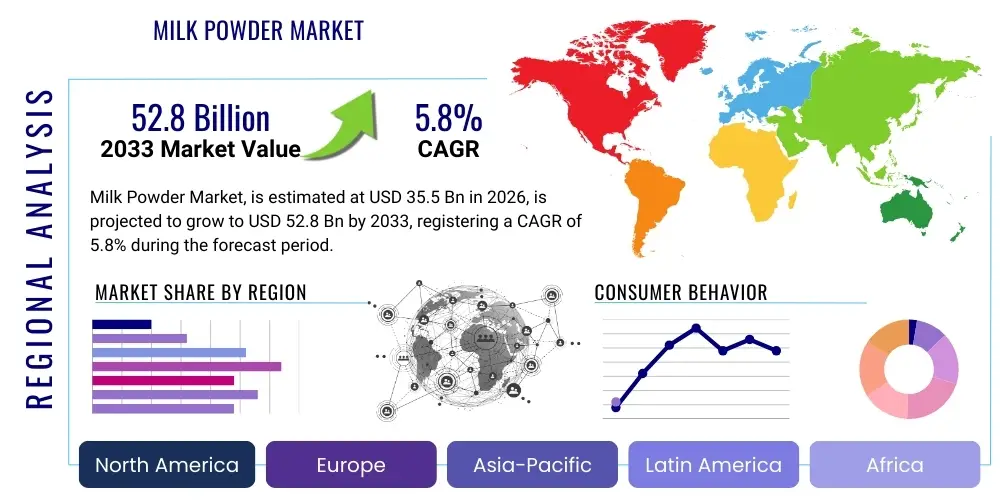

Milk Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437181 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Milk Powder Market Size

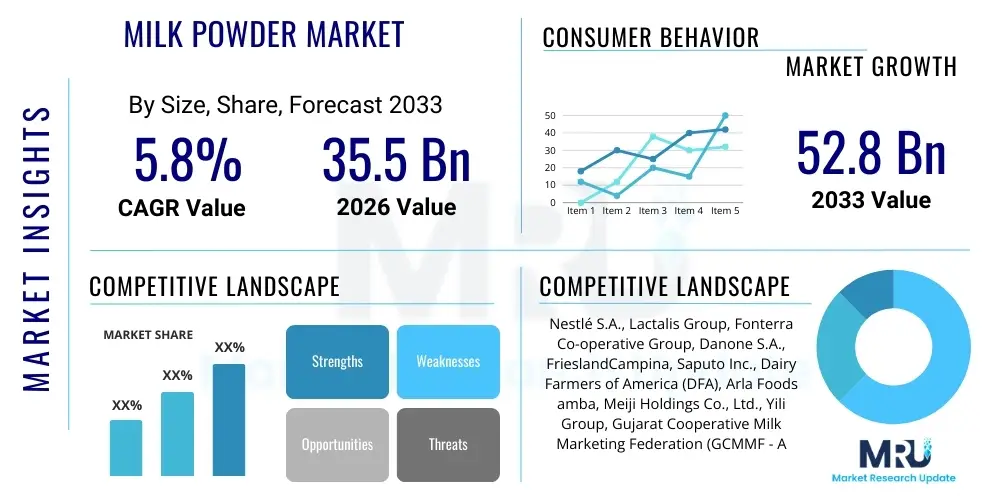

The Milk Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 52.8 Billion by the end of the forecast period in 2033.

Milk Powder Market introduction

The Milk Powder Market encompasses a diverse range of dehydrated dairy products derived from milk, primarily through processes like spray drying or roller drying. These products, which include Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Buttermilk Powder, and specialized derivatives such as lactose and whey proteins, offer extended shelf-life, ease of storage, and convenience in transportation compared to liquid milk. The fundamental process involves pasteurization, concentration via evaporation, and subsequent dehydration. This enables dairy processors to manage seasonal milk surpluses effectively and cater to regions with limited cold chain infrastructure or high ambient temperatures.

Major applications of milk powder span the food and beverage industry, pharmaceutical sector, and animal feed manufacturing. Within the food sector, milk powders are indispensable ingredients in confectionery (chocolates, candies), bakery products (breads, pastries), ready-to-drink beverages, and processed foods due to their functional properties, including emulsification, flavor enhancement, and texture stabilization. WMP provides richer mouthfeel and fat content crucial for products like infant formula and premium chocolates, while SMP is favored in low-fat applications. The rising global demand for nutritional fortification and functional foods further solidifies milk powder’s role as a staple ingredient.

Key driving factors accelerating market expansion include rapid urbanization, leading to higher demand for packaged and shelf-stable foods, particularly in emerging economies of Asia Pacific and Latin America. Additionally, the growing awareness regarding protein and calcium intake, coupled with the increasing penetration of organized retail channels, facilitates broader access to milk powder products. The versatility of milk powder, allowing its reconstitution into liquid milk or use as an ingredient enhancer, makes it crucial for industrial scale food manufacturing and humanitarian aid efforts globally, underpinning sustained market growth despite fluctuations in raw milk supply and pricing volatility.

Milk Powder Market Executive Summary

The global Milk Powder Market is characterized by robust growth, primarily driven by demographic shifts, expanding applications in the functional food sector, and advancements in drying and preservation technologies. Business trends indicate a strong focus on strategic mergers and acquisitions (M&A) among major dairy cooperatives and multinational corporations to consolidate market share, secure diverse raw material sources, and optimize global supply chains. Furthermore, there is a discernible shift towards sustainable sourcing and transparent labeling, spurred by increasing consumer scrutiny regarding environmental impact and animal welfare. Manufacturers are investing heavily in research and development to produce specialized milk powders, such as fortified variants, low-lactose powders, and customized protein compositions tailored for sports nutrition and clinical dietetics, positioning these high-value segments as key growth accelerators.

Regional trends highlight the Asia Pacific region as the undisputed leader in both consumption and manufacturing capacity, primarily due to large population bases, rising disposable incomes, and the massive scale of the infant formula market in countries like China and India. While established markets in North America and Europe demonstrate moderate growth, their focus remains centered on premiumization, organic offerings, and specialized functional ingredients. In contrast, markets in Latin America and the Middle East and Africa are experiencing dynamic growth fueled by expanding middle classes, increased consumption of processed foods, and often a reliance on international trade to meet domestic dairy requirements, positioning these regions as critical targets for global exporters.

Segment trends demonstrate the significant commercial superiority of Skimmed Milk Powder (SMP) by volume, attributable to its lower cost base and extensive use in industrial applications. However, the Whole Milk Powder (WMP) segment remains economically crucial, particularly within the retail and infant nutrition spaces. The fastest-growing segment is projected to be specialized milk powders, including high-protein isolates and infant formulas, which command premium pricing and benefit from targeted marketing towards health-conscious consumers and specialized dietary needs. This segmentation underscores a dual market structure: a high-volume, cost-competitive commodity segment (SMP) serving the mass market, coexisting with a high-value, innovation-intensive segment (specialized powders) driving profit margins and technological advancement.

AI Impact Analysis on Milk Powder Market

Common user questions regarding AI's impact on the Milk Powder Market often center on its efficacy in enhancing supply chain resilience, improving product quality consistency, and optimizing resource utilization in manufacturing processes. Users frequently inquire about how AI can predict fluctuating raw milk prices and ensure traceability from farm to finished product. The overarching theme is the expectation that AI and machine learning (ML) will transition milk powder production from reactive quality control to proactive predictive maintenance and dynamic demand forecasting, minimizing waste and maximizing efficiency across the entire value chain. Key user concerns revolve around the initial capital investment required for AI infrastructure, data security, and the need for specialized training for dairy processing personnel to effectively implement these sophisticated analytical tools.

- AI-driven predictive maintenance optimizes spray drying equipment scheduling, minimizing downtime and energy consumption during critical dehydration phases.

- Machine learning algorithms analyze large datasets to forecast regional and seasonal milk supply fluctuations, enabling processors to hedge procurement costs and adjust inventory levels proactively.

- Computer vision and image analysis, powered by AI, enhance quality control by automatically detecting contamination or inconsistencies in powder texture and color during processing and packaging.

- AI tools improve supply chain traceability by integrating blockchain technology, instantly verifying the origin and handling history of raw milk and finished powder for compliance and consumer trust.

- Generative AI assists in product formulation by simulating the functional properties of new milk powder blends (e.g., protein solubility, heat stability) before physical batch testing, accelerating R&D cycles.

- Advanced demand forecasting models integrate external factors (weather, socio-economic events, holiday spikes) with historical sales data to optimize production scheduling and minimize costly overstocking or stockouts.

- AI optimizes energy management in highly energy-intensive stages like evaporation and drying, leading to significant cost savings and reduced carbon footprint per kilogram of produced powder.

- Personalized nutrition solutions leverage AI to recommend specialized milk powder ingredients for infant formulas or clinical nutrition based on individual genetic or health profiles.

DRO & Impact Forces Of Milk Powder Market

The market dynamics of the Milk Powder Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities. A primary driver is the burgeoning global population, particularly in developing regions, which sustains fundamental demand for affordable, shelf-stable protein sources. Coupled with this is the continuous growth in the consumption of processed and convenience foods, where milk powder is an essential functional ingredient for texture, flavor, and stability. Furthermore, advancements in specialized nutrition, particularly the sophisticated regulatory and market demands for infant milk formula (IMF) and specialized medical nutrition, drive innovation and push up the market value, offsetting volatility experienced in the commodity segments.

However, the industry faces significant restraints, most notably the high volatility and unpredictable fluctuation of raw milk prices, which directly impact manufacturers' profit margins and pricing strategies. Regulatory barriers related to international trade, including tariffs, quotas, and complex food safety standards varying across jurisdictions (e.g., EU regulations versus USDA standards), complicate export strategies and limit market access. Additionally, increasing consumer awareness regarding dairy alternatives (plant-based milks) poses a long-term competitive threat, forcing traditional dairy producers to invest heavily in functional enhancements and differentiated product claims to maintain market share.

Opportunities in the market are centered around technological leverage and geographic expansion. The potential for capitalizing on emerging markets in Southeast Asia and Africa, where domestic dairy production often lags behind burgeoning demand, presents substantial export opportunities. Technological advancements in drying techniques, such as low-temperature or vacuum drying, offer the prospect of preserving heat-sensitive nutritional compounds, enhancing the value proposition for premium functional powders. Furthermore, integrating advanced traceability systems (like blockchain) throughout the supply chain offers a critical competitive advantage, satisfying the growing consumer and regulatory demand for transparency and assured product integrity, thereby mitigating the impact of food safety concerns.

Segmentation Analysis

The Milk Powder Market is extensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse utilization profile of the product across various industries. Analysis reveals that segmentation based on type, specifically the distinction between Skimmed Milk Powder (SMP) and Whole Milk Powder (WMP), drives most production decisions, with SMP dominating volume due to its utility in numerous low-fat industrial formulations. However, the Application segment, particularly Infant Formula, commands the highest revenue share due to rigorous safety standards, required nutritional complexity, and high retail pricing, necessitating specialized, dedicated production lines and certifications. Understanding these segments is crucial for strategic market positioning, allowing companies to allocate resources towards high-growth, high-margin areas such as specialized protein powders versus volume-driven commodity trading.

- By Type:

- Whole Milk Powder (WMP)

- Skimmed Milk Powder (SMP)

- Dairy Whitener/Creamer

- Buttermilk Powder

- Specialized Milk Powders (Lactose-free, Organic, Fortified)

- By Application:

- Infant Formula

- Confectionery

- Bakery

- Dairy Products (Yogurts, Ice Cream)

- Nutritional Products (Sports Supplements, Clinical Nutrition)

- Retail/Household

- By Distribution Channel:

- B2B (Industrial Manufacturers)

- B2C (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

Value Chain Analysis For Milk Powder Market

The value chain of the Milk Powder Market begins with extensive upstream activities, primarily encompassing raw milk production and collection. This stage is highly dependent on climate conditions, feed costs, herd management efficiency, and farmer cooperatives. Successful processors establish robust milk procurement networks, often utilizing advanced telemetry and temperature monitoring during transport to ensure the quality and bacterial count of the raw milk meet stringent processing standards immediately upon arrival. Upstream consolidation and strategic partnerships with large-scale, high-yield dairy farms are crucial for ensuring consistent volume supply required for continuous, cost-effective spray drying operations, which is the most common technique used for milk powder manufacturing globally.

The midstream phase involves the core processing steps: pasteurization, evaporation (concentration of milk solids), and the final spray drying or roller drying process. This stage is extremely capital and energy-intensive. Efficiency in evaporation—reducing the moisture content before drying—is key to lowering operational costs. The choice of drying technology determines the functional properties of the final powder, such as solubility and heat stability, which are critical for specific applications like instant coffee creamers or specialized infant formula bases. Quality assurance (QA) protocols, including moisture content analysis and particle size distribution checks, are integrated throughout this phase to ensure the product adheres to both domestic and international standards before packaging.

Downstream activities focus on packaging, logistics, distribution, and final sales channels. Packaging must be optimized for moisture barriers and oxygen scavenging to maintain the powder's integrity and shelf-life, especially for export. Distribution channels are bifurcated into B2B (industrial sales) and B2C (retail sales). Direct sales are frequent between major processors and large industrial buyers (e.g., confectionery giants or IMF manufacturers). Indirect distribution utilizes wholesalers, importers, and regional distributors to move products through organized retail, online platforms, and institutional catering sectors, requiring sophisticated inventory management and cold storage options for certain temperature-sensitive derivatives like whey protein isolates or specialized medicinal powders.

Milk Powder Market Potential Customers

The primary customers for high-volume milk powder are industrial end-users, predominantly within the food processing sector, specifically manufacturers of bakery, confectionery, and savory products. These large B2B buyers utilize milk powder as a foundational ingredient for its functional attributes—serving as a binder, emulsifier, source of milk solids non-fat (MSNF), and flavor enhancer. For instance, confectionery companies rely on Whole Milk Powder (WMP) to achieve the characteristic flavor and smooth texture of milk chocolate, demanding consistent quality and specific fat content. Their purchasing decisions are heavily influenced by price stability, guaranteed supply volume, and adherence to strict specifications regarding bacterial load and solubility, making long-term supply contracts a prevalent feature of this segment.

A second, exceptionally high-value segment consists of manufacturers specializing in Infant Milk Formula (IMF) and Clinical/Sports Nutrition products. IMF manufacturers are perhaps the most demanding customers, requiring pharmaceutical-grade purity, meticulous traceability, and milk powder that is often partially hydrolyzed or enriched with specialized vitamins and minerals. The regulatory environment surrounding IMF is intensely strict, meaning suppliers must possess advanced certifications and often implement dedicated, segregated production facilities to avoid cross-contamination. Similarly, sports nutrition companies buying specialized protein isolates (like whey protein concentrate/isolate derived from milk processes) prioritize high protein purity and bioavailability, often paying a significant premium for specialized processing techniques that maximize nutritional integrity.

The third major customer group comprises retail consumers and institutions (HORECA). Retail consumers purchase packaged milk powder primarily for home consumption, reconstitution as a substitute for fresh milk, or use in baking. This segment is driven by convenience, brand loyalty, and price point. Institutional buyers, such as hotels, restaurants, and catering services, use milk powder in large quantities for efficiency and long-term storage capabilities, especially in remote or underdeveloped areas. The retail segment, increasingly dominated by e-commerce, demands smaller, consumer-friendly packaging and clear, detailed nutritional information, reflecting the broader market trend towards health awareness and ingredient transparency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 52.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Lactalis Group, Fonterra Co-operative Group, Danone S.A., FrieslandCampina, Saputo Inc., Dairy Farmers of America (DFA), Arla Foods amba, Meiji Holdings Co., Ltd., Yili Group, Gujarat Cooperative Milk Marketing Federation (GCMMF - Amul), Glanbia plc, Kerry Group plc, Abbott Laboratories, Mengniu Dairy, Synlait Milk Ltd., Dairygold Co-Operative Society Ltd., Tirlán (formerly Glanbia Ireland), IDP Group, and Hochdorf Holding AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milk Powder Market Key Technology Landscape

The technological landscape of the Milk Powder Market is dominated by advancements in drying and separation technologies, aimed at improving product quality, reducing energy consumption, and enhancing functional properties. Spray drying remains the gold standard for producing high-quality, free-flowing powders, but continuous innovation focuses on two areas: optimizing atomizer designs for uniform particle size distribution, which is crucial for instant solubility, and implementing multi-stage drying systems. These systems often incorporate fluid-bed post-drying, reducing the temperature exposure of the product, thereby preserving heat-sensitive components like vitamins and delicate proteins, making the powder more suitable for premium applications like infant formula and medical nutrition. Furthermore, the integration of automation and process control sensors ensures precise moisture management, mitigating the risk of product caking or microbial growth.

Membrane filtration technology, specifically ultrafiltration (UF) and reverse osmosis (RO), is revolutionizing the pre-concentration phase upstream of drying. By using membrane processes to remove water and selectively separate milk components (like protein and lactose) before evaporation, processors can significantly reduce the energy load required for the subsequent thermal drying stage. This not only lowers operational costs substantially but also allows for the creation of highly specialized, standardized powders, such as whey protein isolates (WPI) and concentrates (WPC), which are essential ingredients for the burgeoning sports nutrition segment. Advancements in ceramic and polymeric membrane materials are continuously improving flux rates and membrane lifespan, making filtration an increasingly viable and cost-effective pre-treatment method.

Beyond processing, packaging and safety technologies are paramount. Modified Atmosphere Packaging (MAP) and nitrogen flushing are standard practices used to minimize oxygen exposure, preventing lipid oxidation and maintaining the freshness of fat-containing powders (WMP) over long periods. Moreover, the adoption of advanced traceability systems, often leveraging blockchain technology, is becoming crucial for market competitiveness, particularly in export-focused regions. These systems provide immutable records of sourcing, processing parameters, and logistics history, addressing critical consumer demands for transparency and regulatory requirements for rapid recall management in case of contamination incidents, thereby solidifying trust in high-value products like specialized infant nutritional powders.

Regional Highlights

The Asia Pacific (APAC) region stands as the largest and most dynamic market for milk powder globally. This dominance is primarily attributed to densely populated nations like China and India, coupled with rapidly expanding middle classes experiencing urbanization and a shift towards Westernized diets that incorporate more dairy products. The demand for infant formula, driven by cultural factors and high population birth rates in countries like Vietnam and Indonesia, makes this region the central focus for global dairy exporters. Furthermore, domestic dairy processing in major APAC nations often struggles to keep pace with demand, necessitating substantial imports of both WMP and SMP for use in local food manufacturing and reconstitution, maintaining the region's position as a net importer and key determinant of global commodity prices.

North America and Europe represent mature markets characterized by stringent quality regulations and a strong emphasis on value-added and specialized dairy ingredients. While overall volume growth is slower than in APAC, these regions lead in innovation, focusing on organic milk powders, lactose-free alternatives, and high-purity protein ingredients targeted towards fitness and clinical sectors. European production, underpinned by major cooperatives, benefits from high levels of efficiency and strong export networks, positioning them competitively in high-value segments globally. The trend here is towards localized sourcing, enhanced sustainability metrics, and the utilization of milk powder derivatives in high-end functional beverages and supplements, rather than basic commodity consumption.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging as significant growth poles. MEA nations, heavily reliant on imported dairy products due to arid climates limiting domestic raw milk production, show rising consumption driven by economic diversification and population growth. LATAM markets, especially Brazil and Mexico, are seeing increased demand for milk powder in processed foods and as retail staple due to economic stability and logistical advantages of using shelf-stable dairy. These regions present substantial opportunities for international dairy exporters willing to navigate local regulatory requirements and establish efficient cold-chain distribution networks for reconstitution and local industrial utilization.

- Asia Pacific (APAC): Dominates market size and growth, driven by massive consumption in infant formula and confectionery sectors (e.g., China, India). Significant reliance on imports to meet surging domestic demand.

- North America: Focus on premiumization, specialized protein powders (WPI, WPC), and organic dairy options. Market characterized by high disposable income and strong regulatory environment.

- Europe: Leading exporter of high-quality dairy ingredients; emphasis on sustainable sourcing, stringent food safety standards, and advanced processing technologies. Key markets include Germany, France, and Ireland.

- Latin America (LATAM): Rapidly increasing consumption in industrial food applications due to urbanization and growing consumer bases (e.g., Brazil, Mexico).

- Middle East and Africa (MEA): High growth potential due to import dependence and rising population, driving demand for shelf-stable dairy products, particularly in GCC countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milk Powder Market.- Nestlé S.A.

- Lactalis Group

- Fonterra Co-operative Group

- Danone S.A.

- FrieslandCampina

- Saputo Inc.

- Dairy Farmers of America (DFA)

- Arla Foods amba

- Meiji Holdings Co., Ltd.

- Yili Group

- Gujarat Cooperative Milk Marketing Federation (GCMMF - Amul)

- Glanbia plc

- Kerry Group plc

- Abbott Laboratories

- Mengniu Dairy

- Synlait Milk Ltd.

- Dairygold Co-Operative Society Ltd.

- Tirlán (formerly Glanbia Ireland)

- IDP Group

- Hochdorf Holding AG

Frequently Asked Questions

Analyze common user questions about the Milk Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Whole Milk Powder (WMP)?

The primary driver for Whole Milk Powder (WMP) demand is its essential role in the production of high-value consumer goods, particularly infant formula and high-quality milk chocolate and confectionery products, where the fat content and rich flavor profile are critical functional attributes. Additionally, WMP is vital for reconstitution in regions lacking access to fresh liquid milk.

How does raw milk price volatility affect the Milk Powder Market?

Raw milk price volatility significantly compresses the operating margins of milk powder processors, especially those specializing in commodity Skimmed Milk Powder (SMP). Price fluctuations necessitate sophisticated risk management strategies and influence global trade flows, often leading to temporary shifts in regional export competitiveness and industrial procurement costs.

Which geographical region dominates the consumption of milk powder and why?

Asia Pacific (APAC) dominates global milk powder consumption, primarily driven by massive demand from populous nations like China and India, where it is extensively used in infant nutrition, confectionery manufacturing, and as a retail staple due to increasing disposable incomes and limitations in domestic fresh milk supply chains.

What technological advancement is crucial for producing high-quality specialized milk powders?

The implementation of multi-stage drying systems, combining traditional spray drying with fluid-bed post-drying, is crucial. This technology lowers the overall temperature exposure during processing, effectively preserving delicate nutritional components like vitamins and functional proteins, which is essential for high-quality infant formula and nutritional supplements.

What are the key differences in market trends between WMP and SMP?

Skimmed Milk Powder (SMP) dominates the market by volume and is used extensively in industrial, low-fat applications due to its lower cost. Whole Milk Powder (WMP) commands higher revenue and is driven by demand in retail and premium applications like infant formula, where fat content is necessary and premium pricing offsets the higher production costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Coconut Milk Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Instant Full Cream Milk Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dry Whole Milk Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Coconut Milk Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Dairy Ingredients Market Size Report By Type (Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Buttermilk Powder, Cream Powder, Blenders & Replacer, Rolled Dried Powder, Fat-filled Powde, Permeate Powder/Dried Permeate, Lactose & Derivatives, Casein & Caseinate, MPC & MPI, Whey Ingredients), By Application (Bakery & Confectionery, Chocolate, Ice-Cream, Others, Dairy Products, Recombinant Milk, Others, Convenience Food, Infant Milk Formula, Sports & Clinical Nutrition, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager