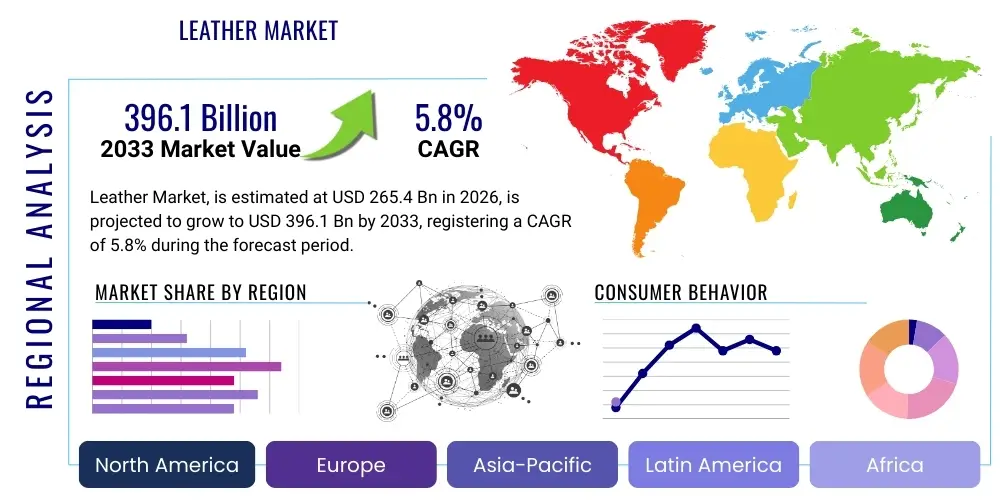

Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438534 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Leather Market Size

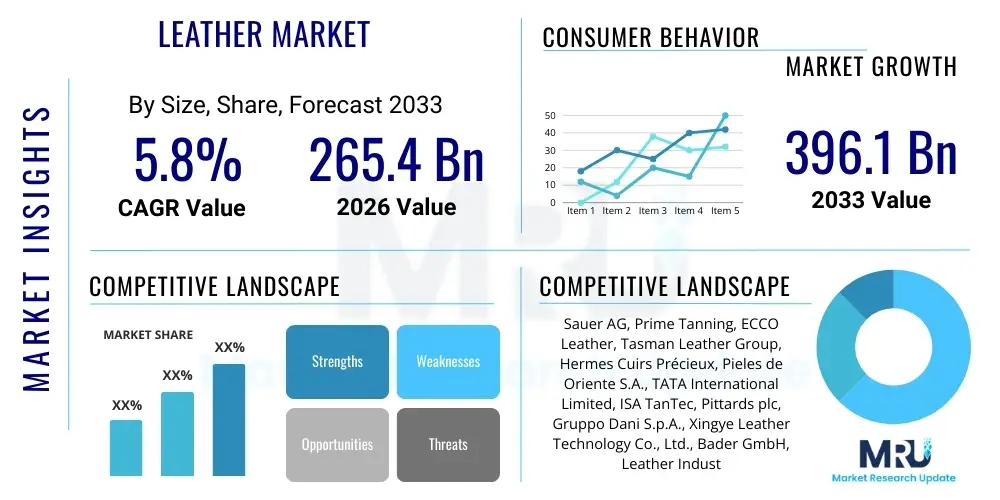

The Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $265.4 Billion in 2026 and is projected to reach $396.1 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by robust demand across major end-use industries, particularly footwear, apparel, and automotive interiors, coupled with rising disposable incomes in emerging economies that fuel luxury goods consumption.

Leather Market introduction

The Leather Market encompasses the entire global supply chain involved in the production, processing, and distribution of leather and finished leather goods. Leather, a natural, durable, and flexible material created by tanning animal hides and skins, is a cornerstone material for various industries due to its unique aesthetic properties, longevity, and resistance to wear. Key raw materials primarily include cattle hide, sheep skin, and goat skin, sourced globally from the meat industry, positioning leather production as a vital component of the circular economy, utilizing by-products that would otherwise be waste. The complex production process involves preparation, tanning, and finishing stages, with tanning being the critical chemical process that stabilizes the collagen structure of the hide, preventing decay and enhancing physical properties.

Major applications of leather span several high-value sectors, notably the footwear industry (dress shoes, boots, and athletic footwear), the apparel industry (jackets, gloves, and accessories), and the automotive sector, where high-grade leather is used extensively for seating, dashboards, and interior trim, offering superior comfort and luxury aesthetics. Furthermore, the market benefits from significant utilization in producing various consumer goods such as handbags, wallets, belts, and furniture upholstery. The inherent benefits of leather—including breathability, high tensile strength, elasticity, and a tactile sensation that improves with age—sustain its premium positioning against synthetic alternatives, particularly in luxury segments. The enduring consumer preference for authentic, high-quality materials ensures consistent demand across mature and developing economies.

Driving factors for market growth include the globalization of fashion and luxury trends, rapid urbanization, and increasing per capita expenditure on accessories and premium vehicles across Asia Pacific and Latin America. However, the market faces increasing pressure from environmental and ethical concerns related to traditional tanning processes, pushing manufacturers towards sustainable practices such as chrome-free tanning, vegetable tanning, and developing innovative bio-based leathers. Technological advancements in finishing treatments are also enhancing leather’s performance characteristics, making it resistant to water, stains, and UV light, thereby broadening its application scope and maintaining its competitive edge in a material-intensive global economy.

Leather Market Executive Summary

The global leather market is characterized by shifting business trends leaning heavily toward sustainability and ethical sourcing, driven by stringent consumer demand and regulatory pressures, particularly in Europe and North America. Key business trends involve significant investments in green chemistry for tanning and enhanced traceability systems, often utilizing blockchain technology, to verify the ethical origin of raw hides and the environmental compliance of processing facilities. Regional trends highlight the sustained dominance of the Asia Pacific (APAC) region, which acts as the largest manufacturing hub for leather goods, leveraging cost advantages and massive consumer bases, especially in countries like China and India. Conversely, Europe maintains its strong position in the high-end, luxury leather goods segment, focusing on quality, craftsmanship, and brand heritage. The regional dynamics show a clear bifurcation between high-volume production in the East and high-value brand positioning in the West.

Segmentation trends reveal robust growth in the automotive leather segment, spurred by the increasing penetration of luxury vehicles and the preference for premium interiors globally. While the footwear segment remains the largest volume consumer, the rise of athleisure and sustainable footwear options is compelling traditional leather manufacturers to innovate with lighter, performance-oriented materials and finishes suitable for modern shoe designs. Furthermore, the market is witnessing a polarization of product type demand, with heavy-weight leather maintaining demand in upholstery and automotive sectors, while light-weight leather is expanding its share in fashion apparel and premium accessories, where pliability and texture are paramount. This segmentation movement underscores the need for versatility in manufacturing capabilities and specialized product development to meet diverse industrial requirements.

In summary, the market's trajectory is one of cautious, yet steady expansion, where traditional processes are rapidly being challenged and supplemented by technological advancements focused on reducing ecological footprint and improving efficiency. The competitive landscape is intensely fragmented, necessitating strategic alliances between raw hide suppliers, tanners, and end-product manufacturers to secure stable supply chains and maintain quality control. Successful navigation of the forecast period hinges upon mastering sustainable supply chain practices and agilely responding to evolving consumer preferences that increasingly prioritize ethical production and environmental stewardship alongside quality and durability. Pricing volatility of raw materials, linked to the global meat production cycle, remains a critical factor influencing profitability across all market segments.

AI Impact Analysis on Leather Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Leather Market primarily revolve around optimizing resource utilization, enhancing quality control consistency, and accelerating design-to-market cycles. Common user questions seek to understand how AI can solve critical supply chain issues, such as predicting raw hide quality variations, automating complex grading processes previously reliant on skilled human inspectors, and minimizing chemical usage in tanning through predictive modeling. Users are keen on AI’s role in improving sustainability metrics, specifically reducing water consumption and waste generation by optimizing dyeing and finishing recipes. The key themes summarized from user concerns focus on AI implementation costs, data infrastructure requirements for sophisticated machine learning models, and the displacement of manual labor in highly specialized, traditional tanning and finishing roles. Expectations are high regarding AI’s ability to unlock new efficiencies, enhance traceability through sensor data analysis, and facilitate highly personalized product customization, thereby offering a significant competitive advantage to early adopters in the luxury goods sector.

- AI-driven Quality Control: Utilization of computer vision systems and machine learning algorithms to automatically detect defects (scars, scratches, insect bites) on raw hides, ensuring consistent grading and reducing material wastage.

- Predictive Tanning Optimization: AI models analyze historical data, chemical batch specifications, and real-time process parameters to predict optimal chemical concentrations and process timings, leading to minimized resource consumption (water, chemicals) and energy savings.

- Supply Chain Traceability Enhancement: Implementation of AI to process data from RFID tags, sensors, and blockchain entries, verifying the ethical sourcing and movement of hides from farm to finished product.

- Automated Cutting and Nesting: Advanced algorithms optimize leather utilization during the cutting stage by calculating the most efficient placement (nesting) of pattern pieces on uneven hide surfaces, maximizing yield and reducing scrap material.

- Trend Forecasting and Design Acceleration: AI analyzes consumer data, social media trends, and runway movements to predict demand for specific colors, textures, and leather finishes, aiding designers in accelerated product development cycles.

- Predictive Maintenance: Deployment of AI to monitor the condition of heavy machinery (drum mixers, drying tunnels) in tanneries, predicting equipment failure before it occurs, thereby reducing costly downtime and maintenance expenses.

DRO & Impact Forces Of Leather Market

The dynamics of the Leather Market are shaped by a complex interplay of internal growth drivers (D), external constraints (R), future opportunities (O), and pervasive impact forces. The primary drivers include the consistent growth in demand for footwear and luxury accessories, fueled by rising global affluence and rapid urbanization, particularly across Asian markets. Consumer preference for natural, durable materials over synthetics, especially in high-end automotive and furniture upholstery, sustains premium pricing and market value. Conversely, significant restraints include increasingly stringent global environmental regulations concerning wastewater treatment and chemical usage (e.g., REACH regulations in Europe), high costs associated with compliance and transitioning to sustainable tanning methods, and vocal activism from animal welfare and vegan movements, which promote non-animal-based alternatives. These restraints necessitate substantial R&D expenditure and operational restructuring, often slowing down traditional manufacturers.

Opportunities in the market primarily reside in technological innovation, specifically the commercial scaling of bio-based or "lab-grown" leather alternatives that mimic the properties of genuine leather without the environmental and ethical baggage associated with animal sourcing. Furthermore, market players can leverage digital transformation to enhance transparency, implementing blockchain-enabled supply chains to guarantee ethical sourcing and consumer confidence. Developing high-performance, functionally enhanced leather (e.g., lightweight, water-resistant, antimicrobial) for specialized sports and technical apparel also presents a viable avenue for premium market penetration. The continuous evolution of finishing technologies allows manufacturers to rejuvenate and repurpose lower-grade hides, expanding the usable material pool and reducing waste, thus contributing to both sustainability and cost management goals.

Impact forces, based on Porter's Five Forces analysis, significantly influence market structure and profitability. The Bargaining Power of Suppliers (raw hide providers) is moderately high, as hide availability is directly dependent on the meat industry cycle, leading to supply fluctuations and price volatility. The Bargaining Power of Buyers (major footwear and automotive manufacturers) is substantial due to the availability of substitute materials and high-volume purchasing capabilities, compelling tanneries to maintain competitive pricing and high quality. The Threat of Substitutes is elevated due to the proliferation and improved performance of synthetic and bio-engineered materials (e.g., Pinatex, Mycelium-based leather), which increasingly offer competitive aesthetics and better sustainability profiles. Finally, the Intensity of Competitive Rivalry is high, driven by market fragmentation, capacity oversupply in some tanning regions, and the need for constant innovation to differentiate products, requiring continuous investment to maintain relevance.

Segmentation Analysis

The Leather Market segmentation provides a crucial framework for understanding the diverse demands and supply characteristics across the global industry. The market is primarily segmented based on Type (determining weight and end application), Process (reflecting the chemical or vegetable tanning method used), and End-Use Industry (identifying major consuming sectors). The Type segmentation categorizes leather into bovine, sheep, goat, and others (exotic hides), with bovine leather dominating the volume due to its widespread availability and versatility in producing heavy-weight products like automotive upholstery and shoe soles, while sheep and goat skin cater primarily to apparel and gloves due to their fine grain and pliability. Process segmentation distinguishes between chromium-tanned leather, which offers speed and superior water resistance, and chrome-free alternatives such as vegetable-tanned leather, gaining traction due to its ecological credentials, despite its longer processing time and higher costs.

Analyzing the End-Use segmentation reveals that the Footwear industry consistently holds the largest market share globally, driven by continuous consumer demand for both formal and casual shoes, where leather provides essential durability and comfort. However, the fastest growth is often observed in the Automotive segment, fueled by rising production of luxury vehicles worldwide and the consumer expectation of premium, long-lasting interior materials. This segment demands specialized leather finishes with high resistance to abrasion, temperature fluctuations, and UV light exposure. The Apparel and Accessories segments, while highly volatile and driven by fashion cycles, maintain a high-value contribution, especially in high-end luxury goods where brand positioning is heavily reliant on the material's perceived quality and ethical provenance.

Geographically, market segmentation is equally critical, dividing the market into major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. APAC not only dominates in manufacturing capacity but also represents a rapidly growing consumer base, shifting the focus from purely export-oriented production to meeting domestic demand. Europe remains the epicenter of quality leather goods and technology innovation, setting global standards for luxury and sustainability. Understanding these granular segmentations allows manufacturers to tailor their production capabilities, optimize their supply chains, and focus their marketing efforts on the most lucrative and high-growth niches, ensuring effective capital deployment and risk mitigation against market volatility.

- By Type:

- Bovine Leather (Cattle Hide)

- Sheep Leather

- Goat Leather

- Others (Equine, Pigskin, Exotic Skins)

- By Process:

- Chrome Tanning

- Vegetable Tanning

- Aldehyde Tanning (Wet White)

- Other Tanning Methods

- By End-Use Industry:

- Footwear (Largest segment)

- Apparel & Garments

- Automotive Upholstery (Fastest-growing segment)

- Furniture & Upholstery

- Accessories & Leather Goods (Handbags, Wallets, Belts)

Value Chain Analysis For Leather Market

The Leather Market value chain begins with the upstream segment, centered on raw material acquisition. This stage involves the slaughterhouses and meat processing facilities, which supply the crucial raw hides and skins (a byproduct). Efficiency in this stage is vital, as the quality of the raw hide, including proper preservation (salting or chilling) immediately after flaying, directly impacts the final leather grade and yield. Key upstream participants include large-scale meat producers and hide traders/brokers. Chemical suppliers, providing crucial tanning agents (e.g., chromium salts, vegetable tannins), dyes, and finishing chemicals, also form a critical part of the upstream segment. The cost and sustainability profiles of these chemicals heavily influence the overall environmental footprint and final product cost, making supplier relationships strategic.

The midstream phase is where the core value addition occurs, encompassing the preparatory stages (soaking, liming, fleshing) and the subsequent tanning process (converting putrescible hide into stable leather). Tanners and leather processors utilize specialized machinery and chemistry to produce intermediate products such as wet blue, wet white, or crust leather, which are then further processed through dyeing, drying, and finishing operations. Distribution channels play a critical role downstream; indirect channels, such as wholesale distributors, agents, and specialized leather merchants, handle bulk sales of finished leather to end-product manufacturers (e.g., a footwear company). These indirect intermediaries manage inventory, logistics, and quality assurance checks, particularly important for cross-border trade.

The final downstream stage involves the production of finished consumer goods and their ultimate sale. Direct distribution channels include tanneries or leather product manufacturers selling directly to consumers through owned retail stores (B2C) or dedicated e-commerce platforms. This direct route offers higher margin control and immediate consumer feedback but requires significant investment in brand building and retail infrastructure. Conversely, sales to major global brands, automotive original equipment manufacturers (OEMs), and furniture makers constitute large B2B transactions. The value chain is intrinsically linked to global regulations and sustainability standards, requiring continuous monitoring and compliance at every stage, from ethical sourcing of raw hides to responsible wastewater discharge by the tanneries, ensuring the longevity and legitimacy of the final leather product in the eyes of the discerning global consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $265.4 Billion |

| Market Forecast in 2033 | $396.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sauer AG, Prime Tanning, ECCO Leather, Tasman Leather Group, Hermes Cuirs Précieux, Pieles de Oriente S.A., TATA International Limited, ISA TanTec, Pittards plc, Gruppo Dani S.p.A., Xingye Leather Technology Co., Ltd., Bader GmbH, Leather Industries of America (LIA), Pavoni S.p.A., Wolverine Worldwide, Sadesa, General Leather, Rino Mastrotto Group, Heller-Leder GmbH, and Jinjiang Xinfeng Leather Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather Market Key Technology Landscape

The contemporary Leather Market is rapidly integrating advanced technologies to address long-standing challenges related to environmental impact, efficiency, and material consistency. A primary focus is on sustainable tanning technologies. Chrome-free tanning, particularly wet white processing using glutaraldehyde or synthetic polymers, is gaining traction as it produces non-toxic effluent and allows for easier disposal and recycling of tannery waste compared to traditional chrome tanning. Furthermore, intensive research is dedicated to optimizing vegetable tanning processes by reducing processing time and enhancing the final material properties, often through the use of bio-based agents and enzyme technology, making this ancient method more commercially viable for modern industrial scale. These innovations are critical for market players aiming to meet evolving B2B customer sustainability mandates.

Digitalization and automation constitute another pivotal technological shift. Automated machinery, utilizing sophisticated robotics and sensor technology, is increasingly employed in tasks such as fleshing, shaving, and spray finishing, ensuring greater precision, reduced human error, and enhanced consistency across large batches. Moreover, the implementation of 3D scanning and sophisticated computerized numerical control (CNC) cutting tables, integrated with AI-driven nesting software, maximizes the yield from each hide by optimally arranging patterns, minimizing waste, which is crucial given the costliness and natural variation of the raw material. These automated systems significantly improve operational efficiency and address the labor shortage often faced by tanneries in mature markets.

Lastly, advanced finishing technologies are crucial for dictating the final look, feel, and performance of the leather. These include specialized coatings for enhancing abrasion resistance, waterproofing, and UV stabilization, particularly important for automotive and outdoor applications. The development of intelligent finishing, often involving nano-technologies, allows manufacturers to imbue leather with antimicrobial properties or self-cleaning capabilities. Furthermore, traceability technology, leveraging Internet of Things (IoT) devices and blockchain platforms, is fundamentally changing how supply chains are managed. By tagging hides early in the process and logging process data immutably, these systems provide unprecedented transparency to consumers and regulators, validating claims of ethical sourcing and environmental compliance, thus building essential consumer trust in a highly scrutinized industry.

Regional Highlights

- North America: Characterized by high consumer spending on luxury leather goods, automotive interiors, and premium footwear. The market is driven by technological adoption in processing (automation) and a strong regulatory focus on product safety and labeling. Key relevance lies in high-value consumption and demand for ethical, sustainable products.

- Europe: The global hub for luxury leather manufacturing, particularly Italy and Germany, known for high-quality tanning, finishing, and craftsmanship. Europe imposes the strictest environmental regulations (e.g., REACH), forcing innovation in chrome-free and sustainable tanning, positioning the region as a leader in technological advancements and premium segment exports.

- Asia Pacific (APAC): The dominant region in terms of production volume and rapidly increasing consumption, led by China, India, and Vietnam. APAC benefits from lower manufacturing costs, large raw hide supply chains, and a burgeoning middle class driving domestic demand for leather apparel and accessories. It is the primary global manufacturing base for footwear and general leather goods.

- Latin America (LATAM): A significant source of raw hides, particularly Argentina and Brazil, due to large cattle populations. The region focuses heavily on exporting raw hides and intermediate leather products (wet blue), while also developing domestic markets for footwear and basic accessories. Economic stability often dictates market performance and export volumes.

- Middle East and Africa (MEA): Represents a smaller but growing market, with specific relevance in hide sourcing (especially Ethiopia and South Africa) and regional demand for traditional leather products. The region is increasingly focused on developing local manufacturing capabilities to reduce dependence on imported finished goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather Market.- Sauer AG

- Prime Tanning

- ECCO Leather

- Tasman Leather Group

- Hermes Cuirs Précieux

- Pieles de Oriente S.A.

- TATA International Limited

- ISA TanTec

- Pittards plc

- Gruppo Dani S.p.A.

- Xingye Leather Technology Co., Ltd.

- Bader GmbH

- Leather Industries of America (LIA)

- Pavoni S.p.A.

- Wolverine Worldwide

- Sadesa

- General Leather

- Rino Mastrotto Group

- Heller-Leder GmbH

- Jinjiang Xinfeng Leather Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Leather Market?

The primary factor driving market growth is the increasing global demand for high-quality, durable consumer goods, particularly in the premium footwear and automotive upholstery sectors, fueled by rising disposable incomes in emerging economies (APAC).

How is the leather industry addressing environmental sustainability concerns?

The industry is addressing sustainability by shifting towards eco-friendly tanning processes, such as chrome-free and vegetable tanning, optimizing water and chemical usage through AI, and implementing advanced wastewater treatment technologies to minimize ecological footprint.

Which end-use segment holds the largest share in the Leather Market?

The Footwear end-use segment holds the largest volume share due to universal demand for leather shoes, boots, and sandals, valued for their durability, comfort, and breathability compared to synthetic alternatives.

What are the main substitutes challenging the genuine leather market?

The main substitutes are advanced synthetic materials (e.g., polyurethane and polyvinyl chloride) and innovative bio-based leathers derived from sources like mushroom mycelium, pineapple leaves (Pinatex), or agricultural waste, often marketed based on their lower environmental impact and ethical sourcing.

Why is Asia Pacific considered critical for the global leather market?

Asia Pacific is critical because it functions both as the largest manufacturing and processing hub globally, benefiting from competitive labor costs, and simultaneously represents the fastest-growing consumer market due to a rapidly expanding middle-class population increasing luxury consumption.

The global leather market continues to showcase resilience and adaptability in the face of evolving consumer ethics and stringent environmental mandates. Strategic investments in technology, focused on both processing efficiency and supply chain transparency, are paramount for securing a competitive advantage in this complex industry. The future growth trajectory hinges significantly on the successful adoption of sustainable practices that can effectively bridge the gap between traditional craftsmanship and modern ecological responsibility. Key stakeholders across the value chain, from raw material suppliers to high-end luxury retailers, are collaboratively investing in bio-innovation and digital transformation to ensure the material retains its premium positioning. The market environment necessitates continuous monitoring of regulatory shifts, particularly in Europe, and consumer preference dynamics, especially the rising acceptance and performance improvement of non-animal alternatives. Maintaining flexibility in material sourcing and optimizing operational costs through automation will be essential for profitability in the highly competitive global tanning sector. Furthermore, regional differentiation remains crucial; while APAC focuses on volume and expanding domestic consumption, Europe retains its dominance in setting the global quality benchmark for high-value exports and luxury branding, cementing the leather market's dual nature of mass production and specialized artisanship. The long-term success of market participants depends on achieving certified traceability and verifiable environmental performance standards, thereby guaranteeing the long-term viability of leather as a globally preferred material.

The integration of advanced data analytics and predictive modeling tools is reshaping how manufacturers manage inventory, forecast demand, and minimize waste throughout the extensive tanning process. By leveraging large datasets on hide characteristics, chemical reaction kinetics, and machine performance, tanneries can reduce the variability inherent in processing natural materials, leading to more uniform quality and substantial cost savings. This shift towards data-driven manufacturing is pivotal, transforming the traditional, experience-based craft of leather making into a highly scientific and optimized industrial process. The focus on circularity is also intensifying, with growing efforts to recycle or repurpose leather scraps and tannery sludge, aligning the industry with broader global sustainability objectives. This proactive engagement with environmental challenges is not merely a compliance issue but a fundamental business strategy aimed at enhancing brand reputation and ensuring market access, especially within segments governed by stringent environmental, social, and governance (ESG) investing criteria. Continued research into novel binding agents and biodegradable finishing chemicals promises to further reduce the reliance on conventional, environmentally challenging inputs. The convergence of material science, digital technology, and ethical sourcing defines the modern Leather Market's forward momentum and its commitment to sustainable luxury.

The segment of bovine leather remains overwhelmingly dominant due to its sheer availability and suitability for durable, heavy-gauge applications, such as seating and industrial goods. However, the sheep and goat leather segments are witnessing robust growth in fashion-forward applications, where flexibility, light weight, and a soft touch are prioritized. Technological advancements in splitting and finishing techniques now allow for greater utilization of thinner hides, reducing material consumption per unit product. The competitive environment requires manufacturers to operate with lean principles, minimizing overheads while ensuring compliance with international quality standards (ISO certifications). Furthermore, market maturity in regions like North America and Europe necessitates a focus on innovation in high-performance leather designed for specialized outdoor and technical gear, pushing the boundaries of traditional leather attributes. This specialized product development differentiates premium market players from those competing primarily on price in volume-driven segments. Overall market stability is intertwined with the global economic outlook, as consumer confidence directly impacts discretionary spending on luxury leather items and new vehicle purchases, highlighting the cyclical nature of demand in certain high-value end-use sectors.

In terms of distribution, the e-commerce channel is increasingly vital, not only for finished leather goods but also for B2B transactions of processed leather, allowing tanneries to directly reach smaller manufacturers globally, bypassing traditional brokers. This digitalization of B2B sales streamlines transactions and provides greater transparency regarding pricing and inventory availability. The geographical segmentation analysis confirms that investment strategies must be tailored to regional strengths; capital expenditure in APAC continues to target capacity expansion and modernization, while investment in European facilities prioritizes R&D and specialized, high-margin processes. Trade policies and tariffs, particularly those affecting raw hide exports and finished leather goods imports, present an ongoing element of market risk that stakeholders must strategically manage through diversified production and sourcing strategies. The industry's evolution reflects a broader global trend of materials science meeting sustainability ethics, ensuring leather retains its status as a highly valued, natural product adaptable to modern industrial demands and consumer consciousness.

The automotive industry's increasing emphasis on interior luxury and personalized design is consistently driving innovation in leather finishes. This demand focuses on enhanced durability, reduced weight for fuel efficiency, and specialized treatments that inhibit bacterial growth and resist common spills, thereby prolonging the life and aesthetic appeal of car interiors. Tanners servicing this sector must meet rigorous performance standards set by global car manufacturers, often requiring long-term, high-volume contracts and specialized certifications. This segmentation highlights a crucial distinction in the market: automotive leather production is highly concentrated and technically demanding, requiring scale and sophisticated quality assurance protocols, contrasting sharply with the fragmented nature of the fashion and accessories segment, which demands agility and rapid response to seasonal trends. The shift towards electric vehicles (EVs) is also influencing automotive leather design, with EVs often featuring more minimalistic and sustainable interiors, prompting innovation in lightweight and bio-based leather alternatives that meet the luxury aesthetic without the weight penalty.

The competitive rivalry within the market is intense, fueled by significant overcapacity in specific tanning centers, especially in South Asia. Companies seek differentiation not only through product quality but increasingly through ethical sourcing and certified compliance, leveraging these factors as marketing tools to appeal to socially conscious consumers and major brand purchasers. Mergers and acquisitions are common, serving as a strategy for consolidation, achieving economies of scale, securing raw material supply, and acquiring specialized finishing technologies. Small to medium-sized tanneries often thrive by specializing in niche markets, such as custom artisanal leather or specific exotic hides, avoiding direct price competition with high-volume producers. Furthermore, investment in talent—chemists, designers, and process engineers—is essential, as the sophisticated nature of modern leather production requires highly skilled human capital to operate complex machinery and manage cutting-edge chemical processes, sustaining the industry’s capacity for innovation and high-quality output. The global market, despite its fragmentation, remains highly sensitive to macroeconomic indicators, reflecting its deep linkage to consumer discretionary spending across multiple luxury and essential product categories.

The strategic importance of geographical location in the leather value chain cannot be overstated. Regions rich in livestock, such as Brazil, Australia, and the US, command influence over the raw material cost and availability, acting as key suppliers to global tanneries. Conversely, regions known for advanced chemical manufacturing, predominantly Western Europe and parts of Asia, dictate the pace of process innovation and chemical supply costs. This reliance on global sourcing requires robust logistics networks capable of handling perishable raw hides efficiently across continents, often involving complex cold chain management. The interdependence between upstream suppliers, midstream processors, and downstream manufacturers makes the market susceptible to geopolitical shifts and trade barriers. For instance, temporary restrictions on hide exports can significantly inflate raw material costs for tanneries lacking diversified supply bases, directly impacting the final price of consumer goods like luxury handbags or premium car interiors. Effective risk management involves hedging against commodity price volatility and strategically positioning production facilities close to either the raw material source or the major end-use manufacturing hubs, optimizing both supply security and logistical efficiency in a deeply integrated global marketplace.

In addition to technological advancements in tanning, the market is leveraging digital tools to enhance consumer engagement and supply chain transparency. Many luxury brands are adopting digital product passports, powered by blockchain technology, which provide end-consumers with immutable records of the leather's journey—from the farm or slaughterhouse through the tanning process to the final artisan who crafted the product. This level of traceability addresses growing consumer skepticism regarding product origins and supports ethical sourcing claims, thereby building significant brand value. Furthermore, the use of virtual reality (VR) and augmented reality (AR) in B2B sales allows manufacturers to showcase leather textures, finishes, and colors to international buyers without the need for extensive physical travel or sampling, accelerating the product development and selection process. These digital solutions not only improve efficiency but also contribute indirectly to sustainability by reducing the carbon footprint associated with global sampling and logistics. The transition from physical samples to digital twins represents a transformative change in how leather products are marketed and specified across the automotive and high-fashion sectors, setting a new standard for industry collaboration and speed to market.

The specialized segment of exotic leather, though small in volume, contributes significantly to market value, catering to the ultra-luxury fashion segment. This segment, involving hides from crocodiles, snakes, and ostriches, is governed by extremely strict international regulations, such as the Convention on International Trade in Endangered Species (CITES), demanding meticulous documentation and certification. Companies operating in this niche must demonstrate impeccable traceability and sustainable farming practices to maintain their licenses and brand reputation. The high barrier to entry and specialized processing techniques required for these materials contribute to their exorbitant price points, making them a crucial component of the high-end accessories and bespoke market. The ethical scrutiny surrounding this segment continues to pressure manufacturers to ensure all operations are conducted transparently and comply fully with global wildlife protection laws, highlighting the complex intersection of luxury commerce, environmental responsibility, and regulatory compliance within the broader leather market ecosystem.

Looking ahead, the demand for modular and repairable leather products is expected to grow, aligning with broader consumer trends favoring longevity and circular economy principles. Manufacturers are increasingly designing products that allow components, such as straps or panels, to be replaced or refurbished, extending the lifespan of the leather item and reducing waste. This shift necessitates developing leather that is durable enough to withstand multiple repairs and processes. Furthermore, collaborative partnerships between leather producers and research institutions are focusing on developing biodegradable polymers and natural compounds to replace conventional synthetic finishing agents, aiming for a truly closed-loop material cycle. This commitment to 'end-of-life' considerations marks a maturing industry dedicated to redefining its environmental legacy. The long-term viability of the natural leather market depends intrinsically on its ability to offer performance and aesthetic appeal while consistently outperforming synthetic alternatives in verifiable sustainability metrics, ensuring its relevance in a resource-constrained future.

The regulatory framework governing the leather industry is complex, encompassing chemical restrictions, wastewater discharge limits, labor standards, and international trade agreements. Compliance requires substantial ongoing investment in monitoring and technological upgrades, particularly for tanneries operating in regions with less historically stringent environmental enforcement. The EU's proactive stance on chemical safety, exemplified by regulations like REACH, often sets a global standard, influencing purchasing decisions by major international brands that demand suppliers adhere to these elevated compliance levels regardless of the supplier’s geographical location. Non-compliance risks significant financial penalties, trade restrictions, and severe reputational damage, making regulatory adherence a top strategic priority for all serious market participants. The cost of environmental compliance is often cited as a key restraint, particularly for small and medium-sized enterprises (SMEs), leading to industry consolidation as smaller players struggle to meet the required capital expenditure for modernization.

The ongoing professionalization of the leather industry workforce is also a silent driver of quality and efficiency. Specialized training programs and vocational institutes, particularly in Europe and Asia, focus on imparting modern tanning chemistry, process control techniques, and digital manufacturing skills. This investment in human capital ensures the industry can effectively implement and manage the sophisticated AI and automation technologies being adopted. The blend of traditional leather craftsmanship with modern scientific expertise is crucial for maintaining the quality differentiation that justifies leather's premium pricing. This dual focus on heritage skills and technical innovation underscores the market’s evolutionary path, positioning leather as a high-tech material refined through centuries of experience. The complexity of the chemistry involved in modern tanning necessitates continuous education to keep pace with evolving sustainable chemical alternatives and process optimization methodologies.

Financial stability within the leather market is highly sensitive to fluctuations in global commodity markets, particularly the prices of raw hides and key tanning chemicals. Since raw hides are by-products of the meat industry, their supply is inelastic and dictated by meat consumption trends, creating price volatility that tanneries must manage through rigorous procurement strategies, futures contracts, and inventory management. Chemical costs, especially for chromium and specialized dyes, are subject to global petroleum and mining market dynamics. Successful market players employ advanced risk management tools and strategic vertical integration—from hide processing to finishing—to mitigate external price shocks. Furthermore, access to capital for expensive modernization projects, essential for meeting environmental standards, often dictates the scale and viability of tanning operations, emphasizing the critical role of corporate finance and investment in shaping the competitive structure of the global leather market.

The market for performance-enhanced leather is expanding rapidly, targeting specific applications in aviation, marine, and high-end sports equipment where conventional materials fall short. This specialized segment demands materials with superior fire retardancy, extreme resistance to moisture and salt, and high durability under intense mechanical stress. Developing these features requires proprietary chemical formulations and advanced physical treatments, often involving vacuum drying and specialized compression techniques. Companies excelling in this area typically hold strong patent portfolios and possess specialized manufacturing facilities, allowing them to command premium prices and maintain high barriers to entry against generalist tanneries. The investment in performance leather underscores a strategic move by market leaders to diversify beyond traditional fashion cycles and secure lucrative, long-term contracts within highly regulated and technically demanding industries, further segmenting the overall market based on functional attributes and technological capability.

Finally, the growing influence of global corporate social responsibility (CSR) initiatives places increasing pressure on leather producers regarding animal welfare and labor practices. Major international brands demand verifiable assurances that their leather sources comply with best practices in livestock treatment and that all labor across the supply chain meets ethical standards regarding wages, safety, and working conditions. Auditing and certification bodies play a crucial intermediary role, providing independent verification necessary for brands to confidently use leather in their final products. This emphasis on social sustainability is evolving into a non-negotiable prerequisite for participation in high-value segments of the market, reinforcing the transition toward a more transparent and ethically accountable global industry structure. Stakeholders must strategically invest in third-party auditing and robust reporting mechanisms to validate their commitment to these increasingly important societal expectations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Leather Goods Repair Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Leather Bags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Leather Wipes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive PVC and PU Leather Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Leather Bag Accessories and Zippers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager