Auto Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433217 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Auto Parts Market Size

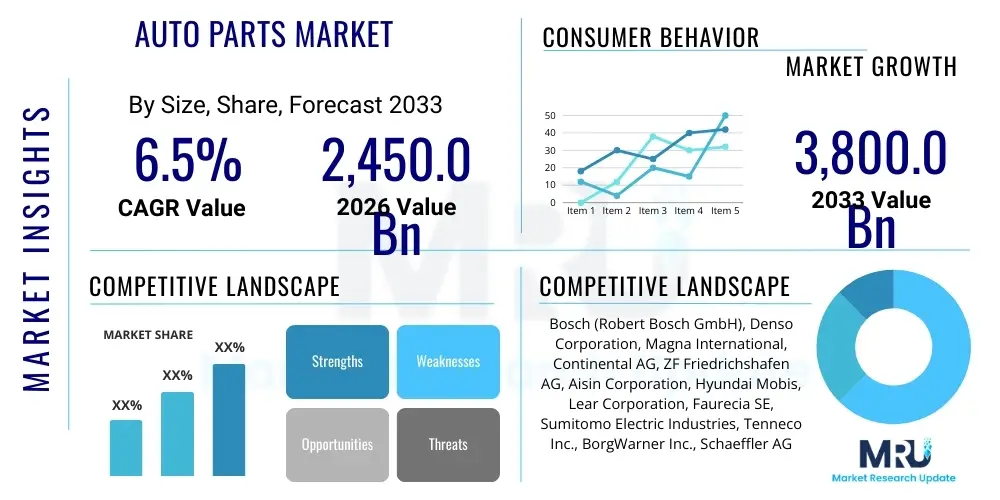

The Auto Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2,450.0 Billion in 2026 and is projected to reach USD 3,800.0 Billion by the end of the forecast period in 2033.

Auto Parts Market introduction

The Global Auto Parts Market encompasses the manufacturing, distribution, and sale of various components required for the production, maintenance, and repair of motorized vehicles, including passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). This highly complex ecosystem includes original equipment manufacturers (OEMs) providing parts for new vehicle assembly and the robust aftermarket segment catering to replacement, customization, and repair needs. Key product categories range from essential mechanical components like engine blocks, transmission systems, and braking assemblies, to sophisticated electrical and electronic systems such as sensors, wiring harnesses, and advanced driver assistance systems (ADAS).

Major applications of auto parts are segmented primarily into two domains: the OEM channel, where components are supplied directly to vehicle assembly lines for new vehicle manufacturing, and the aftermarket channel, which covers components sold through various distribution networks (retailers, independent garages, and dealership service centers) for vehicle maintenance and repair. The market's significant benefits include ensuring vehicle safety and performance longevity, supporting a massive global infrastructure for repair services, and facilitating technological innovation in areas such as vehicle efficiency, emission reduction, and enhanced driver connectivity. The persistent growth in vehicle parc globally, combined with the increasing average age of vehicles in developed economies, underpins the demand for reliable and accessible auto parts.

Driving factors shaping the market trajectory include rapid technological shifts toward vehicle electrification (EVs), necessitating new components like battery management systems and power electronics; stringent global safety and emission regulations requiring advanced components (e.g., complex catalytic converters and ADAS sensors); and the rising propensity for vehicle customization and personalization, particularly in emerging markets. Furthermore, the digitalization of the supply chain and enhanced e-commerce penetration are streamlining distribution, making parts more readily available, thereby accelerating market expansion. The shift towards autonomous driving also creates massive opportunities for advanced sensor and computing components.

Auto Parts Market Executive Summary

The Auto Parts Market is characterized by robust resilience, driven fundamentally by the expanding global vehicle fleet and increasing technological complexity of modern vehicles. Business trends highlight a significant divergence in growth trajectories between the traditional internal combustion engine (ICE) components and high-growth segments related to electric mobility (e-powertrains, thermal management) and vehicle connectivity (sensors, embedded software). Supply chain restructuring, prompted by geopolitical instability and the need for localized production (nearshoring), is a critical focus area for major manufacturers, seeking to mitigate reliance on single-source suppliers and enhance inventory resilience. Furthermore, mergers and acquisitions remain prevalent as companies consolidate expertise in key technological niches, particularly software integration and lightweight material manufacturing. Sustainability is emerging as a core operational mandate, influencing material sourcing and waste reduction throughout the component lifecycle.

Regional trends indicate that Asia Pacific (APAC) remains the dominant engine of market expansion, primarily due to the massive scale of vehicle production and subsequent rapid growth in the aftermarket sector in countries like China and India. North America and Europe, while growing at a more mature pace, are leading the charge in high-value components, especially those related to ADAS integration, advanced safety features, and premium electric vehicle platforms. These developed regions are witnessing significant investment in digital service infrastructure, facilitating predictive maintenance and data-driven inventory management in the aftermarket. Latin America and the Middle East and Africa (MEA) offer substantial long-term growth potential, fueled by improving road infrastructure, increasing consumer wealth, and the gradual standardization of vehicle maintenance practices.

Segmentation trends reveal that the Electrical & Electronics segment is experiencing the fastest acceleration, outpacing traditional mechanical components, due to the proliferation of sensors, ECUs (Electronic Control Units), and advanced lighting systems integral to modern vehicle architecture. Within distribution, the aftermarket is demonstrating higher growth rates than the OEM channel in certain sub-segments, driven by the delayed replacement cycle for high-quality components and the increasing consumer preference for professional installation services over DIY. Component manufacturers are strategically pivoting their R&D investments to capture the burgeoning demand for lightweight materials, sophisticated thermal systems critical for battery longevity, and modular component designs that facilitate ease of repair and installation across different vehicle platforms.

AI Impact Analysis on Auto Parts Market

User queries regarding the impact of Artificial Intelligence (AI) on the Auto Parts Market typically revolve around three central themes: optimization of manufacturing and supply chain logistics, enhancement of component quality control, and the integration of AI-enabled components (like predictive maintenance sensors) into the vehicle itself. Users are keenly interested in how AI can address persistent industry challenges such as reducing lead times, predicting component failures before they occur, and personalizing the driving experience through AI-driven vehicle systems. Concerns often focus on the required investment in infrastructure, the necessary skills upgrade for the workforce, and data privacy implications associated with collecting real-time operational data from vehicles and factories. The expectation is that AI will fundamentally redefine the manufacturing floor, logistics networks, and the functional capabilities of the final automotive product.

The application of AI in manufacturing processes is already yielding transformative results, particularly in complex operations such as precision machining and assembly. Machine learning algorithms are deployed to analyze sensor data from production lines, instantly identifying anomalies that could lead to defects, thus ensuring near-perfect quality control and minimizing waste. This shift from reactive to proactive quality management drastically reduces recall rates and improves the overall reliability of auto parts, from microchips to heavy-duty structural components. Furthermore, generative design, powered by AI, allows engineers to rapidly iterate lightweight, high-performance part geometries that were previously impossible to conceptualize through traditional design methods, accelerating the development cycle for mission-critical parts.

Beyond manufacturing, AI is revolutionizing the aftermarket and service landscape. Predictive maintenance is perhaps the most significant functional impact, where embedded sensors and AI models analyze vehicle performance data (telematics) to accurately forecast the remaining useful life of components (e.g., brakes, batteries, filters). This enables service providers to proactively schedule repairs, optimizing inventory holdings and improving customer satisfaction. For distribution, AI algorithms optimize warehouse layouts, predict regional demand fluctuations with high fidelity, and manage dynamic pricing strategies, ensuring that the right parts are available at the right location at the optimal price point, drastically enhancing operational efficiency across the entire supply chain network.

- AI-Powered Generative Design: Optimization of component weight and structure, leading to better fuel efficiency and material utilization.

- Predictive Maintenance (PMM): Utilization of telematics and machine learning to forecast component failure, driving scheduled replacement demand in the aftermarket.

- Advanced Quality Control: Real-time defect detection during manufacturing using computer vision and anomaly detection algorithms.

- Supply Chain Optimization: AI-driven demand forecasting, inventory management, and route optimization for parts distribution.

- Autonomous Vehicle Components: AI algorithms are integral to ADAS and autonomous driving modules, requiring specialized component design and testing.

- Personalized Vehicle Experience: Components embedded with AI capabilities supporting personalized infotainment and driver assistance features.

DRO & Impact Forces Of Auto Parts Market

The dynamics of the Auto Parts Market are shaped by a complex interplay of internal and external forces. Key Drivers (D) include the escalating global vehicle production, particularly the exponential growth in Electric Vehicle (EV) manufacturing requiring entirely new component supply chains, and the increasing average age of vehicles in established markets, which fuels stable aftermarket demand for replacement parts. Restraints (R) primarily center on volatile raw material costs (steel, aluminum, specialized plastics), global supply chain fragility exacerbated by geopolitical tensions, and the substantial capital investment required for manufacturers to pivot from ICE-focused production lines to EV component manufacturing. Opportunities (O) are significant, revolving around the integration of advanced electronics (ADAS components, connectivity modules), the rapid expansion of the e-commerce channel for parts distribution, and the development of sustainable, circular economy models for component refurbishment and recycling. These forces combine to create a highly competitive and technologically demanding environment, compelling firms to prioritize resilience and innovation.

Impact forces within the market are predominantly driven by technological evolution and regulatory mandates. The shift towards electrification fundamentally disrupts the entire component landscape; established suppliers must either adapt or face obsolescence, while new entrants specializing in battery systems and power electronics gain market share. Regulatory pressure, especially concerning emissions (e.g., Euro 7 standards) and mandatory safety features (e.g., mandatory ADAS systems in new vehicles), continuously forces innovation in engine components, exhaust systems, and sensor technologies. Furthermore, consumer behavior, particularly the growing demand for connectivity, personalization, and durability, exerts significant influence, pushing manufacturers to integrate higher levels of quality control and software functionality into hardware components. Economic cycles and global vehicle sales performance directly impact the OEM channel, necessitating flexible production capacities.

The combination of these factors dictates the strategic priorities of market players. For instance, the restraint posed by high raw material costs is mitigated by the opportunity presented by lightweight material technologies (e.g., carbon fiber composites), enhancing vehicle performance while offsetting cost pressures. The market’s sensitivity to global crises (such as semiconductor shortages) underscores the imperative for vertical integration and regional diversification of manufacturing hubs. The overarching impact is a transformation of the auto parts industry from a traditional mechanical sector to a high-tech manufacturing domain, where software and hardware components are increasingly inseparable, demanding new levels of collaboration between traditional auto parts firms and technology companies.

Segmentation Analysis

The Auto Parts Market is rigorously segmented to accurately reflect the complex interplay between component types, vehicle applications, and distribution methodologies. This granular analysis is crucial for understanding specific growth pockets and technological imperatives across the industry value chain. Segmentation by component reveals distinct market dynamics: traditional mechanical parts face slower growth but maintain high volume, while electronic and specialized EV components exhibit explosive growth rates. Segmentation by distribution channel highlights the persistent competitive tension between the high-volume, cost-sensitive OEM market and the higher-margin, customer-service-driven aftermarket. Understanding these segments is vital for stakeholders seeking to align their manufacturing capacities and strategic investments with prevailing industry shifts, particularly the global transition to sustainable mobility solutions.

The segmentation structure provides a roadmap for market participation. For example, firms focusing on the passenger vehicle segment must prioritize advanced safety features and lightweighting, whereas those targeting the heavy commercial vehicle (HCV) segment emphasize durability, efficiency, and predictive maintenance solutions. The distinction between the components utilized in original assembly (OEM) versus those sold for maintenance (Aftermarket) dictates inventory strategy and pricing models, with the aftermarket often benefiting from longer product lifecycles and brand loyalty. The ongoing shift in powertrain technology further necessitates a re-evaluation of component definitions, moving away from purely mechanical classifications toward integrated electro-mechanical systems.

- By Component:

- Engine Parts (Crankshafts, Pistons, Camshafts)

- Drive Train & Transmission Components (Gearboxes, Axles, Clutches)

- Suspension & Braking Systems (Shock Absorbers, Brake Pads, Calipers, ABS Modules)

- Electrical & Electronics (Sensors, ECU, Wiring Harnesses, Battery Components)

- Body & Exterior (Panels, Lighting, Bumpers, Mirrors)

- Filters (Oil, Air, Cabin, Fuel)

- Others (Hoses, Belts, Seals, Gaskets)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (LCV, HCV, Buses)

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Independent Workshops, Dealers, Retail Chains, E-commerce)

- By End-Use:

- Vehicle Production

- Vehicle Repair & Maintenance

Value Chain Analysis For Auto Parts Market

The Auto Parts Market value chain is highly complex, typically starting with upstream raw material suppliers (metals, plastics, rubber, and semiconductors) and extending through sophisticated manufacturing and intricate distribution networks. Upstream activities involve sourcing high-quality, often specialized materials, where pricing volatility and supply security are critical risks. Primary manufacturers then transform these materials into components through processes like casting, forging, machining, and electronic assembly, requiring high capital investment in automation and precision engineering. The efficiency and quality control implemented at the manufacturing stage are paramount, as components must meet stringent OEM specifications for safety and performance.

The transition between manufacturing and the market occurs via distribution channels, categorized broadly into direct (OEM) and indirect (Aftermarket). In the direct channel, Tier 1 and Tier 2 suppliers deliver components just-in-time (JIT) directly to vehicle assembly plants, necessitating close collaborative relationships and strict adherence to volume and quality schedules. This channel is high-volume, low-margin, and highly dependent on global vehicle production cycles. In contrast, the indirect channel involves a multi-layered distribution network utilizing regional warehouses, wholesalers, independent garages, and increasingly, direct-to-consumer e-commerce platforms. The aftermarket is typically characterized by higher margins, a broader product catalog, and a focus on logistical speed and service availability to meet immediate repair needs.

Downstream analysis focuses on the end-users: vehicle manufacturers utilizing parts for assembly, and vehicle owners/service providers utilizing parts for repair and maintenance. The growth of digitalization impacts both ends; OEMs leverage digital twins for component testing, while service providers use digital tools for diagnostics and parts ordering. The rising prominence of the independent aftermarket (IAM) versus authorized dealership service centers reflects evolving consumer preferences for cost-effective and localized repair options. Successful players in this value chain must manage material sourcing resilience, optimize highly automated manufacturing, and establish robust, digitally integrated distribution channels capable of servicing both the massive industrial demand of OEMs and the unpredictable, urgent needs of the global aftermarket.

Auto Parts Market Potential Customers

Potential customers for the Auto Parts Market are categorized into distinct segments based on their purchasing role and need, including Original Equipment Manufacturers (OEMs), independent aftermarket professionals, fleet operators, and direct consumers. OEMs, such as General Motors, Volkswagen, and Toyota, represent the largest volume purchasers, requiring massive quantities of components for integration into new vehicle production lines. Their purchasing decisions are driven by specifications, cost-efficiency, and supplier reliability, operating within strict long-term contracts. The shift to electric and autonomous vehicles means OEMs are increasingly seeking suppliers capable of delivering software-integrated hardware and advanced electronic modules rather than purely mechanical parts.

The aftermarket buyer landscape is much more fragmented but highly profitable. This group includes franchised dealerships, independent service garages (ISG), specialty repair shops, and large parts retailers (like AutoZone or O'Reilly). These buyers prioritize rapid availability, competitive pricing, and certified quality, often relying on multi-brand suppliers. Fleet operators, managing large vehicle pools (e.g., logistics companies, taxi services), represent a high-value customer group focused on minimizing vehicle downtime through robust, durable parts and leveraging predictive maintenance services. Their purchasing is driven by total cost of ownership (TCO) rather than initial component cost.

Finally, the direct consumer segment, although historically minor, is growing rapidly through e-commerce channels. These DIY (Do-It-Yourself) buyers seek simple, easy-to-install maintenance items (e.g., wiper blades, filters, bulbs) and prioritize online product information, reviews, and competitive pricing. Effectively servicing this diverse customer base requires a multi-faceted strategy that caters to the volume demands of OEMs, the service needs of repair professionals, and the convenience sought by the individual consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2,450.0 Billion |

| Market Forecast in 2033 | USD 3,800.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch (Robert Bosch GmbH), Denso Corporation, Magna International, Continental AG, ZF Friedrichshafen AG, Aisin Corporation, Hyundai Mobis, Lear Corporation, Faurecia SE, Sumitomo Electric Industries, Tenneco Inc., BorgWarner Inc., Schaeffler AG, Federal-Mogul LLC (Tenneco), Akebono Brake Industry Co., Ltd., Delphi Technologies (BorgWarner), Valeo SA, Johnson Controls (Adient), Hella GmbH & Co. KGaA, Mahle GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auto Parts Market Key Technology Landscape

The technology landscape of the Auto Parts Market is undergoing radical transformation, driven predominantly by three macro trends: vehicle electrification, enhanced safety features, and connectivity. Electrification requires specialized manufacturing for high-voltage battery components, sophisticated thermal management systems critical for battery performance and longevity, and advanced power electronics like inverters and converters. These technologies necessitate materials capable of handling extreme temperatures and ensuring high efficiency, shifting the focus from traditional metallurgy to advanced composites and specialized semiconductor materials. Furthermore, the integration of 48V mild-hybrid systems is driving parallel growth in optimized starter motors and regenerative braking systems, blending traditional components with electric propulsion technology.

Advanced Driver Assistance Systems (ADAS) and eventual autonomous driving platforms are fundamentally redefining the role of electronics and software within auto parts. This segment relies heavily on high-precision sensors (LiDAR, Radar, ultrasonic), high-speed networking components (Ethernet), and powerful Electronic Control Units (ECUs) capable of processing massive amounts of real-time data. Component manufacturers must now excel not only in hardware quality but also in robust software development, ensuring functional safety standards (ISO 26262) are met. The increasing complexity mandates the use of digital manufacturing techniques, including 3D printing for rapid prototyping and specialized coating technologies to protect sensitive electronics from harsh operating environments.

Manufacturing technology itself is evolving rapidly, moving towards Industry 4.0 principles. Smart factories leverage IoT sensors, AI, and big data analytics to achieve unprecedented levels of operational efficiency and flexibility. Robotics and highly automated assembly lines are common, particularly in high-precision component production. Furthermore, the market is focusing on lightweighting technologies, utilizing advanced materials such such as aluminum alloys, carbon fiber reinforced polymers (CFRP), and high-strength plastics to reduce vehicle mass, thereby improving fuel economy for ICE vehicles and extending range for EVs. These technological innovations not only enhance component functionality but also ensure manufacturing processes are scalable, cost-efficient, and capable of rapid adaptation to changing OEM demands.

Regional Highlights

The geographical analysis reveals distinct market maturity and growth dynamics across global regions, heavily influenced by local manufacturing ecosystems, regulatory environments, and consumer adoption rates of new vehicle technologies.

- Asia Pacific (APAC): APAC is the global powerhouse for both OEM production and aftermarket growth, driven primarily by China, India, Japan, and South Korea. China leads in EV manufacturing capacity, making it a critical hub for EV component supply, including batteries and power electronics. India is experiencing explosive growth in the traditional aftermarket due to its large and aging vehicle parc. The region benefits from lower manufacturing costs but is rapidly transitioning to higher-value electronic component manufacturing, challenging established European and North American suppliers. The massive urban populations and growing middle class ensure sustained demand for maintenance and repair parts, leading to high competition among local and international suppliers.

- North America: This region is characterized by high demand for sophisticated, high-margin components, particularly those integrated into luxury and high-performance vehicles, and a leading role in the adoption of ADAS and autonomous technologies. The aftermarket here is robust, supported by strong consumer preferences for professional service and a well-established retail distribution network. The US government’s push for localized supply chains and EV subsidies is stimulating significant domestic investment in battery manufacturing and related auto parts facilities. Focus areas include cybersecurity for connected components and complex software integration for vehicle systems.

- Europe: Europe maintains a strong focus on premium, technically advanced components, driven by stringent Euro 7 emission standards and ambitious decarbonization targets. Germany, France, and Italy are central to high-end component manufacturing, specializing in sophisticated engine management systems, lightweight body parts, and advanced braking systems. The European market leads in circular economy initiatives, emphasizing remanufacturing and recycling of auto parts. High labor costs necessitate significant investment in automation and high-precision machinery, positioning the region as a leader in technological quality and sustainable production practices.

- Latin America (LATAM): LATAM, centered around Brazil and Mexico, functions primarily as a manufacturing hub for vehicle export and a growing regional aftermarket. Market stability is often challenged by economic volatility and currency fluctuations, making robust inventory management essential. The primary focus remains on affordable, durable parts suitable for challenging road conditions, though the adoption of basic electrification technologies is beginning to accelerate, especially in urban public transport sectors, slowly increasing demand for electric driveline components.

- Middle East and Africa (MEA): This region is heavily reliant on vehicle imports, resulting in a parts market dominated by the aftermarket channel. The Gulf Cooperation Council (GCC) countries drive demand for luxury and high-performance replacement parts. Africa’s burgeoning vehicle fleet, characterized by older, imported vehicles, necessitates a constant supply of basic, cost-effective maintenance components. Infrastructure challenges and complex logistics make the MEA market challenging but offer high growth potential for firms capable of navigating complex cross-border trade and establishing localized distribution centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auto Parts Market.- Bosch (Robert Bosch GmbH)

- Denso Corporation

- Magna International

- Continental AG

- ZF Friedrichshafen AG

- Aisin Corporation

- Hyundai Mobis

- Lear Corporation

- Faurecia SE

- Sumitomo Electric Industries

- Tenneco Inc.

- BorgWarner Inc.

- Schaeffler AG

- Federal-Mogul LLC (Tenneco)

- Akebono Brake Industry Co., Ltd.

- Delphi Technologies (BorgWarner)

- Valeo SA

- Johnson Controls (Adient)

- Hella GmbH & Co. KGaA

- Mahle GmbH

Frequently Asked Questions

Analyze common user questions about the Auto Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Auto Parts Aftermarket segment?

The aftermarket growth is primarily driven by the increasing average age and size of the global vehicle fleet (vehicle parc), coupled with the rising complexity of components that necessitate professional installation. Furthermore, the expansion of e-commerce platforms is significantly enhancing accessibility and convenience for purchasing replacement parts.

How is vehicle electrification impacting traditional component suppliers?

Electrification is forcing traditional suppliers to pivot their product portfolios away from ICE-dependent components (e.g., fuel injection systems) toward electric vehicle parts, such as power electronics, thermal management systems for batteries, and specialized lightweight chassis components, requiring massive R&D re-investment.

Which technology segment is expected to show the highest CAGR in the Auto Parts Market?

The Electrical and Electronics segment, specifically components related to Advanced Driver Assistance Systems (ADAS), sensor technologies, and high-voltage battery management systems (BMS), is anticipated to exhibit the highest Compound Annual Growth Rate due to regulatory requirements and the global shift towards connected and autonomous vehicles.

What are the primary geopolitical risks affecting the Auto Parts supply chain?

The primary geopolitical risks include trade disputes leading to tariffs, supply chain disruptions exacerbated by regional conflicts, and the concentration of critical raw material and semiconductor manufacturing in specific geographic locations, driving market players toward regionalization and multi-sourcing strategies.

What role does digitalization play in the Auto Parts distribution channel?

Digitalization plays a critical role by enabling sophisticated inventory optimization through AI-driven demand forecasting, streamlining logistics via real-time tracking, and facilitating direct-to-consumer sales through robust e-commerce platforms, ultimately improving speed and transparency across the distribution network.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Auto Parts and Accessories Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Auto Parts Manufacturing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Auto Parts and Accessories Market Size Report By Type (Driveline & Powertrain, Interiors & Exteriors, Electronics, Bodies & Chassis, Seating, Lighting, Wheel & Tires, Others), By Application (OEMs, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- NVH (System, Parts, Materials) Market Statistics 2025 Analysis By Application (Auto Parts Market, Automobile Market), By Type (Rubber Shock Absorber, Sound Insulation), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Continuous Corrugated Cardboard Market Statistics 2025 Analysis By Application (Home Appliance Packaging, Auto Parts Packaging, Furniture Packaging, Building Material Packaging, Medical Device Packaging, Electronic Product Packaging), By Type (Single Tile Three Layers, Double Tile Five Layers, Three Tiles And Seven Layers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager