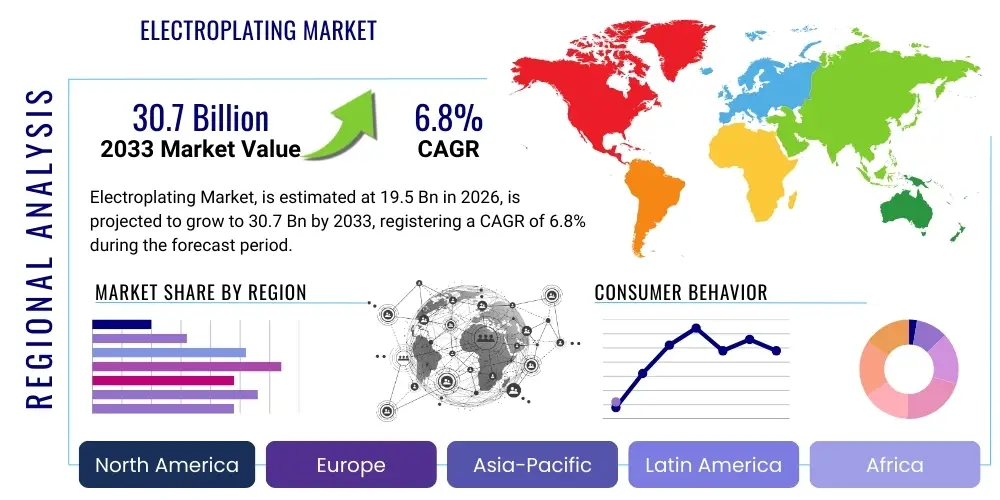

Electroplating Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442832 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Electroplating Market Size

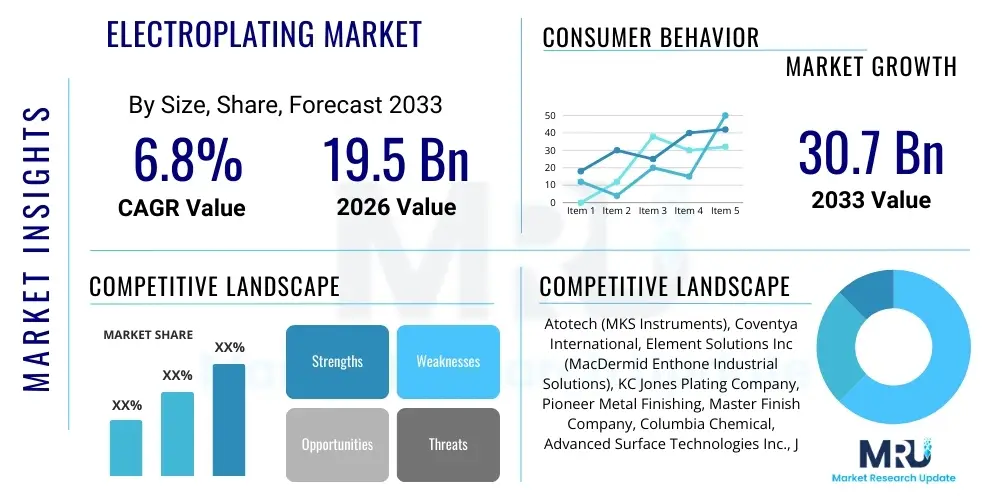

The Electroplating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.7 Billion by the end of the forecast period in 2033.

Electroplating Market introduction

The Electroplating Market encompasses the processes utilizing an electric current to reduce dissolved metal cations in a solution, enabling them to form a thin, coherent metal coating on an electrode. This surface finishing technology is indispensable across numerous industrial sectors, primarily driven by the need to enhance material properties such as corrosion resistance, wear resistance, lubricity, aesthetic appeal, and electrical conductivity. Electroplating facilitates the deposition of various metallic films, including nickel, chromium, copper, zinc, gold, and silver, tailored to specific application requirements. Key product descriptions within this market include functional coatings for engineering applications, decorative coatings for consumer goods, and specialized plating for microelectronics and semiconductor manufacturing. The versatility of electroplating techniques allows for high precision and cost-effective surface modification, positioning it as a foundational process in modern manufacturing.

Major applications of electroplating span the automotive sector, where coatings are crucial for engine components, trim, and electronic systems to ensure durability and reliability under harsh conditions; the aerospace industry, demanding high-performance, lightweight corrosion-resistant coatings; and the electronics segment, where precise deposition of metals like gold and palladium is essential for connectivity, circuitry, and reliable soldering. Beyond these primary sectors, medical devices rely on bio-compatible electroplated surfaces, and the jewelry industry utilizes the process extensively for decorative finishes. The inherent benefits of electroplating, such as improved longevity of base materials, reduced maintenance costs, and the ability to reclaim or repair worn components, underscore its critical role in the value chain of countless products globally. Furthermore, the development of sustainable plating solutions, focusing on reducing hazardous waste and optimizing energy consumption, is currently shaping technological advancements in the industry.

Driving factors for market expansion are intrinsically linked to global industrial output and technological progression. The burgeoning demand for consumer electronics, coupled with the rapid transition towards electric vehicles (EVs), necessitates vast amounts of specialized electroplated components for batteries, power control units, and advanced sensors. Additionally, stricter regulatory standards concerning component lifespan and performance, particularly in high-reliability sectors like defense and aerospace, further stimulate the demand for advanced electroplating services. Geographical industrialization, especially in Asia Pacific economies, coupled with increasing investments in infrastructure and manufacturing capabilities, acts as a strong catalyst for market growth, ensuring the continued adoption and innovation within electroplating processes.

Electroplating Market Executive Summary

The Electroplating Market is characterized by robust growth, propelled primarily by escalating demand from the automotive and electronics sectors, particularly concerning sophisticated functional coatings required for next-generation technologies. Business trends indicate a significant shift towards adopting sustainable and environmentally compliant plating processes, driven by stringent global regulations such as REACH and RoHS. Companies are investing heavily in trivalent chromium plating (T-Cr) as an alternative to hexavalent chromium (H-Cr) and exploring novel electrolyte systems that minimize toxic chemical usage and wastewater generation. Competitive strategy increasingly focuses on vertical integration, acquiring specialized chemical suppliers or surface treatment providers to secure supply chains and proprietary technology. Furthermore, the trend toward high-throughput, automated plating lines, often incorporating robotic handling and real-time process monitoring, is redefining operational efficiency across the industry.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in market size and growth trajectory, largely attributable to the concentration of electronics manufacturing hubs and expansive automotive production facilities in countries like China, South Korea, and Japan. North America and Europe maintain maturity, focusing heavily on specialized, high-margin applications, advanced functional coatings for aerospace and defense, and leading the transition to environmentally safer processes. These regions are prioritizing R&D into nanocoatings and composite electroplating techniques. Emerging markets within Latin America and the Middle East and Africa (MEA) are showing promising growth, underpinned by infrastructure development and nascent electronics assembly industries, though they often rely on imported expertise and materials.

Segment trends reveal that Nickel plating continues to hold a substantial market share due to its versatility and critical importance in decorative and corrosion-resistant applications. However, Copper plating is experiencing high growth, driven by its essential use in advanced printed circuit boards (PCBs) and electrical interconnects required for high-frequency computing and EV battery components. In terms of application methods, rack plating remains dominant for larger, intricate parts, while barrel plating is preferred for high-volume processing of smaller components. The end-use application segment confirms the automotive sector as the most dominant consumer, though the electronics segment is forecasted to exhibit the highest CAGR due to miniaturization and the pervasive need for high-performance surface finishes in microelectronic devices.

AI Impact Analysis on Electroplating Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Electroplating Market frequently center on themes such as process optimization, quality control enhancement, predictive maintenance capabilities, and the potential for fully autonomous plating lines. Users are keenly interested in how machine learning algorithms can analyze complex bath chemistry data, temperature fluctuations, and current density variations in real-time to predict and prevent defects, thereby improving yield and reducing material waste. Concerns often revolve around the initial investment required for sensor integration and data infrastructure, the availability of skilled personnel capable of managing AI-driven systems, and the accuracy of predictive models given the inherent complexity and variability of electroplating baths. Expectations are high regarding the capability of AI to achieve unprecedented levels of consistency and efficiency, moving the industry toward 'smart manufacturing' characterized by reduced human intervention and optimized resource use.

AI’s influence is profound, primarily manifesting in the ability to move beyond reactive process control to proactive optimization. Traditional electroplating relies heavily on manual adjustments and scheduled maintenance based on periodic sample testing. AI systems, integrated with IoT sensors (e.g., pH meters, conductivity probes, spectral analysis tools), continuously monitor hundreds of variables, identifying subtle correlations that affect plating quality, which human operators might miss. This data-driven approach allows for dynamic adjustment of current, dwell time, and chemical dosing, ensuring optimal deposition rates and uniformity across batches. For instance, AI algorithms can predict the depletion rate of additives based on production throughput and history, enabling 'just-in-time' dosing that maintains precise chemical balance, minimizing the risk of burnt deposits or poor adhesion.

Furthermore, AI is instrumental in enhancing defect detection and inspection processes. Machine vision systems powered by deep learning models are capable of high-speed, accurate surface inspection, classifying defect types (e.g., pitting, roughness, blistering) with greater consistency and speed than human inspectors. This not only increases throughput but also provides invaluable feedback loops, linking specific processing parameters to the observed defects, thus allowing AI to suggest automated process corrections immediately. This integrated quality assurance and predictive modeling capability transforms the electroplating operation from an empirical art into a precise, scientifically managed industrial process, significantly lowering operational costs and bolstering compliance with demanding industry quality standards, especially in mission-critical applications like aerospace and medical devices.

- Real-time predictive maintenance scheduling based on equipment wear and bath condition monitoring.

- Optimization of electrolyte composition and dosing through machine learning algorithms, maximizing bath life and reducing chemical consumption.

- Enhanced defect detection and quality assurance using AI-powered machine vision systems for automated surface inspection.

- Automated process parameter adjustments (current density, temperature) to maintain plating consistency and improve yield rates.

- Simulation and digital twin technology deployment to test new plating protocols before physical implementation.

DRO & Impact Forces Of Electroplating Market

The Electroplating Market is shaped by a powerful confluence of driving forces, regulatory constraints, and emerging technological opportunities. Key market Drivers include the explosive expansion of the electric vehicle industry, requiring specialized copper and nickel plating for battery components and power electronics, and the ongoing miniaturization trend in the electronics sector, necessitating high-precision plating for microprocessors and advanced PCBs. Restraints primarily revolve around severe environmental and health regulations concerning traditional processes, notably the restrictions on hexavalent chromium (Cr VI) and cyanide compounds, which impose substantial compliance costs and necessitate expensive process redesigns. Opportunities are abundant in the development of sustainable, non-toxic plating chemistries (e.g., alternatives to H-Cr), the adoption of advanced surface modification techniques like electroless plating and composite coatings, and the implementation of Industry 4.0 elements, such as IoT and AI, for optimized manufacturing.

Impact forces within the market are predominantly exerted by regulatory bodies and technological innovation. The regulatory pressure, particularly from the European Union’s REACH and RoHS directives and similar mandates in Asia, acts as a pivotal force, driving material substitution and process modernization. Companies unable to transition rapidly to compliant chemistries face significant market barriers. Conversely, the rapid pace of technological innovation in material science and process automation acts as a strong upward force. The demand for materials with extreme functional properties—such as diamond-like carbon coatings or amorphous metallic glass coatings produced via electroplating—in high-stress environments like aerospace engines or high-frequency electronics continuously pushes the boundaries of conventional plating, rewarding firms capable of delivering these advanced solutions.

The interplay between these forces dictates competitive dynamics. Firms that successfully navigate the environmental regulatory landscape by investing in closed-loop systems, effluent treatment, and greener chemicals gain a significant competitive advantage and improved public perception. Furthermore, economic volatility in major end-user sectors, such as cyclical downturns in general automotive production or fluctuations in metal commodity prices (e.g., gold, palladium), exerts a financial impact force on market profitability and investment cycles. Successful mitigation involves diversification across end-user industries and securing long-term supply agreements for critical raw materials, ensuring resilience against these macro-economic pressures.

Segmentation Analysis

The Electroplating Market is segmented comprehensively based on several critical parameters, including the type of metal plated, the process utilized, the end-use application, and the function of the coating. Analyzing these segments provides a nuanced view of market dynamics, revealing specific areas of high growth and technological focus. Metal type segmentation—covering nickel, chromium, copper, gold, silver, and zinc—reflects the material science requirements of different industries; for instance, gold and palladium dominate the high-reliability electronics sector, while nickel and chromium are staple coatings for corrosion protection in industrial and automotive applications. Process segmentation delineates between barrel, rack, continuous, and vibratory plating methods, directly corresponding to component size, batch volume, and required coating uniformity. The functional segmentation, differentiating between decorative and functional coatings, highlights the split between aesthetic consumer demands and critical engineering requirements for wear resistance and electrical properties.

Geographically, segmentation underscores the differing regulatory and industrial maturity levels worldwide. APAC leads due to high-volume manufacturing capabilities, while North America and Europe focus on specialized, high-performance plating for aerospace, defense, and medical devices. The largest revenue contribution originates from the functional coatings segment, reflecting the increasing global requirement for enhanced durability and performance in harsh operating environments across complex machinery. Within the end-use segment, the automotive industry historically commands the largest share, leveraging electroplating extensively for corrosion protection, component longevity, and improving the efficiency of internal combustion engines and, increasingly, electric vehicle systems. However, the electronics segment is projected to experience the fastest growth due to the unrelenting demand for faster, smaller, and more powerful connected devices, all dependent on high-precision metallic layers.

The future trajectory of market segmentation points towards rapid growth in niche areas such as composite electroplating (combining metals with inert particles like silicon carbide or PTFE) to achieve specialized functional properties such as enhanced lubricity and superior hardness. Furthermore, the segmentation by coating type, specifically focusing on alternatives to traditional hazardous materials, demonstrates substantial investment. For example, zinc-nickel plating is rapidly replacing pure zinc in automotive chassis applications due to its superior corrosion resistance, directly responding to the segment drivers pushing for extended component lifecycles and lower environmental impact, demonstrating how regulatory pressure fundamentally reshapes market structure.

- By Metal Type: Nickel, Chromium, Copper, Gold, Silver, Zinc, Others (e.g., Palladium, Platinum, Cadmium).

- By End-Use Industry: Automotive, Electronics and Electrical, Aerospace and Defense, Industrial Machinery, Jewelry, Medical Devices, Others.

- By Plating Method: Barrel Plating, Rack Plating, Continuous/Reel-to-Reel Plating, Vibratory Plating.

- By Function: Decorative Coatings, Functional Coatings (Corrosion Resistance, Wear Resistance, Electrical Conductivity, Thermal Barrier).

Value Chain Analysis For Electroplating Market

The Electroplating Market value chain begins with Upstream Analysis, encompassing the procurement and refining of essential raw materials. This includes critical metal salts (e.g., nickel sulfate, copper cyanide, chromium trioxide), specialized chemical additives (brighteners, leveling agents, stabilizers), and base substrate materials (plastics, metals, ceramics) requiring treatment. The pricing and availability of these raw materials, often subject to global commodity markets and geopolitical stability, significantly impact the final product cost and market profitability. Suppliers of specialized chemicals and additives hold crucial leverage due to proprietary formulations that directly determine the performance and environmental profile of the plating process. Innovation at this stage focuses on developing less hazardous, high-performance electrolyte formulations and securing ethical sourcing of precious metals.

The core of the value chain involves the plating service providers and equipment manufacturers, where the actual electroplating process takes place. This midstream segment is characterized by high capital expenditure requirements for sophisticated plating lines, waste treatment facilities, and quality control equipment. Processors range from large, integrated surface treatment facilities serving major automotive original equipment manufacturers (OEMs) to smaller, specialized job shops focusing on high-precision or rapid prototyping services for electronics and medical sectors. Distribution channels, both Direct and Indirect, connect these processors to the final consumer. Large OEMs often maintain in-house electroplating facilities (direct model) for critical components, ensuring strict quality control and secrecy, while smaller and medium-sized enterprises (SMEs) and specialized sectors typically rely on outsourcing to external, independent job shops (indirect model).

Downstream analysis focuses on the integration of electroplated components into final manufactured goods across sectors like automotive, aerospace, and electronics. The demand characteristics and stringent quality specifications of these End-Users dictate the requirements throughout the chain. For instance, the electronics industry demands reel-to-reel continuous plating with ultra-high precision, driving investment in highly automated equipment. Logistical considerations, including the timely and safe transport of treated materials, and robust post-treatment quality checks, including adhesion tests, thickness verification, and corrosion testing, are vital to maintaining the value proposition. The value chain culminates with disposal or recycling processes, increasingly influenced by environmental regulations mandating responsible end-of-life management for plated products and process residues.

Electroplating Market Potential Customers

The potential customers for the Electroplating Market are diverse and strategically vital, spanning multiple high-value industries globally, as the need for enhanced surface functionality is nearly universal in durable goods manufacturing. The primary End-Users/Buyers of electroplating services and technology include major automotive manufacturers (OEMs and Tier 1 suppliers) who require reliable corrosion protection for chassis components, decorative trim, and specialized coatings for intricate engine and transmission parts. With the accelerating shift towards Electric Vehicles (EVs), potential customers now heavily include battery pack manufacturers and power electronics suppliers who rely on copper and nickel plating for thermal management and electrical connectivity in battery cells, busbars, and power control units (PCUs).

The electronics and electrical components industry represents the second largest and fastest-growing customer base. These buyers, including semiconductor manufacturers, PCB fabricators, and connector suppliers, demand precious metal plating (gold, silver, palladium) for contacts, interconnects, and solderable surfaces to ensure reliable signal transmission and durability in microelectronic devices. The pursuit of miniaturization and high-frequency performance necessitates continuous innovation in plating processes tailored specifically for nanometer-scale accuracy. Aerospace and Defense companies are premium customers, demanding highly specialized, robust coatings for extreme conditions, focusing on materials like hard chromium, nickel-boron, and specific alloys for turbines, landing gear, and missile components where failure is not an option, driving demand for certified, high-specification plating shops.

Beyond these major segments, significant potential customers exist in the Industrial Machinery sector, utilizing hard chrome and nickel plating for hydraulic cylinders, rollers, and tooling to improve wear resistance and reduce friction. The Medical Device industry is also a critical buyer, requiring bio-compatible and sterilization-resistant coatings (often gold or platinum group metals) for surgical tools, implants, and diagnostic equipment. Lastly, the General Manufacturing and Consumer Goods sector, including jewelry and fixtures, provides steady demand for aesthetically driven decorative chrome and nickel finishes. These diverse end-user requirements necessitate that electroplating providers offer specialized process lines, rigorous quality management systems (like ISO/TS 16949 for automotive), and detailed material traceability, catering precisely to the high standards of their specific customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atotech (MKS Instruments), Coventya International, Element Solutions Inc (MacDermid Enthone Industrial Solutions), KC Jones Plating Company, Pioneer Metal Finishing, Master Finish Company, Columbia Chemical, Advanced Surface Technologies Inc., JCU International, Ronatec, LLC, Ashton and Moore Ltd., Allied Finishing Inc., Electrochemical Products Inc. (EPI), ECF Electro Chemical Finishing, Okuno Chemical Industries Co. Ltd., Midland Plating, Bajaj Plating, Techmetals Inc., Precision Plating Company Inc., Peninsula Plating Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electroplating Market Key Technology Landscape

The technology landscape within the Electroplating Market is currently undergoing a significant transformation driven by sustainability requirements and the increasing demand for advanced material functionality. One critical technological evolution involves the shift away from highly toxic processes, primarily the replacement of hexavalent chromium (Cr VI) plating with superior, safer alternatives such as trivalent chromium (Cr III) and advanced nickel alloy systems. Cr III plating technology has matured significantly, offering comparable corrosion resistance and aesthetic qualities for many decorative and functional applications, although challenges remain in achieving the high hardness and thickness traditionally associated with hard Cr VI. Furthermore, advancements in specialized alloy plating, such as zinc-nickel and tin-zinc, are being heavily adopted in the automotive sector for enhanced sacrificial corrosion protection, demonstrating a clear technological migration towards high-performance, environmentally compliant chemistries.

Another pivotal area of technological innovation is in process control and automation, reflecting the broader Industry 4.0 movement. Modern electroplating facilities increasingly incorporate highly sophisticated automation systems, including robotic loading and unloading, automated chemical dosing based on real-time sensor data, and closed-loop control systems. These technologies, enabled by industrial Internet of Things (IoT) connectivity, allow for unprecedented precision in managing parameters like current density distribution, bath temperature profiles, and agitation rates. Continuous reel-to-reel plating lines, used predominantly in the electronics industry for plating connectors and lead frames, have become highly digitized, employing high-speed vision inspection systems and computerized process optimization to ensure micron-level uniformity and minimize defects across extremely high volumes.

Future technological advancements are focused on developing composite and functionalized coatings that integrate nanoparticles or ceramics into the metal matrix (Nano-Electroplating), enhancing properties such as hardness, lubricity, and thermal stability far beyond what pure metal deposits can achieve. Technologies like Pulse Plating, which uses a specific cycle of current on and off periods rather than continuous current, are gaining traction. Pulse Plating offers superior control over grain structure and deposit morphology, enabling the deposition of fine-grained, high-density coatings with improved mechanical properties, crucial for demanding applications in microelectronics and medical implants. This continuous push towards cleaner, smarter, and functionally superior coatings defines the contemporary technology landscape of the electroplating industry.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global electroplating market, fueled by its status as the world’s primary manufacturing hub for electronics, automotive components, and consumer goods. Countries like China, India, South Korea, and Japan possess massive production capacities requiring high volumes of surface treatment. The region benefits from lower operating costs and governmental support for industrial expansion, though it faces increasing pressure to adopt Western environmental standards, driving investment in modern, sustainable plating facilities. The high concentration of semiconductor and PCB manufacturing, especially in Taiwan and South Korea, makes this region crucial for high-precision copper and precious metal plating services.

- North America: The North American market is mature, characterized by stringent regulatory environments and a focus on high-value, specialized applications, particularly within the Aerospace, Defense, and Medical sectors. Demand is driven by the need for complex, highly certified coatings (e.g., specialized cadmium alternatives, aerospace chromates) that meet demanding military and FAA specifications. While bulk manufacturing has migrated elsewhere, North America leads in the adoption of automated, environmentally compliant processes and advanced research into new plating alloys and composite materials, often commanding premium pricing for superior quality and traceability.

- Europe: Europe is defined by the rigorous enforcement of environmental regulations, notably REACH and RoHS, which heavily restrict the use of hazardous substances like hexavalent chromium, lead, and cadmium. This regulatory landscape compels high innovation rates, positioning Europe as a leader in developing sustainable plating chemistries, such as specialized trivalent chromium baths and PVD/electroplating hybrid systems. The strong automotive industry (Germany, France) and the specialized industrial machinery sectors drive demand for highly durable, corrosion-resistant functional coatings, emphasizing quality and sustainability over volume.

- Latin America (LATAM): LATAM represents an emerging market with moderate growth, primarily tied to the regional automotive production (Brazil, Mexico) and infrastructure investment. The market often lags technologically behind APAC and Europe, relying on imported expertise and mature plating technologies. However, increasing foreign direct investment in manufacturing is gradually modernizing facilities, particularly those serving export-oriented industries, increasing the demand for reliable surface finishing services aligned with international quality standards.

- Middle East and Africa (MEA): The MEA market is currently small but exhibits growth potential, mainly driven by expansion in the region's oil and gas sector (requiring heavy corrosion-resistant coatings for pipelines and equipment) and burgeoning construction and automotive assembly industries. Market dynamics are highly influenced by localized infrastructure projects and require specialized coatings resilient to high temperatures and harsh desert environments. The region is largely reliant on international suppliers for advanced chemicals and equipment, making cost and logistics a key factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electroplating Market.- Atotech (MKS Instruments)

- Coventya International

- Element Solutions Inc (MacDermid Enthone Industrial Solutions)

- KC Jones Plating Company

- Pioneer Metal Finishing

- Master Finish Company

- Columbia Chemical

- Advanced Surface Technologies Inc.

- JCU International

- Ronatec, LLC

- Ashton and Moore Ltd.

- Allied Finishing Inc.

- Electrochemical Products Inc. (EPI)

- ECF Electro Chemical Finishing

- Okuno Chemical Industries Co. Ltd.

- Midland Plating

- Bajaj Plating

- Techmetals Inc.

- Precision Plating Company Inc.

- Peninsula Plating Inc.

Frequently Asked Questions

Analyze common user questions about the Electroplating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary environmental challenges facing the electroplating industry?

The key environmental challenge is the phase-out of hazardous substances, specifically hexavalent chromium (Cr VI) and cyanide compounds, mandated by global regulations like REACH. The industry is rapidly transitioning to safer alternatives such as trivalent chromium and non-cyanide baths, requiring significant investment in new chemistries and advanced wastewater treatment technologies to meet zero-discharge goals.

How is the electric vehicle (EV) sector impacting demand in the electroplating market?

The EV sector is a major growth driver, significantly increasing demand for high-conductivity and corrosion-resistant copper and nickel plating for battery components (busbars, connectors) and power electronics. These applications require extremely reliable, functional coatings to ensure thermal management and power efficiency in high-stress operating environments.

What is the difference between rack plating and barrel plating?

Rack plating is used for large, complex, or fragile parts that require precise, uniform plating thickness across the surface, as parts are individually fixed to conductive racks. Barrel plating is a high-volume, cost-effective method where small, durable parts are tumbled inside a rotating perforated barrel submerged in the plating solution, offering excellent efficiency but potentially less uniform deposition.

Which geographical region holds the largest share of the global electroplating market?

The Asia Pacific (APAC) region holds the largest market share, driven by its expansive and high-volume manufacturing base in electronics, semiconductors, and automotive production, particularly in industrial giants like China, Japan, and South Korea, which command global supply chains.

What role does automation play in modern electroplating facilities?

Automation, often utilizing robotic systems and IoT sensors, plays a critical role in enhancing efficiency, consistency, and traceability. It enables precise control over process parameters, automated chemical dosing, and high-speed quality inspection (AI-vision systems), leading to higher yield rates and reduced human error in complex plating cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electroplating Chemicals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electroplating Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electroplating Equipment Market Size Report By Type (Automatic, Semi-Automatic, Others), By Application (Automotive, Machinery, Home Appliance, Electronic, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Blower Market Statistics 2025 Analysis By Application (Electroplating Industry, Chemical Industry, Hospital, Laboratory), By Type (Low Pressure, Medium Voltage, High Pressure), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Chromic Anhydride Market Statistics 2025 Analysis By Application (Printing and Dyeing Industry, Electroplating Industry, Wood Preservation), By Type (Purity 99.7%, Purity 99.8%, Purity 99.9%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager