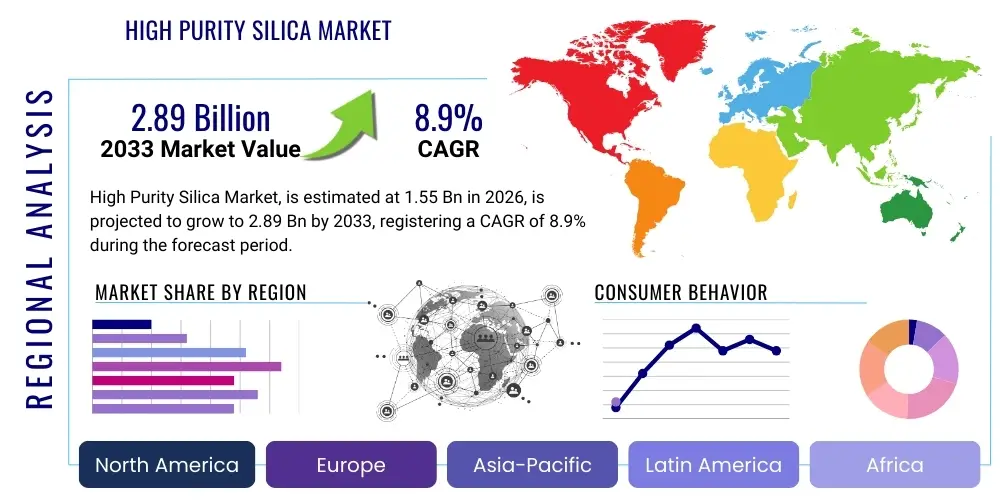

High Purity Silica Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440157 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

High Purity Silica Market Size

The High Purity Silica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.55 billion in 2026 and is projected to reach USD 2.89 billion by the end of the forecast period in 2033.

High Purity Silica Market introduction

High Purity Silica (HPS) represents a specialized segment within the broader silica market, characterized by its exceptionally low impurity levels, often exceeding 99.99% SiO2. This superior purity is critical for its performance in highly sensitive applications where even trace contaminants can significantly compromise product functionality or lifespan. The market for high purity silica is driven by the relentless demand for advanced materials in sectors like electronics, optics, and renewable energy, which necessitate materials with predictable and stable properties under extreme operating conditions. Its unique combination of properties, including excellent thermal stability, chemical inertness, and high electrical insulation, makes it indispensable for numerous high-tech manufacturing processes.

The product itself typically manifests in various forms, including fused silica, synthetic silica, and crystal silica, each tailored to specific application requirements through rigorous processing and purification techniques. Fused silica, for instance, is produced by melting natural quartz or synthetic precursors at extremely high temperatures, followed by controlled cooling to achieve an amorphous structure. This process imparts superior optical transparency, low thermal expansion, and excellent resistance to thermal shock. Synthetic silica, often derived from chemical processes such as the sol-gel method or vapor phase hydrolysis, allows for even greater control over purity and particle morphology, making it ideal for advanced semiconductor and display technologies. The consistent quality and precise specifications of these high purity silica products are paramount, as they form foundational components in complex technological systems.

Major applications of high purity silica span across several critical industries. In the semiconductor sector, it is essential for the fabrication of quartzware, crucibles, and wafers, playing a crucial role in enabling the high-performance integrated circuits that power modern electronics. The solar photovoltaic industry relies on HPS for crucibles used in silicon ingot production and as a material for solar cell coatings, enhancing efficiency and durability. Furthermore, its excellent optical properties make it vital for the production of high-performance optical fibers, lenses, and prisms used in telecommunications, lasers, and scientific instruments. The benefits derived from using high purity silica include enhanced device reliability, improved optical transmission, superior thermal resistance, and extended product lifecycles, all of which contribute significantly to the advancement of technological innovation. Driving factors for this market include the ongoing miniaturization and increasing complexity of electronic devices, the global push for renewable energy sources, and continuous advancements in optical communication technologies, all demanding higher performance and purity from raw materials.

High Purity Silica Market Executive Summary

The High Purity Silica market is experiencing robust growth, primarily fueled by relentless technological advancements across various high-tech sectors. Key business trends indicate a strong emphasis on research and development, particularly in developing novel synthesis methods that can achieve even higher purity levels and custom material properties. There is also a growing trend towards strategic collaborations and partnerships between raw material suppliers and end-product manufacturers to ensure a stable supply chain and co-develop application-specific solutions. Companies are investing heavily in expanding production capacities, especially in regions with burgeoning electronics and solar industries, to meet escalating demand. Furthermore, sustainability and environmental considerations are becoming increasingly important, prompting innovations in more energy-efficient production processes and recycling initiatives for silica-containing waste.

From a regional perspective, Asia Pacific continues to dominate the High Purity Silica market, driven by its expansive manufacturing base for semiconductors, solar cells, and consumer electronics, particularly in countries like China, South Korea, Taiwan, and Japan. This region benefits from significant government support for high-tech industries and a large pool of skilled labor, making it a critical hub for both production and consumption. North America and Europe also represent substantial markets, characterized by strong demand from advanced research institutions, specialized optics manufacturers, and high-value-added semiconductor applications. These regions are leaders in innovation and often demand the highest grades of purity for their cutting-edge technologies, fostering continuous development in material science. Emerging markets in Latin America and the Middle East and Africa are showing nascent growth, driven by investments in telecommunications infrastructure and renewable energy projects, albeit at a smaller scale.

Segmentation trends reveal strong performance across various categories. By type, fused silica and synthetic silica segments are expected to witness significant growth due to their critical roles in semiconductor fabrication and advanced optical components. The increasing complexity and shrinking geometries in semiconductor manufacturing demand superior material properties that only these high-purity forms can provide. In terms of application, the semiconductor and solar photovoltaic sectors remain the primary drivers, with continuous innovation in chip design and solar panel efficiency directly translating into increased demand for HPS. The optics and telecommunications segment is also projected to expand steadily, propelled by the global rollout of 5G networks and the growing need for high-bandwidth communication infrastructure. Purity level requirements are consistently escalating, with demand for 99.999% and even higher grades becoming more prevalent, underscoring the market's trajectory towards ultra-pure materials to meet the exacting standards of future technologies.

AI Impact Analysis on High Purity Silica Market

User questions related to the impact of AI on the High Purity Silica market frequently revolve around how artificial intelligence can enhance material quality, optimize manufacturing processes, predict market demand, and accelerate new product development. Key themes emerging from these inquiries highlight concerns about AI's role in ensuring ultra-high purity levels, automating complex production steps, and mitigating supply chain risks. Users are keen to understand if AI can make HPS production more cost-effective, reduce waste, and improve consistency, particularly given the stringent requirements of end-use applications like semiconductors. There is also significant interest in how AI-driven analytics can provide deeper market insights, forecast price fluctuations, and identify emerging application opportunities, thereby informing strategic business decisions and fostering innovation within the sector.

- AI-driven process optimization: Enhancing efficiency in purification and synthesis, reducing energy consumption and waste.

- Predictive maintenance: Using AI algorithms to monitor equipment performance, preventing costly downtime in HPS production facilities.

- Quality control and inspection: AI-powered vision systems for real-time defect detection and impurity analysis, ensuring ultra-high purity standards.

- Material discovery and design: Accelerating the identification of new HPS formulations with enhanced properties for niche applications.

- Supply chain management: AI algorithms for forecasting demand, optimizing inventory, and mitigating disruptions in raw material sourcing and distribution.

- Automated experimentation: AI-guided robotics in labs to rapidly test and characterize new HPS samples, speeding up R&D cycles.

- Market intelligence and trend analysis: Leveraging AI to analyze vast datasets for market shifts, competitive landscapes, and emerging technological needs in HPS.

DRO & Impact Forces Of High Purity Silica Market

The High Purity Silica market is significantly shaped by a confluence of intricate dynamics, encapsulated by its Drivers, Restraints, Opportunities, and inherent Impact Forces. A primary driver is the burgeoning demand from the semiconductor industry, fueled by the relentless pace of digital transformation, the proliferation of IoT devices, and the increasing complexity of integrated circuits. Each new generation of microprocessors and memory chips requires higher purity and more precisely engineered materials, making HPS an indispensable component. Similarly, the global transition towards renewable energy sources, particularly solar photovoltaics, mandates a steady supply of high purity silica for crucibles and specialized coatings to enhance solar cell efficiency and durability. The expansion of 5G infrastructure and advanced optical communication networks further amplifies demand, as HPS is crucial for manufacturing high-performance optical fibers and lenses that ensure rapid and reliable data transmission. These technological advancements collectively create a robust and sustained growth trajectory for the market, pushing manufacturers to innovate and expand their production capabilities to meet the escalating needs of these critical sectors.

Despite these strong growth drivers, the High Purity Silica market faces notable restraints that can impede its expansion. One of the most significant challenges is the high capital expenditure required for establishing and operating HPS production facilities, given the stringent purity requirements and complex manufacturing processes. This high entry barrier can limit new market entrants and consolidate power among established players. Furthermore, the specialized nature of raw material sourcing and the elaborate purification steps contribute to elevated production costs, which can translate into higher end-product prices and potentially limit broader adoption in cost-sensitive applications. Supply chain vulnerabilities, often exacerbated by geopolitical tensions or unforeseen global events, pose another substantial restraint, leading to potential delays and price volatility. Maintaining consistently ultra-high purity levels also demands sophisticated quality control mechanisms and continuous R&D investments, adding to operational complexities and financial burdens for manufacturers.

Nevertheless, the market is rife with significant opportunities that promise future growth and innovation. The emergence of new high-tech applications, such as quantum computing, advanced lithography, and specialized medical diagnostics, presents new avenues for HPS utilization, demanding materials with even more extreme purity and bespoke properties. Continuous research and development in novel synthesis methods, including more efficient sol-gel processes or advanced vapor deposition techniques, offer the potential to reduce production costs, enhance purity, and enable the creation of new forms of high purity silica with tailored characteristics. Geographical expansion into developing economies, which are increasingly investing in their own electronics and renewable energy infrastructure, offers untapped market potential. The increasing focus on material circularity and sustainable production practices also opens opportunities for developing environmentally friendly HPS manufacturing processes and recycling solutions, which could attract eco-conscious consumers and investors. The impact forces within this market, such as the intense competitive rivalry among a few dominant players, the significant bargaining power of major buyers (e.g., large semiconductor manufacturers), and the high threat of substitutes from alternative advanced materials in specific niche applications, continuously shape market dynamics, driving innovation and strategic positioning among market participants.

Segmentation Analysis

The High Purity Silica market is broadly segmented across several critical dimensions, allowing for a granular understanding of its diverse applications and product forms. These segmentations are crucial for identifying specific market niches, understanding demand drivers within different end-use industries, and facilitating strategic planning for manufacturers. The primary categorizations include segmentation by type of silica, by the myriad applications it serves, by its physical form, and by the crucial purity level required for various technological implementations. Each segment exhibits unique growth characteristics and demand patterns, influenced by factors such as technological advancements, economic trends, and regulatory landscapes in the respective industries. Analyzing these segments provides invaluable insights into market dynamics, competitive landscapes, and future growth opportunities for high purity silica.

- By Type

- Fused Silica

- Synthetic Silica

- Crystal Silica (e.g., Electronic Grade Quartz)

- Colloidal Silica

- Other Types (e.g., Precipitated Silica)

- By Application

- Semiconductors (e.g., Quartzware, Wafers, Etching Chambers)

- Solar Photovoltaics (e.g., Crucibles, Coatings)

- Optics and Telecommunications (e.g., Optical Fibers, Lenses, Prisms)

- Electronics (Non-Semiconductor, e.g., Displays, Insulation)

- Refractories

- Medical and Healthcare

- Chemical and Catalysis

- Aerospace and Defense

- Other Applications

- By Form

- Powder

- Granules

- Ingots/Wafers

- Glass/Components (e.g., Tubes, Rods, Plates)

- Sols/Dispersions

- By Purity Level

- 99.9% - 99.99% SiO2

- 99.99% - 99.999% SiO2

- 99.999% and Above SiO2 (Ultra-High Purity)

Value Chain Analysis For High Purity Silica Market

The value chain for the High Purity Silica market is a complex network of activities that spans from the extraction of raw materials to the final integration into advanced end-user products. The upstream segment of this chain is characterized by the sourcing and initial processing of high-quality natural quartz, often from specialized mines known for their geological purity, or the synthesis of chemical precursors for synthetic silica. This involves mining, crushing, grinding, and initial washing processes to remove gross impurities. For synthetic silica, the upstream activities include the procurement of highly pure silicon-containing compounds, such as silanes or silicon tetrachloride, which serve as the foundational building blocks. Specialized suppliers in this stage are critical, as the purity of the initial raw material significantly impacts the feasibility and cost-effectiveness of subsequent purification steps. Intensive research and development in this initial phase focuses on identifying and accessing purer natural deposits or developing more efficient and environmentally friendly synthetic pathways to ensure a consistent supply of suitable feedstock for high purity applications.

The midstream portion of the value chain is where the rigorous purification and manufacturing of high purity silica products take place. This stage involves sophisticated chemical and physical purification processes, such as acid leaching, thermal treatment, plasma purification, or advanced crystallization techniques, designed to remove even trace amounts of metallic ions and other contaminants to achieve the desired ultra-high purity levels. Following purification, the silica is processed into various forms, including ingots, powders, granules, or specialized components like tubes and crucibles, using advanced manufacturing techniques such as melting, drawing, and precision machining. Quality control is paramount at every step, utilizing highly sensitive analytical instruments to verify purity and ensure adherence to stringent specifications. The efficiency and technological sophistication of these manufacturing operations are key determinants of a company's competitive advantage within the HPS market, as they directly impact product quality, yield, and cost structure.

The downstream segment of the value chain focuses on the distribution, sales, and integration of high purity silica into end-user applications. Distribution channels in this specialized market are typically direct, involving direct sales teams and technical support specialists who work closely with large-scale manufacturers in the semiconductor, solar, and optics industries. This direct engagement allows for tailored solutions and extensive post-sales support, which is critical for complex high-tech applications. Indirect channels, such as specialized distributors or agents, may be utilized for smaller customers or in regions where direct presence is less feasible, often requiring distributors with deep technical knowledge of HPS properties and applications. Ultimately, the high purity silica products are incorporated into final goods, such as microchips, solar panels, optical fibers, and scientific instruments, where their superior performance is leveraged to enable advanced technological capabilities. This entire value chain emphasizes precision, quality control, and close collaboration between suppliers and customers to meet the exacting demands of the high-tech industries that rely on high purity silica.

High Purity Silica Market Potential Customers

The potential customers for High Purity Silica are predominantly sophisticated industrial entities operating within highly specialized technological sectors where material purity and performance are paramount. At the forefront are semiconductor manufacturers, including integrated device manufacturers (IDMs), foundries, and specialized component producers, who rely on HPS for the fabrication of quartzware like crucibles, diffusion tubes, and wafer carriers, as well as for the actual silicon wafers and advanced packaging materials. These customers require HPS with extremely low metallic impurity levels and excellent thermal stability to ensure reliable performance and high yields in their intricate manufacturing processes. The continuous drive towards miniaturization and higher performance in electronic devices makes this segment a perennial and growing consumer of ultra-high purity silica, demanding materials that can withstand increasingly harsh processing environments and contribute to superior chip functionality.

Another major segment of potential customers includes companies in the solar photovoltaic industry, specifically those involved in the production of silicon ingots, wafers, and complete solar panels. High Purity Silica crucibles are essential for melting and crystallizing polysilicon into ingots, a critical step in solar cell manufacturing. The purity of the silica directly impacts the efficiency and lifespan of the resulting solar cells, making it a non-negotiable requirement for manufacturers aiming to produce high-performance and durable solar energy solutions. As global efforts to transition to renewable energy intensify, and with continuous advancements in solar cell technology pushing for higher efficiencies, the demand for consistent and high-quality HPS from this sector is expected to grow significantly. These customers seek reliable suppliers capable of providing large volumes of HPS meeting precise specifications for their energy-efficient production lines.

Beyond semiconductors and solar, the High Purity Silica market caters to a diverse range of other high-tech industries. This includes manufacturers of advanced optical components, such as producers of optical fibers for telecommunications, specialized lenses for cameras, lasers, and scientific instruments, and prisms for spectroscopy. These customers value HPS for its exceptional optical transparency, low refractive index, and minimal thermal expansion, which are critical for precision optics and high-bandwidth data transmission. The medical and healthcare sector also represents a growing customer base, utilizing HPS in laboratory equipment, diagnostic tools, and certain implantable devices where biocompatibility and chemical inertness are essential. Furthermore, companies in aerospace and defense, chemical processing (for catalytic supports or high-temperature applications), and even specialty ceramics also constitute potential customers, each requiring specific grades and forms of high purity silica tailored to their unique functional and environmental demands, highlighting the broad and critical utility of this advanced material across the technological landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 billion |

| Market Forecast in 2033 | USD 2.89 billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus Holding, Shin-Etsu Chemical Co. Ltd., Tosoh SGM, Wacker Chemie AG, Momentive Technologies, Gelest Inc. (Mitsubishi Chemical Group), Cabot Corporation, Evonik Industries AG, Merck KGaA, Dow Inc., AGC Inc., Saint-Gobain S.A., Elkem ASA, Ferro Corporation, KMG Chemicals (Cabot Microelectronics), Nippon Denki Glass Co. Ltd., Corning Inc., Pyromatics Inc., Quartz Scientific Inc., Sumitomo Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Silica Market Key Technology Landscape

The High Purity Silica market is characterized by a sophisticated technological landscape, primarily driven by the intricate processes required for achieving and maintaining ultra-high purity levels, along with methods for tailoring material properties for specific applications. A cornerstone of this landscape involves advanced synthesis technologies. For natural quartz-based HPS, this includes highly refined mineral processing techniques, such as multi-stage beneficiation, acid leaching, and flotation, designed to physically and chemically remove metallic and organic impurities from raw quartz. For synthetic HPS, key technologies include flame hydrolysis (e.g., for producing fumed silica), sol-gel processes that allow for precise control over particle size and morphology, and chemical vapor deposition (CVD) methods, which enable the growth of ultra-pure silica layers or structures with exceptional uniformity. These synthesis routes are continuously evolving, with R&D efforts focused on increasing efficiency, reducing environmental impact, and achieving even higher levels of material control and purity.

Beyond initial synthesis, purification technologies form another critical component of the HPS technological landscape. Achieving purity levels of 99.99% SiO2 and beyond requires highly specialized and often proprietary techniques. These can include vacuum melting to remove volatile impurities, advanced chemical purification methods that selectively leach out specific contaminants, and sophisticated crystallization processes that enhance the structural integrity and purity of the silica lattice. Thermal treatment in controlled atmospheres is also widely employed to eliminate hydroxyl groups and other non-metallic impurities that can degrade performance in optical and electronic applications. The efficacy of these purification steps is often validated by state-of-the-art analytical technologies, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Glow Discharge Mass Spectrometry (GDMS), which can detect impurities at parts-per-billion or even parts-per-trillion levels, ensuring the material meets the exacting standards required by high-tech industries.

Furthermore, the technology landscape encompasses advanced processing and fabrication techniques that transform purified silica into usable components. This includes precision machining for shaping fused silica into complex optical components or semiconductor quartzware, specialized drawing processes for manufacturing optical fibers with specific core-cladding designs, and various thin-film deposition techniques for applying HPS coatings to substrates. Innovations in these areas are focused on improving manufacturing yield, reducing defects, and enabling the creation of intricate designs with micron-level precision. Automation and robotics are increasingly being integrated into HPS production lines to enhance consistency, reduce human contamination, and improve overall operational efficiency. The confluence of these cutting-edge synthesis, purification, and fabrication technologies, supported by rigorous analytical capabilities, defines the sophisticated and continuously evolving technological foundation of the High Purity Silica market, enabling the development of next-generation materials for a wide array of advanced applications.

Regional Highlights

- Asia Pacific: This region stands as the undisputed leader in the High Purity Silica market, primarily driven by its robust and rapidly expanding electronics, semiconductor, and solar photovoltaic manufacturing hubs in countries like China, South Korea, Taiwan, and Japan. The presence of numerous global contract manufacturers and a significant portion of the world's solar panel production capacity fuels an enormous demand for HPS. Investments in advanced manufacturing facilities and strong government support for high-tech industries further solidify its dominant position.

- North America: Characterized by strong innovation and R&D capabilities, North America is a significant market for high-purity silica, particularly for cutting-edge applications in advanced semiconductors, aerospace, defense, and specialized optics. The region benefits from a mature technological infrastructure and a demand for ultra-high purity grades for highly sensitive and performance-critical end-products.

- Europe: Europe represents a substantial market with a focus on high-value applications in specialty optics, precision instrumentation, advanced medical devices, and niche semiconductor segments. Countries like Germany and France are hubs for advanced materials research and development, driving demand for HPS with tailored properties and stringent quality control.

- Latin America: This region is an emerging market for high purity silica, primarily driven by growing investments in telecommunications infrastructure and increasing adoption of renewable energy projects, particularly solar power. While smaller in scale compared to other regions, there is potential for steady growth as industrialization and technological adoption advance.

- Middle East and Africa (MEA): The MEA region is also witnessing nascent demand, largely influenced by infrastructure development projects, investments in solar energy, and expanding telecommunications networks. However, the market here is still in its early stages, with growth potential tied to economic diversification and industrialization initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Silica Market.- Heraeus Holding

- Shin-Etsu Chemical Co. Ltd.

- Tosoh SGM

- Wacker Chemie AG

- Momentive Technologies

- Gelest Inc. (Mitsubishi Chemical Group)

- Cabot Corporation

- Evonik Industries AG

- Merck KGaA

- Dow Inc.

- AGC Inc.

- Saint-Gobain S.A.

- Elkem ASA

- Ferro Corporation

- KMG Chemicals (Cabot Microelectronics)

- Nippon Denki Glass Co. Ltd.

- Corning Inc.

- Pyromatics Inc.

- Quartz Scientific Inc.

- Sumitomo Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Silica market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Silica used for?

High Purity Silica (HPS) is a critical material primarily used in the semiconductor industry for quartzware and wafers, in solar photovoltaics for crucibles and coatings, and in optics and telecommunications for optical fibers and lenses. Its exceptional purity, thermal stability, and optical properties make it indispensable for advanced electronic devices, renewable energy solutions, and high-bandwidth communication infrastructure.

What drives the growth of the High Purity Silica market?

The growth of the High Purity Silica market is principally driven by the burgeoning demand from the semiconductor industry, propelled by increasing miniaturization and complexity of electronic components. Additionally, the global expansion of the solar photovoltaic sector and advancements in optical communication technologies, including 5G network rollouts, are significant drivers, as these industries require materials with superior performance and reliability.

What are the main challenges in the High Purity Silica market?

The primary challenges in the High Purity Silica market include the high capital investment required for establishing and maintaining production facilities, the complex and costly purification processes to achieve ultra-high purity levels, and stringent quality control standards. Supply chain vulnerabilities and fluctuations in raw material costs also pose significant restraints, impacting overall market stability and profitability.

How does AI impact High Purity Silica manufacturing?

Artificial Intelligence (AI) impacts High Purity Silica manufacturing by optimizing production processes, enhancing real-time quality control through advanced defect detection, and facilitating predictive maintenance to minimize downtime. AI also aids in accelerating material discovery and design, forecasting market demand, and improving supply chain efficiency, ultimately leading to more cost-effective and consistent production of ultra-pure materials.

Which region dominates the High Purity Silica market?

Asia Pacific currently dominates the High Purity Silica market. This leadership is attributed to the region's extensive manufacturing base for semiconductors, solar cells, and consumer electronics, particularly in countries like China, South Korea, Taiwan, and Japan. Strong governmental support and continuous investment in high-tech industries further solidify Asia Pacific's prominent position in both HPS production and consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Purity Silica Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Purity Silica Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Purity Silica Powder Market Statistics 2025 Analysis By Application (Solar, Semiconductor, Fiber Optic Communication, Lighting Industry, Optical), By Type (Purity 99.9%, Purity 99.99%, Purity 99.999%, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager