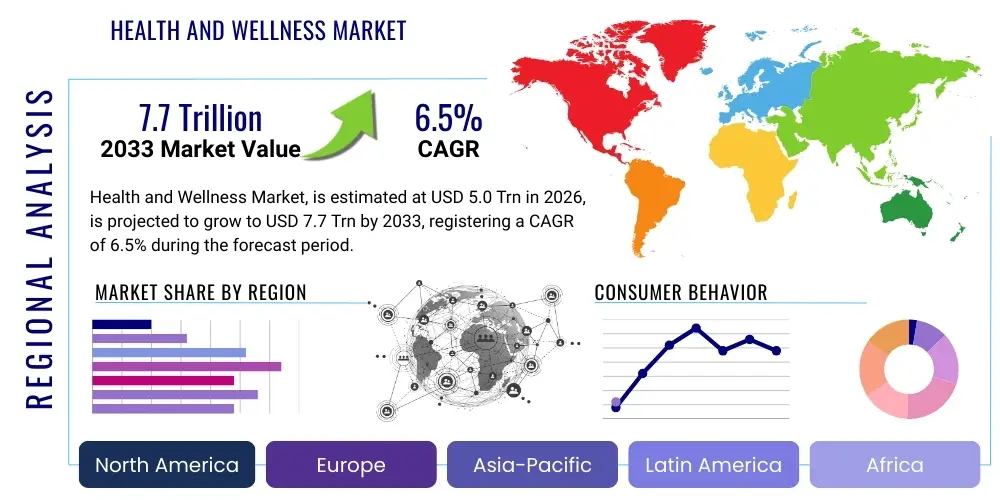

Health and Wellness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436937 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Health and Wellness Market Size

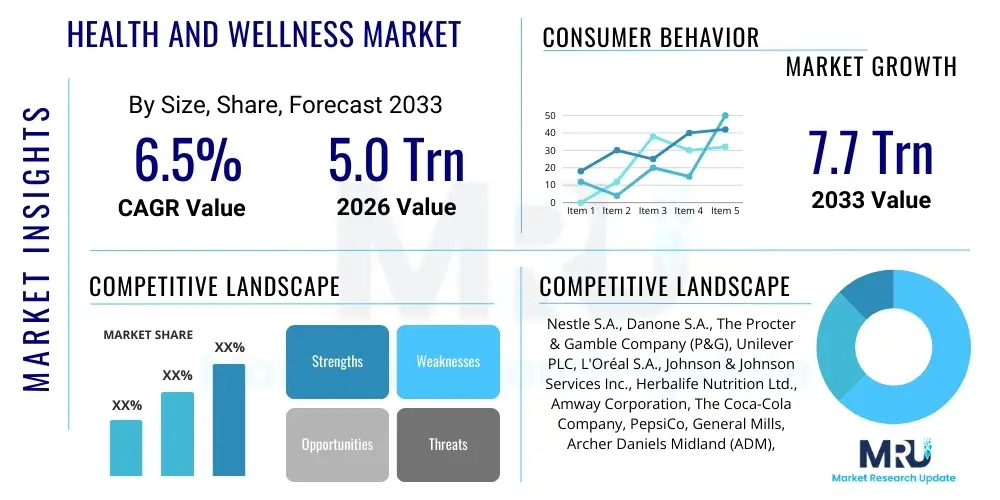

The Health and Wellness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.0 Trillion in 2026 and is projected to reach USD 7.7 Trillion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating consumer awareness regarding preventive healthcare, coupled with rising disposable incomes across developing economies, enabling greater expenditure on personalized nutrition, fitness technology, and holistic well-being solutions. The market encompasses a vast spectrum of industries, including functional foods, dietary supplements, beauty and personal care, preventative medicine, and digital health tools, all converging to meet the demand for sustained, proactive health maintenance.

Health and Wellness Market introduction

The global Health and Wellness Market is defined by products and services dedicated to maintaining and improving physical and mental well-being, moving beyond traditional sickness care toward holistic, preventative self-management. This expansive market covers five core segments: health and wellness food, beauty and personal care, wellness tourism, fitness and mind-body exercises, and preventative and personalized health. The fundamental product description involves items ranging from organic food and fortified beverages to wearable fitness trackers and specialized supplements designed to address specific deficiencies or enhance physical performance. Crucially, the increasing integration of technology, particularly AI and IoT, is transforming product offerings into personalized, data-driven experiences, significantly enhancing efficacy and consumer engagement.

Major applications of health and wellness products span dietary management for chronic diseases, anti-aging solutions, stress reduction, sleep optimization, and physical rehabilitation. These applications are universal, catering to demographics from millennials seeking biohacking solutions to the elderly focusing on mobility and cognitive health. The primary benefits derived from these products include improved quality of life, increased longevity, enhanced physical appearance, and reduced reliance on reactive medical interventions. The shift toward preventative spending is a monumental economic benefit, reducing the long-term burden on national healthcare systems and empowering individuals to take proactive ownership of their health outcomes, thereby driving sustained consumer loyalty within the market.

Key driving factors propelling this market include the global rise in lifestyle diseases such as obesity and diabetes, heightened media attention on mental health issues, and rapid urbanization leading to increased stress levels and demand for convenience-based wellness solutions. Furthermore, powerful macroeconomic forces, such as the aging population in developed nations (demanding specific nutritional and physical health products) and the cultural trend favoring natural, clean-label, and sustainable products, provide constant momentum. Regulatory bodies worldwide are increasingly recognizing the importance of nutritional integrity and supplement safety, fostering greater consumer trust and stimulating innovation in efficacious, scientifically backed wellness products, thereby solidifying market growth prospects over the forecast period.

Health and Wellness Market Executive Summary

The Executive Summary highlights a paradigm shift in consumer behavior toward proactive health management, defining the market's robust trajectory. Business trends indicate significant mergers and acquisitions (M&A) activity as major CPG (Consumer Packaged Goods) companies acquire specialized niche brands to quickly penetrate high-growth segments like plant-based nutrition and sustainable personal care. Furthermore, a critical trend is the pivot toward direct-to-consumer (DTC) models supported by sophisticated digital marketing and subscription services, emphasizing personalization and long-term customer relationships. Technological integration, particularly in diagnostics and customized supplement formulation using genetic data, is transforming the competitive landscape, rewarding companies capable of delivering scientifically validated, highly tailored wellness solutions.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing region, fueled by massive population bases, increasing affluence in countries like China and India, and deeply ingrained traditional wellness practices now merging with modern scientific methods. North America and Europe remain foundational markets, dominating in terms of technological innovation, regulatory compliance, and high per-capita spending on premium, high-efficacy products. In emerging markets, accessibility and affordability dictate the adoption of wellness products, with mass-market supplements and basic fitness services seeing substantial uptake, while in mature markets, the emphasis shifts toward luxury, experience-based wellness, such as boutique fitness studios and high-end wellness resorts.

Segment trends underscore the phenomenal rise of functional foods and beverages, especially those fortified with prebiotics, probiotics, and adaptogens, surpassing the growth rate of traditional dietary supplements. The beauty and personal care segment is undergoing a massive clean-label revolution, with consumers demanding transparency regarding ingredient sourcing and processing, prioritizing organic and cruelty-free claims. Wellness technology, encompassing wearables, telehealth platforms, and mental health apps, is maturing rapidly, moving from novelty tracking to providing actionable, personalized health interventions. Investment is heavily concentrated in digital platforms that seamlessly integrate data from multiple wellness activities, offering a unified, continuous monitoring and feedback loop crucial for long-term health adherence.

AI Impact Analysis on Health and Wellness Market

User queries regarding AI's impact on Health and Wellness predominantly focus on personalization capabilities, diagnostic accuracy improvements, and the ethics surrounding health data privacy. Users frequently ask about how AI can create truly customized diet and exercise plans based on real-time biometric feedback and genetic markers, moving beyond generalized recommendations. Concerns center on the reliability of AI-driven wellness coaches and the potential for algorithmic bias in health recommendations for diverse populations. Expectations are high concerning the role of AI in streamlining administrative healthcare tasks, accelerating pharmaceutical and supplement R&D through predictive modeling, and making advanced diagnostic tools accessible at home, democratizing health insights previously limited to clinical settings. The central theme is the transition from mass-market products to highly specific, predictive, and preventative AI-guided wellness regimens.

- AI enables hyper-personalized nutrition plans based on genomics, microbiome analysis, and real-time activity data.

- Predictive modeling assists in identifying individuals at risk of lifestyle diseases, facilitating early intervention strategies.

- AI-powered mental health chatbots and therapeutic apps provide scalable, accessible first-line psychological support and counseling.

- Optimized supply chain management and inventory forecasting for specialized supplements based on localized demand signals.

- Enhanced efficacy and validation of functional ingredients through machine learning analysis of clinical trial data and molecular interactions.

- Automated quality control and safety monitoring in the manufacturing of nutraceuticals and clean-label personal care products.

- AI drives innovation in wearable technology, transforming raw biometric data into actionable health scores and personalized behavioral nudges.

- Improved diagnostic accuracy in digital health platforms, reducing human error in remote monitoring and initial assessment.

DRO & Impact Forces Of Health and Wellness Market

The Health and Wellness market is powerfully shaped by synergistic Drivers, Restraints, and Opportunities (DRO). Key drivers include the global epidemic of chronic diseases, the pervasive influence of social media promoting healthy lifestyles, and significant technological advancements making health tracking accessible and engaging. Restraints primarily involve the high cost of premium, personalized wellness products, the persistent challenge of regulatory inconsistency across various geographic markets for supplements and functional foods, and widespread consumer confusion stemming from unsubstantiated health claims, leading to consumer skepticism. Opportunities lie within integrating wellness with mainstream medical systems (preventative care reimbursement), the vast untapped potential of the mental wellness segment, and the global demand for sustainable, ethically sourced ingredients, offering a pathway for premium brand differentiation and long-term value creation.

Impact forces dynamically interact, influencing market trajectory. The intense competitive rivalry is a major impact force, compelling companies to constantly innovate, invest heavily in clinical validation, and differentiate themselves through branding and technology integration. Buyer power is substantial due to the availability of numerous substitute products (e.g., opting for whole foods over supplements) and the ease of information access, forcing price sensitivity and demanding high product efficacy and transparency. Supplier power is generally moderate, though it becomes high for proprietary, clinically proven, or sustainably sourced raw materials (e.g., rare botanicals, specialized probiotic strains). The threat of new entrants remains high, particularly in the digital health sector where low entry barriers and scalable technology facilitate quick market penetration, although scaling physical product distribution remains a challenge.

Furthermore, regulatory impact is becoming increasingly pivotal, particularly concerning safety and labeling standards. Stricter enforcement in regions like the EU and North America is acting as a barrier for non-compliant smaller players, but simultaneously increases consumer trust in reputable brands. Socio-cultural shifts, particularly the mainstreaming of fitness culture and the normalization of discussing mental health, act as powerful drivers, perpetually broadening the consumer base beyond traditional health enthusiasts. Geopolitical stability and global trade agreements influence the sourcing and cost of raw materials, which significantly impacts the profitability and final pricing structure of mass-market wellness products, underscoring the necessity for robust, diversified supply chain strategies.

Segmentation Analysis

The Health and Wellness Market is extensively segmented by product type, focusing on the specific need being addressed, and by end-user demographics, reflecting consumption patterns across different age groups and lifestyles. The core segmentation by product includes functional foods and beverages (driving volume and daily consumption), dietary supplements (targeting specific deficiencies), beauty and personal care (focused on 'inner beauty' and clean ingredients), preventative medicine (including diagnostic services), and wellness tourism and fitness (experience-based services). Analyzing these segments reveals that consumer expenditure is rapidly shifting towards proactive, daily consumption products, prioritizing functional benefits delivered through familiar formats, such as protein bars, fortified waters, and specialized nutritional shakes.

Segmentation by distribution channel is crucial, highlighting the accelerated importance of online retail and direct-to-consumer (DTC) sales, especially post-pandemic. E-commerce platforms offer greater reach, detailed product information, and opportunities for personalized bundle creation, which traditional retail cannot easily replicate. Conversely, pharmacies, supermarkets, and specialized retail stores continue to hold significant shares for impulse buys and products requiring immediate availability, such as essential vitamins and OTC remedies. Geographic segmentation remains essential for tailoring products to local regulatory environments, cultural dietary preferences (e.g., Ayurvedic influences in Asia), and regional economic capacities, ensuring market offerings are relevant and accessible to the local target audience.

The highest growth is anticipated in the functional food segment, specifically centered on immune health and gut health, reflecting pandemic-driven priorities. The dietary supplement segment is experiencing a transformation, moving away from generic multivitamins toward personalized, DNA-tested formulations, elevating the average transaction value. The beauty and personal care segment is seeing significant overlap with wellness, with 'nutricosmetics' (supplements consumed for skin/hair benefits) becoming a major cross-segment trend. These segmented analyses confirm that the market is evolving into highly specialized, scientifically backed micro-markets, demanding precision marketing and localized production capabilities.

- By Product Type:

- Functional Foods and Beverages (Probiotic, Prebiotic, Fortified, Energy Drinks)

- Dietary Supplements (Vitamins, Minerals, Herbal/Botanical, Sports Nutrition)

- Beauty and Personal Care (Natural/Organic Cosmetics, Clean Label Personal Care)

- Wellness Tourism and Spas (Medical, Ecotourism, Destination Spas)

- Preventative and Personalized Health (Diagnostic Services, Wellness Coaching)

- Fitness Equipment and Services (Gym Memberships, At-home Equipment, Digital Subscriptions)

- By Distribution Channel:

- Retail Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail (E-commerce platforms, Direct-to-Consumer websites)

- Specialty Stores

- By End-User:

- Adults (25-55)

- Geriatric Population (55+)

- Children and Adolescents

Value Chain Analysis For Health and Wellness Market

The Health and Wellness market value chain begins with upstream activities focused on raw material sourcing, which is highly complex due to the global demand for specialized, sustainable, and organic ingredients, including high-purity botanicals, patented probiotic strains, and specialized protein sources. This stage involves rigorous quality control, clinical testing of novel ingredients, and adherence to global sourcing ethics (e.g., fair trade). The midstream phase involves manufacturing, formulation, and packaging, where technological investment in precision fermentation, encapsulation techniques, and automated production lines ensures product stability, bioavailability, and scalability, particularly for complex functional foods and high-dose supplements.

Downstream analysis highlights the critical role of sophisticated distribution channels. Direct and indirect sales models coexist, maximizing market reach. Direct sales, particularly through dedicated brand e-commerce sites and subscription boxes, allow companies to control the customer experience, gather invaluable first-party data, and foster brand loyalty, bypassing traditional retail margins. Indirect channels, including large retail chains, specialty health food stores, and pharmacies, provide essential visibility, accessibility, and credibility, often being the primary purchasing point for mass-market wellness items. Effective value chain management requires seamless integration between R&D, manufacturing precision, and robust, multi-channel distribution networks capable of handling both perishable goods (functional foods) and regulated non-perishables (supplements).

Furthermore, digital transformation has deeply integrated into the value chain. Marketing, sales, and post-sale support increasingly rely on data analytics to personalize offerings and optimize inventory. Transparency and traceability, from farm to consumer, are now non-negotiable value-adds, particularly for clean-label brands. The role of third-party logistics (3PLs) specialized in temperature-controlled or regulated product handling is growing, ensuring product integrity remains intact throughout the complex global distribution process. Efficiency in this chain directly impacts the final cost to the consumer and the speed with which new, trendy wellness products can reach the diverse global marketplace.

Health and Wellness Market Potential Customers

Potential customers for the Health and Wellness Market are broad, encompassing virtually all demographic segments but are fundamentally segmented by their approach to health, disposable income, and life stage needs. The primary target includes the proactive wellness seeker—typically affluent, educated individuals aged 25-55 who are already engaged in preventative health behaviors and are early adopters of fitness technology, personalized supplements, and high-end organic foods. This group seeks efficacy, convenience, and status associated with maintaining peak physical and mental performance, often prioritizing biohacking and longevity solutions.

A secondary, high-growth customer segment includes individuals aged 55 and above, driven by reactive needs related to managing age-related conditions, mobility issues, and cognitive decline. This segment predominantly purchases clinically validated supplements, low-impact exercise services, and personalized nutritional products recommended by healthcare professionals. They prioritize trust, reliability, and guaranteed safety, making pharmaceutical-grade and medically endorsed products highly appealing. Furthermore, parents purchasing wellness products for children—focusing on immune support, cognitive development, and clean ingredients—constitute a steadily growing segment, driven by parental concern and increasing awareness of early-life nutrition's long-term impact.

The market also heavily targets customers struggling with lifestyle diseases, such as diabetes and cardiovascular issues, who seek functional foods and specialized dietary supplements to manage their conditions. These buyers are highly motivated by clinical evidence and are crucial users of telehealth and condition-specific wellness apps. Ultimately, the customer base is characterized by a high degree of health consciousness, a willingness to spend on quality preventative care, and reliance on digital and social media for information and product validation before purchase. Successfully engaging these customers requires transparency, scientific backing, and seamless omnichannel purchasing experiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.0 Trillion |

| Market Forecast in 2033 | USD 7.7 Trillion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestle S.A., Danone S.A., The Procter & Gamble Company (P&G), Unilever PLC, L'Oréal S.A., Johnson & Johnson Services Inc., Herbalife Nutrition Ltd., Amway Corporation, The Coca-Cola Company, PepsiCo, General Mills, Archer Daniels Midland (ADM), GNC Holdings Inc., Bayer AG, Abbott Laboratories, Tivity Health, Inc., WW International, Inc. (Weight Watchers), Talkspace, Headspace Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Health and Wellness Market Key Technology Landscape

The Health and Wellness market is undergoing a profound digital transformation driven by the convergence of biosensors, data analytics, and artificial intelligence. The foundational technology remains the advancement in wearable devices (smartwatches, fitness trackers, smart rings), which are moving beyond mere activity counting to providing medically relevant data points, such as continuous glucose monitoring (CGM) and advanced sleep stage tracking. This constant influx of high-fidelity, personalized biometric data fuels the subsequent stages of the technology landscape, enabling predictive modeling of health risks and allowing companies to move from static product sales to continuous health intervention services. Furthermore, advancements in genomics and microbiome sequencing technologies are becoming cheaper and more accessible, serving as the input for truly personalized nutritional and therapeutic recommendations, elevating the specificity and perceived value of wellness solutions.

A major technological component is the rise of sophisticated digital health platforms, encompassing telehealth, mental wellness apps, and integrated wellness management systems. These platforms utilize AI algorithms to analyze user-generated content, biometric data, and behavioral patterns to deliver customized coaching, cognitive behavioral therapy (CBT) modules, and meditation guides at scale. Crucially, the development of secure, blockchain-based systems is being explored to manage sensitive health data (Personal Health Records - PHR), addressing paramount consumer concerns regarding privacy and data integrity, thereby increasing user trust in digital wellness services. This infrastructure allows for seamless data exchange between wearables, virtual coaches, and healthcare providers, creating a truly interconnected ecosystem.

In the product manufacturing space, key technologies involve precision fermentation and cellular agriculture, which are revolutionizing the sourcing of ingredients, particularly specialized proteins, vitamins, and sustainable food alternatives, reducing reliance on conventional agricultural methods and improving purity. Furthermore, augmented reality (AR) and virtual reality (VR) technologies are enhancing the fitness and mental wellness segments by offering immersive exercise experiences (e.g., virtual cycling classes) and guided relaxation environments. This technological integration is shifting the consumer expectation from simply buying a product to subscribing to a comprehensive, personalized, and digitally managed health outcome, ensuring that technological adoption is critical for market competitiveness and long-term viability across all segments of the Health and Wellness Market.

Regional Highlights

Regional dynamics illustrate the varied stages of wellness market maturity and penetration across the globe, requiring tailored strategies from market participants. North America currently holds the largest market share, driven by high consumer awareness, widespread adoption of advanced fitness technologies (especially wearables and digital subscriptions), and a highly developed regulatory environment that supports rapid innovation in supplements and functional foods. The U.S. consumer exhibits a strong willingness to pay premiums for convenience, scientific validation, and natural/organic ingredients. Significant expenditure on mental wellness services and personalized nutrition platforms ensures North America remains a dominant force in terms of absolute market size and technological leadership.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive demographic shifts, including the rising middle class, increasing urbanization, and greater penetration of digital infrastructure. Countries like China and India are seeing unprecedented demand for dietary supplements and preventative health measures, often blending modern products with traditional wellness practices (e.g., Traditional Chinese Medicine and Ayurveda). Government initiatives promoting healthy lifestyles and fitness, coupled with a growing perception of imported Western wellness brands as high-quality, further accelerate market growth across the densely populated urban centers of APAC.

Europe represents a mature yet dynamic market, characterized by stringent regulations regarding food safety and supplement claims, which fosters high consumer trust in certified products. Western European nations, such as Germany and the UK, exhibit strong demand for clean-label cosmetics, sustainable packaging, and specialized nutritional products tailored for the aging population. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is constrained by lower disposable incomes but compensated by high demand for basic nutritional products and generic fitness services. Localized production and affordable pricing strategies are essential for capturing these nascent but promising market segments, with increasing awareness campaigns driving incremental growth.

- North America: Dominant market share; leadership in wearable tech, personalized supplements, and high consumer spending on holistic wellness and preventative health services.

- Europe: High regulatory standards driving consumer trust; strong focus on organic foods, sustainable beauty, and addressing the nutritional needs of an aging demographic.

- Asia Pacific (APAC): Fastest-growing region; driven by rising disposable incomes, urbanization, fusion of traditional and modern medicine, and large-scale adoption of affordable fitness apps.

- Latin America: Emerging market; growing awareness of lifestyle diseases, increasing demand for affordable, accessible mass-market nutritional supplements and beverages.

- Middle East and Africa (MEA): Focus on managing diet-related chronic diseases; substantial potential in sports nutrition and cosmetic wellness, influenced heavily by global brands penetrating luxury segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Health and Wellness Market.- Nestle S.A.

- Danone S.A.

- The Procter & Gamble Company (P&G)

- Unilever PLC

- L'Oréal S.A.

- Johnson & Johnson Services Inc.

- Herbalife Nutrition Ltd.

- Amway Corporation

- The Coca-Cola Company

- PepsiCo

- General Mills

- Archer Daniels Midland (ADM)

- GNC Holdings Inc.

- Bayer AG

- Abbott Laboratories

- Tivity Health, Inc.

- WW International, Inc. (Weight Watchers)

- Talkspace

- Headspace Health

- Philips Healthcare

Frequently Asked Questions

Analyze common user questions about the Health and Wellness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary segments driving growth in the Health and Wellness Market?

The primary growth drivers are Functional Foods and Beverages, particularly those focusing on gut health and immunity, and the Digital Wellness segment, which includes sophisticated fitness trackers, mental health apps, and personalized nutrition platforms. Consumers are prioritizing convenience and scientifically validated products for daily, preventative self-care.

How is technology, specifically AI, reshaping the consumer experience in wellness?

AI is crucial for hyper-personalization, enabling companies to offer customized supplements and fitness programs based on individual genetic data, lifestyle patterns, and real-time biometric feedback. This enhances product efficacy and moves the market from generic recommendations to precise, actionable health interventions, drastically improving user engagement and outcomes.

Which geographical region exhibits the fastest growth potential in Health and Wellness?

The Asia Pacific (APAC) region is projected to show the highest CAGR. This accelerated growth is primarily attributed to rapidly expanding middle-class populations in countries such as China and India, increasing urbanization, rising disposable incomes, and a growing adoption of preventative health measures integrated with digital health technologies.

What are the main regulatory challenges faced by supplement and functional food manufacturers?

Key regulatory challenges include the lack of globally standardized definitions for functional claims and health benefits, varying product approval processes across regions, and intense scrutiny regarding misleading labeling and unsubstantiated marketing claims. Compliance requires significant investment in clinical validation and transparent ingredient sourcing.

What role does the demand for sustainability play in the Health and Wellness industry?

Sustainability is now a critical differentiator, driving consumer preference for ethically sourced, organic, and clean-label products. This trend compels manufacturers to adopt sustainable packaging, reduce carbon footprints, and ensure supply chain transparency, particularly impacting the beauty, personal care, and functional food segments where eco-conscious purchasing is prevalent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Seniors Health and Wellness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Health And Wellness Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Health and Wellness Products Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Functional Foods, Functional Beverages, Supplements, Personal Care Products), By Application (Hypermarket and Supermarket, Drug Stores, Single Brand Stores, Online Stores), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Frozen Waffles Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Traditional Frozen Waffles, Health and Wellness Frozen Waffles), By Application (Supemarkets and Hyemarkets, Convenience Stores, Specialist Rtailes, Online Retailers), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager