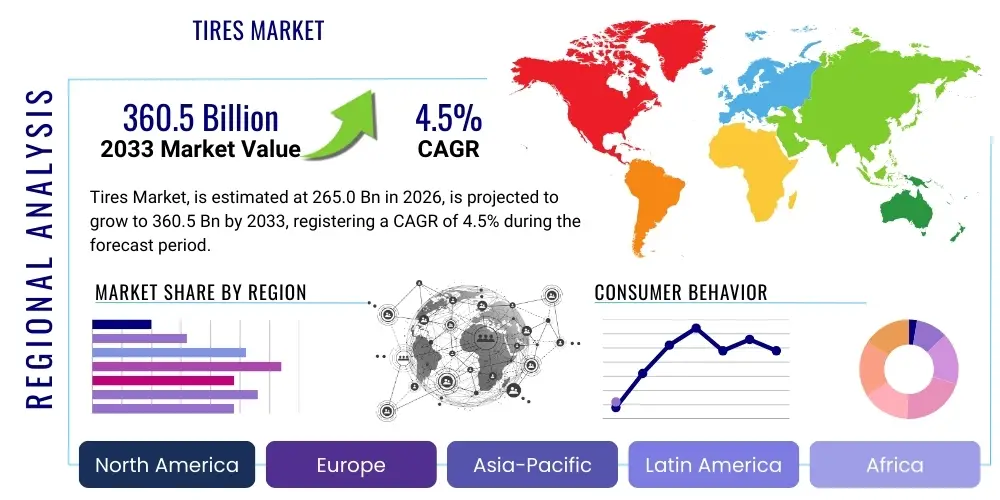

Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441316 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Tires Market Size

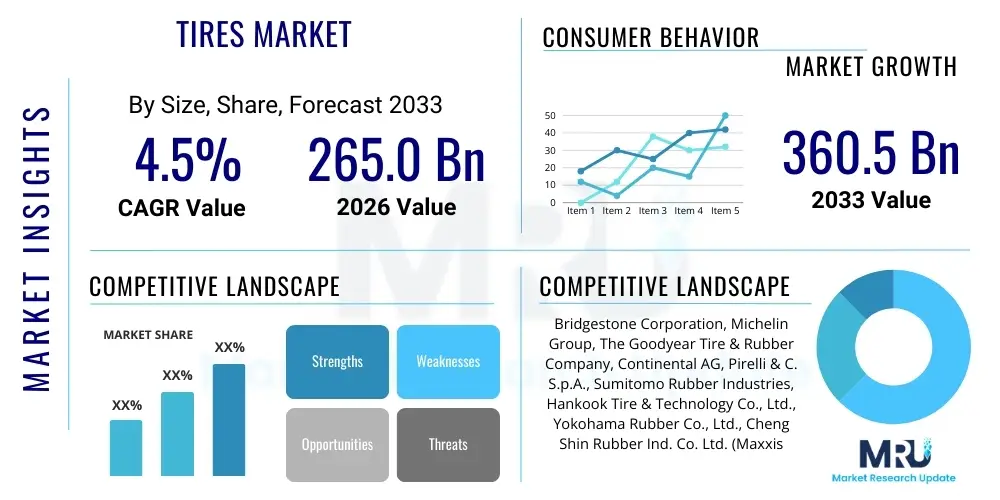

The Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $265.0 Billion in 2026 and is projected to reach $360.5 Billion by the end of the forecast period in 2033.

Tires Market introduction

The global Tires Market encompasses the manufacturing, distribution, and sale of pneumatic and non-pneumatic tires used across various vehicle types, ranging from passenger cars and commercial trucks to off-the-road (OTR) vehicles and aircraft. Tires are critical safety components that transmit traction, braking, and steering forces between the vehicle and the road surface, supporting the vehicle’s weight while absorbing road shocks. This vital component is characterized by complex material science, involving synthetic rubber, natural rubber, carbon black, and advanced chemical compounds designed to maximize durability, fuel efficiency, and performance under diverse operating conditions globally. The industry is highly sensitive to raw material price fluctuations and global automotive production volumes, influencing supply chain strategies and product pricing across key geographic regions.

The primary applications of tires span two major market segments: the Original Equipment Manufacturer (OEM) segment, which supplies tires directly to vehicle assembly lines; and the Aftermarket (Replacement) segment, which covers tire replacements during the vehicle’s operational life. Major applications include use in passenger vehicles (sedans, SUVs, light trucks), commercial vehicles (heavy-duty trucks, buses), two-wheelers, and specialized industrial or agricultural machinery. The market benefits significantly from ongoing infrastructure development, particularly in emerging economies, which increases the demand for commercial and construction vehicle tires. Furthermore, the rising adoption of electric vehicles (EVs) is driving innovation toward low-rolling resistance and high load-bearing capacity tires, posing both a challenge and a substantial opportunity for manufacturers.

Key benefits provided by modern tires include enhanced safety through improved wet and dry grip capabilities, reduced fuel consumption due to minimized rolling resistance, and increased longevity facilitated by advanced tread compounds and structural integrity. Driving factors propelling market expansion include robust growth in the global automotive fleet, stringent governmental regulations mandating minimum safety and efficiency standards (such as tire pressure monitoring systems and tire labeling requirements), and the accelerating trend of urbanization, leading to higher utilization rates of transportation networks. Technological advancements, such as the integration of sensor technology for 'smart tires' that provide real-time performance feedback, are fundamentally transforming the competitive landscape and driving premiumization within the market structure.

Tires Market Executive Summary

The global Tires Market Executive Summary highlights a period of sustained growth driven primarily by robust demand in the replacement market, particularly in high-growth economies across Asia Pacific, coupled with significant technological shifts focused on sustainability and digitalization. Business trends show a heightened competitive environment where major players are prioritizing mergers and acquisitions (M&A) to secure raw material supplies and expand manufacturing footprints closer to key consumer bases. The industry is witnessing a strong pivot towards specialized tire offerings, including high-performance tires for luxury and sports vehicles, and durable, long-lasting tires optimized for the demanding characteristics of heavy electric vehicle batteries, which require new material compositions to manage increased torque and weight.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, maintains its dominance, serving as both the largest production base and the most significant consumer market, underpinned by massive domestic vehicle sales and expanding road networks. North America and Europe, while representing mature markets, are leading in the adoption of premium and environmentally friendly tire technologies, driven by strict emissions standards and strong consumer preference for certified sustainable products. These mature markets are crucial for validating advanced concepts such as non-pneumatic tires and self-sealing technologies. The operational focus in these regions is shifting towards optimizing supply chains for efficiency and reducing the environmental footprint throughout the tire lifecycle, from manufacturing to recycling.

Segment trends reveal that the Passenger Car segment retains the largest market share due to sheer volume, but the Commercial Vehicle segment is exhibiting a faster growth trajectory, particularly in developing economies where logistics and construction activities are booming. By construction type, radial tires overwhelmingly dominate the market due to their superior performance, fuel efficiency, and comfort attributes compared to bias-ply tires. Furthermore, the rising awareness regarding tire maintenance and safety has amplified the aftermarket segment’s importance, compelling manufacturers to invest heavily in extensive retail networks and digital platforms for consumer engagement. The market structure is evolving to integrate advanced materials, such as bio-based polymers and specialized reinforcing fillers, aiming to meet both regulatory mandates for efficiency and consumer expectations for durability and enhanced grip across varying climates and road conditions.

AI Impact Analysis on Tires Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into the traditional tire manufacturing process and product lifecycle. Common questions revolve around whether AI can significantly improve tire safety, reduce production costs, and enhance the longevity of the product. Users are particularly concerned with the transition to "smart tires" equipped with embedded sensors and the corresponding data analysis capabilities, asking how this data is used for predictive maintenance and optimal fleet management. Key themes identified include the expectation of AI driving precision engineering in material composition, enabling predictive failure analysis for consumer safety, and optimizing complex logistics chains, thereby fundamentally restructuring the value proposition of modern tires from a simple component to an intelligent system integrated within the vehicle ecosystem.

The integration of AI into the Tires Market spans the entire value chain, beginning with R&D, where ML algorithms are used to simulate and test thousands of material combinations virtually, drastically cutting down the time required for compound development and identifying optimal characteristics for low-rolling resistance or enhanced wear. In manufacturing, AI-powered quality control systems utilize computer vision and deep learning to inspect tires in real-time, identifying micro-defects invisible to the human eye, thereby increasing production consistency and reducing waste. Furthermore, AI optimizes the curing and molding processes by dynamically adjusting parameters based on real-time sensor data, ensuring maximum homogeneity and structural integrity in the final product, which is crucial for high-performance and safety-critical applications.

Post-sale, AI plays a pivotal role through smart tire technologies. Sensors embedded within the tire collect vast amounts of data—including pressure, temperature, tread depth, and road conditions—which AI algorithms analyze to provide highly personalized recommendations to drivers or fleet managers. This predictive maintenance approach allows users to schedule tire replacement or rotation exactly when needed, maximizing tire lifespan and minimizing unexpected failures, which significantly enhances operational safety and reduces overall vehicle running costs. For large commercial fleets, AI models optimize route planning based on real-time tire wear predictions across varied terrains, translating directly into substantial fuel savings and enhanced logistical efficiency, cementing AI’s role as a transformative technology in market differentiation.

- AI optimizes raw material formulation through predictive modeling, accelerating the development of sustainable and high-performance compounds.

- Machine learning enhances manufacturing efficiency by implementing precision control in curing and assembly, reducing defects and improving quality consistency.

- Smart tires utilize AI algorithms for real-time analysis of embedded sensor data, enabling predictive maintenance alerts for optimal safety and longevity.

- AI-driven fleet management systems optimize vehicle routing based on tire condition and road friction dynamics, leading to significant fuel economy improvements.

- Computer vision systems powered by deep learning facilitate automated quality inspection, identifying microscopic flaws in finished products faster than traditional methods.

DRO & Impact Forces Of Tires Market

The dynamics of the Tires Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various internal and external Impact Forces. A primary driver is the continuous expansion of the global vehicle parc—the total number of vehicles in use—which sustains steady demand for replacement tires, the largest segment of the market. Concurrently, increasing emphasis on vehicular safety and performance, coupled with regulatory mandates requiring better fuel efficiency and lower emissions, forces manufacturers to innovate constantly, particularly in reducing rolling resistance. However, the market faces significant restraints, chiefly volatile pricing and supply chain unpredictability of key raw materials, especially natural rubber and petroleum-derived synthetics, which directly impacts profit margins and necessitates hedging strategies. The market structure is further constrained by the substantial capital expenditure required for maintaining state-of-the-art manufacturing facilities and compliance with increasingly rigorous environmental standards.

Opportunities for growth are abundant, focusing primarily on the swift electrification of the automotive industry. Electric Vehicles (EVs) require specialized tires capable of handling higher instantaneous torque, heavier loads due to battery weight, and quieter operation, creating a premium sub-segment for specialized EV tires. Furthermore, the transition toward mobility-as-a-service (MaaS) and autonomous driving systems necessitates the integration of smart tire technology (Tire Performance Management Systems), opening new revenue streams based on data services rather than just physical product sales. Another crucial opportunity lies in adopting circular economy principles, focusing on tire recycling technologies and the use of sustainable or bio-based materials in production, which appeals to environmentally conscious consumers and aligns with global sustainability goals, offering a competitive advantage to early adopters.

The impact forces currently exerting the most pressure include technological transformation, regulatory changes, and economic volatility. Technologically, the shift towards connectivity and sensor integration is revolutionizing product definition, making performance data a key marketable feature. Regulatory forces, particularly the implementation of stricter tire labeling requirements (e.g., EU regulations on wet grip, noise, and rolling resistance), compel manufacturers across all regions to meet high minimum standards, impacting design and material choices. Economically, global inflationary pressures and trade tariffs can disrupt international sourcing and distribution channels, increasing operational costs. These forces collectively dictate investment priorities, product development timelines, and regional market penetration strategies, ensuring that competitive success is contingent upon agility in responding to macro-environmental shifts and rapidly integrating new material science breakthroughs.

Segmentation Analysis

Segmentation analysis provides a crucial framework for understanding the diverse facets of the Tires Market, allowing stakeholders to identify high-growth areas based on product attributes, vehicle application, end-use, and construction type. The market is broadly fragmented by vehicle type, differentiating between high-volume passenger car tires and heavy-duty commercial tires, which require different performance characteristics, regulatory compliance, and distribution models. The complexity is further deepened by the distinct requirements of the Original Equipment (OEM) segment, which demands high precision and just-in-time delivery for vehicle assembly, versus the Aftermarket (Replacement) segment, which is more sensitive to price, brand loyalty, and availability across extensive retail networks globally. Understanding these segment dynamics is essential for manufacturers to tailor their production capacities and marketing efforts effectively across regions.

A significant dimension of segmentation involves end-use, distinguishing between replacement sales, which dominate the overall market volume and are less cyclical, and OEM sales, which fluctuate directly with global vehicle production cycles. Manufacturers often employ differing pricing and distribution strategies for these two channels; OEM contracts often involve lower margins but provide guaranteed volume and market presence, while the replacement market offers higher potential margins but requires extensive branding and retail investment. Furthermore, segmentation by material and technological advancement is becoming critical, with specialized segments like run-flat, self-sealing, and increasingly, tires specifically designed for Electric Vehicles (EVs) commanding premium pricing due to the proprietary technology and performance enhancements they offer compared to standard pneumatic radials.

Segmentation also highlights regional disparities in demand and product requirements. For instance, winter tire penetration is highest in North America and Europe, driven by seasonal weather patterns and safety regulations, whereas all-season tires are more prevalent in milder climates. Analyzing the market by construction type, specifically the overwhelming dominance of radial tires over bias tires across all major applications, confirms the industry standard for efficiency and durability. Detailed analysis across these multiple dimensions—vehicle, end-use, construction, and technology—enables manufacturers to optimize their product portfolio, focus R&D investment on the most promising high-growth niche segments, and strategically allocate resources to maximize returns in both mature and emerging market geographies.

- By Type:

- Radial Tires

- Bias Tires

- By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers

- Off-the-Road (OTR) Vehicles (Construction, Mining, Agricultural)

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement)

- By Sales Channel:

- Online Sales

- Dealer/Distributor Network

- Direct Sales (Fleet Operators)

- By Season:

- Summer Tires

- Winter Tires

- All-Season Tires

Value Chain Analysis For Tires Market

The Value Chain for the Tires Market is extensive and complex, starting with the upstream sourcing of raw materials, moving through energy-intensive manufacturing, and concluding with a multi-layered downstream distribution network and, increasingly, end-of-life management. Upstream analysis reveals heavy reliance on two major inputs: natural rubber, primarily sourced from Southeast Asia, and synthetic rubber, derived from petroleum products, alongside reinforcing materials like steel cord, carbon black, and specialized chemicals. Vulnerability to global commodity price fluctuations and regional political stability significantly influences operational costs and risk management strategies for tire manufacturers. Securing stable, high-quality material supply is a critical competitive necessity, leading many industry leaders to engage in long-term supply agreements or vertical integration strategies to mitigate supply chain risk and ensure consistency in compound quality, which directly affects tire performance metrics.

Midstream activities center on the sophisticated and capital-intensive manufacturing process, which includes mixing, forming, curing (vulcanization), and final inspection. This stage demands precision engineering and high levels of automation to manage the complexity of building a tire with multiple layers of specialized compounds and textiles. Distribution channels represent a pivotal point in the value chain, categorized into direct channels, predominantly supplying OEMs and large commercial fleets, and indirect channels, which serve the vast replacement market. Indirect channels include independent distributors, authorized dealers, third-party logistics providers, and, increasingly, e-commerce platforms, requiring robust inventory management systems and regional warehousing capabilities to ensure rapid fulfillment for consumers.

Downstream analysis focuses on market access and customer interaction. Direct sales are straightforward for OEM agreements, often managed through long-term supply contracts tied to vehicle production forecasts. However, the aftermarket segment utilizes a fragmented system. Independent tire dealers and specialized automotive service centers remain the primary touchpoints for retail consumers, offering fitting and maintenance services. The rise of digital commerce has introduced a hybrid model where consumers research and purchase tires online, often having them shipped directly to an installer, thereby bypassing traditional layers of distribution. Effective management of this complex, hybrid distribution landscape, coupled with efficient end-of-life tire recycling or repurposing initiatives, is vital for maximizing profitability and maintaining brand reputation in a circular economy context.

Tires Market Potential Customers

Potential customers for the Tires Market are segmented across two primary, structurally distinct groups: Original Equipment Manufacturers (OEMs) and end-users served through the Aftermarket. OEMs, comprising major global automotive, commercial vehicle, and aerospace manufacturers, represent the first-point customers, purchasing tires in large volumes to be fitted onto new vehicles rolling off the assembly line. These buyers prioritize product consistency, advanced technological compliance (e.g., specific rolling resistance targets for certification), long-term contractual pricing stability, and precise logistical integration (Just-In-Time delivery). Success in the OEM segment requires significant investment in co-development and rigorous testing capabilities to meet exacting vehicle performance specifications and often involves multi-year commitments that solidify market leadership and prestige for the tire supplier.

The second and volumetrically larger customer base consists of the varied end-users of the aftermarket segment, which includes retail consumers, commercial fleet operators, government agencies, and agricultural businesses. Retail consumers are generally price-sensitive but increasingly swayed by brand reputation, safety ratings, and specialized performance attributes (e.g., fuel efficiency labels, winter performance). Fleet operators, managing logistics and transportation networks, are highly sophisticated buyers whose purchasing decisions are driven by Total Cost of Ownership (TCO), focusing on tire longevity, retreadability, fuel efficiency, and the integration of predictive maintenance services, often preferring direct relationships with manufacturers or specialized fleet service providers to secure volume discounts and tailored support.

Specialized buyers, such as construction companies, mining operations, and large-scale agricultural enterprises, constitute the Off-the-Road (OTR) segment, which demands extremely durable, high-load capacity tires engineered for severe operating conditions. These customers require bespoke product solutions and highly specialized service support, including on-site repairs and maintenance, making the sales cycle relationship-intensive and dependent on technical expertise. Furthermore, the growing segment of customers focused on sustainability and green procurement is increasingly influencing purchasing decisions, favoring manufacturers who can demonstrate verifiable reductions in environmental impact, such as through the use of sustainable materials or advanced recycling programs, thus creating a premium buyer segment based on ethical sourcing and corporate responsibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $265.0 Billion |

| Market Forecast in 2033 | $360.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Michelin Group, The Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Hankook Tire & Technology Co., Ltd., Yokohama Rubber Co., Ltd., Cheng Shin Rubber Ind. Co. Ltd. (Maxxis), Cooper Tire & Rubber Company (Acquired by Goodyear), Triangle Tyre Co., Ltd., Apollo Tyres Ltd., MRF Limited, Kumho Tire Co., Inc., Nokian Tyres plc, Trelleborg AB, Toyo Tire Corporation, Sailun Group Co., Ltd., Zhongce Rubber Group Co., Ltd. (ZC Rubber), Giti Tire Pte. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tires Market Key Technology Landscape

The technological landscape of the Tires Market is undergoing rapid transformation, driven primarily by the demands of electrification, autonomous driving, and increasing pressure for sustainability. A core area of innovation is the development of advanced material compounds that reduce rolling resistance without compromising wet grip or wear life, often involving highly specialized silica compounds and bio-based elastomers. Manufacturers are heavily investing in proprietary mixing technologies and high-performance polymers to meet stringent regulatory requirements for fuel efficiency globally. Furthermore, sophisticated structural designs, including the integration of lightweight materials and optimized tread patterns developed through advanced finite element analysis (FEA), are crucial for maximizing durability and minimizing road noise, particularly for passenger vehicles where acoustic comfort is a key differentiator.

Perhaps the most significant technological shift is the advent of 'Smart Tire' technology. This involves embedding sophisticated sensors—such as Tire Pressure Monitoring Systems (TPMS) and more advanced sensors capable of measuring tread depth, temperature, and acceleration forces—directly into the tire structure. These sensors feed real-time performance data to the vehicle’s central system and external cloud platforms. This connectivity facilitates predictive maintenance, enhances safety by alerting drivers to potential issues before failure, and provides crucial data for fleet management optimization, allowing operators to move from reactive servicing to proactive management based on actual usage patterns. The standardization and durability of these integrated sensor systems remain a key focus for ongoing research and development efforts across the industry.

Looking forward, disruptive technologies such as non-pneumatic tires (NPTs), often referred to as 'airless tires,' are gaining traction, promising puncture immunity, reduced maintenance, and potential lifecycle cost savings, although they are currently primarily utilized in niche industrial or military applications. Moreover, manufacturers are exploring sustainable manufacturing processes, including the industrialization of processes using recycled rubber, pyrolysis oils, and specialized sustainable additives derived from agricultural waste. Additive manufacturing (3D printing) is also being researched for prototyping and specialized, low-volume production of specific tire components or treads, indicating a future where personalization and on-demand manufacturing could potentially reduce logistical footprints and manufacturing lead times for certain high-value products within the overall market structure.

Regional Highlights

Regional dynamics play a vital role in shaping the global Tires Market, reflecting varied economic maturity levels, consumer preferences, regulatory environments, and automotive production bases. Asia Pacific (APAC) dominates the global market, both in production capacity and consumption volume. This region, particularly led by China, India, and Japan, benefits from high domestic vehicle production (OEM demand) and an exponentially expanding vehicle fleet requiring constant replacement tires (Aftermarket demand). Infrastructure development, economic urbanization, and the rapid adoption of two-wheelers and commercial vehicles in Southeast Asian nations further solidify APAC's leading position. Manufacturers in this region focus on optimizing cost efficiencies while rapidly scaling up production to meet the immense domestic and export demands, although increasing regulatory scrutiny on environmental compliance is pushing for cleaner manufacturing practices.

North America (NA) and Europe represent highly mature, high-value markets characterized by demand for premium, high-performance, and specialized tires, such as dedicated winter tires and high-speed rated radials. These regions are at the forefront of regulatory changes, with the European Union imposing strict tire labeling standards regarding wet grip, rolling resistance, and noise emissions, forcing manufacturers to innovate aggressively toward sustainability and safety. The increasing penetration of Electric Vehicles (EVs) is significantly impacting product requirements in these regions, driving up demand for low-noise, heavy-load capacity tires. Furthermore, consumer awareness regarding brand quality and advanced technology, such as run-flat capabilities and smart tire integration, is notably higher in North America and Western Europe, resulting in stronger average selling prices for premium segments.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as high-potential growth markets. In LATAM, fluctuating economic conditions and dependence on commodity markets create demand volatility, but long-term growth is supported by expanding automotive manufacturing and developing road networks. The region typically exhibits a stronger focus on robust, durable tires capable of handling diverse road quality conditions. The MEA region is witnessing high demand growth driven by infrastructure investment, especially in the Gulf Cooperation Council (GCC) countries, supporting heavy construction and logistics sectors. Demand is segmented, with premium brand usage in established urban centers and strong price sensitivity in other sub-regions. Manufacturers often focus on designing products capable of withstanding extreme heat and harsh operating environments specific to these geographical areas, focusing on heat resistance and structural integrity for prolonged high-speed use.

- Asia Pacific (APAC): Dominates the market share due to vast production volumes, large vehicle parc expansion, and robust OEM and Aftermarket sales in China, India, and Southeast Asia. Focus is on rapid scaling and cost efficiency.

- North America: High demand for specialized and premium tires, stringent quality standards, and rapid adoption of EV-specific tire technologies. Strong replacement market driven by high vehicle utilization and performance expectations.

- Europe: Regulatory leader driving innovation in rolling resistance and noise reduction through mandatory EU tire labeling. Mature market with high penetration of winter and all-season tires; substantial investment in sustainable material research.

- Latin America (LATAM): Emerging market characterized by strong growth potential driven by urbanization and expanding logistics sectors; demand focused on durability and price sensitivity, highly influenced by regional economic stability.

- Middle East & Africa (MEA): Growing demand fueled by infrastructure development, particularly in the GCC states; specialized requirements for heat resistance and high durability due to extreme climate conditions and varied road quality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tires Market.- Bridgestone Corporation

- Michelin Group

- The Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries

- Hankook Tire & Technology Co., Ltd.

- Yokohama Rubber Co., Ltd.

- Cheng Shin Rubber Ind. Co. Ltd. (Maxxis)

- Cooper Tire & Rubber Company (Acquired by Goodyear)

- Triangle Tyre Co., Ltd.

- Apollo Tyres Ltd.

- MRF Limited

- Kumho Tire Co., Inc.

- Nokian Tyres plc

- Trelleborg AB

- Toyo Tire Corporation

- Sailun Group Co., Ltd.

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- Giti Tire Pte. Ltd.

Frequently Asked Questions

Analyze common user questions about the Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the replacement tires market?

The primary factor is the increasing global vehicle parc (total number of operational vehicles). As the global fleet expands, irrespective of new car sales cycles, the consistent wear and tear of existing tires ensure stable and growing demand in the highly crucial replacement segment. Furthermore, government mandates regarding minimum tread depth standards contribute significantly to consistent replacement cycles globally.

How is the rise of Electric Vehicles (EVs) impacting tire design and production?

EVs demand specialized tires due to their unique performance characteristics. EV tires must handle higher instantaneous torque, bear heavier battery weight, and minimize road noise for cabin comfort. This necessitates the use of advanced silica compounds, reinforced sidewalls, and highly optimized low-rolling resistance designs to maximize driving range and durability, creating a distinct and premium sub-market for tire manufacturers.

What role does sustainability play in the current competitive landscape of the Tires Market?

Sustainability is rapidly becoming a key competitive differentiator. Leading manufacturers are focusing on two main areas: reducing the carbon footprint of manufacturing facilities and developing tires using recycled, bio-based, and renewable materials. This emphasis addresses stricter global environmental regulations and strong consumer preference for eco-friendly products, influencing brand loyalty and market positioning, particularly in mature economies like Europe.

Which geographical region holds the largest market share for tire consumption and manufacturing?

The Asia Pacific (APAC) region currently holds the largest share in terms of both manufacturing capacity and consumption volume. This dominance is driven by the vast manufacturing base, particularly in China, and the massive and continuously expanding vehicle fleets in developing economies like India and Southeast Asia, ensuring robust demand across both OEM and replacement market segments.

What are 'smart tires' and how do they benefit commercial fleet operators?

Smart tires are equipped with integrated sensors that collect real-time data on pressure, temperature, and wear. For commercial fleet operators, this data is invaluable for implementing predictive maintenance strategies, drastically reducing unexpected downtime, optimizing fuel efficiency through maintained pressure, and extending the lifespan of the tires, thereby lowering the Total Cost of Ownership (TCO) for the fleet significantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Engineering Machinery Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Low Rolling Resistance Tires (LRRT) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Motorcycle Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Touring Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Motorcycle Racing Grade Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager