Laser Micromachining Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432051 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Laser Micromachining Market Size

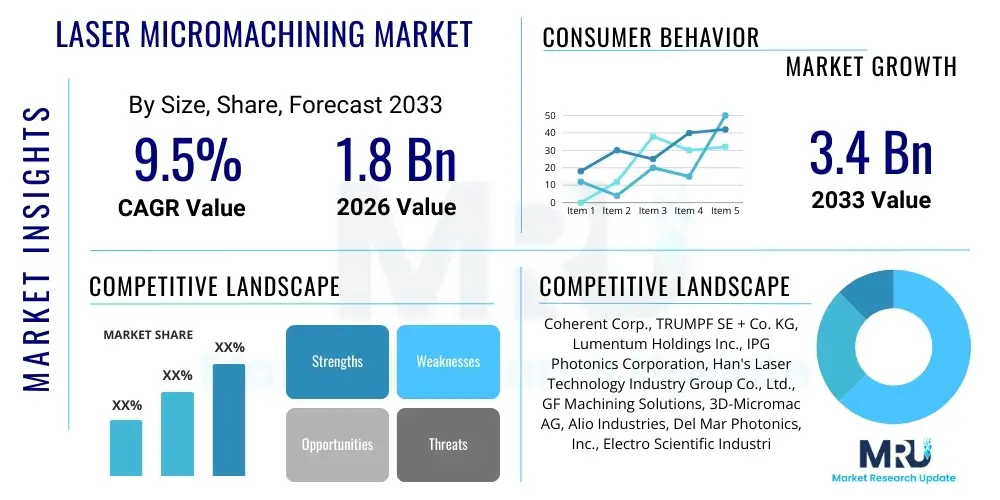

The Laser Micromachining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.4 Billion by the end of the forecast period in 2033.

Laser Micromachining Market introduction

Laser micromachining encompasses highly precise material processing techniques utilized for fabricating minute features, often measured in microns, on various substrates including metals, polymers, glass, and ceramics. This technology employs highly focused laser beams—typically pulsed lasers such as picosecond, femtosecond, or excimer lasers—to remove, modify, or deposit material with minimal thermal damage (Heat Affected Zone or HAZ). The precision offered by laser micromachining is essential for advanced manufacturing processes where feature size, material integrity, and throughput are critical requirements, distinguishing it from traditional mechanical machining methods due to its non-contact nature and ability to handle delicate materials.

Major applications of laser micromachining span across high-tech industries, predominantly including semiconductor manufacturing for wafer dicing and trimming, medical device fabrication (e.g., stent cutting, catheter drilling), and consumer electronics for display structuring and circuit patterning. The inherent benefits of this technology include superior dimensional accuracy, high process repeatability, reduced material waste, and the capability to process extremely hard or brittle materials that are challenging for conventional tools. Furthermore, the speed and flexibility of modern laser systems allow for rapid prototyping and mass production with intricate geometries.

The market is primarily driven by the relentless miniaturization trend across all electronics sectors and the growing demand for complex, high-precision medical implants and instruments. The increasing adoption of advanced packaging techniques in the semiconductor industry, coupled with the shift towards ultra-fast lasers (such as femtosecond lasers) that offer "cold ablation" and superior process quality, significantly accelerates market expansion. Additionally, regulatory demands in the medical sector for highly accurate component fabrication further solidify the critical role of laser micromachining technology.

Laser Micromachining Market Executive Summary

The Laser Micromachining Market is experiencing robust growth driven by the escalating demand for miniaturized components, particularly within the MedTech, semiconductor, and consumer electronics industries. Business trends indicate a strong move toward integrating ultra-short pulse (USP) lasers, such as femtosecond and picosecond systems, which offer enhanced precision and quality by minimizing thermal damage. Key market players are focusing on developing turnkey systems equipped with advanced motion control and automated vision inspection capabilities to improve throughput and process reliability, thereby catering to high-volume manufacturing environments. Strategic partnerships between laser manufacturers and system integrators are becoming prevalent to offer specialized solutions tailored to niche applications, such as micro-drilling of critical aerospace components and complex circuit board repair.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, fueled by massive investments in semiconductor fabrication facilities and the region's prominent position in global electronics manufacturing, particularly in countries like South Korea, Taiwan, and China. North America and Europe maintain strong market shares, focusing on high-value applications in the medical device and aerospace sectors, emphasizing stringent quality control and high-mix, low-volume production requirements. The intense competition among regional hubs dictates that manufacturers continuously innovate to improve system efficiency and accessibility, especially in developing economies where local manufacturing capacity is rapidly increasing.

Segmentation trends highlight the increasing dominance of the USP laser segment due to its unparalleled precision, overtaking traditional nanosecond lasers in critical applications. Furthermore, the application segment related to advanced packaging and micro-drilling is forecast to exhibit the highest CAGR, reflective of the current semiconductor boom and the proliferation of high-density interconnects (HDIs). The medical sector continues to be a cornerstone market, requiring constant refinement in laser processing for biodegradable materials and high-tolerance surgical tools, thus securing specialized laser systems as essential capital expenditure for medical device manufacturers worldwide.

AI Impact Analysis on Laser Micromachining Market

User queries regarding AI's impact on laser micromachining primarily revolve around enhancing process control, predicting maintenance needs, and optimizing throughput without sacrificing micron-level accuracy. Users are keen to understand how AI-driven vision systems can improve defect detection during high-speed processing and how machine learning algorithms can dynamically adjust laser parameters (like fluence, pulse duration, and focus) in real-time to compensate for material variability or machine drift. The underlying concern is moving from empirical, manual parameter setting to data-driven, autonomous manufacturing, ensuring consistent quality and maximizing the lifespan of expensive laser optics and components. Expectations are high for AI to fundamentally transform quality assurance and significantly reduce scrap rates in delicate, high-value component fabrication.

The integration of Artificial Intelligence and Machine Learning (ML) is beginning to revolutionize the operational aspects of laser micromachining. AI is deployed primarily for sophisticated image processing in quality control, enabling rapid, accurate identification of microscopic defects that might be missed by human operators or conventional software. Furthermore, ML algorithms analyze vast datasets generated during the machining process—including power fluctuations, beam quality, and acoustic emissions—to build predictive models for equipment failure, thereby shifting maintenance strategies from reactive to predictive. This proactive approach ensures maximum uptime and reduces the substantial costs associated with unexpected system failures, which is critical given the high capital expenditure involved in advanced laser machinery.

Beyond quality control and maintenance, AI systems are instrumental in process optimization. By employing deep learning techniques, machines can now learn the optimal processing recipes for new materials much faster than traditional trial-and-error methods. This capability is particularly valuable in R&D and rapid prototyping, where optimizing parameters for complex 3D structures or composite materials is often time-consuming. AI-assisted systems accelerate time-to-market for new micro-components by quickly determining the most efficient combination of laser settings, motion profiles, and atmospheric conditions required to achieve the desired microstructure and surface finish, drastically improving overall operational efficiency.

- Enhanced Process Optimization: AI algorithms dynamically adjust laser parameters (pulse energy, repetition rate) in real-time based on material feedback, maximizing ablation efficiency and minimizing thermal damage.

- Predictive Maintenance: Machine learning models analyze sensor data (vibration, temperature, current) to anticipate component wear and schedule maintenance, increasing system uptime and extending the lifespan of optical components.

- Automated Quality Control (AQC): AI-powered vision systems perform ultra-fast, high-resolution inspection of micro-features, significantly improving defect detection rates compared to manual or rule-based systems.

- Recipe Generation and Material Calibration: ML enables faster calibration for new or varying material batches, automatically generating optimized machining recipes, thereby reducing development cycles.

- Increased Throughput and Yield: By minimizing errors and optimizing speeds, AI contributes directly to higher production yields, especially in high-volume semiconductor and medical manufacturing.

DRO & Impact Forces Of Laser Micromachining Market

The Laser Micromachining Market is propelled by substantial technological drivers, particularly the adoption of ultra-short pulse (USP) lasers which enable cold ablation, drastically improving the quality of micro-features. The pervasive trend of miniaturization across consumer electronics and the exponential growth of advanced semiconductor packaging (e.g., 3D integration, fan-out wafer-level packaging) serve as primary market boosters, necessitating processing techniques beyond conventional methods. Furthermore, the rising demand for highly precise and sterile medical implants and drug delivery systems mandates the use of non-contact, high-resolution machining. These powerful drivers are tempered by significant restraints, including the substantial initial investment required for high-end USP laser systems and the complexity associated with integrating and maintaining these sophisticated machines, which requires highly specialized technical expertise. Additionally, the limited throughput compared to bulk mechanical processes can be a constraining factor in very large-scale, low-tolerance industrial applications.

Opportunities for market growth are abundant, primarily rooted in the exploration of new materials processing, such as advanced composites, ceramics, and bioresorbable polymers used in the aerospace and medical industries. The emerging electric vehicle (EV) sector offers a lucrative pathway, specifically in battery manufacturing for intricate cell structuring and conductive material processing where laser precision is paramount for efficiency and safety. Further, the increasing governmental focus on domestic semiconductor manufacturing and advanced technology adoption, often backed by substantial subsidies and R&D funding, creates significant potential for market penetration and specialization. Developing more user-friendly, modular laser systems that reduce the required operator skill level represents a critical area for expansion into mid-tier manufacturing facilities.

The interplay of these factors creates significant impact forces shaping the competitive landscape. The high capital expenditure associated with USP technology drives consolidation, favoring larger companies capable of sustained R&D investment and global service network support. The pressure to achieve zero-defect quality in sectors like MedTech and aerospace mandates the constant technological advancement of laser sources and integrated monitoring systems, making process control a critical impact force. Ultimately, the market trajectory is heavily influenced by the speed at which cost-effective, high-power USP laser sources become accessible to a broader manufacturing base, balancing precision requirements with industrial throughput demands.

Segmentation Analysis

The Laser Micromachining Market is intricately segmented based on technology type, process, application, and end-use industry, reflecting the diverse and specialized requirements of advanced manufacturing worldwide. The segmentation by technology highlights the shift towards picosecond and femtosecond lasers, which offer superior results in terms of material quality and feature accuracy, though nanosecond lasers remain dominant in cost-sensitive, high-volume general machining. Process segmentation differentiates between subtractive methods like drilling and ablation, and additive/modifying methods such as laser-induced forward transfer (LIFT) or surface texturing, each serving unique functional requirements for components.

Application segmentation illustrates the varied utility of the technology, encompassing critical processes like semiconductor wafer dicing, micro-fluidic channel fabrication, and precision cutting of medical stents. The semiconductor and medical sectors are the primary revenue generators, driven by stringent quality standards and the necessity for extreme miniaturization. Analyzing these segments is essential for market participants seeking to align product development with the most rapidly growing industrial demands and technological shifts, ensuring strategic resource allocation toward high-growth, high-margin opportunities like advanced packaging applications.

- By Laser Type:

- Excimer Lasers

- Diode-Pumped Solid-State (DPSS) Lasers

- Fiber Lasers

- Picosecond Lasers (Ultra-Short Pulse - USP)

- Femtosecond Lasers (Ultra-Short Pulse - USP)

- By Process:

- Laser Ablation

- Laser Drilling (Micro-vias, High Aspect Ratio Holes)

- Laser Cutting

- Laser Etching/Scribing

- Laser Thin-Film Removal

- Laser Surface Texturing

- By Application:

- Precision Micro-Drilling

- Wafer Dicing and Trimming

- Micro-welding and Soldering

- Surface Structuring and Marking

- Medical Stent Cutting and Fabrication

- By End-Use Industry:

- Semiconductors & Electronics

- Medical & Life Sciences (MedTech)

- Automotive

- Aerospace & Defense

- Photovoltaics (Solar)

- Watchmaking & Jewelry

Value Chain Analysis For Laser Micromachining Market

The value chain for the Laser Micromachining Market commences with upstream analysis, involving critical component suppliers. This segment includes manufacturers of laser sources (e.g., diode manufacturers, crystal suppliers for DPSS systems, and fiber suppliers), advanced beam delivery optics (lenses, mirrors, scanners), and precision motion control systems (high-resolution stages, galvanometers). The competitiveness at this stage is dictated by technological superiority and cost-efficiency in producing high-power, high-stability components, particularly ultra-fast pulse lasers which require specialized manufacturing processes. Strategic control over proprietary laser architecture is a key competitive advantage for upstream vendors.

Mid-chain activities focus on system integration and manufacturing, where raw components are assembled into complete laser micromachining workstations. System integrators customize these machines based on specific end-user application needs (e.g., cleanroom compatibility for semiconductors or specialized fixtures for medical devices). This stage involves complex software development for process control, vision systems, and automation interfaces. Distribution channels are varied: direct sales teams handle large, complex capital equipment deals, ensuring direct interaction with high-volume end-users, while indirect channels, utilizing regional distributors and local agents, are crucial for market penetration in geographically diverse areas and for servicing smaller enterprises.

The downstream analysis involves the end-user application segments—semiconductors, medical devices, and aerospace—which drive demand for the technology. The successful integration of laser systems at this stage requires extensive post-sale support, training, and application engineering consultation, ensuring the equipment meets stringent manufacturing tolerances and regulatory requirements (especially in MedTech). The value derived downstream is significant, as the use of micromachining enables the production of high-value, previously unattainable components, reinforcing the necessity for reliable service and long-term partnership between the system supplier and the manufacturing client.

Laser Micromachining Market Potential Customers

The primary potential customers for laser micromachining technology are established and emerging manufacturers operating in industries requiring sub-micron precision and high material processing flexibility. End-users in the semiconductor and electronics sectors, including large-scale wafer fabricators (Fabs), outsourced semiconductor assembly and test (OSAT) providers, and advanced packaging companies, are critical buyers. These entities utilize micromachining for micro-via drilling in advanced printed circuit boards, trimming thin film resistors, and precision singulation of delicate chips, necessitating ultra-fast lasers to maintain silicon integrity and throughput for high-density interconnects.

The medical device industry represents another cornerstone customer base, driven by the continuous innovation in minimally invasive procedures. Manufacturers of stents (both metallic and bioresorbable polymers), catheters, neurovascular devices, and intricate surgical instruments rely heavily on laser micromachining for non-contact, high-precision cutting and drilling. The ability of USP lasers to process complex geometries on temperature-sensitive materials without generating debris or thermal stress makes this technology indispensable for meeting strict regulatory and biocompatibility requirements for implantable devices.

Furthermore, the automotive and aerospace industries are rapidly increasing their adoption of laser micromachining for high-performance applications. Automotive manufacturers use it for precision etching of fuel injector nozzles and processing sensors required for advanced driver-assistance systems (ADAS). In aerospace and defense, potential customers include component suppliers utilizing the technology for intricate drilling of cooling holes in turbine blades using specialized laser drilling techniques, and for manufacturing high-precision sensors and micro-electromechanical systems (MEMS) components where reliability under extreme conditions is non-negotiable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coherent Corp., TRUMPF SE + Co. KG, Lumentum Holdings Inc., IPG Photonics Corporation, Han's Laser Technology Industry Group Co., Ltd., GF Machining Solutions, 3D-Micromac AG, Alio Industries, Del Mar Photonics, Inc., Electro Scientific Industries (ESI, now part of MKS Instruments), Toptica Photonics AG, Fotonica, Inc., Novanta Inc. (Cambridge Technology), Amplitude Laser Group, Oxford Lasers Ltd., Optec Group, Resonetics, Lasertec Corporation, Micronic Laser Systems AB, Lumen Dynamics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Micromachining Market Key Technology Landscape

The technological landscape of the laser micromachining market is currently dominated by the shift toward Ultra-Short Pulse (USP) lasers, specifically picosecond (ps) and femtosecond (fs) laser systems. These lasers operate with pulse durations in the range of 10-12 to 10-15 seconds, fundamentally changing the interaction mechanism between the laser light and the material. Unlike nanosecond lasers, which rely on thermal vaporization, USP lasers induce non-linear absorption, leading to "cold ablation." This process minimizes the Heat Affected Zone (HAZ), prevents micro-cracking, and achieves superior edge quality and dimensional accuracy, making them indispensable for processing heat-sensitive, brittle, or multi-layered materials critical in semiconductor and medical applications.

Another crucial technological advancement involves beam delivery systems and sophisticated optics. High-speed scanning galvanometer systems coupled with customized focusing optics (like telecentric lenses) enable high-speed processing while maintaining spot size consistency across the entire work area. Parallel processing techniques, utilizing diffractive optical elements (DOEs) or spatial light modulators (SLMs), are emerging to split a single laser beam into multiple micro-beams. This approach significantly boosts throughput for applications such as high-volume micro-drilling or large-area surface texturing, addressing the constraint of limited throughput often associated with single-beam, high-precision laser processing methods.

Furthermore, the integration of advanced control systems, including real-time monitoring through in-situ sensors and high-resolution cameras, is standard across modern machining platforms. These systems employ sophisticated algorithms to monitor beam characteristics, material removal rates, and plume dynamics, allowing for immediate process correction. The convergence of these powerful laser sources, precision beam steering, and intelligent process control forms the backbone of the next generation of industrial micromachining equipment, ensuring the high levels of precision and repeatability demanded by the most advanced manufacturing sectors globally.

Regional Highlights

Regional dynamics are critical to understanding the distribution and growth potential of the Laser Micromachining Market, with significant variances in demand drivers, regulatory environments, and technological adoption rates across continents.

- Asia Pacific (APAC): APAC is the global leader and fastest-growing region, primarily driven by its massive installed base in consumer electronics manufacturing, particularly in China, Japan, South Korea, and Taiwan. These economies are heavily invested in semiconductor production, requiring extensive laser processing for advanced packaging, wafer dicing, and display manufacturing (OLED/Micro-LED structuring). Government initiatives supporting domestic high-tech manufacturing, coupled with the presence of major electronics OEMs, ensures sustained high demand for high-throughput, automated laser systems. The shift from traditional nanosecond lasers to USP technology is accelerating rapidly in this region to maintain competitive advantage in precision manufacturing.

- North America: North America holds a substantial market share, focused predominantly on high-value, stringent-tolerance applications in the medical device, aerospace, and defense sectors. The region's robust research and development ecosystem drives innovation, particularly in developing next-generation USP sources and specialized systems for micro-fluidics and bio-photonics. Demand here is characterized by a need for customized, highly flexible laser processing stations capable of high-mix, low-volume production, adhering strictly to FDA and aerospace quality standards. Investments are driven by technological performance rather than sheer unit cost reduction.

- Europe: Europe is a mature market characterized by strong manufacturing bases in Germany (machine tools, automotive), Switzerland (watchmaking, high-precision engineering), and Ireland (medical devices). The market exhibits strong demand for highly reliable, industrial-grade systems, emphasizing energy efficiency and integration with automated production lines. European players are leaders in advanced laser source development (e.g., fiber and picosecond lasers). The automotive sector’s pivot toward electric mobility and the stringent quality demands of European MedTech manufacturers are key factors sustaining market stability and technological advancement in this region.

- Latin America (LATAM): The LATAM market is emerging, driven mainly by localized automotive manufacturing and electronics assembly in countries like Brazil and Mexico. Adoption rates are slower compared to APAC or North America, typically relying on more cost-effective, established laser technologies (nanosecond and excimer). Growth potential lies in the increasing establishment of regional medical component manufacturing facilities and foreign direct investment in high-tech industrial parks, pushing the gradual need for advanced micromachining capabilities.

- Middle East and Africa (MEA): MEA represents the smallest segment, with demand concentrated primarily in high-value oil & gas related instrumentation, defense applications, and early-stage medical device manufacturing initiatives, particularly in the UAE and Saudi Arabia. Market growth is sporadic and dependent on large-scale governmental or private industrialization projects aimed at diversifying the economy away from traditional energy sectors. The region often relies on imported turnkey systems from European and Asian suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Micromachining Market.- Coherent Corp.

- TRUMPF SE + Co. KG

- Lumentum Holdings Inc.

- IPG Photonics Corporation

- Han's Laser Technology Industry Group Co., Ltd.

- GF Machining Solutions

- 3D-Micromac AG

- MKS Instruments (Electro Scientific Industries - ESI)

- Toptica Photonics AG

- Amplitude Laser Group

- Novanta Inc. (Cambridge Technology)

- Sintec Optronics Pte Ltd.

- Resonetics

- LISA Laser Products GmbH

- Oxford Lasers Ltd.

- Lumera Laser GmbH

- Micronic Laser Systems AB

- Spectra-Physics (MKS Instruments)

- Focuslight Technologies Inc.

- Aptos Inc.

Frequently Asked Questions

Analyze common user questions about the Laser Micromachining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of femtosecond lasers in micromachining?

Femtosecond lasers offer "cold ablation," which minimizes the Heat Affected Zone (HAZ) by delivering energy faster than the material can disperse heat. This precision allows for the processing of sensitive, brittle materials like glass, ceramics, and advanced polymers with superior edge quality and virtually no micro-cracking, crucial for semiconductor and medical component fabrication.

Which end-use industry is currently the largest consumer of laser micromachining technology?

The Semiconductors and Electronics industry is the largest consumer. Demand is driven by the perpetual trend of component miniaturization, necessitating ultra-precise processes like wafer dicing, micro-via drilling for High-Density Interconnects (HDI), and advanced packaging techniques where micron-level accuracy is mandatory for functionality and reliability.

How does laser micromachining differ from traditional mechanical machining at the micro-scale?

Laser micromachining is a non-contact process, meaning there is no tool wear, no mechanical stress introduced to the material, and significantly higher flexibility in processing complex 3D geometries or fragile substrates. Traditional methods face limitations in achieving sub-10-micron features and often induce higher thermal or mechanical damage.

What are the key financial restraints affecting the adoption rate of advanced micromachining systems?

The main restraint is the substantial initial capital expenditure (CapEx) required for acquiring high-power, ultra-short pulse (USP) laser sources and integrated automated workstations. This high cost, coupled with the need for specialized personnel for operation and maintenance, can limit adoption, particularly among small and medium-sized enterprises (SMEs).

Which geographical region is projected to experience the highest growth rate (CAGR) in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR. This rapid expansion is attributed to large-scale government investments in domestic semiconductor fabrication, the region’s dominance in global consumer electronics manufacturing, and the quick adoption of next-generation laser processing techniques to meet intense market competition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Micromachining Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Multi-access Laser Micromachining Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Multi-access Laser Micromachining Market Size Report By Type (CO2 Laser Micromachining, IR Laser Micromachining, Green Laser Micromachining, UV Laser Micromachining, Others), By Application (Automotive, Electronic Industry, Hospitals, R & D Centers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Laser Micromachining System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (IR Laser Micromachining, CO2 Laser Micromachining, Green Laser Micromachining, UV Laser Micromachining, Others), By Application (Semiconductor, FPD, Medical, Vehicle, Optical sectors, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager