Ayurvedic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432524 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Ayurvedic Market Size

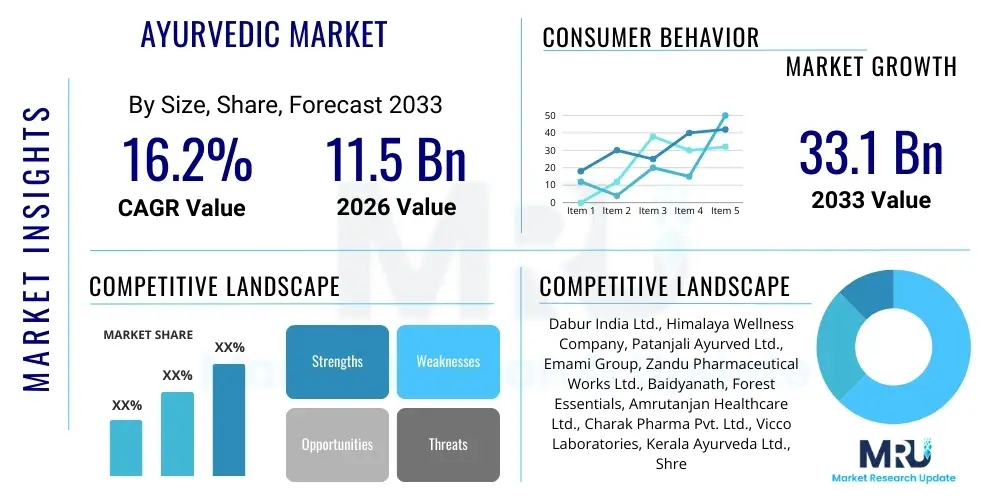

The Ayurvedic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.2% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 33.1 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a global shift towards preventive healthcare models, increased consumer preference for natural and traditional remedies, and significant regulatory support promoting standardization of Ayurvedic products across key geographies. The market's valuation reflects burgeoning demand in high-growth regions like Asia Pacific and the increasing mainstream acceptance in Western economies, where clinical validation efforts are strengthening consumer confidence in traditional medicine systems. The high growth trajectory indicates robust investment in manufacturing, research and development, and advanced distribution channels.

Ayurvedic Market introduction

The Ayurvedic Market encompasses a diverse range of products and services derived from traditional Indian healing practices, focusing on achieving holistic wellness through natural ingredients, specialized formulations, and lifestyle recommendations. Products typically include herbal drugs, dietary supplements, cosmeceuticals, and medicated oils, all derived from plants, minerals, and animal sources according to classical Ayurvedic texts. Major applications span chronic disease management, metabolic disorder treatment, mental and physical wellness enhancement, and daily personal care, positioning Ayurveda not just as an alternative treatment but often as a primary preventive approach. The market's enduring appeal stems from the perceived minimal side effects and the system's commitment to personalized health solutions.

Key benefits driving market adoption include the philosophy of treating the root cause of illness rather than just the symptoms, the utilization of sustainable and naturally derived ingredients, and the increasing integration of personalized medicine concepts rooted in determining individual doshas (Vata, Pitta, Kapha). This personalization resonates strongly with modern consumers seeking tailored health regimes. Furthermore, global market penetration is bolstered by widespread cultural familiarity in countries like India and growing clinical trials aimed at validating the efficacy and safety profiles of standardized Ayurvedic formulations, thereby bridging the gap between ancient knowledge and contemporary scientific rigor. The perception of Ayurveda as a safe, time-tested approach enhances its competitiveness against synthetic pharmaceutical products, particularly for lifestyle-related ailments and long-term wellness maintenance.

The primary driving factors fueling this market expansion include rising consumer awareness regarding the potential adverse effects of allopathic medicines, particularly for chronic conditions, coupled with governmental initiatives in countries such as India (AYUSH ministry) dedicated to promoting and regulating traditional medicine. The burgeoning demand for natural personal care and cosmetic products also significantly contributes to the market growth, as Ayurvedic principles are increasingly incorporated into high-end beauty and skincare ranges. Digital transformation, particularly the rise of e-commerce platforms, has drastically improved product accessibility worldwide, allowing specialized Ayurvedic practitioners and manufacturers to reach a global consumer base efficiently and transparently. This confluence of consumer preference, regulatory support, and digital infrastructure creates a highly favorable environment for sustained market growth.

Ayurvedic Market Executive Summary

The Ayurvedic Market is experiencing significant dynamic growth, propelled by favorable business trends centered around globalization, rigorous standardization, and strategic digital adoption. Business trends indicate a movement away from localized, fragmented supply chains towards internationally standardized production facilities that comply with Good Manufacturing Practices (GMP), fostering increased cross-border trade and regulatory acceptance. Furthermore, strategic partnerships between traditional Ayurvedic practitioners and modern biotech firms are accelerating clinical validation studies, enhancing market credibility and facilitating entry into highly regulated Western markets. The increasing investment in sustainable and organic sourcing of raw herbs addresses mounting consumer demands for ethical and environmentally conscious products, thereby strengthening brand loyalty and market differentiation within the wellness industry.

Regionally, the Asia Pacific (APAC) region, spearheaded by India, remains the dominant revenue generator due to deep cultural integration and robust government initiatives supporting the sector, establishing APAC as the global hub for research and raw material sourcing. However, North America and Europe are emerging as the fastest-growing regions, driven by the increasing popularity of holistic health practices, sophisticated marketing strategies targeting preventative wellness, and the acceptance of Ayurvedic supplements and cosmeceuticals within mainstream retail chains. This geographical expansion is transforming Ayurveda from a niche ethnic segment into a globally recognized wellness category. Regional trends also include a rise in medical tourism focused on Ayurvedic treatments in South Asian countries, further boosting service sector revenues.

Segment trends reveal that the Supplements and Nutraceuticals segment holds the largest market share, reflecting the consumer shift toward proactive health maintenance and immunity boosting, particularly post-pandemic. The Cosmetics and Personal Care segment is exhibiting the highest CAGR, fueled by the demand for 'natural' and 'clean label' beauty products, where Ayurvedic ingredients are highly valued. Distribution Channel analysis highlights the exponential growth of the E-commerce segment, which offers unmatched accessibility and consumer education, enabling smaller, specialized manufacturers to compete effectively globally. The shift in product focus from purely therapeutic drugs to daily wellness and lifestyle products ensures broad market appeal across various demographic and economic segments.

AI Impact Analysis on Ayurvedic Market

User queries regarding AI's influence on the Ayurvedic market frequently revolve around how artificial intelligence can authenticate traditional practices, standardize herbal formulations, and expedite clinical trials without compromising the holistic philosophy of Ayurveda. Key concerns include the potential for AI to de-personalize treatment methods, which traditionally rely on deep patient-practitioner interaction, and the challenge of training algorithms on highly complex, often qualitative data derived from classical texts (Shastras) versus quantitative modern data. Users also express high expectations for AI in predictive diagnostics (identifying Dosha imbalances earlier), improving supply chain transparency, and accelerating the discovery of novel therapeutic compounds within the vast repository of medicinal plants documented in Ayurvedic literature. The central theme is leveraging AI to bridge the gap between ancient wisdom and modern regulatory and scientific requirements.

The primary impact of Artificial Intelligence centers on enhancing the efficacy, safety, and standardization necessary for global market acceptance. AI and Machine Learning (ML) algorithms are being deployed to analyze vast, disparate datasets—including genomic data, pharmacological information of herbal extracts, clinical trial outcomes, and classical textual references—to identify optimal synergistic combinations of herbs (polyherbal formulations). This data-driven approach significantly reduces the time and cost associated with validating traditional knowledge, allowing manufacturers to present scientifically robust evidence to regulatory bodies. Furthermore, AI contributes to quality control by analyzing spectroscopic data of raw materials to detect adulteration and ensure consistent potency, directly addressing one of the major historical challenges in the Ayurvedic supply chain.

Beyond formulation and quality control, AI is transforming patient engagement and personalized therapy. AI-powered diagnostic tools are being developed to interpret individual constitutional profiles (Prakriti analysis) and current imbalances (Vikriti), offering highly customized diet, lifestyle, and treatment recommendations far faster than traditional manual processes. This application maintains the personalized core of Ayurveda while scaling its accessibility. Moreover, the use of predictive analytics helps optimize cultivation and harvesting schedules for medicinal plants, ensuring sustainable sourcing, managing environmental impact risks, and securing a reliable supply of high-quality raw materials, which is crucial for meeting rapidly escalating global demand.

- AI-driven standardization of complex polyherbal formulations using ML to determine optimal ingredient ratios and extraction parameters.

- Enhanced quality control and anti-adulteration measures through AI analysis of raw material spectroscopic data and fingerprinting.

- Accelerated drug discovery by screening medicinal plant databases and predicting compound efficacy against modern disease biomarkers.

- Development of personalized Ayurvedic recommendation engines based on digital Prakriti and Vikriti assessment.

- Optimization of the herbal supply chain, including predictive modeling for sustainable cultivation and inventory management.

- Integration of AI tools for rapid interpretation of classical Sanskrit texts and linking traditional knowledge with contemporary pharmacological mechanisms.

DRO & Impact Forces Of Ayurvedic Market

The Ayurvedic market is fundamentally shaped by a triad of Driving forces, Restraints, and Opportunities (DRO), collectively forming crucial impact forces that dictate market trajectory and competitive landscape. The primary Drivers include soaring consumer preference for natural healing approaches, increasing regulatory support and standardization initiatives (such as WHO guidelines and national AYUSH frameworks), and the demonstrated efficacy of Ayurvedic treatments in managing chronic and lifestyle diseases where conventional medicine often presents significant side effects. These forces create a positive feedback loop, enhancing consumer trust and expanding the global addressable market. The proactive stance of governments in promoting Ayurveda as part of national healthcare systems further solidifies its foundational market strength and accelerates infrastructure development, including research institutions and educational programs focused on traditional medicine.

However, significant Restraints challenge rapid, large-scale expansion. These include the persistent challenge of standardizing formulations globally, given the natural variation in raw materials and complex preparation methods, which can lead to inconsistencies in product quality and potency, thus complicating regulatory approval processes in stringent Western markets. Another major constraint is the lack of comprehensive, high-quality, double-blind clinical trials adhering to international standards for many classical formulations, which hinders their acceptance among skeptical medical professionals and payers. Furthermore, the fragmented supply chain, often involving small-scale cultivators, poses risks regarding traceability, sustainability, and quality control, making it difficult for large international players to ensure consistent sourcing, thereby impacting brand reputation and market entry strategies.

Opportunities for growth are abundant and strategically vital. The integration of Ayurveda into preventative healthcare and wellness tourism offers vast potential, attracting high-spending consumers seeking holistic experiences. The expansion of the e-commerce and digital consultation sector provides scalable distribution and direct-to-consumer access, significantly reducing geographical barriers. Crucially, the application of modern science and technology, including advanced extraction techniques, analytical chemistry, and AI, presents a pathway to overcome standardization issues, enabling manufacturers to scientifically validate traditional claims and develop novel, proprietary polyherbal formulations for specific modern ailments. Impact forces such as rapid urbanization, increasing disposable income in emerging economies, and the growing prevalence of chronic diseases like diabetes and cardiovascular issues reinforce the demand for gentle, long-term management solutions, making the Ayurvedic approach increasingly relevant and economically viable for consumers worldwide, ensuring the market's upward momentum despite inherent challenges.

Segmentation Analysis

The Ayurvedic market segmentation provides a critical view of product performance, consumer behavior, and distribution efficiencies across various categories, enabling stakeholders to refine targeting strategies and allocate resources effectively. The market is broadly categorized based on Product Type, Application, and Distribution Channel. Product segmentation reveals a shift in consumer focus from traditional medicine preparations toward lifestyle and wellness items like supplements and cosmeceuticals, reflecting the market's mainstream integration into daily consumer spending habits rather than solely emergency or chronic illness treatment. Application segments highlight areas of highest consumer investment, such as immunity boosting and stress management, mirroring contemporary health concerns, particularly post global health crises. Distribution channel analysis confirms the growing dominance of digital platforms, which facilitate global outreach and provide educational content alongside product sales, thereby lowering entry barriers for specialized brands.

Analyzing these segments is vital for understanding market dynamics. For instance, within the Product Type segment, Ayurvedic Supplements (including churna, tablets, and capsules focused on general wellness and specific deficiencies) maintain substantial volume, while Ayurvedic Cosmetics and Personal Care items drive value growth through premiumization and innovative formulations that appeal to the 'natural beauty' consumer. Geographically, segmentation helps identify high-potential areas; while India leads in traditional drug consumption, Western markets show higher uptake in high-margin, packaged supplements and topical applications. This disparity requires tailored marketing and regulatory compliance strategies based on the target segment's prevailing health attitudes and legal framework.

Furthermore, segmentation allows for a granular understanding of competitive advantages. Companies specializing in vertically integrated supply chains benefit greatly within the Supplements segment by ensuring authenticity from farm to consumer. Conversely, brands focusing on the E-commerce channel leverage digital marketing to articulate the complex benefits of Ayurvedic treatments, bridging the knowledge gap for new global consumers. This detailed structural breakdown provides the foundation for targeted product development, addressing specific therapeutic needs, whether they relate to managing complex metabolic disorders or providing daily preventive care, ensuring resource efficiency and maximizing market penetration across diverse consumer groups globally.

- Product Type: Ayurvedic Drugs (Classical, Patent & Proprietary), Ayurvedic Supplements (Chyawanprash, Single Herb Supplements, Multi-Herbals), Ayurvedic Cosmetics (Skincare, Hair Care, Oral Care), Ayurvedic Devices/Equipment (Panchakarma tools).

- Application: Hair Care & Skin Care, Oral Hygiene, Chronic Disease Management (Diabetes, Arthritis), Metabolic Disorders, Mental Wellness & Stress Management, Digestive Health, Immunity & Vitality Enhancement.

- Distribution Channel: Pharmacies & Drug Stores, Supermarkets/Hypermarkets, E-commerce Platforms (Online Retailers, Company Websites), Specialty Ayurvedic Stores/Clinics.

Value Chain Analysis For Ayurvedic Market

The Ayurvedic market value chain is extensive and highly interconnected, starting with the complex process of sustainably sourcing raw materials and culminating in specialized distribution to the end consumer, requiring high coordination to maintain product integrity and efficacy. The upstream activities are crucial, involving the cultivation, harvesting, and collection of medicinal plants, often relying on traditional knowledge and sustainable practices, including organic farming and wildcrafting. Challenges in this stage include maintaining genetic purity, ensuring geographic specificity (terroir) for optimal potency, and addressing volatility caused by climate change and unregulated harvesting practices. Effective upstream management requires investment in research for high-yield cultivation techniques and establishing fair trade relationships with local farmers and tribal communities to secure consistent, high-quality material while supporting socio-economic development.

Midstream activities involve the extraction, processing, and formulation of raw materials into finished products. This phase includes advanced manufacturing processes such as standardized solvent extraction, preparation of classical formulations (e.g., decoctions, asavas, arishtas), and modern dosage form creation (tablets, capsules, creams). The key differentiator here is adherence to GMP standards and scientific validation methods to standardize active ingredient concentration, which is essential for gaining trust in international markets. Companies that invest heavily in analytical testing and quality assurance protocols at this stage gain significant competitive advantage, allowing them to mitigate risks associated with heavy metal contamination or pesticide residues, issues that have historically restrained global acceptance of certain Ayurvedic products.

Downstream analysis focuses on distribution channels, marketing, and sales. Distribution involves both direct channels, such as company-owned clinics and specialized Ayurvedic hospitals providing personalized treatments, and indirect channels, utilizing conventional retail structures like pharmacies, supermarkets, and increasingly, e-commerce platforms. E-commerce is rapidly gaining prominence due to its ability to bypass geographical limitations and directly engage consumers with educational content, which is essential for products rooted in complex health philosophies. The success of downstream operations relies heavily on accurate product positioning—marketing supplements for wellness in Western markets while simultaneously maintaining traditional medicinal authority in Eastern markets. The indirect distribution network often necessitates robust cold chain logistics for certain fresh or highly sensitive formulations, ensuring product stability until it reaches the final point of sale.

Ayurvedic Market Potential Customers

The Ayurvedic market caters to a broad spectrum of consumers, moving beyond its traditional base to capture mainstream demographics globally, driven primarily by the perceived safety and holistic benefits of natural healthcare. Potential customers can be broadly categorized into several key segments: the Wellness Seekers, who prioritize preventive health and lifestyle management; the Chronic Condition Managers, who utilize Ayurveda as a complementary or alternative treatment for long-term ailments like arthritis, digestive issues, and diabetes; and the Natural Beauty Enthusiasts, who specifically seek clean label, plant-based ingredients for skincare and cosmetics. The common thread among these groups is a discerning approach to health, an inclination to research product origins, and a growing skepticism toward synthetic ingredients commonly found in conventional medicine and cosmetics, positioning quality, authenticity, and natural claims as significant purchasing criteria.

A rapidly expanding customer segment comprises millennials and Gen Z, especially in developed economies, who are characterized by high digital literacy and a keen interest in self-care, sustainability, and transparency. These consumers actively seek detailed information regarding ingredient sourcing, manufacturing ethics, and scientific evidence supporting health claims, driving demand for innovative, easy-to-use Ayurvedic products like supplements, herbal teas, and high-performance cosmeceuticals. For this demographic, Ayurvedic brands that emphasize traceability, certified organic status, and minimalist packaging resonate strongly. This shift indicates that the market is no longer solely reliant on older generations familiar with traditional practices but is actively integrating into modern health and beauty routines facilitated by engaging online content and influencer marketing.

Furthermore, the high-value potential customers include individuals involved in medical tourism and high-income groups seeking customized, integrated health solutions. These customers often utilize specialized Ayurvedic clinics and wellness retreats for intensive Panchakarma therapies or personalized consultation services. These services represent a premium segment of the market, focusing on comprehensive diagnostic assessments and long-duration, highly specialized treatments rather than packaged goods. Companies targeting this segment must ensure highly trained practitioners, state-of-the-art facilities, and strong international accreditation to justify the premium price point and maintain trust. Understanding these diverse buyer personas allows manufacturers and service providers to tailor their offerings—from mass-market immunity boosters sold via e-commerce to highly specialized, physician-prescribed classical medicines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 33.1 billion |

| Growth Rate | 16.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dabur India Ltd., Himalaya Wellness Company, Patanjali Ayurved Ltd., Emami Group, Zandu Pharmaceutical Works Ltd., Baidyanath, Forest Essentials, Amrutanjan Healthcare Ltd., Charak Pharma Pvt. Ltd., Vicco Laboratories, Kerala Ayurveda Ltd., Shree Baidyanath Ayurved Bhawan Pvt. Ltd., The Ayurvedic Company, Maharishi Ayurveda Products Pvt. Ltd., Kama Ayurveda, AVP (Arya Vaidya Pharmacy) Group, Lotus Herbals, Organic India Pvt. Ltd., Pothys Herbal, Sandu Pharmaceuticals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ayurvedic Market Key Technology Landscape

The integration of advanced technologies is pivotal for the modernization and global acceptance of the Ayurvedic market, moving the industry beyond traditional preparation methods while preserving core principles. A significant technological focus is placed on analytical chemistry and quality assurance, utilizing techniques such as High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and Nuclear Magnetic Resonance (NMR). These technologies are essential for establishing standardized herbal extracts by precisely identifying and quantifying the active phytoconstituents within complex polyherbal mixtures. This scientific fingerprinting capability addresses critical regulatory demands regarding product consistency and batch-to-batch variation, thereby providing robust evidence of efficacy and safety, which is necessary for entry into stringent international pharmaceutical and nutraceutical markets. Furthermore, advanced analytical tools are indispensable in detecting and mitigating contaminants such as heavy metals (e.g., lead, arsenic, mercury) and pesticide residues, safeguarding consumer health and enhancing brand reliability globally.

Another transformative area is the application of advanced extraction and formulation technologies designed to maximize bioavailability and stability. Supercritical Fluid Extraction (SFE) using carbon dioxide, for example, allows for the highly selective extraction of therapeutic compounds without using harsh chemical solvents, resulting in pure, high-potency extracts that retain their natural synergistic properties. Nano-technology and liposomal encapsulation are increasingly employed to improve the delivery mechanisms of poorly absorbed Ayurvedic compounds, such as curcumin or certain polyphenols, ensuring that the active ingredients are efficiently transported across biological barriers and reach target sites within the body. These innovations not only improve the therapeutic outcome but also allow for smaller, more convenient dosage forms, enhancing patient compliance and market acceptance among consumers accustomed to modern pharmaceutical delivery standards. The successful implementation of these processes requires substantial investment in state-of-the-art manufacturing facilities adhering to global GMP standards.

Beyond manufacturing, Digital Health technologies are revolutionizing the delivery of Ayurvedic care. Tele-Ayurveda platforms utilizing high-definition video consultations and digital diagnostic tools (often AI-assisted) enable practitioners to assess patients' constitutional types (Prakriti) and current imbalances (Vikriti) remotely, offering personalized recommendations on a global scale. Blockchain technology is also emerging as a critical tool for ensuring supply chain transparency and traceability, allowing consumers to verify the authenticity and origin of herbs, thereby combating counterfeiting and reinforcing consumer trust in premium Ayurvedic products. The synergy between digital data management, advanced analytical validation, and sophisticated formulation techniques creates a robust technological landscape that supports both the scientific rigor and the holistic essence of Ayurvedic medicine, facilitating its seamless integration into the 21st-century global healthcare and wellness ecosystem, driving both efficiency and consumer confidence.

Regional Highlights

Asia Pacific (APAC) dominates the global Ayurvedic Market, fundamentally driven by India's historical and cultural association with the practice, coupled with proactive governmental support through the Ministry of AYUSH. India serves as the primary hub for raw material sourcing, traditional knowledge, and manufacturing, benefiting from a large domestic consumer base deeply ingrained in Ayurvedic healthcare practices. The market maturity in countries like India, Nepal, and Sri Lanka means that both classical therapeutic drugs and daily wellness products enjoy high penetration. Regional growth is further bolstered by medical tourism focused on integrated Ayurvedic treatments, attracting international visitors seeking holistic therapies. Other APAC countries, including Southeast Asia, are rapidly adopting Ayurvedic products, particularly supplements and personal care items, due to increasing urbanization and rising health awareness, often influenced by the region's strong cultural ties and proximity to the source of traditional knowledge. The regulatory framework, although varied, generally supports traditional medicine systems, paving the way for easier product approvals compared to Western regions.

North America is positioned as the fastest-growing market region, characterized by a massive shift toward preventive and integrative health practices. Market demand in the U.S. and Canada is concentrated in the high-value segments of Ayurvedic Supplements (e.g., ashwagandha, turmeric) and premium cosmeceuticals, often marketed under the umbrella of 'holistic wellness' rather than traditional medicine. Key growth drivers include high consumer disposable income, a sophisticated retail infrastructure that supports the distribution of wellness products, and increasing acceptance among alternative health practitioners. However, market entry for Ayurvedic products in North America requires stringent compliance with FDA and Health Canada regulations, typically classifying products as dietary supplements or cosmetics, necessitating robust scientific documentation to substantiate any structure/function claims. This regulatory environment drives manufacturers to invest heavily in scientific validation and quality control, leading to high-quality, standardized products catering to the cautious but affluent Western consumer base.

Europe represents a highly lucrative but challenging market, where consumer interest in natural, clean-label products is exceptionally strong, particularly in Germany, the UK, and France. The European market primarily consumes Ayurvedic supplements, focusing on stress reduction, digestive health, and immunity enhancement. The challenge lies in the complex and varying regulatory landscape across the European Union, where therapeutic products often face hurdles related to the Traditional Herbal Medicinal Products Directive (THMPD), demanding extensive historical use data and quality dossiers. Consequently, many Ayurvedic companies initially enter the European market by classifying products as foods or cosmetics. Nevertheless, the growing trend of personalized nutrition and the rise of ethical, sustainable sourcing preferences align perfectly with Ayurvedic principles, providing substantial opportunity for brands that successfully navigate the regulatory environment and can clearly communicate their scientific rigor and ethical sourcing credentials. The Middle East and Africa (MEA) region also shows nascent growth, particularly in urban centers, driven by expatriate populations and growing exposure to global wellness trends, though infrastructure for distribution remains a key limiting factor.

- Asia Pacific (APAC): Dominant market, driven by cultural integration (India, Sri Lanka) and robust government support (AYUSH). High volume consumption of classical drugs and supplements.

- North America: Fastest-growing region, focused on premium supplements (adaptogens) and natural cosmeceuticals. Growth fueled by high disposable incomes and mainstream acceptance of holistic wellness.

- Europe: High-value market with strong demand for certified natural ingredients. Growth constrained by stringent and diverse regulatory requirements (THMPD), pushing focus toward supplements and cosmetics.

- Latin America: Emerging market demonstrating increasing interest in herbal remedies and natural personal care, presenting potential for market penetration in Brazil and Mexico.

- Middle East & Africa (MEA): Growth concentrated in urban areas and wellness tourism sectors, with rising consumer awareness regarding traditional and natural therapies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ayurvedic Market.- Dabur India Ltd.

- Himalaya Wellness Company

- Patanjali Ayurved Ltd.

- Emami Group

- Zandu Pharmaceutical Works Ltd.

- Baidyanath

- Forest Essentials

- Amrutanjan Healthcare Ltd.

- Charak Pharma Pvt. Ltd.

- Vicco Laboratories

- Kerala Ayurveda Ltd.

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- The Ayurvedic Company

- Maharishi Ayurveda Products Pvt. Ltd.

- Kama Ayurveda

- AVP (Arya Vaidya Pharmacy) Group

- Lotus Herbals

- Organic India Pvt. Ltd.

- Pothys Herbal

- Sandu Pharmaceuticals

Frequently Asked Questions

Analyze common user questions about the Ayurvedic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the significant growth in the global Ayurvedic market?

The Ayurvedic market is predominantly driven by increasing global consumer preference for natural, holistic, and preventive healthcare solutions due to growing concerns over the side effects of allopathic medicine. Substantial governmental support for traditional medicine systems, particularly in Asia Pacific nations, through dedicated ministries and standardization initiatives, plays a critical role. Furthermore, the robust expansion of the e-commerce sector has significantly improved global accessibility and distribution, allowing Ayurvedic products to reach mainstream consumers across North America and Europe, thereby fueling robust market growth across various product categories, including supplements and personal care items. This confluence of consumer demand for natural ingredients, regulatory promotion, and scalable digital distribution mechanisms ensures sustained market momentum and justifies the high projected CAGR during the forecast period.

What are the main regulatory challenges faced by Ayurvedic products entering Western markets?

The main regulatory challenges center on standardization and clinical validation required by Western regulatory bodies such as the FDA (USA) and the European Medicines Agency (EMA). Unlike pharmaceuticals, Ayurvedic products often involve complex polyherbal formulations with natural variations in chemical composition, making consistent quality control difficult to demonstrate according to stringent Western standards. In Europe, classification under the Traditional Herbal Medicinal Products Directive (THMPD) demands extensive historical use data and detailed documentation, which can be burdensome. Consequently, many products are classified as dietary supplements or cosmetics, limiting the medical claims that can be legally made. Overcoming these hurdles requires significant investment in modern analytical testing, robust supply chain traceability, and internationally accepted, high-quality clinical trials to scientifically substantiate efficacy and safety claims for global acceptance.

How is technology, specifically AI and modern analysis, transforming the manufacturing of Ayurvedic medicines?

Technology is revolutionizing Ayurvedic manufacturing by ensuring standardization, quality, and accelerated research. Artificial Intelligence (AI) and Machine Learning (ML) are being utilized to analyze classical texts and modern pharmacological data, aiding in the optimal formulation and discovery of synergistic herbal combinations, thereby enhancing efficacy. Advanced analytical techniques like HPLC and MS provide precise 'fingerprinting' of herbal extracts, ensuring batch-to-batch consistency and confirming the presence and concentration of active compounds, which addresses critical quality control issues. Furthermore, technologies such as Supercritical Fluid Extraction (SFE) and nano-delivery systems are improving the potency, purity, and bioavailability of finished products, making them more stable and effective, thus positioning Ayurveda favorably in the competitive global nutraceutical and pharmaceutical sectors. This technological shift is essential for bridging traditional knowledge with contemporary scientific expectations.

Which product segment holds the highest growth potential in the Ayurvedic market, and why?

The Ayurvedic Cosmetics and Personal Care segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the immense global appetite for 'natural,' 'organic,' and 'clean-label' beauty products. Consumers are increasingly scrutinizing ingredient lists and actively avoiding synthetic chemicals, parabens, and sulfates found in conventional cosmetics. Ayurvedic brands leverage ancient, time-tested ingredients like turmeric, sandalwood, and neem, positioning them as superior, ethically sourced alternatives in the premium segment. The relatively lower regulatory burden for cosmetic products compared to therapeutic drugs also facilitates faster market entry and global expansion. This segment capitalizes heavily on marketing focusing on holistic wellness and skin vitality, making it highly attractive to younger, digitally-native consumers seeking sustainable and transparent beauty solutions, ensuring exponential growth.

What role does sustainability and ethical sourcing play in the modern Ayurvedic value chain?

Sustainability and ethical sourcing have become central pillars in the modern Ayurvedic value chain, critically impacting consumer trust and brand reputation, particularly in Western markets. The reliance of Ayurveda on wild-crafted and cultivated medicinal plants necessitates rigorous strategies to prevent over-harvesting, biodiversity loss, and genetic erosion. Companies are increasingly adopting certified organic farming practices and establishing fair trade agreements with local farmers and tribal communities to ensure ecological responsibility and social equity. Blockchain technology is sometimes used to verify the origin and supply chain integrity of raw materials, enhancing transparency. Consumers are willing to pay a premium for certified ethical and sustainable products, making verifiable sourcing practices a key competitive differentiator and a fundamental requirement for long-term supply stability and mitigating risks associated with raw material price volatility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ayurvedic Medicine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ayurvedic Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ayurvedic Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ayurvedic Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ayurvedic Market Size Report By Type (Health Care, Oral Care, Skin Care, Others), By Application (Women, Men, Kids), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager