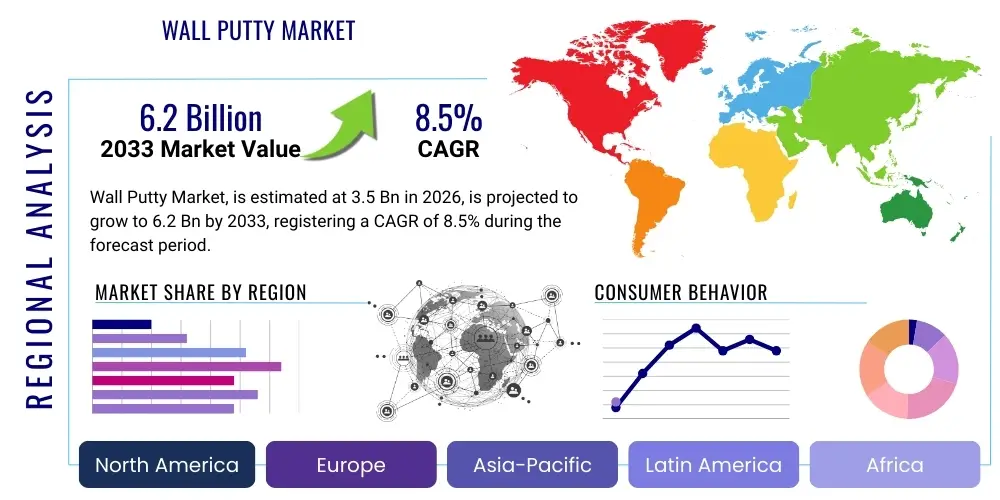

Wall Putty Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442945 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Wall Putty Market Size

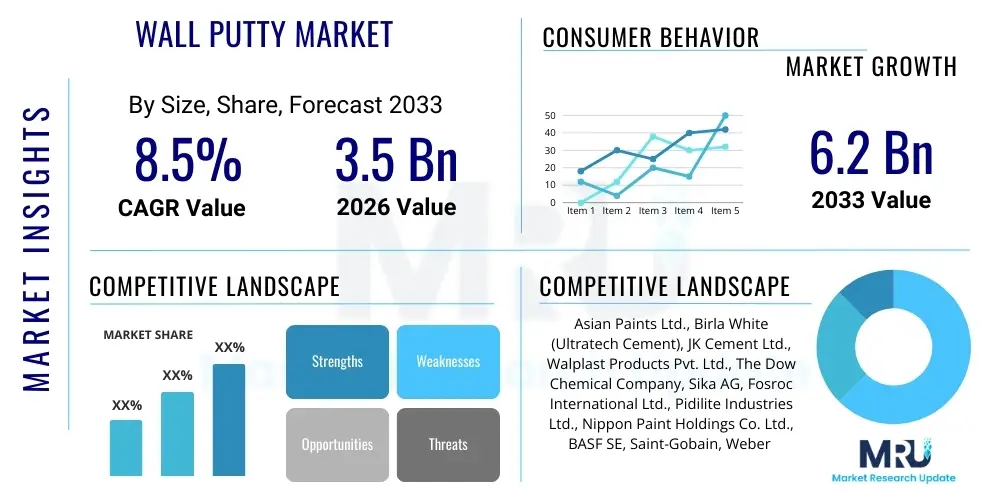

The Wall Putty Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Wall Putty Market introduction

Wall putty, fundamentally a highly refined construction chemical product, serves as the critical intermediary layer between raw plastered or concrete surfaces and the final aesthetic paint application. Historically rooted in simple cement and lime mixtures, modern wall putty has evolved into sophisticated polymer-modified compounds, primarily categorized as white cement-based or acrylic/polymer-based formulations, designed to deliver exceptional surface quality. The core function remains surface preparation: filling minute air voids, hairline cracks, and surface undulations to create a perfectly smooth, non-absorbent, and structurally sound foundation. This crucial preparation step is instrumental in enhancing the performance characteristics of high-end paints, ensuring uniform color distribution, preventing dampness penetration, and significantly increasing the overall lifespan of the painted surface. The rising standard of living across developing nations is directly translating into increased demand for premium building finishes, thereby solidifying wall putty's indispensable role in both interior decoration and exterior protection across residential, commercial, and institutional structures. The market’s dynamism is sustained by ongoing research focusing on improved application efficacy, faster curing times, and enhanced environmental safety profiles, driven by contractor demand for efficiency and regulatory pressure for sustainability in the construction chemical segment. This material not only provides protection but also plays a vital role in the aesthetics and perceived quality of the finished structure, differentiating high-quality construction projects in competitive real estate markets.

Major applications for wall putty traverse the entire spectrum of the construction lifecycle, from large-scale greenfield development projects, such as new metropolitan housing complexes and massive infrastructure hubs, to intricate brownfield renovation and repair activities focused on heritage buildings and aging commercial structures. The benefits derived from using specialized wall putty are multi-fold, including superior adhesion to various substrates, resistance to efflorescence (salt deposits), and excellent anti-carbonation properties that protect the underlying concrete structure from atmospheric degradation. Driving factors for market acceleration are intrinsically tied to global economic trends, most notably the unprecedented pace of urbanization in Asia and Africa, which demands the rapid construction of high-quality, durable housing stock. Furthermore, stringent quality mandates from architects and structural engineers necessitate the use of high-performance surface preparation materials to meet exacting standards for seismic resilience and moisture control. Product innovation, particularly the introduction of ready-mix and colored putties, simplifies the application process for masons and contractors, reducing reliance on manual mixing and further driving market acceptance and consumption across diverse operational environments. The confluence of these technological and macroeconomic drivers confirms the wall putty market's status as a high-growth segment within the broader construction chemicals industry.

Wall Putty Market Executive Summary

The operational landscape of the Wall Putty Market is characterized by vigorous competition and a strategic migration towards specialized product lines, reflecting pervasive business trends centered on quality assurance and supply chain efficiency. Key business trends include the increasing investment by multinational chemical giants in local manufacturing facilities across high-growth regions like South Asia and Southeast Asia, aimed at reducing logistical costs and capitalizing on regional demand dynamics. Market leaders are emphasizing portfolio diversification, moving beyond conventional white cement putty to embrace high-margin polymer and acrylic-based formulations that cater to the exacting demands of modern architecture requiring superior finish and water resistance. Digital transformation is also a notable trend, with companies leveraging e-commerce platforms and B2B digital procurement tools to streamline sales and enhance direct engagement with large contracting firms. Furthermore, sustainability initiatives are shaping corporate strategy, promoting the development of products with lower embodied carbon, less dust generation during mixing, and compliance with global environmental standards, which serves as a competitive differentiator in mature Western markets seeking 'green' building solutions. Strategic alliances focused on co-development of application tools and training programs with contractor associations are enhancing market penetration and ensuring appropriate product usage, crucial for maintaining product performance integrity in the field.

Regional consumption patterns demonstrate a stark contrast between volume-driven emerging markets and value-driven mature markets. The Asia Pacific region retains its undisputed leadership due to the sheer scale of urban residential and commercial construction, alongside substantial government-led public infrastructure expenditures, creating unparalleled demand for cement-based and cost-effective polymer putties. North America and Europe, in contrast, showcase slower overall volume growth but exhibit a robust appetite for premium, specialty putties, such as gypsum-based or ready-mix variants, driven by extensive renovation cycles and high regulatory emphasis on indoor air quality (low VOC). This is supported by a preference for products that offer speed and minimal disruption during refurbishment projects. Emerging markets in Latin America are experiencing steady adoption, driven by stable urbanization and improved economic outlooks, positioning them as critical targets for future expansion strategies. The Middle East and Africa present a unique regional trend, where extreme climate conditions mandate highly durable, weather-resistant exterior putties, necessitating localized product development tailored for high heat and humidity resistance, thereby driving innovation in specialized chemical additives for this segment.

Analysis of segment trends confirms the Polymer/Acrylic-Based Putty category as the fastest growing segment, projected to capture increasing market share from traditional cement variants due to inherent performance advantages that justify a higher price point. Within the end-user segments, the Residential sector continues to account for the largest share of consumption, catalyzed by rising housing starts and the universal consumer desire for high-quality, long-lasting home finishes. However, the Commercial segment, encompassing large-scale office towers, retail complexes, and healthcare facilities, is demonstrating the highest CAGR. This accelerated growth is linked to the complex, demanding specifications of modern commercial construction which requires flawless surfaces for specialty coatings and complex lighting designs, making high-performance putty non-negotiable. Furthermore, infrastructure projects, particularly in transport and public utilities, are emerging as a vital sub-segment, requiring industrial-grade putties capable of withstanding severe environmental stresses. The interior application segment remains marginally larger than exterior, but the demand for technologically advanced exterior putties, offering enhanced durability against environmental factors like UV radiation and heavy rain, is closing the gap, reflecting the global focus on structural resilience and facade maintenance.

AI Impact Analysis on Wall Putty Market

Analysis of common user questions related to the impact of AI on the Wall Putty Market reveals key themes revolving around supply chain optimization, quality control standardization, and advanced material science. Users frequently inquire about how AI can predict raw material price fluctuations, automate inventory management for highly volatile construction schedules, and optimize logistics from manufacturing plant to distant project sites. Another major area of user concern is the application of AI in ensuring consistent product quality across different batches and improving the precision of formulation development by simulating the performance characteristics of novel polymer additives. Expectations center on AI driving efficiency, minimizing waste, and ultimately lowering the overall cost of surface preparation while maintaining or exceeding current quality standards in construction projects globally. The discourse surrounding Artificial Intelligence integration into the Wall Putty Market centers on how cognitive technologies can overcome traditional manufacturing and logistical inefficiencies inherent in the construction chemical supply chain. Common user questions reflect a strong interest in AI's capacity to optimize the complex formulations of polymer-modified putties, specifically concerning the precise ratios of cement, polymers, and mineral fillers required to achieve specific performance metrics like setting time, bonding strength, and water permeability. Users are also concerned about leveraging predictive maintenance schedules for sophisticated blending machinery, reducing unplanned downtime which significantly impacts production targets. Furthermore, the role of AI in analyzing regional architectural preferences, correlated with climatic data and local material availability, is a recurring theme. The overarching expectation is that AI will introduce a paradigm shift from reactive quality control to proactive process management, ensuring that product characteristics are tailored precisely to specific project requirements, leading to reduced material waste and substantial cost efficiencies throughout the entire construction value chain, thereby enhancing the overall competitiveness of manufacturers.

- AI-driven Predictive Analytics: Optimizing raw material procurement and inventory management based on real-time construction activity forecasts, minimizing storage costs and mitigating supply chain disruptions.

- Automated Quality Control (AQC): Utilizing machine vision and sensor data during manufacturing to ensure precise compositional consistency and adherence to quality parameters (e.g., fineness, bonding strength).

- Formulation Optimization: Employing machine learning algorithms to rapidly test and refine new polymer and additive blends, accelerating the development of specialized, high-performance wall putty variants.

- Smart Logistics and Distribution: Enhancing route optimization and delivery scheduling, crucial for time-sensitive construction projects, ensuring just-in-time delivery of materials.

- On-Site Application Guidance: Developing AI tools or apps that provide contractors with optimized application techniques, thickness recommendations, and curing time estimates based on local climate and substrate type.

- Market Trend Forecasting: Analyzing large datasets of building permits, contractor bids, and regional economic indicators to provide manufacturers with accurate demand forecasts for different putty types.

DRO & Impact Forces Of Wall Putty Market

The expansion trajectory of the Wall Putty Market is fundamentally propelled by powerful, interconnected driving forces that reflect global macroeconomic stability and evolving consumer expectations regarding building quality. Primary drivers include the massive, ongoing global commitment to infrastructure spending, particularly in rapidly urbanizing corridors across Asia and Africa, where governments are investing heavily in public housing, road networks, and civic buildings that require durable and high-quality finishes. Simultaneously, the burgeoning middle class in these regions is exhibiting a pronounced preference for aesthetically superior interior and exterior finishes, moving away from cheaper, less durable alternatives, thereby creating sustained demand for branded, polymer-modified wall putties. Technological advancements leading to easier-to-use and higher-performing products, such as ready-mix variants that simplify on-site preparation and application, are also significantly reducing labor complexity and accelerating construction project turnaround times, further boosting adoption rates among contractors who seek efficiency and reliability in their material supplies. These factors collectively establish a robust foundation for market growth, emphasizing the functional necessity and enhanced value proposition of modern wall putty formulations.

Conversely, the market confronts substantial restraints that temper its growth potential and necessitate diligent risk management. The foremost challenge is the chronic volatility and inflation in the price of key raw materials, especially white cement, specialty polymers (like RDP), and titanium dioxide (for whiteness), which directly compress manufacturing margins and complicate long-term fixed-price contracting. Furthermore, the construction industry's inherent reliance on seasonal weather patterns, particularly in temperate regions, introduces periods of fluctuating demand and supply chain instability. A critical operational restraint is the persistent shortage of highly skilled applicators and masons in many emerging markets, which can lead to improper product usage, compromised finish quality, and subsequent brand damage. Environmental restrictions, particularly concerning dust levels during application and disposal of construction waste, further impose developmental restraints, requiring manufacturers to invest heavily in developing cleaner, eco-friendly formulations that maintain performance while adhering to stringent compliance regimes. Addressing these restraints requires manufacturers to pursue vertical integration to secure raw material supply and invest heavily in training and certification programs for the application workforce, ensuring that high-performance products are utilized to their maximum potential in diverse construction environments globally.

Opportunities for strategic expansion and value creation in the Wall Putty Market are abundant, especially through focused product innovation and geographical segmentation. Significant opportunities lie in the development and vigorous promotion of highly specialized, high-margin putties tailored for niche applications, such as putties with integrated thermal insulation properties, antimicrobial resistance for healthcare facilities, or formulations specifically designed for refurbishment over non-standard substrates like wood or metal panelling. Geographically, penetrating the vast, previously untapped Tier 2 and Tier 3 cities in developing nations, where rapid construction is just beginning to take hold and local suppliers often lack quality consistency, presents enormous potential for branded players. The growing global emphasis on sustainable building practices provides a unique opportunity for companies that can successfully market and certify their low-VOC, dust-reducing, and eco-friendly products, positioning them as leaders in the 'green construction' segment. Strategic collaborations between manufacturers and large paint retailers or contracting associations can unlock new distribution avenues and foster faster product adoption. Leveraging digital channels for direct-to-contractor sales and providing robust technical support and online training resources also represents a key avenue for deepening market presence and fostering long-term professional loyalty, ensuring sustained revenue generation across diverse customer touchpoints.

Segmentation Analysis

The structure of the Wall Putty Market is strategically segmented to differentiate consumption patterns based on material composition, intended application environment, and ultimate user category, providing manufacturers with critical insights for tailored product development and marketing efforts. The core segmentation by product type—encompassing traditional white cement-based, technologically advanced polymer/acrylic-based, and specialized gypsum-based formulations—is paramount, as it directly correlates product performance capabilities with specific project requirements (e.g., moisture resistance for exterior applications or ultra-smoothness for high-gloss interiors). The clear trend within this structure is the market's gradual transition towards polymer-modified putties, which, despite a higher unit cost, deliver superior value in terms of longevity, workability, and reduced wastage, aligning with modern construction demands for enhanced surface durability and flawless aesthetic execution across complex architectural projects globally. This detailed segmentation aids stakeholders in accurately forecasting demand shifts and allocating resources efficiently across key growth areas.

- By Product Type:

- White Cement-Based Wall Putty

- Polymer/Acrylic-Based Wall Putty

- Gypsum-Based Wall Putty

- Specialty Putty (e.g., ready-mix, waterproof, crack-bridging)

- By Application:

- Interior Wall Putty (Focus on smoothness, quick drying)

- Exterior Wall Putty (Focus on water resistance, UV stability, durability)

- By End-User:

- Residential Sector (Largest volume consumer, sensitive to price and application ease)

- Commercial Sector (High-growth, demands specialized performance and aesthetic consistency)

- Industrial Sector (Requires robust, chemically resistant surfaces)

- Infrastructure (Public utilities, requiring high durability and adherence to specifications)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Wall Putty Market

The Wall Putty Value Chain initiates with the sourcing and procurement of bulk raw materials, establishing the upstream foundation of the market. This phase is dominated by suppliers of high-grade white cement, fine calcium carbonate (extenders), and key chemical specialty inputs, notably sophisticated polymer additives such as Redispersible Polymer Powders (RDPs) and specific cellulose ethers. Upstream profitability is profoundly affected by global commodity price swings and the long-term negotiating power manufacturers possess to secure favorable supply agreements, critical for maintaining competitive pricing. Following procurement, the manufacturing stage involves stringent quality control processes and high-speed blending technology to ensure micron-level particle uniformity, critical for the putty's performance and application smoothness. Investing in state-of-the-art, automated blending facilities allows large manufacturers to achieve economies of scale and consistent batch quality, significantly lowering per-unit production costs and reinforcing brand reliability in a quality-sensitive construction environment. Efficient management of this upstream segment is foundational to controlling overall production costs and ensuring the stability of supply required by high-volume construction schedules.

The midstream segment involves packaging, logistics, and warehousing, where optimization focuses on ensuring the product's shelf life and stability under various climatic conditions, particularly high humidity which can compromise powder formulations. Efficient logistics planning is essential due to the bulk nature and moderate shelf life of the product, requiring robust warehousing networks close to major construction hubs. Downstream activities encompass the distribution architecture, which is bifurcated into direct and indirect channels. Direct channels involve sales teams engaging large institutional buyers, real estate developers, and major contracting firms, offering customized pricing, dedicated technical support, and assured delivery schedules, ensuring project continuity. Indirect channels, which handle the majority of volume for residential and SME projects, rely on extensive networks of authorized distributors, stockists, and thousands of localized hardware and paint retailers, requiring complex inventory management systems and promotional support to maintain product visibility and accessibility across dispersed geographic territories. Channel efficiency and speed to market are crucial competitive factors in this highly fragmented downstream environment.

The successful execution of the value chain is increasingly reliant on the adoption of digital technologies for enhanced transparency and tracking. Modern Enterprise Resource Planning (ERP) systems and dedicated Supply Chain Management (SCM) software are being deployed to monitor raw material input quality, track inventory levels across multiple warehouses, and optimize the final delivery schedules. Customer feedback mechanisms, often facilitated through digital channels and technical service teams, feed directly back into the R&D and manufacturing processes, ensuring rapid formulation adjustments based on real-world performance data—a key characteristic of a responsive, customer-centric value chain. Crucially, the final step—application by the end-user (mason/contractor)—determines the perceived value, emphasizing the importance of manufacturer-led training and on-site support, which acts as a value-added service and reinforces brand preference over generic competitors. Maintaining high product availability and ensuring robust post-sales technical service are non-negotiable elements for sustaining market leadership in this functionally demanding sector.

Wall Putty Market Potential Customers

The identification and prioritization of potential customers in the Wall Putty Market necessitate a strategic understanding of the construction ecosystem’s hierarchy and purchasing drivers. The largest and most influential customer cohort comprises major real estate conglomerates and large-scale residential and commercial property developers. These entities operate on tight schedules and massive project scales, making them high-volume buyers who prioritize consistent product quality, certified adherence to specifications (e.g., fire ratings, water resistance), and the supplier’s capability for guaranteed, timely bulk delivery. Procurement decisions within this segment are often centralized and highly technical, favoring manufacturers with proven track records, established technical support infrastructure, and competitive long-term contract pricing. Secondly, specialized construction segments, including hospitals, hotels, and institutional facilities, represent high-value potential customers, driven by unique performance requirements such as antimicrobial properties, specific surface texture demands, and enhanced indoor air quality considerations (requiring low-VOC putties), which mandate the use of premium, specialized product variants.

A second vital customer base consists of small-to-medium-sized contracting firms and independent painting professionals who execute renovation, maintenance, and smaller residential projects. This group constitutes a highly fragmented market but collectively accounts for significant consumption volume, particularly for readily available, user-friendly products. These customers typically purchase through indirect distribution channels (hardware stores, dealers) and are highly responsive to factors such as ease of mixing, smoothness of application, brand trust, and localized promotional offers. Manufacturers must target this group through strong dealer relationships, effective point-of-sale marketing, and consistent quality that builds strong word-of-mouth recommendations among the application community. The rise of sophisticated DIY users, particularly in mature Western markets, also presents a distinct, albeit smaller, customer segment that seeks pre-mixed, easily dispensable, and specialty repair putties, purchased primarily through large home improvement retail chains and online platforms, prioritizing convenience and minimal application skill requirements.

Crucially, government bodies and municipal departments, through their involvement in public works, road construction, and affordable housing initiatives, act as significant institutional customers. While often bound by strict tender processes and bureaucratic timelines, the long-term stability and guaranteed volume of their projects make them key strategic targets. Their purchasing criteria often balance cost-effectiveness with rigorous performance standards stipulated by national building codes, demanding high durability and material consistency. Furthermore, large paint manufacturers and specialty coating companies are increasingly influencing the wall putty procurement process, sometimes co-branding or integrating putty into a complete surface preparation system, positioning the putty as an essential prerequisite for their premium paint warranties. Effectively serving these diverse customer segments requires a sophisticated, multi-channel approach that addresses the unique technical, logistical, and commercial requirements of each buyer type, ensuring maximum market penetration and share capture across the entire construction value chain spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asian Paints Ltd., Birla White (Ultratech Cement), JK Cement Ltd., Walplast Products Pvt. Ltd., The Dow Chemical Company, Sika AG, Fosroc International Ltd., Pidilite Industries Ltd., Nippon Paint Holdings Co. Ltd., BASF SE, Saint-Gobain, Weber (Saint-Gobain), HIL Limited, Snowcem Paints Pvt. Ltd., Myk Laticrete India Pvt. Ltd., Roff (Pidilite), AkzoNobel N.V., Kansai Nerolac Paints Ltd., Magicrete Building Solutions, Seal Chemicals Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wall Putty Market Key Technology Landscape

The technological evolution of the Wall Putty Market is dictated by continuous advancements in construction chemical synthesis and material science, striving to deliver superior functionality, easier application, and enhanced environmental compatibility. A cornerstone of this landscape is the advanced integration of synthetic polymers, particularly high-quality Redispersible Polymer Powders (RDPs), which significantly improve crucial properties such as adhesion to porous surfaces, flexibility to accommodate minor structural movements, and impermeability to moisture. Modern technology focuses on manipulating the particle size and morphology of mineral fillers, like ultra-fine calcium carbonate, through precise grinding and classification techniques. This refinement ensures that the putty offers maximum coverage and an exceptionally smooth, uniform substrate, thereby minimizing sanding time and reducing paint consumption for the final coat, representing tangible cost savings for professional applicators and developers operating under stringent project budgets and tight delivery timelines. The shift towards proprietary polymer blends is increasing the performance gap between generic and branded products.

Further technological innovation is evident in the development of specialized additive packages tailored to accelerate the curing process, known as flash-setting technology, which dramatically reduces the waiting time between putty application layers and subsequent painting, directly addressing construction efficiency demands. Conversely, sophisticated rheology modifiers and water retention agents are engineered to extend the working time of the putty in hot climates, preventing premature drying and improving workability for masons. The deployment of advanced manufacturing processes, including computerized batching and high-shear mixers, is paramount to ensure the homogenous dispersion of all components, particularly the low-dosage functional chemical additives. This automated approach guarantees batch-to-batch consistency and performance reliability, crucial factors for securing large contracts in the institutional and infrastructure segments where material failure carries high financial and operational risks and performance specifications are rigorously enforced by certifying authorities.

The emerging technological frontier is increasingly dominated by sustainable chemistry and multifunctionality. Manufacturers are heavily investing in research focused on incorporating recycled or bio-based polymer components to reduce dependence on fossil fuels and minimize the overall carbon footprint of the product, aligning with global green building standards (e.g., LEED certification). Furthermore, the integration of nano-technology is being explored to imbue putties with specific functionalities, such as enhanced resistance to fungal and bacterial growth (antimicrobial putties for hospitals) or superior thermal reflective properties, transforming the putty from a mere leveling agent into a functional building envelope component. The rapid digitalization of the research pipeline, utilizing simulation software and AI modeling to predict the performance of novel material combinations without extensive physical testing, is accelerating the speed of innovation, positioning the market to respond dynamically to evolving architectural demands for smart and sustainable surface preparation solutions globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for volume growth, attributed to demographic shifts, aggressive urbanization, and unparalleled governmental spending on infrastructure, including massive smart city and affordable housing initiatives in India and China. The market is highly price-sensitive but rapidly accepting high-performance polymer putties due to increased awareness and quality mandates, driving capacity expansion across major regional manufacturers to meet relentless demand surges.

- North America: The market is defined by stability and high value, driven largely by cyclical renovation and maintenance projects rather than new construction volume. Consumers and contractors demand premium products, with a strong emphasis on compliance with strict low-VOC and environmental regulations. Ready-mix and high-flexibility putties are dominant, reflecting the high labor cost and preference for efficiency and minimal on-site mixing requirements.

- Europe: Growth is steady, catalyzed by stringent EU directives promoting energy-efficient building refurbishment and the restoration of historical facades. The market favors specialized, technologically advanced formulations that offer exceptional durability and compatibility with complex, aging substrates. Sustainability and certifications (e.g., environmental product declarations) are key competitive differentiators influencing procurement decisions.

- Middle East and Africa (MEA): This region is experiencing high double-digit growth, powered by petrodollar investments in large-scale commercial and residential projects (e.g., Saudi Vision 2030). The demand is acute for exterior putties engineered specifically to withstand extreme high temperatures, intense UV exposure, and sand abrasion, necessitating robust polymer and additive systems for façade protection and longevity.

- Latin America (LATAM): Market expansion is accelerating, supported by improving economic stability and increasing foreign investment into housing and public works, especially in Brazil and Mexico. The market is gradually transitioning from rudimentary fillers to branded, cement-based and entry-level polymer putties, fueled by localized manufacturing and enhanced distribution networks reaching previously untapped secondary urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wall Putty Market.- Asian Paints Ltd.

- Birla White (Ultratech Cement)

- JK Cement Ltd.

- Walplast Products Pvt. Ltd.

- The Dow Chemical Company

- Sika AG

- Fosroc International Ltd.

- Pidilite Industries Ltd.

- Nippon Paint Holdings Co. Ltd.

- BASF SE

- Saint-Gobain

- Weber (Saint-Gobain)

- HIL Limited

- Snowcem Paints Pvt. Ltd.

- Myk Laticrete India Pvt. Ltd.

- Roff (Pidilite)

- AkzoNobel N.V.

- Kansai Nerolac Paints Ltd.

- Magicrete Building Solutions

- Seal Chemicals Pvt. Ltd.

Frequently Asked Questions

What is the primary difference between cement-based and polymer-based wall putty?

Cement-based putty is typically more economical and focuses on filling minor surface irregularities. Polymer-based putty offers superior adhesion, higher flexibility, better water resistance, and smoother finish, making it the preferred choice for high-end, demanding interior or exterior applications where durability is paramount.

How does wall putty contribute to paint life and wall durability?

Wall putty creates a sealed, smooth, and alkali-resistant base layer by filling pores and cracks. This foundational barrier prevents moisture ingress and stops alkaline substances from the wall from reacting with the paint, thereby significantly enhancing the durability, adhesion, and visual longevity of the topcoat.

Which region dominates the global consumption of wall putty and why?

The Asia Pacific (APAC) region currently dominates the global Wall Putty Market volume. This leadership is driven by extensive and rapid urbanization, coupled with massive governmental and private sector investments in large-scale residential and infrastructure construction projects across key nations like India and China.

Are there environmentally friendly options available, and what technological shift drives this trend?

Yes, the market is aggressively developing eco-friendly formulations, specifically low Volatile Organic Compound (VOC) and formaldehyde-free polymer putties. This trend is driven by stringent global health regulations and a technological shift towards sustainable chemistry and bio-based polymer alternatives in the construction sector.

What are the key performance metrics demanded for exterior wall putty in extreme climates?

Exterior wall putty must demonstrate exceptional water resistance, superior UV stability to prevent degradation, strong crack-bridging capabilities to handle thermal stress, and maximum adhesion to prevent peeling, ensuring the integrity and protection of the external facade against harsh weather elements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Exterior Wall Putty Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Interior Wall Putty Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Interior Wall Putty Powder Market Statistics 2025 Analysis By Application (Residential, Commercial building), By Type (Cement-based Putty, Gypsum-based Putty), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Exterior Wall Putty Powder Market Statistics 2025 Analysis By Application (Residential, Commercial Building), By Type (Water Resistant Type, Alkali Type, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager