Disinfectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433593 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Disinfectors Market Size

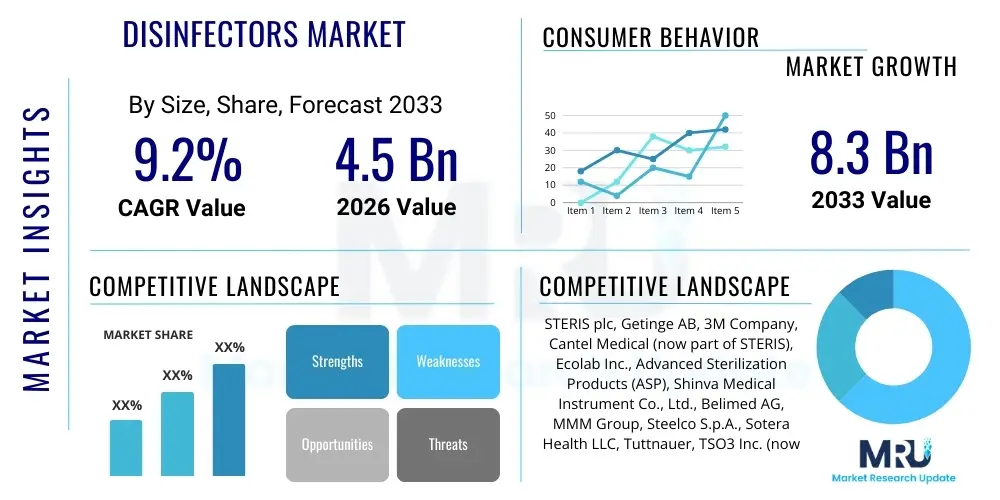

The Disinfectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global focus on healthcare-associated infections (HAIs), heightened regulatory scrutiny concerning sterilization standards in medical facilities, and the rapid technological advancements leading to automated and high-throughput disinfection systems. The post-pandemic environment has irreversibly raised the standard for sanitation protocols across all end-user sectors, cementing disinfection equipment as critical infrastructure rather than merely an optional component.

Disinfectors Market introduction

The Disinfectors Market encompasses the global sale of specialized equipment and systems designed to eliminate or significantly reduce microbial contamination (excluding bacterial spores) on surfaces, medical instruments, and in air/water mediums. These systems utilize various technologies, including thermal, chemical, ultraviolet (UV), and pulsed xenon light, tailored to meet stringent safety and efficacy requirements, primarily within the medical, pharmaceutical, and laboratory environments. Key applications involve the pre-sterilization reprocessing of reusable medical devices, general surface disinfection in operating theaters, and maintaining aseptic conditions in critical care units. The core objective of these products is to mitigate the risk of cross-contamination and control infectious disease outbreaks, thereby safeguarding patient and healthcare worker well-being.

The core product offerings within this market range from sophisticated washer-disinfectors used for surgical instruments to high-capacity decontamination units essential for flexible endoscopes and respiratory therapy devices. Driving factors for market acceleration include demographic shifts leading to increased surgical procedures, mandatory adherence to global infection control guidelines established by bodies such as the WHO and CDC, and continuous investment in upgrading aging infrastructure in developed healthcare economies. The increasing complexity of medical instrumentation, which often incorporates heat-sensitive materials, is also spurring demand for non-thermal, advanced chemical and UV-based disinfection alternatives, demanding continuous innovation from market incumbents.

Disinfectors Market Executive Summary

The Disinfectors Market is undergoing robust growth, propelled by sustained governmental and private sector investment in infection prevention strategies following recent global health crises. Business trends indicate a strong shift towards automated, integrated, and environmentally sustainable disinfection systems that minimize manual handling and reduce chemical waste. Key strategic movements observed across leading companies include mergers and acquisitions aimed at consolidating technology portfolios, particularly focusing on incorporating smart monitoring capabilities and advanced material science to enhance equipment longevity and efficiency. Furthermore, there is a pronounced focus on providing comprehensive validation and documentation services, moving the market structure from mere equipment provision to holistic infection control partnership.

Regionally, North America maintains market dominance due to early adoption of stringent sterilization protocols, high healthcare expenditure, and the presence of major industry players and advanced regulatory frameworks. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive infrastructure development in healthcare, rising awareness of HAIs, and improving medical tourism sectors, particularly in nations like China and India. Segment trends show that the end-user preference is rapidly shifting toward high-level disinfection (HLD) solutions for non-critical and semi-critical devices, while technological adoption favors UV-C light and vaporized hydrogen peroxide systems for room and surface disinfection, offering faster cycle times and superior material compatibility compared to traditional chemical soaking methods.

AI Impact Analysis on Disinfectors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Disinfectors Market frequently revolve around automation efficacy, predictive maintenance capabilities, and the potential for real-time compliance monitoring. Users are concerned about whether AI can truly enhance disinfection protocols beyond simple programming, especially in complex environments like operating theaters and sterile processing departments (SPDs). Key themes emerging from these questions include the use of machine learning (ML) to optimize chemical dosing based on bioburden data, the integration of robotics for autonomous terminal cleaning, and the development of intelligent sensors capable of verifying disinfection completeness—addressing the core industry challenge of ensuring zero-tolerance compliance and reducing human error in the highly regulated sterilization workflow.

The integration of AI systems is primarily focused on transforming reactive maintenance into predictive operational management and enhancing quality assurance. AI algorithms analyze vast datasets derived from disinfection cycles (temperature, pressure, chemical concentration, cycle time) to detect subtle anomalies that could indicate equipment malfunction or non-compliance, flagging issues before they lead to inadequate reprocessing. This predictive capability significantly reduces downtime, extends the lifespan of expensive equipment, and, crucially, provides an immutable audit trail necessary for regulatory compliance. Furthermore, AI-powered computer vision is being employed in robotic systems to autonomously map surfaces, ensuring complete coverage during terminal disinfection procedures, optimizing resource usage, and standardizing the cleaning process across diverse physical layouts.

- AI algorithms optimize disinfection cycle parameters based on instrument type and predicted bioburden level.

- Machine learning enables predictive maintenance, forecasting equipment failure and scheduling proactive servicing, thereby maximizing uptime.

- AI-powered visual recognition systems confirm surface cleanliness and monitor adherence to terminal disinfection protocols.

- Robotics integrated with AI facilitates autonomous room disinfection (e.g., UV-C robots) with optimized movement paths for comprehensive coverage.

- Real-time data analytics provide continuous compliance auditing and automated generation of regulatory documentation.

- AI assists in inventory management of consumables (chemicals, filters) and optimizes throughput in sterile processing departments (SPDs).

DRO & Impact Forces Of Disinfectors Market

The Disinfectors Market dynamic is shaped by a powerful confluence of drivers rooted in public health necessity, restraints stemming from operational complexity, and significant opportunities arising from technological convergence and expansion into emerging markets. The fundamental driving force is the global imperative to curb Healthcare-Associated Infections (HAIs), which impose massive financial burdens and mortality rates worldwide. This imperative is consistently reinforced by rigorous global and regional regulatory standards (like those from the FDA and European Commission) mandating high-level disinfection and sterilization processes, thereby creating non-discretionary demand for validated disinfection equipment. Additionally, the proliferation of complex, minimally invasive surgical instruments, which are challenging to clean and sterilize, drives innovation toward highly effective, yet gentle, reprocessing solutions, significantly impacting market growth trajectory.

Key restraints tempering growth include the substantial initial capital investment required for high-capacity, automated disinfection systems, often proving prohibitive for smaller healthcare facilities or those in developing economies. Furthermore, the complexity of maintaining regulatory compliance across various jurisdictions, coupled with the need for highly skilled technicians to operate and validate these sophisticated systems, presents operational hurdles. Opportunities, however, abound, particularly in the rapid development of non-traditional disinfection technologies, such as plasma sterilization and photocatalytic disinfection, which offer faster cycle times and reduced environmental impact. Penetration into non-traditional end-user segments, including large-scale commercial facilities, educational institutions, and public transportation networks, driven by enhanced epidemiological vigilance, also represents a significant avenue for future market expansion.

Impact forces currently governing the market include the enduring influence of the COVID-19 pandemic, which permanently heightened global epidemiological awareness and accelerated governmental spending on public health infrastructure. Technology substitution risk is another key force, where older thermal and chemical methods face competition from advanced UV-C and vaporized sterilization techniques. Moreover, the increasing public and regulatory pressure regarding environmental sustainability is forcing manufacturers to innovate systems that reduce water consumption, minimize harsh chemical residues, and improve energy efficiency, making green innovation a critical competitive differentiator and market influencer.

Segmentation Analysis

The Disinfectors Market is comprehensively segmented based on technology, product type, end-user application, and geographical region, providing granular insights into demand patterns and competitive strategies. The technological landscape is diverse, ranging from traditional thermal disinfection (moist heat) to advanced chemical and radiation-based methods, with recent growth heavily skewed toward low-temperature options required for sophisticated, heat-sensitive medical devices such as flexible endoscopes and advanced monitoring probes. The sophistication of segmentation allows market players to tailor product development and marketing efforts precisely to the specific needs of high-volume hospitals versus specialized ambulatory surgical centers, accounting for differences in reprocessing capacity, regulatory demands, and budget constraints.

Product type segmentation reveals a dominant share held by automated washer-disinfectors, essential for initial cleaning and high-level disinfection (HLD) of reusable surgical instruments. However, the fastest growth is observed in dedicated endoscope reprocessors, reflecting the rising volume of minimally invasive procedures globally and the specific, high-risk nature of endoscope contamination. End-user categorization clearly highlights hospitals and specialized sterile processing departments (SPDs) as the largest consumers, given their volume of critical and semi-critical device reprocessing. Nonetheless, the pharmaceutical and biotechnology sectors are rapidly increasing their adoption of environmental and surface disinfection systems to maintain required cleanroom standards and Good Manufacturing Practices (GMP).

- Product Type:

- Washer-Disinfectors (Manual, Semi-Automated, Fully Automated)

- Automatic Endoscope Reprocessors (AERs)

- Steam Sterilizers (Autoclaves)

- UV-C Disinfection Systems (Mobile and Fixed)

- Chemical High-Level Disinfectants and Wipes

- Airborne Pathogen Disinfection Systems

- Technology:

- Thermal Disinfection (Moist Heat, Dry Heat)

- Chemical Disinfection (Glutaraldehyde, Peracetic Acid, Hydrogen Peroxide)

- Radiation Disinfection (UV-C, Pulsed Xenon)

- Vaporized Hydrogen Peroxide (VHP) Systems

- Ozone Disinfection

- End-User:

- Hospitals and Surgical Centers (Largest Share)

- Ambulatory Surgical Centers (ASCs)

- Pharmaceutical and Biotechnology Companies (Fastest Growing)

- Medical Device Manufacturing Facilities

- Clinical Diagnostic Laboratories

- Research and Academic Institutions

- Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Disinfectors Market

The value chain for the Disinfectors Market begins with upstream suppliers providing critical raw materials and components, predominantly specialized stainless steel, advanced polymers for housing and tubing, precise control electronics (sensors, microprocessors), and formulation chemicals for liquid disinfectants. Given the highly technical nature of the equipment, relationships with component suppliers focusing on reliability and regulatory compliance (e.g., ISO certifications for material quality) are paramount. Upstream analysis focuses heavily on supply chain stability, as disruptions in electronic component manufacturing or specialized material sourcing can severely impact production timelines and costs for complex automated units. Manufacturers are increasingly integrating vertical control over certain critical components to mitigate these risks and ensure quality control in adherence to medical device standards.

The manufacturing and assembly phase involves complex integration of thermal, chemical delivery, and electromechanical systems, followed by rigorous testing and validation protocols mandated by global regulatory bodies such as the FDA (in the U.S.) and European Notified Bodies. Distribution channels are highly specialized, often relying on a blend of direct sales forces for large hospital systems and specialized third-party distributors who possess expertise in sterile processing equipment installation, validation, and maintenance. Direct channels are preferred for high-value, complex systems requiring intensive training, while indirect channels using regional distributors are effective for reaching smaller clinics and overseas markets, balancing logistical costs with market reach.

The downstream activities involve installation, comprehensive user training, validation testing (IQ, OQ, PQ protocols), and ongoing lifecycle management, including maintenance and chemical replenishment services. Post-sales service is a critical component of the value proposition, often generating substantial recurring revenue streams. Due to the critical nature of disinfection processes, the reliability and speed of technical support are key competitive differentiators. End-users demand robust maintenance contracts to ensure minimal downtime, as non-functioning disinfection equipment can halt critical hospital operations, placing significant emphasis on rapid response and predictive maintenance capabilities, increasingly utilizing IoT connectivity for remote diagnostics.

Disinfectors Market Potential Customers

The primary and largest volume buyers (End-Users) of disinfectors are institutional healthcare providers, specifically large multi-specialty hospitals and dedicated surgical centers. These customers require high-throughput, validated systems, including centralized sterile processing departments (SPDs) equipped with multiple high-capacity washer-disinfectors and steam sterilizers to process thousands of instruments daily. Their purchasing decisions are heavily influenced by regulatory compliance, long-term operational efficiency (reducing utility consumption), and integration capabilities with existing hospital IT and tracking systems (like instrument tracking software), prioritizing equipment that minimizes manual intervention and maximizes patient safety standards.

Secondary high-growth customer segments include ambulatory surgical centers (ASCs) and specialized outpatient clinics (e.g., GI endoscopy units and dental clinics). These smaller entities often require smaller footprint, more versatile, and cost-effective solutions, such as compact Automatic Endoscope Reprocessors (AERs) and specialized benchtop sterilization units. Their demand is driven by the rising shift toward outpatient care, which necessitates adherence to the same rigorous disinfection standards as acute care hospitals but within constrained space and budgetary frameworks. These buyers value ease of use, rapid cycle times, and robust customer support to ensure compliance without dedicated, full-time SPD staff.

Non-traditional, yet rapidly expanding, customer bases include pharmaceutical and biotechnology manufacturing facilities, which utilize industrial-grade disinfectors and advanced UV systems for environmental control within cleanrooms and laboratories. Furthermore, public health entities, research institutions, and large commercial facilities (like airports and schools, particularly post-COVID-19) are increasingly investing in specialized mobile and area disinfection solutions (e.g., hydrogen peroxide vapor generators and mobile UV-C robots) for high-touch surface and air decontamination, broadening the market scope beyond traditional medical applications and creating diversified revenue streams for manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | CAGR 9.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | STERIS plc, Getinge AB, 3M Company, Cantel Medical (now part of STERIS), Ecolab Inc., Advanced Sterilization Products (ASP), Shinva Medical Instrument Co., Ltd., Belimed AG, MMM Group, Steelco S.p.A., Sotera Health LLC, Tuttnauer, TSO3 Inc. (now part of Getinge), Atmos Aeronautical & Medical, Hoshizaki Corporation, Miele Professional, CISA Group, Midmark Corporation, Matachana Group, SAKURA SI Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disinfectors Market Key Technology Landscape

The technology landscape of the Disinfectors Market is characterized by a dynamic evolution away from manual chemical soaking toward integrated, verifiable, and low-temperature solutions. The primary shift is driven by the need to effectively process complex, heat-sensitive instruments like flexible endoscopes without damaging delicate optics or electronic components. Vaporized Hydrogen Peroxide (VHP) sterilization systems and advanced ozone disinfection units represent crucial low-temperature modalities, gaining significant traction due to their rapid cycle times, non-toxic byproducts (water and oxygen), and excellent material compatibility, positioning them as superior alternatives to traditional Ethylene Oxide (EtO) systems, which face increasing regulatory scrutiny due to carcinogenicity concerns.

In parallel, the market for Automatic Endoscope Reprocessors (AERs) continues to innovate, focusing on optimizing fluid mechanics and incorporating advanced channel flushing verification systems to ensure that every lumen is adequately exposed to high-level disinfectants. Furthermore, UV-C light technology, both static and robotic, is emerging as a critical supplemental tool for terminal room disinfection. These systems utilize germicidal light at specific wavelengths (254 nm) to inactivate microorganisms rapidly on surfaces and in the air. The newest generation of UV-C disinfectors integrates AI for path planning and dosage mapping, ensuring consistent microbial kill rates and providing verifiable documentation of treatment coverage, significantly improving the efficacy of hospital environmental services.

Connectivity and data management are rapidly transforming from optional features to essential requirements. Modern disinfectors incorporate Internet of Things (IoT) sensors and connectivity modules that enable real-time monitoring of operational parameters (temperature curves, chemical concentration, pressure integrity). This digitalization supports remote diagnostics, automated logging of cycle data for regulatory audit purposes, and integration with hospital data systems to link instrument reprocessing records directly to specific patient procedures. This push toward digital integration enhances accountability, minimizes human error, and facilitates adherence to increasingly complex global standards for sterile reprocessing.

Regional Highlights

Geographical analysis reveals significant disparities in market maturity, regulatory rigor, and investment capacity, directly influencing the adoption rates of advanced disinfector technologies. North America, encompassing the United States and Canada, holds the largest market share, characterized by high disposable income, established universal adherence to complex reprocessing protocols (e.g., AAMI standards), and rapid uptake of cutting-edge technology such as VHP and robotic UV-C systems. The highly competitive and concentrated healthcare landscape in the U.S. drives constant demand for equipment upgrades to maximize throughput and minimize legal risk associated with HAIs.

Europe represents the second-largest market, with significant contributions from Germany, the U.K., and France, where centralized healthcare systems heavily influence purchasing decisions, often favoring large, centralized sterile service facilities (CSSDs). European adoption is strongly guided by harmonized standards (e.g., European Medical Device Regulation – MDR), promoting sustainable and resource-efficient disinfection practices. The primary drivers here include aging infrastructure replacement programs and the push toward reducing chemical usage, favoring automated washer-disinfectors and thermal disinfection where appropriate.

The Asia Pacific (APAC) region is poised for the most accelerated growth. This growth is fueled by substantial investments in public and private hospital infrastructure, particularly in fast-developing economies like China, India, and Southeast Asia. As middle-class populations grow and demand for high-quality healthcare increases, there is a consequential rise in the implementation of Western-standard infection control practices. While cost remains a significant barrier, increasing awareness of HAI risks and government initiatives promoting medical hygiene are rapidly driving the adoption of basic and intermediate disinfection equipment, creating massive potential for market penetration for standardized, high-volume products.

- North America: Dominant market share; driven by stringent FDA regulations, high healthcare spending, early adoption of automated and robotic disinfection systems, and strong presence of leading manufacturers. Focus on high-throughput, integrated Sterile Processing Departments (SPDs).

- Europe: Mature market with steady growth; regulatory environment driven by MDR; emphasis on eco-friendly solutions, centralized sterilization services, and infrastructure modernization across key economies like Germany and the UK.

- Asia Pacific (APAC): Highest CAGR; rapid expansion of healthcare infrastructure, increasing awareness of infectious disease control, government focus on hygiene improvement, particularly strong growth in China and India. Growing demand for affordable, reliable automated solutions.

- Latin America (LATAM): Moderate growth; expansion driven by medical tourism and increasing private sector investment; market sensitive to economic instability and reliance on imports for advanced machinery.

- Middle East & Africa (MEA): Emerging market; growth concentrated in GCC countries due to significant government healthcare investment and the establishment of international-standard hospitals. Focus remains on robust basic disinfection equipment and addressing resource constraints in less developed areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disinfectors Market.- STERIS plc

- Getinge AB

- 3M Company

- Ecolab Inc.

- Advanced Sterilization Products (ASP)

- Belimed AG

- MMM Group

- Steelco S.p.A.

- Cantel Medical (now part of STERIS)

- Tuttnauer

- TSO3 Inc. (now part of Getinge)

- Shinva Medical Instrument Co., Ltd.

- Matachana Group

- CISA Group

- Sotera Health LLC

- Hoshizaki Corporation

- Miele Professional

- Midmark Corporation

- Nanosonics Limited

- Sterlink Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Disinfectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Disinfectors Market?

Market growth is primarily driven by the escalating global incidence of Healthcare-Associated Infections (HAIs), the mandatory implementation of stringent infection control regulations by global health authorities, and the necessity to adopt advanced automated reprocessing systems for complex medical devices.

How is technological innovation impacting traditional chemical disinfection methods?

Innovation is shifting the market towards low-temperature, rapid, and verifiable solutions, such as Vaporized Hydrogen Peroxide (VHP) and UV-C light systems. These technologies are challenging traditional chemical methods by offering superior material compatibility, reduced toxic residue, and enhanced cycle monitoring capabilities, particularly crucial for sensitive devices like endoscopes.

Which end-user segment accounts for the largest share of the Disinfectors Market?

Hospitals and centralized sterile processing departments (SPDs) constitute the largest end-user segment due to the immense volume of critical and semi-critical devices they must reprocess daily, requiring high-capacity, integrated washer-disinfectors and sterilizers to maintain compliance and operational throughput.

What role does AI play in modern disinfection equipment?

AI is integrated into modern disinfection equipment primarily for predictive maintenance, optimizing reprocessing cycles based on real-time data analysis, and providing verifiable compliance records through automated auditing and robotic coverage planning, minimizing human error and maximizing equipment uptime.

Why is the Asia Pacific region projected to exhibit the highest growth rate?

APAC's high growth is attributed to significant ongoing investments in healthcare infrastructure development, rapidly increasing awareness of infection control standards, and rising medical tourism, leading to greater adoption of automated disinfection equipment across emerging economies like China and India to meet global quality benchmarks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dental Washer and Washer Disinfectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dental Washer-Disinfectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Endoscope Washer-Disinfectors Market Size Report By Type (Single Chamber, Multi Chamber), By Application (Single Chamber, Multi Chamber), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Washer-Disinfectors Market Size Report By Type (Benchtop Dental Washer-Disinfectors, Undercounter Dental Washer-Disinfectors, Freestanding Dental Washer-Disinfectors), By Application (Dental Clinics, Hospitals, Laboratories), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Washer/Washer Disinfectors Market Statistics 2025 Analysis By Application (Dental Clinic, Hospital, Laboratories), By Type (Benchtop Dental Washer-Disinfectors, Undercounter Dental Washer-Disinfectors, Freestanding Dental Washer-Disinfectors), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager