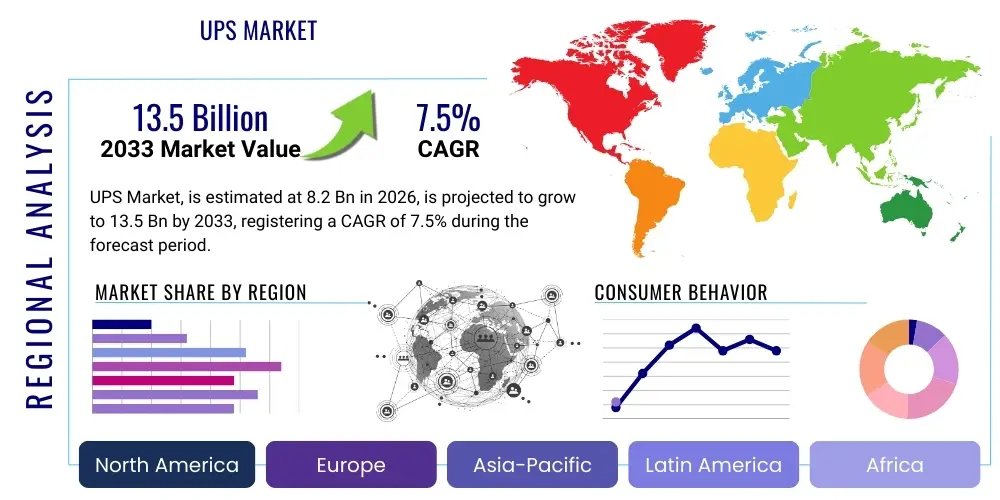

UPS Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442006 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

UPS Market Size

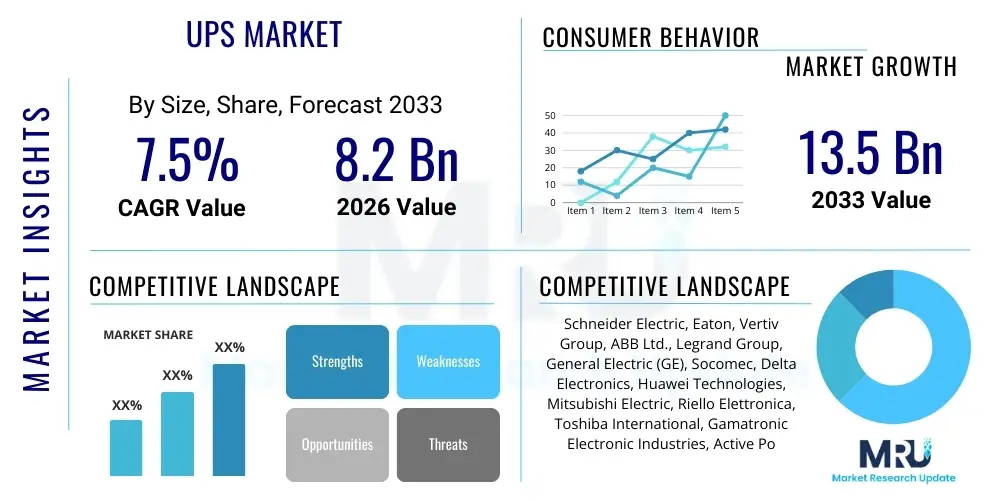

The UPS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 8.2 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global dependence on continuous, high-quality power supply, particularly within critical infrastructure sectors such as data centers, telecommunications, and healthcare. The resilience against power disturbances has become paramount for maintaining business continuity in an increasingly digitalized global economy, justifying significant capital expenditure on reliable power protection systems.

UPS Market introduction

The Uninterruptible Power Supply (UPS) Market encompasses devices that provide instantaneous backup power when the primary power source fails, protecting essential electrical equipment from surges, brownouts, and blackouts. These critical systems ensure operational continuity for sensitive electronics by storing energy, typically in batteries or flywheels, and supplying clean, regulated power during utility outages. Major applications span hyper-scale and edge data centers, industrial manufacturing facilities requiring precise process control, sophisticated medical diagnostic equipment, and vast telecommunication networks essential for modern connectivity. The primary benefit derived from deploying UPS systems is the prevention of data loss, equipment damage, and critical process interruption, which translates directly into preserved revenue and enhanced operational reliability. Key factors driving market growth include the relentless expansion of the Internet of Things (IoT), aggressive cloud infrastructure build-out, the increasing complexity of modern electrical loads, and stringent regulatory requirements mandating continuous operation in critical sectors.

UPS technology is broadly categorized into Offline/Standby, Line-Interactive, and Online/Double-Conversion topologies, each offering varying levels of power protection and efficiency suitable for different applications. Online double-conversion UPS systems, which provide the highest level of isolation and power quality by continuously regenerating AC power, are gaining traction in high-density environments like Tier IV data centers. Conversely, Line-Interactive systems offer a cost-effective balance between protection and efficiency, dominating the small to mid-range enterprise segments. The ongoing shift toward modular and scalable UPS architectures is optimizing space utilization and allowing organizations to scale power capacity incrementally, aligning investments more closely with immediate demand and minimizing long-term total cost of ownership (TCO).

The market landscape is characterized by intense technological innovation focused on improving energy density, particularly through the integration of Lithium-ion batteries, which offer extended life cycles, smaller footprints, and lower maintenance burdens compared to traditional Valve Regulated Lead-Acid (VRLA) batteries. Furthermore, the convergence of power management with network management capabilities is enabling smarter, remotely monitored UPS deployments. These advancements are instrumental in addressing the escalating power demands and efficiency targets set by major corporations committed to sustainable and resilient operations. The continuous infrastructural development across emerging economies further solidifies the long-term growth trajectory of the global UPS market, establishing it as an indispensable component of modern energy infrastructure.

UPS Market Executive Summary

The global UPS market trajectory is characterized by rapid technological assimilation and geographic diversification, evidenced by several pronounced business, regional, and segmental trends. Business trends are dominated by a strong pivot towards highly efficient, modular UPS systems, enabling easy scalability and reducing installation time, which is particularly crucial for rapidly deployable edge computing infrastructure. Key players are heavily investing in Research and Development (R&D) to integrate advanced battery technologies, such as Lithium-ion, addressing growing concerns regarding space constraints and maintenance overheads associated with conventional lead-acid batteries. Furthermore, the market is seeing increased consolidation and strategic partnerships aimed at offering integrated power solutions, encompassing power distribution units (PDUs) and cooling systems alongside core UPS units, providing a holistic approach to critical infrastructure management.

Regionally, the Asia Pacific (APAC) market is exhibiting the highest growth momentum, fueled primarily by massive government and private sector investments in digitalization, the establishment of numerous new data centers in countries like China, India, and Southeast Asia, and the accelerated adoption of 5G infrastructure. North America and Europe remain foundational markets, distinguished by early and sustained adoption of advanced, high-power density solutions and stringent regulatory standards requiring high efficiency and operational redundancy. Trends in these mature regions often center around retrofitting existing facilities with highly efficient, sustainable UPS technology to meet corporate carbon reduction goals. This geographical disparity in maturity dictates varied market strategies, ranging from aggressive capacity expansion in APAC to efficiency optimization and technological refresh cycles in the West.

Segmentally, the market is witnessing the sustained dominance of the Online/Double Conversion topology due to its superior power quality, making it indispensable for mission-critical applications. By phase, the Three-Phase UPS segment is the largest revenue generator, corresponding directly to the power requirements of large data centers and industrial sites exceeding 10 kVA. Conversely, the smaller rating segments (below 10 kVA) are experiencing robust volume growth driven by the proliferation of small-to-medium enterprises (SMEs) and distributed networking equipment. End-user analysis highlights the Data Center and IT sector as the primary revenue engine, though sectors like healthcare and manufacturing are increasingly critical due to the rising reliance on automated and digitally managed processes that cannot tolerate power interruptions. These segmented dynamics underscore the necessity for vendors to tailor offerings across a spectrum of power needs and application criticality levels.

AI Impact Analysis on UPS Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the UPS market frequently revolve around its role in enhancing predictive maintenance capabilities, optimizing energy efficiency in complex power architectures, and enabling fully autonomous power management systems. Users are keen to understand how AI algorithms can analyze vast streams of operational data—such as battery health, load fluctuations, and environmental conditions—to predict potential failures before they occur, thereby minimizing downtime and extending asset lifespan. Another major theme is the expectation that AI can dynamically adjust UPS operational modes (e.g., maximizing efficiency during low-load periods or switching sources optimally) in real-time within complex microgrid environments. Furthermore, there is significant interest in how AI integration will influence the necessity for traditional human oversight and maintenance protocols, projecting a future where UPS systems are largely self-diagnosing and self-correcting.

The integration of AI and machine learning (ML) capabilities is rapidly transforming the operational paradigm of Uninterruptible Power Supplies, moving them beyond mere reactive backup devices toward proactive, intelligent power management hubs. AI algorithms are being deployed to monitor the complex aging process of batteries, the most critical and failure-prone component of any UPS. By analyzing parameters like temperature history, charge/discharge cycles, and impedance variations against expected decay models, AI can accurately forecast the remaining useful life of battery strings, allowing facility managers to schedule replacements precisely during planned downtime, eliminating the risk of unexpected failure during an outage event. This shift from time-based preventative maintenance to condition-based predictive maintenance (PdM) is a major driver of reduced operational expenditure (OpEx) for end-users.

Beyond asset maintenance, AI is optimizing the operational efficiency of large-scale UPS installations, particularly those employing modular and distributed architectures in hyperscale environments. AI-driven software dynamically manages the load distribution across multiple UPS units and modules, ensuring that units operate near their peak efficiency point (often 40-60% load) while maintaining required redundancy levels. This continuous, automated optimization minimizes energy wastage and reduces cooling demands. For instance, in dynamic operating environments, AI can manage the interplay between the UPS, associated generators, and potentially renewable energy sources, ensuring seamless transitions and prioritizing the most cost-effective and sustainable power pathway, thereby significantly contributing to overall data center power usage effectiveness (PUE) improvements and demonstrating the profound strategic impact of AI on critical power infrastructure management.

- AI enables predictive maintenance by analyzing battery and component degradation data.

- Optimization of energy efficiency through real-time load balancing across modular UPS units.

- Facilitates autonomous power source selection in complex microgrid environments.

- Improves fault detection and isolation speed through pattern recognition and anomaly tracking.

- Enhances remote monitoring capabilities, reducing the necessity for manual site inspections.

- Enables dynamic capacity management and automatic adjustment of redundancy levels (N+1, 2N) based on immediate load requirements.

- Contributes to lower Power Usage Effectiveness (PUE) ratios in data centers by reducing conversion losses.

- Supports integration with building management systems (BMS) for unified critical infrastructure control.

- Allows for customized operational profiles based on historical site-specific power quality data.

- Drives the shift towards intelligent, self-aware, and failure-resistant power protection solutions.

DRO & Impact Forces Of UPS Market

The dynamics of the UPS market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate investment decisions and technological focus. The primary drivers are centered around the explosive growth in data generation and processing, necessitating ubiquitous connectivity and the deployment of massive data center capacity globally, thereby creating an unyielding demand for high-reliability power backup. Concurrently, increasing regulatory mandates, particularly in sectors like finance and healthcare that require uninterrupted data integrity, compel organizations to adopt robust UPS solutions. These driving forces are strongly correlated with global digitalization initiatives and the acceleration of cloud computing adoption, establishing a high baseline demand for power protection infrastructure.

However, the market faces significant restraints that temper its growth potential. High initial capital expenditure (CapEx) associated with large-scale, high-efficiency UPS deployments remains a barrier for small and medium enterprises (SMEs) and organizations operating with tighter budgets. Moreover, the environmental challenge posed by the disposal and recycling of traditional lead-acid batteries, which form the core energy storage medium for many legacy systems, presents a significant regulatory and logistical hurdle. Operational complexity, specifically in managing highly integrated, multi-vendor power ecosystems, requires specialized technical expertise which can be scarce, adding to the total cost of ownership (TCO) and serving as an adoption restraint.

Despite these challenges, substantial opportunities exist, particularly in the rapid development and commercialization of modular and decentralized UPS systems that cater to the burgeoning edge computing segment. The transition from legacy VRLA batteries to advanced Lithium-ion batteries offers opportunities for manufacturers to provide higher power density, longer life, and superior monitoring capabilities, aligning with modern efficiency goals. Furthermore, the integration of UPS solutions within emerging smart grid and microgrid architectures positions them as crucial components for balancing renewable energy intermittency and enhancing overall grid stability, opening up new application areas beyond traditional data center environments. The core impact force propelling the market forward remains the societal imperative for continuous digital connectivity and transactional security.

- Drivers: Proliferation of hyper-scale and edge data centers globally.

- Drivers: Increasing adoption of cloud computing and virtualization technologies.

- Drivers: Stringent regulatory requirements for data integrity and uptime in critical sectors.

- Restraints: High initial investment costs (CapEx) for high-capacity systems.

- Restraints: Environmental and logistical challenges associated with battery waste management (VRLA).

- Restraints: Supply chain volatility impacting critical component availability (e.g., semiconductors).

- Opportunity: Expansion into modular and containerized UPS solutions for rapid deployment.

- Opportunity: Integration of UPS with renewable energy sources and smart grid technology.

- Opportunity: Technological advancements in energy storage, primarily Lithium-ion batteries.

- Impact Force: Global digitalization necessitates continuous power reliability for economic stability.

Segmentation Analysis

The UPS market segmentation provides a critical framework for understanding diverse product offerings and application requirements across the global infrastructure landscape. The market is primarily segmented based on Topology, Phase Type, kVA Rating, and End-User Application, reflecting the broad range of critical power needs from small office environments to massive industrial and hyperscale facilities. Analyzing these segments helps vendors tailor their product development strategies and market penetration efforts, ensuring alignment with specific customer demands for power quality, efficiency, scalability, and cost. The technological shift toward higher efficiency systems, coupled with the granular demands of edge computing, continually refines the relevance and growth rate of these individual segments.

Topology segmentation distinguishes between Online, Line-Interactive, and Offline systems, with Online systems dominating revenue due to their double-conversion capability ensuring the highest power quality for mission-critical loads, despite generally higher costs and lower efficiency compared to Line-Interactive during normal operation. The kVA Rating segmentation is crucial, with the Greater than 200 kVA segment representing the largest share, driven by the colossal power needs of enterprise and hyperscale data centers. Conversely, the 10.1 kVA to 50 kVA range is demonstrating rapid growth, fueled by mid-sized businesses and the rise of distributed IT infrastructure requiring robust, localized protection.

End-user segmentation clearly indicates the Data Center and IT sector as the paramount revenue generator, reflecting the foundational need for uninterrupted digital operations. However, the diversification of applications across industrial automation, medical imaging, and telecommunications highlights the pervasive reliance on UPS technology across modern industrialized societies. The increasing sophistication of medical devices, for example, demands medical-grade UPS systems that adhere to stringent safety and operational standards, showcasing a specialized, high-growth niche within the broader healthcare end-user segment. Understanding these granular segment behaviors is essential for precise market forecasting and competitive positioning.

- By Topology:

- Online/Double Conversion

- Line-Interactive

- Offline/Standby

- By Phase Type:

- Single Phase

- Three Phase

- By kVA Rating:

- Below 10 kVA

- 10.1 kVA – 50 kVA

- 50.1 kVA – 100 kVA

- 100.1 kVA – 200 kVA

- Above 200 kVA

- By Application/End-User:

- Data Center & IT (Hyperscale, Enterprise, Edge)

- Telecommunication

- Healthcare (Hospitals, Clinics, Laboratories)

- Industrial Manufacturing and Automation

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Retail and Commercial

- Oil and Gas

- By Component:

- Hardware (UPS Unit, Batteries, Monitoring Tools)

- Services (Installation, Maintenance, Consulting)

Value Chain Analysis For UPS Market

The value chain of the UPS market initiates with the critical upstream analysis, focusing heavily on the procurement of raw materials and sophisticated electronic components. The most significant input components include battery cells (VRLA and Lithium-ion), power semiconductors (IGBTs, MOSFETs), magnetics, capacitors, and highly specialized microcontrollers for control and monitoring. Given that battery costs constitute a substantial portion of the overall UPS system cost, relationships with key battery suppliers are paramount. Supply chain resilience, especially concerning semiconductor chips, has become a major focus area due to global shortages, prompting manufacturers to dual-source components and redesign modules for greater flexibility. The manufacturing phase involves highly technical assembly, quality control, and testing to ensure compliance with international power standards and reliability metrics, often requiring vertically integrated facilities or strategic outsourcing of specific module production.

Midstream activities encompass the core manufacturing, assembly, and integration of the final UPS product, often followed by extensive customization based on end-user specifications regarding voltage, redundancy, and footprint. Following production, the distribution channel plays a pivotal role in market reach. The distribution model for UPS systems is bifurcated into direct and indirect channels, dictated by the system's size and complexity. Direct distribution channels are typically employed for large, custom-engineered, three-phase systems (above 100 kVA) sold to hyperscale data center operators, large enterprises, and government bodies, where deep technical consulting and installation services are mandatory. This channel allows manufacturers to maintain tight control over the sales process and subsequent service contracts.

Conversely, indirect distribution channels utilize a broad network of value-added resellers (VARs), system integrators, electrical contractors, and e-commerce platforms for selling standardized, smaller capacity (single-phase) UPS units (below 10 kVA). This channel provides wide geographical coverage and localized support necessary for the SME and consumer segments. Downstream analysis focuses on post-sales activities, including professional installation, commissioning, maintenance services, and eventual battery replacement and system upgrade cycles. The service component, including comprehensive maintenance agreements and remote monitoring packages, is increasingly becoming a major revenue stream, ensuring prolonged customer engagement and providing critical insights into product performance and reliability. The successful management of this value chain hinges on efficient component sourcing, advanced manufacturing processes, and a robust, dual-channel distribution strategy capable of handling varying product complexities.

UPS Market Potential Customers

The potential customer base for Uninterruptible Power Supply (UPS) systems is exceptionally broad, spanning any organization or process reliant on continuous, clean electrical power, making the products indispensable for sustaining modern digital and industrial infrastructure. The primary and most lucrative customer segment consists of hyperscale data centers and large enterprise IT facilities, where the sheer volume of high-density computing equipment mandates continuous power flow to protect billions of dollars worth of data and operational capability. These customers demand advanced, high-efficiency, three-phase modular systems, often procured directly from Tier 1 manufacturers with comprehensive service level agreements (SLAs). The rapid global deployment of 5G networks further enhances the importance of the telecommunication sector as a critical customer, requiring resilient UPS deployments at thousands of base stations and central offices.

Another major segment encompasses the healthcare sector, particularly hospitals, laboratories, and specialized medical imaging centers. Here, power continuity is not merely a financial concern but a matter of patient safety and regulatory compliance. Customers in this segment require high-reliability UPS units certified for use with life-support systems, surgical equipment, and electronic health record (EHR) systems. The manufacturing industry, specifically those engaged in continuous process manufacturing such as chemical, automotive, and semiconductor fabrication, represents a growing customer base. Power interruptions in these settings can result in massive material losses, equipment damage, and long restart procedures, compelling these firms to invest significantly in industrial-grade, ruggedized UPS solutions capable of handling demanding electrical loads and harsh environments.

The Banking, Financial Services, and Insurance (BFSI) sector remains a consistently high-value customer group due to the criticality of real-time transactional security and regulatory requirements for continuous operation (e.g., electronic trading platforms). Governmental and public infrastructure entities, including national security installations, air traffic control, and emergency services, also represent highly strategic customers, prioritizing reliability and cybersecurity in their UPS procurement. Finally, the vast landscape of small and medium enterprises (SMEs) and home users constitutes a high-volume market for smaller, single-phase Line-Interactive UPS units, fulfilling the basic need for protection against power flicker and brief outages for desktop computers and networking gear. These diverse applications necessitate highly differentiated product strategies across the manufacturer base to capture market share effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.2 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Eaton, Vertiv Group, ABB Ltd., Legrand Group, General Electric (GE), Socomec, Delta Electronics, Huawei Technologies, Mitsubishi Electric, Riello Elettronica, Toshiba International, Gamatronic Electronic Industries, Active Power (Piller Group), Shenzhen KSTAR Science and Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UPS Market Key Technology Landscape

The technological landscape of the UPS market is currently undergoing a significant transformation, driven by demands for higher efficiency, smaller footprint, enhanced power density, and increased intelligence. The most critical shift involves energy storage, where traditional Valve Regulated Lead-Acid (VRLA) batteries are being systematically replaced by advanced Lithium-ion (Li-ion) batteries, particularly in medium to large-scale deployments. Li-ion technology offers distinct advantages, including a significantly reduced physical size and weight, superior energy density, a longer calendar and cycle life, and improved tolerance to higher operating temperatures. This transition not only lowers the space requirement within data centers but also reduces cooling energy consumption, directly contributing to improved PUE metrics. Furthermore, the inherent battery management systems (BMS) integrated with Li-ion solutions allow for much more precise monitoring and predictive failure analysis than VRLA systems.

Another pivotal technological development is the proliferation of modular and scalable UPS architectures. Modular systems consist of multiple independent power modules that can be hot-swapped and scaled according to instantaneous load demands. This design provides unparalleled flexibility, allowing end-users to right-size their power infrastructure, minimizing stranded capacity and reducing initial investment costs. Modular UPS systems also inherently enhance fault tolerance, as the failure of one module does not compromise the operation of the entire system, maintaining redundancy levels (N+1, 2N). This modularity is essential for the rapid deployment required by edge computing facilities and containerized data centers, where speed of deployment and spatial efficiency are paramount design considerations.

Beyond energy storage and physical architecture, innovation in power conversion and control electronics is crucial. High-efficiency UPS topologies are increasingly utilizing advanced silicon carbide (SiC) and gallium nitride (GaN) semiconductor devices in their inverter and rectifier stages. These wide-bandgap materials significantly reduce switching losses compared to traditional silicon, pushing the maximum efficiency of online double-conversion UPS systems closer to 98-99% in ECO mode and over 97% in double conversion mode, substantially lowering operational expenditures. Additionally, advanced control algorithms and integration with cloud-based monitoring platforms enable sophisticated remote diagnostics, firmware updates, and predictive maintenance schedules, ensuring that the UPS system operates not just reliably, but intelligently within the broader critical power ecosystem.

Regional Highlights

The global UPS market demonstrates highly varied growth patterns and technological adoption levels across its major geographical segments: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). North America remains a cornerstone of the market, characterized by technological maturity and early adoption of high-efficiency and high-density power solutions. The presence of hyperscale cloud providers, coupled with stringent regulatory environments and a strong emphasis on cybersecurity and business continuity, drives consistent demand for advanced, three-phase modular UPS systems, particularly those incorporating Lithium-ion battery technology and sophisticated monitoring software. Investment in energy-efficient data center upgrades and retrofits is a primary activity in this region.

The Asia Pacific region currently holds the highest growth potential, largely fueled by massive governmental and private sector investments in digital transformation and infrastructure build-out. Countries like China, India, Japan, South Korea, and Southeast Asian nations are experiencing exponential data center expansion, driven by mobile internet penetration, e-commerce growth, and 5G deployment. This necessitates substantial deployment of both mid-range and high-capacity UPS units. APAC’s growth is volume-driven, with competition often revolving around cost-efficiency, though large metropolitan areas are rapidly adopting high-end modular systems to maximize space utilization in dense urban settings.

Europe presents a strong, stable market focused intensely on energy efficiency and sustainability. Strict European Union regulations regarding energy performance and environmental impact heavily influence UPS purchasing decisions, favoring products with high efficiency ratings (above 96%) and clear lifecycle management plans for components like batteries. The European market leads in the integration of UPS systems with renewable energy sources and smart grid initiatives. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is primarily linked to ongoing urbanization, industrialization, and infrastructure modernization projects, particularly in banking, telecom, and oil and gas sectors, creating significant opportunities for medium-capacity UPS systems and related support services.

- North America: Market leader in technology adoption (Li-ion, modular), driven by hyperscale cloud and stringent reliability standards. Focus on large-scale, high-density installations.

- Europe: Driven by regulatory emphasis on energy efficiency, sustainability, and green power solutions. High adoption of advanced power protection for industrial automation and BFSI.

- Asia Pacific (APAC): Highest growth region due to unprecedented data center construction (China, India), rapid digitalization, and 5G network expansion. Strong demand across all kVA segments.

- Latin America: Emerging market characterized by infrastructure modernization in countries like Brazil and Mexico. Demand concentrated in telecommunication and government sectors.

- Middle East & Africa (MEA): Growth tied to diversification efforts away from oil economies, leading to investments in IT infrastructure, smart cities, and enhanced power grid reliability, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UPS Market.- Schneider Electric SE

- Eaton Corporation plc

- Vertiv Group Corporation

- ABB Ltd.

- Legrand Group

- General Electric (GE)

- Socomec Group

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Riello Elettronica Group

- Toshiba International Corporation

- Gamatronic Electronic Industries Ltd.

- Active Power (Piller Group GmbH)

- Shenzhen KSTAR Science and Technology Co., Ltd.

- Siemens AG

- Xiamen Kehua Digital Energy Co., Ltd.

- Chloride Group (Piller Group)

- Uninterruptible Power Supplies Ltd (UPSL)

- Paramount Power Systems

Frequently Asked Questions

Analyze common user questions about the UPS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the UPS market?

The primary factor driving market growth is the exponential increase in data center construction and the widespread global reliance on digital services, which necessitate continuous, high-quality power supply to prevent costly downtime, data loss, and maintain critical operations.

How are Lithium-ion batteries impacting the selection and design of modern UPS systems?

Lithium-ion batteries are fundamentally changing UPS design by offering higher energy density, longer life spans, reduced weight, and a smaller footprint compared to traditional VRLA batteries. This enables smaller, more efficient UPS units that significantly lower cooling demands and TCO for data center operators.

Which UPS topology is preferred for mission-critical and hyperscale data center applications?

The Online/Double Conversion topology is preferred for mission-critical and hyperscale data center applications because it provides continuous, regulated power, offering the highest degree of power isolation and protection against all nine common power quality issues, ensuring zero transfer time during a power failure.

What role does Artificial Intelligence (AI) play in modern UPS management?

AI is increasingly used to optimize UPS management through predictive maintenance, monitoring battery health with high accuracy, and dynamically managing load balancing across modular units to ensure operation at peak efficiency, minimizing energy waste and maximizing system uptime proactively.

Which geographical region is expected to show the fastest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate due to aggressive investments in IT infrastructure, rapid expansion of cloud services, large-scale 5G deployments, and government-backed digitalization initiatives across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Heel Cups Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HR Tech Startups Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Transformer-Free UPS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Toddler Sippy Cups Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smart Drinking Cups Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager