Cushion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433887 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cushion Market Size

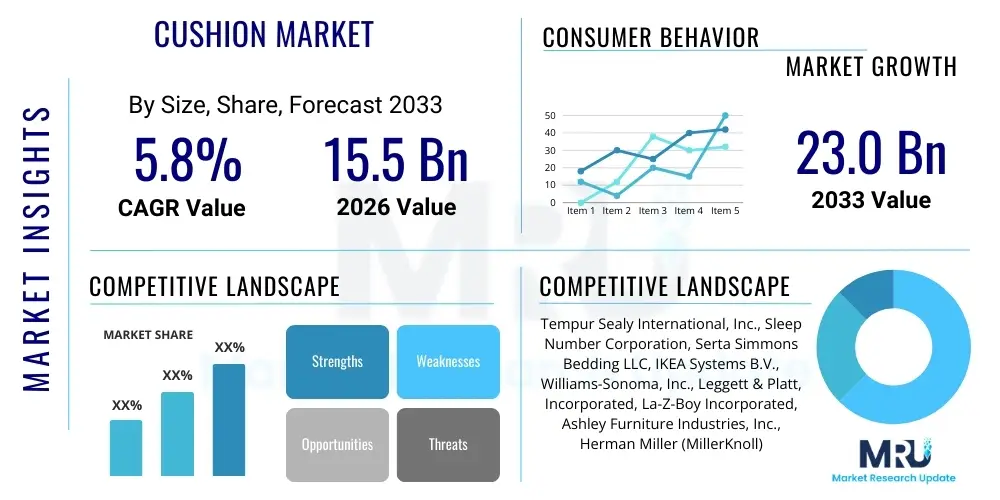

The Cushion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033. This growth trajectory is fueled primarily by increased consumer spending on home furnishings, a rising focus on ergonomic seating solutions in both residential and commercial sectors, and the expanding hospitality and automotive industries globally.

The valuation reflects robust demand across diverse application segments, ranging from aesthetic home décor items to highly functional medical and specialized ergonomic products. Developing economies, particularly in the Asia Pacific region, are experiencing rapid urbanization and growing middle-class populations, leading to substantial investment in residential and commercial infrastructure, thereby significantly boosting the demand for both decorative and utilitarian cushions.

Furthermore, innovation in material science, including the adoption of advanced memory foam, sustainable latex, and temperature-regulating gel infusions, is enhancing product performance and driving premium pricing. The market's stability is underpinned by its ubiquitous application, ensuring consistent replacement demand and continuous adoption in new construction projects and vehicle manufacturing.

Cushion Market introduction

The Cushion Market encompasses the manufacturing and distribution of soft pads or bags filled with elastic materials, used primarily for comfort, support, and aesthetic appeal. These products serve multifaceted roles, acting as functional seating accessories, ergonomic supports, and critical components of interior design. Key materials utilized include polyurethane foam, memory foam, cotton, polyester fibers, and increasingly, sustainable and natural latex. Major applications span residential settings (sofas, chairs, beds), commercial environments (offices, hotels, restaurants), automotive interiors (seating comfort), and specialized healthcare use (pressure ulcer prevention and therapeutic positioning). The primary benefits derived from cushions include enhanced physical comfort, improved posture and ergonomic alignment, noise reduction, and the ability to quickly refresh interior aesthetics without significant investment.

The market is significantly driven by global trends focusing on home personalization and the 'work-from-home' culture, which elevates the importance of comfortable and aesthetically pleasing seating arrangements. Consumer awareness regarding ergonomic health and the prevention of musculoskeletal disorders also fuels the demand for specialized orthopedic and support cushions. Additionally, the rapid expansion of the hospitality industry and the steady growth in new vehicle sales contribute substantially to bulk orders for durable, high-quality cushioning solutions. Technological advancements in fabric manufacturing, offering features like stain resistance, UV protection, and improved breathability, further stimulate market growth by increasing product longevity and utility.

While the market is mature in terms of product concept, continuous innovation in filling materials (such as bio-based foams and recycled textiles) and cover fabrics maintains its dynamic nature. The integration of smart features, such as heating, cooling, and pressure sensors, represents a nascent, high-potential area. The global nature of the supply chain, combined with the low barrier to entry for basic product categories, fosters intense competition, driving manufacturers to focus heavily on brand differentiation, design innovation, and sustainable sourcing practices to capture market share.

Cushion Market Executive Summary

The Cushion Market is positioned for stable growth through the forecast period, underpinned by strong business trends centered on sustainability, customization, and enhanced digital distribution. Key business trends include the shift towards eco-friendly materials, driven by consumer demand for responsibly sourced products, necessitating substantial investment in production technologies for recycled polyester and organic cotton. Manufacturers are increasingly leveraging mass customization models to offer personalized comfort solutions, particularly in the premium and ergonomic segments. Furthermore, the reliance on e-commerce platforms is accelerating, demanding robust logistical infrastructures and high-quality digital marketing strategies to reach fragmented residential consumer bases efficiently.

Regionally, Asia Pacific (APAC) is projected to exhibit the fastest growth, primarily due to expanding urbanization, rising disposable incomes, and large-scale infrastructure projects including residential development and hospitality expansion. North America and Europe remain mature markets, characterized by high demand for ergonomic office seating and premium decorative cushions, focusing on health and wellness trends. The regulatory environment in these regions often favors standardized ergonomic products, influencing product design and material selection. In contrast, emerging regions in Latin America and the Middle East & Africa are characterized by increasing international brand penetration and demand for basic, cost-effective cushioning solutions.

Segment-wise, the Memory Foam category continues to dominate the material segment due to its superior viscoelastic properties and increasing use in orthopedic and health-related cushions. The Residential application segment holds the largest market share, consistently driven by fashion cycles and home refurbishment activities. However, the Commercial (Office and Hospitality) segment is experiencing significant acceleration as companies prioritize employee wellness and guest comfort, requiring large volumes of durable, fire-retardant, and easy-to-clean products. Distribution channels show a distinct favoring of online retail, which offers convenience and a broader selection, challenging traditional brick-and-mortar furniture stores to enhance their experiential retail strategies.

AI Impact Analysis on Cushion Market

Common user questions regarding AI's impact on the Cushion Market center on personalized comfort optimization, supply chain efficiency, and sustainable material innovation. Users frequently ask how AI can tailor cushion firmness and shape based on individual physiological data, moving beyond standard sizing to true personalization. Furthermore, there is significant interest in how AI tools can predict material demand fluctuations, optimize inventory levels for seasonal designs, and streamline complex, international supply chains, reducing lead times and waste. Key expectations also revolve around AI-driven generative design for rapid prototyping of novel cushion shapes and patterns, ensuring aesthetic relevance and functional superiority in a fast-paced retail environment, while addressing concerns about the cost and complexity of integrating such technologies into conventional manufacturing processes.

AI is fundamentally transforming the design and manufacturing lifecycle of cushions by enabling high-precision mass customization. Machine learning algorithms analyze extensive consumer preference data, postural requirements, and biomechanical measurements to automatically generate optimal cushion designs tailored for specific body types and usage scenarios (e.g., long-haul driving, intensive office work, post-operative support). This significantly reduces the time from conceptualization to market for specialized products, providing manufacturers a competitive edge in ergonomic and premium segments. AI-powered quality control systems, utilizing computer vision, also ensure consistent density, stitching quality, and material integrity across high-volume production runs, minimizing defects and improving overall product reliability.

In the retail and customer experience domain, AI-driven recommendation engines are crucial for guiding consumers through the vast array of available options, matching user-defined needs (such as back pain relief or specific aesthetic requirements) with the most suitable products. Furthermore, predictive maintenance models, analyzing sensor data from smart cushions, can alert users or commercial entities (like hotel chains) to material degradation or required replacement, ensuring continuous comfort and safety standards are met. This integration of smart technology and AI analytics moves the cushion from a passive commodity item to an active, data-generating product, opening up new service-oriented revenue streams for market players.

- AI-Driven Design Personalization: Uses machine learning to create customized cushion geometries and densities based on biometric data and comfort profiles.

- Supply Chain Optimization: Predictive analytics forecasts demand for specific colors and materials, reducing inventory holding costs and minimizing stockouts.

- Generative Design: AI tools rapidly prototype aesthetically unique and functionally superior cushion patterns and forms.

- Automated Quality Control: Computer vision systems inspect stitching, fabric defects, and foam consistency on the assembly line, ensuring adherence to high standards.

- Smart Cushion Integration: Analysis of pressure mapping data from sensors to provide real-time ergonomic feedback and predict material lifespan.

DRO & Impact Forces Of Cushion Market

The Cushion Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its direction. Primary drivers include the global proliferation of e-commerce, which simplifies the purchasing process and expands the geographical reach for specialized products, alongside the accelerating global trend towards prioritizing ergonomic health in both residential and professional settings. Restraints often manifest as high volatility in the prices of raw materials, such as crude oil derivatives used in synthetic foam production, and increasing regulatory pressure concerning fire safety standards and chemical content (e.g., restrictions on harmful flame retardants). Opportunities are predominantly concentrated in the development and commercialization of sustainable, bio-based materials and the integration of Internet of Things (IoT) technology to create 'smart cushions' offering customizable therapeutic functionalities, promising higher profit margins and market differentiation.

A key driver is the demographic shift towards older populations globally, which increases the need for medical and therapeutic cushions designed to alleviate pressure points and assist with mobility challenges, ensuring sustained demand from the healthcare sector. Simultaneously, the booming residential real estate sector in emerging economies acts as a substantial volume driver for decorative and basic utility cushions. However, a major restraining force is product commoditization in the lower-end market segments, leading to intense price competition, which squeezes profit margins for conventional manufacturers. Countering this restraint requires heavy investment in brand building and intellectual property protection related to patented material compositions.

The impact forces strongly favor companies that are agile in material innovation and have robust direct-to-consumer (DTC) digital presence. The emphasis on corporate social responsibility (CSR) means that opportunities stemming from circular economy principles (recycling end-of-life products) and sustainable sourcing are becoming necessities rather than optional extras. The ability of companies to manage complex global logistics networks to mitigate the impact of fluctuating material costs and geo-political disruptions is crucial for maintaining competitive pricing and reliable supply, positioning supply chain resilience as a powerful impact force in the market.

Segmentation Analysis

The Cushion Market is highly diversified and is comprehensively segmented based on material type, application, end-user, and distribution channel, providing a granular view of consumer preferences and market dynamics. Understanding these segments is vital for strategic planning, as different categories exhibit varying growth rates, price sensitivities, and adoption patterns. The material segment, which includes synthetic foams, natural fibers, and specialized gels, dictates the comfort, durability, and cost profile of the final product, directly influencing end-user choice, particularly in high-performance applications like orthopedics and automotive seating. Application segments distinguish between high-volume consumer goods (residential) and high-specification industrial needs (medical, commercial), each requiring compliance with distinct regulatory standards and performance criteria.

Segmentation by end-user differentiates between institutional buyers (hotels, hospitals, corporate offices) that prioritize bulk purchasing, durability, and commercial-grade specifications, versus individual residential consumers who focus more on aesthetic alignment, trend relevance, and localized purchasing convenience. The distribution channel breakdown highlights the accelerating pivot towards online retail, which is restructuring the competitive landscape and necessitating investment in digital infrastructure and seamless logistics management. Analyzing these distinct segments helps market participants to tailor their product development, pricing strategies, and marketing campaigns to effectively target the most lucrative opportunities within this expansive market.

The segmentation structure also illuminates geographical disparities in product preference; for example, North America and Europe show high preference for cooling gel memory foam and certified ergonomic designs, while APAC markets often exhibit higher demand for traditional fiber-filled and competitively priced cotton cushions for household use. Successful market penetration therefore relies on deep, localized segmentation analysis, ensuring product portfolios are adapted to specific regional regulatory and cultural requirements while leveraging global material sourcing efficiencies.

- By Material:

- Memory Foam

- Latex (Natural & Synthetic)

- Polyester Fiber

- Cotton/Wool

- Others (e.g., Gel Infusions, Microbeads)

- By Application:

- Residential (Sofas, Chairs, Beds, Patio Furniture)

- Commercial (Office Seating, Hospitality/Hotels, Restaurants)

- Automotive/Transportation

- Medical/Therapeutic (Wheelchair Cushions, Posture Supports)

- By End-User:

- Individual Consumers

- Institutional Buyers (B2B)

- By Distribution Channel:

- Offline Retail (Furniture Stores, Specialty Stores, Supermarkets)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Cushion Market

The Value Chain of the Cushion Market begins with upstream activities focused on raw material sourcing, which is highly sensitive to global commodity markets. This stage involves acquiring petroleum-based chemicals (Polyols, Isocyanates) for foam production, processing natural materials (latex harvesting, cotton farming), and manufacturing specialized textiles and covers. Key upstream challenges include securing sustainable and non-toxic material supplies, maintaining quality control over complex chemical formulations, and managing volatility in oil prices, which directly impacts the cost of synthetic foam. Efficiency in this phase hinges on strategic supplier relationships and long-term procurement contracts to ensure supply stability and cost predictability for downstream manufacturers.

Midstream processes involve core manufacturing, including foam molding and fabrication, textile cutting, sewing, and final assembly. This stage is capital-intensive, requiring advanced machinery for precision cutting and sophisticated sewing operations. Manufacturers must adhere to stringent quality standards, particularly fire retardancy and chemical emission regulations (e.g., CertiPUR-US or Oeko-Tex certifications). The competitive advantage in manufacturing is often derived from economies of scale, vertical integration (controlling both foam production and assembly), and the adoption of lean manufacturing principles to reduce waste and optimize production cycles.

Downstream analysis focuses on distribution and sales. The market utilizes both direct and indirect channels. Direct channels involve B2B sales to institutional clients (hotels, hospitals) or Direct-to-Consumer (DTC) sales through proprietary e-commerce sites, allowing for greater control over branding and margins. Indirect channels involve wholesalers, large furniture retailers, mass merchandise stores, and third-party e-commerce giants. Effective distribution requires robust logistics, warehousing strategies optimized for bulky products, and sophisticated inventory management. The shift towards online sales necessitates specialized packaging solutions to protect products during transit and enhanced digital marketing to drive consumer engagement and brand loyalty at the point of purchase.

Cushion Market Potential Customers

The potential customer base for the Cushion Market is exceptionally broad, spanning multiple sectors from residential households seeking comfort and aesthetic upgrades to highly specialized institutional entities demanding strict performance criteria. Primary end-users include individual residential consumers who drive the largest volume segment, purchasing decorative throw pillows, functional seat cushions, and outdoor patio sets, often influenced by seasonal trends and interior design cycles. This demographic values aesthetic versatility, material comfort, and accessible pricing points, often preferring online channels for convenience and variety selection. Marketing efforts aimed at this group focus heavily on visual appeal and lifestyle integration.

Another crucial customer segment comprises institutional buyers, including commercial businesses such as corporate offices, which procure large quantities of ergonomic lumbar and seat cushions to comply with occupational health standards and enhance employee well-being. The hospitality sector (hotels and resorts) represents a major B2B customer, demanding durable, fire-resistant, and aesthetically pleasing cushions for lobbies, rooms, and outdoor areas, prioritizing longevity and ease of cleaning. Furthermore, healthcare facilities—hospitals, nursing homes, and rehabilitation centers—are vital buyers of therapeutic, medical-grade pressure relief cushions designed to prevent bedsores and aid post-operative recovery, where performance certifications and clinical efficacy are non-negotiable purchasing criteria.

The automotive industry also constitutes a substantial long-term customer segment, integrating specialized cushions and foam components into vehicle seating to enhance driver and passenger comfort, safety, and acoustic properties. These customers require highly specialized materials meeting rigorous safety and durability standards. Lastly, design firms and interior decorators act as influential intermediaries, purchasing cushions in bulk on behalf of their clients, often focusing on premium, custom-made, or unique designer pieces that reflect high-end specifications and unique material combinations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tempur Sealy International, Inc., Sleep Number Corporation, Serta Simmons Bedding LLC, IKEA Systems B.V., Williams-Sonoma, Inc., Leggett & Platt, Incorporated, La-Z-Boy Incorporated, Ashley Furniture Industries, Inc., Herman Miller (MillerKnoll), Steelcase Inc., Foam Rubber Products, Inc., Carpenter Co., Future Foam, Inc., The White Company, Kurlon Enterprise Ltd., Duroflex Private Limited, Fabbrica Home Furniture, Inter IKEA Systems B.V., Springs Global, Crate and Barrel Holdings, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cushion Market Key Technology Landscape

The Cushion Market is continually evolving through advancements in material science and manufacturing processes, driven by the need for superior comfort, durability, and sustainability. Key technology innovations center around enhanced foam technology, specifically the development of open-cell memory foams that offer better breathability and temperature regulation compared to traditional closed-cell structures, mitigating the common issue of heat retention. Furthermore, the commercial adoption of bio-based polyols and recycled content in polyurethane foam manufacturing addresses the growing environmental consciousness of consumers and regulatory bodies, reducing dependence on petroleum-derived inputs and decreasing the overall carbon footprint of the product.

Textile technology plays a crucial role in the functional performance and longevity of cushion covers. Innovations include the use of high-performance fabrics engineered for stain resistance, moisture-wicking properties, and enhanced abrasion resistance, particularly important for commercial and outdoor applications. The application of nanotechnology allows for the integration of antimicrobial and hypoallergenic finishes, significantly improving hygiene, particularly beneficial for medical and pediatric cushions. Manufacturing techniques are also advancing, with sophisticated 3D knitting and automated cutting systems minimizing material waste and allowing for the precise production of complex cushion shapes required by modern ergonomic designs.

The most transformative emerging technology is the integration of 'smart' components, specifically pressure-mapping sensors, heating elements, and connectivity modules (IoT). These smart cushions are capable of monitoring user posture, dynamically adjusting firmness based on detected pressure distribution, and providing personalized health data feedback via companion apps. While currently niche, this technology represents a significant future growth area, merging comfort with quantifiable health and wellness benefits. Mass customization technologies, such as computational fluid dynamics used in foam molding simulation, also ensure that new material combinations deliver optimal viscoelastic properties efficiently across diverse product lines.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by rapid urbanization, significant expansion in the middle-class population, and large-scale residential and commercial construction projects, especially in countries like China, India, and Southeast Asian nations. The region presents a high-volume, price-sensitive market for standard household cushions but also displays increasing demand for Western-style ergonomic office seating due to the influx of multinational corporations and improved corporate wellness initiatives. Investment in local manufacturing capabilities and direct-to-consumer e-commerce platforms are critical success factors here.

- North America: North America holds a dominant market share in terms of value, characterized by high consumer awareness regarding ergonomic health and a strong preference for premium, technologically advanced cushioning products, such as gel-infused memory foam and orthopedic supports. The market is driven by robust replacement cycles in the residential sector and stringent regulatory requirements for fire safety in the commercial segment. High digital penetration means online channels account for a significant portion of sales, necessitating complex, highly visual digital storefronts and efficient last-mile delivery services for bulky goods.

- Europe: Europe is a mature market focusing heavily on sustainability and quality certification. Demand is strong for natural and organic materials, particularly certified organic cotton and natural latex, reflecting stringent EU regulations concerning chemical content (REACH) and strong consumer preference for eco-friendly products. Germany, the UK, and France are key markets, driving innovation in sophisticated textile treatments and aesthetically driven, high-durability outdoor furniture cushions. The emphasis here is on long product lifecycles and circular economy models.

- Latin America (LATAM): The LATAM market exhibits nascent growth, characterized by fluctuating economic stability that impacts discretionary spending on non-essential home goods. Key drivers include expanding domestic furniture manufacturing and gradual adoption of international interior design trends in urban centers like Brazil and Mexico. Price competitiveness is essential, often favoring local manufacturers using readily available, cost-effective materials, though premium imported products are gaining traction among affluent consumers.

- Middle East & Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by extensive luxury real estate development and booming hospitality sectors (hotels, high-end residential complexes). This region demands high-specification, durable, and luxury-oriented cushions, often procured through B2B contracts. The African segment remains diverse, with lower-income nations driving demand for essential, durable, and basic cushioning, while South Africa acts as a regional hub for specialized imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cushion Market.- Tempur Sealy International, Inc.

- Sleep Number Corporation

- Serta Simmons Bedding LLC

- IKEA Systems B.V.

- Williams-Sonoma, Inc.

- Leggett & Platt, Incorporated

- La-Z-Boy Incorporated

- Ashley Furniture Industries, Inc.

- Herman Miller (MillerKnoll)

- Steelcase Inc.

- Foam Rubber Products, Inc.

- Carpenter Co.

- Future Foam, Inc.

- The White Company

- Kurlon Enterprise Ltd.

- Duroflex Private Limited

- Fabbrica Home Furniture

- Inter IKEA Systems B.V.

- Springs Global

- Crate and Barrel Holdings, Inc.

- Hanesbrands Inc.

- Nitori Holdings Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Cushion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the ergonomic cushion segment?

The primary driver is the global increase in awareness regarding musculoskeletal health issues associated with prolonged sitting, coupled with the permanent establishment of hybrid and work-from-home models, necessitating superior ergonomic seating solutions in domestic and corporate settings. Regulatory standards also push companies to prioritize employee wellness, boosting B2B demand for certified orthopedic cushions.

How are sustainable materials impacting cushion market profitability?

Sustainable materials, such as organic cotton and bio-based foams, initially increase production costs; however, they enhance brand value and market differentiation, allowing companies to command premium pricing, particularly in environmentally conscious markets like Europe. This shift attracts ethical consumers, improving long-term brand loyalty and market resilience.

What is the expected influence of e-commerce on traditional furniture retailers in this market?

E-commerce is forcing traditional retailers to adopt omnichannel strategies. Online platforms offer broader selection and price comparison, capturing market share, especially for non-bulky items. Traditional retailers must differentiate through experiential showrooms, immediate availability, and personalized design consultation services to maintain relevance.

Which cushion material provides the best long-term therapeutic support?

Memory foam (viscoelastic polyurethane) and natural latex are generally considered superior for long-term therapeutic support. Memory foam conforms to the body, distributing pressure evenly, while latex offers resilient, supportive firmness that prevents sinking and maintains spinal alignment, making both ideal for medical and high-use ergonomic applications.

What role does smart technology play in the future of cushions?

Smart technology, including integrated pressure sensors and IoT connectivity, transforms cushions into active wellness devices. These products monitor posture, provide real-time adjustments, and collect data for health analysis, opening lucrative segments in preventative healthcare and advanced consumer goods markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Paper Cushion System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Multifunctional Orthopedic Cushion Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cushion Running Shoes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wheelchair Cushion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wedge Cushion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager