Coffee Shops Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436725 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Coffee Shops Market Size

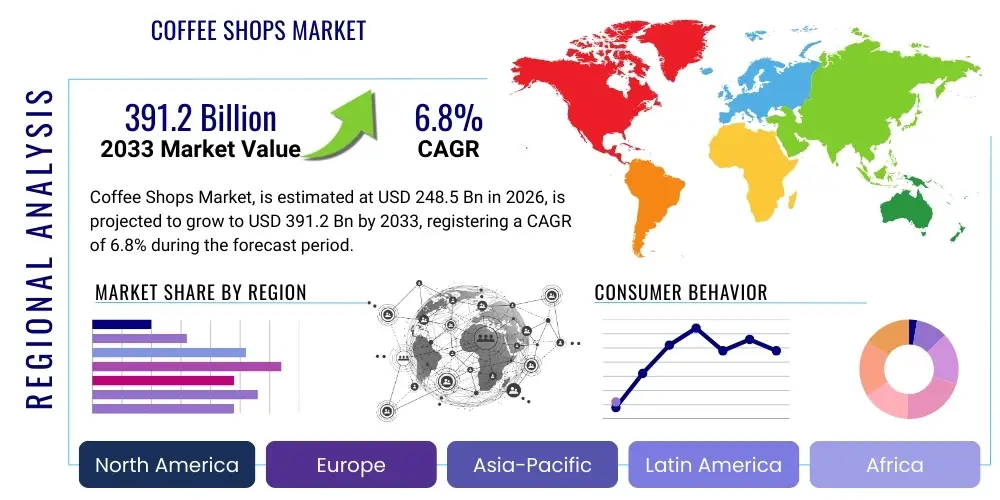

The Coffee Shops Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 248.5 Billion in 2026 and is projected to reach USD 391.2 Billion by the end of the forecast period in 2033. This robust expansion is fueled by evolving consumer preferences for premium and specialty coffee, increased urbanization driving demand for convenient social and workspace settings, and continuous innovation in service delivery models, including mobile ordering and sophisticated loyalty programs. The market size reflects the global proliferation of both multinational chains and independent artisanal establishments competing on quality, experience, and ethical sourcing practices.

Coffee Shops Market introduction

The Coffee Shops Market encompasses all establishments primarily engaged in selling prepared coffee, beverages, and related food items for on-premise consumption or takeaway. This highly fragmented yet rapidly consolidating industry serves as a crucial component of the global food and beverage sector, transitioning from a basic commodity service to a sophisticated experiential retail environment. Key products include espresso-based drinks, brewed coffee, cold brews, and specialty beverages, often complemented by pastries, light meals, and merchandise. The core value proposition of coffee shops lies not only in the product quality but also in providing a third space—a relaxed, welcoming environment distinct from home and work, fostering social interaction and productivity.

Major applications of coffee shops extend beyond simple refreshment, functioning as critical venues for informal business meetings, academic study, and community gathering points. The expansion of remote work paradigms, particularly post-2020, has significantly amplified the use of coffee shops as auxiliary office spaces, driving demand for reliable Wi-Fi, comfortable seating, and extended operating hours. Furthermore, coffee shops are pivotal in launching and popularizing new consumer trends, acting as testing grounds for sustainable packaging, plant-based dairy alternatives, and geographically specific coffee roasts, thereby setting standards for the broader food service industry.

Driving factors underpinning the market growth include rising disposable incomes in emerging economies, the sustained cultural shift toward coffee consumption among younger demographics, and relentless product innovation focusing on customization and health attributes. The benefits derived by consumers are manifold, ranging from enhanced alertness and productivity to social connection and the enjoyment of high-quality, ethically sourced products. Technological integration, particularly in point-of-sale (POS) systems and customer relationship management (CRM), is also a significant driver, allowing operators to streamline operations, reduce waiting times, and personalize the customer experience, thereby increasing visit frequency and average transaction values.

Coffee Shops Market Executive Summary

The global Coffee Shops Market exhibits strong growth momentum, primarily steered by shifting business trends toward digitalization and experiential retail. Leading chains are prioritizing tech-enabled services, such as seamless app integration for ordering and payment, alongside aggressive expansion into high-density urban centers and non-traditional locations like hospitals and transit hubs. A key business trend involves market polarization, where large, standardized global players coexist with highly localized, artisanal third-wave coffee shops focusing on single-origin beans and direct trade relationships. Sustainability and ethical sourcing remain central competitive differentiators, influencing consumer purchasing decisions and corporate branding strategies across the market landscape.

Regionally, the market dynamics are highly differentiated. Asia Pacific (APAC) is projected to record the highest growth rate, driven by the rapid adoption of Western coffee culture in countries like China and India, coupled with rising middle-class consumer spending power. North America and Europe, while mature, maintain dominance in terms of overall market value, characterized by intense competition, a high penetration of specialty coffee shops, and leading-edge adoption of automation technologies, particularly in back-of-house operations. Latin America, rooted in coffee production, is witnessing increasing domestic consumption and the emergence of premium local brands capitalizing on farm-to-cup traceability.

Segmentation trends highlight the robust performance of the chain-operated segment due to standardized quality and strong brand recognition, contrasting with independent shops which rely on unique ambiance and localized community engagement. By type, specialty coffee continues to outpace traditional brewed coffee, reflecting consumer willingness to pay a premium for complex flavors and high-quality preparation methods. Furthermore, the non-store-based segment, encompassing kiosks, pop-ups, and delivery-focused models, is experiencing accelerated growth, leveraging mobility and logistical optimization to capture consumer demand for convenience and speed. These intertwined trends necessitate strategic flexibility and investment in technology to maintain competitive edge.

AI Impact Analysis on Coffee Shops Market

User inquiries regarding Artificial Intelligence (AI) in the coffee shop sector commonly center on operational efficiency, personalized marketing, and the potential displacement of human labor. Key themes revolve around how AI can optimize inventory management to minimize waste, the feasibility of AI-driven robotics for tasks like automated brewing and latte art, and the application of predictive analytics to forecast demand patterns based on hyper-local variables such as weather or events. Consumers and industry stakeholders are highly interested in AI’s role in creating ultra-personalized customer experiences, analyzing purchase history and mood indicators to suggest tailored menu items, while simultaneously expressing concerns about maintaining the essential human element and 'third place' atmosphere that defines the coffee shop experience.

AI is fundamentally transforming the front-of-house and back-of-house operations, moving beyond simple automation to genuine predictive decision-making. In the supply chain, AI algorithms are being used to monitor bean quality from harvest to roast, identifying optimal storage and transportation conditions, thus ensuring product consistency across global outlets. For customer interaction, advanced AI chatbots handle order modifications and reservations, offloading routine tasks from baristas, allowing them to focus on complex beverage preparation and enhanced customer engagement. This strategic implementation of AI elevates service speed and consistency, directly addressing the modern consumer demand for rapid, high-quality service, particularly during peak operating hours.

The long-term strategic impact involves utilizing AI for site selection and market penetration analysis. By processing vast datasets on demographic shifts, foot traffic patterns, and competitor density, AI provides highly accurate projections on the viability of new locations. This predictive power reduces investment risk and optimizes geographic clustering strategies. Moreover, AI-driven dynamic pricing models are emerging, adjusting menu prices in real-time based on current demand, inventory levels, and competitor pricing, maximizing revenue yield per hour. This pervasive application ensures operational precision and fosters a data-driven culture within the traditionally manual food service environment.

- AI-driven Predictive Demand Forecasting: Optimizing labor scheduling and inventory levels to minimize spoilage and wait times.

- Automated Barista Systems: Robotics and specialized machines managed by AI for high-volume, consistent beverage preparation.

- Personalized Customer Experience: Utilizing machine learning algorithms to recommend customized drinks and offers based on past behavior and context.

- Supply Chain Optimization: Real-time tracking and quality assurance of raw materials (coffee beans) using sensor data and AI analytics.

- Enhanced POS and CRM Integration: Streamlining order flow and managing loyalty programs through integrated AI assistants and interfaces.

- Fraud Detection and Security: AI monitoring of transactions and security systems in both physical stores and digital platforms.

- Efficient Energy Management: Optimizing HVAC and equipment usage in shops to reduce operational energy costs based on occupancy predictions.

DRO & Impact Forces Of Coffee Shops Market

The Coffee Shops Market is currently shaped by a powerful confluence of Drivers, Restraints, and Opportunities, collectively forming the key impact forces determining its future trajectory. A primary driver is the accelerating urbanization trend globally, concentrating potential customers in high-density areas and increasing the need for accessible, convenient gathering spaces. Simultaneously, the persistent shift towards premiumization—where consumers view high-quality, ethically sourced coffee as an affordable luxury—bolsters average spending per visit. These drivers are amplified by aggressive marketing and standardization efforts by global chain operators, ensuring brand consistency and rapid scalability across diverse international markets. The cumulative force of these factors ensures sustained market vitality and capital investment, particularly in technologically advanced operational models.

Conversely, significant restraints pose ongoing challenges to market profitability and stability. The volatility of raw material prices, specifically green coffee beans, driven by climate change and geopolitical factors, creates persistent cost pressures that coffee shops must absorb or pass on to consumers. Furthermore, intense market saturation, particularly in developed urban areas, leads to escalating commercial real estate costs and fierce competition, compressing profit margins for independent and small-chain operators. The perennial labor challenge—characterized by high turnover rates and rising minimum wage requirements in many regions—further strains operational finances, necessitating substantial investment in automation and efficiency programs to mitigate these rising personnel costs.

However, substantial opportunities exist for strategic growth and innovation. The untapped potential in emerging markets, notably Southeast Asia, Africa, and specific Latin American countries, represents a large consumer base ready for coffee culture adoption. Furthermore, the strategic focus on diversification, including expanding menu offerings into ready-to-drink (RTD) coffee products, specialized food pairings, and branded merchandise, opens new revenue streams beyond traditional in-shop sales. The integration of advanced digital technologies, specifically augmented reality (AR) for enhanced customer engagement or blockchain for supply chain transparency, offers avenues for competitive differentiation and enhanced consumer trust, positioning early adopters for significant market share gains. These impact forces compel operators to maintain flexibility, prioritize customer experience, and continuously seek operational efficiencies.

Segmentation Analysis

The Coffee Shops Market is comprehensively segmented based on various operational and consumer-centric metrics, including ownership type, service format, application, and distribution channel. Understanding these segments is critical for developing targeted marketing strategies and optimizing product offerings. The segmentation highlights the intrinsic differences in consumer behavior between those seeking standardized, rapid service (often characteristic of chain outlets and drive-thrus) and those prioritizing the artisanal experience, unique ambiance, and specialty coffee offerings found in independent shops. This structural diversity allows the market to cater to a broad spectrum of demographic and psychographic profiles, from daily commuters requiring speed and efficiency to remote workers seeking comfort and consistency.

A crucial differentiator within the market is the Service Format segmentation, which clearly separates sit-down cafes from quick-service restaurants (QSR) and specialized kiosks. While QSRs focus on maximizing throughput and minimizing preparation time, sit-down cafes emphasize dwell time and the sale of complementary, higher-margin food items. The ownership type—Chain versus Independent—dictates marketing expenditure, supply chain robustness, and standardization levels. Chains benefit from economies of scale and centralized branding, whereas independent shops often thrive through localized partnerships, unique product development, and strong community ties, appealing to consumers seeking authenticity and variety.

Geographically, market performance is segmented by maturity and consumer adoption rates. Regions like North America and Europe are characterized by high market penetration and a focus on premium and sustainable products, driving vertical differentiation. In contrast, Asia Pacific segments are defined by horizontal market expansion, with rapid establishment of new outlets and introduction of coffee culture to traditionally tea-drinking populations. Analyzing these segmentation dynamics provides the foundational knowledge required for accurate forecasting and strategic investment decisions across the global coffee shop ecosystem.

- By Ownership:

- Chain Outlets

- Independent Outlets

- By Service Format:

- Dine-in Cafes

- Quick Service Restaurants (QSR) / Takeaway

- Kiosks and Vending Machines

- Drive-Throughs

- By Application:

- Social Gatherings

- Business and Work Meetings

- Leisure and Relaxation

- On-the-Go Consumption

- By Product Type (Primary Offerings):

- Hot Coffee (Espresso, Brewed, Pour-over)

- Cold Coffee (Cold Brew, Iced Lattes, Frappes)

- Other Beverages (Tea, Smoothies, Juices)

- Food & Snacks (Pastries, Sandwiches)

Value Chain Analysis For Coffee Shops Market

The value chain for the Coffee Shops Market is complex, beginning with upstream activities focused on the cultivation, harvesting, and processing of green coffee beans. This initial phase is characterized by significant agricultural risks, sustainability challenges, and the high impact of direct trade relationships, which bypass intermediaries to ensure traceability and better returns for farmers. Key upstream stakeholders include coffee farmers, cooperative organizations, commodity traders, and specialized coffee exporters. Efficiency and quality control at this stage are paramount, as the inherent quality of the raw material dictates the final product's premiumization potential. Investments in sustainable farming practices, such as water conservation and shade-grown cultivation, are becoming vital components of brand integrity and consumer appeal.

Midstream activities primarily involve roasting, blending, and logistics. Roasters transform green beans into the retail product, where decisions regarding roast profile (light, medium, dark) significantly affect flavor characteristics and market positioning. Logistics networks manage the efficient warehousing and transportation of roasted beans and other supplies (milk, sugar, equipment) to thousands of retail outlets globally. Downstream activities constitute the core retail operation: the actual coffee shop. This involves beverage preparation, customer service, store ambiance management, and final point-of-sale transactions. The efficiency of the downstream segment is highly dependent on standardized operational procedures, sophisticated inventory management systems, and well-trained personnel capable of delivering consistent quality under pressure.

Distribution channels are multifaceted, incorporating direct sales through the physical stores, indirect sales via online ordering platforms for pick-up or delivery, and, increasingly, retail partnerships allowing branded coffee products to be sold in supermarkets or other food service venues. Direct sales channels (the brick-and-mortar shop) remain the primary source of revenue and brand identity. However, the rapidly expanding delivery ecosystem utilizes third-party aggregators and proprietary delivery fleets, significantly increasing market reach but introducing complexity in quality control and margin management. Successful market players strategically optimize their distribution mix to balance experiential retail with convenience-driven, indirect sales, maintaining high standards across all customer touchpoints.

Coffee Shops Market Potential Customers

Potential customers for the Coffee Shops Market are diverse, broadly categorized into three main segments: daily commuters and convenience seekers, professionals and students requiring workspaces, and socializers looking for leisure and meeting venues. The first group prioritizes speed, consistency, and accessibility, relying heavily on drive-thrus, mobile ordering, and strategically located kiosks near transportation hubs. Their purchasing decisions are primarily driven by time efficiency and the habit of incorporating coffee into their daily routine. This segment is highly responsive to loyalty programs and bundled offers designed to streamline the morning rush.

The second segment, encompassing remote workers, freelancers, and university students, views the coffee shop as an essential 'third space' providing reliable infrastructure—specifically, power outlets, robust Wi-Fi, and a productive atmosphere. For this group, criteria such as seating comfort, noise levels, and extended operational hours are more critical than speed. They often exhibit longer dwell times and higher consumption of complementary food items, making them highly valuable for maximizing per-table revenue outside of peak commuting hours. Targeting this segment requires investment in infrastructure and designing comfortable, flexible seating arrangements conducive to long periods of work or study.

The third segment focuses on the experiential aspect of coffee consumption. These customers are drawn to specialty coffee shops, appreciating the nuances of different roasts, the skill of the barista, and the unique ambiance. They are typically younger, urban demographics with higher disposable income who are willing to pay a premium for ethically sourced, single-origin beans and artisanal preparation methods. Marketing to this group emphasizes brand storytelling, sustainability credentials, and the unique, high-quality sensory experience provided by the shop, fostering a sense of community around the appreciation of specialty coffee culture.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 248.5 Billion |

| Market Forecast in 2033 | USD 391.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Starbucks Corporation, Costa Coffee (Coca-Cola), McDonald's (McCafe), Tim Hortons, JDE Peet's, Lavazza Group, Retail Food Group (Gloria Jean's), Dunkin' Brands (Inspire Brands), Coffee Bean & Tea Leaf, Luckin Coffee, Blue Bottle Coffee (Nestle), Caffe Nero, JAB Holding Company, Max Brenner, Caribou Coffee, Peet's Coffee, Arabica, Tully's Coffee, Pret A Manger, The Coffee Club |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coffee Shops Market Key Technology Landscape

The modern coffee shops market is heavily reliant on technological infrastructure to maintain efficiency, consistency, and customer engagement. Key technologies primarily center around Point-of-Sale (POS) systems, which have evolved into sophisticated platforms capable of integrating inventory management, detailed sales analytics, loyalty program tracking, and multi-channel order aggregation. Cloud-based POS solutions offer scalability and real-time data accessibility, enabling multi-site operators to monitor performance metrics across their entire portfolio instantly. These systems are fundamental for dynamic pricing strategies and ensuring rapid transaction processing during high-volume periods, significantly reducing the friction associated with the payment process.

Mobile applications and digital ordering platforms represent another critical technological pillar. These technologies facilitate pre-ordering, customization, and payment, addressing the consumer demand for ultimate convenience. The integration of robust Customer Relationship Management (CRM) tools within these apps allows coffee shops to capture detailed purchasing data, enabling highly personalized communication and targeted promotional campaigns. Furthermore, technologies focusing on automation in the back-of-house, such as precision grinders, volumetric espresso machines, and increasingly sophisticated robotic baristas, ensure consistently high product quality, mitigating reliance on manual labor for routine tasks and allowing human staff to focus on complex, high-touch customer interactions.

Emerging technologies, including Internet of Things (IoT) sensors and Artificial Intelligence (AI) algorithms, are being deployed to optimize environmental controls and resource consumption. IoT devices monitor equipment performance, predicting maintenance needs before failures occur, thereby minimizing costly downtime. AI is also integral to logistics and supply chain transparency, utilizing blockchain technology to create immutable records of coffee bean provenance, addressing the growing consumer requirement for ethical sourcing verification. This technology landscape reflects a strategic shift from simple retail transactions to a data-driven service industry focused on hyper-efficiency and enhanced consumer trust.

Regional Highlights

- North America: This region holds a significant share of the global market value, characterized by mature consumer markets and fierce competition between large chains (Starbucks, Tim Hortons, Dunkin'). The focus here is on high-volume drive-thrus, advanced mobile ordering technology adoption, and a strong preference for specialty, single-origin coffee. Sustainability and ethically sourced beans are primary purchasing drivers for the affluent consumer base, propelling innovation in plant-based milk alternatives and complex cold beverage offerings.

- Europe: Europe represents a historically robust market, with Western Europe showing high market saturation but strong demand for independent, artisanal cafes, particularly in capital cities like London, Paris, and Rome. The market is highly fragmented, balancing global chains with strong national and local traditions. The growth trajectory is driven by the expansion of the "third wave" coffee movement and a cultural emphasis on quality, slow-bar brewing methods, and premium espresso culture.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid urbanization, rising disposable incomes, and the cultural shift away from tea towards coffee, especially among younger populations in China, India, and Southeast Asia. Market growth is characterized by heavy foreign investment, rapid store rollout by major international chains, and localization of menu items to suit regional flavor preferences. Convenience and brand status are key market drivers.

- Latin America (LATAM): While traditionally a major coffee producer, domestic consumption in LATAM is increasing substantially. The market is driven by the emergence of local premium brands focused on showcasing national origin coffees (e.g., Colombian, Brazilian). The value chain often benefits from greater vertical integration, allowing producers to capture higher margins through direct retail operations. The market still faces challenges related to economic instability and infrastructure limitations but shows strong potential for growth in experiential retail.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, driven by high youth populations and a significant affinity for luxury and experiential dining. Coffee shops often serve as important social hubs, leading to large, elaborate store designs and high spend on interior ambiance. Africa is seeing nascent growth in urban centers, particularly South Africa and Kenya, reflecting rising middle-class disposable income and increased exposure to global brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coffee Shops Market.- Starbucks Corporation

- Costa Coffee (Coca-Cola)

- McDonald's (McCafe)

- Tim Hortons

- JDE Peet's

- Lavazza Group

- Retail Food Group (Gloria Jean's)

- Dunkin' Brands (Inspire Brands)

- Coffee Bean & Tea Leaf

- Luckin Coffee

- Blue Bottle Coffee (Nestle)

- Caffe Nero

- JAB Holding Company (including Peet's Coffee, Caribou Coffee)

- Max Brenner

- Arabica

- Tully's Coffee

- Pret A Manger

- The Coffee Club

- Doutor Coffee Co., Ltd.

- Zus Coffee

Frequently Asked Questions

Analyze common user questions about the Coffee Shops market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trend in the Coffee Shops Market?

The primary growth factors are the global trend of premiumization, where consumers increasingly demand and pay more for high-quality, specialty coffee; rising urbanization, which increases demand for convenient out-of-home consumption points; and substantial technological investments, particularly in mobile ordering and loyalty applications, which enhance customer convenience and speed of service.

How significant is the impact of ethical sourcing and sustainability on consumer choices?

Ethical sourcing, including fair trade practices and sustainable cultivation, has become a critical competitive differentiator, moving beyond a niche interest to a mainstream consumer expectation. Consumers, especially in North America and Europe, are willing to pay a premium for beans certified for traceability and low environmental impact, directly influencing brand preference and loyalty in the specialty segment.

Which geographical region exhibits the fastest expansion potential in the Coffee Shops Market?

Asia Pacific (APAC), particularly emerging economies like China, India, and Indonesia, demonstrates the highest growth rate. This rapid expansion is due to significant cultural adoption of Western coffee habits, supported by rapid economic development and increasing discretionary spending among the burgeoning middle-class population.

What technological innovations are reshaping the operational efficiency of coffee shops?

Key technological innovations include AI-driven predictive analytics for optimizing inventory and staffing, sophisticated cloud-based Point-of-Sale (POS) systems integrated with Customer Relationship Management (CRM), and the proliferation of self-service kiosks and automated brewing systems. These technologies collectively aim to reduce labor costs, minimize waste, and ensure product consistency.

What are the main challenges facing independent coffee shops in competing with large chains?

Independent coffee shops primarily struggle with achieving the same economies of scale and purchasing power as large chains, leading to higher operational costs for raw materials and supplies. They also face challenges in marketing reach, securing prime retail locations, and retaining staff against the standardized pay and benefits offered by multinational operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Coffee Shops & Cafes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Packaged Coffee and Cafe Chain Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Packaged Coffee, Coffee Shops & Cafe), By Application (Hyper & Super market, Convenience Store, On-line, Cafe Chain), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager