Food Safety Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441821 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Food Safety Market Size

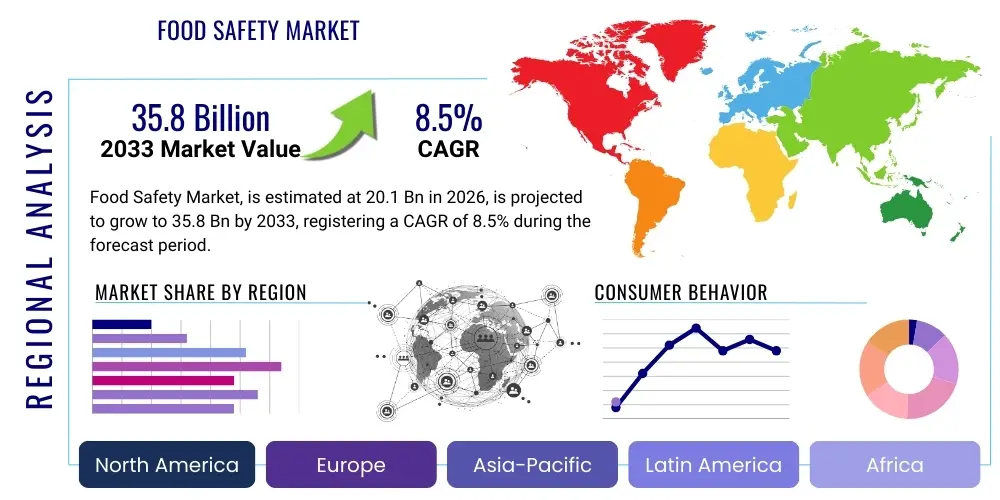

The Food Safety Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 20.1 Billion in 2026 and is projected to reach USD 35.8 Billion by the end of the forecast period in 2033.

Food Safety Market introduction

The Food Safety Market encompasses a vast array of sophisticated testing, inspection, and certification services, alongside specialized hardware and consumable systems designed to ensure the integrity and wholesomeness of food products across the global supply chain. This sector is fundamentally driven by stringent governmental regulations aimed at minimizing the incidence of foodborne illnesses, protecting public health, and maintaining consumer trust in consumable goods. Core activities within this market include the detection of harmful pathogens, such as Salmonella and E. coli, the measurement of chemical residues like pesticides and heavy metals, and the comprehensive analysis of allergens and genetically modified organisms (GMOs). The necessity for robust safety protocols extends from primary production and raw material handling through complex manufacturing, processing, packaging, and final retail distribution, making food safety an indispensable component of modern agribusiness and commerce.

The operational scope of food safety technologies includes traditional microbiological culturing methods, alongside advanced molecular diagnostics like Polymerase Chain Reaction (PCR) and next-generation sequencing (NGS), which provide rapid, highly sensitive, and definitive identification of contaminants. Product descriptions within this domain range from rapid test kits and handheld devices utilized for immediate on-site verification to large, automated laboratory instruments, such as mass spectrometers and chromatography systems, employed for detailed compositional analysis. Major applications span critical sectors including meat and poultry processing, dairy production, fresh produce analysis, and highly regulated infant formula manufacturing. The primary function is risk mitigation, ensuring that food products comply with both domestic and international standards, thereby facilitating global trade and reducing financial liabilities associated with large-scale recalls or outbreaks.

The benefits derived from a robust food safety infrastructure are multifaceted, yielding increased consumer confidence, reduced economic burden from public health crises, and enhanced brand reputation for food manufacturers. Key driving factors accelerating market expansion include the increasing globalization of the food supply chain, which introduces complexity and necessitates harmonization of international standards; the rising consumer awareness regarding food quality, origin, and traceability; and the dramatic growth in regulatory scrutiny, particularly in emerging economies seeking parity with established global trade norms. Furthermore, technological advancements, especially the integration of automation and digitalization, are continuously enhancing the efficiency and accuracy of safety testing protocols, pushing the market toward non-invasive, high-throughput screening solutions capable of handling massive sample volumes rapidly.

Food Safety Market Executive Summary

The Food Safety Market is currently characterized by significant consolidation among major testing and inspection providers and a rapid shift towards digitized, end-to-end traceability solutions. Business trends indicate a strong preference for outsourcing testing services to large, accredited third-party laboratories, driven by the substantial capital investment required for in-house testing infrastructure and the complexity of regulatory compliance across multiple jurisdictions. Strategic mergers and acquisitions are commonplace, particularly focused on integrating regional testing facilities to achieve economies of scale and expand geographic footprints. The demand is segmenting, with high-growth opportunities identified in rapid testing technologies that reduce time-to-result, crucial for perishable goods, and in authenticity testing, driven by concerns over food fraud and economic adulteration, which poses both safety and integrity risks to the supply chain.

Regionally, North America and Europe maintain market dominance, primarily due to their mature regulatory frameworks, mandatory compliance standards, and high consumer spending on safe and traceable food products. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by increasing urbanization, rising disposable incomes leading to greater demand for processed and imported foods, and the rapid development of local food safety governance structures. Countries like China and India are significantly investing in national food surveillance programs and laboratory accreditation, transforming from regional suppliers to major global trading partners that must comply with sophisticated international safety requirements. Latin America and the Middle East and Africa (MEA) are also experiencing moderate growth, primarily driven by export-oriented food industries that require internationally recognized certifications to access lucrative overseas markets, emphasizing compliance with standards such as ISO 22000 and Hazard Analysis and Critical Control Points (HACCP).

Segment trends reveal that the Services segment (encompassing auditing, certification, and regulatory consulting) commands the largest market share, reflecting the continuous, complex nature of compliance and the industry's reliance on expert validation. Within the Technology segment, rapid testing methods, particularly those leveraging molecular biology and immunology, are experiencing explosive growth, displacing slower, conventional methods. This trend is vital for mitigating recall risks and ensuring just-in-time logistics. Application-wise, the meat and poultry sector remains the largest consumer of food safety services due to its high propensity for microbial contamination, yet the fruits and vegetables sector is demonstrating accelerated adoption of testing protocols, driven by increased public scrutiny of pesticide residues and microbial outbreaks linked to fresh produce consumption. Overall, the market trajectory is defined by innovation in speed, automation, and data connectivity, linking safety testing results directly into broader supply chain management systems.

AI Impact Analysis on Food Safety Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Food Safety Market center around its capabilities in predictive modeling, automating complex data interpretation, and transforming real-time monitoring. Users frequently inquire about how AI can predict contamination outbreaks before they occur, optimize sampling strategies in large manufacturing facilities, and integrate disparate data sources—such as environmental data, processing logs, and testing results—to provide actionable insights. A prevalent concern is the potential replacement of human expertise in auditing and quality control versus the augmentation of human decision-making. Users are also keen on understanding AI's role in detecting subtle forms of food fraud, which traditional testing might overlook, and how machine learning algorithms can manage the overwhelming volume of data generated by modern genomic sequencing and high-throughput screening instruments. The overall expectation is that AI will introduce unprecedented levels of efficiency, precision, and proactive risk management into the food safety ecosystem.

AI’s influence is profoundly evident in enhancing the speed and accuracy of analytical processes. Machine learning models are being deployed to analyze spectral and image data (from hyperspectral imaging systems) to rapidly identify foreign materials, assess product quality parameters, and detect early signs of spoilage without physical sampling. Furthermore, AI algorithms are becoming integral to laboratory operations, optimizing workflow scheduling, performing automated data quality checks, and accelerating the interpretation of complex results, such as metagenomic sequencing data used for microbial source tracking. This automation minimizes human error and significantly reduces the turnaround time for critical safety decisions, transforming food safety from a reactive measure into a highly proactive system.

In the realm of predictive analytics, AI models are ingesting vast quantities of historical outbreak data, environmental conditions, supply chain logistics, and production metrics to forecast areas and products at high risk of contamination. This capability allows manufacturers and regulators to implement targeted interventions, focusing limited resources on the most vulnerable points in the supply chain. For example, AI can identify specific farms or processing batches likely to harbor pathogens based on sensor data and historical trends, enabling preemptive testing and isolation. Furthermore, the integration of AI with Internet of Things (IoT) sensors facilitates continuous, real-time monitoring of critical control points (CCPs), ensuring immediate alert generation upon deviation from established safety thresholds, thus enabling truly adaptive food safety management systems.

- AI-driven predictive modeling for proactive outbreak prevention.

- Automated image analysis (e.g., hyperspectral imaging) for non-invasive contaminant detection.

- Optimization of laboratory workflows and high-throughput data interpretation using machine learning.

- Enhanced food fraud detection by identifying anomalous patterns in sourcing and compositional data.

- Real-time monitoring and alert generation through AI integration with IoT sensors at Critical Control Points (CCPs).

- Improved microbial risk assessment and source tracking using genomic data analysis.

DRO & Impact Forces Of Food Safety Market

The Food Safety Market is dynamically shaped by a crucial interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces influencing its trajectory. The primary driver is the accelerating stringency of global regulatory standards, notably the implementation and enforcement of modern safety acts across major economies, such as the Food Safety Modernization Act (FSMA) in the US and equivalent European Union regulations. This regulatory pressure mandates continuous monitoring and validation across the entire supply chain. Concurrent with this is the escalating rate of reported foodborne illnesses and high-profile product recalls, which severely damage consumer confidence and compel industry participants to invest heavily in advanced testing and traceability solutions. Furthermore, the rapid growth of the global processed food industry and international trade necessitates standardized, rapid, and reliable testing protocols to ensure compliance and market access, thereby stimulating demand for sophisticated analytical technologies and comprehensive inspection services.

Conversely, significant restraints impede the market's full potential. The high capital expenditure required for acquiring and maintaining advanced diagnostic equipment, such as mass spectrometers and genomic sequencers, presents a substantial barrier to entry for smaller food processing facilities, particularly in developing regions. Furthermore, the necessity for skilled personnel—highly trained laboratory technicians and data scientists—to operate and interpret results from these complex systems often leads to operational bottlenecks and higher service costs. Another key restraint is the current lack of harmonization among international food safety standards, which creates compliance complexity and redundancy in testing for companies operating across multiple borders. The challenge of developing sufficiently rapid, yet highly accurate, testing methods that can handle complex food matrices without generating false positives or negatives also acts as a technical limitation that the industry is constantly striving to overcome.

Opportunities within the Food Safety Market are primarily concentrated around technological innovation and geographic expansion. The increasing development and commercial adoption of rapid testing kits, particularly those incorporating Point-of-Care (POC) diagnostics and biosensors, offer a significant growth avenue by enabling immediate, decentralized testing directly on the processing floor. Furthermore, the market benefits from the massive opportunity presented by digital transformation, specifically the integration of blockchain technology and advanced data analytics to create secure, transparent, and immutable food traceability systems, addressing rising concerns about supply chain provenance and integrity. From a geographic perspective, the burgeoning middle class and expanding domestic consumer markets in Asia Pacific and Latin America offer fertile ground for market expansion, requiring the establishment of new accreditation bodies, testing labs, and certified service networks to meet escalating local and international safety demands, fundamentally changing the risk profile and requiring continuous technological evolution.

Segmentation Analysis

The Food Safety Market segmentation provides a granular view of distinct revenue streams based on the type of intervention (product or service), the application area (end-user industry), the technology utilized (conventional versus rapid methods), and the specific target organism or contaminant. This structured analysis is essential for identifying high-growth niches, understanding industry procurement patterns, and formulating targeted market strategies. The market is predominantly divided between the provision of physical testing kits and instruments (systems) and the delivery of professional compliance, auditing, and laboratory analysis services. The performance of these segments is heavily correlated with regulatory cycles and technological maturity, with services often providing stable, recurring revenue, while product sales are driven by innovation and replacement cycles.

Within the technology landscape, the shift from conventional microbiological techniques, which are time-intensive, to advanced molecular and immunodiagnostic platforms is the most defining segment trend. Applications are intrinsically linked to the inherent risks associated with different food categories; for instance, meat and dairy require intense pathogen screening, while fruits and vegetables necessitate detailed pesticide and residue analysis. Understanding these specific application needs guides research and development efforts toward specialized testing solutions, ensuring maximal relevance and compliance effectiveness for diverse food manufacturers worldwide. This detailed segmentation allows market participants to tailor their offerings precisely to the regulatory requirements and contamination concerns specific to each food matrix.

- By Component: Systems (Instruments, Kits and Reagents), Services (Auditing, Certification, Regulatory Consulting, Laboratory Testing)

- By Application: Meat and Poultry, Dairy Products, Processed Food, Fruits and Vegetables, Cereals and Grains, Beverages

- By Technology: Traditional/Conventional (Culturing Methods), Rapid Technologies (PCR, Immunoassay, Chromatography, Spectroscopy)

- By Target Contaminant: Pathogens (Bacteria, Viruses, Parasites), Toxins, Pesticides and Chemical Residues, Adulterants, GMOs, Allergens

Value Chain Analysis For Food Safety Market

The value chain for the Food Safety Market begins with the upstream activities centered on the research, development, and manufacturing of critical testing supplies. This upstream segment is dominated by specialized biotechnology and life science companies that produce complex analytical instruments, standardized reference materials, molecular biology reagents (like primers and probes for PCR), and specialized microbiological media. These manufacturers invest heavily in R&D to enhance detection sensitivity, increase throughput, and reduce testing time, aiming for global accreditation (e.g., ISO 17025 compliance) to validate their product performance. Key strategic considerations in this stage involve intellectual property management and securing reliable supply chains for critical chemical and biological components, which directly impact the final reliability and cost of safety testing solutions deployed downstream.

The midstream of the value chain is characterized by the delivery of testing and inspection services. This involves independent third-party laboratories, accredited inspection bodies, and certification organizations (such as SGS, Eurofins, and Intertek). These entities procure the upstream instruments and reagents to perform routine and specialized analytical tests on behalf of food processors, retailers, and governmental agencies. Distribution channels for both products and services are crucial; direct sales teams handle large, capital-intensive equipment to food processing giants and central labs, while specialized distributors and service agents manage consumable reagents and rapid testing kits. The distribution model for services is primarily direct, focusing on establishing long-term contracts for recurring compliance and auditing services, often involving global networks of strategically located testing facilities to ensure localized logistical efficiency and rapid sample handling.

Downstream activities involve the final end-users—the food producers, distributors, and retailers—who utilize the testing results and certifications to ensure product compliance and market access. Direct channels are utilized when manufacturers establish highly specialized, on-site laboratories for routine quality control, procuring instruments and kits directly from suppliers. Indirect distribution, however, is far more common, where food companies contract with third-party testing labs, relying on the labs' established expertise and accreditations to meet stringent regulatory requirements. This complex distribution structure, involving both direct supply to internal QA departments and heavy reliance on extensive third-party service networks, ensures that safety validation is integrated throughout the global supply chain, from farm-to-fork, mitigating risks associated with handling and storage at every logistical step.

Food Safety Market Potential Customers

The potential customer base for the Food Safety Market is broad and encompasses all entities involved in the production, processing, distribution, and commercial sale of food and feed products, where ensuring public health and regulatory adherence is paramount. Primary end-users include large-scale commercial food processors across meat, dairy, beverage, and packaged goods sectors, which face continuous pressure to comply with hygiene standards and contamination limits. These customers require high-throughput testing solutions and comprehensive risk management services to handle massive production volumes and minimize the high financial risk associated with product recalls. They often invest in both internal quality assurance labs and rely on external services for specialized, non-routine testing and validation, making them the largest consumer segment for both instrumentation and services.

A second crucial customer group comprises retail and hospitality sectors, including major supermarket chains, foodservice distributors, and restaurant groups. Although they may not perform complex analytical testing themselves, they are intensely focused on supplier assurance and traceability validation. These customers require extensive auditing and certification services to verify that their suppliers meet required standards (e.g., GFSI-recognized schemes like BRCGS or SQF). Furthermore, they are significant users of rapid testing devices for immediate checks at distribution centers and points of receipt to verify temperature compliance and basic hygiene standards, acting as the final checkpoint before products reach the consumer, demanding robust supply chain visibility and accountability.

Government agencies and regulatory bodies form a specialized customer segment, serving as both regulators and direct consumers of food safety products and services. National public health laboratories, import/export inspection authorities, and public food surveillance programs utilize advanced analytical instrumentation for official compliance testing, monitoring pathogen prevalence, and investigating foodborne outbreaks. This segment is driven less by profit and more by statutory requirements and public health mandates, necessitating procurement of the most accurate, often high-cost, reference testing methods. Additionally, customers include agricultural producers (farmers and cooperatives) who increasingly require testing for soil contaminants, pesticide residues, and animal feed safety, driven by farm-to-table traceability initiatives and heightened environmental monitoring requirements enforced by upstream processors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.1 Billion |

| Market Forecast in 2033 | USD 35.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Thermo Fisher Scientific, SGS SA, Intertek Group, Eurofins Scientific, Bureau Veritas, Merck KGaA, VWR International, Bio-Rad Laboratories, Neogen Corporation, Romer Labs, Agilent Technologies, Danaher Corporation, Shimadzu Corporation, PerkinElmer, QIAGEN, Biorad, Testo SE & Co. KGaA, FoodChain ID, Charm Sciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Safety Market Key Technology Landscape

The technological landscape of the Food Safety Market is undergoing continuous transformation, moving from laborious, culture-based microbiology to highly automated, molecular-based detection systems. Conventional technologies, while still foundational for certain types of quantitative microbial analysis, are increasingly being supplemented or replaced by Rapid Technologies due to the critical need for speed and early detection. Polymerase Chain Reaction (PCR) technology, including real-time quantitative PCR (qPCR) and digital PCR (dPCR), is a cornerstone of modern pathogen detection, offering unparalleled specificity and sensitivity for identifying even minute quantities of microbial DNA or RNA. These molecular methods significantly reduce the time required for a definitive diagnosis from several days to mere hours, a factor crucial in preventing large-scale distribution of contaminated product batches. Furthermore, advanced automation systems integrated with PCR platforms allow for high-throughput screening, accommodating the massive testing volumes demanded by large food processors and centralized laboratories, establishing PCR as a mandatory compliance tool.

Immunoassay techniques, including Enzyme-Linked Immunosorbent Assay (ELISA) and lateral flow devices (LFDs), represent another vital technological pillar, particularly for the detection of allergens, toxins (mycotoxins, marine toxins), and certain chemical residues. LFDs are highly valued for their simplicity, portability, and low cost, making them ideal for on-site, rapid screening applications outside of dedicated lab settings, such as at loading docks or processing lines where immediate pass/fail decisions are required. ELISA, offering higher sensitivity and the capacity for quantitative analysis, remains essential in centralized laboratories for rigorous validation. The recent trend involves miniaturization and integration of these immunoassay techniques with microfluidics, leading to highly efficient, multi-analyte portable testing platforms that can simultaneously screen for several contaminants from a single food sample, enhancing comprehensive risk assessment capabilities dramatically.

In the realm of chemical analysis and food authenticity, advanced separation science and mass spectrometry techniques are indispensable. Technologies like High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), and their coupling with various Mass Spectrometry (MS) detectors (GC-MS/MS, LC-MS/MS) provide definitive identification and quantification of complex chemical contaminants, including persistent organic pollutants, veterinary drug residues, and complex pesticide mixes. These high-end instruments are also pivotal in detecting economically motivated adulteration (EMA) and food fraud, such as identifying undeclared species in meat products or confirming geographical origins of high-value goods like olive oil and honey through sophisticated compositional profiling. Emerging technologies, including whole-genome sequencing (WGS) and blockchain traceability platforms, are also beginning to revolutionize the market by providing unprecedented depth in microbial source tracking during outbreaks and establishing transparent, immutable records of food provenance and safety checks throughout the supply chain.

Regional Highlights

Regional dynamics heavily influence the adoption rates and strategic focus areas within the Food Safety Market, reflecting differences in regulatory maturity, consumer spending power, and food production intensity. North America, encompassing the United States and Canada, represents a mature market characterized by exceptionally stringent regulatory environments, driven significantly by the U.S. Food Safety Modernization Act (FSMA). This region leads in adopting advanced technologies, particularly rapid diagnostics and complex chemical analysis (LC-MS/MS), necessitated by a highly complex, often imported, food supply chain and high consumer demand for transparency. Key investments here are focused on traceability solutions and predictive risk analytics to mitigate costly recalls, making it a hub for innovative laboratory service providers and instrument manufacturers.

Europe stands as another dominant region, defined by the rigorous standards imposed by the European Food Safety Authority (EFSA) and the strong focus on consumer protection and environmental sustainability. European markets show a high concentration of accredited third-party testing laboratories and are leaders in certification services, particularly those related to quality schemes, organic labeling, and allergen management. Demand is robust for solutions that address chemical residues and authentic identification of food products, driven by past high-profile contamination incidents and strong regulatory oversight regarding genetically modified organisms (GMOs) and maximum residue limits (MRLs). Germany, France, and the UK are primary contributors to the market size, with substantial R&D activity centered on harmonization of testing protocols across member states.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, transitioning rapidly due to increased industrialization of food processing and heightened awareness regarding public health. Population growth, rising disposable incomes, and the expansion of import/export activities are forcing countries like China, India, and Japan to dramatically modernize their food safety infrastructure. While initial adoption may focus on basic microbial testing and sanitation services, the long-term growth is driven by massive governmental investments in upgrading national laboratory capabilities, leading to rapid procurement of modern instrumentation and a corresponding increase in demand for comprehensive certification and training services necessary to align with global export standards. Latin America (LATAM) and the Middle East and Africa (MEA) present growth opportunities tied primarily to export-oriented industries (e.g., meat, aquaculture, fresh produce), where the need for international certification (e.g., compliance with Codex Alimentarius) drives the outsourcing of sophisticated testing requirements.

- North America: Market leader, driven by FSMA compliance, advanced molecular testing adoption, and high investment in traceability technology.

- Europe: High adoption of certification and auditing services, focus on chemical residue and allergen management, driven by EFSA guidelines.

- Asia Pacific (APAC): Fastest growing market, fueled by increasing regulatory modernization, rising urbanization, and government investment in laboratory infrastructure.

- Latin America and MEA: Growth dependent on increasing food exports and the necessity for international accreditation and compliance standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Safety Market. These companies are instrumental in shaping technological development, regulatory compliance standards, and the global delivery of essential testing and inspection services, often engaging in strategic acquisitions to consolidate their geographic and segment dominance.- Thermo Fisher Scientific

- SGS SA

- Eurofins Scientific

- Intertek Group

- Bureau Veritas

- Neogen Corporation

- 3M Company

- Merck KGaA

- Bio-Rad Laboratories

- VWR International (Avantor)

- Agilent Technologies

- Danaher Corporation

- Shimadzu Corporation

- PerkinElmer Inc.

- QIAGEN N.V.

- Romer Labs (DSM)

- Charm Sciences Inc.

- Testo SE & Co. KGaA

- FoodChain ID

- 3M Health Care

Frequently Asked Questions

Analyze common user questions about the Food Safety market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the expansion of the Food Safety Market?

The primary driver is the accelerating stringency and mandatory enforcement of global regulatory standards, such as FSMA and EU directives, which compel food producers to adopt advanced, frequent, and validated testing protocols across all stages of the supply chain to minimize public health risks and ensure legal compliance. Increased consumer awareness regarding food quality and provenance also plays a significant supporting role.

Which technological segment is demonstrating the highest growth rate?

The Rapid Testing Technologies segment, particularly those utilizing Polymerase Chain Reaction (PCR) and advanced molecular diagnostics, is experiencing the highest growth. This acceleration is driven by the critical industry need for faster time-to-result, enabling proactive containment of potential contamination events and reducing costly product hold times compared to slower, conventional microbiological culturing methods.

How is Artificial Intelligence (AI) specifically transforming food safety operations?

AI is transforming food safety by enabling predictive modeling to forecast contamination risks based on historical and real-time data, optimizing complex sampling strategies, and automating the interpretation of high-throughput analytical data (e.g., genomic sequencing). This shifts the industry towards proactive, risk-based interventions rather than reactive responses to outbreaks.

What are the major challenges facing small and medium-sized food enterprises (SMEs) in adopting modern food safety solutions?

SMEs face significant challenges due to the high initial capital expenditure required for purchasing sophisticated analytical instruments and the subsequent ongoing costs of specialized consumables and reagents. Additionally, the lack of sufficient highly trained technical personnel to operate advanced equipment and maintain complex compliance documentation often necessitates expensive outsourcing of testing services, impacting operational margins.

Which geographical region is expected to exhibit the fastest market growth, and why?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest market growth. This is attributed to rapid urbanization, rising disposable incomes leading to higher demand for traceable and imported food, and massive governmental efforts to modernize and standardize domestic food safety infrastructure to align with international trade requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Food Safety Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Food Safety Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Food Safety Testing Market Size Report By Type (Pathogen, Genetically modified organism (GMO), Chemical and toxin, Others, , Agar culturing, PCR-based assay, Immunoassay-based, Others), By Application (Meat, Poultry, & Seafood Products, Dairy & Dairy Products, Processed Food, Beverages, Cereals & Grains, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Csa Food Safety Testing Market Size Report By Type (Allergen Testing, Chemical & Nutritional Testing, Genetically Modified Organism (GMO) Testing, Microbiological Testing, Residues & Contamination Testing, Others), By Application (Meat, Poultry, & Seafood Products, Dairy & Dairy Products, Processed Food, Beverages, Cereals & Grains, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Multi-channel Pesticide Residue Detector Market Statistics 2025 Analysis By Application (Food Safety & Environmental Authorities, Farmers Market, Research Lab), By Type (8 Channels, 12 Channels, 24 Channels), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager