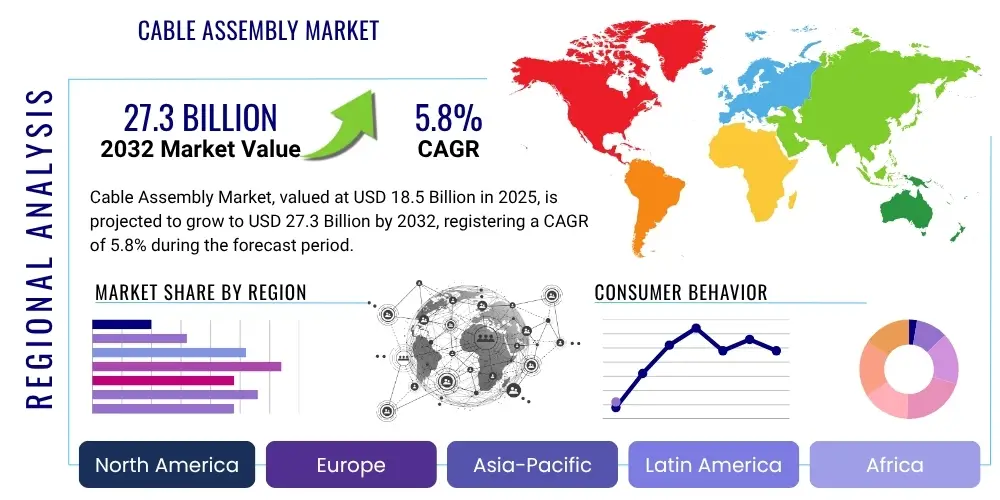

Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428657 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Cable Assembly Market Size

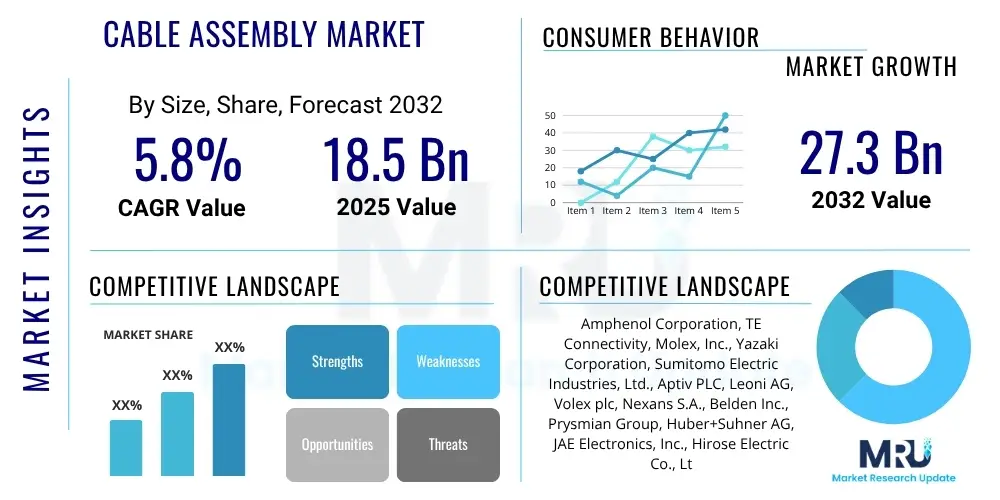

The Cable Assembly Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 27.3 Billion by the end of the forecast period in 2032.

Cable Assembly Market introduction

The Cable Assembly Market encompasses the design, manufacture, and distribution of electrical or optical cables with connectors installed on one or both ends. These assemblies are critical components in a vast array of electronic and electrical systems, providing essential connectivity for power, data, and signal transmission. The market is characterized by a diverse product portfolio, ranging from simple wire harnesses to complex, high-performance assemblies designed for specialized applications.

Cable assemblies are engineered solutions that integrate multiple wires or optical fibers, often encased in protective sheathing, terminated with appropriate connectors. Their primary function is to ensure reliable and efficient communication or power delivery between different electronic devices or modules. Major applications span across critical sectors including automotive, aerospace and defense, medical devices, telecommunications, industrial machinery, and consumer electronics. The benefits of using pre-assembled cables include enhanced reliability, improved signal integrity, ease of installation, and reduced manufacturing complexity for end-users. Key driving factors for this market include the relentless technological advancements in end-use industries, the increasing demand for high-speed data transmission, the proliferation of connected devices, and the continuous push for automation and electrification across various sectors.

Cable Assembly Market Executive Summary

The Cable Assembly Market is experiencing robust growth, propelled by the increasing complexity and interconnectivity requirements across modern industries. Business trends indicate a strong emphasis on customization, miniaturization, and the development of high-performance assemblies capable of handling higher frequencies and data rates. Companies are focusing on advanced materials, automated manufacturing processes, and rigorous testing protocols to meet stringent industry standards and customer demands for reliability and durability. Strategic partnerships and mergers and acquisitions are common as firms seek to expand their technological capabilities and market reach, particularly in niche high-growth segments like electric vehicles and 5G infrastructure. Sustainable manufacturing practices and the use of environmentally friendly materials are also gaining traction, reflecting evolving regulatory landscapes and corporate social responsibility initiatives.

Regional trends reveal Asia Pacific as the dominant market, driven by its extensive manufacturing base, rapid industrialization, and significant investments in telecommunications and automotive sectors, particularly in China, Japan, and India. North America and Europe demonstrate mature markets characterized by high demand for specialized, high-reliability assemblies in aerospace, medical, and industrial automation, along with significant R&D activities. Latin America, the Middle East, and Africa are emerging as growth regions, fueled by infrastructure development, increasing foreign investments, and expanding manufacturing capabilities. Each region presents unique opportunities and challenges influenced by local economic conditions, technological adoption rates, and regulatory frameworks.

Segment trends highlight strong growth in high-speed data and power cable assemblies due to the expansion of data centers, IoT devices, and electric vehicles. The automotive segment is a major contributor, driven by the increasing electronic content in vehicles, including advanced driver-assistance systems (ADAS) and infotainment. The telecommunications sector, particularly with the rollout of 5G networks, is fueling demand for high-frequency and robust fiber optic cable assemblies. Medical and industrial applications continue to require highly reliable, specialized, and often custom-designed assemblies, emphasizing precision and compliance with strict regulatory standards. The demand for standard cable assemblies remains consistent, providing foundational connectivity across a multitude of devices and systems, while custom solutions cater to bespoke engineering requirements.

AI Impact Analysis on Cable Assembly Market

User questions related to the impact of Artificial Intelligence (AI) on the Cable Assembly Market frequently revolve around how AI can enhance manufacturing efficiency, improve product design, optimize supply chain management, and contribute to predictive maintenance for cable systems. Key themes include the automation of inspection processes, the role of AI in material selection, and the potential for AI-driven insights to customize cable assembly solutions more effectively. Concerns often arise regarding the initial investment costs for AI integration, the need for specialized skills, and the cybersecurity implications of highly connected manufacturing environments. Expectations are high for AI to deliver significant improvements in quality control, reduce waste, accelerate product development cycles, and enable more proactive maintenance strategies, thereby extending the lifespan and reliability of cable assemblies.

- AI enables advanced predictive maintenance for cable systems, anticipating failures and reducing downtime.

- AI-driven automation in manufacturing streamlines assembly processes, improving speed and precision.

- AI assists in optimizing cable assembly designs by simulating performance under various conditions, reducing prototyping costs.

- Enhanced quality control through AI-powered visual inspection systems identifies defects with greater accuracy than human inspection.

- AI optimizes supply chain logistics, forecasting demand for raw materials and finished products, reducing inventory costs.

- AI can personalize cable assembly solutions based on specific application requirements and environmental factors.

- AI facilitates advanced material selection, recommending optimal conductors and insulators for specific performance criteria.

- AI contributes to energy efficiency in manufacturing by optimizing machine operations and resource allocation.

DRO & Impact Forces Of Cable Assembly Market

The Cable Assembly Market is significantly shaped by a confluence of driving forces, restraining factors, and emerging opportunities that collectively determine its trajectory. Key drivers include the rapid expansion of various end-use industries such as automotive (especially electric vehicles), telecommunications (5G and data centers), and industrial automation, all of which require sophisticated and reliable connectivity solutions. Technological advancements, particularly in high-speed data transmission and miniaturization, continually push the demand for more advanced cable assemblies. The increasing adoption of IoT devices, smart homes, and industrial IoT (IIoT) further fuels this demand, as these interconnected systems rely heavily on robust and efficient cable infrastructure for communication and power.

However, the market also faces considerable restraints. Volatility in raw material prices, including copper, aluminum, and various plastics, can significantly impact manufacturing costs and profit margins. The complex and often custom nature of cable assembly manufacturing, coupled with stringent quality and performance standards, requires substantial investment in R&D and specialized equipment, posing a barrier for new entrants. Furthermore, intense competition from established players and regional manufacturers can lead to price pressures. The need for specialized labor and expertise in designing and producing high-performance assemblies also presents a challenge, particularly in regions with labor shortages.

Opportunities for growth are abundant and strategically important. The global shift towards electric and hybrid vehicles represents a massive growth avenue for high-voltage and specialized data cable assemblies. The ongoing deployment of 5G networks globally is creating significant demand for high-frequency, low-loss, and fiber optic cable assemblies in both infrastructure and end-user devices. Emerging markets in Asia Pacific, Latin America, and Africa offer untapped potential due to their rapid industrialization and growing digital economies. Furthermore, the increasing demand for medical devices, automation in manufacturing, and advanced aerospace applications provides niches for highly specialized and high-margin custom cable assembly solutions, emphasizing innovation in materials and design for extreme environments.

Segmentation Analysis

The Cable Assembly Market is extensively segmented based on various attributes to provide a granular view of its dynamics and growth prospects. These segmentation categories help in understanding the diverse applications, product types, and end-use industries that drive market demand and shape competitive strategies. By analyzing these segments, stakeholders can identify key growth areas, evaluate market penetration, and tailor their product offerings and marketing efforts to specific customer needs. The market’s segmentation reflects the broad utility and customized nature of cable assemblies across a multitude of technological ecosystems.

- By Type

- Custom Cable Assemblies

- Standard Cable Assemblies

- By Application

- Power Cable Assemblies

- Data Cable Assemblies

- RF Cable Assemblies

- Audio/Video Cable Assemblies

- Medical Cable Assemblies

- Automotive Cable Assemblies

- By End-Use Industry

- Automotive

- Telecommunications

- Medical & Healthcare

- Industrial

- Consumer Electronics

- Aerospace & Defense

- Energy & Power

- Data Centers

- Others (e.g., Marine, Scientific Instrumentation)

Value Chain Analysis For Cable Assembly Market

The value chain for the Cable Assembly Market involves several critical stages, beginning with the sourcing of raw materials and extending through manufacturing, assembly, distribution, and ultimately, to the end-users. Upstream activities primarily involve the procurement of fundamental components and materials necessary for cable assembly production. These include conductors (such as copper and aluminum wires), insulators (PVC, PE, Teflon), shielding materials (braids, foils), jacketing materials, and various types of connectors (USB, HDMI, coaxial, fiber optic, automotive connectors). Suppliers in this segment are crucial for ensuring the quality, availability, and cost-effectiveness of these foundational elements, which directly impact the performance and durability of the final product. Relationships with these suppliers are often long-term and strategic, aiming for consistent quality and supply chain resilience.

Midstream activities encompass the manufacturing and assembly processes. This stage involves cutting, stripping, soldering, crimping, molding, and testing of individual wires and components into complete cable assemblies. Manufacturers leverage various technologies, from manual assembly for highly specialized or low-volume orders to advanced automation for high-volume, standardized products. Quality control and testing are paramount at this stage to ensure electrical integrity, mechanical robustness, and compliance with industry standards and customer specifications. The ability to innovate in design, material usage, and manufacturing techniques provides a significant competitive advantage.

Downstream activities focus on the distribution and sale of finished cable assemblies to various end-users. The distribution channel is multifaceted, comprising both direct and indirect sales approaches. Direct sales involve manufacturers selling directly to Original Equipment Manufacturers (OEMs), large industrial clients, or government agencies, often for custom or highly specialized assemblies where close technical collaboration is required. This approach allows for direct feedback and stronger customer relationships. Indirect distribution involves working with a network of distributors, wholesalers, and value-added resellers (VARs) who provide access to a broader customer base, including smaller businesses, maintenance, repair, and operations (MRO) markets, and retail consumers. These intermediaries often offer logistics, inventory management, and technical support services. The choice between direct and indirect channels depends on the product complexity, volume, customer base, and strategic market reach objectives. E-commerce platforms are also gaining prominence, providing another avenue for reaching diverse customers and supporting global sales.

Cable Assembly Market Potential Customers

The potential customers for the Cable Assembly Market are incredibly diverse, reflecting the ubiquitous need for connectivity across almost every sector of the modern economy. These end-users and buyers range from large multinational corporations to small and medium-sized enterprises (SMEs), and even individual consumers, depending on the specific type and application of the cable assembly. Key segments of potential customers include Original Equipment Manufacturers (OEMs) who integrate cable assemblies into their final products, such as automobile manufacturers, telecommunication equipment providers, and consumer electronics brands. These OEMs often require custom-designed, high-volume solutions tailored to their unique product specifications and performance requirements.

Another significant group comprises Tier 1 suppliers in various industries, particularly in automotive and aerospace, who develop sub-systems that incorporate cable assemblies before delivering them to the main OEM. Furthermore, industrial enterprises that require durable and high-performance cable assemblies for machinery, automation systems, and energy infrastructure represent a substantial customer base. Medical device manufacturers, defense contractors, and data center operators also stand as critical buyers, demanding highly reliable, often specialized, and rigorously certified cable assemblies due to the critical nature of their applications. The growth in these sectors directly correlates with increased demand for cable assembly products. Service providers, such as those in telecommunications or utilities, also procure these assemblies for infrastructure development, maintenance, and expansion projects. The market is thus driven by both capital expenditures in manufacturing and infrastructure, and by ongoing operational needs for replacements and upgrades across various industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2032 | USD 27.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amphenol Corporation, TE Connectivity, Molex, Inc., Yazaki Corporation, Sumitomo Electric Industries, Ltd., Aptiv PLC, Leoni AG, Volex plc, Nexans S.A., Belden Inc., Prysmian Group, Huber+Suhner AG, JAE Electronics, Inc., Hirose Electric Co., Ltd., Phoenix Contact GmbH & Co. KG, LAPP Group, Harting Technology Group, Alpha Wire, RS Components |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cable Assembly Market Key Technology Landscape

The Cable Assembly Market is continuously evolving, driven by advancements in various technological domains that aim to enhance performance, reduce size, increase durability, and improve manufacturing efficiency. A primary technological focus is on miniaturization, as end-user devices become smaller and more compact, requiring cable assemblies that offer high functionality within extremely limited spaces. This involves developing finer gauge wires, smaller connectors, and advanced routing techniques without compromising signal integrity or power delivery capabilities. Another crucial area is high-frequency and high-speed data transmission, necessitated by the proliferation of 5G networks, data centers, and advanced computing. This demands cable assemblies with superior shielding, low insertion loss, and excellent crosstalk performance, often employing specialized coaxial or fiber optic designs and materials capable of operating in the gigahertz range and beyond. The shift towards higher bandwidth and lower latency is a perpetual driver of innovation in this segment.

Material science plays a pivotal role, with ongoing research into advanced polymers for insulation and jacketing that offer improved flexibility, temperature resistance, chemical inertness, and flame retardancy. For demanding applications in aerospace, defense, and medical sectors, materials that withstand extreme temperatures, harsh chemicals, or provide biocompatibility are critical. The development of robust and lightweight materials is also essential for applications like electric vehicles and drones, where weight reduction directly impacts performance and efficiency. Furthermore, innovative connector technologies, including smaller form factors, higher pin densities, and improved mating cycles, are integral to the overall performance and reliability of cable assemblies. These advancements are vital for ensuring secure, dependable connections in increasingly complex electronic systems, pushing the boundaries of what cable assemblies can achieve in diverse operational environments.

Manufacturing technologies are also undergoing significant transformation, with increasing adoption of automation and robotics in the assembly process to improve precision, reduce labor costs, and accelerate production cycles. Automated wire cutting, stripping, crimping, and soldering machines enhance consistency and throughput. Advanced testing and inspection methodologies, including automated optical inspection (AOI) and sophisticated electrical testing equipment, ensure that cable assemblies meet stringent quality standards and performance specifications before deployment. Furthermore, the integration of smart manufacturing principles, such as predictive maintenance for machinery and real-time data analytics, optimizes production lines and minimizes downtime. These technological advancements collectively contribute to the development of more efficient, reliable, and cost-effective cable assembly solutions, addressing the ever-growing demands of modern electronic systems.

Regional Highlights

- North America: This region is characterized by high demand for advanced and high-reliability cable assemblies, particularly from the aerospace and defense, medical, and industrial automation sectors. The United States and Canada are significant contributors, driven by robust R&D, technological innovation, and early adoption of advanced manufacturing techniques. The region benefits from substantial investments in data centers and the ongoing expansion of 5G infrastructure, fueling demand for high-speed data and fiber optic cable assemblies.

- Europe: A mature market with strong growth in the automotive (especially EV), industrial, and telecommunications sectors. Countries like Germany, France, and the UK are leaders in industrial automation and high-end automotive manufacturing, requiring specialized and high-performance cable assemblies. Strict regulatory standards for safety and environmental compliance also drive innovation in material science and manufacturing processes within the European market.

- Asia Pacific (APAC): The largest and fastest-growing market due to rapid industrialization, urbanization, and significant investments in manufacturing, telecommunications, and consumer electronics. China, Japan, South Korea, and India are key players, with China leading in both production and consumption. The region benefits from a large consumer base, government initiatives supporting manufacturing, and widespread adoption of new technologies, including electric vehicles and 5G networks.

- Latin America: An emerging market driven by infrastructure development, growth in the automotive industry, and increasing foreign investments. Brazil and Mexico are prominent markets, with automotive manufacturing playing a crucial role. The region shows potential for growth as economies expand and technological adoption increases, leading to higher demand for various cable assembly types.

- Middle East and Africa (MEA): This region is experiencing growth propelled by investments in energy and power infrastructure, telecommunications network expansion, and diversification efforts beyond oil. Countries in the GCC region are investing heavily in smart city projects and industrial development, creating new opportunities for cable assembly suppliers. However, political instability and economic volatility can sometimes pose challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cable Assembly Market.- Amphenol Corporation

- TE Connectivity

- Molex, Inc.

- Yazaki Corporation

- Sumitomo Electric Industries, Ltd.

- Aptiv PLC

- Leoni AG

- Volex plc

- Nexans S.A.

- Belden Inc.

- Prysmian Group

- Huber+Suhner AG

- JAE Electronics, Inc.

- Hirose Electric Co., Ltd.

- Phoenix Contact GmbH & Co. KG

- LAPP Group

- Harting Technology Group

- Alpha Wire

- RS Components

- ITT Inc.

Frequently Asked Questions

What is a cable assembly and why is it important?

A cable assembly consists of one or more electrical or optical cables with connectors attached to one or both ends, designed to transmit power, data, or signals. It is crucial for providing reliable and efficient connectivity in electronic and electrical systems across various industries, ensuring proper function and safety.

Which industries are the primary consumers of cable assemblies?

Key industries include automotive, telecommunications, medical & healthcare, industrial automation, consumer electronics, and aerospace & defense. These sectors rely heavily on specialized and standard cable assemblies for their complex and varied connectivity needs.

What are the main factors driving growth in the Cable Assembly Market?

Growth is primarily driven by the expansion of end-use industries, technological advancements demanding higher data speeds and miniaturization, increasing adoption of IoT devices, and the global rollout of 5G networks and electric vehicles.

What impact does AI have on cable assembly manufacturing and design?

AI enhances manufacturing efficiency through automation, improves quality control via advanced inspection, optimizes cable design through simulations, and aids in predictive maintenance for deployed cable systems, leading to more reliable and cost-effective solutions.

What are the key challenges faced by the cable assembly market?

Challenges include volatility in raw material prices, the complexity and high cost associated with manufacturing specialized assemblies, intense market competition, and the need for continuous innovation to meet evolving technological standards and stringent regulatory requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fiber Optic Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ac Dc Cable Assembly Market Size Report By Type (Flexible Cables, Semi Flexible Cables, Semi Rigid Cables, Rigid Cables), By Application (Aerospace And Defense, Medical, Telecom, Railways, Power Generation, Consumer Electronics, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Cable Assembly Market Size Report By Type (Data cable assembly, High Speed Cable Assembly, Conventional Cable Assembly), By Application (Communications, Medical Equipment, Machine, Automotive), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fiber Optical Cable And Cable Assembly Product Market Statistics 2025 Analysis By Application (Automotive, IT and Telecommunication, Defense and Government, Industries), By Type (Connectorized Assemblies, Long Length Assemblies, High Complex Breakout Assemblies, Fibre Jumpers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager