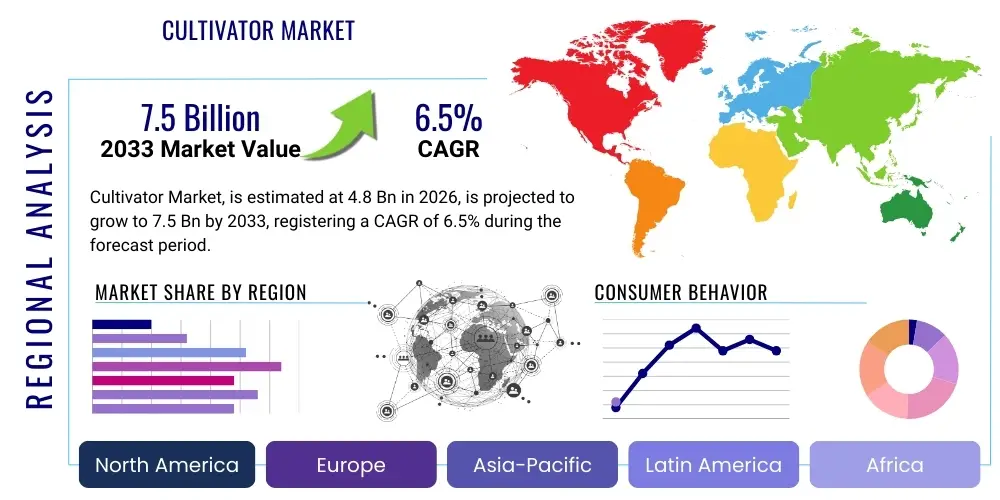

Cultivator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443355 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cultivator Market Size

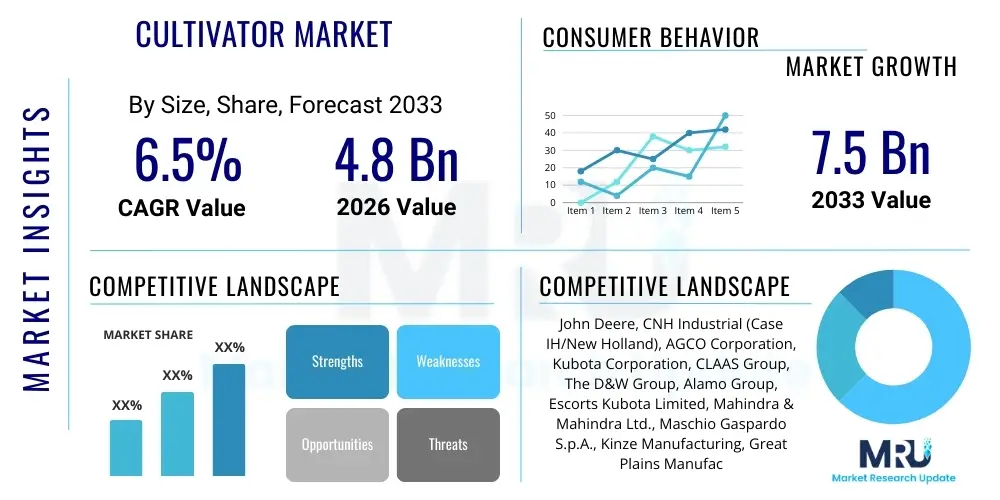

The Cultivator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% CAGR between 2026 and 2033. This robust expansion is primarily driven by increasing global demand for food security, accelerated farm mechanization across developing economies, and the widespread adoption of precision agriculture techniques that necessitate optimized soil preparation. The cultivator market is essential for efficient tillage operations, providing crucial benefits such as improved soil aeration, weed control, and residue management, which ultimately contribute to enhanced crop yields.

The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial increase reflects a shift towards more advanced cultivator types, including heavy-duty implements and models integrated with GPS and sensor technology for variable depth and speed control. Furthermore, governmental subsidies supporting agricultural modernization, particularly in regions like Asia Pacific and Latin America, are catalyzing the replacement of traditional, inefficient implements with modern, energy-efficient cultivators, thereby fueling market growth across the globe.

Cultivator Market introduction

The Cultivator Market encompasses the manufacturing, distribution, and utilization of agricultural machinery designed specifically for secondary tillage, primarily involving the preparation of seedbeds and the control of weeds between rows of crops. These implements range from traditional drag-type models to highly sophisticated rotary tillers and specialized inter-row cultivators, essential for ensuring optimal soil structure necessary for root growth and nutrient uptake. The core function of a cultivator is to effectively break up soil clods, level the surface, and incorporate organic matter or fertilizers into the topsoil, optimizing moisture retention and minimizing soil compaction, which is a critical concern in mechanized farming operations worldwide.

Major applications of cultivators span large-scale commodity farming, including grains such as wheat and corn, as well as row crops like cotton, soybeans, and specialized vegetables. The primary benefit derived from employing modern cultivators lies in operational efficiency; they drastically reduce the time and labor required for pre-planting soil treatment compared to manual or less advanced methods. Driving factors for market expansion include escalating global population demanding higher food output, coupled with diminishing arable land, which necessitates increased yield per hectare through precision farming practices facilitated by advanced tillage equipment. Moreover, the increasing focus on sustainable farming techniques, such as conservation tillage and reduced environmental impact, is promoting the demand for specialized shallow-tillage and residue management cultivators.

Product descriptions vary significantly based on their power source and functionality, categorized broadly into primary (heavy-duty implements used for initial deep soil breaking) and secondary cultivators (lighter tools for seedbed preparation). The market is witnessing a notable trend towards minimum tillage or no-till cultivators, which are designed to disturb the soil minimally, preserving soil health and structure, while still effectively managing residue and preparing a narrow seed trench. The adoption rate of these advanced implements is directly tied to government policies promoting sustainable agriculture and the economic viability they offer through reduced fuel consumption and operational hours.

Cultivator Market Executive Summary

The global Cultivator Market is characterized by robust business trends centered on technological integration and consolidation among major Original Equipment Manufacturers (OEMs). Key business strategies currently emphasize mergers and acquisitions to expand geographical footprints and diversify product portfolios to include smart implements capable of variable-rate application (VRA) and real-time adjustments based on soil conditions. A significant overarching trend is the move toward fully autonomous or semi-autonomous cultivators, utilizing advanced connectivity and GPS guidance systems, positioning the industry at the forefront of agricultural technology transformation. Furthermore, OEMs are increasingly offering comprehensive service contracts and telematics solutions, shifting the revenue model partly towards after-sales support and precision farming subscriptions, ensuring sustained engagement with high-value customers.

Regional trends indicate that the Asia Pacific (APAC) region, driven by countries like India, China, and Southeast Asian nations, is the fastest-growing market due to rapid farm mechanization initiatives, supportive government subsidies, and the conversion of manual labor to mechanized processes across millions of small to medium-sized farms. North America and Europe, while already mature, dominate the market in terms of value, characterized by the demand for high-horsepower, integrated, and precise tillage machinery aligned with large-scale corporate farming operations and stringent environmental regulations demanding soil preservation. Latin America shows strong potential, particularly Brazil and Argentina, where large agricultural exports require continuous investment in efficient, large-scale primary and secondary tillage equipment to maximize productivity in expansive land areas.

Segment trends highlight the dominance of spring-tine and rigid-tine cultivators, particularly in emerging markets, due to their versatility and lower initial capital cost. However, the rotary tiller segment is experiencing accelerated growth due to its efficiency in specialized crops and intensive farming systems. From an application perspective, the row crop segment remains the largest consumer, but the grain farming segment is rapidly adopting heavier, wider cultivators to maximize coverage efficiency in vast fields. The increasing sophistication of hydraulic control systems and the proliferation of precision agriculture kits that can be retrofitted onto existing cultivator fleets are transforming the segment dynamics, favoring technologically advanced and durable equipment over basic, manual versions.

AI Impact Analysis on Cultivator Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Cultivator Market reveals key themes centered on maximizing efficiency, predictive maintenance, and integrating decision-support systems into tillage processes. Users frequently inquire about how AI can optimize cultivator settings—such as depth, speed, and angle—in real-time based on varying soil moisture content, residue levels, and historical yield data, moving beyond fixed operational parameters. Concerns often revolve around the cost justification of AI-integrated systems and the necessary sensor infrastructure. Expectations are high regarding AI's capability to facilitate fully autonomous cultivation operations, reduce human error, and achieve unprecedented levels of fuel and input efficiency, ultimately leading to substantial long-term savings and enhanced yield consistency across diverse field conditions.

- AI-driven real-time optimization of tillage depth and aggression based on sensor feedback (soil texture, moisture profile).

- Implementation of predictive maintenance algorithms to schedule component replacement for tines, bearings, and hydraulic systems, minimizing unexpected downtime during critical farming windows.

- Integration of machine vision and learning models for precise inter-row cultivation, distinguishing between crops and weeds for selective, targeted tillage and minimizing physical damage to cash crops.

- Development of autonomous cultivator fleets managed by centralized AI platforms, optimizing field routes, minimizing overlap, and reducing operational labor costs significantly.

- AI synthesis of historical yield maps, weather forecasts, and soil health data to recommend optimal cultivation strategies specific to individual zones within a field (Variable Rate Tillage).

DRO & Impact Forces Of Cultivator Market

The dynamics of the Cultivator Market are heavily influenced by a multifaceted array of Drivers, Restraints, Opportunities, and broader Impact Forces that shape investment and adoption patterns globally. The primary drivers include the necessity for enhanced farm productivity to feed a growing world population, coupled with the ongoing shift toward mechanized farming practices, particularly in previously manual-labor-intensive regions. Simultaneously, technological advancements, such as the integration of GPS and sensor technology into cultivator designs, are creating high-precision implements that offer superior soil management capabilities, thereby driving replacement demand and modernization investments. These factors collectively exert a powerful upward impact force on market valuation, encouraging innovation in material science and implement design.

Key restraints, however, temper this growth trajectory. The high initial capital investment required for purchasing modern, heavy-duty cultivators, especially those equipped with precision technology, acts as a significant barrier for small and marginal farmers worldwide. Furthermore, volatility in commodity prices directly affects farmers' disposable income and willingness to invest in large equipment purchases, leading to cyclical market slowdowns. Specific to certain regions, fragmented landholding patterns make the utilization of large-scale, high-capacity implements impractical, favoring smaller, lower-cost alternatives, thus limiting the adoption of high-value products offered by major international OEMs.

Opportunities for market growth are plentiful, primarily stemming from the increasing focus on conservation agriculture, which necessitates specialized equipment for residue management and minimal soil disturbance. This opens lucrative avenues for manufacturers developing sophisticated residue-handling cultivators and strip-tillage implements. Moreover, the burgeoning trend of equipment rental and leasing services in emerging economies mitigates the high initial cost barrier, expanding accessibility to modern equipment and generating a sustainable revenue stream for manufacturers and distributors. The overall impact forces compel continuous research and development into fuel efficiency and durability, positioning the market for long-term sustainable growth centered around smart farming solutions.

Segmentation Analysis

The Cultivator Market is segmented based on several critical parameters, including implement type, functional capacity, mechanism of operation, application crop, and power source, allowing for a detailed analysis of market dynamics and targeted product development strategies. Segmentation provides clarity on which product categories are experiencing rapid technological advancements versus those sustaining baseline demand in developing agricultural sectors. Understanding these segments is crucial for manufacturers tailoring their offerings, from heavy-duty field cultivators designed for deep primary tillage to light-duty row crop cultivators focusing on precision weed management and inter-row aeration. The increasing focus on specialization necessitates diverse product lines to cater to varying soil types, climate conditions, and crop rotations encountered globally.

- By Type:

- Tine Cultivators (Spring Tine, Rigid Tine)

- Rotary Tillers/Rotavators

- Disc Harrows (Offset, Tandem)

- Field and Row Crop Cultivators (Inter-row)

- Chisel Ploughs and Subsoilers (Often classified as heavy cultivators)

- By Power Source/Mounting:

- Tractor-Mounted (Semi-Mounted, Fully Mounted)

- Tractor-Towed (Trailed)

- Self-Propelled (Less common, specialized applications)

- By Application:

- Grain Farming (Wheat, Corn, Barley)

- Row Crop Farming (Soybeans, Cotton, Sugarcane)

- Specialty Crops (Vegetables, Fruits, Horticulture)

- By End User:

- Large Farms/Corporate Farming

- Medium Farms

- Small Farms (often through rental/shared services)

Value Chain Analysis For Cultivator Market

The Value Chain for the Cultivator Market begins with the Upstream Analysis, which focuses on the sourcing of critical raw materials and components necessary for manufacturing robust agricultural implements. Key upstream suppliers provide high-grade steel alloys and specialized castings for tines, frames, and discs, ensuring durability against abrasive soil conditions and high operational stresses. Hydraulic systems, power transmission components, bearings, and sophisticated electronic control units (ECUs) are sourced from specialized industrial component manufacturers. Efficiency in this phase depends heavily on managing raw material price volatility, maintaining stringent quality control standards, and ensuring a stable supply chain for highly customized hydraulic and sensor technology required for precision cultivators.

The midstream stage involves the design, fabrication, assembly, and testing of the final cultivator product. OEMs invest heavily in Research and Development (R&D) to innovate implement designs that minimize fuel consumption, maximize working width, and integrate seamlessly with modern high-horsepower tractors via advanced hitch systems. Manufacturing processes utilize advanced welding and automated assembly lines to ensure consistency and structural integrity. Distribution channels form the link between manufacturers and end-users, primarily consisting of a robust network of authorized dealer dealerships (indirect channels) and, increasingly, online parts and support platforms (direct channels). Dealers play a crucial role, providing localized sales, essential after-sales service, spare parts availability, and operator training, which significantly influences the purchasing decisions of farmers.

The Downstream analysis focuses on the utilization and eventual decommissioning or resale of the equipment. Direct distribution often targets large corporate farms or governmental procurement agencies, facilitating bulk orders and direct negotiations. Indirect distribution through dealerships dominates sales to small and medium-sized farm operations, benefiting from local inventory and credit facilities. The lifecycle management includes routine maintenance, repair services, and the trade-in or auction of used equipment. Technological integration, particularly telematics and remote diagnostics capabilities, is enhancing downstream services, enabling proactive maintenance and reducing machine downtime, thereby maximizing the total cost of ownership for the farmer and strengthening the manufacturer’s brand loyalty.

Cultivator Market Potential Customers

The primary consumers and end-users of cultivators span the entire spectrum of agricultural operations, ranging from massive corporate agribusinesses managing tens of thousands of hectares to independent smallholder farmers relying on basic, cost-effective implements. Large-scale commercial farms represent the most valuable customer segment, characterized by their demand for high-capacity, heavy-duty cultivators, often requiring working widths exceeding 15 meters and equipped with advanced precision features like hydraulic depth control, auto-leveling systems, and integrated GPS guidance. These customers prioritize operational speed, durability, and the total cost of ownership (TCO) efficiency, viewing cultivators as critical assets for maximizing time-sensitive fieldwork during planting preparation windows.

Medium-sized farms, prevalent in regions like North America and Europe, constitute another significant customer base. Their purchasing decisions are often balanced between technology adoption and budget constraints. They seek versatile, mid-range cultivators that can handle multiple tasks, such as primary and secondary tillage, and are increasingly adopting retrofittable precision farming kits to enhance their existing machinery. This segment also highly utilizes equipment rental services, acting as significant indirect customers for manufacturers that partner with large rental fleets, allowing them to access state-of-the-art machinery without the high upfront capital expenditure.

In emerging economies, the potential customers include millions of smallholder farmers whose access to advanced cultivators is often facilitated through government subsidies, cooperative ownership models, or agricultural equipment sharing programs. Their demand centers on durable, low-maintenance, and low-horsepower compatible equipment, such as smaller rotary tillers or rigid-tine cultivators. Furthermore, agricultural contractors who offer custom field preparation services form a crucial segment, as they invest heavily in a diverse fleet of high-performance cultivators to serve multiple client farms, requiring the utmost reliability and efficiency to sustain their service business model.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | John Deere, CNH Industrial (Case IH/New Holland), AGCO Corporation, Kubota Corporation, CLAAS Group, The D&W Group, Alamo Group, Escorts Kubota Limited, Mahindra & Mahindra Ltd., Maschio Gaspardo S.p.A., Kinze Manufacturing, Great Plains Manufacturing, Vaderstad AB, Trelleborg AB (Trelleborg Wheel Systems), Lemken GmbH & Co. KG, Kverneland Group, Kuhn Group, Amazone-Werke, Buhler Industries Inc., and Unia Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cultivator Market Key Technology Landscape

The Cultivator Market is undergoing a rapid technological transformation driven by the integration of digital agriculture tools aimed at optimizing soil management and maximizing operational efficiency. The cornerstone of this technological landscape is Precision Tillage, which incorporates Global Positioning System (GPS) guidance and Real-Time Kinematics (RTK) correction systems to ensure unparalleled accuracy in implement pathing, minimizing overlap and maximizing the utilization of field area. This technology allows for repeatable, controlled depth application, ensuring consistent seedbed quality across varying field topography. Furthermore, advanced hydraulic and electronic control units (ECUs) are utilized to facilitate Variable Rate Tillage (VRT), where the implement's settings (depth, downforce, tilling aggression) are adjusted on-the-go based on pre-loaded prescription maps or real-time sensor data regarding soil compaction or moisture levels.

Sensor integration represents another critical technological advancement. Modern cultivators are increasingly fitted with specialized soil sensors, including penetrometers and radar systems, which measure factors such as soil density, organic matter content, and moisture percentage. These sensors feed data back to the tractor’s terminal, allowing the operator, or the automated VRT system, to make instantaneous adjustments. This level of responsiveness significantly reduces fuel consumption by only applying the necessary force where required and prevents unnecessary soil disturbance in areas where tillage is not needed. Additionally, Telematics and Internet of Things (IoT) connectivity are standardizing operations, enabling remote diagnostics, proactive maintenance scheduling, and detailed performance data logging for fleet management and optimization.

Beyond soil sensing, the design of the implements themselves is evolving technologically. Manufacturers are focusing on durable, lightweight, and wear-resistant materials for tines and discs, such as specialized carbides and boron steel, to enhance lifespan and reduce maintenance frequency. Furthermore, the development of specialized residue management technologies, particularly for conservation tillage systems (strip-till and vertical tillage), requires sophisticated residue flow management systems that prevent plugging while ensuring adequate seedbed preparation. The future trajectory includes wider adoption of electric drive systems, replacing traditional mechanical power take-offs (PTOs) and hydraulics, which will improve energy efficiency and allow for finer electronic control over rotating components.

Regional Highlights

- North America: This region is a mature, high-value market characterized by large-scale farming operations and a strong emphasis on high-horsepower, wide-span cultivators integrated with advanced precision agriculture technologies (GPS, VRT). Demand is driven by the need for maximum efficiency and adherence to environmental stewardship practices, favoring heavy-duty chisel ploughs and sophisticated vertical tillage implements.

- Europe: Europe is characterized by stringent environmental regulations encouraging conservation tillage and reduced soil erosion, fueling the demand for specialized shallow-tillage equipment, strip-tillage units, and high-precision inter-row cultivators. Germany, France, and the UK are major markets, prioritizing fuel efficiency, lower emissions, and operator comfort in machine design.

- Asia Pacific (APAC): The fastest-growing region, driven by governmental initiatives promoting farm mechanization (e.g., India and China). The market here is volume-driven, demanding affordable, durable, and versatile rotary tillers (rotavators) and smaller, tractor-mounted cultivators suitable for smaller and fragmented landholdings.

- Latin America: This region, particularly Brazil and Argentina, represents a significant market for heavy-duty primary tillage equipment due to vast areas dedicated to export crops like soybeans and corn. The focus is on large, trailed cultivators and subsoilers designed to handle challenging tropical soils and heavy crop residues efficiently.

- Middle East and Africa (MEA): A nascent but high-potential market, where growth is highly dependent on governmental investments in irrigated agriculture projects and improving food security. Demand focuses on basic, durable equipment suitable for low-input environments, with growing interest in technologically advanced implements for controlled environment farming.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cultivator Market.- John Deere

- CNH Industrial (Case IH / New Holland)

- AGCO Corporation

- Kubota Corporation

- CLAAS Group

- The D&W Group

- Alamo Group

- Escorts Kubota Limited

- Mahindra & Mahindra Ltd.

- Maschio Gaspardo S.p.A.

- Kinze Manufacturing

- Great Plains Manufacturing

- Vaderstad AB

- Trelleborg AB (Trelleborg Wheel Systems)

- Lemken GmbH & Co. KG

- Kverneland Group

- Kuhn Group

- Amazone-Werke

- Buhler Industries Inc.

- Unia Group

- McFarlane Manufacturing Co., Inc.

- Salford Group Inc.

Frequently Asked Questions

Analyze common user questions about the Cultivator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Cultivator Market?

The Cultivator Market is projected to grow at a robust rate of 6.5% CAGR between 2026 and 2033. This growth is primarily attributed to accelerated farm mechanization, global food demand pressure, and the adoption of precision tillage practices across major agricultural regions worldwide.

How do technological advancements like GPS and sensors impact cultivator adoption?

GPS and sensor integration facilitate precision tillage, allowing cultivators to adjust operational parameters (e.g., depth, downforce) in real-time based on soil conditions (Variable Rate Tillage). This significantly enhances fuel efficiency, optimizes soil health, and leads to superior crop yield outcomes, driving the replacement cycle toward high-tech models.

Which geographical region is expected to lead the growth in the Cultivator Market?

The Asia Pacific (APAC) region, specifically countries like India and China, is projected to be the fastest-growing market segment. This rapid expansion is fueled by extensive government subsidies supporting agricultural modernization, high demand for entry-level and mid-range mechanized tillage solutions, and the shift from manual labor to machine-based farming.

What are the main segments driving demand in the modern Cultivator Market?

Demand is primarily driven by the Tine Cultivators and Rotary Tillers segments. Functionally, the highest growth is observed in implements designed for conservation agriculture, such as strip-till and vertical tillage cultivators, reflecting the industry's focus on soil preservation and sustainable farming methods.

What challenges restrain the expansion of the Cultivator Market?

The primary restraints include the significant high initial investment cost required for advanced, large-scale cultivators, which limits adoption among smallholder farmers. Additionally, volatility in global agricultural commodity prices directly impacts farmers' purchasing power and investment decisions for new equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cultivator Camera Guidance System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Mini Tiller Cultivator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cultivator Finisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cultivator Share Market Size Report By Type (Chisel, Triangular, Reversible), By Application (OEM, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Mini Tiller Cultivator Market Statistics 2025 Analysis By Application (Farm, Garden), By Type (Gasoline Engine, Diesel Engine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager