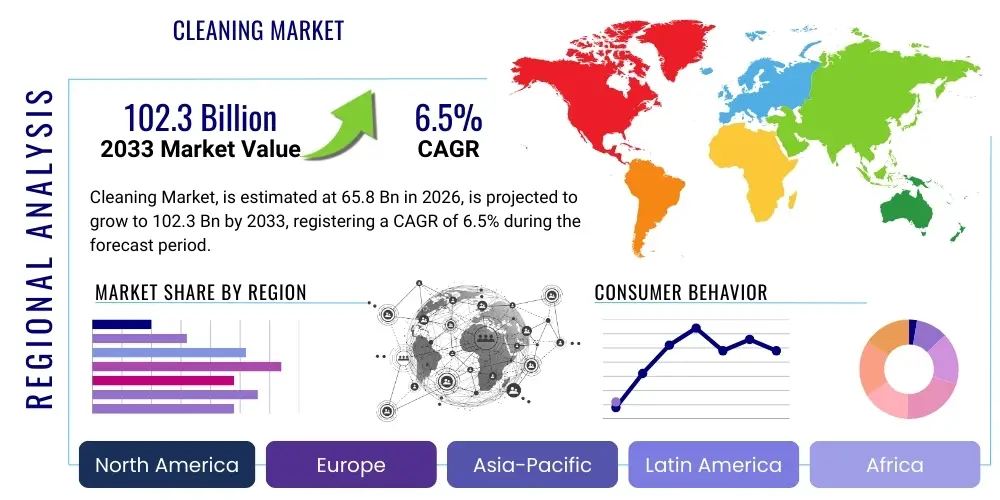

Cleaning Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440339 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Cleaning Market Size

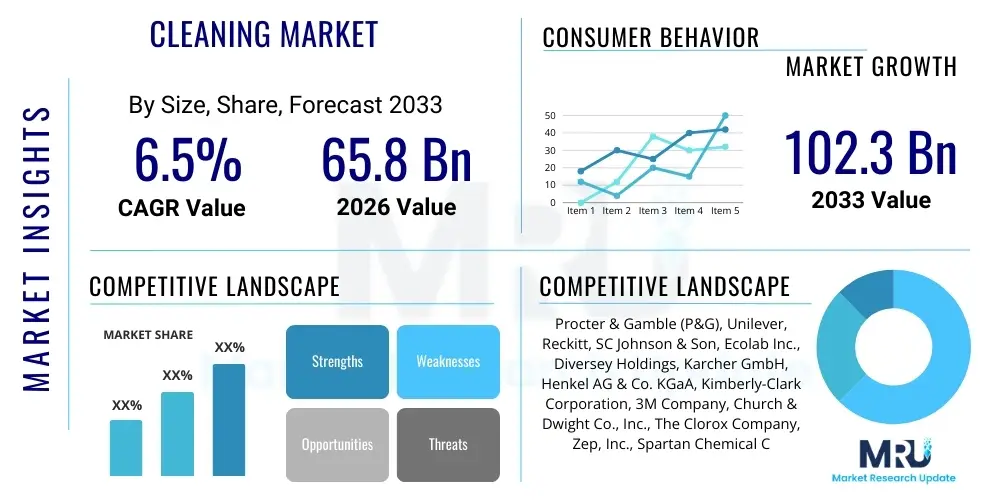

The Cleaning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 65.8 billion in 2026 and is projected to reach USD 102.3 billion by the end of the forecast period in 2033.

Cleaning Market introduction

The global cleaning market encompasses a vast array of products, services, and technologies designed to maintain hygiene, aesthetics, and operational efficiency across residential, commercial, and industrial sectors. This market is driven by an ever-increasing emphasis on health, sanitation, and safety standards, particularly in the wake of global health crises which have dramatically heightened public awareness regarding cleanliness protocols. From household detergents and disinfectants to specialized industrial cleaning equipment and professional janitorial services, the market offers comprehensive solutions tailored to diverse needs. The product landscape is continuously evolving, incorporating sustainable formulations, smart cleaning devices, and advanced chemical agents that provide superior efficacy while minimizing environmental impact. Key product segments include surface cleaners, laundry detergents, dishwashing products, air fresheners, and specialized industrial solvents, each designed to address specific cleaning challenges across various substrates and environments. The market's dynamism is further fueled by continuous innovation in material science, biotechnology, and automation, leading to the development of more effective, efficient, and user-friendly cleaning solutions.

Major applications for cleaning products and services span a wide spectrum of end-user industries. In the residential sector, products are crucial for daily household chores, ensuring a hygienic living environment. Commercial applications are extensive, covering offices, retail spaces, hospitality (hotels, restaurants), healthcare facilities (hospitals, clinics), and educational institutions, where maintaining impeccable cleanliness is paramount for public health, brand reputation, and regulatory compliance. Industrial applications, on the other hand, involve heavy-duty cleaning for manufacturing plants, automotive industries, food processing units, and transportation hubs, often requiring specialized equipment and powerful chemicals to remove stubborn contaminants, comply with strict safety regulations, and maintain machinery. The scope of cleaning extends beyond visible dirt to microscopic pathogens, allergen control, and odor elimination, underscoring its foundational role in public welfare and economic productivity. The demand for professional cleaning services is particularly robust in the commercial and industrial segments, driven by the need for expertise, specialized equipment, and adherence to stringent hygiene standards that in-house teams may struggle to meet.

The benefits derived from a well-established and growing cleaning market are multifaceted and far-reaching. Primarily, enhanced hygiene and sanitation contribute directly to public health by reducing the spread of infectious diseases and creating healthier living and working environments. For businesses, professional cleaning services and high-quality products lead to improved employee morale, increased productivity, and a positive brand image, attracting customers and retaining staff. Economically, the market generates substantial employment opportunities and fosters innovation in chemical engineering, robotics, and sustainable practices. Driving factors include urbanization, which increases the density of living and working spaces, necessitating more frequent and thorough cleaning; rising disposable incomes in developing economies, enabling greater expenditure on cleaning products and services; and stringent regulatory frameworks mandating high standards of hygiene in various industries. Furthermore, the increasing prevalence of allergies and asthma, coupled with a growing awareness of environmental sustainability, drives demand for hypoallergenic and eco-friendly cleaning solutions, thereby continually shaping the market's trajectory and fostering a culture of cleanliness globally.

Cleaning Market Executive Summary

The global cleaning market is currently experiencing robust growth, propelled by a confluence of evolving business trends, shifting consumer preferences, and advancements in cleaning technologies. A predominant business trend is the increasing adoption of professional cleaning services across commercial and industrial sectors. Companies are recognizing the value proposition of outsourcing cleaning operations to specialized firms that offer expertise, advanced equipment, and trained personnel, allowing them to focus on core competencies. This trend is driven by cost efficiencies, regulatory compliance requirements, and the desire for consistently high standards of hygiene. Furthermore, there is a notable shift towards green cleaning products and sustainable practices, as businesses and consumers alike prioritize environmental responsibility and seek to minimize the ecological footprint of their cleaning activities. This has led to significant investment in research and development for biodegradable ingredients, concentrated formulas, and reduced plastic packaging. The integration of smart cleaning solutions, including robotic vacuum cleaners, autonomous floor scrubbers, and IoT-enabled monitoring systems, represents another critical business trend, promising enhanced efficiency, reduced labor costs, and data-driven insights into cleaning performance. The market is also witnessing a surge in demand for specialized cleaning solutions tailored to specific industries, such as healthcare (e.g., hospital-grade disinfectants), food service (e.g., grease-cutting agents), and manufacturing (e.g., heavy-duty degreasers), highlighting a move towards more targeted and effective cleaning protocols.

Regional trends significantly influence the dynamics of the cleaning market. North America and Europe currently represent mature markets, characterized by high adoption rates of advanced cleaning technologies, stringent regulatory standards, and a strong emphasis on sustainability. These regions are leaders in promoting eco-friendly products and leveraging automation to optimize cleaning processes. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, primarily due to rapid urbanization, increasing disposable incomes, and a burgeoning commercial and industrial infrastructure in countries like China, India, and Southeast Asian nations. This growth is also fueled by a heightened awareness of hygiene, particularly in post-pandemic scenarios, and expanding hospitality and healthcare sectors. Latin America and the Middle East & Africa (MEA) are also demonstrating considerable growth potential, driven by infrastructure development, rising health consciousness, and the gradual adoption of modern cleaning practices. Governments in these regions are increasingly investing in public sanitation initiatives, further stimulating market expansion. The demand for both consumer-grade and professional cleaning solutions is escalating across all regions, albeit with varying degrees of maturity and technological adoption, reflecting diverse socio-economic conditions and cultural preferences regarding cleanliness.

Segmentation trends within the cleaning market reveal distinct areas of growth and innovation. By product type, disinfectants and sanitizers have experienced an unprecedented surge in demand, a trend significantly amplified by recent global health crises, solidifying their status as indispensable components of modern cleaning regimens. Specialty cleaners, catering to niche applications such as floor care, glass cleaning, and upholstery treatment, are also witnessing steady growth, driven by consumer desire for targeted and effective solutions. In terms of end-users, the commercial and industrial sectors continue to be the largest revenue contributors, with the healthcare sector showing particular dynamism due to the imperative for sterile environments. The residential segment, while traditionally dominated by conventional household cleaners, is increasingly embracing premium, natural, and smart cleaning devices, indicating a shift towards convenience and advanced performance. Distribution channel trends highlight the continued dominance of supermarkets and hypermarkets for consumer products, while online retail is rapidly gaining traction, offering convenience and a wider product selection. For professional-grade products and services, direct sales and specialized distributors remain crucial. The market is also seeing a rise in subscription-based models for cleaning products, catering to a growing consumer demand for seamless replenishment and personalized offerings, ultimately shaping a market characterized by continuous evolution and specialization.

AI Impact Analysis on Cleaning Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the cleaning market predominantly revolve around questions of efficiency gains, cost reduction, job displacement, and the integration of smart technologies. Users are keenly interested in how AI can automate repetitive tasks, optimize cleaning routes, and predict maintenance needs, thereby enhancing operational effectiveness and reducing labor expenditures. There are significant concerns about the potential for AI-powered robotics to render human cleaners obsolete, prompting questions about workforce retraining and the future of manual cleaning jobs. Additionally, users inquire about the capabilities of AI in discerning dirt levels, identifying specific contaminants, and adapting cleaning protocols in real-time for superior hygiene outcomes. The expectation is that AI will usher in an era of 'smart cleaning,' where systems are not only autonomous but also intelligent, data-driven, and highly adaptable, offering unprecedented levels of cleanliness and operational foresight. The themes underscore a desire for innovation that balances technological advancement with human employment, alongside a clear demand for more effective, data-informed, and resource-efficient cleaning solutions.

- Autonomous Cleaning Systems: AI powers robotic vacuums, floor scrubbers, and window cleaners, enabling them to navigate complex environments, identify obstacles, and perform cleaning tasks without human intervention, significantly reducing labor costs and increasing operational hours.

- Predictive Maintenance: AI algorithms analyze sensor data from cleaning equipment to predict potential breakdowns, schedule preventative maintenance, and optimize equipment lifespan, minimizing downtime and repair costs.

- Optimized Resource Allocation: AI-driven platforms can analyze building occupancy patterns, traffic flow, and real-time cleanliness data to dynamically adjust cleaning schedules and resource deployment, ensuring efficient use of staff and supplies.

- Enhanced Hygiene Monitoring: AI-powered vision systems and sensors can detect dirt, grime, and even specific pathogens, providing real-time feedback on cleanliness levels and ensuring adherence to stringent hygiene standards, particularly in sensitive environments like healthcare facilities.

- Personalized Cleaning Solutions: AI can process user preferences and environmental data to recommend customized cleaning products and methods, offering tailored solutions for different surfaces, materials, and levels of contamination.

- Supply Chain Optimization: AI models can forecast demand for cleaning supplies, optimize inventory management, and streamline procurement processes, leading to reduced waste and improved cost efficiency for cleaning service providers and product manufacturers.

- Smart Disinfection: AI integrates with UV-C light robots and electrostatic sprayers to ensure comprehensive disinfection coverage, adjusting power and duration based on spatial geometry and target pathogen characteristics for maximum efficacy.

DRO & Impact Forces Of Cleaning Market

The Cleaning Market is profoundly shaped by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that influence its growth trajectory and competitive landscape. Key drivers include the escalating global health consciousness, significantly amplified by recent pandemics, which has institutionalized higher hygiene standards across all sectors, from residential to industrial. This heightened awareness fuels demand for advanced cleaning products and services. Rapid urbanization and industrialization, particularly in developing economies, lead to increased construction of commercial spaces, healthcare facilities, and residential complexes, all requiring consistent and professional cleaning. The proliferation of various infectious diseases and allergies further compels consumers and businesses to invest in effective sanitization solutions. Technological advancements, such as the development of smart cleaning equipment, eco-friendly formulations, and automated systems, also act as significant drivers, enhancing efficiency, reducing environmental impact, and expanding the market's capabilities. Additionally, stringent regulatory frameworks and health and safety mandates across industries are compelling organizations to adopt comprehensive cleaning protocols, thereby sustaining and increasing demand for specialized cleaning solutions and services. The rise in disposable incomes in emerging markets allows for greater expenditure on premium and professional cleaning services, contributing to market expansion.

Despite robust growth drivers, the cleaning market faces several significant restraints. The high initial investment required for advanced cleaning equipment and robotic systems can be a barrier for smaller businesses and independent cleaning service providers, hindering widespread adoption of cutting-edge technologies. Fluctuations in raw material prices, particularly for chemicals and packaging components, directly impact the manufacturing cost of cleaning products, potentially leading to increased end-user prices and reduced profit margins. Another considerable restraint is the labor-intensive nature of traditional cleaning services, which often grapples with high turnover rates, a shortage of skilled labor, and rising labor costs, especially in developed economies. This workforce challenge drives up operational expenses for service providers. Environmental concerns regarding the chemical composition of some cleaning agents and their potential impact on air and water quality also act as a restraint, pushing manufacturers towards more sustainable but potentially costlier alternatives. Furthermore, the intense competition within the market, characterized by numerous local and international players, can lead to price wars and diminished profitability, making it challenging for new entrants to establish a strong foothold. The lack of standardization in cleaning protocols across different regions and industries can also create operational inefficiencies and compliance complexities for multinational cleaning service providers.

Opportunities within the cleaning market are abundant and diverse, promising sustained innovation and growth. A significant opportunity lies in the burgeoning demand for green cleaning products and sustainable solutions. With growing consumer and corporate environmental consciousness, manufacturers who invest in biodegradable, non-toxic, and energy-efficient products and practices stand to gain a competitive edge. The expansion of smart cleaning technologies, including AI-powered robots, IoT-enabled sensors, and data analytics for predictive cleaning, presents a vast opportunity for enhanced efficiency, cost savings, and superior hygiene outcomes. Customization and specialization of cleaning services for niche sectors such as healthcare, food processing, and data centers, where specific regulatory requirements and high-stakes environments demand tailored approaches, offer lucrative avenues for market players. The rise of e-commerce platforms provides an excellent opportunity for cleaning product manufacturers to reach a wider consumer base and streamline distribution. Additionally, the increasing focus on air quality and allergen control creates demand for specialized air purification systems and hypoallergenic cleaning agents. Developing robust training programs for professional cleaners to operate advanced equipment and adhere to evolving hygiene standards also represents an opportunity to improve service quality and address labor skill gaps. Finally, strategic partnerships and collaborations between technology providers and traditional cleaning companies can accelerate innovation and market penetration, merging advanced capabilities with established service networks to unlock new growth potential.

Segmentation Analysis

The global cleaning market is intricately segmented across various dimensions, providing a granular view of its diverse landscape and enabling targeted strategies for market participants. This segmentation helps in understanding the specific demands and characteristics of different product categories, end-user groups, and geographical regions, allowing for a more nuanced analysis of market trends and growth opportunities. The primary segmentation typically revolves around product type, application or end-user, formulation, and distribution channel, each revealing distinct market dynamics. The market's complexity arises from the wide array of cleaning needs, ranging from everyday household chores to highly specialized industrial processes, each demanding specific solutions, ingredients, and delivery methods. Understanding these segments is crucial for manufacturers to tailor their product offerings, for service providers to customize their service packages, and for investors to identify high-growth areas. The continuous evolution of consumer preferences, technological advancements, and regulatory requirements further refines these segments, making dynamic analysis imperative for strategic market positioning and sustained competitive advantage.

- By Product Type:

- Surface Cleaners:

- All-Purpose Cleaners

- Glass Cleaners

- Floor Cleaners

- Bathroom Cleaners

- Kitchen Cleaners

- Specialty Surface Cleaners (e.g., wood, metal)

- Laundry Care Products:

- Laundry Detergents (Liquid, Powder, Pods)

- Fabric Conditioners/Softeners

- Bleach

- Stain Removers

- Laundry Boosters

- Dishwashing Products:

- Dishwashing Liquids

- Dishwasher Detergents (Pods, Gels, Powders)

- Rinse Aids

- Dishwasher Cleaners

- Disinfectants and Sanitizers:

- Surface Disinfectants

- Hand Sanitizers (Gels, Sprays, Foams)

- Air Sanitizers

- Toilet Care Products:

- Toilet Bowl Cleaners

- Toilet Blocks/Gels

- Air Fresheners:

- Sprays

- Gels

- Plug-Ins

- Candles

- Specialty Cleaning Agents:

- Carpet Cleaners

- Oven Cleaners

- Drain Cleaners

- Polishes (Furniture, Metal)

- Pest Control Cleaners

- Cleaning Tools & Equipment:

- Mops & Buckets

- Brushes & Sponges

- Gloves

- Vacuum Cleaners

- Robotic Cleaners

- Floor Scrubbers & Polishers

- High-Pressure Washers

- Surface Cleaners:

- By Application/End-User:

- Residential:

- Household Cleaning

- Personal Care Facilities (e.g., home offices)

- Commercial:

- Offices & Commercial Buildings

- Retail & Hospitality (Hotels, Restaurants, Malls)

- Healthcare Facilities (Hospitals, Clinics, Nursing Homes)

- Educational Institutions

- Government & Public Sector

- Sports & Recreation Facilities

- Industrial:

- Manufacturing & Production Facilities

- Food & Beverage Processing

- Automotive

- Transportation (Airports, Train Stations)

- Oil & Gas

- Pharmaceuticals

- Mining

- Residential:

- By Formulation:

- Chemical-Based

- Bio-Based/Enzymatic

- Eco-Friendly/Green

- Concentrated

- Ready-to-Use

- By Distribution Channel:

- Offline:

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Hardware Stores

- Wholesale Distributors

- Online:

- E-commerce Platforms

- Company-Owned Websites

- Direct Sales (for professional services/industrial products)

- Offline:

- By Service Type (for Cleaning Services Segment):

- Janitorial Services

- Window Cleaning

- Carpet & Upholstery Cleaning

- Floor Care Services

- Specialty Cleaning (e.g., post-construction, trauma)

- Disinfection Services

Value Chain Analysis For Cleaning Market

The value chain for the cleaning market is a complex ecosystem involving multiple stages, from the sourcing of raw materials to the final delivery and disposal of products and services. Upstream analysis focuses on the initial stages, primarily encompassing the procurement and processing of raw materials. This includes specialty chemicals such as surfactants, solvents, fragrances, dyes, and disinfectants, which are often derived from petrochemicals, natural oils, or bio-based sources. Manufacturers also source packaging materials like plastics, glass, and cardboard. Suppliers of manufacturing equipment, including mixing tanks, filling machines, and labeling systems, are also critical upstream players. The quality, cost, and availability of these raw materials and equipment directly impact the production capabilities and final cost of cleaning products. Key challenges in the upstream segment include ensuring sustainable sourcing practices, managing price volatility of commodities, and complying with stringent environmental and safety regulations related to chemical handling and processing. Innovation in bio-based materials and green chemistry plays a significant role in enhancing sustainability and reducing dependency on traditional petrochemicals, offering a competitive advantage to players who invest in these areas.

The midstream segment of the value chain involves the manufacturing, formulation, and branding of cleaning products. This stage is dominated by large chemical companies and consumer goods manufacturers who develop proprietary formulations, produce various cleaning agents, and package them for consumer or industrial use. This stage includes extensive research and development activities to create more effective, safe, and environmentally friendly products. Quality control, regulatory compliance (e.g., ingredient safety, labeling requirements), and efficient production processes are paramount here. For cleaning services, the midstream involves developing service protocols, training cleaning personnel, and investing in specialized cleaning equipment and technology. Downstream analysis then focuses on distribution channels and end-user engagement. For consumer cleaning products, this involves moving goods through wholesalers, distributors, and various retail outlets such as supermarkets, hypermarkets, convenience stores, and increasingly, e-commerce platforms. The efficiency of this distribution network is crucial for market penetration and consumer accessibility. Marketing and branding efforts at this stage are vital for creating product awareness and fostering customer loyalty, influencing purchasing decisions through advertising, promotions, and brand reputation.

The distribution channel landscape for the cleaning market is bifurcated between direct and indirect approaches, each catering to specific market segments. Indirect channels are predominant for consumer-grade cleaning products, where a multi-tiered distribution network ensures widespread availability. This typically involves manufacturers selling to large distributors or wholesalers, who then supply to various retail formats. E-commerce has emerged as a powerful indirect channel, providing consumers with convenience, competitive pricing, and a vast selection, directly impacting the traditional retail landscape. Direct channels are more common for professional cleaning services and industrial-grade cleaning products. In this model, manufacturers or service providers directly engage with commercial and industrial end-users, often through sales teams, specialized consultants, or direct contracts. This approach allows for customized solutions, technical support, and long-term relationships with clients who have specific and often complex cleaning requirements, such as hospitals, manufacturing plants, or large corporate offices. The choice of distribution strategy depends heavily on the product's nature, target audience, pricing, and the desired level of customer interaction and support, all contributing to the overall efficiency and effectiveness of the cleaning market's value delivery system, from raw material to end-use application and disposal management.

Cleaning Market Potential Customers

The potential customers for the cleaning market are incredibly diverse, encompassing nearly every individual, household, and organization across all sectors of the economy. At the most fundamental level, every household is a potential buyer of cleaning products, from laundry detergents and dish soap to surface cleaners and disinfectants, essential for maintaining a hygienic and pleasant living environment. This vast residential segment is driven by daily needs, personal preferences for specific brands or formulations (e.g., eco-friendly, hypoallergenic), and varying income levels affecting purchasing power. Within this segment, there's a growing demographic of consumers interested in premium, smart, and sustainable cleaning solutions, indicating a shift towards convenience, efficacy, and environmental consciousness. Beyond individual households, residential cleaning services also target affluent individuals, busy professionals, and families seeking to outsource domestic chores for convenience and time-saving benefits, further broadening the customer base within this sphere. This segment also includes property managers and landlords who require cleaning services for communal areas in apartment buildings or for preparing properties between tenants.

Moving beyond the residential sphere, the commercial sector represents a monumental segment of potential customers, driven by the critical need to maintain clean, safe, and presentable environments for employees, clients, and the public. This includes a wide array of establishments such as office buildings, corporate campuses, retail stores, shopping malls, hotels, restaurants, and other hospitality venues. In these settings, cleaning is not just about hygiene but also about brand image, customer experience, and compliance with health and safety regulations. The healthcare sector is another massive and highly specialized customer group, encompassing hospitals, clinics, nursing homes, and laboratories. These facilities have exceptionally stringent hygiene requirements to prevent the spread of infections, making them significant consumers of medical-grade disinfectants, specialized cleaning equipment, and highly skilled cleaning services that adhere to rigorous protocols. Similarly, educational institutions, from daycare centers to universities, rely heavily on cleaning products and services to ensure healthy learning environments, which is crucial for student well-being and institutional reputation, making them consistent and substantial customers.

Finally, the industrial sector constitutes a significant and unique segment of potential customers, characterized by heavy-duty cleaning needs and specialized requirements driven by operational efficiency, safety regulations, and product quality standards. This includes manufacturing plants across various industries (e.g., automotive, electronics, food and beverage, pharmaceuticals), where cleaning is essential for machinery maintenance, contaminant control, and worker safety. Food and beverage processing facilities, for example, require rigorous sanitation to prevent contamination and meet strict food safety standards, making them key purchasers of industrial-grade sanitizers and cleaning equipment. The transportation sector, including airports, train stations, and public transit systems, also represents a large customer base for cleaning services and products to ensure public health and passenger comfort. Furthermore, specialized industries such as mining, oil and gas, and construction have unique cleaning challenges involving heavy machinery, hazardous materials, and large-scale waste management, necessitating highly specialized cleaning solutions and expertise. These diverse end-users collectively underscore the pervasive and indispensable role of the cleaning market across the entire economic landscape, continually driving innovation and demand for comprehensive cleaning solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.8 billion |

| Market Forecast in 2033 | USD 102.3 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever, Reckitt, SC Johnson & Son, Ecolab Inc., Diversey Holdings, Karcher GmbH, Henkel AG & Co. KGaA, Kimberly-Clark Corporation, 3M Company, Church & Dwight Co., Inc., The Clorox Company, Zep, Inc., Spartan Chemical Company, Inc., Nilfisk Group, Tennant Company, ISS A/S, ABM Industries, ServiceMaster Global Holdings, Inc., Coverall North America, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cleaning Market Key Technology Landscape

The cleaning market's technological landscape is undergoing a profound transformation, driven by advancements in robotics, artificial intelligence (AI), sensor technologies, and sustainable chemistry, aiming to enhance efficiency, efficacy, and environmental responsibility. One of the most impactful technological developments is the advent and increasing sophistication of autonomous cleaning robots. These robots, including robotic vacuum cleaners, floor scrubbers, and window washers, leverage AI and advanced navigation systems (SLAM – Simultaneous Localization and Mapping) to operate independently, mapping environments, avoiding obstacles, and optimizing cleaning routes. This not only reduces the reliance on manual labor but also ensures consistent cleaning quality, especially in large commercial and industrial spaces. Integration with IoT (Internet of Things) platforms allows for remote monitoring, performance analytics, and predictive maintenance of these machines, transforming cleaning operations from reactive to proactive, leading to significant operational cost savings and improved resource allocation. The use of drones for high-reach or difficult-to-access exterior cleaning tasks is also an emerging niche, offering enhanced safety and efficiency for specialized applications in large building complexes.

Another crucial technological frontier is the innovation in cleaning formulations, specifically the shift towards green chemistry and bio-based solutions. This involves the development of biodegradable surfactants, plant-derived solvents, enzymatic cleaners, and probiotic cleaning agents that are effective yet environmentally benign. Nanotechnology is also being explored to create self-cleaning surfaces or to enhance the efficacy of traditional cleaning agents by improving their ability to penetrate and lift dirt at a microscopic level, offering prolonged cleanliness and reduced need for frequent cleaning. Smart dispensing systems and concentrated formulas are gaining traction, allowing for precise dilution, minimizing waste, and reducing transportation costs and carbon footprint. Furthermore, advanced disinfection technologies are rapidly evolving, moving beyond traditional chemical disinfectants to incorporate UV-C light robots, electrostatic sprayers, and ozone generators. These technologies offer highly effective pathogen elimination, critical for healthcare facilities and public spaces, often operating autonomously or with minimal human intervention, providing a higher level of sanitation assurance.

The integration of sensor technology and data analytics is revolutionizing how cleaning needs are identified and addressed. Occupancy sensors, air quality monitors, and surface cleanliness detection devices provide real-time data on environmental conditions, allowing cleaning schedules and intensity to be dynamically adjusted based on actual demand rather than fixed routines. This 'clean-on-demand' or 'needs-based cleaning' approach optimizes labor and resource utilization, ensuring that cleaning efforts are concentrated where and when they are most needed. AI algorithms process this data to predict high-traffic areas, identify potential contamination hotspots, and recommend optimal cleaning protocols. Virtual reality (VR) and augmented reality (AR) are also finding applications in cleaner training, offering immersive simulations for operating complex equipment and practicing safety procedures in hazardous environments. These technological advancements collectively contribute to a more efficient, sustainable, and intelligent cleaning ecosystem, addressing contemporary challenges such as labor shortages, environmental impact, and the ever-increasing demand for higher standards of hygiene and cleanliness across all market segments, thereby redefining the very nature of cleaning operations and services.

Regional Highlights

- North America: A mature market characterized by high adoption of professional cleaning services, robust demand for eco-friendly products, and significant investment in smart cleaning technologies like AI-powered robots. Stringent health and safety regulations, particularly in the healthcare and food service sectors, drive consistent demand. The United States and Canada are key contributors, leading in innovation and sustainability initiatives.

- Europe: Similar to North America, Europe is a well-established market with a strong emphasis on sustainability, green cleaning solutions, and automation. Countries like Germany, the UK, and France are at the forefront of adopting advanced cleaning equipment and services, driven by high labor costs and strict environmental policies. The hospitality and commercial sectors are major consumers.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, industrialization, and increasing disposable incomes in countries such as China, India, Japan, and Australia. Rising health awareness, coupled with expanding commercial infrastructure (offices, retail, hospitality) and a burgeoning middle class, significantly boosts demand for both consumer and professional cleaning solutions.

- Latin America: This region exhibits significant growth potential, driven by improving economic conditions, increasing infrastructure development, and a growing awareness of hygiene. Countries like Brazil, Mexico, and Argentina are seeing rising demand for both household cleaning products and commercial cleaning services as urbanization accelerates.

- Middle East and Africa (MEA): Emerging market with considerable growth opportunities, propelled by significant investments in tourism, hospitality, and large-scale infrastructure projects (e.g., in UAE, Saudi Arabia). The region's hot and dusty climate also necessitates frequent and thorough cleaning, driving demand for robust cleaning solutions and professional services.

- Germany: A key European market, known for its focus on high-quality, efficient, and technologically advanced cleaning solutions. Strong regulatory environment and a preference for sustainable products drive market trends.

- United Kingdom: A major player in Europe with a developed commercial cleaning services sector and growing consumer demand for innovative and eco-friendly household cleaning products.

- China: Dominant in APAC, characterized by rapid industrial growth and a massive consumer base. Increasing focus on public health and environmental protection is spurring demand for advanced cleaning technologies and green products.

- India: A high-growth market in APAC, driven by urbanization, rising disposable incomes, and increasing awareness of hygiene. Significant opportunities for both affordable consumer products and scalable professional cleaning services.

- United States: The largest market globally, characterized by high adoption of robotic cleaning, extensive use of specialized commercial cleaning services, and a strong market for premium and sustainable cleaning products across all segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cleaning Market.- Procter & Gamble (P&G)

- Unilever

- Reckitt

- SC Johnson & Son

- Ecolab Inc.

- Diversey Holdings

- Karcher GmbH

- Henkel AG & Co. KGaA

- Kimberly-Clark Corporation

- 3M Company

- Church & Dwight Co., Inc.

- The Clorox Company

- Zep, Inc.

- Spartan Chemical Company, Inc.

- Nilfisk Group

- Tennant Company

- ISS A/S

- ABM Industries

- ServiceMaster Global Holdings, Inc.

- Coverall North America, Inc.

Frequently Asked Questions

What are the key drivers of growth in the Cleaning Market?

The key drivers include increasing global health consciousness, rapid urbanization and industrialization, technological advancements in cleaning equipment and formulations, stringent health and safety regulations across industries, and rising disposable incomes in emerging economies, all contributing to a heightened demand for effective cleaning solutions and services.

How is AI impacting the Cleaning Market?

AI is significantly impacting the cleaning market by enabling autonomous cleaning robots, optimizing cleaning routes and resource allocation, facilitating predictive maintenance for equipment, enhancing hygiene monitoring through sensors, and supporting smart disinfection systems, leading to greater efficiency, cost savings, and higher cleanliness standards.

Which regions offer the most significant growth opportunities for cleaning products and services?

The Asia Pacific (APAC) region, particularly countries like China and India, offers the most significant growth opportunities due to rapid urbanization, increasing disposable incomes, and growing health awareness. Latin America and the Middle East & Africa (MEA) are also emerging as high-potential growth markets driven by infrastructure development.

What are the main types of cleaning products available in the market?

The main types of cleaning products include surface cleaners (all-purpose, glass, floor), laundry care products (detergents, fabric softeners), dishwashing products (liquids, dishwasher detergents), disinfectants and sanitizers, toilet care products, air fresheners, and specialty cleaning agents (carpet, oven, drain cleaners), alongside various cleaning tools and equipment.

What are the primary challenges faced by the Cleaning Market?

Primary challenges include the high initial investment required for advanced cleaning technologies, volatility in raw material prices, labor shortages and high turnover rates in cleaning services, increasing environmental concerns regarding chemical formulations, and intense competition leading to potential price pressures across segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Cleaning Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Household Green Cleaning Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Air Duct Cleaning Robot Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Snow Cleaning Vehicles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Central Air Conditioning Duct Cleaning Robot Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager