Electric Car Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433685 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electric Car Market Size

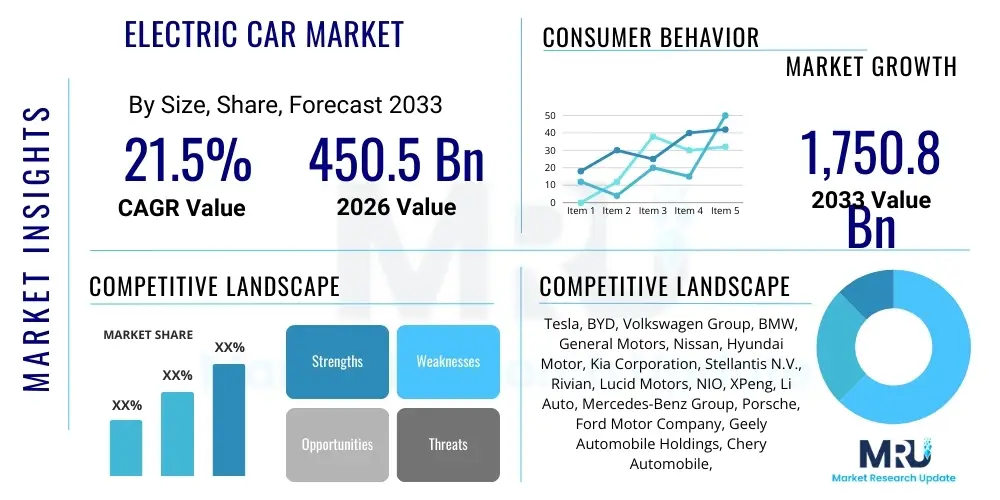

The Electric Car Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 1,750.8 Billion by the end of the forecast period in 2033.

Electric Car Market introduction

The Electric Car Market encompasses the design, manufacture, distribution, and sale of vehicles powered fully or partially by electricity, primarily drawing energy from on-board rechargeable batteries. This includes Battery Electric Vehicles (BEVs), which are purely battery-driven; Plug-in Hybrid Electric Vehicles (PHEVs), which combine electric power with an internal combustion engine; and, to a lesser extent, Fuel Cell Electric Vehicles (FCEVs). The product offering is characterized by high technological integration, focusing on battery density, charging speed, range capabilities, and sophisticated driver assistance systems. These vehicles address critical global mandates for reducing greenhouse gas emissions and achieving energy independence from volatile fossil fuel sources.

Major applications of electric cars span both the passenger vehicle segment, including sedans, SUVs, and compact cars, and the expanding commercial vehicle segment, encompassing delivery vans, heavy-duty trucks, and public transit buses. The primary benefits driving adoption are zero tailpipe emissions in BEVs, significantly lower operating and maintenance costs compared to conventional internal combustion engine (ICE) vehicles, and a superior driving experience characterized by immediate torque and quiet operation. The integration of advanced features such as over-the-air (OTA) updates and autonomous driving capabilities further enhances their market attractiveness and consumer utility.

Key driving factors propelling market expansion include increasingly stringent global environmental regulations, substantial governmental subsidies and tax incentives promoting EV purchases and charging infrastructure deployment, and significant investment by established automotive OEMs and disruptive start-ups into new EV platforms and battery technology research. Furthermore, advancements in battery chemistry, particularly solid-state technology, are addressing historical consumer concerns related to range anxiety and charging infrastructure accessibility, solidifying the market's trajectory towards mass adoption.

Electric Car Market Executive Summary

The Electric Car Market is exhibiting robust expansion, characterized by rapid technological maturation and intensive capital investment across the entire value chain. Key business trends include the vertical integration of battery manufacturing by major automotive OEMs to secure supply chains and mitigate cost volatility, alongside a crucial shift towards software-defined vehicles (SDVs), where revenue generation increasingly relies on subscription services and digital features. The competitive landscape is intensely dynamic, with traditional automotive giants rapidly electrifying their fleets while facing strong competition from pure-play EV manufacturers who possess inherent advantages in software and battery management systems. Supply chain resilience, particularly for critical minerals like lithium and cobalt, remains a central strategic priority for market participants, influencing geopolitical collaborations and sourcing strategies globally.

Regionally, Asia Pacific, led by China, continues to dominate the market in terms of production volume and consumer adoption, supported by aggressive national policy support and extensive public charging networks. Europe follows closely, driven by strict CO2 emission standards and high consumer environmental awareness, particularly in markets like Germany, Norway, and the United Kingdom. North America is accelerating its adoption curve, fueled by significant governmental acts such as the Inflation Reduction Act (IRA) in the United States, which provides substantial consumer tax credits and incentivizes domestic manufacturing. Emerging markets in Latin America and the Middle East are initiating foundational infrastructure projects, indicating future growth potential, albeit at a slower pace due to initial cost barriers.

Segmentation trends indicate the Battery Electric Vehicle (BEV) segment holds the largest and fastest-growing share, driven by improvements in battery range and declining pack costs. The passenger vehicle application segment remains the primary revenue contributor, though the commercial vehicle sector, particularly electric light commercial vehicles (eLCVs) and heavy-duty electric trucks, is poised for exponential growth, driven by fleet operational efficiency requirements and last-mile delivery demands. In terms of componentry, advanced battery technology, focusing on energy density and fast-charging capabilities, represents the most significant area of research and development expenditure, fundamentally determining future market performance and competitiveness.

AI Impact Analysis on Electric Car Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Electric Car Market primarily revolve around three critical domains: the acceleration of autonomous driving capabilities, the optimization of battery performance and lifecycle management, and the enhancement of personalized in-car user experiences. Users frequently question how AI algorithms improve safety features, reduce latency in decision-making for ADAS (Advanced Driver-Assistance Systems), and manage complex sensor fusion required for Level 4 and Level 5 autonomy. Furthermore, significant interest is directed towards AI's role in predictive maintenance for high-voltage systems and optimizing charging schedules based on grid load and driver behavior, addressing concerns related to cost, reliability, and range anxiety. The overarching expectation is that AI will be the fundamental enabling technology for transforming electric vehicles from mere transportation devices into intelligent, networked, and sustainable computing platforms.

AI is fundamentally reshaping the design, manufacturing, and operation of electric vehicles. In manufacturing, AI-powered systems are used for quality control, predictive maintenance of assembly lines, and optimizing complex gigafactory operations, leading to faster production scaling and reduced defects. Operationally, Machine Learning models are crucial for energy management systems, dynamically allocating power between the motor, auxiliary systems, and climate control to maximize range under varying driving conditions. This technological integration not only enhances the vehicle's functional performance but also provides manufacturers with unprecedented data streams, which, when analyzed by AI, inform future design iterations, battery chemistry choices, and software updates.

The strategic deployment of AI ensures competitive differentiation. Companies leveraging generative AI for synthetic data creation are significantly accelerating the training and validation of perception stacks for autonomous driving, overcoming the constraints of real-world data collection. Moreover, AI algorithms are integral to cybersecurity protocols, protecting the vast amounts of vehicle-generated data and the integrity of over-the-air software update processes. The continuous refinement of pricing models for charging services, energy arbitrage based on renewable energy availability, and optimized fleet logistics for commercial EVs are all reliant on sophisticated AI frameworks, driving sustainable operational economics across the market ecosystem.

- AI enhances Battery Management Systems (BMS) through predictive modeling of degradation, optimizing charging cycles for maximum lifespan and safety.

- Advanced Driver-Assistance Systems (ADAS) and autonomous driving rely entirely on AI algorithms for real-time sensor fusion, object recognition, path planning, and decision-making.

- AI facilitates manufacturing efficiency in gigafactories by optimizing robot paths, identifying defects in battery cells, and managing complex material flow logistics.

- In-car personalized experiences, including customized climate control, route planning, and infotainment, are managed using machine learning to adapt to user preferences.

- Predictive maintenance schedules for high-voltage components and electric motors are determined by AI analyzing real-time diagnostic data, significantly reducing unscheduled downtime.

- AI optimizes charging infrastructure deployment and smart grid integration by forecasting energy demand, facilitating Vehicle-to-Grid (V2G) capabilities.

DRO & Impact Forces Of Electric Car Market

The Electric Car Market is driven primarily by decisive government policies promoting decarbonization, significant consumer cost savings derived from declining battery prices and lower fuel expenses, and increasing investment in charging infrastructure development worldwide. However, expansion is constrained by substantial upfront vehicle costs, persistent supply chain vulnerabilities, particularly concerning critical battery materials like lithium and nickel, and limitations in public charging availability in certain geographies, leading to range anxiety among potential adopters. Opportunities abound in the development of solid-state battery technology, which promises superior energy density and safety, the expansion into underserved segments such as heavy-duty trucking, and the monetization of connected car services (V2X and software subscriptions). These forces interact dynamically, with regulatory drivers often mitigating the constraints imposed by cost and infrastructure, collectively shaping the market's trajectory towards inevitable electrification.

The primary driver momentum stems from the global consensus on climate change, institutionalizing emission reduction targets that necessitate a shift away from internal combustion engines. This translates into regulatory mandates and lucrative incentive structures that directly influence purchasing decisions and corporate fleet strategies. The declining cost curve for lithium-ion battery packs, although subject to short-term inflationary pressures, maintains a long-term downward trend, steadily narrowing the price gap between EVs and comparable ICE vehicles, thus accelerating market accessibility for middle-income consumers. Furthermore, the high performance characteristics inherent to electric powertrains, delivering immediate torque and reduced noise pollution, serve as a significant pull factor for technologically sophisticated consumers.

Restraining forces centered on infrastructure gaps remain crucial, especially the variance in charging standards, payment systems complexity, and the requirement for massive investment in high-speed DC charging networks along major intercity routes. The inherent complexity and capital intensity associated with establishing a robust, localized battery supply chain also present a significant hurdle, exposing manufacturers to geopolitical risks and commodity price volatility. Nevertheless, the market presents substantial opportunities through technological breakthroughs, such as ultra-fast charging capabilities and enhanced battery recycling processes, which promise to address both the infrastructure and resource scarcity challenges, ultimately accelerating the mass market transition and increasing consumer confidence in EV ownership.

- Drivers (D):

- Stricter global emission regulations and governmental mandates (e.g., phase-out dates for ICE vehicles).

- Substantial governmental subsidies, tax credits, and non-monetary incentives (e.g., preferential parking, toll exemptions).

- Rapid technological advancements leading to increased battery energy density and improved vehicle range.

- Lower operational costs compared to ICE vehicles (fuel savings and reduced maintenance needs).

- Restraints (R):

- High initial purchase price of electric vehicles compared to conventional counterparts.

- Inadequate charging infrastructure density and standardization in various regions.

- Supply chain instability and high dependency on critical battery raw materials (lithium, cobalt, nickel).

- Extended charging times compared to traditional refueling processes, especially for non-fast chargers.

- Opportunities (O):

- Development and commercialization of next-generation battery technologies (e.g., solid-state batteries).

- Expansion into emerging markets with rapidly growing middle-class populations.

- Integration of Vehicle-to-Grid (V2G) technology, turning EVs into mobile energy storage assets.

- Growth in the electric commercial vehicle segment (heavy-duty trucks and last-mile delivery vans).

- Impact Forces:

- Technological Disruption: Continuous advancements in battery chemistry and power electronics continually lower costs and improve performance, fundamentally shifting consumer expectations.

- Regulatory Influence: Government policies act as the single most impactful force, either accelerating adoption through incentives or restricting ICE sales through mandatory timelines.

- Infrastructure Development: The rate of charging infrastructure deployment dictates the speed of mass market saturation and mitigates range anxiety, acting as a crucial enabling force.

- Supply Chain Security: Vulnerability in raw material sourcing creates risk, necessitating strategic partnerships and increased investment in localized extraction and processing capabilities.

Segmentation Analysis

The Electric Car Market is comprehensively segmented based on vehicle type, component, and application, allowing for precise market sizing and strategic targeting. The segmentation by vehicle type, specifically between BEVs, PHEVs, and FCEVs, highlights the dominance and accelerating growth trajectory of pure BEVs due to decreasing battery costs and improved energy density. Component segmentation focuses on high-value parts such as batteries, which represent the largest cost component of the vehicle, and associated infrastructure components like charging stations. Application segmentation distinguishes between passenger vehicles, which drive current sales volume, and the rapidly professionalizing commercial sector, which offers vast potential for fleet electrification and operational cost savings.

Analyzing these segments reveals shifts in manufacturing priorities. While PHEVs provided an essential bridge technology, investment is overwhelmingly focused on optimizing BEV performance, particularly in 800V architecture for ultra-fast charging. The commercial segment is gaining traction, driven by regulations enforcing low-emission zones in urban centers, making electric buses and light commercial vehicles increasingly viable. Furthermore, within the component market, the development of advanced battery chemistries (e.g., lithium iron phosphate or LFP, and high-nickel cathodes) aimed at improving longevity, safety, and energy efficiency continues to be a central competitive factor.

- By Type:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- By Component:

- Battery Pack

- Electric Powertrain (Motor, Inverter, Transmission)

- Infotainment and Telematics Systems

- Charging Infrastructure (Hardware and Software)

- By Vehicle Class/Application:

- Passenger Vehicles (Sedan, SUV, Hatchback)

- Commercial Vehicles (Bus, Van, Truck)

Value Chain Analysis For Electric Car Market

The Electric Car Market value chain begins with upstream activities centered on the extraction and processing of critical raw materials, predominantly lithium, cobalt, nickel, and graphite, necessary for battery production. This stage is characterized by high capital intensity, geopolitical risk, and stringent environmental scrutiny. The midstream involves complex manufacturing processes, including cathode and anode material production, cell fabrication, and the final assembly into battery packs and electric motors. This manufacturing segment requires deep technological expertise and significant investment in highly automated gigafactories, often necessitating direct partnerships or joint ventures between material suppliers and automotive Original Equipment Manufacturers (OEMs) to secure reliable supply and control costs.

The downstream activities encompass the final vehicle assembly, integrating the electric powertrain, body, and sophisticated software components. Distribution channels are varied, including traditional dealer networks, direct-to-consumer sales models pioneered by new entrants, and fleet sales for commercial applications. The market is increasingly influenced by the aftermarket sector, which covers maintenance, replacement parts, and the crucial lifecycle management of batteries, including repair, repurposing for stationary storage, and eventual recycling. The profitability of the downstream is heavily reliant on software monetization and the provision of continuous connectivity services.

The distribution mechanism involves both direct and indirect approaches. Direct sales models, favored by companies like Tesla and Lucid, offer greater control over pricing and customer experience but require substantial investment in service centers and logistics. Indirect distribution, relying on franchised dealerships, remains the dominant method for legacy automakers, leveraging established physical footprints and regional familiarity, though requiring adaptation to the unique sales and service requirements of electric vehicles. Crucially, the deployment and maintenance of charging infrastructure, often facilitated by third-party charging network operators (CPOs) or utility companies, forms a distinct, high-growth component of the overall distribution and service value proposition.

Electric Car Market Potential Customers

Potential customers for the Electric Car Market span a wide demographic, including environmentally conscious individuals, early technology adopters, urban commuters, and large commercial fleet operators seeking operational cost efficiencies. Early adopters, typically residing in high-income urban centers, are motivated by performance, sustainability values, and access to the latest vehicle technology. The mass market penetration phase targets suburban and middle-class buyers, prioritizing affordability, practical driving range (over 300 miles), fast-charging access, and minimal total cost of ownership (TCO). This segment is highly sensitive to government incentives and the availability of comparable EV models across various price points and body styles.

The commercial segment represents a rapidly expanding category of buyers. Potential customers here include logistics and delivery companies focusing on last-mile delivery (eLCVs), municipalities purchasing electric buses for public transport systems, and large corporations committed to electrifying their heavy-duty trucking fleets. These customers are driven less by lifestyle and more by strict financial metrics, specifically the rapid return on investment achieved through lower energy costs, reduced maintenance expenditure, and compliance with increasingly strict urban emission zones. Financial viability for commercial buyers is often tied to predictable vehicle utilization rates and optimized routing solutions.

Furthermore, mobility-as-a-service (MaaS) providers and rental car agencies constitute a significant customer base, leveraging EVs for shared mobility platforms and short-term rentals, recognizing the vehicles' high utilization potential and low per-mile operational expense. Geographically, customers in regions with favorable regulatory environments, high fuel prices, and extensive renewable energy integration show the highest propensity for adoption, indicating that potential customer density is heavily influenced by regional policy support and energy infrastructure maturity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 1,750.8 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, BYD, Volkswagen Group, BMW, General Motors, Nissan, Hyundai Motor, Kia Corporation, Stellantis N.V., Rivian, Lucid Motors, NIO, XPeng, Li Auto, Mercedes-Benz Group, Porsche, Ford Motor Company, Geely Automobile Holdings, Chery Automobile, Tata Motors, Volvo Car Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Car Market Key Technology Landscape

The technological landscape of the Electric Car Market is dominated by relentless innovation focused on enhancing three core parameters: energy storage, power delivery efficiency, and digital connectivity. Battery technology remains the most critical competitive frontier, with extensive research directed towards developing solid-state batteries, which promise significant increases in energy density (longer range) and inherent safety improvements compared to current liquid-electrolyte lithium-ion cells. Parallel advancements include the adoption of silicon-anode materials and structural battery packs, which integrate the battery into the chassis, reducing vehicle weight and improving crash safety. The market is also seeing widespread transition to higher voltage architectures (e.g., 800V systems), which drastically cut down charging times, addressing a key constraint to mass adoption.

Beyond battery chemistry, significant technological disruption centers on the Electric Powertrain and power electronics. The adoption of Silicon Carbide (SiC) inverters is gaining prominence across high-performance and premium EV segments. SiC power modules offer superior thermal management and efficiency compared to traditional silicon components, minimizing energy loss during power conversion and contributing directly to extended driving range. Furthermore, the motors themselves are evolving, with manufacturers experimenting with both Permanent Magnet Synchronous Motors (PMSMs) for high efficiency and reliability, and asynchronous induction motors, often optimizing motor design for specific applications, such as high-torque commercial vehicles versus long-range passenger cars.

Crucially, the rise of the Software-Defined Vehicle (SDV) is defining the digital technology stack. This involves sophisticated integration of high-performance computing platforms capable of running complex AI algorithms for autonomous driving, advanced battery management, and comprehensive vehicle diagnostics. Over-the-air (OTA) updates are standardizing, allowing vehicles to receive feature upgrades, security patches, and performance enhancements remotely, effectively monetizing software post-sale. Connectivity technologies, including 5G, Vehicle-to-Everything (V2X) communication, and advanced telematics, are enabling intelligent traffic management, enhanced safety through real-time data exchange, and the integration of the vehicle into smart city ecosystems, creating future revenue streams far beyond the initial hardware sale.

Regional Highlights

The regional analysis reveals a heterogeneous market characterized by divergent adoption rates influenced by regulatory environments, economic capacity, and infrastructure maturity.

- Asia Pacific (APAC): Dominance and Manufacturing Hub

APAC is the global leader in the Electric Car Market, driven overwhelmingly by China, which boasts the world's largest EV production capacity and sales volume. Government backing, including robust subsidies and mandates for new energy vehicles (NEVs), has created a highly competitive domestic market. Beyond China, countries like South Korea and Japan are strong innovation centers focusing on battery technology and FCEVs, respectively, while India is accelerating its electrification efforts, particularly in the two and three-wheeler segments, positioning the region for continued dominance throughout the forecast period. The market here is characterized by fierce price competition and rapid iteration of technology, particularly in infotainment and battery cost reduction.

- China: Largest consumer base and producer; strong regulatory push (NEV credits); local champions like BYD and NIO highly influential.

- South Korea: Leaders in global battery supply (LG Energy Solution, Samsung SDI); high domestic adoption rates fueled by competitive local OEMs.

- Japan: Historically strong focus on hybrid technology, but shifting towards BEVs and FCEV infrastructure development.

- Europe: Regulatory Driven Transition

Europe represents the second-largest EV market, propelled by the European Union's stringent CO2 emission targets and the planned phase-out of ICE vehicle sales. Scandinavian countries, particularly Norway, exhibit the highest per-capita EV penetration globally due to generous tax exemptions and incentives. Germany and France are massive markets driven by strong OEM commitments (Volkswagen, BMW, Stellantis) and national incentive schemes. The region is investing heavily in local battery supply chain establishment (gigafactories) to reduce reliance on Asian imports, emphasizing sustainability and circular economy principles in EV production.

- Germany: Large production base; strong demand for premium and high-performance EVs; significant investment in charging networks.

- Norway: World leader in adoption rate; aggressive tax incentives making EVs cheaper than comparable ICE vehicles.

- United Kingdom: Clear ICE phase-out date; focus on urban air quality and extensive home charging infrastructure support.

- North America: Infrastructure and Policy Acceleration

The North American market, led by the United States, is experiencing accelerated growth, fundamentally altered by substantial governmental incentives, notably the US Inflation Reduction Act (IRA). The IRA provides consumer tax credits conditional on sourcing and manufacturing within North America, driving massive domestic investment in battery plants and assembly lines. While historically slower in adoption than Europe, the shift is rapid, characterized by a high demand for electric trucks (e.g., Ford F-150 Lightning, Tesla Cybertruck) and SUVs. Infrastructure remains a key focus, with significant federal funding allocated to build a national charging network.

- United States: Focus on large vehicle segments (trucks, SUVs); massive federal investment stimulating domestic manufacturing and charging infrastructure.

- Canada: Provincial incentives supplement federal programs; strong commitment to fleet electrification and public charging corridors.

- Latin America, Middle East, and Africa (LAMEA): Emerging Potential

LAMEA currently holds a smaller market share but demonstrates high long-term growth potential, particularly in nations with stable regulatory frameworks and significant urban population centers. The Middle East, notably UAE and Saudi Arabia, is strategically investing in EV production and charging infrastructure as part of economic diversification away from oil dependence. Brazil and Mexico in Latin America are focusing on public transportation electrification (electric buses) and gradually introducing policies to promote passenger EV adoption, though challenges related to electricity grid stability and initial vehicle cost remain influential barriers to widespread, immediate adoption across the broader region.

- Middle East: Strategic investment in smart cities and EV fleets as part of sustainability and economic diversification goals.

- Brazil: Growing interest in flex-fuel electric hybrids; primary focus on urban public transit electrification projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Car Market.- Tesla Inc.

- BYD Auto Co. Ltd.

- Volkswagen Group

- Bayerische Motoren Werke AG (BMW)

- General Motors Company (GM)

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

- Kia Corporation

- Stellantis N.V.

- Rivian Automotive, Inc.

- Lucid Motors, Inc.

- NIO Inc.

- XPeng Inc.

- Li Auto Inc.

- Mercedes-Benz Group AG

- Porsche AG

- Ford Motor Company

- Geely Automobile Holdings Limited

- Chery Automobile Co., Ltd.

- Tata Motors Limited

Frequently Asked Questions

Analyze common user questions about the Electric Car market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the long-term growth of the Electric Car Market?

The primary long-term growth factor is the global imperative to meet net-zero emission targets, leading to mandatory regulatory timelines for phasing out internal combustion engine vehicles, coupled with the decreasing total cost of ownership (TCO) for EVs due to continuous battery cost reductions and lower maintenance requirements.

How is the current volatile supply chain impacting EV battery pricing and availability?

Supply chain volatility, particularly for critical raw materials like lithium, nickel, and cobalt, creates short-term price inflation pressures on battery packs. However, manufacturers are mitigating this through vertical integration, diversification of material sources, and adopting alternative chemistries such as LFP (Lithium Iron Phosphate) which reduces reliance on high-cost materials.

What are the most significant technological advancements expected to transform the EV sector by 2030?

The most significant advancements include the commercialization of solid-state batteries, offering greater energy density and enhanced safety; the standardization of 800-volt charging architectures for ultra-fast recharging; and the widespread integration of advanced AI for Level 4 autonomous driving capabilities and predictive energy management.

Which geographic region dominates the electric car sales volume and manufacturing?

The Asia Pacific region, specifically China, dominates the global electric car sales volume and manufacturing capacity. This dominance is sustained by aggressive government support, extensive charging network development, and the presence of highly competitive domestic pure-play and traditional automotive manufacturers.

What role does the Software-Defined Vehicle (SDV) concept play in the profitability of Electric Car manufacturers?

The SDV concept is crucial for future profitability, shifting revenue generation from a one-time vehicle sale to recurring income streams via over-the-air (OTA) updates, subscription services for advanced features like navigation or driver assistance, and personalized data monetization, enhancing customer lifetime value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hybrid and Electric Car Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electric Car Chargers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Battery Electric Car Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electric Car Chargers Market Size Report By Type (Slow AC, Fast AC, Fast DC), By Application (Home, Office, Commercial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Electric Car Charger Columns Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Normal Charging, Super Charging, Inductive Charging), By Application (Public, Private), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager