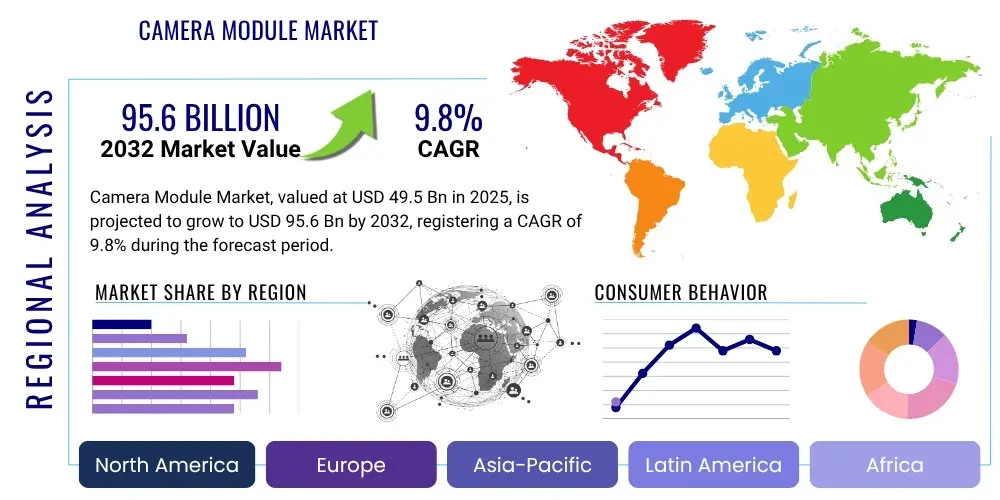

Camera Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430061 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Camera Module Market Size

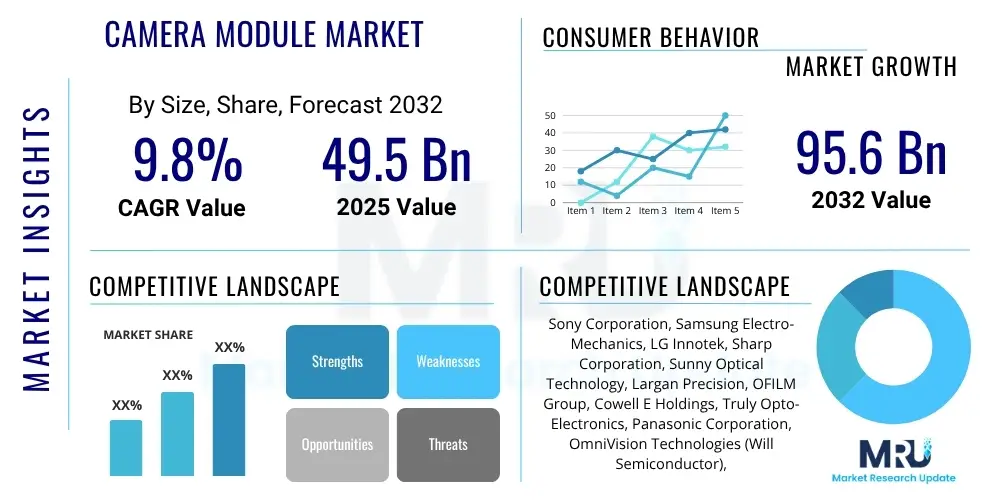

The Camera Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. This robust growth trajectory underscores the increasing demand for advanced imaging solutions across a multitude of industries. The market is estimated at USD 49.5 Billion in 2025, reflecting its current significant valuation and widespread adoption. It is projected to achieve a substantial valuation of USD 95.6 Billion by the end of the forecast period in 2032, indicating nearly a doubling in market size over seven years. This expansion is attributed to continuous technological advancements and the proliferation of camera-integrated devices globally.

Camera Module Market introduction

The Camera Module Market encompasses the intricate ecosystem surrounding the design, manufacturing, and deployment of compact, integrated optical imaging systems. These modules are sophisticated assemblies typically comprising a high-resolution lens, an advanced image sensor (predominantly CMOS), an embedded image signal processor (ISP) for data refinement, and a flexible printed circuit (FPC) for electrical connectivity, all meticulously packaged into a miniaturized unit. Their fundamental purpose is to capture optical light, convert it into digital electronic signals, and process these signals into usable images or video streams, effectively serving as the digital "eyes" for a vast array of electronic devices and systems.

The versatility and performance of camera modules have propelled their integration into numerous critical applications across diverse sectors. In the consumer electronics domain, they are indispensable for smartphones, enabling sophisticated photography features, video conferencing, and augmented reality experiences. The automotive industry heavily relies on camera modules for advanced driver-assistance systems (ADAS), rearview cameras, 360-degree surround view, and emerging autonomous driving capabilities, enhancing vehicle safety and intelligence. Furthermore, industrial applications leverage these modules for precise machine vision, quality control, automation, and robotics, demanding high reliability and accuracy. Their utility extends to security and surveillance systems, medical imaging diagnostics, drones, and cutting-edge virtual and augmented reality devices, each presenting unique demands for image capture and processing.

The compelling benefits offered by modern camera modules include their remarkably compact form factor, enabling seamless integration into sleek and portable devices, alongside their continually improving performance in terms of image resolution, low-light sensitivity, and dynamic range. Key driving factors propelling the substantial growth of this market involve the insatiable consumer demand for smartphones with superior photographic capabilities and multi-camera setups. Additionally, the automotive sector's stringent safety regulations and the rapid advancements in autonomous vehicle technologies significantly bolster market expansion. The proliferation of smart devices within the Internet of Things (IoT) ecosystem, coupled with the increasing integration of artificial intelligence for enhanced visual perception and analysis, further accelerates market development, fostering innovation across the entire value chain and ensuring sustained momentum through the forecast period.

Camera Module Market Executive Summary

The Camera Module Market is experiencing profound transformations, characterized by dynamic business trends that emphasize innovation, miniaturization, and intelligent integration. Manufacturers are heavily investing in research and development to push the boundaries of image sensor technology, optical design, and computational photography. Key trends include the widespread adoption of multi-camera systems in consumer devices, enabling advanced features like optical zoom and enhanced depth sensing. There is a growing focus on AI-enabled image signal processors (ISPs) that perform edge computing for real-time analysis, object recognition, and scene understanding, reducing reliance on cloud processing. The industry also witnesses a shift towards more robust, higher-resolution modules designed to meet the rigorous demands of industrial automation and sophisticated automotive applications, necessitating superior durability and precision in diverse operating environments.

Geographically, the Asia Pacific (APAC) region stands as the undisputed leader in the Camera Module Market, both in terms of production and consumption. This dominance is primarily fueled by the presence of a vast and technologically advanced manufacturing base in countries like China, South Korea, Japan, and Taiwan, which are global hubs for smartphone and consumer electronics production. The region also boasts the largest consumer market, driving high volumes of camera module integration. North America and Europe represent critical markets for advanced applications, particularly in the automotive sector, where strict safety regulations mandate sophisticated camera systems for ADAS. These regions are also significant for industrial machine vision and high-end medical imaging, benefiting from substantial R&D investments and technological leadership in AI and IoT integration.

A granular analysis of market segments reveals several key insights. The CMOS image sensor segment continues its trajectory of leadership, owing to its inherent advantages in cost-effectiveness, superior image quality, and lower power consumption compared to CCD sensors. Within the application landscape, the smartphone segment remains the largest revenue contributor, albeit with signs of maturity in certain sub-segments. Conversely, the automotive camera module segment is poised for the most significant growth, driven by the escalating demand for ADAS features and the ongoing development of autonomous vehicles. Furthermore, the market is witnessing a notable trend towards higher-resolution modules (16MP and above) across consumer, automotive, and industrial applications, reflecting the universal desire for enhanced visual fidelity. Specialized segments like 3D sensing modules, crucial for augmented reality, virtual reality, and advanced human-machine interfaces, are also gaining substantial traction, indicative of a broader shift towards more intelligent and perceptive vision systems.

AI Impact Analysis on Camera Module Market

Common user questions related to the impact of Artificial Intelligence on the Camera Module Market frequently revolve around how AI enhances imaging capabilities, enables new application paradigms, and influences the design and specifications of future camera modules. Users are particularly interested in understanding the tangible benefits of AI in areas such as image quality improvement, object recognition accuracy, and the capacity for autonomous decision-making within camera systems. Significant concerns often include the computational overhead, power consumption implications for integrating AI at the edge, data privacy considerations, and the need for specialized hardware to support complex AI algorithms. Expectations are high for camera modules to evolve into intelligent visual perception systems capable of real-time analysis, predictive insights, and adaptive responses, transcending their traditional role as mere data capture devices and embodying a new era of computational vision.

- Enhanced Computational Photography: AI algorithms are increasingly integrated into Image Signal Processors (ISPs) to perform advanced tasks such as real-time noise reduction, dynamic range optimization, sophisticated color correction, and semantic segmentation, significantly improving overall image quality and enabling features like background blur and scene recognition in challenging lighting conditions.

- Advanced Object Detection and Recognition: AI empowers camera modules with the ability to accurately identify and classify objects, persons, and events. This is critically important for autonomous vehicles, where it enables pedestrian detection, traffic sign recognition, and lane keeping assistance, as well as for smart surveillance systems that can differentiate between normal activity and potential threats, and for industrial automation in quality control and robotic guidance.

- Real-time Data Processing at the Edge: The integration of AI accelerators and specialized neural processing units (NPUs) directly within camera modules allows for intelligent data processing at the source. This 'edge AI' reduces the need to transmit raw data to the cloud or central processing units, thereby minimizing latency, conserving bandwidth, enhancing data privacy, and enabling faster decision-making for time-critical applications.

- Facial Recognition and Biometric Authentication: AI-powered camera modules are fundamental to secure biometric systems, enabling accurate and fast facial recognition for unlocking devices, secure access control, and identity verification. This capability is vital for smartphones, smart locks, and various security infrastructures, providing enhanced levels of user authentication.

- Gesture Control and Human-Computer Interaction: AI-enabled camera modules facilitate intuitive, touchless interaction with devices through gesture recognition. This technology finds applications in smart home devices, automotive infotainment systems, and consumer electronics, allowing users to control functions with simple hand movements, improving user experience and accessibility.

- Predictive Analytics and Anomaly Detection: In industrial settings, AI-integrated camera modules can monitor equipment for wear and tear, detect anomalies in manufacturing processes, and predict maintenance needs, thus enabling preventative maintenance and reducing downtime. In security, they can identify unusual patterns or behaviors, alerting authorities to potential incidents before they escalate.

- Advanced 3D Sensing and Depth Perception: AI algorithms refine data from 3D camera modules (Time-of-Flight or structured light) to create highly accurate depth maps. This is crucial for applications in augmented reality (AR) and virtual reality (VR) for realistic environment mapping, robotics for navigation and manipulation, and advanced human-machine interfaces that require precise spatial understanding.

- Personalized User Experiences: AI in camera modules allows for intelligent adaptation to user preferences, such as automatic scene optimization based on detected content or user habits, and advanced content creation features like intelligent framing and video stabilization, significantly enhancing the overall user experience in consumer devices.

DRO & Impact Forces Of Camera Module Market

The Camera Module Market is experiencing robust growth driven by a confluence of powerful factors. The ubiquitous adoption of smartphones, coupled with consumers' escalating demand for sophisticated photography and video capabilities, consistently fuels the market for high-resolution, multi-lens camera modules. Concurrently, the automotive industry's relentless pursuit of enhanced safety and the rapid progression towards autonomous driving are catalyzing an unprecedented demand for advanced camera modules crucial for Advanced Driver-Assistance Systems (ADAS), parking assistance, and in-cabin monitoring. Moreover, the global expansion of industrial automation, smart home ecosystems, and advanced security and surveillance infrastructures are significant market catalysts, as these applications critically depend on precise and reliable visual data capture for operational efficiency and safety.

Despite its dynamic expansion, the Camera Module Market navigates several notable restraints. The inherently high costs associated with continuous research and development in areas such as miniaturization, novel sensor technologies, and advanced optical designs present a substantial barrier, particularly for smaller and emerging market players. Furthermore, the intense competitive landscape, characterized by numerous global and regional manufacturers vying for market share, often leads to aggressive pricing strategies, thereby exerting downward pressure on profit margins across the industry. Adding to these challenges, the intricate and globally dispersed supply chain for electronic components, including image sensors, lenses, and specialized materials, remains highly susceptible to disruptions from geopolitical tensions, natural disasters, and global pandemics, which can result in production delays, component shortages, and amplified operational costs for manufacturers worldwide.

However, the market is replete with substantial opportunities that promise sustained future growth. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities directly into camera modules for intelligent edge processing presents a transformative opportunity, enabling real-time analytics, enhanced decision-making, and new levels of automation without relying heavily on cloud infrastructure. Significant advancements in 3D sensing technologies, such as Time-of-Flight (ToF) and structured light, are unlocking new applications in augmented reality (AR), virtual reality (VR), and advanced human-machine interfaces, creating demand for specialized modules. Additionally, the proliferation of the Internet of Things (IoT) ecosystem, coupled with smart city initiatives, the burgeoning medical imaging sector requiring high-precision cameras, and the evolution of drone technology, collectively represent fertile grounds for innovation and market expansion. These interwoven drivers, restraints, and opportunities, alongside technological advancements, economic shifts, and evolving regulatory standards, collectively shape the dynamic trajectory and impact forces within the Camera Module Market, compelling stakeholders to innovate and adapt strategically.

Segmentation Analysis

The Camera Module Market is meticulously segmented across multiple critical dimensions, including its constituent components, underlying technological principles, diverse end-use applications, varying resolution capabilities, and established interface standards. This comprehensive segmentation framework is instrumental in offering a granular and insightful perspective into the market's intricate structure, pinpointing specific areas of growth, technological preferences, and evolving consumer and industrial demands. The broad spectrum of applications, ranging from mainstream consumer electronics to highly specialized medical and industrial vision systems, underscores the necessity of a nuanced analytical approach. Each segment and sub-segment presents unique technical requirements, performance expectations, and market dynamics, demanding tailored product development and strategic market penetration strategies from camera module manufacturers and suppliers.

- By Component: This segment categorizes the market based on the essential parts that constitute a camera module.

- Image Sensor: Primarily CMOS (Complementary Metal-Oxide-Semiconductor) and, to a lesser extent, CCD (Charge-Coupled Device) sensors, which convert optical images into electronic signals.

- Lens Module: Consists of multiple optical lenses, responsible for focusing light onto the image sensor.

- Voice Coil Motor (VCM)/Actuator: Mechanisms used for autofocus and optical image stabilization (OIS).

- Image Signal Processor (ISP): A dedicated circuit that processes raw image data from the sensor into a viewable format.

- Flexible Printed Circuit (FPC): Provides electrical connection between the components and the host device.

- Others: Includes housing, infrared filters, connectors, and protective glass.

- By Technology: Differentiates the market based on the fundamental image sensing technology employed.

- CMOS Camera Module: Dominant due to its lower power consumption, higher integration capabilities, and superior image quality in modern applications.

- CCD Camera Module: Less prevalent in general consumer electronics but still used in niche applications requiring high sensitivity and low noise.

- By Application: Groups the market according to the primary end-use industries and devices.

- Smartphones: The largest application segment, driven by multi-camera setups and advanced imaging features.

- Automotive: Includes cameras for ADAS, autonomous driving, rearview, and in-cabin monitoring.

- Industrial: Machine vision for automation, quality control, robotics, and logistics.

- Medical: Diagnostic imaging, endoscopic cameras, surgical navigation, and laboratory equipment.

- Security & Surveillance: IP cameras, CCTV, video doorbells, and access control systems.

- Consumer Electronics: Drones, laptops, tablets, wearables, smart home devices, and gaming consoles.

- Others: Augmented Reality (AR), Virtual Reality (VR), professional cameras, and specialized scientific instruments.

- By Resolution: Classifies modules based on the number of pixels they can capture, indicating image detail.

- VGA (Video Graphics Array): Lower resolution, typically used in basic applications or where compact size and cost are critical.

- 2MP to 5MP: Common in mid-range devices and entry-level automotive or industrial applications.

- 8MP to 13MP: Standard for many smartphones and mainstream surveillance systems, offering a good balance of detail and cost.

- 16MP and Above: High-end modules for premium smartphones, advanced automotive systems, and specialized industrial or medical imaging requiring exceptional detail.

- By Interface: Categorizes modules by the data transfer protocol used to communicate with the host processor.

- MIPI CSI (Mobile Industry Processor Interface Camera Serial Interface): Predominant in mobile and embedded applications due to its high bandwidth and low power consumption.

- USB (Universal Serial Bus): Widely used for plug-and-play simplicity, especially in consumer electronics and certain industrial cameras.

- LVDS (Low-Voltage Differential Signaling): Employed in applications requiring high-speed data transfer over longer distances, such as in automotive systems.

- Parallel: Older interface, less common in new designs but still found in some legacy or simple embedded systems.

- Ethernet: Increasingly used in industrial and professional cameras for long-distance data transmission and network integration.

Value Chain Analysis For Camera Module Market

The value chain for the Camera Module Market is a complex, multi-tiered structure that commences with upstream activities, fundamentally centered around the research, development, and manufacturing of raw materials and foundational components. This initial stage involves highly specialized suppliers of semiconductor wafers for image sensors, precision glass manufacturers for optical lenses, and providers of various micro-electromechanical systems (MEMS), voice coil motors (VCMs), and flexible printed circuit boards (FPCBs). These upstream innovators are critical for driving technological advancements, defining performance benchmarks, and ensuring the availability of high-quality, miniaturized components that ultimately determine the efficacy and cost-efficiency of the final camera module assembly. Their capabilities in material science and micro-fabrication form the bedrock of the entire camera module ecosystem.

Moving further down the value chain, the midstream segment is characterized by the intricate processes of camera module design, assembly, and rigorous testing. This stage involves specialized camera module manufacturers who procure the various discrete components from the upstream suppliers. These manufacturers then undertake precise and often automated assembly operations within cleanroom environments, integrating lenses, sensors, actuators, and ISPs onto FPCBs. This process requires exceptional precision to ensure optimal optical alignment, reliable electrical connections, and robust mechanical integrity. Extensive quality control measures, including optical performance testing, environmental stress testing, and functional verification, are performed to guarantee that the modules meet stringent industry standards and customer specifications before being dispatched to the next stage.

The downstream segment of the value chain involves the integration of the finished camera modules into a vast array of end-user products by original equipment manufacturers (OEMs) and system integrators across diverse industries. This includes major smartphone brands, leading automotive companies incorporating modules for ADAS and autonomous driving systems, manufacturers of industrial automation equipment, and consumer electronics firms producing drones, laptops, and smart home devices. The distribution channels for these modules are typically bifurcated: large-volume orders from tier-one OEMs are often handled through direct sales agreements, fostering close collaboration in product development. Conversely, smaller OEMs, niche application providers, or regional markets may rely on indirect channels, utilizing a network of specialized distributors and value-added resellers. Both direct and indirect distribution strategies are vital for ensuring comprehensive market penetration and efficiently delivering camera module solutions to their intended applications, adapting to varied customer scales and technical support requirements across the global landscape.

Camera Module Market Potential Customers

The Camera Module Market caters to an exceptionally broad and evolving spectrum of potential customers, predominantly comprised of Original Equipment Manufacturers (OEMs) and sophisticated system integrators that embed camera modules as core components within their final products. These customers leverage the advanced imaging capabilities of camera modules to deliver critical functionalities, enhance user experiences, and facilitate innovative new applications across their respective industries. A deep understanding of the unique technical requirements, volume demands, and strategic objectives of these diverse end-users is paramount for camera module manufacturers to successfully develop tailored product offerings, cultivate robust supply chain relationships, and forge enduring strategic partnerships that drive mutual growth and market penetration.

Prominent customer segments include the global leaders in smartphone manufacturing, who are constantly seeking cutting-edge, miniaturized camera modules featuring multi-lens arrays, advanced image sensors, and sophisticated computational photography capabilities to differentiate their flagship devices and meet the ever-increasing consumer demand for superior mobile imaging. The automotive industry represents another cornerstone customer base, with major vehicle manufacturers and Tier 1 suppliers integrating camera modules for a comprehensive suite of safety-critical Advanced Driver-Assistance Systems (ADAS), such as lane-keeping assist, adaptive cruise control, pedestrian detection, as well as for parking assistance, 360-degree surround view systems, and the foundational visual input for emerging autonomous driving platforms. These customers demand modules with exceptional reliability, durability under harsh environmental conditions, and adherence to stringent automotive industry standards.

Beyond consumer and automotive sectors, the market extends to significant buyers in the industrial automation and robotics sector, where companies require robust and highly precise camera modules for machine vision applications, including automated quality inspection, robotic guidance, and process control in manufacturing environments. The medical device industry is also a vital customer, with manufacturers developing endoscopic cameras, surgical navigation systems, diagnostic imaging equipment, and laboratory instruments that rely on high-resolution, often specialized, camera modules. Furthermore, providers of security and surveillance solutions, manufacturers of drones, developers of augmented and virtual reality (AR/VR) head-mounted devices, and a wide array of other consumer electronics brands for laptops, tablets, and smart home devices constitute a broad and continuously expanding customer ecosystem. Each segment presents distinct technical specifications, volume requirements, and pricing sensitivities, necessitating flexible, innovative, and customized product development and supply strategies from camera module providers to effectively address the expansive global market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 49.5 Billion |

| Market Forecast in 2032 | USD 95.6 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Samsung Electro-Mechanics, LG Innotek, Sharp Corporation, Sunny Optical Technology, Largan Precision, OFILM Group, Cowell E Holdings, Truly Opto-Electronics, Panasonic Corporation, OmniVision Technologies (Will Semiconductor), STMicroelectronics, Foxconn (Hon Hai Precision Industry Co., Ltd.), Continental AG, Magna International, Valeo, ON Semiconductor, Ambarella, PixelPlus, Teledyne FLIR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Module Market Key Technology Landscape

The Camera Module Market is characterized by an exceptionally dynamic and innovative technological landscape, with relentless advancements driving new functionalities and performance benchmarks. At the core, Complementary Metal-Oxide-Semiconductor (CMOS) image sensors remain the dominant technology, undergoing continuous evolution to achieve smaller pixel sizes, higher quantum efficiency for superior low-light performance, increased dynamic range (HDR) for capturing details in extreme lighting conditions, and faster readout speeds essential for high-frame-rate video and burst photography. These sensor advancements are pivotal for meeting the escalating demands of both consumer devices and highly specialized industrial applications where precise image fidelity and real-time data acquisition are paramount.

Beyond the sensor, the market is profoundly shaped by the integration of advanced optical and mechanical solutions. Wafer-Level Optics (WLO) and Wafer-Level Camera (WLC) technologies are gaining substantial traction, enabling the production of ultra-compact and thinner camera modules at significantly reduced costs through batch processing, which is critical for space-constrained devices like smartphones and wearables. Precision actuators, including Voice Coil Motors (VCMs) and increasingly sophisticated Micro-Electro-Mechanical Systems (MEMS) actuators, are being refined to deliver highly accurate and rapid autofocus capabilities alongside superior optical image stabilization (OIS), effectively mitigating blur in challenging shooting conditions and dynamic environments. Furthermore, the proliferation of multi-camera arrays, particularly prevalent in modern smartphones and advanced automotive systems, drives intensive research into sophisticated algorithms for image fusion, depth mapping, and computational photography techniques that leverage data from multiple lenses to produce richer, more detailed, and dimensionally aware images.

A transformative trend in the technological landscape is the pervasive adoption of 3D sensing technologies, including Time-of-Flight (ToF) sensors, which measure depth by calculating the time light takes to reflect from an object, and structured light sensors, which project a known pattern to deduce depth information. These technologies are becoming indispensable for applications requiring accurate spatial data, such as facial recognition for biometric security, highly realistic augmented reality (AR) and virtual reality (VR) experiences, and advanced robotic navigation and manipulation. Concurrently, the power and intelligence of embedded Image Signal Processors (ISPs) are rapidly increasing, with these chips now incorporating dedicated AI and machine learning accelerators. These intelligent ISPs can perform complex real-time image enhancement, advanced object detection, semantic segmentation, and scene understanding directly at the camera module level ('edge AI'), thereby minimizing latency, reducing bandwidth requirements for data transmission, enhancing data privacy, and enabling faster, more autonomous decision-making in diverse applications. This convergence of advanced optics, sophisticated sensors, and intelligent processing defines the cutting edge of camera module technology.

Regional Highlights

- Asia Pacific (APAC): This region unequivocally dominates the Camera Module Market, serving as both a primary manufacturing hub and the largest consumer base. Countries such as China, South Korea, Japan, and Taiwan are at the forefront of producing and innovating camera modules, driven by their robust electronics manufacturing infrastructure and leading positions in smartphone production. The immense demand for camera-equipped smartphones, coupled with rapid urbanization and industrial growth in emerging economies within the region, significantly propels market expansion, making APAC a critical region for both supply and demand dynamics.

- North America: A highly advanced market, North America exhibits strong growth propelled by significant investments in R&D, particularly in Artificial Intelligence, IoT, and advanced computing. The region is a key adopter of cutting-edge automotive safety systems (ADAS) and autonomous driving technologies, requiring sophisticated camera modules. Furthermore, its robust healthcare sector drives demand for high-end medical imaging and specialized industrial vision solutions, showcasing a preference for innovative, high-performance camera technologies. Silicon Valley continues to be a global nexus for imaging technology innovation.

- Europe: The European market demonstrates substantial growth, primarily driven by its highly developed automotive sector. Stringent vehicle safety regulations and the increasing integration of ADAS features across all vehicle segments significantly boost the demand for automotive camera modules. The region also exhibits strong adoption in industrial automation, machine vision, and security applications, with countries like Germany and France leading in industrial and security technology implementation. Europe's emphasis on privacy and data protection also influences the development of secure and ethical AI-powered camera solutions.

- Latin America: This region represents an emerging market with considerable growth potential. Increasing smartphone penetration, coupled with growing investments in public and private security infrastructure, drives the demand for camera modules. As disposable incomes rise and urbanization accelerates, there is a growing market for mid-range and affordable camera-equipped consumer electronics, as well as demand for surveillance systems in urban centers, making it an attractive region for market expansion focusing on cost-effective yet reliable solutions.

- Middle East and Africa (MEA): The MEA region is experiencing steady market expansion, primarily fueled by rapid urbanization, significant government investments in smart city initiatives, and the escalating demand for enhanced security and surveillance systems. The increasing availability and adoption of digital infrastructure, alongside a growing consumer electronics market, contribute to the rising integration of camera modules across various applications. The demand for advanced imaging solutions in sectors like oil and gas, and transportation, also adds to the market's growth trajectory in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Module Market. These companies are at the forefront of innovation, driving technological advancements, and shaping competitive strategies across various application segments. Their extensive R&D investments, strategic partnerships, and global manufacturing capabilities are instrumental in meeting the evolving demands of the diverse customer base, from high-volume smartphone integration to specialized automotive and industrial applications.- Sony Corporation

- Samsung Electro-Mechanics

- LG Innotek

- Sharp Corporation

- Sunny Optical Technology

- Largan Precision

- OFILM Group

- Cowell E Holdings

- Truly Opto-Electronics

- Panasonic Corporation

- OmniVision Technologies (Will Semiconductor)

- STMicroelectronics

- Foxconn (Hon Hai Precision Industry Co., Ltd.)

- Continental AG

- Magna International

- Valeo

- ON Semiconductor

- Ambarella

- PixelPlus

- Teledyne FLIR

Frequently Asked Questions

Analyze common user questions about the Camera Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Camera Module Market?

The Camera Module Market's robust growth is predominantly fueled by the insatiable global demand for smartphones equipped with advanced multi-camera systems and superior imaging capabilities. Concurrently, the escalating integration of camera modules into the automotive sector for Advanced Driver-Assistance Systems (ADAS) and autonomous driving is a significant catalyst. Furthermore, the expansion of industrial automation, smart surveillance, and emerging IoT applications that require sophisticated visual perception consistently contribute to market expansion, underscoring the indispensable role of camera modules in modern technology.

How is Artificial Intelligence (AI) transforming the applications and capabilities of camera modules?

Artificial Intelligence is profoundly transforming camera module applications by enabling intelligent visual perception directly at the edge. AI algorithms embedded within camera modules enhance computational photography, delivering superior image quality, advanced object detection and recognition crucial for autonomous systems, and real-time analytics for security and industrial automation. This integration allows modules to perform complex tasks like facial recognition, gesture control, and predictive analysis, moving beyond mere image capture to become smart sensing devices capable of autonomous decision-making and significantly expanding their utility across various sectors.

Which geographical regions are identified as key players or dominant markets for camera modules?

The Asia Pacific (APAC) region stands as the dominant market for camera modules, serving as both the leading manufacturing hub and the largest consumer base, primarily driven by its vast smartphone production and consumer electronics industry in countries like China, South Korea, and Japan. North America and Europe are also critical markets, particularly for high-end automotive applications due to stringent safety regulations, and for advanced industrial and medical imaging, reflecting their strong innovation ecosystems and high adoption rates of sophisticated technologies.

What are the key technological advancements expected to shape the future of camera modules?

Future camera modules will be shaped by continuous advancements in CMOS image sensors for enhanced low-light performance and higher resolution, the widespread adoption of 3D sensing technologies like Time-of-Flight (ToF) for AR/VR and advanced human-machine interfaces, and further miniaturization through wafer-level optics. Crucially, the integration of powerful AI processors directly within modules will enable intelligent edge computing, real-time analytics, and advanced computational photography, fundamentally transforming their capabilities and fostering new application paradigms across industries.

What are the primary challenges and restraints impacting the Camera Module Market's growth?

The Camera Module Market faces several significant challenges, including the substantial research and development costs required for continuous technological innovation and miniaturization. Intense competition among manufacturers leads to pricing pressures, affecting profit margins. Furthermore, the global supply chain for critical components is prone to disruptions from geopolitical events and material shortages, causing production delays and increased operational complexities. Maintaining a balance between cost-effectiveness, high performance, and robust reliability while adhering to evolving industry standards remains a constant challenge for market players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- MIPI Camera Module Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Camera Module Adhesives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Camera Module Assembly Adhesives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Camera Module Assembly Glue Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Vehicle Camera Module Market Size Report By Type (Back Camera, Front Camera, Others), By Application (Sedans, SUVs, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager