, and scaling up production efficiently for novel technologies like cultivated meat.

How does the Alternative Protein Market contribute to sustainability?

Alternative proteins contribute to sustainability by generally requiring less land, water, and energy, and producing fewer greenhouse gas emissions compared to traditional animal agriculture, thus reducing the overall environmental footprint of food production.

Which regions are leading the growth in the Alternative Protein Market?

North America and Europe currently lead in market size and innovation, driven by high consumer adoption and investment. The Asia Pacific region is projected to be the fastest-growing market due to rapid urbanization, increasing disposable incomes, and evolving dietary preferences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fermentation for Alternative Protein Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Neutral Alternative Protein Market Size Report By Type (Plant Protein, Insect Protein, Algae Protein, Others), By Application (Food & Beverage, Healthcare product), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Neutral Alternative Protein Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Plant Protein, Insect Protein, Algae Protein, Others), By Application (Food Beverage, Healthcare Product), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager