Dispensing Nozzles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433331 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dispensing Nozzles Market Size

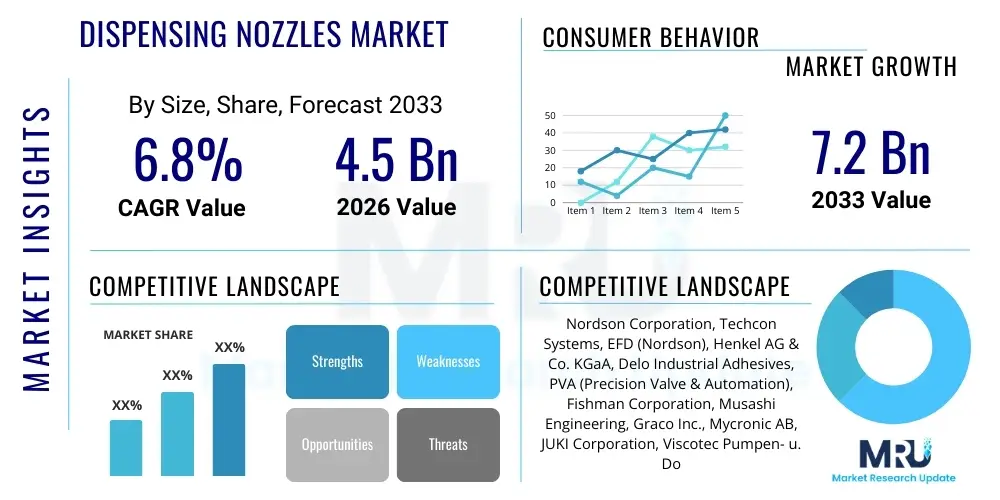

The Dispensing Nozzles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Dispensing Nozzles Market introduction

The Dispensing Nozzles Market encompasses the manufacturing, distribution, and utilization of precision components designed to control the flow, pattern, and volume of various fluids, including adhesives, sealants, lubricants, coatings, and solder pastes, across diverse industrial applications. These components are critical for achieving high-precision material placement in automated and semi-automated assembly processes. Dispensing nozzles, ranging from standard plastic tapered tips to specialized stainless steel micro-dispensing systems, are essential for ensuring product quality, process efficiency, and material conservation in sectors demanding stringent quality control and miniaturization, such as electronics, medical device manufacturing, and automotive assembly. The effectiveness of a dispensing system is heavily reliant on the material, geometry, and tolerance of the nozzle, necessitating ongoing innovation in material science and design engineering to meet evolving industry requirements for speed and accuracy.

The primary application areas for dispensing nozzles include micro-electronics assembly, where they are vital for applying encapsulated materials and conductive adhesives; medical device manufacturing, requiring sterile and highly precise application of biocompatible materials; and automotive production, used for applying structural adhesives and sealants for lightweighting and enhanced safety. The core benefits derived from advanced dispensing nozzle technology include improved volumetric accuracy, reduced material waste, faster production cycle times, and enhanced reliability of the final product. Furthermore, the specialized design of certain nozzles, such such as jetting or spray tips, allows for non-contact dispensing, which is crucial for sensitive substrates and extremely high-speed applications, significantly driving their adoption in high-volume manufacturing environments globally.

Key driving factors fueling the expansion of this market include the global trend toward automation and miniaturization, particularly in the consumer electronics and semiconductor industries, where smaller components necessitate ultra-fine dispensing resolution. The increasing demand for electric vehicles (EVs) is also a significant catalyst, as battery pack assembly requires extensive use of specialized thermal interface materials (TIMs) and structural adhesives, which rely on robust, high-throughput dispensing systems. Regulatory requirements, particularly in the medical and pharmaceutical sectors demanding verifiable and repeatable dispensing processes, further necessitate the use of high-quality, certified dispensing nozzles, thus sustaining market growth and stimulating investment in advanced materials like ceramic and specialized polymers for enhanced durability and chemical resistance.

Dispensing Nozzles Market Executive Summary

The Dispensing Nozzles Market is characterized by robust growth, primarily driven by the escalating demand for advanced automation solutions and the continuous trend of product miniaturization across high-tech manufacturing industries. Business trends indicate a strong shift towards integrated dispensing solutions, where the nozzle is viewed not as a standalone consumable but as a critical component of a larger, smart dispensing system equipped with feedback loops and real-time monitoring capabilities. Leading manufacturers are focusing heavily on developing chemically inert and wear-resistant materials, such as specific grades of PTFE and hardened steel alloys, to cope with the aggressive characteristics of modern industrial fluids (e.g., highly abrasive thermal pastes or high-viscosity epoxy resins), thereby extending nozzle lifespan and improving process uptime. Strategic mergers, acquisitions, and partnerships aimed at strengthening technological portfolios in areas like micro-jetting and piezoelectric dispensing technology are common among market leaders seeking to capture niche high-precision segments.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, fueled by massive investments in semiconductor fabrication plants (fabs) and the prolific expansion of electronics manufacturing in countries such as China, South Korea, and Taiwan. This region's need for high-speed, repeatable dispensing solutions for wafer-level packaging and surface mount technology (SMT) applications creates substantial demand for premium-grade nozzles. North America and Europe, while representing more mature markets, exhibit consistent demand driven by the stringent quality requirements of the aerospace, medical device, and specialized automotive sectors, where adoption is centered on ultra-high precision, certified dispensing equipment and highly specialized application tooling. The Middle East and Africa (MEA) and Latin America are emerging markets, primarily driven by localized growth in infrastructure projects and basic manufacturing, focusing more on high-volume, standard-grade dispensing applications for construction chemicals and packaging.

Segment trends highlight the increasing prominence of automated dispensing systems, where specialized nozzles designed for robotic integration command a higher market share due to their superior positional accuracy and rapid throughput capabilities. The segmentation by material reveals a growing preference for specialty materials (ceramics, tungsten carbide) over conventional plastic or metal, particularly in applications involving harsh chemicals or extremely tight tolerances (less than 50 microns). Furthermore, the adhesive and sealant application segment remains the largest by volume, benefiting from its ubiquitous use in assembly operations across nearly every industrial vertical. However, the coatings and encapsulation materials segment is projecting the fastest CAGR, stimulated by the protective requirements of sensitive electronic components exposed to harsh environmental conditions, thereby demanding advanced, conformal coating dispensing technologies that utilize sophisticated nozzle geometries for uniform coverage.

AI Impact Analysis on Dispensing Nozzles Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dispensing Nozzles Market predominantly center on how AI can enhance dispensing precision, optimize material usage, predict nozzle wear, and automate calibration processes. Common themes include the integration of machine learning algorithms for real-time viscosity compensation, ensuring consistent output despite temperature fluctuations or material batch variations. Users are keen to understand if AI can reduce the frequency of manual nozzle inspection and replacement by predicting degradation based on flow rate anomalies, thereby minimizing unscheduled downtime. Furthermore, there is significant interest in using generative AI models to design specialized nozzle geometries optimized for non-Newtonian fluid dynamics, achieving material specific dispensing patterns that were previously too complex or time-consuming for traditional engineering methods. The overall expectation is that AI will transform dispensing from a mechanically deterministic process into an intelligent, adaptive, and predictive operation.

The practical application of AI in this domain involves leveraging sensor data—such as pressure, temperature, and visual inspection feedback (via high-speed cameras)—to train models that instantly adjust parameters like valve timing, plunger speed, and substrate distance. This real-time feedback loop allows for dynamic calibration, significantly exceeding the capabilities of static, pre-programmed dispensing profiles. For manufacturers, AI-driven process optimization translates directly into higher first-pass yield rates and substantial reductions in expensive material waste, a critical factor given the high cost of many advanced adhesives and thermal compounds. This predictive maintenance capability ensures that nozzles are replaced optimally, maximizing their operational life while preventing catastrophic dispensing failures that could scrap entire batches of high-value products like semiconductor chips or medical implants.

The impact extends to supply chain and inventory management, where AI systems can analyze usage patterns across multiple production lines and predict future consumable needs, ensuring just-in-time delivery of specific nozzle types and materials. This integration of process intelligence elevates the role of the nozzle from a simple consumable to a smart tool within the manufacturing ecosystem. Companies adopting this technology gain a significant competitive advantage through enhanced process stability, particularly crucial when transitioning to more complex, multi-material dispensing applications, solidifying AI as a core enabler for next-generation automated dispensing systems.

- AI enhances real-time volumetric precision by compensating for material viscosity and temperature changes.

- Machine learning algorithms predict nozzle wear and tear, facilitating predictive maintenance and reducing unscheduled downtime.

- AI optimizes complex dispensing paths and speeds for robotic systems, maximizing throughput and material placement accuracy.

- Generative AI models accelerate the design of novel, application-specific nozzle geometries for non-standard fluids.

- Automated visual inspection integrated with AI minimizes human error in defect detection during the dispensing process.

- AI-driven inventory management optimizes supply chains for high-consumption nozzle types based on forecast demand.

DRO & Impact Forces Of Dispensing Nozzles Market

The dynamics of the Dispensing Nozzles Market are shaped by a powerful interplay of drivers (D), restraints (R), and opportunities (O), which together dictate the investment landscape and strategic direction. The primary drivers are the accelerating pace of automation across global manufacturing sectors, coupled with the unrelenting demand for miniaturization in consumer electronics and medical devices, necessitating ultra-precise fluid handling. These trends force manufacturers to invest in advanced nozzle designs capable of dispensing sub-microliter volumes with high repeatability and speed. Restraints, conversely, include the high capital expenditure associated with integrated, high-precision dispensing equipment, especially systems utilizing micro-jetting technology, which limits adoption among smaller manufacturers. Furthermore, the chemical incompatibility of certain advanced industrial fluids with standard nozzle materials necessitates constant material research, increasing R&D costs and lead times. Opportunities lie in the burgeoning electric vehicle (EV) market, particularly the need for highly effective thermal management solutions requiring specialized nozzles for high-viscosity TIM application, and the rapid expansion of the bio-medical sector demanding sterile, disposable, and certified dispensing components.

The market is subject to intense impact forces stemming from regulatory pressure and technological shifts. The impact of industry standards, such as ISO 13485 for medical devices and stringent environmental regulations (e.g., limits on volatile organic compounds – VOCs), compels nozzle manufacturers to develop chemically resistant and environmentally safe solutions. Technological impact forces include the continuous evolution of industrial adhesives and sealants towards more complex chemistries (e.g., two-part epoxies, UV-curable resins), which place higher demands on nozzle material inertness and mixing capabilities. The constant pressure from end-users for "zero-defect" production mandates the adoption of nozzles with extremely tight manufacturing tolerances, ensuring consistency and contributing to the overall quality assurance framework of automated assembly lines. Geopolitical factors affecting raw material supply chains for specialized polymers and metals also impose external impact forces, influencing production costs and pricing strategies.

The synthesis of these DRO forces indicates a market trajectory focused on specialized, high-performance nozzles rather than commoditized products. The increasing complexity of dispensed materials requires vendors to offer comprehensive material compatibility testing alongside their products. The most significant opportunity lies in positioning dispensing nozzles as integrated components of Industry 4.0 systems, enabling connectivity and data exchange to optimize the entire fluid handling process. Conversely, companies failing to innovate in materials science or integrate smart features face increasing competitive pressure. The market is thus pivoting towards intelligent, customized dispensing solutions that address specific industrial material challenges, driving sustainable growth primarily within the high-value, high-precision segments.

Segmentation Analysis

The Dispensing Nozzles Market is meticulously segmented based on critical technical and application parameters, providing a detailed understanding of market dynamics and varying demand profiles across industries. Key segmentations include Material Type, which distinguishes between polymer-based (e.g., polypropylene, PTFE), metal-based (e.g., stainless steel, brass), and specialty materials (e.g., ceramics, tungsten carbide); the degree of precision required, typically categorized into standard dispensing, high-precision, and micro-dispensing; and the End-User Industry, highlighting major consumers such as Electronics, Automotive, Healthcare, and Aerospace. This detailed segmentation allows stakeholders to accurately gauge demand trends, focus R&D efforts on specific material challenges (e.g., erosion resistance for abrasive fillers), and tailor product offerings to the stringent quality requirements of high-value sectors like medical device assembly.

Segmentation by Type further separates nozzles into tapered tips, bent tips, straight wall tips, specialty jetting nozzles, and dispensing needles. Tapered tips are highly favored for general high-viscosity fluid applications due to their ease of use and ability to prevent clogging, forming the backbone of standard assembly operations. Conversely, micro-dispensing needles and jetting nozzles, engineered with extremely fine bores and sophisticated internal geometries, cater exclusively to applications requiring micron-level accuracy, such as advanced semiconductor packaging and microfluidic device fabrication, driving premium pricing and technological investment. The choice of segmentation parameters is fundamentally driven by the physical properties of the fluid being dispensed (viscosity, particle load, reactivity) and the required output characteristics (dot size, line width, speed).

The evolution of industrial materials dictates the shifting landscape within these segments. For instance, the rise of specialized electrically conductive and thermal interface materials (ECAs, TIMs) in electronics drives demand in the metal and specialty materials segments, as these materials often contain abrasive particulate fillers that rapidly degrade standard plastic nozzles. Conversely, the healthcare sector’s focus on single-use applications sustains demand for cost-effective, sterile plastic dispensing tips, but with increasing requirements for certified biocompatibility and stringent quality control processes. Analyzing these segments reveals that while volume is dominated by lower-cost polymer nozzles, the value and future growth reside disproportionately in the highly technical, specialty materials segment necessary for next-generation automated assembly and advanced manufacturing techniques.

- By Material Type:

- Polymer/Plastic (Polypropylene, PTFE, Polyethylene)

- Metal (Stainless Steel, Brass, Nickel)

- Specialty Materials (Ceramic, Tungsten Carbide, Glass)

- By Tip Geometry/Type:

- Tapered Tips

- Straight Wall Tips

- Bent/Angled Tips

- Jetting Nozzles

- Spray Nozzles

- Dispensing Needles (Blunt End, Tapered, Precision)

- By Application Type:

- Adhesives and Sealants Dispensing

- Solder Paste and Flux Application

- Grease and Lubricant Dispensing

- Coating and Encapsulation Material Application

- Thermal Interface Material (TIM) Dispensing

- By End-User Industry:

- Electronics and Semiconductor

- Automotive and Transportation

- Medical Devices and Healthcare

- Aerospace and Defense

- Packaging and Consumer Goods

- General Industrial Assembly

Value Chain Analysis For Dispensing Nozzles Market

The value chain for the Dispensing Nozzles Market begins with raw material sourcing, primarily involving specialized polymers (e.g., medical-grade polypropylene, high-density polyethylene, chemically inert PTFE) and high-grade metals (e.g., surgical stainless steel, carbide alloys). The upstream segment is dominated by chemical and metallurgical suppliers who must provide materials meeting strict dimensional tolerances and chemical purity standards. Precision manufacturing and conversion is the next critical stage, involving specialized processes like injection molding for polymer tips and high-precision CNC machining or micro-drilling for metal needles and jetting components. This stage adds significant value through proprietary design engineering, ensuring the internal geometry of the nozzle optimizes fluid flow characteristics and minimizes shear stress on sensitive materials. Quality control at this stage, including laser measurement systems, is paramount to maintaining the integrity of the dispensing process downstream.

The downstream segment focuses on market access, distribution, and end-user integration. Dispensing nozzles are typically distributed through two primary channels: direct sales to large OEMs (Original Equipment Manufacturers) who purchase in high volumes for their automated production lines, and indirect distribution via specialized industrial distributors, automation system integrators, and fluid handling consumables suppliers. The latter often serve smaller enterprises and provide value-added services such as material testing, system calibration, and technical support. Since the nozzle is a consumable component, strong inventory management and efficient logistics are crucial for distributors to ensure continuous supply to high-throughput manufacturing operations, minimizing stockouts that could halt production lines.

The increasing complexity of dispensing systems has fostered a tight integration between the nozzle manufacturer and the manufacturers of dispensing robots and fluid control systems (pumps, valves). Direct collaboration ensures that nozzle design is optimized for specific machinery and material viscosity, creating closed-loop solutions. For example, a manufacturer of piezoelectric jetting valves often works directly with specialty nozzle producers to co-design tips that maximize jetting frequency and placement accuracy. The value chain is shifting towards a service-oriented model where technical consultation regarding material compatibility and process optimization is as critical as the physical product itself. End-users seek comprehensive support to implement complex micro-dispensing processes, driving the importance of indirect channels that offer localized technical expertise and fast, reliable delivery of certified components.

Dispensing Nozzles Market Potential Customers

The primary customers and end-users of dispensing nozzles are global manufacturers operating highly automated assembly and production lines where precise material deposition is mandatory for product functionality and longevity. The Electronics and Semiconductor industries represent the largest and most technologically demanding customer base, utilizing nozzles for applying solder paste, flux, underfill, glob top, and thermal management materials during surface mount technology (SMT) and advanced packaging (e.g., 3D stacking, fan-out packaging). These customers require micro-dispensing capabilities (often below 100 µm dot size) and materials resistant to corrosive chemicals and high temperatures, leading them to favor high-cost specialty material nozzles and integrated jetting systems.

Another major segment is the Automotive industry, particularly those involved in Electric Vehicle (EV) and advanced powertrain manufacturing. These customers heavily rely on nozzles for high-volume application of structural adhesives, body sealants, gasketing materials, and critically, thermal interface materials (TIMs) used in battery module assembly and electronic control units. The requirement here is throughput and robustness; nozzles must handle highly viscous, often abrasive, materials over long production cycles with minimal erosion. Manufacturers in the medical device and pharmaceutical sectors form a distinct customer group, demanding sterile, disposable, and often custom-designed polymer nozzles (e.g., for catheter bonding or diagnostic strip production), where regulatory compliance, validation, and lot traceability are non-negotiable purchasing criteria.

Furthermore, general industrial assembly, encompassing packaging, consumer appliance manufacturing, and construction, constitutes a substantial, although less technologically intensive, customer base. These end-users primarily consume standard polymer tapered tips and metal nozzles for applying general-purpose adhesives, lubricants, and sealants. However, the emerging aerospace and defense sectors, due to their requirements for applying highly specialized, high-performance materials (e.g., fire-resistant sealants, high-strength structural epoxies) in extreme environments, represent a high-value niche market. These customers demand the highest level of material certification and consistency, ensuring a continuous market for premium, precision-engineered dispensing solutions capable of meeting exacting Mil-Spec and Aerospace industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Techcon Systems, EFD (Nordson), Henkel AG & Co. KGaA, Delo Industrial Adhesives, PVA (Precision Valve & Automation), Fishman Corporation, Musashi Engineering, Graco Inc., Mycronic AB, JUKI Corporation, Viscotec Pumpen- u. Dosiertechnik GmbH, KRAS Recycling, GPD Global, EIS, Illinois Tool Works (ITW), DOPAG, Permabond Engineering Adhesives, Loctite (Henkel), SEMCO (PPG) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dispensing Nozzles Market Key Technology Landscape

The technology landscape governing the Dispensing Nozzles Market is characterized by a rapid evolution toward non-contact dispensing methods and the utilization of highly specialized, durable materials. A significant technological shift involves the transition from traditional time/pressure dispensing, which is inherently subject to fluid viscosity changes, to volumetric dispensing technologies, such as positive displacement pumps and screw valves, which ensure highly accurate and consistent output volume regardless of external fluid characteristics. Nozzle technology must therefore be precisely matched to these advanced valve systems, requiring extremely tight tolerance control, particularly at the nozzle exit orifice, to handle the high pressures and high shear forces generated by these modern pumping mechanisms. Furthermore, advancements in specialized polymer and ceramic sintering technologies are enabling the production of nozzles with unparalleled smoothness and chemical inertness, crucial for handling demanding, abrasive materials like conductive silver epoxies and heavily filled thermal pastes without rapid internal erosion or clogging.

The most disruptive technologies currently impacting the market are piezoelectric jetting nozzles and specialized micro-dispensing tips. Piezoelectric jetting allows for non-contact dispensing of fluid droplets at extremely high frequencies (up to 1,000 drops per second), producing micro-dots below 50 microns in diameter. This technology is essential for the highest-density semiconductor packaging applications where traditional contact dispensing is impossible. The corresponding nozzle tips for these jetting systems are proprietary, utilizing advanced materials like tungsten carbide or highly polished ceramics to manage the fluid dynamics at ultra-high speed and ensure drop-on-demand reliability. Simultaneously, the integration of advanced sensors and software—forming the core of Industry 4.0—is transforming nozzles into smart components. This includes integrating temperature sensors directly into the dispensing head or using machine vision systems to perform real-time geometrical verification of the dispensed material pattern, automatically signaling necessary adjustments to the nozzle or pump parameters.

Future technological advancements are focused on multi-material dispensing capabilities and enhanced maintenance features. Research efforts are targeting nozzles capable of handling two-part reactive materials with integrated mixing chambers situated immediately at the tip, ensuring optimal reaction time and precise placement of the activated material. Furthermore, self-cleaning and modular nozzle assemblies are gaining traction to minimize changeover time and labor costs. The push for sustainability also drives material innovation, focusing on bio-degradable or easily recyclable polymer tips for high-volume, disposable applications within the medical and consumer goods sectors. The technological trajectory firmly points toward customized, durable, and highly intelligent nozzle solutions designed to maximize throughput and precision in next-generation automated production environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for growth in the Dispensing Nozzles Market, fueled primarily by the overwhelming concentration of electronics, semiconductor manufacturing (foundries and packaging), and high-volume automotive production (especially EV manufacturing) across China, South Korea, Taiwan, and Japan. The region's focus on high-density interconnection (HDI) and advanced packaging techniques generates enormous demand for ultra-fine pitch dispensing needles and high-speed jetting nozzles for applications like underfill and conductive adhesive application. Government initiatives supporting automation and smart factory development further accelerate the adoption of premium, precision dispensing technology.

- North America: This region represents a mature, high-value market driven by the stringent quality requirements of the aerospace, defense, and advanced medical device manufacturing sectors. Demand is characterized by the need for highly certified, durable, and traceable dispensing components, often made from specialty materials like stainless steel or ceramic. Investment is concentrated on leveraging AI and machine vision integration with dispensing systems to ensure compliance with strict regulatory standards (e.g., FDA validation for medical applications), prioritizing consistency and long-term process reliability over sheer volume.

- Europe: Europe maintains a strong market share, primarily driven by the sophisticated automotive industry (focusing on lightweighting and structural bonding) and advanced industrial machinery manufacturing base (Germany, Italy). European demand is shifting towards sustainable and specialized application solutions, focusing on nozzles designed for highly viscous, two-component adhesives and sealants required for structural integrity in modern vehicle chassis and renewable energy components. Regulatory pressure concerning material safety and traceability also influences nozzle design and material selection.

- Latin America (LATAM): The LATAM market is growing steadily, mainly driven by expansion in infrastructure, packaging, and localized consumer goods manufacturing. The demand profile is generally focused on cost-effective, high-volume polymer nozzles for general assembly and sealing applications. Market adoption of high-precision technologies is slower compared to APAC or North America but is increasing with foreign investment in advanced manufacturing facilities, particularly in Mexico and Brazil.

- Middle East and Africa (MEA): MEA is an emerging market, with demand concentrated in infrastructure, construction chemicals, and oil/gas sectors, requiring robust nozzles for applying heavy-duty sealants and protective coatings. While the overall volume is low, specific industrial hubs show rapid adoption of automated dispensing solutions to improve efficiency in large-scale manufacturing and assembly operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dispensing Nozzles Market.- Nordson Corporation

- Techcon Systems

- EFD (Nordson)

- Henkel AG & Co. KGaA

- Delo Industrial Adhesives

- PVA (Precision Valve & Automation)

- Fishman Corporation

- Musashi Engineering

- Graco Inc.

- Mycronic AB

- JUKI Corporation

- Viscotec Pumpen- u. Dosiertechnik GmbH

- KRAS Recycling

- GPD Global

- EIS

- Illinois Tool Works (ITW)

- DOPAG

- Permabond Engineering Adhesives

- Loctite (Henkel)

- SEMCO (PPG)

Frequently Asked Questions

Analyze common user questions about the Dispensing Nozzles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of materials are commonly dispensed using precision nozzles?

Precision nozzles are utilized to dispense a wide range of industrial fluids, including highly viscous structural adhesives (epoxies, urethanes), sealants, thermal interface materials (TIMs), solder pastes, flux, lubricants, and specialized conductive inks required for advanced electronic assembly and battery manufacturing.

How does nozzle material choice impact the dispensing process?

The nozzle material (polymer, stainless steel, ceramic) directly affects chemical compatibility, wear resistance, and cost. Specialty materials like tungsten carbide are necessary for abrasive or highly filled fluids (e.g., thermal pastes) to prevent rapid erosion, ensuring consistent flow rate and tip geometry over extended production cycles.

What is the primary difference between time/pressure dispensing and volumetric dispensing?

Time/pressure dispensing relies on applying air pressure for a set duration, making it sensitive to fluid viscosity changes. Volumetric dispensing, utilized with piston or screw valves, moves a precise, measured volume of material, offering superior accuracy and repeatability essential for high-precision applications regardless of material variation.

Which industry currently drives the highest demand for micro-dispensing nozzles?

The Electronics and Semiconductor industry is the dominant driver for micro-dispensing nozzles, requiring sub-microliter dispensing capabilities for applications such as underfill, glob top, and flux application in advanced packaging, including flip-chip and wafer-level chip-scale packaging (WLCSP).

What role does automation play in the adoption of advanced dispensing nozzle technology?

Automation requires highly consistent and durable nozzles that can integrate seamlessly with robotic systems and high-speed valves. The shift toward Industry 4.0 necessitates intelligent nozzles optimized for connectivity, precision, and minimizing maintenance downtime, driving demand for specialized materials and jetting technologies.

--- End of Report Content ---

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Dispensing Nozzles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Industrial Micro Dispensing Nozzles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dispensing Nozzles Market Statistics 2025 Analysis By Application (Food, Medical, Semiconductor & Electronics, Others), By Type (Ceramic Nozzles, Metallic Nozzles, Plastic Nozzles), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Micro Dispensing Nozzles Market Statistics 2025 Analysis By Application (Medical, Semiconductor & Electronics, Energy, Others), By Type (Ceramic, Metallic, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager