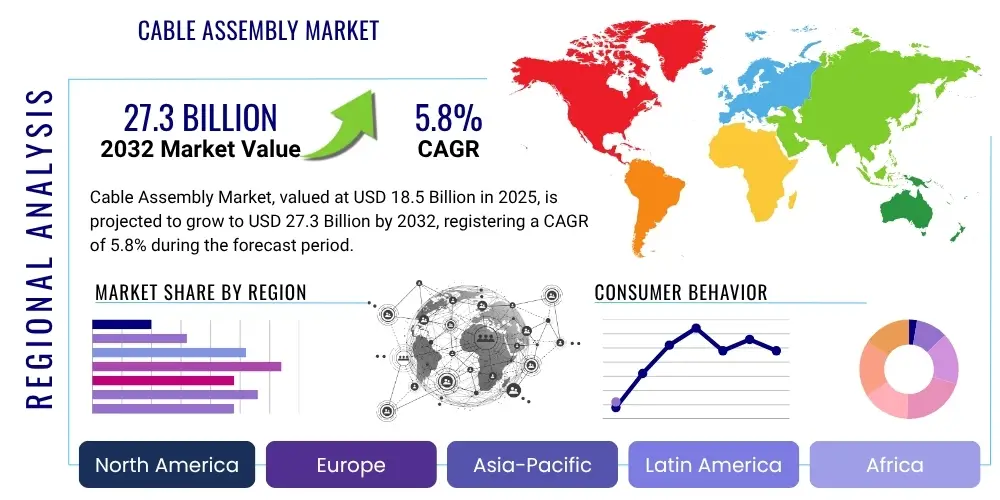

Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437713 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Cable Assembly Market Size

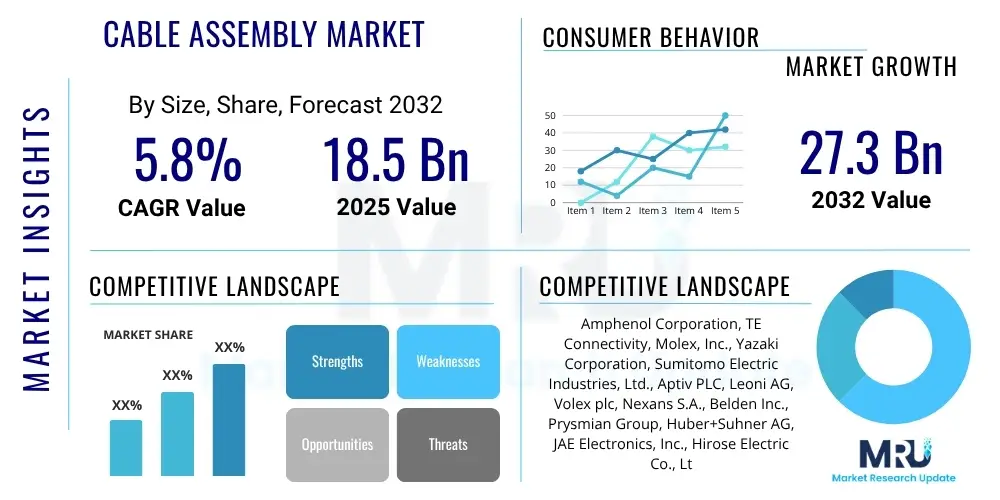

The Cable Assembly Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 165.4 Billion in 2026 and is projected to reach USD 256.7 Billion by the end of the forecast period in 2033.

Cable Assembly Market introduction

The Cable Assembly Market encompasses a broad range of products designed to connect two or more devices, allowing for the transmission of power or signals. These assemblies are critical components in virtually every modern electronic system, spanning complex industrial machinery to consumer devices. A cable assembly differs from raw cable by incorporating connectors and sometimes protective sheathing, strain relief mechanisms, or specialized insulation, ensuring reliability, durability, and plug-and-play functionality in specific operating environments. Key products include high-speed data cables, complex wiring harnesses used in vehicles, and ruggedized assemblies for extreme temperature or vibration applications. The fundamental design considerations involve signal integrity, shielding requirements, current carrying capacity, and mechanical performance specifications tailored to the end-use application.

Major applications driving market demand include the rapidly expanding telecommunications sector, particularly the deployment of 5G infrastructure and data centers, which necessitate high-density, high-speed fiber optic and copper assemblies. Furthermore, the automotive industry's shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requires specialized, lightweight, and robust assemblies for battery management systems and intricate sensor networks. Benefits derived from advanced cable assemblies include enhanced operational efficiency, reduced electromagnetic interference (EMI), improved safety standards compliance, and simplified maintenance. The integration of smart technologies and miniaturization trends further compel manufacturers to innovate in materials science and assembly precision.

Driving factors for sustained market growth are multifaceted, centering primarily on global digitalization and industrial automation. The proliferation of the Internet of Things (IoT) devices across consumer and industrial landscapes necessitates millions of new connection points, each requiring a reliable cable assembly. Simultaneously, the energy transition, focusing on solar, wind, and sophisticated grid infrastructure, demands high-voltage and durable power cable assemblies. Geopolitical factors influencing supply chain resilience, coupled with increased investment in defense and aerospace technologies that mandate stringent reliability, continue to underpin the robust growth trajectory observed across different geographical regions.

Cable Assembly Market Executive Summary

The Cable Assembly Market is characterized by vigorous growth, driven fundamentally by accelerating digitalization and technological convergence across major industrial sectors. Business trends emphasize miniaturization, higher data transmission speeds, and the integration of smart features, such as embedded sensors for monitoring performance and predictive maintenance. Manufacturers are increasingly focused on vertical integration and adopting automated production techniques, including robotics and vision systems, to maintain quality and scale production efficiently, especially concerning complex wiring harnesses used in automotive and aerospace applications. Furthermore, sustainability requirements are driving research into lighter, halogen-free materials and recyclable components, influencing sourcing strategies and product design globally. The competitive landscape remains fragmented but is consolidating through strategic mergers and acquisitions aimed at acquiring specialized technological capabilities, particularly in fiber optics and high-frequency assemblies.

Regional trends indicate that Asia Pacific (APAC) continues to dominate the market in terms of volume and production capacity, fueled by massive manufacturing bases in China, Japan, and South Korea, coupled with rapidly expanding infrastructure investments, particularly in 5G and data centers across India and Southeast Asia. North America and Europe, while being mature markets, exhibit strong demand for high-value, specialized assemblies, driven by rigorous regulatory standards in the medical, aerospace, and defense industries, and significant governmental investment in smart grid modernization. These regions prioritize quality, customization, and compliance over sheer cost efficiency, leading to higher average selling prices (ASPs) for advanced products. Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth areas, primarily due to large-scale urbanization projects and infrastructure development in energy and communication sectors.

Segment trends highlight a substantial shift towards custom cable assemblies, which cater specifically to complex system integration requirements in automotive and industrial automation. The fiber optic segment is experiencing the fastest growth rate, directly correlated with the deployment of high-bandwidth networks globally. Application-wise, the automotive sector remains the largest consumer, but the industrial segment, driven by Industry 4.0 and robotics, is projected to show accelerated growth throughout the forecast period. There is also a notable increase in demand for hybrid cable assemblies that combine power, data, and signal transmission capabilities within a single jacket, optimizing space and reducing installation complexity across diverse applications, from medical imaging equipment to automated factory floors.

AI Impact Analysis on Cable Assembly Market

Common user questions regarding AI’s impact on the Cable Assembly Market revolve primarily around three key themes: how AI can optimize the highly complex manufacturing processes and supply chains; whether AI-driven design tools will accelerate product development and customization; and the direct demand creation spurred by AI hardware (e.g., specialized cables for high-performance computing, data centers, and autonomous systems). Users are keen to understand the shift from traditional manual assembly verification to AI-powered quality control (QC) systems capable of detecting microscopic flaws in soldering or crimping processes. Concerns often center on the necessary investment in AI infrastructure, the retraining of the workforce, and the potential disruption to established quality assurance protocols. The consensus expectation is that AI will transform production efficiency and drive unprecedented demand for ultra-high-speed, highly reliable assemblies required for edge computing and cloud AI infrastructure.

- AI-Driven Quality Control: Implementation of machine vision and deep learning algorithms for real-time inspection of assembly processes, dramatically reducing defect rates in complex harnesses.

- Optimized Manufacturing Scheduling: AI algorithms enhance production planning, material flow management, and equipment predictive maintenance, maximizing throughput and minimizing downtime.

- Accelerated Design Cycle: Generative design tools utilize AI to quickly iterate and validate complex cable routing and connector layouts for new systems (e.g., ADAS or robotics).

- Demand for High-Speed Connectivity: AI applications (data centers, HPC, autonomous vehicles) create enormous, specific demand for high-bandwidth fiber optic, PCIe, and proprietary assemblies.

- Supply Chain Resilience: AI predictive analytics improve demand forecasting and identify potential bottlenecks or risks within the global sourcing network for critical materials like copper and specialty plastics.

- Robotic Assembly and Handling: AI integrates with sophisticated robotics to automate intricate and repetitive tasks, particularly in harness fabrication and testing, overcoming skilled labor shortages.

DRO & Impact Forces Of Cable Assembly Market

The dynamics of the Cable Assembly Market are dictated by a sophisticated interplay between sustained technological drivers and inherent industry restraints, balanced by substantial growth opportunities and the overarching influence of external impact forces. The primary drivers are the irreversible global trends of 5G rollout, rapid cloud expansion necessitating colossal data center buildouts, and the electrification revolution in the automotive sector, all requiring exponentially greater volumes of high-performance assemblies. These forces compel manufacturers towards continuous innovation in materials and signal integrity solutions. However, the market faces significant restraints, notably the volatile pricing and supply chain unpredictability of core raw materials, particularly copper and specialized polymers, alongside the stringent regulatory compliance requirements—such as Restriction of Hazardous Substances (RoHS) and stringent quality standards (e.g., AS9100 for aerospace)—which add complexity and cost to manufacturing.

Opportunities for market players are substantial, particularly in addressing the burgeoning demand for specialized medical cable assemblies (driven by portable diagnostics and complex surgical robotics), and in supporting the transition towards Industry 4.0, which requires ruggedized, smart assemblies for factory automation and robotic systems. Furthermore, penetration into emerging economies undergoing rapid infrastructure modernization presents untapped potential. The key to capitalizing on these opportunities lies in developing customized, niche solutions that offer superior electromagnetic compatibility (EMC) and mechanical resilience. Companies that can swiftly localize production and diversify their supply chains are positioned for disproportionate growth.

The impact forces currently shaping the market are powerful and multifaceted. The geopolitical trade tensions frequently interrupt established supply chains and necessitate regionalized manufacturing strategies, increasing operational costs but sometimes offering tariff advantages in specific markets. Technological obsolescence is a constant impact force, where the relentless push for faster data transfer standards (e.g., PCIe 6.0, 800G Ethernet) mandates rapid product redesigns and significant capital expenditure in advanced testing and manufacturing equipment. Lastly, the increasing global focus on cybersecurity extends even to hardware, requiring cable assemblies and connectors to be designed with anti-tampering features and robust authentication protocols, fundamentally altering traditional product specifications and quality checks.

Segmentation Analysis

The Cable Assembly Market is extensively segmented based on type, application, and material, reflecting the broad functional requirements across various end-use industries. Segmentation analysis provides a nuanced view of market demand, highlighting areas of accelerated growth and technological maturity. The dominance of custom cable assemblies over standard products indicates a shift toward specialized, system-specific solutions required by complex, modern electronics in defense, medical, and high-end industrial sectors. This trend underscores the importance of design collaboration and rapid prototyping capabilities among cable assembly manufacturers.

Further granularity in segmentation reveals the deep dependency of the market on key materials, with copper assemblies still holding the largest share due to their widespread use in automotive and industrial power applications. However, fiber optic assemblies are rapidly gaining traction, particularly in data center and telecommunication applications, driven by the imperative for higher bandwidth and longer transmission distances without signal degradation. Understanding these segments is critical for strategic market planning, allowing companies to allocate resources towards high-growth, high-margin product lines and geographical regions.

- By Type:

- Custom Cable Assemblies

- Standard Cable Assemblies

- By Application:

- Automotive (EVs, ADAS, traditional vehicles)

- Telecommunication (5G infrastructure, fixed line networks)

- Industrial (Robotics, Factory Automation, Heavy Machinery)

- Aerospace & Defense (Avionics, Weapon Systems)

- Consumer Electronics (PCs, Smartphones, Home Appliances)

- Medical (Diagnostic Imaging, Surgical Robotics, Patient Monitoring)

- Energy (Solar, Wind, Power Distribution)

- By Material:

- Copper Cable Assemblies

- Fiber Optic Cable Assemblies

- Aluminum Cable Assemblies

- Hybrid Cable Assemblies (Combining copper, fiber, or pneumatic lines)

Value Chain Analysis For Cable Assembly Market

The value chain for the Cable Assembly Market begins with upstream activities focused on securing and processing essential raw materials, primarily copper wire rods, specialized plastics for insulation and jacketing (such as PVC, PTFE, and cross-linked polyethylene), and high-precision connectors and terminals made from various metals and alloys. Upstream supplier leverage is often high due to the volatile pricing of commodities like copper, necessitating sophisticated risk management and long-term procurement contracts. Manufacturers must also maintain strong relationships with specialized component providers for connectors, which are crucial for defining the assembly’s performance characteristics. Efficiency and cost optimization at this stage are paramount, as raw material costs constitute a significant portion of the final product price.

The core manufacturing stage involves highly specialized processes, including wire cutting and stripping, terminal crimping, soldering, harnessing, and subsequent overmolding or jacketing. For complex wiring harnesses, particularly those used in the automotive and aerospace industries, labor-intensive manual steps are often required, although automation is increasing rapidly. Quality control and rigorous testing—including electrical continuity, pull tests, and signal integrity testing—are non-negotiable elements embedded within this stage. Value is added through precision engineering, compliance certification, and the ability to customize designs rapidly based on client specifications, moving beyond simple component integration to providing critical subsystem solutions.

Downstream activities involve distribution channels, which typically operate via a mix of direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through authorized distributors and value-added resellers (VARs) for smaller orders and Maintenance, Repair, and Operations (MRO) requirements. Direct sales dominate the automotive and aerospace segments due to highly specific technical requirements and integrated supply chain management. Indirect channels are crucial for reaching diverse smaller industrial clients and the broader consumer electronics market. The final stage involves the integration of the cable assemblies into the end products by the customer, often supported by the cable manufacturer's technical services to ensure seamless deployment and compliance with installation standards.

Cable Assembly Market Potential Customers

The potential customer base for the Cable Assembly Market is remarkably diverse, spanning nearly every sector that utilizes electrical or electronic components. Primary end-users are large-scale Original Equipment Manufacturers (OEMs) operating within high-growth, high-regulation industries such as automotive and aerospace. Within the automotive sphere, buyers include major vehicle manufacturers purchasing complex, multi-branch wiring harnesses for traditional vehicles, and specialized high-voltage cable assemblies for battery management and charging infrastructure in electric vehicles (EVs). These customers prioritize safety certification, high reliability, and adherence to severe environmental operating conditions.

Another major segment consists of telecommunication service providers and data center operators who are consistent, high-volume buyers of advanced fiber optic patch cords, multi-fiber assemblies, and high-speed copper interconnects (e.g., DACs and AOCs) required for expanding network bandwidth and cloud computing capability. The industrial sector, driven by the global push towards Industry 4.0, includes robotics manufacturers, machine tool producers, and control system integrators, all requiring ruggedized, flexible, and often hybrid assemblies designed to withstand continuous movement, vibration, and harsh industrial fluids. These customers demand durability and guaranteed long operational lifetimes.

Furthermore, the medical device sector represents a high-margin, technically demanding customer segment. Buyers here include manufacturers of diagnostic imaging equipment (MRIs, CT scanners), patient monitoring systems, and advanced surgical robotics. These applications require bio-compatible materials, high-flex life, and assemblies designed for sterilization environments, demanding extreme precision and zero defects. The defense and aerospace sectors also remain critical buyers, demanding mil-spec, highly secure, and lightweight assemblies capable of performing reliably under extreme thermal and mechanical stresses in avionics and strategic communication systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 165.4 Billion |

| Market Forecast in 2033 | USD 256.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amphenol Corporation, TE Connectivity, Molex LLC, Luxshare Precision Industry Co., Ltd., Belden Inc., Sumitomo Electric Industries, Ltd., Yazaki Corporation, Aptiv PLC, Rosenberger, HIROSE Electric Co., Ltd., Nexans SA, Leoni AG, Volex Group PLC, Jabil Inc., Foxconn Technology Group, Carlisle Companies Incorporated, LAPP Group, Prysmian Group, Shanghai Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cable Assembly Market Key Technology Landscape

The technological landscape of the Cable Assembly Market is being rapidly transformed by the demand for higher performance in constrained spaces. A critical technological focus is on achieving exceptional signal integrity and minimizing insertion loss, especially for high-speed data transmission applications (e.g., 400G and 800G in data centers). This necessitates advanced conductor geometries, specialized dielectrics with low loss tangents, and sophisticated shielding techniques to mitigate crosstalk and electromagnetic interference (EMI). Manufacturers are heavily investing in high-frequency testing equipment and simulation software to accurately model and predict the electrical performance of assemblies before physical production, a key differentiator in highly competitive segments like telecommunications and semiconductor manufacturing equipment.

Another dominant technology trend is the advancement of automated manufacturing systems. The complexity of modern wiring harnesses, particularly those containing hundreds of connection points and intricate branching structures used in aircraft and high-end automotive platforms, is driving the adoption of fully automated wire processing machines, robotic handling systems, and advanced laser stripping technology. Precision crimping tools equipped with sensors and artificial intelligence (AI) verification ensure consistent mechanical reliability, moving away from reliance on manual checks. Furthermore, the development of robust, miniaturized connectors with high pin density, such as those used in medical robotics and portable electronics, pushes the boundaries of micro-assembly techniques and material science.

The push for vehicle electrification and aerospace weight reduction has led to significant technological innovations in lightweight materials and hybrid assemblies. Research is concentrated on high-voltage connectors and cabling that can handle increased power loads while maintaining thermal stability and mechanical integrity, often utilizing aluminum conductors or copper alloys alongside specialized insulation for thermal management. The integration of fiber optics within traditional copper harnesses (hybrid assemblies) is also a key technology, offering combined power delivery and high-speed data transfer solutions in a single, compact package, optimizing space and installation effort across industrial and mobility applications.

Regional Highlights

Regional dynamics significantly influence the Cable Assembly Market, reflecting variations in manufacturing capacity, technological maturity, and infrastructural investment priorities across the globe. Asia Pacific (APAC) stands out as the predominant market in terms of production volume and demand growth. This dominance is attributed to the presence of vast electronics manufacturing ecosystems, major automotive production hubs, and aggressive government-backed initiatives for 5G deployment and industrial modernization, particularly in mainland China, Taiwan, South Korea, and Japan. The rapidly growing economies of India and Southeast Asia are fueling massive infrastructural projects, ensuring sustained demand for both standard and high-performance assemblies, making APAC the engine of global market growth.

North America and Europe represent mature, high-value markets characterized by a strong focus on highly specialized, technologically advanced assemblies. North America’s demand is largely driven by robust investments in high-performance computing (HPC), massive data center expansions, aerospace and defense contracts, and the burgeoning electric vehicle sector. European demand is bolstered by stringent industrial automation standards (Industry 4.0), significant automotive production (though transitioning to EVs), and the high regulatory requirements governing medical device manufacturing. These regions are primary consumers of cutting-edge, customized solutions, often commanding premium pricing due to rigorous compliance and quality specifications.

Latin America and the Middle East & Africa (MEA) are characterized by developing but accelerating demand. Growth in Latin America is tied to industrial recovery, urbanization projects, and investments in telecommunications infrastructure upgrade cycles. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in diversification away from hydrocarbon dependence, leading to large-scale smart city development and renewable energy projects. These efforts necessitate substantial imports of specialized power and communication cable assemblies, representing significant future growth opportunities for international suppliers able to navigate local regulatory frameworks and project-specific demands.

- Asia Pacific (APAC): Dominates in manufacturing and volume consumption; key driver of 5G, consumer electronics, and EV harness demand.

- North America: Leader in high-value segments including Data Centers (HPC), Aerospace & Defense, and high-performance medical devices; focus on custom, compliant assemblies.

- Europe: Strong demand driven by Industrial Automation (Industry 4.0), strict automotive standards, and high regulatory environment for medical and industrial applications.

- Latin America: Emerging market growth tied to infrastructure modernization, telecommunications upgrades, and industrial recovery efforts.

- Middle East & Africa (MEA): High growth potential fueled by smart city projects, renewable energy infrastructure development, and telecommunication expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cable Assembly Market.- Amphenol Corporation

- TE Connectivity

- Molex LLC

- Luxshare Precision Industry Co., Ltd.

- Belden Inc.

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Aptiv PLC

- Rosenberger

- HIROSE Electric Co., Ltd.

- Nexans SA

- Leoni AG

- Volex Group PLC

- Jabil Inc.

- Foxconn Technology Group

- Carlisle Companies Incorporated

- LAPP Group

- Prysmian Group

- Shanghai Electric

Frequently Asked Questions

Analyze common user questions about the Cable Assembly market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Fiber Optic Cable Assembly segment?

The segment's rapid growth is primarily driven by the global deployment of 5G infrastructure, the continuous expansion of hyperscale and enterprise data centers requiring ultra-high bandwidth connectivity, and increasing adoption in bandwidth-intensive applications like medical imaging and autonomous vehicles.

How does the shift to electric vehicles (EVs) impact the Cable Assembly Market?

The EV shift significantly increases demand for specialized high-voltage cable assemblies and wiring harnesses. These assemblies must manage higher current loads, ensure thermal stability for battery systems, and maintain high reliability for complex ADAS sensor networks, leading to a rise in custom solutions.

What are the primary challenges facing manufacturers in this market?

Key challenges include navigating the volatile pricing of critical raw materials (especially copper), managing complex global supply chain disruptions, meeting increasingly stringent regulatory and quality compliance standards (e.g., RoHS, high safety certifications), and the constant need for technological investment to support higher data speeds.

Which application segment holds the largest market share globally?

The Automotive application segment currently holds the largest market share, owing to the high complexity and volume of wiring harnesses required per vehicle, covering power distribution, infotainment, and increasingly sophisticated sensor and control systems, amplified by the transition to electric powertrains.

How is Industry 4.0 influencing cable assembly design and demand?

Industry 4.0 demands ruggedized, highly flexible cable assemblies (e.g., servo motor and sensor cables) designed for continuous motion and harsh environments in robotics and automated production lines. It also drives demand for hybrid assemblies that combine power, data (Ethernet), and control signals in one compact system for machine connectivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fiber Optic Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Ac Dc Cable Assembly Market Size Report By Type (Flexible Cables, Semi Flexible Cables, Semi Rigid Cables, Rigid Cables), By Application (Aerospace And Defense, Medical, Telecom, Railways, Power Generation, Consumer Electronics, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Cable Assembly Market Size Report By Type (Data cable assembly, High Speed Cable Assembly, Conventional Cable Assembly), By Application (Communications, Medical Equipment, Machine, Automotive), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fiber Optical Cable And Cable Assembly Product Market Statistics 2025 Analysis By Application (Automotive, IT and Telecommunication, Defense and Government, Industries), By Type (Connectorized Assemblies, Long Length Assemblies, High Complex Breakout Assemblies, Fibre Jumpers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager