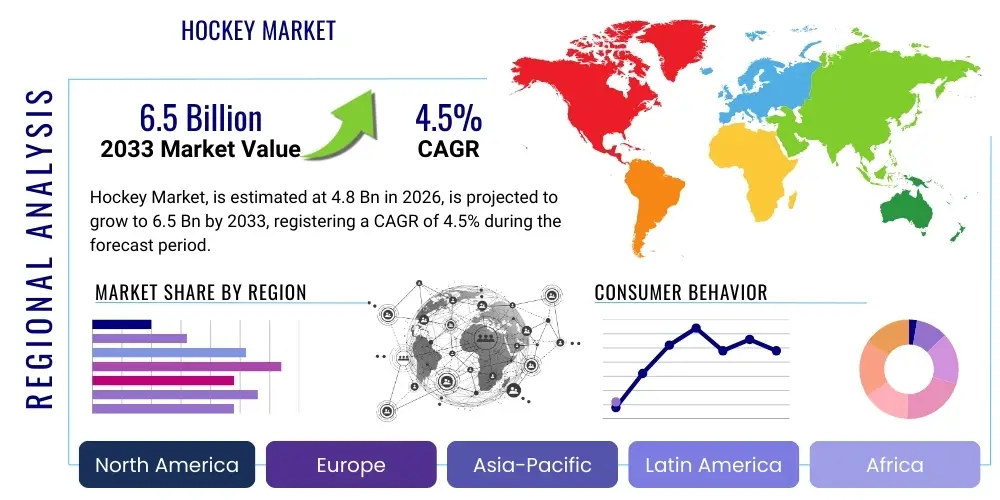

Hockey Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442525 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Hockey Market Size

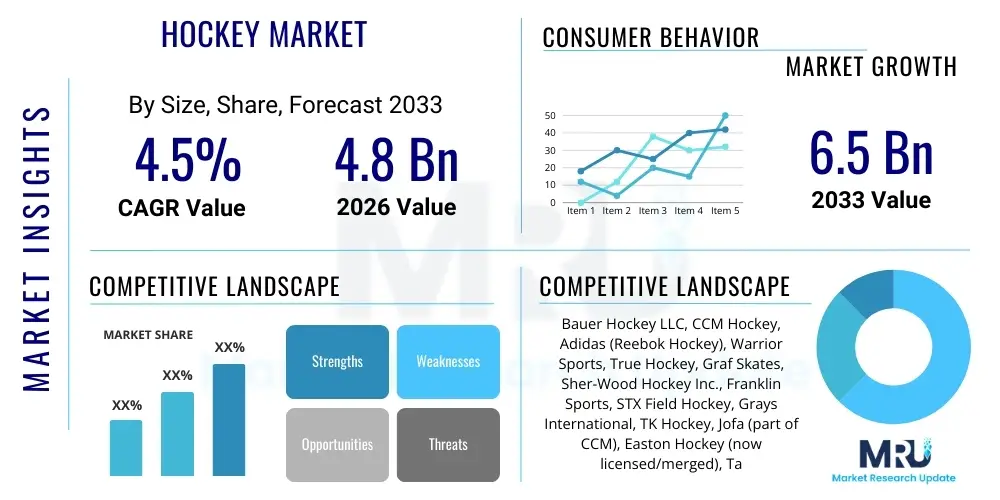

The Hockey Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Hockey Market introduction

The global hockey market encompasses the manufacturing, distribution, and sale of equipment, apparel, and accessories specifically designed for ice hockey, field hockey, and floorball. This robust sports segment is characterized by specialized product lines including sticks, protective gear (helmets, pads), skates, and balls/pucks, catering to both professional athletes and amateur recreational players across various age groups. The demand is heavily influenced by participation rates in key geographical regions, success of professional leagues, and ongoing technological advancements in material science designed to enhance player safety and performance.

Product descriptions within this market range from high-performance carbon composite hockey sticks, engineered for optimal power transfer and lightweight handling, to sophisticated temperature-controlled ice hockey skates featuring thermoformable materials for custom fitting. Major applications include competitive league play, organized youth sports programs, and recreational fitness activities. The increasing emphasis on youth sports development, particularly in North America and Northern Europe, acts as a continuous consumption driver, necessitating regular equipment replacement and upgrades as players mature and skill levels advance.

The primary benefits associated with market growth include increased player safety through advanced protective technologies, improved equipment durability reducing replacement cycles for consumers, and heightened athletic performance derived from superior material engineering. Key driving factors include the expansion of professional hockey viewership globally, governmental initiatives promoting physical fitness and team sports, and continuous product innovation focused on personalization and ergonomics. The overall market resilience is strongly tied to the established cultural significance of hockey in core markets.

Hockey Market Executive Summary

The Hockey Market is currently navigating a pivotal phase defined by significant integration of digital engagement and advanced materials research, setting the stage for steady growth over the forecast period. Business trends show a distinct shift towards direct-to-consumer (D2C) models, driven by established brands seeking enhanced profit margins and deeper customer relationship insights, thereby challenging traditional wholesale distribution channels. Furthermore, sustainability and ethical sourcing have emerged as critical consumer considerations, pressuring manufacturers to adopt environmentally conscious materials and transparent supply chain practices, particularly concerning plastics and composite usage in equipment production.

Regionally, North America maintains its dominance due to high participation rates in ice hockey, underpinned by substantial infrastructure investments in arenas and training facilities. However, the Asia Pacific region, led by countries such as China and South Korea, presents the most compelling growth opportunities, spurred by initiatives to cultivate winter sports participation following major international sporting events. Europe remains a stable, mature market, characterized by strong consumer loyalty to established brands and a balanced demand split between ice hockey and field hockey disciplines. Investment focus is shifting towards developing robust e-commerce platforms tailored for specific regional demands, optimizing inventory management based on seasonal sports cycles.

Segmentation trends highlight the rapid expansion of the protective gear segment, reflecting stringent safety standards enforced by governing bodies and increasing awareness among parents regarding concussion prevention. The segment for high-end, customizable equipment (e.g., custom-fitted skates and personalized stick flex) is also witnessing accelerated revenue growth, indicating a willingness among serious players to invest premium pricing for marginal performance gains. Conversely, the growth of synthetic ice rinks and portable training aids suggests a market adapting to limitations in traditional ice access, expanding training opportunities regardless of location or climate, which influences the distribution of accessory sales.

AI Impact Analysis on Hockey Market

User inquiries regarding Artificial Intelligence (AI) integration in the Hockey Market primarily center on two critical areas: performance optimization and injury prevention. Consumers and coaches are keenly interested in how AI-powered analytics can process vast amounts of game and practice data—such as skate velocity, shot accuracy, and reaction times—to provide individualized training recommendations that transcend traditional manual coaching observation. Simultaneously, there is significant concern and expectation regarding the application of predictive AI models to detect patterns indicative of future injury risk, prompting equipment modifications or adjusted workload management. The key themes revolve around the practical accessibility of these technologies, the cost associated with implementation, and the ethical implications of using player data for competitive advantage or contractual negotiations.

The integration of AI is transforming equipment design by facilitating rapid prototyping and material testing simulations, allowing manufacturers to optimize structural integrity and aerodynamic properties far quicker than conventional methods. AI-driven generative design can propose novel geometric configurations for helmets or protective padding that offer superior impact absorption while minimizing weight, addressing the perennial trade-off between protection and mobility. Furthermore, predictive maintenance models utilizing AI are being deployed in arena operations to monitor ice quality, HVAC systems, and facility usage, ensuring optimal playing conditions and reducing operational downtime. This technological shift is essential for maintaining the high standards required by professional leagues.

From a consumer engagement perspective, AI is enhancing the purchasing experience through personalized recommendations for equipment fit, size, and performance specifications based on user-submitted data (e.g., body type, playing style, position). Virtual fitting technologies, often underpinned by machine learning algorithms, are becoming more accurate, reducing the friction and return rates associated with online equipment purchases. This blend of analytical sophistication applied to both athletic performance and commercial operations marks AI as a crucial catalyst for market modernization, creating new data-driven revenue streams and refining product development cycles across the entire value chain.

- Advanced Player Performance Analytics: AI tracks complex metrics (skate stride, puck handling, defensive positioning) for individualized coaching.

- Predictive Injury Modeling: Algorithms analyze biometric and load data to forecast injury risk and inform training regimens.

- Generative Equipment Design: AI optimizes protective gear and sticks for material efficiency, lightweight properties, and impact resistance.

- Smart Arena Management: Machine learning optimizes energy consumption, ice maintenance quality, and facility security.

- Personalized Consumer Recommendations: AI assists virtual fitting and suggests optimal equipment based on detailed player profiles and historical purchasing data.

DRO & Impact Forces Of Hockey Market

The Hockey Market is simultaneously driven by fundamental participation trends and restrained by significant capital investment requirements, while future growth is shaped by substantial opportunities in emerging economies and digital integration. Key drivers include the robust, established fan base and organizational structure of professional leagues like the NHL and KHL, which consistently boost brand visibility and equipment desirability, particularly among youth. Counteracting these positive forces are restraints such such as the relatively high cost of initial entry for new players, encompassing expenses for specialized skates, protective gear, and league fees, which can create socioeconomic barriers to participation, particularly in less affluent areas or regions where ice infrastructure is scarce. This dynamic interplay of inherent demand and economic barriers dictates the overall pace of market expansion.

Opportunities for growth are heavily concentrated in technological innovation, specifically the development of composite materials that drastically improve equipment performance and lifespan while maintaining competitive pricing structures. Furthermore, the burgeoning popularity of derivative sports like floorball and inline hockey expands the addressable market beyond traditional ice hockey constraints, particularly in warmer climates where infrastructure costs are prohibitive. The rising impact force of sustainability mandates, driven by regulatory pressure and shifting consumer preference, presents both a challenge—due to the cost of retooling manufacturing—and an opportunity for brands that successfully pioneer recyclable or bio-based equipment alternatives. These innovations serve to future-proof the industry against environmental scrutiny.

The market impact forces are categorized by the strong correlation between media exposure and consumer spending; major international tournaments and high-profile league partnerships directly translate into increased equipment sales during peak seasons. Conversely, the market remains highly susceptible to shifts in global commodity prices, especially those relating to carbon fiber, specialized plastics, and rubber components, which directly influence manufacturing costs and, consequently, final retail pricing. The competitive landscape is also an intense impact force, dominated by a few large, established global entities (e.g., Bauer, CCM) whose marketing strategies and rapid product cycles force smaller competitors to innovate niche products or risk consolidation. Navigating these forces requires agile supply chain management and proactive investment in material science R&D to maintain market relevance and profitability.

Segmentation Analysis

The Hockey Market segmentation is fundamentally structured across Product Type, End-User, Distribution Channel, and Geographic Region, reflecting the diverse needs of the global consumer base and the complexity of the supply chain. Analysis by Product Type is the most granular and critical segment, dividing the market into sticks, protective gear (helmets, shoulder pads, shin guards), skates, and accessories/apparel. This segmentation allows manufacturers to target specific performance requirements and safety standards mandated for different equipment categories. The high value and high-replacement rate of sticks and skates often make them the primary revenue drivers, necessitating continuous material and ergonomic innovation in these categories.

End-User segmentation distinguishes between Professional, Amateur/Recreational, and Youth segments, each characterized by distinct purchasing power, brand loyalty, and quality expectations. Professional users demand top-tier, custom-fitted equipment, irrespective of cost, prioritizing marginal performance gains. Youth and amateur segments, however, are highly sensitive to price and durability, focusing on value proposition and growth-related sizing requirements. Distribution Channel analysis separates the market based on retail strategy, primarily differentiating between dedicated sporting goods stores, specialized pro shops (often located within arenas), and the rapidly growing e-commerce platforms. The shifting dominance towards online sales necessitates sophisticated inventory management and robust virtual fitting services.

Understanding these segments is crucial for strategic market penetration. For example, focusing marketing efforts on protective gear within the Youth segment requires emphasizing safety certifications and parental peace of mind, whereas marketing high-end sticks to the Professional segment requires leveraging endorsements and showcasing performance metrics related to specific material compositions. The sustained growth across all segments is linked to the overall health of organized hockey programs globally, ensuring a constant influx of new participants who transition through the various end-user categories over time, sustaining demand for both entry-level and premium products.

- By Product Type:

- Sticks (Ice Hockey, Field Hockey)

- Skates (Ice Hockey Skates, Inline Skates)

- Protective Gear (Helmets, Shoulder Pads, Shin Guards, Gloves, Mouthguards)

- Apparel and Accessories (Jerseys, Training Aids, Bags, Tape)

- By End-User:

- Professional

- Amateur/Recreational

- Youth

- By Distribution Channel:

- Specialty Sporting Goods Stores

- Pro Shops/Arena Retail

- Online Retail/E-commerce

- Mass Merchandisers

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Hockey Market

The value chain for the Hockey Market begins with upstream activities focused on raw material sourcing and primary component manufacturing, primarily involving highly specialized materials such as aerospace-grade carbon fiber, high-density foam composites, and specialized plastics and rubbers for protective gear and skate boots. Manufacturers often engage in proprietary R&D partnerships with chemical and textile companies to secure exclusive access to advanced materials that offer superior strength-to-weight ratios or enhanced impact absorption characteristics. Efficiency in the upstream segment, particularly minimizing waste during composite layup processes and negotiating favorable bulk pricing for raw metals used in blade runners, directly influences final product cost and competitive positioning.

The midstream phase involves complex manufacturing and assembly, transforming raw components into finished goods, which requires high capital expenditure for specialized machinery, including automated stick wrapping, precision skate boot molding, and specialized testing facilities for safety compliance (e.g., helmet certification). Quality control and adherence to international safety standards (such as HECC, CE) are paramount at this stage, establishing product reliability and brand trust. Direct and indirect distribution channels define the downstream segment. Direct channels involve brand-owned retail stores and D2C e-commerce platforms, offering manufacturers maximum control over pricing, inventory, and customer experience. Indirect channels rely on third-party wholesalers, large sporting goods chains, and independent pro shops, which provide wider market penetration, especially in smaller, local markets proximate to arenas.

Effective value capture depends significantly on efficient logistics and channel optimization. Specialized retailers and pro shops play a crucial role by offering value-added services such as skate sharpening, heat molding, and stick cutting, which reinforces customer loyalty and justifies premium pricing. E-commerce platforms, conversely, focus on rapid fulfillment and competitive pricing, particularly for apparel and lower-risk accessories. Optimizing this value chain involves minimizing lead times from material acquisition to retail shelf presence, leveraging digital tools for inventory forecasting, and strategically balancing direct engagement with broad indirect reach to ensure sustained market access and profitability.

Hockey Market Potential Customers

The primary end-users and potential customers of the Hockey Market span a broad demographic spectrum, from structured organizational bodies to individual consumers motivated by recreation or professional aspiration. Organized sports leagues, including professional organizations (NHL, KHL, major European leagues), university teams, and expansive youth hockey associations (e.g., USA Hockey, Hockey Canada), represent significant institutional buyers who require bulk orders of standardized equipment, uniforms, and maintenance tools. These customers prioritize adherence to league regulations, consistency of supply, and competitive institutional pricing contracts, often focusing procurement decisions on safety and durability across large inventories.

Individual consumers form the largest segment of potential customers and can be classified based on their level of commitment: highly dedicated amateur players who participate in adult leagues and require high-performance, frequently replaced gear; casual recreational skaters who prioritize affordability and basic safety features; and parents purchasing for youth players, who prioritize safety certifications, adjustability for growth, and durability for multi-season use. The purchasing decisions of these individual consumers are heavily influenced by brand endorsements, professional athlete usage, peer recommendations, and the availability of specialized fitting services at the point of sale, emphasizing the importance of specialized retail environments.

Furthermore, ancillary customers include arena operators and training facility owners, who purchase bulk items such as practice pucks, nets, synthetic training surfaces, skate sharpening equipment, and facility maintenance supplies. The growing segment of customers focused purely on hockey apparel and fan merchandise (jerseys, hats) provides an additional revenue stream, often driven by marketing campaigns linked to high-profile games or player achievements. Targeting these diverse customer groups requires a multifaceted marketing approach, combining high-performance messaging for elite users with safety and value propositions for the youth and recreational demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bauer Hockey LLC, CCM Hockey, Adidas (Reebok Hockey), Warrior Sports, True Hockey, Graf Skates, Sher-Wood Hockey Inc., Franklin Sports, STX Field Hockey, Grays International, TK Hockey, Jofa (part of CCM), Easton Hockey (now licensed/merged), Tackla Hockey, Vaughn Hockey, Brian’s Custom Sports, Koho, Mission Hockey, Tour Hockey, Mylec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hockey Market Key Technology Landscape

The technological landscape of the Hockey Market is characterized by a relentless pursuit of lighter, stronger, and more protective materials, driven primarily by advanced composite engineering. Carbon fiber technology dominates the stick segment, with manufacturers constantly refining the fiber layup process, resin chemistry, and kick-point customization to maximize energy transfer and responsiveness. The incorporation of nanotechnology into composite structures, aiming to reinforce stress points at the molecular level, represents a critical area of ongoing research, ensuring that high-performance sticks can withstand extreme impact forces without compromising on weight. Furthermore, specialized thermal treatment processes are used to enhance the durability and stiffness of synthetic materials utilized in protective gear and skate components, improving product longevity under harsh conditions.

In the protective gear category, innovation centers on developing multi-density foam systems and integrated shock absorption layers, often utilizing proprietary materials like D3O or specialized EVA foams designed for rate-dependent protection—meaning the material stiffens upon high-velocity impact while remaining pliable during normal movement. Helmet technology is rapidly advancing due to increased awareness of Chronic Traumatic Encephalopathy (CTE) risks, leading to sophisticated internal systems such as rotational impact mitigation technology (e.g., MIPS equivalent systems) embedded within the helmet liner to address oblique and rotational forces. The deployment of sensor technology within helmets and pads to monitor impact severity and location in real-time is becoming increasingly feasible, generating actionable data for both medical professionals and equipment designers.

Skate technology represents another key pillar, moving beyond traditional leather and plastic materials towards lightweight, thermoformable composites that offer highly customized anatomical fits. Features such as specialized runner coatings (e.g., DLC coating for reduced friction and enhanced edge retention) and advanced chassis systems for inline skates illustrate the segment's commitment to optimizing performance characteristics. The manufacturing process itself is adopting digital twins and advanced robotics for precision assembly and quality assurance, particularly in the production of complex components like high-end skate holders and protective cages, ensuring mass production scalability while maintaining stringent tolerances required for professional-grade equipment.

Regional Highlights

- North America (NA): Market Dominance and Innovation Hub

North America, comprising the United States and Canada, stands as the undisputed epicenter of the global Hockey Market, driven by deep cultural heritage, immense professional infrastructure (NHL), and exceptionally high participation rates across all age groups. This region accounts for the majority of global revenue, fueled by consumer willingness to adopt high-end, premium-priced equipment and a massive network of dedicated retail outlets and pro shops. The market here is characterized by fierce competition among key established brands (Bauer, CCM, Warrior) who utilize sophisticated marketing campaigns, including professional player endorsements, to drive consumption. Innovation is frequently launched here first, particularly related to safety technology and carbon fiber composition.

The market benefits from extensive investment in ice rinks and associated training facilities, supporting structured league play from the minor leagues through to the collegiate level. Replacement cycles for equipment are relatively fast, particularly among serious amateur and youth players who require constant upgrades due to growth or performance degradation. The strong presence of e-commerce giants and specialized online retailers in NA has fundamentally shifted distribution strategies, requiring rapid adaptation in logistics and customer service. Regulatory bodies, especially those focused on youth sports safety, significantly influence product design specifications, mandating high safety standards for helmets and protective pads, which drives continuous technological refinement.

Key growth drivers specific to NA include the consistent growth of women’s hockey participation and the expansion of grassroots developmental programs, ensuring a sustained pipeline of new consumers. The market stability, coupled with high average spending per participant, solidifies North America’s critical role in setting global trends for product development and pricing in the ice hockey segment.

- Europe: Diverse Market Structure and High Field Hockey Penetration

The European Hockey Market presents a highly diverse geographical landscape, segmented between strong ice hockey nations (e.g., Sweden, Finland, Czech Republic, Russia) and powerful field hockey hubs (e.g., Netherlands, Germany, UK). Ice hockey demand is robust in Nordic and Eastern European countries, mirroring North American equipment demands but often featuring unique local brand preferences and distribution networks tailored to domestic leagues (KHL, SHL). This segment maintains a mature, stable growth trajectory, supported by consistent government funding for winter sports and established professional leagues that attract global talent.

Crucially, Europe holds a dominant position in the Field Hockey segment globally, particularly in Western Europe. This drives significant market demand for specialized sticks, shoes, and protective equipment distinct from ice hockey gear, focusing heavily on composite materials optimized for turf play and strict adherence to FIH (International Hockey Federation) regulations. Brands specializing in field hockey equipment (Grays, TK Hockey) maintain strong market share, requiring a nuanced approach to product portfolio management to cater to both ice and field disciplines. The overall European market is heavily influenced by cross-border trade and EU regulations concerning manufacturing standards and consumer protection.

Future growth in Europe is expected to be buoyed by the increasing professionalization and commercial viability of both ice and field hockey leagues, attracting greater corporate sponsorship and media coverage. Furthermore, investments in multi-purpose synthetic turf facilities and indoor sports complexes are lowering the barrier to entry for field hockey and floorball in non-traditional regions, broadening the consumer base for associated equipment and accessories. Digital marketing and localized language content are essential for effectively penetrating the fragmented national markets across the continent.

- Asia Pacific (APAC): Emerging Growth Frontier and Winter Sports Investment

The Asia Pacific region is positioned as the primary emerging growth frontier for the Hockey Market, largely due to significant governmental investment in developing winter sports infrastructure and participation, notably spurred by hosting major events like the Winter Olympics. While traditionally a low-participation region for ice hockey, strategic initiatives in countries like China, South Korea, and Japan are rapidly expanding the consumer base. This expansion focuses primarily on the Youth and entry-level amateur segments, creating substantial demand for introductory and mid-range priced equipment, prioritizing value and accessibility over the high-performance attributes demanded in NA or Europe.

Field hockey maintains a historical and culturally significant presence in South Asia and Southeast Asia (e.g., India, Pakistan, Malaysia), representing a large, albeit sometimes cost-sensitive, consumer market for field hockey sticks and accessories. The challenge in APAC remains the disparity in disposable income and the often-prohibitive cost of building and maintaining ice rinks. Consequently, derivative sports like inline hockey and street hockey act as crucial gateway segments, introducing fundamental skills and creating demand for non-ice specific equipment, which is easier to access and requires less infrastructure investment.

Long-term regional growth relies heavily on successful infrastructure development and the cultivation of local manufacturing capabilities to manage supply chain costs. E-commerce platforms are critical for reaching dispersed consumer populations across APAC, often bypassing traditional brick-and-mortar retail limitations. Brands must tailor their distribution and marketing strategies to address the unique cultural nuances and infrastructure challenges present in this vast, economically diverse region, focusing on accessibility, affordability, and promotional partnerships with local sports education institutions to drive sustained market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hockey Market.- Bauer Hockey LLC

- CCM Hockey

- Adidas (Reebok Hockey)

- Warrior Sports

- True Hockey

- Graf Skates

- Sher-Wood Hockey Inc.

- Franklin Sports

- STX Field Hockey

- Grays International

- TK Hockey

- Jofa (part of CCM)

- Easton Hockey (now licensed/merged)

- Tackla Hockey

- Vaughn Hockey

- Brian’s Custom Sports

- Koho

- Mission Hockey

- Tour Hockey

- Mylec

Frequently Asked Questions

Analyze common user questions about the Hockey market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the increased adoption of composite hockey sticks?

The primary driver is the superior performance characteristics of composite materials, specifically carbon fiber, which offers an optimal combination of lightweight design, enhanced shot power transfer, and customizable flex profiles, surpassing the limitations of traditional wooden sticks. Furthermore, improved durability and consistency across mass-produced units contribute significantly to their market dominance among competitive players.

How is technological innovation improving player safety in the Hockey Market?

Safety improvements are centered on advanced protective gear utilizing multi-density foam layers and specialized impact-absorbing materials designed to dissipate kinetic energy more effectively. Key innovations include rotational impact mitigation systems integrated into helmets to address concussion risk, and lightweight, ergonomically designed pads that offer high protection without restricting mobility.

Which geographical region holds the largest market share for hockey equipment and why?

North America (specifically the United States and Canada) holds the largest market share. This dominance is attributed to the deep cultural significance of ice hockey, high participation rates across professional and amateur levels, established organizational infrastructure (NHL, extensive youth leagues), and high consumer willingness to invest in premium, frequently updated equipment.

What is the current trend regarding distribution channels in the hockey equipment industry?

The current market trend shows a significant shift towards online retail and Direct-to-Consumer (D2C) channels, driven by consumer convenience and brands seeking greater control over pricing and customer data. However, specialized pro shops remain crucial due to the necessity of value-added services like precision skate fitting, sharpening, and custom equipment modification which cannot be replicated online.

What are the main financial barriers restricting market growth in developing regions?

The main financial barriers include the high initial cost of quality hockey equipment (skates, protective gear, sticks), which is essential for safe play, coupled with the substantial capital expenditure required for building and maintaining ice rink infrastructure, making the sport largely inaccessible in many emerging markets without significant public or private funding.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ice Hockey Skate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ice Hockey Pucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Roller Hockey Skates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cricket and Field Hockey Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Women Ice Hockey League Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager