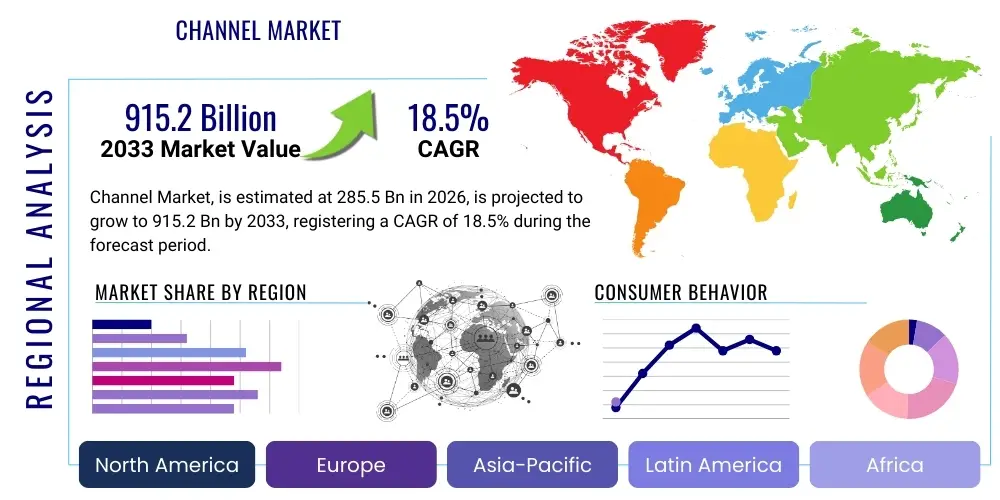

Channel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441950 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Channel Market Size

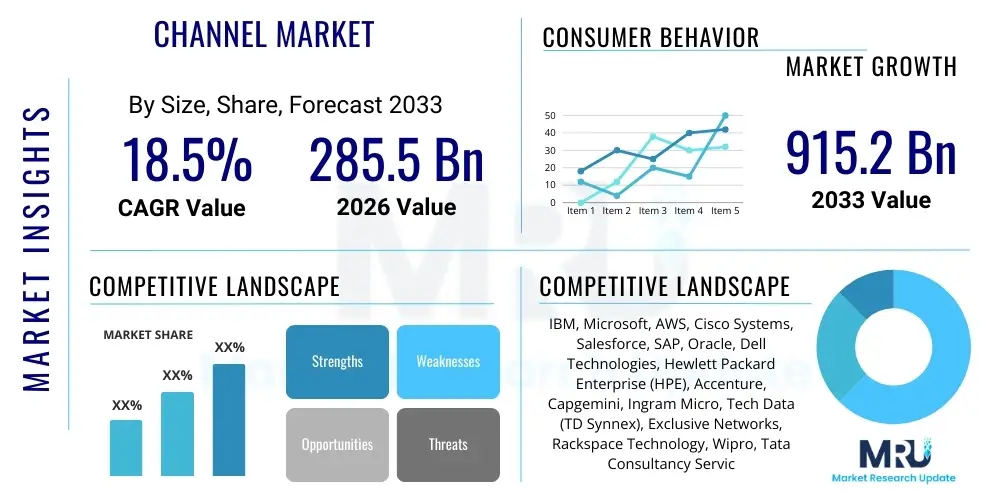

The Digital Distribution Channel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 285.5 Billion in 2026 and is projected to reach USD 915.2 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerating global adoption of cloud-based services, the proliferation of specialized vertical Software-as-a-Service (SaaS) solutions, and the critical necessity for vendors to establish scalable, diversified routes to market. The transition from traditional direct sales models to robust partner ecosystems, encompassing Value-Added Resellers (VARs), Managed Service Providers (MSPs), and system integrators, is fundamentally reshaping how technology and services are consumed. Furthermore, the imperative for hyper-personalization in customer outreach and the complexity associated with integrating multi-cloud environments necessitate sophisticated channel partnerships that can offer localized expertise and tailored support, driving sustained investment in channel infrastructure and programmatic excellence across all major industry verticals. This shift signifies a strategic imperative for market participants to optimize channel efficiency and maximize partner engagement.

Channel Market introduction

The Channel Market, specifically focusing on digital distribution ecosystems, involves the complex network of intermediaries that facilitate the sale, implementation, management, and support of technology products and services from vendors to end-users. This environment is characterized by a high degree of integration, reliance on sophisticated Partner Relationship Management (PRM) platforms, and a continuous evolution driven by consumption models (e.g., subscription services). Products within this market span enterprise software, cloud infrastructure, telecommunications services, and specialized hardware integrated into complete solutions. Major applications include accelerating market penetration in niche geographies, optimizing customer lifetime value through specialized support, and facilitating rapid deployment of complex digital transformation initiatives. Key benefits realized through effective channel strategies include lowered customer acquisition costs, enhanced solution specialization, and localized regulatory compliance assurance. The primary driving factors are the globalization of digital services, the rise of specialized technology stacks requiring expert integration, and the industry-wide mandate for resilience and diversified revenue streams, compelling vendors to invest heavily in incentivizing and empowering their partner networks to act as extensions of their core business operations. The introduction of consumption-based billing models has further complicated and enriched the operational dynamics within these channel structures, necessitating real-time performance tracking and dynamic incentive alignment.

Channel Market Executive Summary

The executive outlook for the Digital Distribution Channel Market highlights several critical business trends that are fundamentally altering competitive dynamics. Business trends emphasize the shift toward ecosystem selling, where multiple partners collaborate to deliver integrated solutions, moving away from single-vendor transactions. This transition requires sophisticated data sharing protocols and shared incentive models to ensure synergy and accountability across the partner lifecycle. Regionally, the Asia Pacific (APAC) market is experiencing the most rapid growth, driven by aggressive digital infrastructure development in emerging economies and the increasing penetration of mobile and cloud services across diverse markets, demanding specialized local channel enablement. North America and Europe remain mature, focusing intensely on optimizing profitability and integrating advanced AI tools into partner performance management and lead generation processes, seeking marginal efficiencies in established, competitive landscapes. Segment trends indicate robust expansion in the Managed Service Provider (MSP) segment, particularly those focused on cybersecurity and specialized cloud management, reflecting the increasing complexity and operational burden faced by end-users. Furthermore, the growth in influencer and affiliate channels, though smaller, is contributing significantly to top-of-funnel pipeline generation, marking a diversification of marketing spend away from traditional channel marketing activities toward digitally native approaches that leverage specialized content creation and targeted community engagement.

AI Impact Analysis on Channel Market

Analysis of common user questions regarding AI's influence on the Channel Market reveals significant focus areas centering on efficiency, displacement, and competitive advantage. Users frequently inquire about AI's role in automating Partner Relationship Management (PRM) workflows, specifically concerning lead distribution, incentive management, and contract lifecycle management. A prevalent concern is the potential for AI-driven self-service platforms to disintermediate traditional resellers, leading to fears of reduced profit margins and relevance for conventional channel partners. Conversely, there is substantial expectation that AI will unlock new revenue opportunities by enabling hyper-personalized sales content, predicting partner churn, and optimizing complex multi-tier distribution logistics, thereby enhancing the overall efficacy and reach of the channel ecosystem. Key themes summarized include the necessity for partners to rapidly adopt AI tools to maintain competitive parity, the impending transformation of traditional channel roles into high-value advisory positions centered around specialized data analysis and strategy, and the vendor requirement to provide AI-powered enablement tools that simplify complex solutions and accelerate time-to-market for partner-led initiatives. Users are fundamentally seeking clarity on how AI shifts the value proposition from transaction fulfillment to intelligence-driven solution selling and ongoing optimization.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fundamentally reshaping every aspect of the Digital Distribution Channel Market, transitioning it from reactive transactional processing to proactive, predictive strategic engagement. AI models are being deployed extensively in lead management systems to accurately score and route opportunities to the most suitable channel partners based on historical performance, specialization alignment, and geographical capabilities, dramatically increasing conversion rates and reducing lead wastage across the complex sales funnel. Furthermore, advanced natural language processing (NLP) systems are now powering sophisticated Partner Relationship Management (PRM) chatbots, offering 24/7 self-service support for partners regarding training, certification status, deal registration processes, and complex incentive queries, significantly lowering the administrative overhead for vendor channel teams and allowing human channel managers to focus on strategic relationship development rather than operational troubleshooting. This technological overhaul facilitates superior partner experience (PX) and directly correlates with enhanced partner loyalty and increased revenue contribution.

Beyond operational improvements, AI is critical in identifying white-space opportunities and predicting potential market saturation or partner underperformance long before traditional metrics would flag issues. Predictive analytics models ingest vast amounts of data—including competitive intelligence, macroeconomic indicators, and historical transaction volumes—to advise partners on the most profitable product mixes and target customer segments, essentially acting as an automated, high-level business consultant embedded within the channel ecosystem. The ethical implications and data privacy concerns associated with centralized data collection and AI-driven performance monitoring are also increasingly scrutinized, requiring robust governance frameworks to ensure fairness and transparency in partner evaluation and compensation structures. The long-term impact points toward a bifurcated channel landscape: partners who successfully integrate AI into their sales and delivery methodologies will become indispensable strategic advisors, while those who resist technological adoption will struggle to maintain relevance in an increasingly automated and data-driven marketplace, highlighting the urgent need for comprehensive vendor-led AI training and adoption programs tailored specifically for the channel community.

- AI optimizes deal registration and pricing approvals, reducing cycle times by up to 40%.

- Predictive analytics identifies high-potential partners and forecasts pipeline conversion rates with greater accuracy.

- Machine learning models automate personalized content generation for partner-led marketing campaigns (Partner Marketing Automation).

- AI-driven sales coaching provides real-time recommendations to partner sales teams based on conversation transcripts and CRM data.

- Chatbots and intelligent assistants handle routine partner support inquiries, improving response times and Partner Experience (PX).

- Advanced algorithms detect and flag potential channel conflict or incentive fraud proactively.

- AI powers specialized vertical solution configurators, simplifying complex product bundling for technical partners.

DRO & Impact Forces Of Channel Market

The dynamics of the Digital Distribution Channel Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively summarized as the DRO framework, which dictates the strategic maneuvers of both vendors and channel partners. The primary driver is the pervasive requirement for vendors to achieve hyper-scale distribution without linearly increasing their internal sales expenditures, making the channel an economically efficient mechanism for market penetration, particularly in fragmented and highly specialized vertical sectors. However, this expansive growth is often restrained by persistent challenges related to channel conflict, where direct sales teams compete with partners, leading to mistrust and reduced engagement. Opportunities lie predominantly in capitalizing on the massive transition to specialized consumption-based services, such as FinOps (Financial Operations in the Cloud) and advanced multi-cloud security management, which require deep, localized expertise that only specialized partners can consistently provide. The impact forces underscore the power shift toward partners who possess proprietary data and specialized intellectual property (IP), granting them significant leverage in negotiations with large technology vendors.

Drivers: The explosive growth of the cloud computing paradigm necessitates sophisticated channel expertise for migration, integration, and optimization, acting as a massive market propellant. Specifically, the complexity associated with hybrid and multi-cloud environments means end-users rely heavily on Managed Service Providers (MSPs) and System Integrators (SIs) to manage these infrastructures effectively. Secondly, the increasing specialization of technology, such as vertical SaaS solutions targeting niche industries like healthcare compliance or agritech, demands channel partners with specific domain knowledge and localized compliance expertise, something that generalist vendor sales teams often lack. Furthermore, the global drive towards digital transformation across small and medium-sized enterprises (SMEs) is predominantly channel-led, as SMEs often lack the internal resources or budget for direct vendor engagement. The economic efficiency of the channel model, providing scalable reach at a lower Customer Acquisition Cost (CAC) compared to direct sales, reinforces its strategic importance, compelling continual investment in partner programs and technology stacks designed for enhanced collaboration and performance transparency. The proliferation of APIs and open ecosystems also facilitates easier integration and co-selling opportunities, accelerating market velocity.

Restraints: Significant challenges persist, notably the inherent difficulty in maintaining consistent Quality of Service (QoS) across a diverse global partner base, which can dilute brand integrity if not rigorously managed through comprehensive training and certification programs. Channel conflict, particularly concerning large enterprise accounts and margin compression due to intense competition in saturated segments like commodity cloud resale, often acts as a significant dampener on partner enthusiasm and investment. Furthermore, the substantial initial investment required by vendors to develop and maintain robust PRM systems, comprehensive training curricula, and attractive incentive structures can pose a barrier to entry for smaller or emerging technology providers. The high rate of technological change necessitates continuous, expensive retraining of channel partners, creating an operational friction point. Data security and intellectual property protection within shared ecosystems also remain a constant concern, requiring stringent contractual agreements and continuous auditing protocols to mitigate risk exposure across the entire supply chain and partner network, which adds considerable regulatory and operational complexity.

Opportunities: The transition towards subscription and consumption-based revenue models opens up substantial opportunities for partners to focus on recurring revenue streams generated through post-sale services, such as optimization, advanced managed services, and Customer Success as a Service (CSaaS), shifting the focus from initial transaction volume to long-term customer value. Geographically, emerging markets in Southeast Asia, Latin America, and Africa represent vast untapped potential, requiring hyper-localized channel strategies to navigate unique regulatory environments and localized consumer preferences. The growing field of security and compliance services, driven by global regulatory mandates (e.g., GDPR, CCPA), offers a high-margin specialization opportunity for security-focused channel partners. Moreover, the development of sophisticated ‘born-in-the-cloud’ partners focused exclusively on hyperscale platforms (AWS, Azure, GCP) and delivering specialized vertical applications represents a high-growth segment, benefiting from vendor programs specifically designed to accelerate these digitally native ecosystems. Strategic mergers and acquisitions among channel partners seeking to broaden their geographical footprint or specialized service offerings also present significant strategic positioning opportunities.

Impact Forces: The overarching impact force is the power shift toward end-users who are increasingly informed and demand highly customized solutions, forcing channel partners to evolve into specialized solution orchestrators rather than simple product distributors. Economic volatility forces end-users to scrutinize IT spending, favoring subscription models and Managed Services that offer predictable operational expenses (OpEx) over large capital expenditures (CapEx), thereby bolstering the recurring revenue channels. The consolidation of technology vendors through strategic mergers further influences the channel landscape by creating super-ecosystems, requiring partners to manage fewer, but significantly larger, vendor relationships, demanding deeper technical alignment and greater specialization commitment. Regulatory environments globally are mandating specific data handling and compliance measures, turning compliance expertise into a competitive differentiator for channel partners operating in regulated sectors. Finally, the velocity of technological advancement, especially in AI and quantum computing, compels partners to continuously reinvest in human capital and technical infrastructure to maintain relevance, acting as a constant pressure force on profitability and long-term sustainability.

Segmentation Analysis

The Digital Distribution Channel Market is meticulously segmented based on several critical dimensions including the type of channel partner, the end-user industry served, the specific technology sold, and the deployment model utilized, providing a granular view of market dynamics and opportunity zones. The segmentation by partner type is crucial for vendors designing targeted enablement programs, differentiating between high-volume transactional resellers and highly specialized, IP-led solution providers. Segmentation by technology allows for focused analysis on high-growth areas such as cybersecurity integration and specialized DevOps consulting, which command premium service fees. Furthermore, the segmentation by end-user size, particularly focusing on the unique needs of the Small and Medium-sized Enterprise (SME) segment versus large enterprise consumption patterns, reveals distinct channel engagement strategies. This layered analytical approach ensures that market players can strategically allocate resources to the most profitable and fastest-growing segments, while effectively mitigating risks in consolidating or decelerating market niches, thereby optimizing the entire channel strategy portfolio.

- By Partner Type:

- Managed Service Providers (MSPs)

- Value-Added Resellers (VARs)

- System Integrators (SIs)

- Distributors

- Affiliates and Referral Partners

- Independent Software Vendors (ISVs)

- Consulting Partners

- By Technology Focus:

- Cloud Infrastructure Services (IaaS, PaaS)

- Cybersecurity Solutions

- Business Applications (SaaS)

- Data Analytics and AI Solutions

- Telecommunication Services

- IoT and Edge Computing

- By End-User Industry:

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- IT and Telecommunications

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- By Deployment Model:

- On-Premise

- Cloud (Public, Private, Hybrid)

- Hybrid IT Management

Value Chain Analysis For Channel Market

The Value Chain Analysis of the Channel Market begins with the upstream component, which encompasses the core technology vendors (Original Equipment Manufacturers or Software Developers) responsible for innovation, product development, and supply chain management. This stage focuses heavily on R&D investment and establishing foundational intellectual property, creating the products that will flow downstream. The midstream is dominated by distributors and specialized aggregators who manage logistics, inventory, credit financing, and basic partner onboarding, ensuring efficient product flow from vendor to the point of sale. The crucial downstream segment involves the core channel partners (MSPs, VARs, SIs) who add substantial value through customization, integration, specialized consulting, implementation, and ongoing managed services, transforming generic products into bespoke customer solutions. Distribution channels are increasingly bifurcated: Direct channels handle strategic large accounts or complex, custom deployments, while Indirect channels, facilitated by distributors and PRM platforms, manage the vast majority of transactional volume and localized support, providing the scalable reach necessary for global growth. The effectiveness of the overall value chain hinges on seamless digital integration and shared data insights between all tiers, optimizing inventory management and customer intelligence.

Channel Market Potential Customers

Potential customers for the Digital Distribution Channel Market are highly diverse, encompassing virtually every industry vertical and organizational size, defined primarily as the entities requiring specialized IT solutions and ongoing technology management services that exceed their internal capabilities. The primary buyers (End-Users) are typically Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and procurement leaders across both large enterprises and the SME sector seeking expertise in digital transformation, cloud migration, security compliance, and operational efficiency improvements. Large enterprises frequently engage System Integrators and specialized Consulting Partners for complex, multi-million dollar digital transformation projects, leveraging the channel for highly specialized skills and geographical reach. Conversely, Small and Medium-sized Enterprises (SMEs) are the primary consumers of Managed Service Providers (MSPs) and Value-Added Resellers (VARs), relying on them for comprehensive, outsourced IT infrastructure management, security patching, and essential SaaS application support on a subscription basis. Furthermore, governmental agencies and regulated industries like healthcare and finance are critical buyers, relying on channels that possess specific regulatory certifications and secure, localized service delivery capabilities, demanding deep technical and compliance assurance expertise throughout the entire engagement lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 Billion |

| Market Forecast in 2033 | USD 915.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, AWS, Cisco Systems, Salesforce, SAP, Oracle, Dell Technologies, Hewlett Packard Enterprise (HPE), Accenture, Capgemini, Ingram Micro, Tech Data (TD Synnex), Exclusive Networks, Rackspace Technology, Wipro, Tata Consultancy Services (TCS), Atos, CDW, Fastly |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Channel Market Key Technology Landscape

The technological underpinnings of the Digital Distribution Channel Market are defined by sophisticated, interconnected platforms designed to manage, enable, and incentivize partner ecosystems at scale, ensuring efficiency and transparency across complex, multi-tiered relationships. Central to this landscape are robust Partner Relationship Management (PRM) systems. Modern PRM platforms are evolving beyond simple transactional tools to become highly integrated hubs that manage every stage of the partner lifecycle, from recruitment and onboarding to training, deal registration, incentive calculation, and marketing enablement. These systems leverage microservices architectures to allow seamless integration with existing Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and Marketing Automation systems, creating a unified data environment essential for predictive analytics and accurate performance tracking. The shift towards 'Through-Channel Marketing Automation' (TCMA) technologies is particularly noteworthy, allowing vendors to centrally create marketing campaigns that partners can easily customize and deploy locally, ensuring brand consistency while providing localized relevance. This reliance on TCMA removes significant resource barriers for smaller channel partners, accelerating their marketing effectiveness and increasing the return on channel investment for the vendor.

Furthermore, cloud billing and subscription management platforms constitute a vital technological layer, especially given the market's rapid transition to consumption-based models. Channel partners require billing systems that can handle complex, usage-based metering, multi-currency transactions, and dynamic pricing adjustments in real-time, often necessitating specialized orchestration software that sits between the vendor's financial backend and the customer’s consumption profile. Security technology forms another foundational pillar; channel partners are heavily reliant on advanced security orchestration, automation, and response (SOAR) platforms to deliver robust, managed cybersecurity services to their end-clients. The ability to integrate and automate security protocols across diverse client environments using a centralized partner platform provides a significant competitive advantage. Data analytics platforms are essential for extracting actionable insights from the immense volume of data generated by partner interactions, sales transactions, and customer support queries, driving strategic decisions regarding territory planning, incentive optimization, and identifying product gaps within the vendor portfolio. This data-driven approach is key to moving beyond reactive management to proactive strategic guidance within the channel.

The emergence of AI and Low-Code/No-Code (LCNC) platforms is profoundly influencing the accessibility and efficiency of channel operations. AI is being embedded into PRM systems to automate lead scoring, predict partner attrition, and personalize training modules based on individual partner performance metrics, fostering a highly tailored enablement experience. LCNC platforms empower channel partners, especially specialized ISVs and SIs, to rapidly build and deploy vertical-specific integrations or custom front-ends for vendor solutions without extensive coding expertise. This rapid innovation capability significantly reduces time-to-market for specialized partner solutions, fostering greater ecosystem innovation. Looking ahead, blockchain technology is being explored for securing incentive payments and ensuring immutable, auditable records of multi-party transactions and agreements within complex channel ecosystems, aiming to resolve issues of transparency and conflict resolution. The technology landscape is thus defined by integration, automation, and the democratization of development tools, all aimed at maximizing the speed and efficacy with which value is delivered from the vendor through the partner to the ultimate end-user, requiring vendors to consistently prioritize ease-of-doing-business technologies for their entire partner community.

Regional Highlights

- North America: North America represents the most mature and strategically critical market for digital distribution channels, characterized by high technological sophistication and intense competition, demanding advanced partner programs. The region is the global epicenter for cloud adoption (AWS, Microsoft Azure, Google Cloud) and enterprise SaaS solutions, leading to massive demand for highly skilled MSPs and SIs focused on specialized migration, managed services, and security. The market here focuses heavily on optimizing partner profitability and utilizing cutting-edge AI tools for sales forecasting and process automation, pushing innovation in PRM technologies. Furthermore, the regulatory environment, particularly concerning data privacy and cybersecurity standards, drives significant demand for channel partners capable of delivering specialized compliance-as-a-service offerings. The mature ecosystem means vendors must differentiate by offering unique intellectual property and robust co-development opportunities, moving beyond transactional relationships to strategic, deep partnerships that share customer lifetime value (CLV) metrics and joint innovation roadmaps. The consolidation trend among regional VARs and MSPs is also prominent, seeking scale and broader geographic reach to serve national clients effectively, accelerating the pace of M&A activity within the channel landscape.

- Europe: The European market is highly fragmented, necessitating channel strategies that address diverse linguistic, cultural, and regulatory environments, particularly the strict mandates imposed by the General Data Protection Regulation (GDPR). This regulatory complexity has fueled significant growth in the demand for channel partners specializing in secure cloud environments, data sovereignty, and localized compliance consulting, particularly within the BFSI and healthcare sectors. Western Europe (Germany, UK, France) dominates in terms of overall market value, focusing on digital transformation and hybrid IT integration, relying heavily on traditional VARs and system integrators. However, Central and Eastern Europe (CEE) are demonstrating superior growth rates, driven by industrial modernization and increasing adoption of specialized SaaS applications. Vendors must ensure their channel programs are localized, often partnering with smaller, specialized regional distributors who understand the intricacies of local tax laws and specific vertical market requirements, emphasizing flexibility and multilingual support in all partner enablement materials and technological interfaces.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) globally, fueled by rapid urbanization, massive investments in 5G infrastructure, and aggressive digital adoption across emerging economies like India, Indonesia, and Vietnam. The market is characterized by heterogeneity; while countries like Japan and South Korea possess sophisticated, mature IT markets, the bulk of the growth is driven by the vast SME sector in Southeast Asia, which relies almost entirely on local channel partners for technology procurement and support. Channel strategies here must prioritize low-cost, scalable solutions and mobile-first enablement tools. The primary focus areas for channel partners in APAC include foundational cloud infrastructure deployment, e-commerce platform integration, and addressing the immense scale required by telecommunications providers. Channel partners often act as critical financial intermediaries, providing credit and local financing solutions, which is a major differentiator compared to Western markets. Vendor success hinges on building deep trust with local distributors and implementing multi-tiered channel structures capable of reaching tier-2 and tier-3 cities effectively.

- Latin America (LATAM): The LATAM region presents a challenging yet rewarding landscape, marked by economic volatility, currency fluctuations, and high import taxes, making the role of the channel partner in managing logistics and financing absolutely essential. Channel growth is primarily concentrated in Brazil, Mexico, and Colombia, focusing on modernization projects within the BFSI, mining, and energy sectors. Cybersecurity and resilience solutions are paramount due to high rates of digital fraud and increasing geopolitical threats. Channel partners in this region thrive by bundling hardware, software, and financing into complete monthly packages, simplifying procurement for end-users facing capital constraints. Vendors must offer robust protection against currency risks and provide flexible payment terms to empower their partners. The market for hyper-localized SaaS applications designed to handle specific regional tax and compliance requirements is also rapidly expanding, creating unique opportunities for specialized ISVs within the channel ecosystem.

- Middle East and Africa (MEA): The MEA market is highly influenced by government-led digital initiatives (e.g., Saudi Vision 2030, UAE's smart city projects), which drive large-scale infrastructure investments primarily through large system integrators and consulting partners. The Gulf Cooperation Council (GCC) countries dominate the Middle Eastern market, focusing on sophisticated security, AI applications, and smart governance solutions. Africa, while nascent, is a high-potential market characterized by mobile-first strategies and demand for affordable, scalable cloud solutions accessible through specialized, locally focused channel partners. Telecommunications infrastructure and financial technology (FinTech) solutions form the backbone of channel activities across the African continent. Vendors must navigate complex geopolitical risks and prioritize channel education and capacity building, offering specialized certifications tailored to the region's rapid development curve and unique infrastructure challenges, often requiring tailored product offerings optimized for low-bandwidth environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Channel Market.- IBM Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

- Cisco Systems, Inc.

- Salesforce.com, Inc.

- SAP SE

- Oracle Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- Accenture PLC

- Capgemini SE

- Ingram Micro Inc.

- Tech Data (TD Synnex)

- Exclusive Networks

- Rackspace Technology

- Wipro Limited

- Tata Consultancy Services (TCS)

- Atos SE

- CDW Corporation

- Fastly, Inc.

Frequently Asked Questions

Analyze common user questions about the Channel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Digital Channel Market?

The predominant driver is the increasing technical complexity and specialization required for modern IT environments, particularly involving hybrid cloud and advanced cybersecurity solutions. Vendors rely on channel partners (MSPs, SIs) to provide the specialized expertise, localized support, and complex integration services that scale faster and more cost-effectively than internal resources, optimizing customer acquisition and retention.

How is AI specifically impacting channel partner compensation and incentives?

AI is transforming incentives by enabling predictive modeling to calculate profitability based on customer lifetime value (CLV) rather than just initial transaction size. This leads to more dynamic, outcome-based incentive structures that reward partners for customer success, retention, and recurring revenue generation, moving away from simple volume-based commissions toward value-add services.

Which geographical region offers the highest growth potential for channel expansion?

The Asia Pacific (APAC) region, driven by accelerated digital transformation in emerging economies like India and Southeast Asia, presents the highest growth potential. This growth is supported by substantial government investment in digital infrastructure and the immense, untapped demand from the Small and Medium-sized Enterprise (SME) segment for outsourced IT services and cloud adoption.

What are the greatest risks associated with relying heavily on a multi-tiered distribution channel?

The principal risks involve potential channel conflict between direct sales and partners, margin compression in competitive product segments, and difficulty ensuring consistent quality of service (QoS) across a diverse global ecosystem. Maintaining transparent communication and investing in robust Partner Relationship Management (PRM) tools are essential mitigations for these structural challenges.

How does the shift to subscription models affect traditional Value-Added Resellers (VARs)?

The shift necessitates that traditional VARs transition their business model from upfront transactional sales toward becoming Managed Service Providers (MSPs) or specialized consultants. This requires developing capabilities for recurring revenue streams, continuous customer engagement, and focusing on high-margin post-sale services like optimization, renewal management, and security monitoring to maintain profitability and relevance.

What role do distributors play in the modern digital channel ecosystem?

Distributors have evolved beyond logistics providers to become sophisticated channel enablement hubs. They provide critical value-added services such as specialized credit financing, complex cloud billing aggregation, technical training, and access to sophisticated through-channel marketing automation (TCMA) tools, effectively serving as an outsourced channel management layer for vendors and a resource center for partners.

Is channel conflict decreasing due to specialized partnering, and how is it managed?

While specialization (e.g., vertical ISVs) helps mitigate conflict in niche areas, conflict remains significant in generalized market segments, especially hybrid accounts. Management strategies include robust deal registration systems with strict rules of engagement, clear geographical or vertical account segmentation, and implementing transparent communication platforms to mediate disputes swiftly and fairly, ensuring partner confidence in vendor commitment.

What is Partner Experience (PX) and why is it crucial for channel success?

Partner Experience (PX) refers to the cumulative ease and effectiveness with which partners interact with a vendor’s program, technologies, and people. It is crucial because a friction-filled or complex PX directly leads to low partner engagement, slow time-to-revenue, and increased partner churn. Optimizing PX through simplified PRM interfaces, fast response times, and clear profitability paths is a key strategic mandate for market leaders.

How are smaller vendors effectively competing against established companies in channel recruitment?

Smaller vendors compete by offering higher gross margins, superior specialization (targeting niche vertical expertise), and unparalleled ease-of-doing-business through highly responsive support and minimal bureaucratic requirements. They often focus on co-developing unique intellectual property (IP) with a select group of high-potential partners, offering exclusivity and deeper technical alignment.

What technological investments should channel partners prioritize in the next five years?

Channel partners must prioritize investments in AI-powered tools for sales and marketing automation, advanced cybersecurity platforms (specifically Managed Detection and Response or MDR), and specialization in cloud financial management (FinOps). Proficiency in integrating diverse vendor platforms using APIs and low-code tools is also essential to deliver seamless, integrated customer solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ball Screw Channel Diamond Roller Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chloride Channel Blockers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Multichannel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Channel Manager Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Endoscopic Channel Cleaning Brush Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager