Healthcare Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434748 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Healthcare Market Size

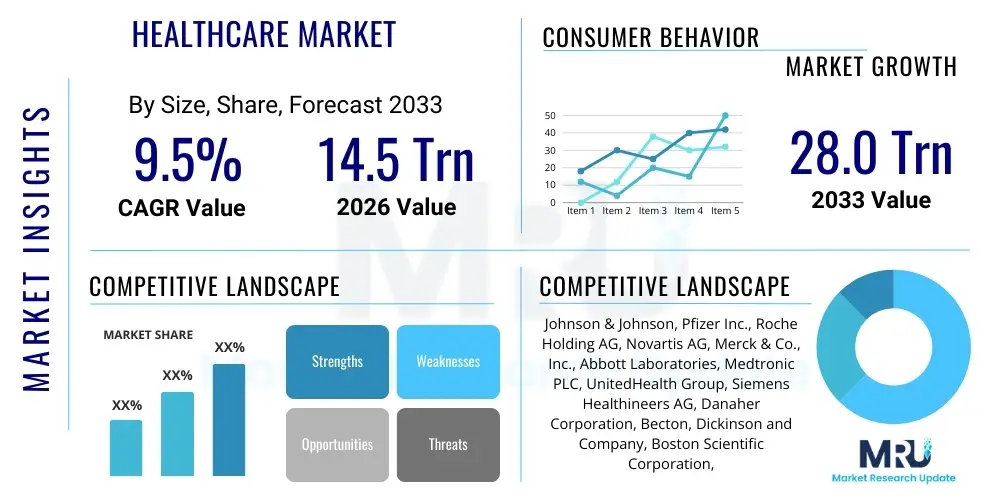

The Healthcare Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% (CAGR) between 2026 and 2033. The market is estimated at USD 14.5 Trillion in 2026 and is projected to reach USD 28.0 Trillion by the end of the forecast period in 2033. This robust expansion is primarily driven by continuous technological advancements in medical devices and pharmaceuticals, coupled with the persistent increase in the global aging population, which necessitates greater access to chronic disease management services. Furthermore, increased health spending across developing economies and the integration of digital health solutions like telehealth and remote patient monitoring are accelerating market velocity, transforming traditional healthcare delivery models into more accessible and patient-centric systems.

Market valuation reflects the combined revenue generated by key sub-sectors, including pharmaceuticals, medical devices, biotechnology, and healthcare services (hospitals, clinics, and long-term care facilities). The shift towards value-based care models, where reimbursement is tied to patient outcomes rather than volume of services, is fundamentally restructuring investment priorities. This environment favors innovations that enhance efficiency and lower the total cost of care, leading to substantial investment in preventative medicine and early diagnostic tools. Geographically, regions with high per capita healthcare expenditure and strong regulatory frameworks, such as North America and Western Europe, continue to dominate market size, although the fastest growth rates are increasingly observed in the Asia Pacific region due to expanding middle-class populations and improving healthcare infrastructure.

Healthcare Market introduction

The global Healthcare Market encompasses a vast ecosystem dedicated to the prevention, diagnosis, treatment, and management of physical and mental impairments, and the promotion of wellness. This highly diversified industry includes core segments such as pharmaceuticals (drug development and manufacturing), medical devices (equipment, instruments, diagnostics), and healthcare services (hospital administration, primary care, specialized treatment centers, and long-term care). The primary product offerings range from life-saving prescription drugs and complex surgical machinery to preventative vaccines and digital health platforms that facilitate remote consultations and data management. Major applications span acute care (emergency services, surgical interventions), chronic disease management (diabetes, cardiovascular conditions), preventative health (wellness programs, screening), and personalized medicine, which tailors treatments based on individual genetic profiles.

The substantial growth and evolution of the market are propelled by several critical driving factors. Firstly, the global demographic transition, characterized by an increasing life expectancy and a larger proportion of elderly individuals, dramatically raises the demand for chronic and age-related care services. Secondly, continuous, rapid advancements in biotechnology, genomics, and information technology enable the creation of highly effective and precise diagnostic and therapeutic solutions, such as gene therapies and advanced robotic surgery systems. Furthermore, heightened public awareness concerning health and wellness, alongside expanding insurance coverage in emerging markets, ensures a broader patient base seeks professional medical intervention. The inherent benefits of a robust healthcare system include reduced mortality rates, improved quality of life, increased economic productivity due to a healthier workforce, and enhanced societal resilience against pandemics and widespread infectious diseases.

Current market dynamics are defined by digital transformation, integrating technologies like Electronic Health Records (EHRs), Artificial Intelligence (AI) for diagnostics, and Internet of Medical Things (IoMT) devices. This integration is improving operational efficiencies, enhancing clinical decision-making, and significantly expanding access to care, particularly in underserved rural areas. The industry is rapidly moving away from a reactive, sickness-based model toward a proactive, preventative, and personalized paradigm. This systemic shift is attracting significant capital investment in health tech startups and encouraging strategic collaborations between traditional pharmaceutical giants and cutting-edge software developers, ultimately leading to higher standards of global healthcare provision and sustained market expansion.

Healthcare Market Executive Summary

The Healthcare Market is undergoing a rapid transformation, characterized by distinct business trends focusing on integration, digitalization, and patient-centricity. Key business trends include the consolidation of provider networks (mergers and acquisitions among hospitals and insurance payers) to achieve economies of scale and better manage risk under value-based care models. Furthermore, pharmaceutical and biotech companies are heavily investing in specialized, high-cost therapies, such as oncology and rare disease treatments, driven by higher margins and unmet clinical needs. Regional trends highlight North America’s dominance in R&D spending and technology adoption, while the Asia Pacific region emerges as the primary growth engine due to increasing healthcare expenditure by governments, rapid urbanization, and the expanding middle class’s ability to afford private health insurance and specialized services. Europe maintains a strong focus on centralized, publicly funded systems, increasingly pressured to incorporate advanced, costly technologies while managing budget constraints.

Segment trends reveal accelerated growth in the digital health sector, including telemedicine platforms, health monitoring apps, and predictive analytics tools, which witnessed massive uptake following the global necessity for remote care. Within the device segment, sophisticated minimally invasive surgical equipment and advanced diagnostic imaging modalities are experiencing heightened demand, driven by their ability to reduce hospital stays and improve recovery times. Conversely, the generic pharmaceuticals segment faces persistent pricing pressure, pushing companies to invest in biologics and biosimilars as growth avenues. This shift towards high-complexity, high-value segments necessitates a highly skilled workforce and robust regulatory infrastructure, influencing global investment patterns and strategic partnerships across the healthcare value chain. Overall, the market landscape is defined by the convergence of clinical necessity, technological capability, and economic sustainability, steering the industry toward highly specialized and efficient service delivery.

The regulatory environment also dictates market behavior, particularly regarding data privacy (e.g., HIPAA in the US, GDPR in Europe) and drug approval processes, which influence the speed and cost of innovation. Sustainability and environmental considerations are becoming increasingly important business metrics, pushing healthcare providers and manufacturers toward eco-friendly practices and reduced waste generation. The emphasis on interoperability—the ability of different IT systems and devices to communicate seamlessly—is a major focus, driven by the need to create holistic patient records and facilitate integrated care pathways. This confluence of technological innovation, regulatory oversight, demographic shifts, and evolving consumer expectations collectively defines the strategic direction and competitive intensity within the global healthcare industry, ensuring continuous but complex market expansion.

AI Impact Analysis on Healthcare Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Healthcare Market predominantly revolve around three critical areas: diagnostic accuracy and speed, implications for patient data privacy and security, and the potential displacement or enhancement of healthcare professional roles. Users frequently question how AI algorithms, specifically machine learning and deep learning, can outperform human clinicians in analyzing complex medical images (radiology, pathology) or genetic data for early disease detection. There is significant concern about ensuring the ethical deployment of AI, maintaining patient confidentiality when vast datasets are used for training models, and establishing regulatory oversight for AI-driven clinical tools. Furthermore, healthcare providers often inquire about the expected return on investment (ROI) for implementing AI systems in hospital operations, focusing on cost reduction through optimized scheduling, resource allocation, and reduced administrative burden, while concurrently addressing the need for specialized training to integrate these new technologies seamlessly into existing workflows. The underlying expectation is that AI will revolutionize drug discovery and personalized medicine, making treatments significantly more targeted and effective.

AI's influence is transforming healthcare processes across the board, moving beyond experimental phases into mainstream clinical and operational use. In drug discovery, AI accelerates target identification and compound optimization, drastically reducing the time and cost associated with bringing new pharmaceuticals to market. Clinically, AI algorithms excel in predictive analytics, identifying patients at high risk of developing specific conditions or complications, thereby enabling proactive intervention. This is particularly valuable in critical care settings and chronic disease management. Operationally, AI-powered tools streamline administrative tasks, manage inventory, optimize patient flow, and prevent claim denials, directly addressing the endemic inefficiencies prevalent in global healthcare systems. The synergy between high-throughput data generation (genomics, electronic health records) and AI processing capability is creating unprecedented opportunities for precision medicine, where diagnostic pathways and therapeutic regimens are tailored to individual molecular signatures.

However, the successful integration of AI hinges on overcoming substantial challenges related to data quality, model interpretability ("black box" problem), and ensuring equitable access to these advanced tools. Regulatory bodies are striving to keep pace with rapid technological advancements, creating frameworks for validating and monitoring AI as a medical device. Despite concerns about job disruption, the consensus is that AI will function primarily as an augmentation tool, freeing up clinicians from routine tasks to focus on complex decision-making and direct patient interaction, ultimately enhancing the quality and speed of care delivery rather than replacing human expertise entirely. This positive disruption solidifies AI as one of the most significant technological forces driving market growth and structural change in the forecast period.

- AI dramatically enhances diagnostic accuracy in radiology and pathology through pattern recognition and deep learning algorithms.

- Accelerated drug discovery and development cycles, reducing R&D costs and time to market for novel therapies.

- Optimization of hospital operations, including patient scheduling, resource allocation, and inventory management, leading to significant cost savings.

- Improved personalized medicine by analyzing genomic data and clinical profiles to tailor treatment regimens precisely.

- Implementation of predictive analytics for early disease detection and risk stratification in chronic care management.

- Enhancement of telehealth services through AI-driven chatbots, triage systems, and remote monitoring analysis.

- Challenges include ensuring data privacy compliance, overcoming model bias, and establishing clear regulatory guidelines for clinical AI applications.

- AI is evolving into a mandatory tool for competitive advantage, necessitating significant investment in cloud infrastructure and data standardization.

DRO & Impact Forces Of Healthcare Market

The dynamics of the Healthcare Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining market trajectory. Key drivers include the escalating prevalence of chronic diseases globally, such as diabetes, cardiovascular conditions, and cancer, necessitating continuous and often complex medical management. Simultaneously, breakthroughs in biotechnological research, coupled with increased government and private sector investment in healthcare infrastructure and R&D, push the boundaries of treatment possibilities. Counteracting these drivers are significant restraints, notably the increasing cost of healthcare services and pharmaceuticals, which place immense financial pressure on both governments and individual consumers, often leading to restricted access. Furthermore, stringent and time-consuming regulatory approval processes for new drugs and devices impede innovation speed, requiring substantial capital investment over long periods before market entry is realized. However, these pressures open doors for key opportunities, particularly the massive potential of digital health technologies, including telemedicine, mobile health (mHealth), and wearable sensors, which offer solutions for cost containment and improved patient accessibility, especially in remote or underserved areas. The convergence of these factors creates powerful impact forces that continually restructure the competitive landscape and investment priorities.

The primary impact force stems from demographic changes: the aging population acts as a persistent, non-cyclical driver, ensuring sustained demand for healthcare services, especially long-term and specialized geriatric care. This driver is counterbalanced by the restraint of fragmented healthcare systems globally, which often lack interoperability between different provider networks and IT platforms, leading to administrative inefficiencies and higher operating costs. The opportunity to standardize data exchange (through initiatives like FHIR) and adopt integrated health models is a major strategic imperative for industry players. Another crucial impact force is the evolving political and economic climate, where shifts in government healthcare policies (e.g., changes in reimbursement rates or drug pricing control measures) can immediately and drastically alter market profitability and investment confidence across regions. Geopolitical stability and supply chain resilience, especially concerning pharmaceutical ingredients and medical device components, are also high-impact variables that require proactive management.

The pursuit of personalized medicine represents a powerful synthesis of opportunities and technological drivers. Advancements in genomics, proteomics, and sophisticated biomarker identification allow for highly targeted therapies, offering unprecedented efficacy. Yet, this specialization often results in higher costs and regulatory complexity, acting as a restraint. Addressing this tension—delivering advanced, personalized care while ensuring affordability and scalability—is the central challenge facing market stakeholders. The strategic focus is shifting toward preventative care and wellness programs, utilizing data analytics to mitigate the progression of chronic diseases before they require expensive acute intervention, leveraging these opportunities to minimize the impact of cost restraints and achieve long-term market sustainability and growth.

- Drivers:

- Global aging population and increased life expectancy, driving demand for chronic disease management.

- Technological breakthroughs in areas such as genomics, robotic surgery, and advanced diagnostics.

- Rising prevalence of chronic and lifestyle diseases globally.

- Increased R&D expenditure by pharmaceutical and medical device companies.

- Restraints:

- High cost of advanced medical treatments and pharmaceuticals, leading to access barriers.

- Stringent regulatory requirements and lengthy approval cycles for new medical products.

- Concerns regarding patient data security and privacy compliance (e.g., GDPR, HIPAA).

- Shortage of skilled healthcare professionals in crucial specialties.

- Opportunity:

- Widespread adoption of digital health solutions, including telehealth, AI, and IoMT for remote patient monitoring.

- Untapped potential in emerging economies due to improving infrastructure and increasing disposable incomes.

- Shift toward preventative care and population health management models.

- Development and commercialization of biosimilars and generics to improve affordability.

- Impact Forces:

- Intense pressure from payers (governments and insurers) to transition to value-based care models.

- Convergence of IT and healthcare, making data analytics and interoperability foundational for success.

- Geopolitical tensions affecting pharmaceutical supply chains and raw material access.

Segmentation Analysis

The Healthcare Market is meticulously segmented across various dimensions, including Product Type, Service Type, End-User, and geographical region, reflecting the diversity and complexity of service provision globally. Segmentation by Product Type typically includes Pharmaceuticals, Medical Devices, and Biomedical/Biotechnology Products, where pharmaceuticals remain the largest revenue generator but medical devices and biologics show superior growth rates due to innovation. Segmentation by Service Type includes Hospitals and Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, and Home Healthcare Services, with the latter experiencing explosive growth driven by cost-efficiency and preference for care outside institutional settings. Analyzing these segments helps stakeholders understand specific market demands, pricing sensitivities, and regulatory requirements that differ significantly across clinical domains and service delivery settings. The strategic analysis of these segments is crucial for allocating R&D capital and developing targeted commercialization strategies to maximize market penetration and profitability in distinct healthcare sectors.

- By Product & Service Type:

- Pharmaceuticals (Branded Drugs, Generics, Over-the-counter Medicines)

- Medical Devices (Diagnostic Imaging, Surgical & Therapeutic Devices, Orthopedics, Patient Monitoring)

- Biotechnology (Biologics, Vaccines, Cell & Gene Therapies)

- Healthcare Services (Inpatient Care, Outpatient Care, Ambulatory Services, Telehealth)

- By Application:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Diabetes Care

- Infectious Diseases

- By End-User:

- Hospitals & Clinics

- Diagnostic Centers

- Research & Academic Institutes

- Home Healthcare Settings

- Pharmaceutical & Biotechnology Companies (as consumers of research services)

Value Chain Analysis For Healthcare Market

The Healthcare Market value chain is a complex, multi-tiered structure beginning with upstream activities focused on innovation and raw material supply, progressing through midstream processing and service delivery, and concluding with downstream activities related to distribution, patient interaction, and utilization. Upstream activities involve extensive research and development (R&D) conducted by pharmaceutical and biotech firms, as well as the manufacturing of high-precision components and active pharmaceutical ingredients (APIs) by specialized suppliers. The quality, stability, and cost of these raw materials critically influence the final product's efficacy and market price. Strategic control over the upstream supply chain is a key competitive differentiator, especially for innovative, complex biological products, which require highly specialized production environments and intellectual property protection.

Midstream activities represent the core service provision and manufacturing processes. This includes the actual production of drugs and devices, complex clinical trials, and, most significantly, the delivery of care through hospitals, clinics, and specialized centers. Payers (governments, private insurers) play a crucial intermediary role here, determining pricing, reimbursement rates, and acceptable treatment protocols, thereby heavily influencing the financial viability of midstream providers. The shift toward integrated delivery networks and Accountable Care Organizations (ACOs) in various markets reflects efforts to streamline this midstream segment, enhancing coordination between different service providers and moving towards holistic, outcome-based care models. Distribution channels link manufacturers and service providers to the ultimate end-user, encompassing wholesale distributors, retail pharmacies, and specialized logistics for cold-chain management.

Downstream analysis focuses heavily on patient accessibility, adherence, and post-market surveillance. Direct channels, such as manufacturer-owned specialty pharmacies or integrated hospital systems, offer greater control over product handling and patient support services, which is critical for high-cost, complex therapies. Indirect channels rely on established networks of independent distributors and retail chains, prioritizing broad geographical reach and convenience. The emergence of digital health platforms and direct-to-consumer telehealth services is rapidly altering the downstream flow, enabling more direct interaction between patients and providers/manufacturers. Effective value chain management, particularly optimizing logistics for perishable or high-value medical supplies and ensuring robust cybersecurity for patient data, is paramount for minimizing operational risk and maximizing patient outcomes across the entire lifecycle, from lab bench to bedside.

Healthcare Market Potential Customers

Potential customers within the Healthcare Market are broadly categorized into Institutional Buyers, Commercial Payers, and Direct Consumers, each having unique purchasing criteria and influence on market demand. Institutional buyers primarily comprise hospitals, large clinic chains, government health departments, and academic research institutions. These entities are volume purchasers of medical devices, bulk pharmaceuticals, and specialized laboratory equipment, and their purchasing decisions are governed by clinical efficacy, total cost of ownership (TCO), interoperability with existing systems (EHRs), and adherence to strict regulatory and procurement standards. Hospitals, as the largest consumers, require end-to-end solutions, ranging from basic supplies to sophisticated surgical robots and complex IT infrastructure for managing patient data securely.

Commercial payers, including private health insurance companies and Managed Care Organizations (MCOs), act as critical intermediaries, determining which products and services are reimbursed and at what price point. Their purchasing criteria are focused less on the physical product and more on demonstrable value, efficacy data, and cost-effectiveness (pharmacoeconomics). They are primary buyers of population health management services and preventative programs aimed at reducing long-term care costs. Finally, individual patients and consumers represent the direct end-user segment, particularly for over-the-counter drugs, wearable health technology, cosmetic procedures, and specialized private medical consultations not fully covered by insurance. This segment’s decisions are heavily influenced by brand trust, convenience, accessibility (especially via telehealth), and out-of-pocket costs, making consumer-facing marketing and user experience increasingly vital components of successful market strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Trillion |

| Market Forecast in 2033 | USD 28.0 Trillion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Pfizer Inc., Roche Holding AG, Novartis AG, Merck & Co., Inc., Abbott Laboratories, Medtronic PLC, UnitedHealth Group, Siemens Healthineers AG, Danaher Corporation, Becton, Dickinson and Company, Boston Scientific Corporation, Stryker Corporation, Baxter International Inc., GE Healthcare, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Cigna Corporation, Anthem, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Healthcare Market Key Technology Landscape

The technological landscape of the Healthcare Market is undergoing radical transformation, moving toward highly integrated, data-driven, and patient-specific solutions. A foundational technology is the robust deployment of Electronic Health Records (EHR) systems, which aim to digitize and centralize patient information, thereby improving coordination and reducing medical errors, though challenges in achieving true interoperability persist. Beyond basic digitalization, the focus has shifted significantly toward sophisticated tools such as Artificial Intelligence (AI) and Machine Learning (ML), which are applied in areas like diagnostic imaging analysis, drug candidate screening, and operational process optimization. Furthermore, the Internet of Medical Things (IoMT), encompassing connected medical devices, wearable sensors, and remote monitoring platforms, is expanding care delivery outside traditional clinical settings, facilitating proactive disease management and real-time data capture. These technologies collectively form the backbone of the rapidly growing digital health ecosystem, promising improved clinical outcomes and efficiency.

Another dominant technological trend is the advancement in precision medicine, heavily reliant on breakthroughs in genomics and genetic sequencing technologies. High-throughput sequencing allows for rapid and cost-effective analysis of individual patient genomes, which directly informs personalized therapeutic decisions, particularly in oncology and rare disease management. Complementing this is the refinement of advanced surgical technologies, notably robotic surgery systems, which offer enhanced precision, reduced invasiveness, and faster patient recovery times, leading to higher surgical volumes and improved patient satisfaction. The integration of 5G networks is also crucial, providing the necessary high-bandwidth, low-latency connectivity required to support real-time data transmission for complex telehealth procedures, remote robotic surgeries, and large-scale AI model deployments, ensuring technological scalability and reliability across diverse geographical areas.

Beyond clinical applications, core infrastructure technologies focusing on security and data integrity are paramount. Blockchain technology is emerging as a potential solution for secure and immutable storage and sharing of medical records, addressing long-standing issues of data fragmentation and ownership, although its adoption remains in nascent stages. Furthermore, the development of biosensors, microfluidics, and point-of-care diagnostics (PoC) is accelerating, enabling rapid testing and diagnosis closer to the patient, particularly vital for managing infectious disease outbreaks and decentralizing routine monitoring. These technological pillars, from data management (EHR, AI) to direct intervention (Robotics, Genomics), are interdependent and drive the competitive advantage for companies that can integrate them effectively into cohesive patient care pathways, defining the next generation of healthcare delivery standards.

Regional Highlights

Geographical market performance varies significantly, dictated by local regulatory environments, government spending priorities, population demographics, and technological readiness. North America, particularly the United States, remains the largest regional market by revenue, characterized by high per capita healthcare expenditure, a strong culture of innovation, and advanced research facilities. The region leads in the adoption of complex medical technologies, specialized pharmaceuticals (especially biologics), and digital health solutions, driven largely by a competitive private insurance-based system that encourages rapid innovation and strategic investment in cutting-edge diagnostics and personalized therapies. High regulatory hurdles (FDA approval) also ensure quality but contribute to high product costs. This dominance is sustained by major global pharmaceutical and medical device headquarters located here, fueling continuous R&D investment.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, fueled by several strong macro trends. Rapid economic development, the expansion of the middle class, improving healthcare infrastructure investments by governments (particularly in China and India), and the increasing awareness of preventative healthcare are driving demand across all segments. While historically characterized by high generic drug consumption, the region is now witnessing substantial growth in advanced medical devices and specialty care services. Government efforts to achieve universal healthcare coverage and tackle prevalent chronic diseases are creating massive market opportunities for accessible and scalable technologies, including telemedicine and localized manufacturing of essential medical supplies. Regulatory harmonization efforts across major APAC economies are also slowly improving market access and predictability for multinational firms.

Europe represents a mature market defined by established universal healthcare systems and a focus on cost-effectiveness and efficiency. Western European nations (Germany, France, UK) prioritize integrated care delivery, emphasizing early diagnosis and preventative strategies to manage costs associated with their large aging populations. The regulatory environment (e.g., European Medicines Agency, MDR/IVDR for devices) is rigorous, ensuring high standards of safety and efficacy. Eastern Europe offers growth potential as these countries upgrade their public health infrastructure and increase expenditure on modern medical technology. Latin America and the Middle East & Africa (MEA) regions present substantial but often volatile opportunities, constrained by uneven distribution of healthcare resources, economic instability, and high reliance on imported medical technology. However, increasing foreign direct investment in MEA health infrastructure and rising oil wealth supporting advanced hospital development in the Gulf Cooperation Council (GCC) countries suggest targeted high-growth pockets are emerging.

- North America: Dominance in R&D, high expenditure, rapid adoption of AI and personalized medicine. High demand for specialty pharmaceuticals and advanced surgical devices.

- Europe: Focus on universal access, cost containment through centralized purchasing, and strong regulatory oversight (MDR compliance). Leading in digital health integration within public systems.

- Asia Pacific (APAC): Highest growth rate, driven by population size, infrastructure investment, and rising middle-class disposable income. Emerging manufacturing hub for medical devices and generics.

- Latin America (LATAM): Growth driven by privatization of healthcare services and increased efforts to combat infectious diseases and improve public health coverage.

- Middle East & Africa (MEA): High investment in advanced hospital facilities (GCC countries), strong potential for medical tourism, but significant disparities in access remain across Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare Market.- Johnson & Johnson

- Pfizer Inc.

- Roche Holding AG

- Novartis AG

- Merck & Co., Inc.

- Abbott Laboratories

- Medtronic PLC

- UnitedHealth Group

- Siemens Healthineers AG

- Danaher Corporation

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Stryker Corporation

- Baxter International Inc.

- GE Healthcare

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Cigna Corporation

- Anthem, Inc.

Frequently Asked Questions

Analyze common user questions about the Healthcare market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Healthcare Market through 2033?

The Healthcare Market is forecast to grow significantly, achieving a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This growth is sustained by the convergence of global demographic shifts (aging population), rapid adoption of digital health technologies, and continuous innovation in biotechnology and specialized pharmaceuticals, pushing the market value to approximately USD 28.0 Trillion by the end of the forecast period.

Which technology is expected to have the most disruptive impact on healthcare delivery?

Artificial Intelligence (AI), particularly machine learning and deep learning, is poised to be the most disruptive technology. AI is revolutionizing drug discovery, significantly improving the speed and accuracy of diagnostic imaging, and optimizing hospital operations through predictive analytics, thereby enabling the shift toward personalized and preventative medicine models.

What are the primary restraints affecting the expansion of the global Healthcare Market?

The primary restraints include the escalating costs of advanced medical treatments and pharmaceuticals, creating affordability and accessibility challenges worldwide. Additionally, stringent and lengthy regulatory approval processes for novel drugs and devices, coupled with growing concerns over patient data privacy and security, inhibit the rapid commercialization and adoption of innovative solutions.

Which geographical region exhibits the fastest growth potential in the healthcare sector?

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This rapid expansion is driven by massive government investments in healthcare infrastructure, increasing disposable incomes, expansion of medical tourism, and a substantial, expanding population base seeking modern medical services.

How is the concept of Value-Based Care (VBC) influencing market strategy for healthcare providers?

VBC models fundamentally shift reimbursement from volume of services to quality of outcomes, compelling providers and manufacturers to invest in solutions that demonstrate superior clinical efficacy and long-term cost savings. This necessitates greater focus on preventative care, care coordination, data interoperability, and the efficient use of resources to maximize patient health per dollar spent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pediatric Healthcare Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smart Healthcare Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Healthcare Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Healthcare Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Medical or Healthcare Scales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager