Mattress Toppers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432665 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Mattress Toppers Market Size

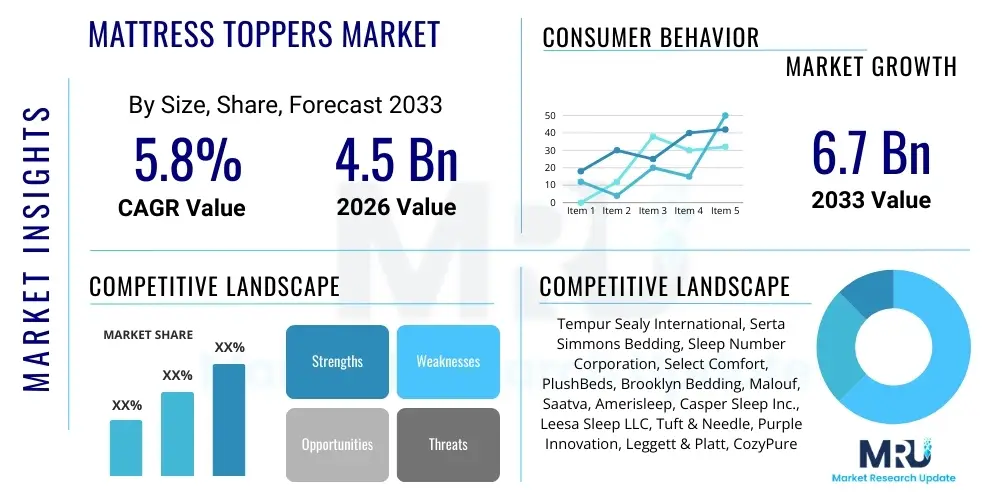

The Mattress Toppers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Mattress Toppers Market introduction

The Mattress Toppers Market encompasses the manufacturing, distribution, and sale of padded layers designed to be placed directly on top of a mattress. These products serve several critical functions, including enhancing comfort, altering the firmness profile of an existing mattress, protecting the mattress from wear and stains, and extending the lifespan of bedding systems. The increasing consumer focus on sleep quality and personalized comfort solutions, driven by rising disposable incomes and greater awareness of health benefits associated with restorative sleep, fundamentally drives this market expansion.

Mattress toppers are typically categorized by the materials used in their construction, such as memory foam, latex, down/feather, polyester, and wool, each offering distinct thermal regulation and pressure relief characteristics. Major applications span both residential sectors, where individuals seek to upgrade their sleeping experience without replacing the entire mattress, and commercial sectors, particularly hotels, hospitality chains, and healthcare facilities, which utilize toppers to standardize comfort levels and simplify maintenance protocols. The diversity of materials allows manufacturers to cater to specific consumer needs, such as orthopedic support or cooling properties.

Key benefits driving market adoption include the cost-effectiveness of enhancing an old mattress compared to purchasing a new one, superior pressure point alleviation, and hypoallergenic options appealing to sensitive users. Driving factors accelerating market growth include advancements in material science, particularly the development of open-cell and gel-infused memory foam for improved breathability, and the expansion of e-commerce platforms which provide consumers with easy access to a wide variety of specialized products and direct-to-consumer bedding brands.

Mattress Toppers Market Executive Summary

The Mattress Toppers Market demonstrates robust growth, primarily fueled by shifting consumer preferences towards customized sleep solutions and sustainability, where toppers offer a less resource-intensive alternative to mattress replacement. Business trends are dominated by strategic partnerships between material suppliers and bedding retailers, emphasizing product innovation such as cooling technologies, eco-friendly natural materials (e.g., organic latex and wool), and integrated smart features for temperature control. Furthermore, the rise of specialized online bedding retailers utilizing targeted marketing and transparent return policies has significantly lowered the barriers to entry for niche product offerings, driving competitive pricing and fostering rapid product cycles focused on consumer feedback.

Regionally, North America and Europe maintain market leadership due to high consumer spending power, established awareness of sleep health, and the presence of major key players, characterized by demand for premium, high-density memory foam and natural latex toppers. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by rapid urbanization, increasing middle-class disposable income, and the expansion of organized retail and hospitality sectors, particularly in emerging economies like China and India. The regional dynamics highlight a dual-market approach: premium, imported products dominate developed markets, while value-based, durable polyester and basic foam toppers cater to mass consumption in developing areas.

Segment trends reveal that the Memory Foam segment continues to command the largest market share owing to its superior contouring and pressure-relieving capabilities, although the Latex segment is gaining traction due to growing preference for sustainable and naturally derived materials. In terms of application, the Residential segment remains the primary revenue contributor, but the Commercial segment, driven by strict hygiene standards and the need for standardized guest comfort in hotels, is poised for accelerated expansion. Distribution channel analysis indicates a strong shift towards the Online retail segment, leveraging digital platforms for product comparison, detailed specifications, and convenient delivery, essential for bulky items like toppers.

AI Impact Analysis on Mattress Toppers Market

User queries regarding AI's influence on the Mattress Toppers Market frequently revolve around personalization, supply chain efficiency, and automated quality control. Key concerns include how AI algorithms can accurately recommend the optimal topper material and firmness based on individual sleep metrics (such as weight distribution, preferred sleeping position, and existing mattress condition), thereby improving customer satisfaction and reducing return rates. Users also inquire about AI's role in optimizing manufacturing processes, predicting material demand volatility, and enhancing e-commerce experiences through sophisticated chatbot support and hyper-personalized promotional campaigns. The expectation is that AI will move the market from generic segmentation towards highly individualized product offerings, making the purchasing decision less ambiguous and more scientifically grounded in physiological data.

- AI-driven Personalization: Algorithms analyze user input (sleep patterns, body type, existing mattress firmness) to recommend the ideal topper material and thickness, minimizing post-purchase returns.

- Predictive Demand Forecasting: AI models utilize sales data, seasonal trends, and material costs to optimize inventory levels for key materials like memory foam and latex, reducing waste and carrying costs.

- Automated Manufacturing Optimization: Machine learning monitors production lines, identifying anomalies in density, temperature curing, and cutting precision, ensuring consistent quality across large batches.

- Enhanced Customer Service: AI-powered chatbots provide instant, detailed product comparisons and technical support regarding material properties and maintenance, improving the online shopping experience.

- Dynamic Pricing Strategy: AI analyzes competitor pricing, real-time demand fluctuations, and inventory levels to dynamically adjust product pricing, maximizing profit margins and market competitiveness.

DRO & Impact Forces Of Mattress Toppers Market

The Mattress Toppers Market is shaped by a complex interplay of positive and negative external forces. The primary Driver is the heightened global awareness regarding the importance of quality sleep for overall health, coupled with the economic incentive provided by toppers as a cheaper alternative to full mattress replacement. Restraints mainly center on the high costs and volatility associated with key raw materials, such as specialized petrochemicals for memory foam and natural latex, alongside the challenge of product differentiation in an increasingly saturated market. Opportunities lie in the rapidly expanding commercial sector and the integration of advanced materials offering unique functionalities like phase-change materials for cooling and antimicrobial treatments. These forces collectively dictate market trajectory, pushing innovation towards sustainable and high-performance products while maintaining consumer affordability.

Drivers (D):

The foremost driver accelerating market growth is the growing consumer prioritization of sleep health and wellness. Modern lifestyles often lead to increased stress and subsequent sleep disorders, prompting consumers to seek ergonomic and therapeutic bedding solutions. Mattress toppers offer an immediate, effective upgrade to an existing setup, providing targeted relief for back pain, pressure points, and thermal discomfort without requiring significant capital investment. This health-conscious consumer behavior, particularly evident in developed economies, translates directly into demand for specialized, high-quality toppers.

Secondly, the rapid expansion and standardization within the global hospitality industry contribute significantly to market dynamics. Hotels and resorts regularly replace or upgrade their bedding to ensure guest satisfaction and maintain brand standards. Toppers are frequently utilized to ensure a uniform level of comfort across different room types or to extend the service life of high-cost mattresses, offering both operational savings and an enhanced guest experience. The continued development of mid-range and luxury hotel chains globally mandates steady demand for durable, hypoallergenic commercial-grade mattress toppers.

Restraints (R):

A significant restraint impacting profitability is the volatility in the cost and supply chain of critical raw materials. Memory foam, relying heavily on polyurethane components derived from petrochemicals, is subject to fluctuations in crude oil prices. Similarly, natural latex supply is dependent on rubber plantation yields and agricultural market dynamics, leading to unpredictable manufacturing costs. This variability makes long-term pricing strategies challenging and often necessitates manufacturers to absorb costs or pass them onto consumers, potentially dampening volume growth in price-sensitive segments.

Furthermore, the lack of standardized consumer metrics for topper performance and the inherent bulkiness of the product present logistical and market hurdles. Consumers often struggle to differentiate between various foam densities, materials, and claimed cooling properties, leading to purchasing confusion and higher return rates, especially in the e-commerce channel. The bulky nature of toppers increases shipping and storage costs, posing a particular constraint for international market penetration and efficient last-mile delivery, contributing to higher operational expenditures compared to other soft furnishing products.

Opportunities (O):

The most compelling opportunity lies in the development and adoption of smart and functional mattress toppers. Integrating sensor technology for sleep tracking, coupled with phase-change materials (PCMs) or internal circulation systems for active temperature regulation, opens up a lucrative premium segment. Consumers are increasingly willing to invest in products that provide measurable health benefits and customizable comfort, offering manufacturers a pathway to differentiate themselves beyond basic material specifications and command higher margins.

Secondly, the focus on environmental sustainability presents a strong opportunity for innovation and market leadership. The demand for eco-friendly products, such as toppers made from recycled materials, organic cotton covers, and naturally derived, responsibly harvested latex, is rapidly increasing. Companies that can transparently demonstrate a circular economy model or utilize sustainable manufacturing processes can capture the growing segment of environmentally conscious consumers, driving brand loyalty and opening access to regulatory-compliant commercial contracts.

Impact Forces:

- Heightened Consumer Focus on Sleep Health (High Impact, Positive)

- Technological Advancements in Cooling and Pressure Relief Materials (Medium Impact, Positive)

- Volatile Raw Material Pricing (Medium Impact, Negative)

- E-commerce Penetration and Direct-to-Consumer Models (High Impact, Positive)

- Strict Global Regulations on Fire Retardancy and Material Safety (Medium Impact, Negative)

Segmentation Analysis

The Mattress Toppers Market is meticulously segmented based on key differentiators including material type, application, thickness, and distribution channel, providing a granular view of consumer preferences and market dynamics. Understanding these segments is crucial for manufacturers to tailor product development and marketing strategies effectively. The dominance of memory foam continues, driven by its medical and orthopedic benefits, while the increasing popularity of online channels reflects a broader shift towards digital commerce for home goods. Future growth will be significantly influenced by material innovation and the commercial sector’s rising demand for specialized products.

Material type segmentation, encompassing memory foam, latex, wool, and others, dictates both the price point and the core functionality of the topper. Memory foam, despite higher costs, remains favored for its viscoelastic properties offering superior pressure relief, particularly in residential settings. Conversely, the segmentation by application, dividing the market into Residential and Commercial use, highlights the different requirements—residential focusing on comfort customization, and commercial emphasizing durability, hygiene, and fire safety compliance.

Furthermore, segmentation by distribution channel—Online versus Offline—reveals evolving purchasing patterns. The online channel benefits from the ease of comparison, extensive product reviews, and convenient home delivery of bulky items, facilitating rapid growth for direct-to-consumer brands. Offline channels, including department stores and specialized bedding retailers, remain important for consumers who prefer to physically test the firmness and feel of the product before committing to a purchase, ensuring these segments retain a significant, albeit slower growing, portion of the market share.

- By Material Type: Memory Foam, Latex, Polyester/Fiberfill, Wool, Others (e.g., Feather/Down, Hybrid)

- By Thickness: Below 2 Inches, 2 to 3 Inches, Above 3 Inches

- By Application: Residential, Commercial (Hotels, Hospitals, Institutional)

- By Distribution Channel: Online Retail, Offline Retail (Specialty Stores, Department Stores, Big Box Retailers)

Analysis By Material Type

The Memory Foam segment holds the largest share due to its exceptional ability to conform to body shape, offering superior spinal alignment and pressure relief—a crucial factor for consumers dealing with chronic back pain or seeking premium comfort. Recent innovations, such as open-cell structures and gel infusions, have addressed historical limitations concerning heat retention, making memory foam increasingly viable in warmer climates and appealing to users concerned about thermal regulation. The perceived value and therapeutic benefits continue to justify the higher price point compared to traditional alternatives, solidifying its market dominance.

Conversely, the Latex segment (both natural and synthetic) is experiencing accelerated growth, driven by environmental consciousness and the demand for natural, breathable, and durable products. Natural latex offers inherent hypoallergenic properties, resistance to dust mites, and a responsive, bouncy feel distinct from the slow recovery of memory foam. This segment is particularly favored by consumers prioritizing sustainability, longevity, and a cooler sleep surface, positioning it as a high-growth premium category competing directly with specialized memory foam products.

The Polyester/Fiberfill segment, while offering minimal orthopedic support, remains vital for the volume market due to its affordability and ease of cleaning. These toppers are frequently used in commercial settings, such as budget hotels or temporary accommodations, where low cost, lightweight structure, and basic comfort enhancement are primary requirements. The Wool and Down/Feather segments cater to niche luxury markets, valued for their natural temperature-regulating properties and plush feel, appealing to consumers seeking traditional, high-end bedding solutions.

- Memory Foam: Dominant segment; superior pressure relief; increasing adoption of cooling technologies (gel-infusion, copper).

- Latex: High-growth segment; preferred for sustainability, durability, and natural cooling properties; high initial cost but longer lifespan.

- Polyester/Fiberfill: Highly affordable; easy to wash; widely used in mass market and hospitality sectors requiring basic comfort.

- Wool: Niche luxury; excellent natural temperature regulation (cooling in summer, warm in winter); appeals to organic/natural product consumers.

Analysis By Application

The Residential segment constitutes the core revenue base for the Mattress Toppers Market, driven by household decisions to improve existing mattresses rather than incurring the expense of a full replacement. Consumer behavior in this segment is highly influenced by personal comfort preferences, medical requirements (e.g., orthopedic needs), and marketing emphasizing luxury and technological innovation, such as adjustable firmness or smart sleep integration. The residential market sees a high demand for premium materials (memory foam, high-density latex) and diverse thickness options, allowing for extensive customization of the sleep surface.

The Commercial segment, encompassing hotels, hospitals, dormitories, and other institutional users, is characterized by bulk purchases and strict procurement criteria focusing on durability, compliance with fire safety regulations (e.g., CAL 117 standards), and hygiene. Hotels utilize toppers to maintain consistency across their inventory, often opting for resilient, easy-to-clean materials like specialized fiberfill or durable synthetic foam. Hospitals prioritize antimicrobial properties and ease of sanitization, often requiring fluid-resistant covers and materials that withstand repeated harsh cleaning cycles, making this segment highly specification-driven.

Growth in the Commercial sector is closely tied to global infrastructure development in tourism and healthcare. Rapid expansion of mid-to-high-end hospitality chains, particularly across the Asia Pacific region, is driving significant demand for robust, standardized, and comfortable toppers. Furthermore, the increasing focus on patient comfort and improved healing environments in healthcare facilities worldwide ensures sustained demand for therapeutic and durable commercial-grade toppers, establishing this segment as a key future growth vector for the overall market.

- Residential: Largest segment; focus on personalized comfort, premium materials, and therapeutic benefits; driven by individual consumer purchasing power and health awareness.

- Commercial: Faster growth rate; high demand for durability, fire resistance, and hygiene compliance; driven by hospitality expansion and healthcare standardization.

Analysis By Thickness

The 2 to 3 Inches thickness segment traditionally accounts for the largest market share, representing the sweet spot between noticeable comfort improvement and practical manageability. Toppers in this range offer sufficient material depth, particularly for memory foam and latex, to provide effective contouring, pressure relief, and a moderate alteration of the underlying mattress firmness. This dimension is highly popular because it addresses the needs of a wide range of consumers looking for a substantial upgrade without making the bed height excessively prohibitive or compromising existing fitted sheet sizes.

The Above 3 Inches segment caters primarily to consumers seeking a significant change in comfort, often utilized when the underlying mattress is excessively firm or significantly aged and requires extensive cushioning. These thicker toppers, frequently made of high-density memory foam or dual-layer construction (e.g., foam base with fiberfill top), offer maximum plushness and deep pressure immersion. While these products provide superior luxury and relief, they represent a smaller market share due to higher cost and the increased weight and bulk, making them less accessible for standard consumer requirements.

The Below 2 Inches segment is characterized by budget-friendly, thin designs, often constructed from basic foam or low-loft fiberfill. These toppers are typically employed for minor comfort enhancement, basic mattress protection, or as a temporary solution. Although less effective for significant pressure point relief, their low profile and affordability make them attractive for temporary bedding, dormitories, or for consumers who only require a slight modification to a relatively new, slightly firm mattress, catering primarily to the value-driven consumer base.

- 2 to 3 Inches: Dominant segment; optimal balance of comfort, pressure relief, and practical integration with existing bedding; highly versatile across materials.

- Above 3 Inches: Premium segment; used for maximum comfort, luxury, and therapeutic cushioning; higher cost and complexity.

- Below 2 Inches: Value segment; used for minor adjustments and basic protection; highly affordable and lightweight.

Analysis By Distribution Channel

The Online Retail channel has rapidly gained prominence and is expected to exhibit the highest CAGR during the forecast period. This growth is attributable to the digital transformation of the retail sector, offering consumers unparalleled access to product comparisons, detailed specifications, and authentic user reviews that build trust for specialized purchases. Direct-to-consumer (D2C) brands leverage online platforms to minimize overhead costs, often offering competitive pricing and robust trial periods or return policies, which mitigates the risk associated with purchasing bedding without prior physical inspection.

Offline Retail, encompassing specialty bedding stores, department stores, and large format retailers, maintains a significant market presence, particularly for high-end and technologically advanced toppers. These channels provide the essential function of allowing consumers to physically touch and test the material, firmness, and overall feel of the product, which is often critical for such a personal comfort item. Specialty stores also benefit from expert sales staff who can provide detailed guidance on material suitability and thickness requirements, appealing to consumers who prioritize personalized consultation.

The future trajectory suggests a hybrid model, where consumers research extensively online but sometimes finalize the purchase through a local physical retailer, or utilize showrooms for testing before ordering online from a D2C brand. However, the logistical advantages of online sales, especially for the heavy and bulky nature of high-density toppers, coupled with increasing consumer confidence in digital purchasing, ensure that the Online Retail segment will continue to drive overall market expansion and influence pricing strategies across the industry.

- Online Retail: Fastest-growing segment; driven by D2C models, wide product selection, price transparency, and convenient delivery of bulky goods.

- Offline Retail: Steady segment; critical for physical product assessment, providing immediate gratification, and expert sales consultation.

Value Chain Analysis For Mattress Toppers Market

The value chain for the Mattress Toppers Market begins with the Upstream activities, focused heavily on the procurement and processing of core raw materials such as petrochemical derivatives (isocyanates and polyols) for memory foam, harvested rubber sap for natural latex, and synthetic fibers or natural fibers (wool, cotton). Innovation at this stage, particularly in creating sustainable, open-cell, or cooling materials, is critical for competitive advantage. Suppliers specializing in high-grade, certified materials that meet international safety standards (e.g., low VOC emissions) command premium pricing, as material quality directly impacts the final product's performance and longevity.

Midstream processes involve manufacturing, where raw materials are converted into finished topper products through processes like foaming, vulcanization (for latex), cutting, and fabrication, often incorporating advanced machinery for consistent density and cooling gel infusion. Distribution channel analysis reveals a critical shift: Direct distribution, where manufacturers sell directly to consumers (D2C via e-commerce), offers higher margins and faster feedback loops. Indirect distribution utilizes established retail networks (department stores, wholesale distributors, specialized bedding shops), relying on brand presence and in-store service but incurring substantial intermediary costs.

Downstream activities involve marketing, logistics, and end-user sales, which are increasingly dominated by sophisticated e-commerce logistics for home delivery. Key success factors at this stage include efficient warehousing for large items, robust packaging to prevent transit damage, and comprehensive after-sales support, including handling trial periods and returns. The effectiveness of digital marketing and search engine optimization (SEO/AEO) in connecting specialized product features (e.g., orthopedic support) with targeted consumer segments is paramount for market penetration in the highly competitive online space.

Mattress Toppers Market Potential Customers

Potential customers for the Mattress Toppers Market are broadly categorized into two main groups: Residential End-Users and Commercial/Institutional Buyers. Residential consumers, who represent the largest volume segment, are typically individuals or households seeking cost-effective methods to improve sleep quality, mitigate discomfort associated with an aging or overly firm mattress, or require specialized support for health conditions. This group is segmented further by age (e.g., elderly seeking softness and pressure relief; young adults seeking modern foam technology) and disposable income, influencing the choice between high-end latex/memory foam and budget fiberfill options.

Commercial End-Users include high-volume buyers such as hotel chains, healthcare facilities (hospitals and clinics), and educational institutions (dormitories). These customers prioritize bulk purchasing efficiency, extreme durability, compliance with institutional hygiene and safety standards (especially fire retardancy), and predictable long-term performance. For the hospitality sector, the buyer's motivation is guest satisfaction and brand consistency. For healthcare, the motivation centers on patient comfort, infection control, and minimizing risk of bedsores, requiring highly specialized, often medical-grade, fluid-resistant toppers.

Furthermore, an emerging customer base includes travelers and outdoor enthusiasts who purchase specialized, foldable, or lighter toppers for RVs, camping mattresses, and temporary lodging. These buyers prioritize portability and ease of storage alongside comfort. Targeting potential customers requires understanding their specific pain points—for example, marketing cooling memory foam to residential users in warm climates, and marketing durable, fire-rated toppers to commercial procurement managers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tempur Sealy International, Serta Simmons Bedding, Sleep Number Corporation, Select Comfort, PlushBeds, Brooklyn Bedding, Malouf, Saatva, Amerisleep, Casper Sleep Inc., Leesa Sleep LLC, Tuft & Needle, Purple Innovation, Leggett & Platt, CozyPure, OrganicPedic, ReSted, OMI Organic Mattresses, IntelliBed |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mattress Toppers Market Key Technology Landscape

The technological landscape of the Mattress Toppers Market is rapidly evolving, driven primarily by innovations aimed at mitigating the traditional drawbacks of foam, mainly heat retention, and enhancing comfort personalization. Gel-infusion technology, involving the incorporation of cooling gel microbeads into memory foam, is now a standardized feature, significantly improving thermal regulation and dissipating heat away from the sleeping surface. A more recent advancement includes the utilization of copper and graphite infusions, which possess high thermal conductivity and antimicrobial properties, offering dual benefits of cooling and hygiene, especially appealing in performance-focused products.

Phase Change Materials (PCMs) represent another frontier, where substances are integrated into the topper cover or foam layer that absorb and release heat to maintain a constant, optimal sleeping temperature. PCMs provide a more proactive form of temperature regulation compared to passive cooling gels. Furthermore, manufacturers are increasingly adopting advanced cellular structures, such as open-cell foam or proprietary lattice designs (like those utilized by Purple Innovation), which enhance airflow and responsiveness, moving away from dense, closed-cell materials that restrict breathability.

Looking ahead, the integration of smart technology is gaining traction. While still niche, certain premium toppers incorporate subtle pressure sensors to gather sleep data, track movement, and even offer customizable firmness zones via internal air chambers. This level of technological sophistication elevates the topper from a simple comfort layer to an integrated component of a smart sleep system, reflecting the broader IoT trend. Ensuring these materials meet strict international certifications for low Volatile Organic Compounds (VOCs) and material safety remains a foundational technological requirement.

Regional Highlights

The global Mattress Toppers Market exhibits distinct consumption patterns and growth dynamics across its primary geographical segments: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA).

- North America: This region holds the largest market share, characterized by high consumer awareness regarding sleep technology, elevated disposable incomes, and a strong preference for high-quality, specialized materials like gel-infused memory foam and organic latex. The US market dominates, driven by aggressive marketing by D2C bedding brands and a culture of frequent home décor upgrades. The demand here is centered on therapeutic benefits, sustainability certifications, and technologically integrated cooling features.

- Europe: Europe represents the second-largest market, with robust demand originating from Western European nations (Germany, UK, France). The European consumer base shows a strong inclination towards natural and certified organic products, favoring wool and responsibly sourced natural latex toppers. Strict regulatory standards regarding material safety and fire retardancy necessitate compliance, influencing product development towards certified, eco-friendly materials. The commercial sector, particularly in high-end hospitality, contributes significantly to stable growth.

- Asia Pacific (APAC): APAC is poised for the highest growth rate during the forecast period. This rapid expansion is fueled by rising urbanization, increasing middle-class income levels, and the booming hospitality and residential real estate sectors, particularly in emerging markets like China, India, and Southeast Asia. While the market currently sees high demand for affordable polyester and basic foam, there is a swift transition towards premium foam and latex toppers, driven by increasing Western influence and awareness of high-quality sleep products.

- Latin America and Middle East & Africa (MEA): These regions represent nascent but growing markets. Growth is sporadic and often concentrated around major economic hubs and tourism centers. In MEA, the luxury segment, catering to high-end hotels and affluent residential complexes, drives demand for imported, high-specification memory foam and natural latex toppers. Latin America shows potential, driven by improving economic conditions and increased accessibility via growing e-commerce platforms, particularly focusing on temperature-regulating products suitable for warmer climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mattress Toppers Market.- Tempur Sealy International

- Serta Simmons Bedding

- Sleep Number Corporation

- Select Comfort

- PlushBeds

- Brooklyn Bedding

- Malouf

- Saatva

- Amerisleep

- Casper Sleep Inc.

- Leesa Sleep LLC

- Tuft & Needle

- Purple Innovation

- Leggett & Platt

- CozyPure

- OrganicPedic

- ReSted

- OMI Organic Mattresses

- IntelliBed

- Hollander Sleep Products

Frequently Asked Questions

Analyze common user questions about the Mattress Toppers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a mattress topper?

The primary benefit of a mattress topper is cost-effective comfort enhancement and mattress lifespan extension. Toppers allow users to adjust the firmness or softness of an existing mattress, alleviate pressure points, and provide an additional protective layer without requiring the purchase of an entirely new mattress set.

Which material type provides the best cooling properties?

Latex and specialized cooling memory foams provide the best cooling properties. Natural latex is inherently breathable and prevents heat buildup, while advanced memory foam uses cooling technologies such as open-cell structures, gel infusions, or phase-change materials (PCMs) to actively dissipate heat and regulate sleep temperature.

How often should a mattress topper be replaced?

The replacement frequency for a mattress topper depends on the material quality and usage, generally ranging from three to five years. High-density latex or premium memory foam toppers often last closer to five years, while less expensive fiberfill or thin foam options may require replacement every two to three years due to compression and loss of support.

What thickness is recommended for significant back pain relief?

For significant back pain relief and noticeable contouring, a thickness of 2 to 3 inches is typically recommended, especially when using high-density memory foam or responsive latex. This thickness provides adequate depth for spinal alignment and effective pressure point cushioning without being overly bulky.

Are organic and natural latex toppers genuinely better than synthetic options?

Organic and natural latex toppers are often considered superior due to their durability, natural resistance to allergens and dust mites, and eco-friendly sourcing. While more expensive, they offer a highly resilient and cooler sleep surface compared to many synthetic foam options, appealing to health- and environment-conscious consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Memory Foam Mattress Toppers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Latex Mattress Toppers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Mattress Toppers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Memory Foam Mattress Topper, Latex Mattress Topper, Feather Mattress Topper, Wool Mattress Topper, Hybrid, Others), By Application (Commercial, Residential, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager