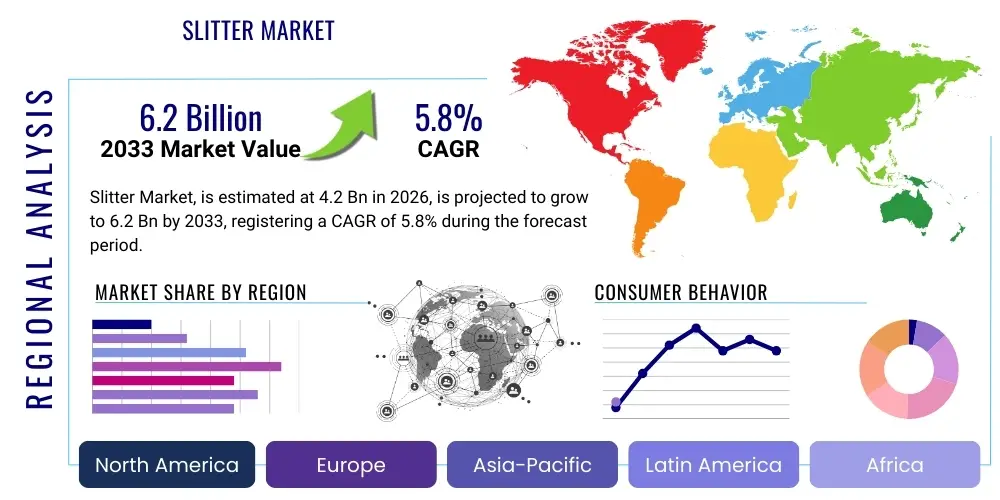

Slitter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441487 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Slitter Market Size

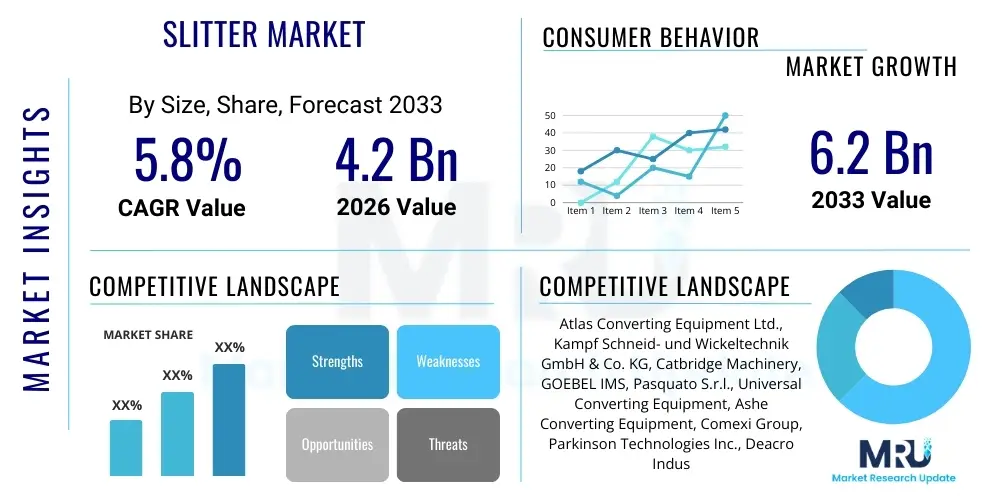

The Slitter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global demand for packaging materials, precision metal sheets, and the increasing utilization of advanced films and foils across various industrial sectors. The shift toward higher volume manufacturing processes and the need for optimized material utilization necessitate the adoption of modern, high-speed slitting technology, contributing significantly to the overall market valuation growth during the projection period.

The consistent growth trajectory observed in the slitter market is intrinsically linked to macro-economic indicators, particularly the expansion of the manufacturing and construction industries in emerging economies like China, India, and Southeast Asia. These regions are investing heavily in infrastructure development and consumer goods production, which directly fuels the demand for processed materials requiring precise slitting operations. Furthermore, technological advancements in automation, such as the integration of sensor technology and sophisticated control systems (PLC/HMI), are enhancing the efficiency and accuracy of slitting machines, thereby increasing their appeal and adoption rate among large-scale converters and processors.

Slitter Market introduction

The Slitter Market encompasses the industry involved in the manufacturing, distribution, and utilization of machinery designed to cut wide rolls of material, known as master rolls, into narrower, precisely sized rolls or strips. These machines, known as slitters or slitter-rewinders, are essential for downstream processing in industries handling flexible substrates, including paper, plastic film, foil, non-woven fabrics, textiles, and thin metals. The primary objective of slitting technology is to provide high-precision dimensional accuracy, ensuring clean cuts and efficient winding tension control, which is critical for material quality and subsequent manufacturing steps. Modern slitters are characterized by high operational speeds, advanced tension control mechanisms, and the ability to handle a wide range of material thicknesses and sensitivities.

Major applications of slitting machinery span across diverse sectors, including flexible packaging production for food and beverages, printing and graphic arts, specialized medical applications (e.g., wound dressings, diagnostic strips), and the processing of electrical components like battery electrodes and conductive foils. The benefits of employing specialized slitting equipment are manifold, centering on reduced material waste, improved product consistency, and maximized throughput rates, which are fundamental requirements in high-volume production environments. Moreover, the evolution towards sustainable and lightweight packaging materials necessitates more precise and delicate handling capabilities, pushing slitter manufacturers to innovate their blade technologies and winding mechanisms.

The market is primarily driven by the rapid growth of the e-commerce sector, which necessitates massive volumes of packaging materials, particularly flexible films and specialized adhesives, all of which require slitting. Additionally, the increasing demand for advanced materials in the automotive and aerospace industries, such as high-performance composite films and precise metal alloys, further contributes to market momentum. Conversely, the market faces constraints related to the high initial capital investment required for advanced automated slitting systems and the necessity for specialized, high-cost maintenance personnel, impacting smaller operations. Despite these restraints, the persistent global focus on efficiency and material quality ensures sustained investment in slitting technology upgrades.

Slitter Market Executive Summary

The Slitter Market is poised for substantial growth, characterized by significant shifts towards automation and precision control driven by the rigorous quality demands of the packaging and electronics industries. Key business trends include the consolidation of specialized slitting providers and an increased focus on modular machine designs that allow for easy integration of advanced features such as laser cutting modules and automated defect detection systems. Manufacturers are increasingly prioritizing energy-efficient models and optimizing machine footprints to meet evolving operational demands globally. Furthermore, the trend toward industrial internet of things (IIoT) integration is leading to enhanced predictive maintenance capabilities and real-time operational diagnostics, improving overall equipment effectiveness (OEE).

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, fueled by rapid industrialization, burgeoning consumer electronics manufacturing, and vast expansion in the flexible packaging supply chain, particularly in China and India. North America and Europe, while mature, exhibit strong demand for advanced, highly customized slitting solutions tailored for specialized applications like pharmaceutical packaging and high-security document printing, emphasizing quality over sheer volume. Segment-wise, the market sees the highest growth in the film and foil slitting category, driven by the electric vehicle (EV) battery production boom and the pervasive use of barrier films in food preservation. The automatic operation mode segment is rapidly gaining share due to labor cost efficiencies and the need for uninterrupted, high-speed production cycles, making automation a critical competitive differentiator.

The technology segment is leaning heavily towards closed-loop tension control systems and non-contact cutting methods for ultra-sensitive materials. This technological advancement addresses critical material handling challenges, particularly with thin gauge films and sensitive printed substrates where physical contact can cause surface damage or dimensional instability. The combination of sustained demand from essential industries and continuous process innovation ensures that the Slitter Market remains an attractive investment area, focusing on suppliers who can deliver bespoke, high-performance solutions that meet stringent industry standards across diverse applications, from converting paper products to complex metallic strips.

AI Impact Analysis on Slitter Market

Common user inquiries regarding AI in the Slitter Market primarily revolve around how AI can enhance precision, minimize waste, and automate quality control processes within high-speed converting operations. Users are keen to understand the feasibility of predictive maintenance models based on machine learning, which can analyze complex sensor data (vibration, temperature, tension parameters) to preemptively schedule maintenance and minimize unplanned downtime, a critical factor given the high throughput of modern slitters. Another core concern centers on AI-driven optimization of the slitting process itself, specifically using algorithms to determine optimal blade settings, tension profiles, and winding parameters based on real-time material properties and ambient conditions, thus achieving superior edge quality and roll geometry consistently. The expectation is that AI integration will lead to a step-change in operational efficiency and material utilization.

- AI algorithms enable predictive maintenance by analyzing sensor data (vibration, temperature, current draw) to forecast equipment failure, dramatically reducing unplanned downtime.

- Machine vision systems powered by deep learning identify and classify subtle material defects (e.g., pinholes, gels, print flaws) in real-time at high speeds, improving quality assurance.

- Optimization of slitting parameters (blade overlap, tension taper, speed) using AI to dynamically adjust settings based on material input variability, ensuring superior roll consistency.

- Automated setup and recipe generation, minimizing reliance on operator experience and significantly reducing changeover times between different materials or job specifications.

- Enhanced inventory and logistics management by integrating slitting line data directly into ERP systems, optimizing raw material supply and finished goods warehousing.

- AI-driven energy management systems analyze operational load and cycle patterns to recommend power-saving modes and reduce the overall energy consumption of high-power motors and heaters.

DRO & Impact Forces Of Slitter Market

The Slitter Market is dynamically shaped by interconnected drivers (D) such as the rapid expansion of the flexible packaging sector and the necessity for precise material processing in advanced manufacturing. Restraints (R) primarily include the high initial capital investment required for automated, large-scale machinery and the complexity associated with integrating these advanced systems into existing production workflows. Opportunities (O) are emerging in specialized areas, notably the manufacturing of components for electric vehicle batteries, demanding ultra-precise slitting of thin metal foils, and the development of sustainable, recyclable packaging films, requiring new handling techniques. These factors collectively create significant impact forces, accelerating the shift toward highly automated and data-driven slitting solutions while simultaneously pressuring manufacturers to reduce system costs and simplify operational interfaces.

The primary driver sustaining market momentum is the relentless global demand for packaged goods, exacerbated by population growth and changing consumer habits (e-commerce). This demands faster, more reliable converting machinery. Conversely, the market faces strong restraint from stringent safety regulations and the technical challenge of ensuring flawless cutting geometry across highly diverse material types, often necessitating specialized and expensive tooling. The opportunity to serve the high-growth electronics sector, particularly in flexible display and photovoltaic manufacturing, provides a compelling pathway for market expansion, requiring slitters capable of sub-millimeter tolerances and ultra-clean operating environments, effectively differentiating high-end manufacturers.

The market impact forces are compelling companies toward continuous innovation in blade technology, tension control, and waste management. The environmental imperative is driving the development of machinery that minimizes material trim waste and efficiently handles bio-based and recycled substrates. Furthermore, labor shortages in developed economies act as a strong force driving the adoption of fully automated slitter-rewinders, minimizing manual intervention and maximizing throughput per employee. Ultimately, success in this market is dictated by the ability to offer a perfect blend of speed, precision, flexibility, and operational efficiency.

Segmentation Analysis

The Slitter Market is comprehensively segmented based on machine type, operational mode, application, and material processed, reflecting the diverse industrial requirements served by this essential equipment. Understanding these segments is crucial for manufacturers targeting niche markets, such as high-speed metal coil processing or ultra-precision flexible electronics film slitting. The segmentation framework allows for a detailed assessment of demand patterns, showing higher growth potential in segments aligned with industrial automation and specialized material conversion. The technology deployed, particularly the type of cutting mechanism—razor, shear, or crush slitting—is a primary differentiator, influencing the speed and quality achievable for specific substrates. The market analysis reveals a distinct trend towards sophisticated automatic systems across all material categories, prioritizing productivity and reduced operator dependency.

- By Material Type:

- Paper & Paperboard

- Plastic Films & Foils (BOPP, PET, PE, PVC)

- Metal Foils & Strips (Aluminum, Copper, Steel)

- Laminates & Composites

- Non-Woven Fabrics & Textiles

- By Machine Type/Cutting Mechanism:

- Razor Slitting (Predominantly for thin films)

- Rotary Shear Slitting (For thicker films, paper, and metal)

- Score/Crush Slitting (For paper, board, and certain laminates)

- By Operation Mode:

- Automatic Slitting Machines (High-speed, integrated controls)

- Semi-Automatic Slitting Machines (Operator assisted setup)

- Manual Slitting Machines (Limited industrial use)

- By Application/End-Use Industry:

- Packaging (Flexible Packaging, Labels, Cartons)

- Printing & Graphics

- Electronics & Electrical (Battery components, Capacitors)

- Automotive

- Textiles & Fabrics

- Medical & Healthcare

Value Chain Analysis For Slitter Market

The value chain of the Slitter Market begins with upstream activities involving the sourcing of highly specialized raw materials, primarily high-grade precision steel for blades, complex electronic components (PLCs, sensors, servo motors), and robust mechanical components (frames, rollers). Key upstream suppliers include steel producers, automation technology providers (Siemens, Rockwell Automation), and specialized bearing manufacturers. The efficiency of the upstream segment is critical, as the precision and reliability of the final slitter machine heavily depend on the quality and tolerance of these core components. Manufacturers often establish long-term relationships with preferred component suppliers to ensure consistency and technological compatibility, especially for integrated software and control systems.

Moving downstream, the distribution channel for slitting machinery is primarily bifurcated into direct sales and indirect channels. Direct sales are common for high-value, customized, and large-scale automatic machines, where complex installation, training, and ongoing technical support necessitate a direct relationship between the manufacturer and the large converter or processor. Indirect channels involve authorized distributors, regional agents, and system integrators who focus on smaller, standardized machines or provide machinery to localized end-users in specialized niches like labeling or localized printing. Aftermarket services, including blade resharpening, component replacement, and software upgrades, form a crucial part of the downstream revenue stream, particularly given the long operational lifespan of industrial slitting equipment.

The end of the value chain involves the application by industrial customers, including major packaging conglomerates, metal service centers, and specialized electronics component producers. The efficiency and quality achieved at this stage directly impact the profitability and overall quality of final products, such as flexible food pouches, lithium-ion battery electrodes, or specialized architectural films. The push towards sustainable manufacturing has led to increased collaboration across the value chain, where slitter manufacturers work closely with material suppliers and end-users to optimize machine settings for new, environmentally friendly substrates, ensuring minimal material degradation and maximum yield.

Slitter Market Potential Customers

The primary customers for slitting machinery are large-scale industrial processors and converters who specialize in handling continuous web materials. These potential customers span a broad range of sectors but share the common need for high-precision, high-speed cutting and rewinding operations. End-users can be broadly categorized into primary material producers and secondary converters. Primary producers, such as aluminum foil manufacturers or large paper mills, require heavy-duty slitter-rewinders to process vast volumes of master rolls produced directly from their core processes. Secondary converters, typically packaging firms or label printers, require highly accurate slitting machines to prepare materials for printing, lamination, and final product formation.

Key buying centers within these organizations include production management, engineering departments, and procurement teams. The purchase decision is typically driven by factors such as throughput capacity, operational accuracy (measured in trim tolerance), automation level, ease of material changeover, and the total cost of ownership (TCO), which includes maintenance and energy efficiency. Given the high capital outlay, long-term operational guarantees and robust after-sales support are critical factors influencing the selection of a slitter machinery supplier. Emerging customers include new entrants in the bio-plastic packaging sector and firms investing in domestic production of EV battery components, both of which require bespoke, state-of-the-art slitting solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Converting Equipment Ltd., Kampf Schneid- und Wickeltechnik GmbH & Co. KG, Catbridge Machinery, GOEBEL IMS, Pasquato S.r.l., Universal Converting Equipment, Ashe Converting Equipment, Comexi Group, Parkinson Technologies Inc., Deacro Industries, Elite Cameron, DCM-ATN, Nobatec S.r.l., Zhejiang Reborn Machinery, Maxcess International, HAGIHARA Industries Inc., SOMA spol. s r.o., Dienes Corporation, Delta Converting S.r.l., Eurolls S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slitter Market Key Technology Landscape

The technology landscape of the Slitter Market is undergoing rapid evolution, focusing heavily on enhancing precision, automation, and speed while minimizing vibration and material stress. A central technological advancement is the integration of sophisticated closed-loop tension control systems, which utilize highly sensitive load cells and advanced proportional-integral-derivative (PID) controllers to maintain consistent web tension throughout the slitting and rewinding process, regardless of roll diameter or speed fluctuations. This precise control is paramount for processing sensitive materials like thin films and specialty papers where inconsistent tension leads to wrinkling, telescoping, or web breaks, directly impacting overall material yield and product quality. Furthermore, the shift toward servo-driven motors and shaftless winding technology is reducing mechanical wear and simplifying the handling of heavy rolls, contributing significantly to operational efficiency and safety standards across industrial settings.

Another pivotal technological development involves the adoption of specialized non-contact measurement and inspection systems. High-resolution optical sensors and cameras are increasingly deployed to perform 100% surface inspection for defects at line speeds exceeding 1,000 meters per minute. Furthermore, automated positioning systems for slitting blades (auto-positioning knife systems) significantly reduce machine setup time and eliminate human error associated with manual blade placement, which is especially critical in job-shop environments requiring frequent material changes. These advanced automated systems leverage PLC and HMI interfaces to manage complex slicing patterns and recipe storage, facilitating rapid, repeatable changeovers and optimizing machine throughput for varied production runs across the entire industrial converting sector.

The integration of Industry 4.0 principles, including IIoT connectivity and cloud-based data analytics, is transforming slitter machinery from standalone units into intelligent manufacturing assets. Modern slitters are equipped with numerous sensors that continuously feedback data on parameters such as roller temperature, blade life, motor performance, and energy consumption. This data is utilized for advanced diagnostics, remote monitoring, and creating digital twins of the machinery. Such connectivity allows manufacturers to offer comprehensive performance optimization services and enables end-users to integrate slitting performance data directly into their enterprise resource planning (ERP) systems, leading to optimized production scheduling, streamlined resource allocation, and a substantial reduction in operational bottlenecks across the entire manufacturing pipeline.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market region, driven by explosive growth in manufacturing sectors, particularly consumer electronics, flexible packaging, and automotive components (including EV batteries). Countries like China, India, and Vietnam are major hubs for converting operations due to lower labor costs and significant investments in modern industrial infrastructure. The increasing domestic consumption of packaged food and e-commerce growth provides a continuous pipeline of demand for high-speed slitter-rewinders.

- North America: Characterized by a demand for high-performance, specialized, and highly automated slitting machinery. The focus is on precision applications, such as medical-grade materials, aerospace components, and advanced composite processing. North American manufacturers emphasize energy efficiency, minimal waste production, and robust integration with existing factory automation systems, driving demand for premium, customized solutions.

- Europe: The European market is highly mature and technology-intensive, focused strongly on sustainability and regulatory compliance (e.g., handling recycled content and bio-based films). Demand is high for versatile slitters capable of handling a broad range of substrates while maintaining strict quality controls, particularly within the pharmaceutical, label printing, and high-quality graphics industries. Germany and Italy remain centers for advanced slitter manufacturing and innovation.

- Latin America: This region shows promising growth, primarily concentrated in Brazil and Mexico, fueled by expanding domestic packaging and consumer goods industries. The market is increasingly adopting semi-automatic and automatic machines to improve efficiency and scale production, moving away from older, manual processes, yet price sensitivity remains a key factor in procurement decisions across various industrial sectors.

- Middle East and Africa (MEA): Growth in MEA is moderate but steady, largely driven by investments in the packaging industry linked to urbanization and retail modernization, particularly in the UAE and Saudi Arabia. Demand is focused on reliable, durable machinery suitable for variable environmental conditions, often imported through distribution partnerships with European and Asian manufacturers to meet growing infrastructure needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slitter Market.- Atlas Converting Equipment Ltd.

- Kampf Schneid- und Wickeltechnik GmbH & Co. KG

- Catbridge Machinery

- GOEBEL IMS

- Pasquato S.r.l.

- Universal Converting Equipment

- Ashe Converting Equipment

- Comexi Group

- Parkinson Technologies Inc.

- Deacro Industries

- Elite Cameron

- DCM-ATN

- Nobatec S.r.l.

- Zhejiang Reborn Machinery

- Maxcess International

- HAGIHARA Industries Inc.

- SOMA spol. s r.o.

- Dienes Corporation

- Delta Converting S.r.l.

- Eurolls S.p.A.

- Dalmec S.r.l.

- Wabash Precision Slitting

- Converting Equipment International

Frequently Asked Questions

Analyze common user questions about the Slitter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-speed slitter-rewinders?

The predominant driver is the exponential growth of the global e-commerce sector, which necessitates massive volumes of flexible packaging, labels, and tapes, requiring slitting machinery capable of high throughput and reliable, continuous operation with minimal material waste.

How do different slitting methods (razor, shear, crush) impact material suitability?

Razor slitting offers the cleanest cut for very thin, flexible films and foils. Rotary shear slitting is ideal for thicker materials like paperboard and dense films. Score or crush slitting is typically reserved for materials where precision is secondary to speed, such as pressure-sensitive labels or certain paper products, due to potential dusting.

Which geographical region holds the largest market share for slitter equipment?

The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid industrialization, massive investments in manufacturing infrastructure, particularly in packaging and electronics, and the sustained high volume demand from nations like China and India.

What role does automation play in the future growth of the Slitter Market?

Automation is crucial for future growth, enabling precise tension control, automated defect detection via vision systems, and fast, repeatable changeovers. Fully automatic slitting systems reduce labor dependency and maximize overall equipment effectiveness (OEE), making them essential for high-volume, quality-sensitive applications.

What are the most demanding applications driving innovation in slitting technology?

The most demanding applications are the processing of components for lithium-ion batteries (requiring ultra-precise slitting of thin metal electrode foils with zero contamination risk) and specialized flexible electronics, pushing manufacturers to develop advanced, high-tolerance, and cleanroom-compatible machinery.

The Slitter Market, being intrinsically tied to the efficiency of the converting and processing industries, continues to prioritize technological development aimed at maximizing speed without compromising accuracy. The shift towards sustainable materials, such as mono-material barrier films and recycled polymers, presents a technical challenge requiring slitter manufacturers to adapt tension control and knife technology to handle materials with inherently different physical properties than traditional plastics. Successful market participants are those who not only offer robust, high-speed machinery but also provide comprehensive data integration and remote diagnostic capabilities, ensuring high uptime for their industrial clientele.

In mature markets like North America and Europe, the emphasis is heavily placed on customized solutions capable of handling niche materials, such as advanced composites used in aerospace or highly sensitive medical films. This necessitates close collaboration between slitter manufacturers and end-users during the design phase to ensure the equipment meets highly specific regulatory and dimensional requirements. The ability to minimize vibration and maintain parallelism across wide webs at high speeds remains a differentiating factor for premium machinery targeting these specialized industrial sectors.

Furthermore, the long-term outlook for the Slitter Market is positively reinforced by global trends in electrification and digital transformation. The manufacturing of components for electric vehicles (EVs) requires thousands of tons of precisely slit copper and aluminum foils. Simultaneously, the proliferation of digital printing demands sophisticated slitter-rewinders capable of handling short runs with rapid setup and breakdown, effectively bridging the gap between traditional volume manufacturing and customized printing services. This blend of volume and specialization ensures a stable, diversified demand profile for slitting technology globally.

The critical success factors for slitter manufacturers include delivering highly reliable machinery with extended operational lifecycles, competitive pricing for semi-automatic models targeting emerging markets, and continuous investment in software capabilities for smart manufacturing integration. The competitive landscape is characterized by established European and North American players focusing on high-end precision, while Asian manufacturers increasingly dominate the mid-to-high volume standard machine segment, often providing competitive solutions with rapidly improving automation features. Customer support, particularly the availability of swift technical service and spare parts, remains a powerful determinant in purchasing decisions across all segments of the market.

Technological advancement is not limited to mechanical components; software interface development is becoming equally important. User-friendly Human-Machine Interfaces (HMIs) that simplify complex parameter settings, integrate real-time quality feedback, and provide multilingual support are increasingly expected by international clientele. The trend towards modular design also allows customers to incrementally upgrade their slitting lines, adding features like automatic core loaders, automated knife positioning, or specialized tension zones as their production needs evolve, offering flexibility and protecting initial capital investment over a longer period.

The impact of materials science on slitting technology cannot be overstated. As the industry moves toward thinner, stronger, and more multi-layered composite materials—especially in high-barrier flexible packaging—the risk of material deflection or thermal stress during cutting increases. This has spurred innovation in specialized blade coatings and heating/cooling systems integrated near the cutting zone to maintain optimal material temperature and minimize frictional effects, thereby ensuring superior cut quality and extending blade longevity under rigorous operating conditions.

Looking specifically at the electronics sector, the demand for battery and capacitor foils necessitates slitter machines operating in ultra-low moisture and high-cleanliness environments (dry rooms/cleanrooms). These specialized slitters must prevent any contamination that could compromise the electrochemical performance of the final battery cell. Manufacturers serving this niche must adhere to strict environmental controls and integrate non-contact handling solutions, driving up the complexity and unit cost of these highly specialized slitting systems.

In conclusion, the Slitter Market's trajectory is firmly upward, fueled by global industrial expansion, technological innovation in precision manufacturing, and the unstoppable growth of the packaging industry. The future competitive advantage will belong to firms that successfully navigate the integration of AI and IoT into their machine designs, offering not just a piece of equipment, but a smart, connected, and highly efficient converting solution.

The demand for wider web widths in master rolls, particularly in film and paper production, puts pressure on slitter manufacturers to design machines that can handle the sheer size and weight while maintaining precision across the entire width. This requires exceptionally rigid machine frames, robust tension control across numerous zones, and highly efficient roll handling systems, including automated loading and unloading mechanisms, which contribute significantly to the overall machinery cost and complexity, particularly for high-end industrial applications.

Furthermore, the maintenance and operational expenditure (OPEX) are key considerations for end-users. Slitter manufacturers are focusing on developing components, such as self-sharpening blades or quick-change cartridge systems, that minimize downtime associated with tooling maintenance. Remote diagnostics and virtual reality (VR) assisted troubleshooting are emerging tools that allow manufacturers to support clients globally, drastically reducing the time required to resolve complex mechanical or software issues, thereby increasing the overall productivity of the installed base.

The convergence of printing and converting technologies also impacts slitting. Modern flexible packaging lines often integrate printing, lamination, and slitting in highly coordinated sequences. Slitters designed for these environments must offer superior tracking and registration capabilities to align precisely with printed graphics or embedded functional layers, demanding integration with sophisticated web guidance systems and sensor technology beyond typical mechanical alignment methods.

This market is moving toward greater customization. While standard models exist, major converters often require bespoke machines tailored to unique material characteristics (e.g., highly abrasive substrates, ultra-stretch films) or specific output requirements (e.g., specialized winding profiles). This necessity for customization means that engineering capability and flexible manufacturing processes are powerful competitive advantages for slitter suppliers.

The increasing global focus on reducing the carbon footprint of industrial operations is prompting buyers to favor slitters with reduced energy consumption, often achieved through regenerative braking systems, highly efficient servo motors, and optimized pneumatic systems. Suppliers who can quantify and demonstrate the energy savings of their equipment hold a competitive edge, aligning with corporate sustainability goals across the manufacturing landscape.

The supply chain risk associated with geopolitical volatility also influences buying behavior, leading companies to seek suppliers who can demonstrate supply chain resilience and local support capabilities. This has occasionally favored regional manufacturers or those with diversified global production and service networks, reducing reliance on long, complex international logistics routes for critical machinery components or urgent technical support.

Finally, the evolution of raw materials, such as the increasing use of recycled polyethylene terephthalate (rPET) or post-consumer recycled (PCR) materials, introduces variability in substrate quality, including inconsistent thickness or embedded imperfections. Slitters must be robust enough to handle these variations without sacrificing cut quality or causing frequent web breaks, requiring adaptable tension systems and enhanced material handling features to ensure successful processing.

The market for slitter blades and tooling, often treated as a recurring revenue stream, is a vital subsection of the overall market. Innovation in blade materials, such as ceramic coatings or specialized alloys, is driven by the need for longer edge life when processing tough or abrasive materials, which ultimately translates into reduced operational expenditure and increased productivity for the end-user. Tooling suppliers that can integrate smart sensors into the blades themselves to monitor wear and recommend replacement times are providing significant added value in the modern converting environment.

Emerging markets continue to see substantial investment in capacity expansion, often characterized by large, centrally planned projects focusing on standardized, high-volume slitting operations for commodity materials like standard paper and basic packaging films. These investments are often backed by government incentives and are aimed at reducing reliance on imports, fueling strong, albeit segment-specific, regional market growth in areas like Southeast Asia and parts of Latin America.

The continuous optimization of machine ergonomics and operator safety is another non-technical but critical aspect of modern slitter design. Features like automated roll handling, enclosed cutting areas, and simplified maintenance access reduce the risk of industrial accidents and improve the work environment, ensuring compliance with increasingly strict global occupational safety standards across all segments of the slitting industry.

Furthermore, the competitive edge is often gained through intellectual property related to proprietary winding technology. Achieving a perfectly straight, tightly wound roll free of defects (like 'dish' or 'telescoping') is crucial for downstream processes. Manufacturers developing unique algorithms for differential winding or specialized web steering mechanisms often secure long-term contracts with premium material converters who demand flawless finished product quality consistently, differentiating them from competitors offering more generic solutions.

The overall market ecosystem is characterized by strong partnerships between machine builders, material producers, and system integrators. These collaborations drive innovation, ensuring that new slitting technologies are developed concurrently with advancements in material science, thus guaranteeing the manufacturability of the next generation of industrial films, papers, and metal components required by high-tech sectors globally.

This dynamic environment, underpinned by robust industrial demand and continuous technological push, ensures that the Slitter Market will remain an area of sustained investment and innovation throughout the forecast period, addressing the complex and diverse precision requirements of the modern manufacturing world across nearly every material-handling sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Slitter Rewinders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Slitter Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Roll Slitting Machine Market Size Report By Type (Roll/Log Slitters, Slitter Rewinders), By Application (Paper and Pulp, Textile, Packaging, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Automatic Slitter Market Statistics 2025 Analysis By Application (Rubber Industry, Food Industry, Agriculture And Avocation), By Type (Hydraulic Slitter, CNC Slitter), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Slitter Rewinders Market Statistics 2025 Analysis By Application (Paper and Nonwoven Fabric, Films, Metal Foils), By Type (Less Than 1000mm Wide, 1000-2000mm Wide, Above 2000mm Wide), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager