Factoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435265 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Factoring Market Size

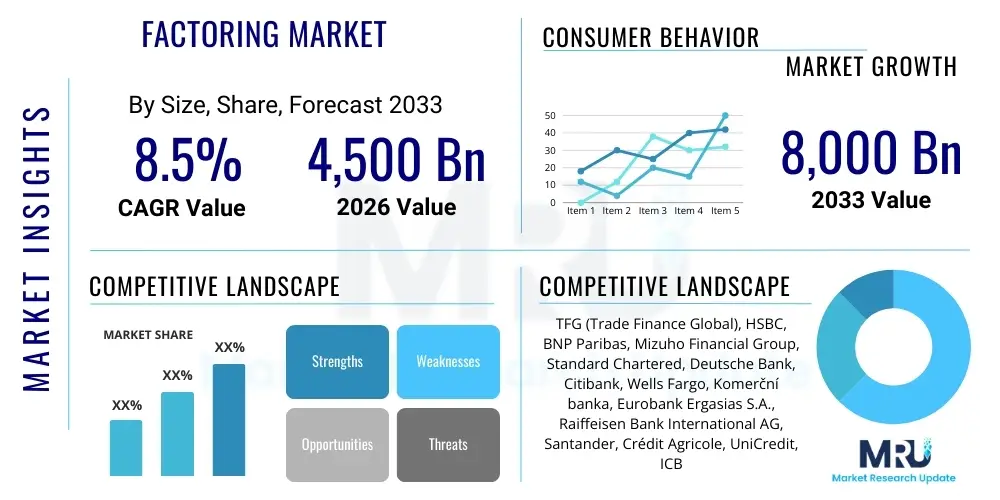

The Factoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4,500 Billion in 2026 and is projected to reach USD 8,000 Billion by the end of the forecast period in 2033.

Factoring Market introduction

Factoring is a sophisticated trade finance instrument involving the sale of a business's accounts receivable (invoices) to a specialized financial institution, known as the factor, at a discount. This immediate monetization of outstanding invoices provides businesses with crucial, accelerated working capital, effectively bypassing the lengthy credit periods (typically 30 to 120 days) imposed by commercial credit terms. This mechanism is particularly vital for Small and Medium-sized Enterprises (SMEs) that often lack the sufficient credit rating or tangible collateral required for securing traditional lines of credit from commercial banks. The primary application spans nearly all sectors engaged in business-to-business (B2B) transactions, including manufacturing, wholesale trade, transportation, and professional services, acting as a direct catalyst for increased sales and operational flexibility.

The core benefit of factoring transcends mere cash acceleration; it functions as a comprehensive financial management tool. Factoring, especially in its non-recourse form, includes the transfer of credit risk from the seller to the factor, thereby improving the selling company’s balance sheet structure by minimizing contingent liabilities. Additionally, factors often assume the entire administrative burden associated with invoice collection, debtor management, and ledger processing, allowing client businesses to reallocate internal resources toward core revenue-generating activities such as product development or market expansion. This strategic outsourcing of debt management and collection is particularly valuable in international trade, where navigating diverse legal and regulatory collection environments can be excessively complex and costly.

The market expansion is currently driven by several structural and technological factors. Globally, the increased pressure on corporate liquidity, exacerbated by protracted economic cycles and supply chain disruptions, has heightened the demand for flexible, asset-backed financing solutions. Concurrently, digitalization in finance has dramatically simplified the factoring process; the implementation of online platforms and automated credit assessment tools has reduced operational costs and processing timelines, making factoring more accessible and competitive against conventional debt instruments. Favorable regulatory environments in several key regions, promoting SME development and alternative financing sources, further solidify factoring's essential role in modern financial architecture.

Factoring Market Executive Summary

The Factoring Market is undergoing a fundamental transformation, defined by aggressive digitalization and a strategic shift toward specialized product offerings. Current business trends show a marked migration from traditional paper-based systems to integrated, cloud-based factoring platforms, enhancing efficiency and scalability. The growing preference for non-recourse factoring signals a rising appetite among businesses to offload credit risk entirely, a trend supported by factors leveraging Big Data and AI for more precise, risk-adjusted pricing. Furthermore, the convergence of factoring with Supply Chain Finance (SCF) platforms, particularly Reverse Factoring, is restructuring the market by introducing large, high-credit-quality corporate buyers as key initiators of financing programs, leading to lower default risks across associated receivable portfolios.

Regionally, Asia Pacific (APAC) stands out as the major growth accelerator, supported by robust export growth, large governmental investments in SME financial inclusion, and the rapid adoption of financial technology. While North America and Europe maintain leading positions in terms of total transaction value and regulatory maturity, their growth is primarily fueled by disruptive fintech models and the specialization of factoring services toward niche, high-value industries like technology and healthcare. This regional divergence necessitates customized market entry strategies, focusing on regulatory compliance and the integration of local data sources for effective credit underwriting, especially in emerging markets where credit history is less established.

Segment-wise, International Factoring is projected to command accelerating market share, reflecting deepening global supply chain integration and the complexity inherent in managing cross-border receivables. The segment defined by enterprise size underscores the continuous importance of SMEs as the core client base, but the fastest transactional growth is seen within the Large Enterprise segment through sophisticated SCF mechanisms. Technological differentiation, particularly in automating the invoice verification and collateral management processes, remains the crucial competitive differentiator. Leading factors are prioritizing investment in proprietary AI risk engines and API integration capabilities to achieve high levels of straight-through processing (STP) and maintain competitive pricing advantage in a rapidly evolving financial landscape.

AI Impact Analysis on Factoring Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally redefining the operational architecture and risk management practices within the Factoring Market. User concerns and market expectations are highly focused on how AI can accelerate the due diligence process, a historically cumbersome and time-consuming element of factoring. Specifically, factors are leveraging AI to automate the laborious task of credit scoring both the client (the seller) and, more crucially, the third-party debtor. By consuming and analyzing diverse, non-traditional data sets—such as trade flow statistics, digital payment behaviors, social credit scores (where applicable), and historical dispute rates—ML algorithms generate superior, predictive risk profiles far surpassing the limitations of traditional, static credit bureau scores. This enhanced analytical capability directly supports faster approval times and more competitive pricing strategies, democratizing access to factoring services.

A second critical area where AI exerts significant impact is in fraud prevention and compliance adherence. Invoice fraud, including the submission of fictitious or duplicate receivables, poses a systemic risk to the factoring industry. AI systems are trained to identify subtle anomalies and patterns indicative of fraudulent behavior that would be invisible to human analysts, operating by cross-referencing invoice details against complex behavioral transaction histories and digital signatures. Furthermore, AI assists in the continuous monitoring required for compliance with stringent global Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, automating document verification and ensuring adherence to complex jurisdictional requirements. This proactive, data-driven defense mechanism not only reduces financial losses but also strengthens the overall integrity and stability of factoring portfolios.

Finally, AI is enabling the transition toward highly dynamic and personalized factoring solutions. Instead of applying standard, fixed discount rates, ML models allow factors to implement dynamic pricing mechanisms that adjust rates in real-time based on the immediate liquidity needs of the client, the current interest rate environment, and the specific, constantly updated risk profile of the underlying debtor. This optimization leads to better capital allocation for the factor and more cost-effective financing for the client. The deployment of predictive analytics also informs sales strategy, helping factors identify potential clients whose cash flow patterns indicate a strong future need for accelerated receivable management, turning a reactive service into a proactive advisory partnership.

- Automated Credit Scoring and Debtor Analysis: Rapid, precise assessment of invoice risk using vast external and internal data sources, leading to quicker funding decisions.

- Enhanced Fraud Detection: Utilization of ML models to identify subtle patterns indicative of double invoicing, manipulated receivables, or fictitious debtors, strengthening portfolio security.

- Dynamic Pricing Models: Real-time calculation and adjustment of discount rates based on liquidity needs, debtor creditworthiness, market conditions, and tenure.

- Operational Efficiency and Process Automation: Reducing manual data entry, streamlining Know Your Customer (KYC) procedures, and automating collection reminders and reconciliation processes.

- Predictive Cash Flow Modeling: Using AI to anticipate client working capital gaps and proactively offer tailored factoring solutions, improving client retention and service utilization.

DRO & Impact Forces Of Factoring Market

The Factoring Market’s trajectory is heavily influenced by systemic drivers, primarily the persistent and growing need for accessible working capital, especially among the globally expanding Small and Medium-sized Enterprise (SME) sector. SMEs often face structural disadvantages in securing traditional financing, making factoring, which is based on the quality of their accounts receivable rather than their balance sheet collateral, an essential and often preferred liquidity solution. A major driver is the accelerating trend of digitalization and platform-based financing. The introduction of fintech platforms offering instantaneous, seamless factoring services via online interfaces has dramatically reduced the frictional costs and processing time, broadening the geographic reach and demographic profile of eligible businesses, particularly in emerging markets where traditional banking infrastructure is slow.

However, significant restraints temper this growth. One major barrier is the perception of high discount fees and administrative costs compared to conventional bank loans, which can erode profitability for clients with large margins. Furthermore, regulatory fragmentation across global markets, particularly concerning the legal enforceability of assignment of receivables, introduces significant operational complexity and cost, especially for international factors seeking standardization. Another critical restraint is the lingering stigma associated with factoring; some businesses view it as a solution reserved for financially distressed companies, leading to reluctance in adoption and potential adverse effects on debtor relationships if not managed confidentially and professionally.

Opportunities for market differentiation and expansion are abundant. The greatest potential lies in the continued growth of Reverse Factoring (Supply Chain Finance), which represents a high-volume, lower-risk opportunity by anchoring financing to large, investment-grade corporate buyers. Furthermore, the integration of advanced technologies like Blockchain offers a pathway to fundamentally reduce risk and costs by providing verifiable, tamper-proof invoice ledgers, mitigating the risk of fraud that currently restricts growth. The increasing focus on ESG (Environmental, Social, and Governance) factors also presents an opportunity, with factors beginning to offer specialized, preferential rates for suppliers that meet sustainability criteria, aligning financing mechanisms with modern corporate responsibility demands. These factors collectively create the strategic impact forces compelling market players to innovate their technology stack and adjust their risk appetite.

Segmentation Analysis

The Factoring Market is structurally diverse, segmented based on transaction type, geographical scope, underlying risk structure, and client profile. This detailed segmentation is crucial for financial institutions to tailor their risk assessment models and optimize capital allocation. The segmentation by Type of Factoring (Recourse vs. Non-Recourse) dictates the allocation of credit risk: Non-Recourse factoring is generally higher priced as the factor assumes the liability for non-payment by the debtor, appealing to risk-averse sellers. Conversely, Recourse factoring places the burden of loss back on the seller, offering a lower rate and is often utilized by companies with strong debtor credit profiles.

Segmentation by Service Type distinguishes between Domestic Factoring, which involves transactions within a single country and relatively straightforward regulatory compliance, and International Factoring (Export and Import Factoring), which navigates complex cross-border legal systems, currency risk, and international trade protocols (often governed by global networks like FCI). The rising star in this classification is Reverse Factoring, which focuses on providing financing to suppliers based on the anchor buyer's credit strength, transforming factoring into a strategic supply chain management tool rather than a purely opportunistic cash flow solution. This dynamic shift demonstrates the market's evolving ability to address complex B2B payment challenges.

Furthermore, segmentation by End-Use Industry and Enterprise Size highlights key demand centers. Industries characterized by long payment cycles, such as Manufacturing, Transportation, and Services (especially IT and healthcare), are primary users. While SMEs remain the volumetric core, their dependence on factoring highlights the gap left by traditional lenders. Large enterprises, although fewer in number, represent significant value due to the scale of their Supply Chain Finance programs. Factors must maintain distinct operational frameworks—from marketing to compliance—to effectively service the unique cash flow requirements, regulatory nuances, and risk tolerances present across these various segmented groups.

- Type of Factoring:

- Recourse Factoring: Seller assumes liability for debtor non-payment.

- Non-Recourse Factoring: Factor assumes the credit risk for debtor default, commanding a higher fee.

- Service Type:

- Domestic Factoring: Transactions confined within national borders.

- International Factoring (Export Factoring, Import Factoring): Involves cross-border trade, currency risk, and complex legal coordination.

- Reverse Factoring/Supply Chain Finance: Buyer-driven financing aimed at optimizing supplier working capital.

- End-Use Industry:

- Manufacturing: Characterized by high capital intensity and long production cycles.

- Transportation and Logistics: Requires rapid liquidity for fuel and operational costs.

- Wholesale and Retail Trade: High volume of transactional trade credit.

- Services (IT, Healthcare, Telecom): Dealing with delayed payment or insurance reimbursement cycles.

- Enterprise Size:

- Small and Medium-sized Enterprises (SMEs): Core customer base seeking liquidity alternatives.

- Large Enterprises: Utilizing factoring primarily for supply chain optimization (Reverse Factoring).

Value Chain Analysis For Factoring Market

The Factoring Market value chain commences with the upstream process of invoice generation and receivable creation by the seller (client). This stage demands high integrity in digital documentation and transactional records. Upstream analysis focuses on the factor’s initial engagement, including client acquisition, meticulous due diligence on both the seller's operations and the creditworthiness of their pool of debtors. Fintech platforms are now dominating this phase by offering rapid, standardized online application and underwriting processes. Factors must assess market liquidity conditions and the cost of funding to determine the appropriate discount rate, which fundamentally dictates the profitability of the receivable portfolio. The increasing reliance on sophisticated API integration allows factors to pull real-time accounting data directly from client systems, optimizing the initial risk assessment.

The central phase involves the financing and risk mitigation activities. Factoring entities source capital either through their own depository bases (in the case of bank-affiliated factors), securitization of receivable portfolios, or via institutional funding lines. Simultaneously, this stage involves critical risk transfer mechanisms, often requiring factors to secure non-recourse insurance coverage against debtor insolvency. Distribution channels are highly variegated; direct channels involve internal sales forces, bank branches, and dedicated factoring houses, which rely on established relationships. Conversely, indirect channels, which are rapidly gaining prominence, include partnerships with enterprise resource planning (ERP) providers, accounting software vendors, and e-commerce platforms, embedding factoring offers directly into the business workflow, thus streamlining client onboarding and expanding reach.

The downstream component of the value chain is focused on the stewardship and ultimate realization of the receivable asset. This involves precise collection management, ledger administration, payment processing, and comprehensive reporting to both the client and internal compliance teams. In non-recourse arrangements, effective downstream collection is paramount to the factor’s profitability. Digital tools, including automated payment reminders, debtor portals, and advanced data analytics, are deployed to predict collection outcomes and manage disputes efficiently. The quality of this downstream service, particularly the factor’s ability to maintain professional debtor relationships and provide transparent reporting, is a key determinant of client satisfaction and long-term contract renewal, completing the cyclical value generation process.

Factoring Market Potential Customers

The Factoring Market caters primarily to business entities that extend commercial credit and possess accounts receivable that are currently outstanding. The most extensive and critical segment of potential customers comprises Small and Medium-sized Enterprises (SMEs) across diverse industries such as light manufacturing, wholesale distribution, and specialized services. These SMEs typically suffer from significant working capital constraints, especially during periods of high growth or investment, due to lengthy payment terms (e.g., Net 60 or Net 90) imposed by larger customers. Factoring offers them an immediate, scalable liquidity solution that sidesteps the often restrictive covenants and collateral demands associated with traditional bank lending, allowing them to fund inventory, manage payroll, and capitalize on new business opportunities promptly.

Beyond domestic SMEs, a high-value customer group includes businesses engaged in complex cross-border trade. Exporters, in particular, face unique challenges relating to currency conversion, political risk, and the difficulties associated with enforcing international debt collection. International factoring provides these entities with essential risk mitigation, ensuring they receive funds in their home currency while outsourcing the complexities of foreign receivable management and default risk. This specialization makes factoring an indispensable financial tool for bolstering global trade volumes and reducing the inherent financial friction of international commerce.

Furthermore, the structural mechanism of Reverse Factoring has fundamentally broadened the definition of a potential customer to include large, multinational corporations. While these corporate entities are not selling their own invoices, they act as the catalyst for the factoring transaction, initiating supply chain finance programs designed to support their vast networks of upstream suppliers. By sponsoring these programs, large companies ensure the financial health of their critical supply base, often securing better overall pricing and reliability. Therefore, potential customers span the entire commercial spectrum, from localized micro-enterprises to globally dominant anchor corporations, all seeking to optimize the timing and cost of cash flow within the B2B transaction cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,500 Billion |

| Market Forecast in 2033 | USD 8,000 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TFG (Trade Finance Global), HSBC, BNP Paribas, Mizuho Financial Group, Standard Chartered, Deutsche Bank, Citibank, Wells Fargo, Komerční banka, Eurobank Ergasias S.A., Raiffeisen Bank International AG, Santander, Crédit Agricole, UniCredit, ICBC, China Construction Bank, Bank of America, JP Morgan Chase, State Bank of India, Sumitomo Mitsui Banking Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Factoring Market Key Technology Landscape

The modern Factoring Market relies heavily on a cutting-edge technological stack designed to achieve speed, security, and scalability. Central to this landscape is the adoption of Cloud-based factoring platforms that offer robust infrastructure for data processing, credit application portals, and real-time portfolio management. These platforms utilize Application Programming Interfaces (APIs) extensively, enabling seamless integration with crucial third-party systems, including client Enterprise Resource Planning (ERP) software, bank treasury systems, and credit bureaus. This API-driven connectivity is essential for the concept of embedded finance, where factoring services are offered contextually within a client's daily accounting environment, dramatically reducing friction and accelerating the funding cycle from days to hours.

Beyond basic automation, the application of sophisticated Artificial Intelligence (AI) and Machine Learning (ML) constitutes the technological core for competitive differentiation. ML algorithms are deployed not only for initial credit scoring but also for continuous behavioral monitoring of both the seller and the debtor, adjusting risk exposure dynamically. This advanced analytics capability supports crucial decision-making regarding non-recourse factoring limits and facilitates automated fraud detection by flagging suspicious transaction patterns, such as sudden changes in invoice volume or inconsistent payment behavior relative to industry benchmarks. The ability to harness Big Data to generate predictive insights is paramount for maintaining profitability and minimizing default rates in highly complex international portfolios.

Furthermore, Distributed Ledger Technology (DLT), specifically blockchain, is poised to address some of the industry’s most persistent structural challenges, primarily the risk of invoice duplication and asset verification. By creating an immutable, shared record of trade documents and invoices among all relevant parties—the seller, the buyer, and the factor—blockchain ensures definitive proof of ownership and authenticity. The deployment of smart contracts on these ledgers automates the transfer of funds upon verification of milestones (e.g., goods received confirmation), enhancing security, reducing the need for costly intermediaries, and significantly improving the efficiency of cross-border factoring transactions. Cybersecurity, encompassing robust data encryption and compliance with data privacy regulations (like GDPR), is the indispensable foundation supporting all these digital advancements.

Regional Highlights

The Factoring Market exhibits sharp regional differentiation, driven by varying economic maturity and regulatory frameworks. North America, characterized by sophisticated financial markets, is dominated by non-bank financial intermediaries that specialize in niche, sector-specific factoring, such as trucking and medical receivables. The growth in this region is less about overall volume expansion and more about high-speed technological optimization, driven by fintech innovation focusing on advanced risk modeling and rapid, automated application processes. The competitive landscape is intense, necessitating factors to maintain razor-thin margins and utilize superior data analytics to gain an edge, often serving businesses with immediate liquidity needs who prioritize speed over marginal cost differences relative to bank loans.

Europe represents a large and highly integrated market, largely governed by harmonized, albeit stringent, EU regulations which facilitate expansive cross-border factoring operations, particularly within the Eurozone. European factors benefit from the establishment of organizations like the EU Federation for Factoring and Commercial Finance (EUF), promoting standardized practices. However, the market faces challenges related to capital adequacy rules (e.g., Basel requirements) which sometimes restrict the factoring capacity of large banking groups. Growth here is steady, concentrated on the shift towards non-recourse models and the development of sophisticated platforms that manage multi-jurisdictional compliance and tax requirements effectively, ensuring stability in high-value B2B trade flows.

Asia Pacific (APAC) is unequivocally the high-growth engine of the global factoring market. Fueled by exponential growth in SME formation, heavy reliance on export-driven economies (China, Vietnam, India), and supportive governmental policies aimed at financial inclusion, APAC is witnessing a rapid expansion in both domestic and international factoring volumes. Factors in this region often bypass legacy systems, adopting mobile-first, digital factoring platforms that are crucial for reaching vast, geographically dispersed populations of small business owners. While regulatory environments can be disparate and challenging in certain countries, the sheer volume of trade receivables generated, combined with technological leapfrogging, guarantees APAC's continued market leadership in terms of growth rate. Latin America and MEA, while smaller, offer long-term potential predicated on improving credit information infrastructure and implementing legal frameworks that unequivocally protect the assignment of receivables, thereby reducing operational risk for international investors.

- Asia Pacific (APAC): Highest projected CAGR; driven by immense SME growth in China and India; rapid adoption of mobile and fintech factoring solutions; crucial hub for international factoring and supply chain finance adoption.

- Europe: Mature and integrated market; high volume of non-recourse transactions; stringent regulatory compliance requiring sophisticated operational platforms; strong emphasis on green and sustainable finance applications.

- North America: Defined by specialized, high-tech non-bank factors; focus on real-time data analytics and rapid funding for niche sectors (e.g., logistics, staffing); strong legal protection for factoring transactions.

- Latin America: High demand driven by volatile economic cycles; requires localized risk mitigation strategies; ongoing improvement in legal frameworks is key to attracting further investment.

- Middle East and Africa (MEA): Nascent growth driven by trade diversification and infrastructure projects; potential linked to regional economic integration (e.g., GCC); challenges related to opaque credit reporting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Factoring Market.- TFG (Trade Finance Global)

- HSBC

- BNP Paribas

- Mizuho Financial Group

- Standard Chartered

- Deutsche Bank

- Citibank

- Wells Fargo

- Komerční banka

- Eurobank Ergasias S.A.

- Raiffeisen Bank International AG

- Santander

- Crédit Agricole

- UniCredit

- ICBC

- China Construction Bank

- Bank of America

- JP Morgan Chase

- State Bank of India

- Sumitomo Mitsui Banking Corporation

Frequently Asked Questions

Analyze common user questions about the Factoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Factoring and Invoice Discounting?

Factoring involves the sale of accounts receivable, typically includes the factor taking over credit control and collection duties, and requires notification to the debtor. Invoice discounting is a confidential financing arrangement (a loan secured by receivables) where the selling company retains control over collections and debtor notification is generally avoided.

How does AI technology specifically reduce risk in non-recourse Factoring?

AI utilizes sophisticated machine learning models to analyze the credit risk of the third-party debtor in real-time. By integrating vast external data sets, including market sentiment and detailed trade payment behavior, AI systems predict default probability with greater accuracy than traditional methods, enabling factors to offer non-recourse services while effectively pricing and mitigating potential losses.

Which geographical region is expected to lead market growth in the next five years?

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to the burgeoning SME sector, governmental support for trade finance digitalization, and the rapid deployment of scalable, mobile-enabled factoring platforms across major manufacturing and export hubs.

What are the main drawbacks or restraints associated with adopting Factoring services?

Key restraints include the relatively high cost structure (discount fees and administrative charges) compared to cheaper, conventional financing, the necessity of debtor notification (in full factoring), and the complexity and cost incurred by factors due to varied legal and regulatory requirements in cross-border transactions.

How does Reverse Factoring contribute to Supply Chain Finance?

Reverse factoring is crucial for Supply Chain Finance (SCF) as it allows suppliers to secure immediate payment based on the strong credit rating of the corporate buyer (the anchor). This mechanism optimizes working capital across the entire supply chain, offering stability and low-cost funding to suppliers while allowing the anchor buyer to negotiate extended payment terms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Freight Factoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Reverse Factoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager