Metal Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435297 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Metal Detector Market Size

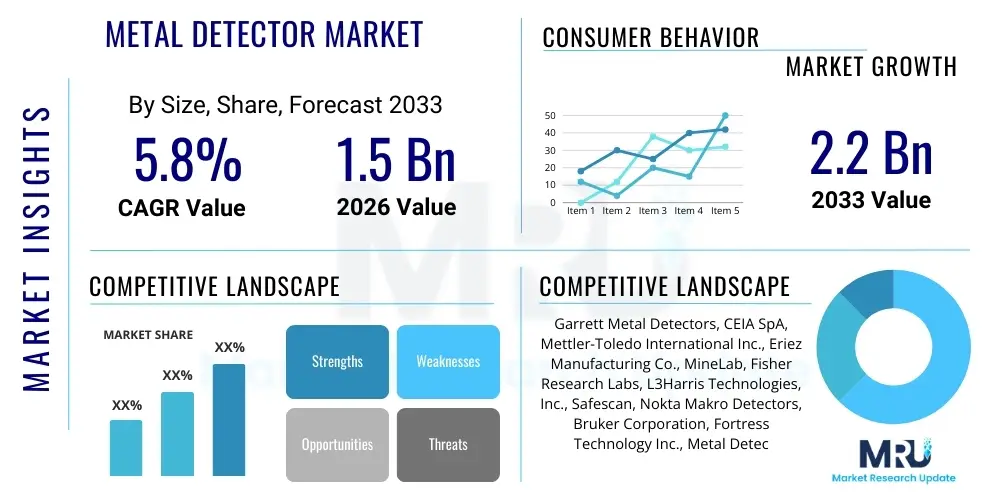

The Metal Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by escalating global security concerns, increased adoption across various industrial sectors such as food processing and pharmaceuticals for quality assurance, and significant technological advancements leading to more sophisticated and accurate detection capabilities. The expanding consumer segment, particularly for hobbyists and relic hunting, also contributes positively to the overall market valuation, reinforcing its steady upward trajectory across all major geographical regions including North America, Europe, and Asia Pacific.

Metal Detector Market introduction

The Metal Detector Market encompasses the design, manufacturing, and distribution of electronic instruments used to detect the presence of metal nearby. These devices operate by transmitting an electromagnetic field into the ground or inspected object and analyzing the return signal, which changes upon encountering conductive materials. The core technology utilized primarily falls under Very Low Frequency (VLF) or Pulse Induction (PI) categories, each optimized for different detection environments and targets, such as industrial quality control, airport security checkpoints, or consumer archaeology and treasure hunting. Continuous innovation focuses on enhancing discrimination capabilities, reducing false positive readings, and improving depth penetration, which are critical performance metrics across professional and governmental applications.

Major applications of metal detectors span critical infrastructure security, where they are essential tools for screening individuals and baggage at airports, government buildings, and transit hubs to mitigate potential threats. In the industrial domain, metal detectors ensure product integrity, particularly in the food and beverage and pharmaceutical industries, by identifying and rejecting products contaminated by metallic fragments, thereby adhering to stringent safety regulations. Furthermore, utility companies utilize specialized detectors for locating buried pipes and cables, while construction and mining sectors rely on robust systems for identifying unwanted metallic debris that could damage expensive machinery. The inherent benefit of these devices lies in their non-invasive nature and high efficiency in confirming material composition or identifying foreign objects across diverse operational environments.

Driving factors for market expansion include the mandatory implementation of advanced security protocols globally, fueled by rising geopolitical instability and terrorist activities, necessitating stricter screening processes in public spaces. Simultaneously, the stringent regulatory landscape governing product safety and quality in manufacturing environments, notably the Food Safety Modernization Act (FSMA) and similar international standards, mandates the use of highly sensitive detection equipment. Technological advancements, such as the integration of digital signal processing (DSP) and simultaneous multi-frequency (SMF) technologies, are significantly improving the precision and speed of detection, making modern units more versatile and reliable, thereby boosting their commercial uptake across both established and emerging markets.

Metal Detector Market Executive Summary

The global Metal Detector Market is characterized by robust business trends centered on technological convergence and heightened regulatory compliance across key sectors. Business growth is prominently spurred by the need for advanced security solutions, driving demand for high-throughput, multi-zone detectors in public screening. The industrial segment shows accelerated investment in intelligent metal detection systems integrated with factory automation protocols (Industry 4.0), optimizing production lines and minimizing recall risks due to contamination. Key market participants are focusing on strategic partnerships and mergers to consolidate market share, leveraging advanced sensor technologies and miniaturization to offer more portable and discreet detection solutions, meeting the evolving needs of both professional security services and consumer hobbyists who demand higher performance and user-friendly interfaces.

Regionally, North America and Europe remain mature markets, maintaining high demand due to established infrastructure security needs and stringent industrial safety standards. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by rapid infrastructural development, increasing investments in food and pharmaceutical manufacturing facilities, and the growing adoption of modern security measures across developing economies like China and India. Government spending on public security infrastructure, coupled with the liberalization of import/export regulations for advanced detection equipment, significantly boosts market growth in APAC. Latin America and the Middle East and Africa (MEA) are also experiencing moderate growth, driven by investments in airport security upgrades and oil and gas infrastructure protection.

Segment trends reveal that the Pulse Induction (PI) technology segment is gaining traction, especially in specialized industrial and deep-search applications, due to its ability to ignore mineralization effects in the ground, offering greater stability and depth. By application, the security sector holds the dominant market share, driven by persistent requirements for reliable screening devices in high-traffic areas. However, the industrial segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the massive global scale-up of food processing and manufacturing facilities that strictly mandate contaminant detection systems. Portable and handheld devices continue to dominate the product type landscape, primarily due to their operational flexibility and ease of deployment across diverse temporary and permanent security checkpoints.

AI Impact Analysis on Metal Detector Market

Common user questions regarding AI's influence on metal detection often revolve around how artificial intelligence can eliminate false positives, automate calibration processes, and differentiate between innocuous metal items and actual threats, particularly in high-volume security settings. Users are keen to understand if AI can significantly improve detection speed without sacrificing accuracy, a perennial challenge in security screening. Concerns also focus on the integration cost, the requirement for specialized data scientists, and the potential reliance on massive datasets for effective training of detection algorithms. Expectations are high that AI-powered systems will move beyond simple signal detection to sophisticated object recognition, providing an unprecedented level of threat assessment in real time, drastically improving operational efficiency and reducing human error associated with subjective interpretation of signals.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the capabilities and operational parameters of modern metal detectors, moving them from passive sensors to intelligent analytical systems. AI algorithms are being deployed to analyze complex electromagnetic signatures derived from detected objects, allowing the system to learn and recognize patterns associated with specific threats, such as weapons (knives, firearms) versus common personal items (keys, coins, belts). This deep-learning approach significantly enhances the detector's ability to discriminate between objects, dramatically reducing the incidence of false alarms, which is a major operational bottleneck in high-throughput environments like airports. By continuously processing data and self-optimizing, AI-driven detectors can maintain peak performance under varying environmental conditions and human traffic flow.

Furthermore, AI facilitates predictive maintenance and automated performance tuning in large-scale industrial and security deployments. In manufacturing, ML models monitor sensor performance deviations, predicting potential failures before they occur, thus ensuring minimal downtime and consistent quality control. For security checkpoints, AI systems can automatically adjust sensitivity settings based on real-time threat assessments or changing passenger volumes, optimizing throughput. This shift towards intelligent, data-driven detection systems represents a paradigm leap in market offerings, driving premium pricing for advanced models and encouraging rapid obsolescence of older, purely analog technologies that lack cognitive capabilities.

- AI algorithms enable sophisticated target discrimination, minimizing false positives.

- Machine learning facilitates automated calibration and optimal sensitivity adjustments in real-time.

- Deep learning enhances threat recognition by classifying metallic objects based on their electromagnetic signature and shape.

- Predictive maintenance models forecast sensor degradation, reducing operational downtime in industrial settings.

- AI integration supports seamless connectivity and data analysis within larger security or industrial IoT ecosystems.

DRO & Impact Forces Of Metal Detector Market

The Metal Detector Market is powerfully shaped by a confluence of accelerating drivers, persistent restraints, and significant opportunities, generating a complex field of impact forces. Key drivers include the global imperative to enhance public safety and security in response to rising threats, compelling governments and private enterprises to invest heavily in advanced screening technologies, particularly walk-through and high-sensitivity handheld devices. Simultaneously, the global expansion and increasing sophistication of the food, beverage, and pharmaceutical manufacturing sectors necessitate superior contaminant detection systems to ensure rigorous compliance with international safety standards, creating substantial demand for industrial metal detectors integrated with automated rejection mechanisms. Restraints often center on the inherent technical challenges, such as the persistent issue of false alarms caused by environmental electromagnetic interference or material mineralization, which can slow down screening processes and necessitate human intervention. Additionally, the initial capital expenditure for advanced, high-precision detection equipment remains high, particularly for small and medium enterprises, potentially limiting broader adoption in certain price-sensitive regions.

Opportunities for market growth are strongly linked to ongoing technological advancements and market diversification. The development of Simultaneous Multi-Frequency (SMF) technology and sophisticated Digital Signal Processing (DSP) allows detectors to achieve greater depth and superior discrimination in complex environments, opening new avenues in archaeological and deep-search applications. Moreover, the integration of metal detection systems with other security technologies, such as X-ray inspection and biometric access control, is creating highly efficient, layered security solutions demanded by modern critical infrastructure. The proliferation of affordable, high-performance consumer detectors, driven by the increasing popularity of metal detecting as a hobby, also represents a growing and largely untapped revenue stream for manufacturers, encouraging innovation in ergonomics and user interface design for this segment. Furthermore, stringent regulatory enforcement across emerging economies concerning product safety offers consistent long-term growth potential for industrial detector manufacturers.

The primary impact forces propelling the market include regulatory mandates, where governmental bodies worldwide enforce the use of metal detectors in specific public and private venues, directly influencing procurement cycles and technology specifications. The competitive landscape force dictates continuous innovation, forcing key players to invest heavily in R&D to provide faster, more accurate, and more reliable systems that integrate seamlessly with Industry 4.0 standards and smart security platforms. Economic stability and industrial capital expenditure cycles influence demand, as high-cost systems are often purchased as part of broader infrastructure upgrades or facility expansions. Finally, public perception and media attention surrounding security incidents amplify the need for visible, effective security measures, directly influencing consumer and institutional purchasing decisions for high-end detection equipment.

Segmentation Analysis

The Metal Detector Market is comprehensively segmented based on technology, product type, application, and end-user, reflecting the diverse requirements across industries ranging from critical security screening to precise industrial quality control. Technology segmentation distinguishes between Very Low Frequency (VLF), which is prevalent in consumer and shallow search applications, and Pulse Induction (PI), favored for deep penetration and stable performance in highly mineralized ground, alongside specialized technologies like Ground Penetrating Radar (GPR) used for non-metallic and complex subsurface imaging. Product type differentiation separates the market into stationary systems, such as large walk-through detectors essential for airports, and portable systems, including handheld wands and smaller industrial inline units, offering flexibility and targeted inspection capabilities across various checkpoints and production environments.

Application segmentation highlights the major end-use sectors, with Security & Screening dominating due to pervasive global requirements, encompassing civil aviation, defense, and public events. The Industrial segment, comprising food processing, pharmaceuticals, textiles, and packaging, is pivotal for quality assurance and regulatory adherence, demanding specialized, high-sensitivity detectors capable of identifying tiny contaminants at high throughput speeds. The Consumer segment, focused on leisure activities like hobby metal detecting, archaeology, and relic recovery, drives demand for ergonomically designed, feature-rich, and lightweight devices. Each application segment presents unique performance criteria and purchase factors, influencing technological design choices and market positioning strategies among manufacturers.

Geographical segmentation remains crucial, outlining market maturity and growth potential across major global regions. North America and Europe possess high market value due to established regulatory frameworks and high spending on public security infrastructure. Asia Pacific, however, represents the fastest-growing market, driven by massive urbanization, infrastructure development, and increased foreign investment in manufacturing, necessitating rapid adoption of advanced detection technologies. This detailed segmentation allows manufacturers to tailor their product offerings, marketing campaigns, and distribution strategies to effectively capture market share within specific niches defined by technological needs, operational environment, and regional regulatory landscapes, ensuring maximum relevance and market penetration.

- By Technology:

- Very Low Frequency (VLF)

- Pulse Induction (PI)

- Beat Frequency Oscillation (BFO)

- Digital Signal Processing (DSP)

- Simultaneous Multi-Frequency (SMF)

- By Product Type:

- Walk-Through Metal Detectors (WTMD)

- Handheld Metal Detectors (HHMD)

- Industrial Inline Detectors

- Ground Search Detectors (Consumer/Hobby)

- Underwater/Submersible Detectors

- By Application/End-User:

- Security & Screening (Aviation, Defense, Government, Public Venues)

- Industrial (Food & Beverage, Pharmaceuticals, Mining, Textiles, Plastics)

- Consumer & Hobby (Treasure Hunting, Archaeology)

- Others (Utility & Construction, Military Explosive Ordnance Disposal - EOD)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA) (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Metal Detector Market

The value chain for the Metal Detector Market commences with upstream activities focusing on the procurement of specialized raw materials and components, which are crucial for the performance of the final device. Key inputs include high-quality copper wiring for coils, sophisticated sensor components (ferrite materials, specialized integrated circuits), microprocessors for digital signal processing, and robust, often custom-molded, plastics or composite materials for housing and ergonomic design. The effectiveness and sensitivity of a metal detector are directly linked to the quality and precision of these input materials, making strategic sourcing and supplier management vital for maintaining product quality and ensuring compliance with stringent electronic and environmental standards. Relationships with specialized electronic component manufacturers, particularly those providing advanced microcontrollers and signal amplification chips, are fundamental at this stage to enable rapid technological iteration and miniaturization in the subsequent manufacturing phase.

The manufacturing phase involves the complex assembly and integration of coils, control boxes, and software systems, followed by rigorous calibration and testing protocols essential for certification (e.g., CE, FCC, TSA compliance). Direct distribution channels involve large manufacturers selling sophisticated industrial or security systems directly to major institutional buyers, such as government agencies, airport authorities, or large food processing conglomerates. This approach facilitates tailored installation, specialized training, and ongoing service contracts, maximizing the effectiveness of high-cost specialized equipment. Indirect distribution utilizes a network of authorized distributors, system integrators, and specialized retailers, which is particularly effective for reaching smaller industrial clients, security firms needing localized support, and the vast consumer/hobbyist market. These intermediate channels often provide regional warehousing, localized technical support, and critical market penetration in diverse geographical areas, utilizing both physical retail outlets and expanding e-commerce platforms to distribute portable and consumer-grade units efficiently.

Downstream activities are dominated by comprehensive installation, post-sale service, and system integration. For large-scale security and industrial systems, integration services are paramount, ensuring seamless connectivity with existing security infrastructure, such as conveyor systems or surveillance networks. After-sales support, including regular software updates, sensor calibration services, and provision of spare parts, constitutes a critical revenue stream and heavily influences long-term customer satisfaction and brand loyalty. The complexity of modern detectors, especially those incorporating AI and network connectivity, necessitates a highly skilled technical service workforce capable of diagnosing and resolving sophisticated hardware and software issues. The feedback loop established through maintenance and service directly informs the upstream R&D process, allowing manufacturers to continuously improve product reliability and adapt to evolving user requirements and regulatory changes, thereby completing the value cycle.

Metal Detector Market Potential Customers

The potential customer base for the Metal Detector Market is remarkably diversified, spanning governmental bodies, large multinational corporations, and individual consumers, segmented by their core operational requirements and regulatory mandates. Primary institutional end-users include governmental agencies responsible for national security, defense departments, civil aviation authorities operating airports, and public venue management (stadiums, concert halls, museums). These customers prioritize high throughput, maximum sensitivity, robust threat identification capabilities, and regulatory compliance, necessitating significant investment in walk-through and advanced checkpoint screening systems that often require complex system integration and long-term service contracts. Security-focused buyers demand robust integration with access control and surveillance infrastructure, making system reliability and certification key purchasing criteria.

Industrial end-users form another crucial customer segment, comprising companies in the highly regulated Food and Beverage (F&B) and Pharmaceutical sectors. These manufacturers are driven by zero-tolerance policies toward contamination and strict adherence to global safety standards (e.g., HACCP, FDA, GMP). Their purchasing decisions are focused on high-precision inline detectors that offer minimal false reject rates, verifiable traceability, and ease of cleaning to meet hygiene standards. Furthermore, mining and construction companies, utilizing large, rugged detectors to protect heavy machinery from metallic debris or locate buried utilities, represent specialized industrial buyers prioritizing durability, depth penetration, and resistance to harsh environmental conditions. The purchase cycle in this segment is strongly correlated with capital expenditure budgets and expansion projects within these heavy industries.

Finally, the consumer segment includes hobbyists, professional archaeologists, and individuals involved in specialized search and recovery operations. This group requires portable, lightweight, and user-friendly devices with advanced discrimination features and clear interfaces. E-commerce platforms and specialized retail outlets are the preferred distribution channels for this segment, which is highly influenced by online reviews, community recommendations, and product feature sets such as waterproofing and multi-frequency performance. The market for entry-level and mid-range consumer detectors is volume-driven and highly sensitive to pricing, contrasting sharply with the procurement process for high-value governmental and industrial systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garrett Metal Detectors, CEIA SpA, Mettler-Toledo International Inc., Eriez Manufacturing Co., MineLab, Fisher Research Labs, L3Harris Technologies, Inc., Safescan, Nokta Makro Detectors, Bruker Corporation, Fortress Technology Inc., Metal Detection Inc., Autoclear LLC, Smiths Detection Group Ltd., Lock Inspection Systems, Shanghai Dahan Detection Technology Co., Ltd., Anritsu Corporation, Thermo Fisher Scientific, S+S Separation and Sorting Technology GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Detector Market Key Technology Landscape

The Metal Detector Market's technological landscape is characterized by a rapid migration from simple analog systems to complex digital platforms, heavily relying on advanced signal processing and multi-frequency capabilities. Key technological drivers include the widespread adoption of Digital Signal Processing (DSP), which allows detectors to filter noise, analyze complex return signals with unprecedented speed, and significantly improve target identification capabilities over traditional analog circuits. DSP enables sophisticated discrimination algorithms that can effectively distinguish between different metals (ferrous vs. non-ferrous, precious metals) and size profiles, dramatically enhancing accuracy in security and industrial inspection applications. This digital foundation also facilitates the integration of advanced features such as data logging, network connectivity, and remote diagnostic capabilities, which are essential for Industry 4.0 compliant industrial systems and centralized security management platforms.

A major advancement gaining dominance is Simultaneous Multi-Frequency (SMF) technology, which allows the detector to transmit and receive signals at multiple frequencies simultaneously, overcoming the traditional trade-off between sensitivity (best achieved at higher frequencies) and depth penetration (best at lower frequencies). SMF technology provides a holistic analysis of the subsurface or inspected material, offering superior performance in highly mineralized ground (relevant for hobby and mining applications) and improved contaminant detection in challenging industrial environments, such as those involving wet or conductive food products. This capability not only boosts detection performance but also ensures consistency across varied operating conditions, solidifying its position as a premium technology in both consumer and professional high-end equipment. Manufacturers are continuously refining SMF algorithms to optimize battery life and processing speed, expanding its applicability.

Furthermore, innovations in coil design and sensor optimization are contributing significantly to performance gains. Modern detectors utilize elliptical or double-D (DD) search coils that offer superior ground coverage and enhanced magnetic field overlap, increasing target resolution and stability, particularly in dense search environments. Pulse Induction (PI) technology, traditionally robust but lacking in discrimination, is being enhanced with sophisticated microprocessors to offer improved discrimination, making it increasingly viable for trash-heavy areas and deep relic hunting where VLF systems struggle due to ground mineralization. The focus across the landscape is moving toward integrated systems that combine metal detection with other sensors, such as X-ray imaging or magnetic resonance, creating comprehensive screening solutions capable of identifying both metallic and non-metallic threats or contaminants in a single pass.

Regional Highlights

- North America: This region maintains a dominant position, driven by the United States’ significant spending on homeland security, stringent regulations enforced by agencies like the Transportation Security Administration (TSA), and robust industrial sectors, particularly food processing and pharmaceuticals. The market benefits from high consumer disposable income, fueling demand for high-end hobby detectors. Technological adoption rates are high, with significant uptake of AI-integrated security screening solutions.

- Europe: Characterized by mature markets in countries like Germany, the UK, and France, Europe is heavily regulated, leading to mandatory implementation of detection systems in public transport, historical sites, and industrial manufacturing to comply with European Union directives. The region is a key hub for industrial metal detector innovation, particularly focusing on systems meeting stringent food safety standards (e.g., IFS, BRC), ensuring continuous market replacement cycles and upgrades.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive infrastructure investment, rapid industrialization, and increasing urbanization in China, India, and Southeast Asian nations. The growing middle class is adopting consumer detectors, while governments are modernizing airport and port security. The expansion of the region’s food and pharmaceutical production facilities significantly boosts demand for industrial inline inspection systems, making it a critical focus area for global manufacturers.

- Latin America: This market shows moderate growth, primarily driven by necessary security upgrades at major international airports and government buildings in countries like Brazil and Mexico. The industrial sector, particularly mining, is a steady purchaser of rugged, high-depth detection equipment used for equipment protection and resource exploration. Economic volatility can sometimes restrain large-scale infrastructural investments, but core security needs remain consistent.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states (UAE, Saudi Arabia) due to high spending on smart city development, critical infrastructure protection (oil and gas pipelines), and counter-terrorism measures. Investments in advanced airport security systems and large-scale construction projects requiring utility location drive the market here. The demand is typically for high-end, certified international products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Detector Market.- Garrett Metal Detectors

- CEIA SpA

- Mettler-Toledo International Inc.

- Eriez Manufacturing Co.

- MineLab

- Fisher Research Labs

- L3Harris Technologies, Inc.

- Safescan

- Nokta Makro Detectors

- Bruker Corporation

- Fortress Technology Inc.

- Metal Detection Inc.

- Autoclear LLC

- Smiths Detection Group Ltd.

- Lock Inspection Systems

- Shanghai Dahan Detection Technology Co., Ltd.

- Anritsu Corporation

- Thermo Fisher Scientific

- S+S Separation and Sorting Technology GmbH

- Shanghai Tianqi Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Metal Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological advancements are driving the growth of the Metal Detector Market?

The market growth is primarily driven by the adoption of Simultaneous Multi-Frequency (SMF) technology and advanced Digital Signal Processing (DSP), which significantly enhance discrimination capabilities and detection depth, reducing false alarms in complex environmental or industrial settings. Furthermore, AI integration is optimizing threat classification in security screening.

How is the industrial sector utilizing metal detectors for quality control?

Industrial sectors, especially Food and Beverage and Pharmaceuticals, use high-sensitivity inline metal detectors integrated with automated rejection systems to identify and remove products contaminated with minute metallic fragments, ensuring strict compliance with global food safety and quality regulations (e.g., HACCP, FSMA).

Which geographical region exhibits the highest growth potential for metal detectors?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to extensive infrastructure development, rapid industrialization, increasing government investment in public security, and the consequent proliferation of manufacturing facilities requiring mandated contaminant detection systems.

What are the primary restraints affecting the Metal Detector Market?

Key restraints include the high initial capital investment required for advanced, certified detection systems, particularly for AI-enabled equipment, and operational challenges such as persistent false alarm occurrences caused by electromagnetic interference or ground mineralization, requiring specialized operator training.

What is the difference between VLF and Pulse Induction (PI) technologies?

Very Low Frequency (VLF) systems are highly effective for discrimination and shallow searching but struggle in mineralized ground. Pulse Induction (PI) systems offer excellent depth penetration and stability in highly conductive or mineralized soils but traditionally have limited discrimination capabilities, making them ideal for specialized deep hunting and beach searching.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Digital Metal Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- MRI Metal Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HandHeld Security Screening Device Market Statistics 2025 Analysis By Application (Transportation, Border Customs, Law Enforcement Department, Enterprise), By Type (Handheld Metal Detector (HHMD), Handheld X-ray System, Handheld Raman Spectrometers, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Separated Metal Detector Market Statistics 2025 Analysis By Application (Food & Beverages, Pharmaceuticals, Packaing, Textile, Others), By Type (Electromagnetic Induction, X-ray, Microwave), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hand Held Metal Detector Market Statistics 2025 Analysis By Application (Schools, Courthouse, Airport), By Type (Foldable, Fixed), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager