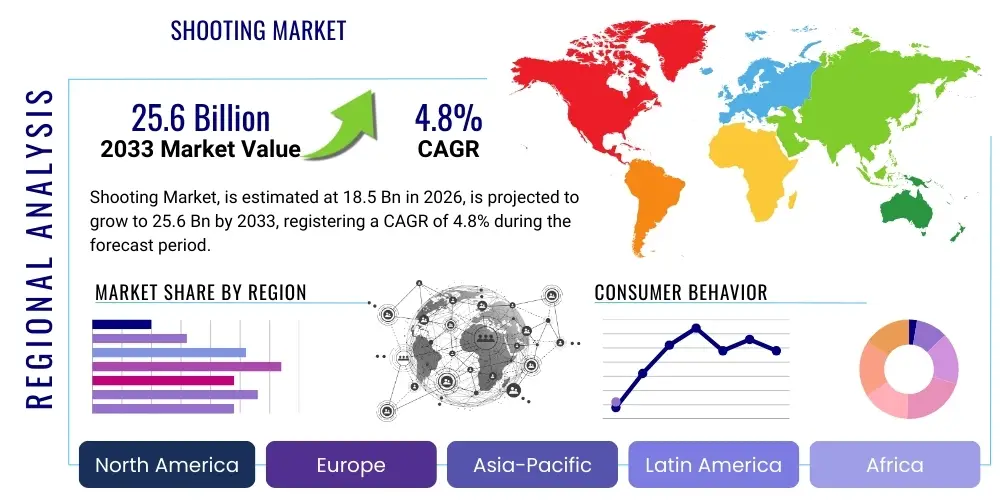

Shooting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442046 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Shooting Market Size

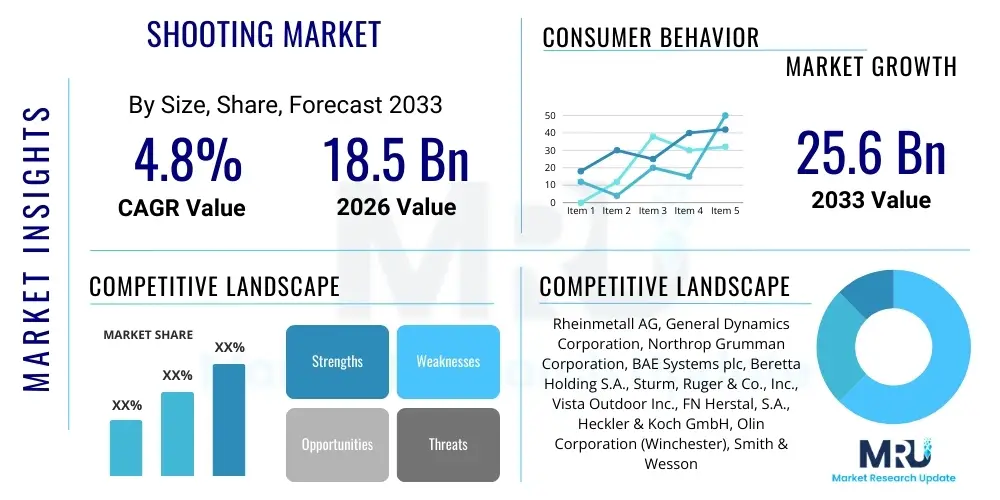

The Shooting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.6 Billion by the end of the forecast period in 2033. This growth trajectory is fueled by increasing global defense expenditures, rising popularity of recreational and competitive shooting sports, and continuous technological advancements in firearm and ammunition manufacturing processes aimed at enhancing safety, precision, and performance across various applications, including military, law enforcement, and civilian use. Furthermore, the market benefits significantly from the expansion of personalized training systems and sophisticated simulation platforms.

Shooting Market introduction

The global Shooting Market encompasses the manufacturing, distribution, and utilization of firearms, ammunition, accessories, and associated equipment used across defense, law enforcement, hunting, competitive sports, and recreational activities. This highly regulated industry is characterized by rigorous safety standards, continuous innovation in materials science, and the integration of advanced ballistics technology. Key products range from small arms like pistols and rifles to specialized ammunition types, high-precision optics, and sophisticated training simulators designed to replicate real-world scenarios, ensuring preparedness and proficiency among professional and civilian users alike. The market's complexity is defined by stringent governmental procurement processes in the defense sector and diverse consumer demands in the sporting and personal protection segments.

The primary applications of shooting products are broadly categorized into military and defense operations, domestic law enforcement and security, and commercial/civilian use. Military applications demand rugged, reliable, and high-caliber weapon systems and armor-piercing ammunition, prioritizing operational effectiveness and soldier safety. Law enforcement agencies utilize non-lethal and standard-issue firearms for peacekeeping, patrol duties, and rapid response scenarios, requiring consistent performance and ease of maintenance. The civilian segment, which constitutes a significant portion of the market, focuses on products for hunting, target practice, professional competition (e.g., Olympic shooting, IPSC), and personal and home defense, driving demand for high-quality sporting rifles, shotguns, and handgun variants, alongside advanced sighting systems and ergonomic accessories.

Market growth is substantially driven by escalating geopolitical tensions globally, prompting countries to modernize and expand their defense capabilities, leading to high-volume procurement of advanced shooting systems. Concurrently, the increasing disposable income and growing interest in outdoor recreation and competitive marksmanship, particularly in North America and parts of Europe, significantly boost the commercial segment. Benefits derived from this market include enhanced national security, effective law enforcement capabilities, robust personal safety options, and the promotion of skilled competitive sports. However, the market remains sensitive to evolving gun control legislation, economic volatility affecting consumer spending, and public perception regarding firearm ownership and usage.

Shooting Market Executive Summary

The Shooting Market is experiencing robust business trends characterized by a dual focus on defense modernization and commercial market diversification. Defense sector growth is driven by state-sponsored research and development into smart weapon systems, modular platforms, and precision-guided ammunition, emphasizing lighter materials and enhanced connectivity. Commercially, the market sees heightened demand for modular firearms that allow easy customization, advanced optics with integrated thermal and night vision capabilities, and the adoption of biodegradable and lead-free ammunition alternatives to address environmental concerns. Manufacturers are increasingly prioritizing supply chain resilience and vertical integration to manage volatile raw material costs, particularly steel alloys and propellants, ensuring stable output and meeting both governmental and consumer inventory requirements across various jurisdictions.

Regionally, North America maintains its dominance due to high levels of civilian firearm ownership, robust competitive shooting infrastructure, and significant defense spending by the United States government. The Asia Pacific region, however, is projected to exhibit the highest growth rate, primarily attributed to the military modernization initiatives in China, India, and other key nations, coupled with rising adoption of advanced security apparatus in urban centers. European market trends focus on compliance with stringent EU safety regulations and an increasing demand for sophisticated training simulation technologies across military and police forces. Emerging markets in Latin America and the Middle East & Africa are characterized by ongoing internal security challenges and subsequent high demand for small arms and specialized tactical gear, presenting long-term growth opportunities for exporters.

Segment trends reveal that the Ammunition segment, specifically specialty and precision-guided rounds, is registering rapid value appreciation, driven by military requirements for extended range and improved terminal ballistics. Within the Firearms segment, demand is shifting towards compact, highly reliable, and easily concealable options for personal defense, while tactical rifles incorporating advanced polymer compounds and ergonomic improvements continue to appeal to law enforcement and defense agencies. The Accessories and Optics segment is innovating rapidly, moving towards digital integration, offering real-time ballistic calculations, environmental monitoring, and connectivity with external devices, thereby transforming the user experience and improving marksmanship outcomes across all segments of the Shooting Market.

AI Impact Analysis on Shooting Market

User inquiries regarding Artificial Intelligence (AI) in the Shooting Market primarily revolve around its potential to revolutionize accuracy, safety, and operational efficiency, balanced against ethical and regulatory concerns. Common questions focus on how AI can be integrated into sighting systems for instant ballistic correction, its role in advanced training simulations, and the development of intelligent armories and inventory management systems. There is significant interest in AI-driven target recognition and threat assessment for military and law enforcement applications, specifically concerning autonomous targeting and the necessary human-in-the-loop oversight to ensure compliance with Rules of Engagement (ROE). Key concerns highlight potential job displacement in certain manufacturing processes and the paramount importance of cybersecurity protocols protecting sensitive data generated by networked weapon systems and training platforms.

The integration of AI technologies is fundamentally transforming the design, manufacturing, and deployment phases within the Shooting Market. In manufacturing, machine learning optimizes production lines, predicting equipment failures and improving quality control for complex components like barrels and precision cartridges, minimizing defect rates and enhancing overall consistency. Operationally, AI algorithms process vast amounts of environmental and ballistic data instantly, informing smart optics and fire control systems to maximize the probability of a hit, particularly in dynamic or long-range scenarios. This paradigm shift moves the industry towards systems that are not just reactive but predictive, offering unprecedented levels of precision and reliability across defense and professional marksmanship disciplines.

Furthermore, AI is pivotal in advanced training methodologies. Virtual reality (VR) and augmented reality (AR) shooting simulators, powered by AI, create highly realistic and adaptive training environments that track trainee performance, identify skill deficiencies, and adjust scenario difficulty in real-time. This personalized feedback mechanism accelerates learning and proficiency development far beyond traditional range practices, offering a cost-effective and safe alternative for high-frequency drills. AI also underpins advanced inventory management systems, utilizing predictive analytics to forecast ammunition usage based on operational tempo, optimizing logistics and reducing waste across military supply chains globally, ensuring essential resources are available when and where they are needed most.

- Enhanced Precision: AI-driven fire control systems providing real-time ballistic adjustments and environmental compensation.

- Advanced Training Simulation: Personalized, adaptive VR/AR scenarios driven by machine learning algorithms for skill assessment.

- Manufacturing Optimization: Predictive maintenance and quality control using AI to increase consistency and throughput in ammunition and firearm production.

- Intelligent Logistics: AI-powered inventory management and supply chain optimization for military and commercial distributors.

- Threat Detection & Targeting: Autonomous or semi-autonomous target recognition capabilities for rapid response systems in defense applications.

- Safety and Compliance: Use of computer vision and sensors to prevent unauthorized use or implement safety protocols in smart firearms.

- Data Analytics in Ballistics: Processing complex external ballistics data faster than human capacity to develop superior ammunition designs.

DRO & Impact Forces Of Shooting Market

The Shooting Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces shaping its future. A primary Driver is the consistently high global military and homeland security spending, fueled by persistent geopolitical instability, cross-border conflicts, and the threat of terrorism, necessitating regular upgrades of small arms inventories and advanced munition stockpiles. This is complemented by the sustained commercial demand, particularly in the U.S., driven by constitutional rights advocacy, perceived security threats, and the cultural acceptance of hunting and sport shooting as established recreational activities. Technological leaps in materials (like carbon fiber composites) and electronic sighting systems further catalyze market expansion by offering lighter, more precise, and durable products that appeal to professional and amateur users seeking performance advantages.

Conversely, significant Restraints challenge the market's unhindered growth. The most prominent are increasingly stringent and fluctuating governmental regulations concerning firearm ownership, sales, and cross-border transfers in numerous jurisdictions, creating complexity and legal uncertainty for manufacturers and retailers. Negative public perception and sociopolitical pressure following high-profile incidents can lead to market boycotts and legislative backlash, severely impacting commercial sales. Furthermore, the volatility of raw material prices (especially for copper, lead, and steel) and the environmental impact associated with traditional ammunition components (e.g., lead contamination) impose cost pressures and necessitate costly shifts towards environmentally friendly alternatives, slowing innovation cycles in some segments.

Opportunities for market growth primarily reside in the development and proliferation of high-tech solutions. The market stands to benefit immensely from the global uptake of non-lethal weapon systems for crowd control and specialized applications, offering ethical alternatives for law enforcement. Crucially, the expansion of sophisticated, interactive shooting simulation technologies (VR/AR) presents an untapped growth area, reducing training costs and environmental impact while increasing user proficiency across defense and civilian training platforms. Additionally, exploring untapped markets in developing economies with rising internal security requirements and diversifying product lines to meet niche competitive shooting demands represent strategic avenues for long-term revenue growth and resilience against regulatory headwinds.

Segmentation Analysis

The Shooting Market is meticulously segmented based on product type, application, caliber, and distribution channel, providing a granular view of market dynamics and end-user preferences. The segmentation by product type is crucial, distinguishing between capital-intensive segments like Firearms (handguns, rifles, shotguns) and high-volume, recurring revenue segments such as Ammunition (centerfire, rimfire, shotgun shells, specialty rounds). This detailed breakdown allows stakeholders to identify core profit centers and focus innovation efforts on specific sub-segments where technological advancement or regulatory changes create the most significant value shifts. For instance, the market for high-precision, large-caliber ammunition for long-range tactical applications differs vastly in requirements and procurement cycle from the high-volume market for recreational rimfire ammunition.

Application-based segmentation highlights the primary end-users, differentiating between defense/military, law enforcement/security, hunting, and sport shooting/recreation. The Defense segment demands extreme durability and reliability, often involving large, long-term procurement contracts subject to government budget cycles. In contrast, the Sport Shooting segment is highly sensitive to product novelty, precision engineering, and consumer disposable income, driven by events and competitive circuits. Understanding these application differences is vital for tailoring marketing strategies and research agendas, ensuring product features meet the specific operational or competitive demands of each user group, such as focusing on low recoil and ergonomics for civilian sport shooters versus ruggedness and suppressibility for military operators.

Further granularity is provided by Caliber and Distribution Channel segmentation. Caliber segmentation (e.g., small, medium, large) dictates manufacturing complexity and end-use, with larger calibers typically reserved for heavy machine guns and artillery support in defense. Distribution channels, categorized into direct government sales, specialized dealer networks, and mass retail/e-commerce, influence pricing strategies and logistical requirements. The increasing prominence of e-commerce platforms for accessories and non-regulated components, alongside strict control over firearm sales via Federal Firearm License (FFL) holders, shapes the modern distribution landscape, demanding robust compliance protocols across all sales pathways.

- By Product Type:

- Firearms (Handguns, Rifles, Shotguns, Machine Guns, Cannons)

- Ammunition (Centerfire, Rimfire, Shotgun Shells, Less-Lethal, Training Rounds)

- Accessories (Magazines, Holsters, Slings, Cleaning Kits)

- Optics and Sighting Systems (Scopes, Red Dot Sights, Thermal Imaging, Night Vision)

- By Application:

- Defense and Military

- Law Enforcement and Homeland Security

- Hunting and Wildlife Management

- Sport Shooting and Recreation

- Personal and Home Defense

- Training and Simulation

- By Caliber:

- Small Caliber (up to 12.7mm/.50 cal)

- Medium Caliber (20mm to 40mm)

- Large Caliber (Above 40mm)

- By Technology:

- Conventional Shooting Systems

- Smart/Connected Systems

- By End User:

- Government Agencies (Military, Police)

- Commercial Security Firms

- Individual Consumers

Value Chain Analysis For Shooting Market

The Value Chain for the Shooting Market is inherently complex, starting with the Upstream Analysis involving raw material extraction and refinement. Key upstream suppliers provide specialized steel alloys (e.g., chrome-molybdenum), high-grade polymers and composites for frames and stocks, propellants (gunpowder), primers (chemical compounds), and metals (copper, brass, lead) for projectiles and casings. The efficiency and pricing stability of these upstream processes are critical, as they directly influence the manufacturing costs of both firearms and, more significantly, the high-volume production of ammunition. Raw material sourcing requires specialized procurement capabilities due to the stringent quality requirements dictated by safety and performance standards within the industry, ensuring material consistency that affects ballistic performance.

The middle segment of the chain is dominated by Original Equipment Manufacturers (OEMs), who undertake the design, precision machining, assembly, and testing of firearms and ammunition. This stage is characterized by high capital investment in CNC machinery, advanced metrology equipment, and rigorous quality assurance processes, often involving proprietary intellectual property related to barrel rifling, chamber design, and propellant loading techniques. Downstream activities involve distribution channels, which are heavily regulated. Direct sales primarily occur between large manufacturers and governmental entities (military/police) through authorized defense contractors and procurement programs. These direct channels often involve long-term service and maintenance contracts, establishing a sustained relationship between the manufacturer and the end-user agency.

Indirect distribution relies on a network of authorized wholesalers, distributors, and licensed retailers (e.g., Federal Firearm License holders in the U.S.) who handle sales to commercial security firms and individual consumers. This indirect channel necessitates robust inventory management and strict compliance tracking due to varied federal, state, and local regulations governing firearm sales. The profitability of the downstream segment is highly dependent on effective logistics, regulatory compliance, and brand recognition among consumers, with optics and accessories often utilizing e-commerce platforms to bypass traditional physical retail constraints, emphasizing the multi-faceted nature of sales routes within the broader Shooting Market ecosystem.

Shooting Market Potential Customers

Potential customers in the Shooting Market span three major categories: governmental agencies, commercial entities, and individual consumers, each possessing distinct procurement requirements and purchasing drivers. Government customers, including national defense forces, homeland security departments, and various police forces, represent the most stable and high-volume segment, driven by national security mandates and cyclical modernization programs. These customers prioritize reliability, interoperability with existing systems (NATO standards, for instance), long-term logistical support, and cutting-edge tactical capabilities, often demanding bespoke weapon systems, specialized high-performance ammunition (e.g., armor-piercing or controlled-expansion rounds), and bulk training packages. Tendering processes are rigorous, involving extensive testing and certification, leading to long sales cycles but highly lucrative, enduring contracts for selected manufacturers.

Commercial customers encompass private security organizations, cash-in-transit services, specialized training academies, and corporate shooting ranges. These entities focus heavily on cost-effectiveness, regulatory compliance, and professional-grade durability. Their demand profiles usually involve standard-issue duty pistols, tactical carbines, and high volumes of cost-effective training ammunition. For training facilities, the adoption of simulation technology is growing rapidly, making them key buyers of advanced digital systems that reduce range maintenance and ammunition expenditure while maximizing training efficacy. This segment values efficient supply chains and accessible maintenance services, driving competition among mid-tier manufacturers and accessory providers.

Individual consumers form the largest and most diverse customer base, categorized into hunting enthusiasts, competitive sport shooters, and those seeking firearms for personal and home defense. Hunting customers are primarily focused on rifle and shotgun precision, caliber suitability for regional game, and high-quality optics, often purchasing premium products. Sport shooters demand specialized precision rifles, customized handguns, and exceptionally consistent match-grade ammunition where minor variations can affect competition outcomes. Personal defense users prioritize reliability, concealability, and ease of use. This segment is highly responsive to marketing, brand reputation, and new product releases, driving innovation in ergonomic design, accessory compatibility, and smart safety features for modern civilian firearms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rheinmetall AG, General Dynamics Corporation, Northrop Grumman Corporation, BAE Systems plc, Beretta Holding S.A., Sturm, Ruger & Co., Inc., Vista Outdoor Inc., FN Herstal, S.A., Heckler & Koch GmbH, Olin Corporation (Winchester), Smith & Wesson Brands, Inc., Colt's Manufacturing Company LLC, SIG SAUER, Inc., Taurus Armas S.A., Remington Arms, Nammo AS, Israel Weapon Industries (IWI), CZ Group, Precision Castparts Corp., Aero Precision. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shooting Market Key Technology Landscape

The technological landscape of the Shooting Market is rapidly evolving, driven by requirements for enhanced precision, miniaturization, and safety. A central focus is on the integration of smart technologies into weapon systems. This includes sophisticated fire control systems that incorporate sensors, microprocessors, and environmental gauges to calculate ballistic solutions in real-time, significantly improving first-round hit probability, especially under challenging field conditions. Furthermore, advancements in materials science, particularly the use of high-strength polymer composites and lightweight alloys (e.g., titanium and carbon fiber), are crucial for reducing the weight of firearms and tactical gear, enhancing soldier mobility and endurance without compromising structural integrity or reliability during sustained heavy use. These material innovations are pivotal in next-generation rifle and pistol platforms, aiming for both operational efficiency and user ergonomics.

Ammunition technology represents another high-growth area, with significant investment directed towards developing precision-guided munitions (PGMs) for small arms, though currently limited primarily to larger calibers and specialized defense projects. More broadly accessible innovations include the refinement of propellant chemistry for temperature stability and reduced muzzle flash, as well as the creation of lead-free and frangible ammunition that addresses environmental regulations and specific training needs (e.g., close-quarters training in steel target ranges). Caseless ammunition and telescoped ammunition systems are under continuous development, promising logistics reduction and enhanced magazine capacity, though widespread adoption still faces hurdles related to reliability and heat management within existing weapon systems. The convergence of manufacturing technologies, such as advanced powder metallurgy and additive manufacturing (3D printing), is enabling the creation of highly specialized, complex internal components with improved tolerances and reduced production lead times.

Finally, the proliferation of advanced optics and simulation platforms is redefining the market's technological boundaries. Digital optics are moving beyond simple magnification, integrating capabilities such as laser range finding, atmospheric sensing, and connectivity via wireless protocols to external battlefield management systems or user devices. Augmented Reality (AR) simulation technology is increasingly used to overlay realistic tactical environments onto training exercises, providing immersion and data-driven feedback crucial for military and law enforcement training. This transition toward 'connected shooting' allows for unparalleled data collection on user performance, equipment health, and operational environment, setting the stage for fully integrated battlefield ecosystems and highly personalized training regimens across the spectrum of shooting applications.

Regional Highlights

Regional dynamics within the Shooting Market exhibit significant variations influenced by geopolitical factors, regulatory frameworks, and cultural acceptance of firearm ownership. North America, specifically the United States, commands the largest market share globally due to its massive civilian market, substantial hunting and sport shooting communities, and the world's highest defense budget, driving demand for both high-end commercial products and large governmental procurement of advanced military systems. Europe, characterized by stricter common market regulations, focuses heavily on domestic production for defense needs (especially among NATO members) and a growing premium segment for competitive marksmanship equipment, with countries like Germany and Italy being manufacturing hubs for high-quality firearms and optics.

The Asia Pacific (APAC) region is projected as the fastest-growing market globally. This surge is underpinned by escalating territorial disputes and military modernization programs, particularly in rapidly developing nations such as India, China, and South Korea, leading to substantial governmental investments in acquiring and indigenously developing sophisticated small arms and ammunition. Increased budgets dedicated to counter-insurgency operations and border security also contribute significantly to the high growth rate observed in this region. Latin America and the Middle East & Africa (MEA) represent distinct segments, primarily driven by internal security challenges, counter-narcotics operations, and ongoing conflicts, resulting in consistent, though sometimes volatile, demand for tactical equipment, rifles, and imported ammunition supplies from global arms manufacturers.

- North America: Dominant market share driven by robust civilian sales, extensive competitive shooting infrastructure, and the massive defense procurement programs of the U.S. military. Key focus on personal defense, tactical rifles, and advanced electro-optics.

- Asia Pacific (APAC): Highest projected CAGR, propelled by military modernization initiatives in China and India, rising security concerns, and increasing adoption of domestic small arms manufacturing capabilities.

- Europe: Stable market characterized by high standards for quality, focus on regulatory compliance, and significant demand from NATO forces for interoperable and advanced weapon systems and sophisticated training simulations.

- Middle East & Africa (MEA): Demand is primarily defense and security-centric, influenced by geopolitical tensions, internal conflicts, and counter-terrorism efforts, leading to reliance on international suppliers for high-caliber tactical equipment.

- Latin America: Characterized by strong demand from law enforcement and military agencies addressing organized crime and internal security issues; a growing, albeit restricted, civilian market exists in specific countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shooting Market, encompassing manufacturers of firearms, ammunition, optics, and related accessories.- Rheinmetall AG

- General Dynamics Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- Beretta Holding S.A.

- Sturm, Ruger & Co., Inc.

- Vista Outdoor Inc.

- FN Herstal, S.A.

- Heckler & Koch GmbH

- Olin Corporation (Winchester)

- Smith & Wesson Brands, Inc.

- Colt's Manufacturing Company LLC

- SIG SAUER, Inc.

- Taurus Armas S.A.

- Remington Arms

- Nammo AS

- Israel Weapon Industries (IWI)

- CZ Group

- Precision Castparts Corp.

- Aero Precision

Frequently Asked Questions

Analyze common user questions about the Shooting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the global Shooting Market?

The primary driver is the sustained increase in global defense expenditure, fueled by escalating geopolitical instability and military modernization programs across major economies. Additionally, the enduring popularity of competitive and recreational shooting sports significantly bolsters the commercial segment, particularly in North America.

How is technology impacting firearm manufacturing and accuracy?

Technology is significantly enhancing both manufacturing efficiency and end-user accuracy. Innovations include advanced materials (lightweight polymers and composites), Computer Numerical Control (CNC) precision machining for improved component tolerances, and AI-integrated smart optics providing real-time ballistic compensation and environmental sensing, leading to superior marksmanship.

Which regional segment is expected to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is largely attributable to massive military modernization programs, increasing internal security requirements, and a growing indigenous manufacturing base across countries like China, India, and South Korea.

What are the main restraints affecting the commercial segment of the Shooting Market?

The main restraints are stringent governmental regulations, including evolving gun control legislation which complicates sales and ownership, fluctuating costs of essential raw materials (e.g., copper, lead), and recurring negative public perception following high-profile incidents, which can rapidly affect consumer demand and corporate image.

How are environmental concerns influencing the Ammunition segment?

Environmental concerns are driving innovation towards eco-friendly ammunition, specifically the development and adoption of lead-free primers and projectiles. This shift requires significant R&D investment but is crucial for compliance with environmental regulations and reducing contamination at shooting ranges and hunting grounds, impacting both defense and commercial procurement strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sport Shooting Cartridges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Paper Shooting Target Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Network Troubleshooting Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Riflescope Market Size Report By Type (Telescopic Sight, Collimating Optical Sight, Reflex Sight), By Application (Hunting, Shooting Sports, Armed Forces), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Shooting Market Size Report By Type (Air Rifle, Air Pistol), By Application (Game/Clay Shooting, Hunting, Competitive Sports), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager