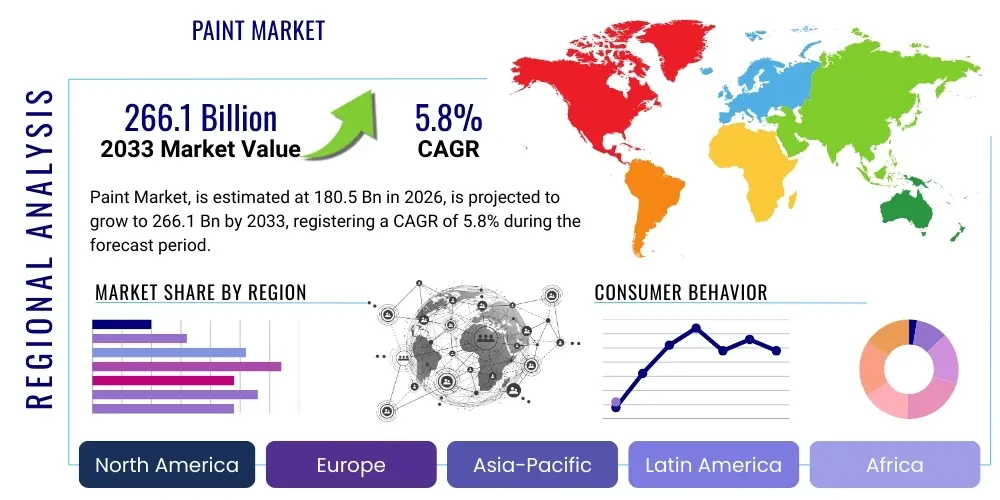

Paint Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443533 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Paint Market Size

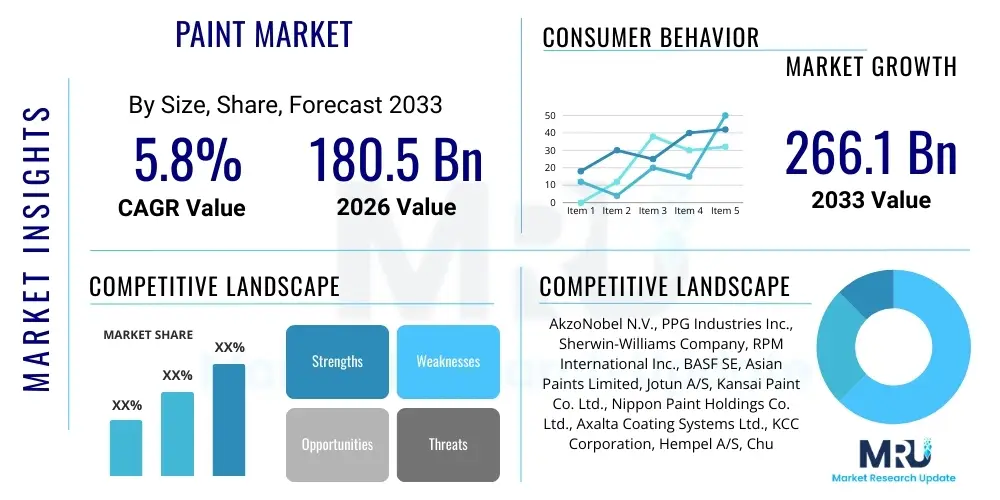

The Paint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $180.5 Billion in 2026 and is projected to reach $266.1 Billion by the end of the forecast period in 2033.

Paint Market introduction

The global Paint Market encompasses a broad spectrum of products, including architectural coatings, industrial coatings, protective coatings, and specialized functional coatings. These products are formulated using complex blends of pigments, binders, solvents, and additives, designed to provide both aesthetic enhancement and critical protective functions against corrosion, weathering, and UV degradation. Architectural paints, which dominate the volume segment, are extensively utilized in residential and commercial construction for interior and exterior decoration and preservation. Meanwhile, industrial coatings are essential for maintaining infrastructure, automotive production lines, aerospace components, and marine vessels, demanding high performance and durability standards that often exceed conventional paint capabilities. The sophistication of modern coatings has evolved significantly, shifting from solvent-based systems to low-VOC and water-based environmentally compliant alternatives, driven by increasingly stringent global environmental regulations and consumer preference for safer products.

The primary application sectors for paints and coatings are bifurcated into decorative (architectural) and industrial end-uses. Decorative applications involve maintaining and enhancing built environments, directly correlating with new construction spending and renovation activities globally. Industrial applications are far more specialized, covering sectors such as automotive OEM and refinish, general industry (machinery, appliances), packaging, protective coatings for heavy-duty infrastructure (bridges, pipelines), and powder coatings used extensively in appliance manufacturing due to their minimal environmental footprint. The benefits derived from these products extend beyond simple coloration; they provide structural integrity protection, fire retardation, antimicrobial surfaces, and energy-saving cool roof capabilities, thereby enhancing the asset lifespan and operational efficiency of the structures they cover. This multifaceted utility ensures paints and coatings remain fundamental components across virtually all manufacturing and construction sectors.

Key driving factors underpinning the market growth include rapid urbanization, particularly in emerging economies across Asia Pacific, which necessitates massive investment in residential and non-residential infrastructure. Furthermore, the global automotive industry's recovery and the increasing production of new vehicles, which require advanced coatings for aesthetics and corrosion resistance, significantly propel demand. A parallel driver is the growing emphasis on sustainable and green building practices. Regulatory bodies worldwide are mandating lower Volatile Organic Compound (VOC) content, pushing manufacturers toward developing innovative, high-solids, powder, and waterborne coatings. The continual need for maintenance and renovation of aging public and private infrastructure, especially in developed markets, further guarantees sustained demand throughout the forecast period, cementing the market’s resilient growth trajectory despite cyclical economic fluctuations.

Paint Market Executive Summary

The Paint Market is characterized by intense competition, continuous technological innovation focused on sustainability, and a pronounced shift in geographical dominance towards Asia Pacific. Business trends show major players are heavily investing in mergers and acquisitions to consolidate market share and expand their specialty coatings portfolios, particularly in segments requiring high-performance characteristics such such as aerospace and protective coatings. A significant structural trend involves the optimization of supply chains, necessitated by recent global volatility in raw material pricing—specifically titanium dioxide, resins, and specialized additives. Companies are increasingly adopting digital tools for inventory management and predictive modeling to mitigate supply chain disruptions, enhancing operational resilience. Furthermore, direct-to-consumer (D2C) models, supported by digital visualization tools and e-commerce platforms, are gaining traction, especially in the architectural segment, improving accessibility and customer engagement.

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) stands as the undisputed engine of growth, fueled by massive infrastructure projects in China, India, and Southeast Asian nations, coupled with burgeoning middle-class consumer demand for decorative paints. North America and Europe, while representing mature markets, demonstrate stable demand primarily driven by renovation, maintenance, and the uptake of advanced, high-value industrial coatings compliant with stringent environmental norms like REACH and local VOC regulations. The Middle East and Africa (MEA) region show high potential linked to ambitious governmental diversification plans involving construction and industrial expansion, though market stability can be subject to geopolitical and oil price fluctuations. Latin America presents a moderate growth scenario, influenced by varying economic health across its major economies, requiring localized product strategies focusing on affordability and regional climatic needs.

Segment-wise, waterborne technology continues to outperform solvent-based systems, propelled by environmental mandates and improving performance parity. The powder coatings segment is experiencing robust growth due to its zero-VOC nature and efficiency in industrial applications. By end-use, the architectural coatings segment maintains the largest market share globally, reflecting the sheer volume of global building activity. However, the fastest growth is often observed in specialized industrial applications, such as automotive refinish and protective marine and energy coatings, where performance specifications justify premium pricing and encourage continuous R&D investment. Key segments such as anti-microbial paints, thermal insulating coatings, and smart coatings are emerging rapidly, transforming traditional paint functions into highly technical material science applications.

AI Impact Analysis on Paint Market

User queries regarding Artificial Intelligence (AI) in the Paint Market primarily center around operational efficiency, product innovation, and supply chain predictability. Common questions focus on how AI can optimize formulation processes—specifically, reducing the time and cost associated with laboratory testing and achieving desired color consistency across batches. Users are also highly interested in AI's role in predictive maintenance applications, where smart coatings embedded with sensors could alert infrastructure managers to imminent corrosion or structural failure, drastically reducing inspection costs. Concerns often revolve around the initial investment required for AI infrastructure, data privacy in connected manufacturing environments, and the need for specialized data scientists to interpret complex coating performance datasets. Overall, the market expects AI to accelerate the transition towards fully customized, sustainable, and precisely manufactured high-performance coatings, fundamentally altering how raw materials are managed and how paint systems are deployed.

The implementation of AI is revolutionizing manufacturing throughput by optimizing machine parameters, reducing material waste, and enhancing Quality Control (QC) through advanced image processing for defect detection on coated surfaces. AI algorithms can analyze thousands of variables simultaneously, including temperature, humidity, and curing times, to predict and adjust production settings in real-time, thereby minimizing batch deviations and improving energy efficiency. Furthermore, in R&D, machine learning models are being utilized to simulate the interaction of novel chemistries, accelerating the identification of viable sustainable replacements for petrochemical-derived ingredients and streamlining the often lengthy compliance approval process. This capability directly addresses the market's pressing need to innovate rapidly in response to environmental pressures and regulatory shifts.

On the customer-facing side, AI is transforming the architectural paint experience. Augmented Reality (AR) and Virtual Reality (VR) tools, often powered by AI algorithms, allow consumers to instantly visualize paint colors on their walls, significantly reducing purchase uncertainty and returns. This integration of digital technology into the customer journey provides highly personalized recommendations based on existing décor, lighting conditions, and regional aesthetic trends. For industrial users, predictive modeling based on AI helps forecast equipment lifespan under specific environmental stresses, enabling highly accurate scheduling of maintenance coatings applications, moving away from time-based scheduling to condition-based maintenance, yielding substantial cost savings and minimizing operational downtime across sectors like marine and oil and gas.

- AI-driven automated color matching ensures precise shade consistency across diverse substrate materials and environmental conditions, minimizing production errors.

- Machine Learning optimizes raw material inventory and procurement strategies by forecasting demand fluctuations and predicting raw material price volatility.

- Predictive maintenance analytics, leveraging smart coatings data, allows for timely recoating, extending the lifespan of infrastructure assets such as bridges and pipelines.

- AI accelerates R&D cycles by simulating molecular interactions, speeding up the development of low-VOC and bio-based resin systems.

- Enhanced quality control using computer vision systems detects micro-defects in coatings applied on automotive bodies or appliances with unprecedented accuracy.

DRO & Impact Forces Of Paint Market

The dynamics of the Paint Market are shaped by a complex interplay of internal growth catalysts, external economic constraints, and emerging technological opportunities. Dominant drivers include robust construction and infrastructure spending in developing nations, coupled with mandatory regulations pushing for low-VOC and sustainable coatings worldwide. These regulations effectively accelerate the adoption of advanced waterborne and powder coating technologies, creating a clear market direction towards sustainability. Simultaneously, the persistent demand for protective coatings in high-value industries like aerospace, marine, and energy, driven by the need to protect assets from extreme environmental degradation, provides a steady, high-margin revenue stream. These positive drivers collectively ensure sustained market expansion, even if the pace varies by geographical region.

However, the market faces significant restraints, most notably the high volatility and increasing cost of key raw materials, including titanium dioxide (TiO2), crude oil derivatives (resins and solvents), and specialized performance additives. Manufacturers often struggle to pass these cost increases entirely onto consumers, pressuring profit margins and necessitating continuous efficiency improvements. Furthermore, the stringent regulatory environment, while driving innovation, also imposes substantial compliance costs and complexity, particularly for small to medium-sized enterprises (SMEs) operating across multiple jurisdictions. The paint application process itself, often labor-intensive and requiring highly specific environmental conditions for optimal curing, remains a logistical challenge, particularly in large industrial projects where climate control is difficult to maintain.

Opportunities for future growth are predominantly found in functional and smart coatings—products that offer capabilities beyond aesthetics and basic protection. This includes self-healing, anti-microbial, anti-fouling, and thermal-regulating coatings (cool roof technology). These specialized solutions command significant price premiums and open new vertical markets outside of traditional construction or industrial use. Additionally, the increasing focus on the circular economy presents opportunities for manufacturers to invest in paint recycling technologies and bio-based raw materials, creating closed-loop production systems that attract environmentally conscious consumers and meet future regulatory requirements. The synergistic impact forces arising from these drivers and restraints emphasize a market transitioning rapidly towards specialized performance, sustainability, and technological differentiation rather than volume-driven commoditization.

Segmentation Analysis

The global Paint Market is highly diverse, segmented extensively based on product type, resin type, technology (composition), end-use application, and geographical region, reflecting the specific functional requirements of different industries. Understanding these segments is crucial for strategic market positioning, as performance requirements, pricing strategies, and regulatory landscapes vary significantly across categories. For instance, decorative paints are primarily segmented by technology (waterborne dominating), while industrial protective coatings are segmented by resin type (epoxy, polyurethane) due to their superior chemical and abrasion resistance.

The segmentation by end-use remains the most critical metric for assessing market demand, delineating between high-volume architectural consumption and high-specification industrial use. Architectural coatings are sensitive to economic indicators like housing starts and interest rates, whereas industrial coatings are tied to capital expenditure cycles in automotive, marine, and energy sectors. Furthermore, the market's technological segmentation highlights the shift from traditional solvent-based systems—which face increasing regulatory pressure due to VOC emissions—towards advanced, environmentally preferred alternatives, including powder, UV-curable, and high-solids liquid coatings. This internal market shift dictates R&D focus and manufacturing investment across the value chain, ensuring compliance and meeting global sustainability goals.

The detailed segmentation structure allows companies to tailor their product offerings precisely. For example, a manufacturer targeting the marine sector will focus on anti-fouling and protective epoxy coatings, requiring different R&D investments and distribution channels than a company focusing on residential interior latex paints. This granularity ensures that market analysis provides actionable insights, detailing pockets of high growth such as functional coatings (e.g., thermal insulation) which often demonstrate growth rates significantly higher than the overall market average, presenting lucrative niche opportunities for specialized players.

- By Resin Type:

- Acrylic

- Epoxy

- Polyurethane

- Alkyd

- Polyester

- Fluoropolymer

- Others (Vinyl, Siloxane)

- By Technology:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- Radiation Cured Coatings (UV/EB)

- By Application (End-Use):

- Architectural/Decorative Coatings:

- Residential (Interior & Exterior)

- Non-Residential/Commercial

- Industrial Coatings:

- Automotive OEM and Refinish

- Protective Coatings (Marine, Energy, Infrastructure)

- General Industrial (Appliances, Machinery)

- Coil and Packaging Coatings

- Wood Coatings

- Aerospace Coatings

- Architectural/Decorative Coatings:

Value Chain Analysis For Paint Market

The Paint Market value chain is complex and resource-intensive, starting with the extraction and processing of core raw materials upstream and concluding with specialized application and post-sales services downstream. Upstream analysis highlights the critical reliance on the petrochemical industry for binders, solvents, and specialized additives, as well as the mining and processing sectors for pigments like titanium dioxide and iron oxides. High market concentration among a few key raw material suppliers, especially for specialty chemicals, often dictates input costs and supply stability, making robust supplier relationship management essential for mitigating pricing risks. Manufacturers focus heavily on backward integration or long-term contracts to secure supply of crucial raw materials, a strategy particularly pertinent during periods of global supply chain instability, as demonstrated recently.

The midstream segment involves the paint and coating manufacturers themselves, where extensive research and development are crucial for formulating compliant, high-performance products. This stage involves complex mixing, dispersion, and grinding processes to ensure product consistency and efficacy. The distribution channel is bifurcated, handling the high-volume, low-margin decorative market through indirect channels (retail chains, distributors, hardware stores) and managing the high-specification, technical industrial market primarily through direct sales and specialized, technically trained distributors. Direct channels are vital for industrial protective coatings and automotive OEM, where technical support, on-site assistance, and precise specification compliance are paramount to the end-user, often involving detailed contractual agreements and performance guarantees.

Downstream activities center on professional application services, ranging from independent painting contractors in the architectural sector to highly specialized coating applicators in marine and industrial environments. The effectiveness and longevity of the coating heavily depend on proper surface preparation and application techniques, emphasizing the importance of training and certified application programs provided by major paint manufacturers. Post-sales services include technical support, site inspections, and warranty provisions. The shift toward direct engagement, supported by digital platforms, allows manufacturers greater control over product integrity and enhances customer loyalty, especially in the premium industrial segments where performance failure can lead to catastrophic financial losses. This value chain structure underscores the need for vertical expertise, from chemical synthesis to final application quality control.

Paint Market Potential Customers

Potential customers for the Paint Market span a vast spectrum of industries and consumer groups, primarily categorized into volume-driven consumer segments and high-specification industrial buyers. The consumer segment, comprising homeowners, property developers, and residential builders, represents the largest volume market, driven by renovation cycles, new housing starts, and aesthetic trends. These customers prioritize ease of application, color accuracy, durability, and increasingly, low-odor and low-VOC formulations, often making purchase decisions based on brand recognition and retail accessibility via indirect channels such as large hardware stores and paint specialized outlets. The volume and frequency of these purchases necessitate efficient retail supply chains and robust consumer marketing strategies focused on brand trust and perceived environmental safety.

The second major group consists of Non-Residential Construction entities, including commercial real estate developers, infrastructure authorities, and government agencies. These buyers require paints with high performance characteristics such as fire-retardancy, anti-graffiti properties, and extreme durability for public spaces and large commercial complexes. Purchase decisions here are often driven by stringent building codes, long-term maintenance cost considerations, and product specifications provided by architects and engineers, favoring manufacturers who can provide comprehensive technical documentation and certifications.

Finally, the industrial segment constitutes the highest value-added customer base, characterized by highly technical requirements and specialized needs. This group includes Automotive Original Equipment Manufacturers (OEMs) and refinish shops, Marine and Offshore companies, Energy (Oil & Gas, Renewables) infrastructure owners, and General Industrial manufacturers (e.g., white goods, machinery). These potential customers require custom formulations (e.g., corrosion resistance in offshore environments, heat resistance in engines) and typically procure directly or through specialized technical distributors. Their purchasing criteria are centered on certified performance, compliance with international standards (e.g., IMO PSPC, ISO specifications), and reliable technical support throughout the coating application process, ensuring that the coating system provides the necessary protection for high-value assets operating in extreme conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $180.5 Billion |

| Market Forecast in 2033 | $266.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel N.V., PPG Industries Inc., Sherwin-Williams Company, RPM International Inc., BASF SE, Asian Paints Limited, Jotun A/S, Kansai Paint Co. Ltd., Nippon Paint Holdings Co. Ltd., Axalta Coating Systems Ltd., KCC Corporation, Hempel A/S, Chugoku Marine Paints, Ltd., DAW SE, Carboline Company, Sika AG, Tikkurila Oyj (PPG), Beckers Group, Wacker Chemie AG, Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paint Market Key Technology Landscape

The contemporary Paint Market technology landscape is defined by innovation centered on reducing environmental impact, improving application efficiency, and imparting advanced functionality to surfaces. A major technological thrust is the transition from solvent-based formulations, which emit high levels of Volatile Organic Compounds (VOCs), to sustainable alternatives. Waterborne coatings have seen substantial improvements in performance parity with traditional solvent systems, particularly in durability and cure speed, driven by advanced dispersion techniques and novel binder chemistry. Simultaneously, powder coatings technology, which contains virtually zero VOCs, is growing rapidly across industrial sectors (e.g., appliance, automotive components) due to its high material utilization rates and robust finish quality, often employing triboelectric or corona charging application systems for optimal adhesion and coverage.

Furthermore, significant R&D investment is dedicated to developing high-performance functional and smart coatings. Nanotechnology plays a crucial role here, enabling the integration of nanoparticles to create coatings with enhanced properties such as superior UV resistance, scratch resistance, self-cleaning (superhydrophobic or hydrophilic surfaces), and anti-microbial capabilities. Self-healing coatings, which utilize microencapsulated healing agents released upon damage, represent a frontier technology particularly valuable for high-stress applications like aerospace and protective infrastructure, promising drastically reduced maintenance intervention and extended asset life cycles. These smart materials utilize chemical engineering breakthroughs to provide dynamic responses to external stimuli.

The rise of Industry 4.0 has also spurred the adoption of application technologies centered on precision and automation. Automated spray painting systems, often coupled with robotics and advanced sensor feedback loops (as discussed in the AI analysis), ensure perfect film thickness and consistent coverage, especially crucial in automotive and aerospace manufacturing. Moreover, the integration of bio-based resins derived from renewable agricultural sources is an emerging trend aimed at reducing the industry's reliance on fossil fuels. These technological advancements collectively drive competitive differentiation, shifting the market focus from basic commodity products to highly engineered surface solutions that deliver tangible benefits in sustainability, performance, and longevity.

Regional Highlights

Regional dynamics play a paramount role in shaping the global Paint Market, reflecting divergent economic growth, varying regulatory environments, and distinct consumption patterns.

- Asia Pacific (APAC): This region is the largest and fastest-growing market globally, primarily due to unprecedented rates of urbanization, industrialization, and massive government-led infrastructure investments in China, India, and Southeast Asian countries. The demand is robust across both architectural and industrial sectors, with an increasing shift towards premium, high-performance coatings as environmental awareness and living standards improve. Regulatory initiatives in countries like China to control air pollution are rapidly accelerating the adoption of waterborne and powder coatings, driving technological upgrades.

- North America: A highly mature market characterized by stable demand driven primarily by repair, renovation, and maintenance activities (R&R) rather than new construction volume. North America leads in the adoption of advanced protective and specialty coatings for aerospace, energy, and automotive refinish applications. Stringent environmental regulations imposed by the EPA and state-level organizations ensure continuous innovation in low-VOC and zero-VOC formulations, resulting in a market highly focused on high-quality, high-margin sustainable products.

- Europe: The market is mature and highly consolidated, with growth primarily influenced by the stability of the Eurozone and strict environmental legislation, particularly the REACH regulation, which forces manufacturers to develop bio-based and highly compliant specialty chemistries. Western European countries exhibit high per-capita consumption of decorative paints, while Eastern Europe shows higher growth rates tied to ongoing modernization and infrastructure development. The European automotive sector is a critical consumer of high-specification OEM and refinish coatings.

- Latin America (LATAM): Market growth is volatile, heavily dependent on the economic health and political stability of key economies like Brazil, Mexico, and Argentina. While possessing vast potential due to urbanization, the market often faces challenges related to raw material import costs and fluctuating currency values. Demand is primarily concentrated in the architectural segment, with slow but steady adoption of industrial protective coatings for local oil and gas and mining operations.

- Middle East and Africa (MEA): This region presents high growth opportunities tied to significant diversification and urbanization projects, particularly in the GCC states (Saudi Arabia, UAE). Demand for protective coatings is strong due to the harsh climate and the dominant presence of the oil and gas industry. Africa's paint market is emerging, driven by increasing population and housing needs, though facing challenges related to fragmented distribution networks and competition from low-cost imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paint Market.- AkzoNobel N.V.

- PPG Industries Inc.

- Sherwin-Williams Company

- RPM International Inc.

- BASF SE

- Asian Paints Limited

- Jotun A/S

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- Axalta Coating Systems Ltd.

- KCC Corporation

- Hempel A/S

- Chugoku Marine Paints, Ltd.

- DAW SE

- Carboline Company

- Sika AG

- Tikkurila Oyj (PPG)

- Beckers Group

- Wacker Chemie AG

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Paint market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift toward waterborne and powder coatings?

The primary driver is stringent global environmental regulation, particularly mandates aimed at reducing Volatile Organic Compound (VOC) emissions, coupled with growing consumer and industrial demand for sustainable, low-odor products. Technological advancements have enabled waterborne and powder systems to achieve performance levels comparable to traditional solvent-based paints, accelerating this transition across architectural and industrial applications.

How is raw material price volatility impacting paint manufacturers?

Volatility in prices for petrochemical derivatives (resins, solvents) and titanium dioxide (TiO2) significantly compresses manufacturers' profit margins. This forces companies to implement operational efficiencies, diversify sourcing strategies, and aggressively pursue R&D into lower-cost, bio-based alternative raw materials to maintain profitability and competitive pricing in key market segments.

Which geographical region holds the highest growth potential for the paint market?

Asia Pacific (APAC), particularly driven by India and Southeast Asian nations, holds the highest growth potential. This growth is sustained by rapid urbanization, massive government infrastructure projects, expanding manufacturing bases (automotive and industrial), and rising discretionary income leading to increased decorative painting and renovation activities.

What are 'smart coatings' and how are they used in industry?

Smart coatings are advanced functional materials that provide dynamic responses to environmental stimuli, offering capabilities beyond basic aesthetics and protection. Industrial uses include self-healing coatings that repair minor damage automatically, anti-fouling marine coatings that release biocides slowly, and thermal coatings that regulate building temperatures for energy efficiency. These high-value products are crucial for asset preservation in sectors like energy and marine.

What role does digitalization and AI play in the future of paint production?

Digitalization and AI are essential for optimizing the value chain, from formulation to application. AI is used to accelerate R&D by simulating new chemical compositions, enhance quality control through automated inspection systems, and optimize complex manufacturing processes in real-time, leading to increased batch consistency, reduced waste, and improved energy consumption in factories globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Paint Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Paint Filter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Anti-Fog Paint Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- TPU Type Paint Protection Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Paint Marker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager