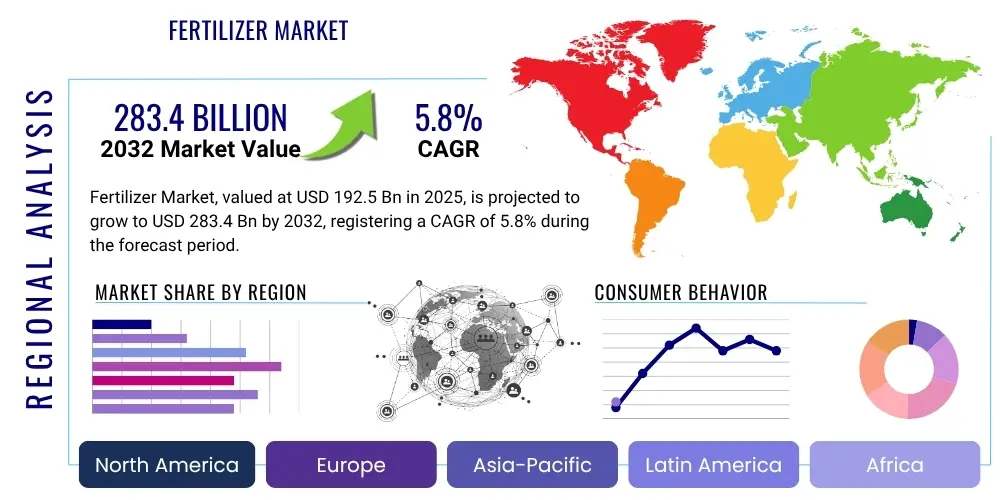

Fertilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429808 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fertilizer Market Size

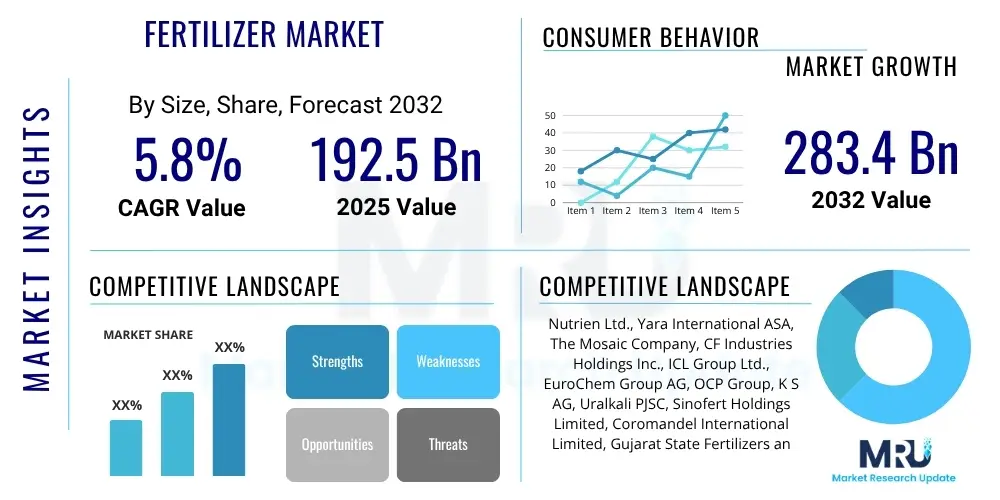

The Fertilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $192.5 Billion in 2025 and is projected to reach $283.4 Billion by the end of the forecast period in 2032.

Fertilizer Market introduction

The global Fertilizer Market is a cornerstone of agricultural productivity, essential for sustaining a growing global population. Fertilizers, which include nitrogenous, phosphatic, and potassic compounds, along with secondary and micronutrients, are substances applied to soil or directly to plant tissues to supply essential elements for plant growth. Their primary function is to enhance crop yield and quality by replenishing soil nutrients depleted by intensive farming practices, thereby ensuring food security and supporting agricultural economies worldwide.

Major applications of fertilizers span across diverse agricultural segments, including the cultivation of grains and cereals, oilseeds and pulses, fruits and vegetables, and various cash crops. Beyond traditional farming, fertilizers are also extensively utilized in horticulture, forestry, and landscaping. The significant benefits derived from fertilizer use encompass increased crop yields, improved nutritional content of agricultural produce, enhanced plant vigor and disease resistance, and the restoration of soil fertility over time. These advantages are crucial in addressing the challenges posed by diminishing arable land and the escalating demand for food and biofuels.

The market's growth is primarily driven by several critical factors. Global population expansion, coupled with rising disposable incomes, fuels the demand for food, particularly high-value crops. Simultaneously, the continuous decrease in available arable land necessitates more intensive and efficient agricultural practices, making fertilizer application indispensable for maximizing output per hectare. Furthermore, advancements in fertilizer technology, such as the development of specialty and controlled-release fertilizers, along with increasing government support for agricultural sectors in many developing nations, further propel market expansion and innovation.

Fertilizer Market Executive Summary

The Fertilizer Market is experiencing robust growth, propelled by relentless global population expansion and the imperative to maximize agricultural output from finite arable land. Key business trends indicate a strong focus on sustainability, with a rising demand for bio-fertilizers, specialty fertilizers, and advanced nutrient management solutions that minimize environmental impact. There is also a notable consolidation among major players and increased investment in research and development to introduce more efficient and eco-friendly products. Companies are increasingly adopting digital farming solutions and precision agriculture technologies to enhance fertilizer efficacy and reduce waste across the value chain.

From a regional perspective, Asia Pacific continues to dominate the global fertilizer market, driven by its vast agricultural base, high population density, and governmental support for food production in countries like China and India. North America and Europe are characterized by advanced agricultural practices and a growing emphasis on environmentally sustainable fertilizer types, including organic and slow-release formulations. Latin America is emerging as a significant growth hub, particularly due to the expansion of soybean and corn cultivation, while the Middle East and Africa present considerable long-term growth opportunities, albeit with existing challenges related to infrastructure and technological adoption.

Segment-wise, nitrogenous fertilizers maintain the largest share due to their fundamental role in plant growth and widespread application. However, the fastest-growing segments include micronutrients and specialty fertilizers, as farmers increasingly recognize the importance of balanced nutrition for optimal crop health and yield in modern agriculture. The shift towards liquid fertilizers and application methods like fertigation is also gaining traction, offering improved nutrient uptake efficiency. This segmentation evolution reflects a broader trend towards customized and data-driven fertilization strategies aimed at achieving higher productivity with reduced resource consumption.

AI Impact Analysis on Fertilizer Market

User inquiries regarding AI's impact on the fertilizer market frequently revolve around its potential to revolutionize traditional farming practices, enhance efficiency, and promote sustainability. Key themes include how AI can optimize fertilizer application, improve crop yield predictions, reduce environmental pollution from nutrient runoff, and make agricultural supply chains more robust. There is significant interest in understanding the tangible benefits for farmers, the technological requirements for adoption, and the overall economic and ecological implications of integrating AI into fertilizer management. Users are particularly keen on solutions that offer precision, cost-effectiveness, and contribute to long-term soil health.

The consensus among market participants and researchers is that Artificial Intelligence is poised to be a transformative force in the fertilizer industry. By leveraging vast datasets on soil conditions, weather patterns, crop health, and historical yield data, AI algorithms can provide highly accurate and actionable insights. This enables farmers to make data-driven decisions regarding the type, quantity, and timing of fertilizer application, moving away from conventional blanket application methods. The expectation is that AI will usher in an era of hyper-precision agriculture, leading to a significant reduction in fertilizer waste, optimized resource utilization, and ultimately, higher crop productivity per unit of input.

Furthermore, AI's influence extends beyond mere application. It is anticipated to play a crucial role in predicting potential nutrient deficiencies before visible symptoms appear, managing pest and disease outbreaks more effectively, and even optimizing the logistics and distribution channels for fertilizer products. Concerns often highlight the initial investment costs, the need for robust data infrastructure, and ensuring equitable access to these advanced technologies for small-scale farmers. Nevertheless, the prevailing outlook is optimistic, foreseeing AI as an indispensable tool for meeting future global food demand sustainably.

- Precision nutrient application through AI-powered sensors and drones.

- Optimized fertilizer recommendations based on real-time soil and crop data.

- Enhanced yield prediction and crop health monitoring using machine learning.

- Automated irrigation and fertigation systems for efficient nutrient delivery.

- Supply chain optimization for fertilizer logistics and distribution.

- Early detection of nutrient deficiencies and plant stress.

- Development of smart farming platforms integrating various agricultural data.

- Reduced environmental impact through minimized overuse and runoff.

- Personalized fertilization plans for diverse crop types and soil conditions.

DRO & Impact Forces Of Fertilizer Market

The Fertilizer Market is fundamentally driven by an ever-increasing global population that demands a consistent and growing food supply. As arable land diminishes and urban sprawl expands, the pressure on existing agricultural areas intensifies, necessitating higher yields per hectare. This core driver is further amplified by government initiatives and subsidies in many countries aimed at bolstering food security and supporting agricultural output. Technological advancements in farming, including precision agriculture and the development of more efficient fertilizer formulations, also significantly contribute to market expansion by enhancing productivity and sustainability. Additionally, a rising awareness among farmers regarding the importance of balanced soil nutrition for long-term productivity and crop quality acts as a substantial growth impetus.

However, the market faces several significant restraints that temper its growth trajectory. Volatility in the prices of raw materials, such as natural gas for nitrogen production and phosphate rock, directly impacts production costs and profit margins. Stringent environmental regulations aimed at mitigating the negative impacts of fertilizer overuse, such as water pollution (eutrophication) and greenhouse gas emissions, impose compliance burdens and limit certain product applications. High capital expenditure required for setting up and operating fertilizer production facilities, along with logistical challenges in reaching remote agricultural areas, especially in developing regions, also pose considerable hurdles. The market must also contend with the perception of excessive use leading to soil degradation and the long-term sustainability concerns associated with conventional fertilizers.

Despite these challenges, substantial opportunities exist for innovation and market penetration. The growing demand for bio-fertilizers and specialty fertilizers, which offer targeted nutrient delivery and reduced environmental footprint, represents a promising avenue for growth. The widespread adoption of precision agriculture techniques, enabled by IoT and AI, allows for optimized fertilizer application, reducing waste and increasing efficiency. Emerging markets in regions like Africa and Latin America, characterized by expanding agricultural sectors and increasing commercial farming, offer untapped potential. Furthermore, continuous advancements in nutrient use efficiency technologies and the development of slow-release and controlled-release fertilizers present opportunities to address both economic and environmental concerns, fostering sustainable agricultural practices globally. Impact forces such as climate change, geopolitical tensions, and global economic fluctuations can significantly alter supply chains and demand patterns, requiring continuous market adaptation.

Segmentation Analysis

The global Fertilizer Market is broadly segmented based on key characteristics that delineate product types, target applications, and methods of delivery. These segmentations are crucial for understanding market dynamics, identifying specific growth areas, and tailoring strategies to meet the diverse needs of agricultural systems worldwide. Analyzing the market through these various lenses provides a comprehensive view of how different factors influence demand, supply, and technological advancements within the industry. This approach helps in recognizing the market's complexity and the nuanced requirements of various end-users.

- By Type

- Nitrogenous Fertilizers

- Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate (UAN)

- Phosphatic Fertilizers

- Diammonium Phosphate (DAP)

- Monoammonium Phosphate (MAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Potassic Fertilizers

- Muriate of Potash (MOP)

- Sulfate of Potash (SOP)

- Secondary Nutrients

- Sulfur

- Calcium

- Magnesium

- Micronutrients

- Zinc

- Boron

- Iron

- Manganese

- Copper

- Molybdenum

- Chlorine

- Nitrogenous Fertilizers

- By Crop Type

- Grains and Cereals

- Wheat

- Rice

- Maize

- Barley

- Oilseeds and Pulses

- Soybean

- Rapeseed

- Sunflower

- Peanut

- Lentils

- Fruits and Vegetables

- Tomatoes

- Potatoes

- Apples

- Citrus

- Berries

- Commercial Crops

- Sugarcane

- Cotton

- Coffee

- Tea

- Others (Turf and Ornamentals, Forages)

- Grains and Cereals

- By Application Method

- Broadcasting

- Foliar Application

- Fertigation

- Drip Irrigation

- Sprinkler Irrigation

- Band Placement

- Deep Placement

- By Form

- Liquid Fertilizers

- Dry Fertilizers

- Granular

- Prilled

- Powder

- By Distribution Channel

- Retail Stores

- Online Platforms

- Direct Sales to Farms

- Agricultural Cooperatives

- Wholesalers

Value Chain Analysis For Fertilizer Market

The value chain for the Fertilizer Market begins with the upstream segment, which involves the extraction and processing of essential raw materials. This includes activities such as mining for phosphate rock and potash, as well as the production of ammonia from natural gas or coal, which is a key component for nitrogenous fertilizers. These raw materials undergo complex chemical processing to convert them into usable fertilizer forms. This stage is highly capital-intensive and often involves large-scale industrial operations, with a significant impact on environmental and energy consumption footprints. The efficiency and cost-effectiveness of these upstream processes are critical determinants of the final fertilizer product's price and availability in the market.

Following the manufacturing and formulation of fertilizers, the products move into the intricate distribution channel. This involves a network of logistics providers, warehouses, wholesalers, and retailers that ensure fertilizers reach the ultimate end-users. Distribution can be direct, where large agricultural enterprises purchase directly from manufacturers, or indirect, involving multiple intermediaries. Indirect channels typically include national distributors, regional dealers, and local agro-input stores or cooperatives, which cater to a wider range of farmers, from large commercial farms to small-scale landholders. The effectiveness of this distribution network is paramount for market penetration, especially in diverse geographical landscapes and varying infrastructural conditions.

The downstream segment of the value chain focuses on sales, marketing, and direct application by farmers. This stage also encompasses providing technical support, advisory services, and education to farmers on optimal fertilizer use, soil health management, and sustainable agricultural practices. The choice between direct and indirect distribution is often influenced by the scale of farming operations and regional market structures. Large-scale corporate farms or plantations might opt for direct bulk purchases, benefiting from economies of scale and direct technical support. In contrast, small and medium-sized farmers often rely on the accessibility and guidance provided by local retailers and cooperatives, which play a crucial role in disseminating product information and best practices.

Fertilizer Market Potential Customers

The primary potential customers in the Fertilizer Market are diverse and span the entire agricultural sector, encompassing a wide array of farming operations and land management entities. At the forefront are individual farmers, ranging from small-scale subsistence farmers in developing regions to large commercial agricultural enterprises in developed economies. These farmers represent the largest segment of demand, utilizing fertilizers to maximize crop yields, improve crop quality, and maintain soil fertility across various crop types, including grains, oilseeds, fruits, and vegetables. Their purchasing decisions are influenced by factors such as crop type, soil analysis results, climactic conditions, and economic considerations like fertilizer prices and expected crop returns.

Beyond individual farming operations, agricultural cooperatives represent a significant customer group. These organizations aggregate the demand from numerous smaller farmers, enabling bulk purchases and often providing collective bargaining power for better prices and access to a broader range of fertilizer products and services. Government agricultural initiatives and state-owned farms also constitute important buyers, particularly in countries focused on national food security or large-scale agricultural development projects. These entities often procure fertilizers in substantial volumes and may have specific requirements related to product specifications or sustainable farming objectives.

Furthermore, the market extends to other specialized end-users, including horticulture businesses, golf courses, landscaping companies, and forestry management operations. These customers utilize fertilizers for maintaining aesthetic appeal, promoting specific plant growth, or supporting forest regeneration. Agricultural research institutions and universities also represent a niche but important customer segment, purchasing fertilizers for experimental purposes, soil science studies, and the development of new agricultural techniques. The varying needs and scales of these potential customers necessitate a diverse product portfolio and flexible distribution strategies from fertilizer manufacturers and suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $192.5 Billion |

| Market Forecast in 2032 | $283.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nutrien Ltd., Yara International ASA, The Mosaic Company, CF Industries Holdings Inc., ICL Group Ltd., EuroChem Group AG, OCP Group, K S AG, Uralkali PJSC, Sinofert Holdings Limited, Coromandel International Limited, Gujarat State Fertilizers and Chemicals Limited (GSFC), Zuari Agro Chemicals Ltd., Haifa Group, Koch Industries Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fertilizer Market Key Technology Landscape

The Fertilizer Market is undergoing a significant technological transformation, moving towards more efficient, sustainable, and data-driven approaches. Precision agriculture technologies are at the forefront, leveraging GPS, sensors, drones, and satellite imagery to provide highly granular data on soil conditions, crop health, and nutrient requirements. This allows for variable rate technology (VRT), where fertilizers are applied precisely where and when needed, optimizing nutrient delivery and significantly reducing waste. These technologies enable farmers to transition from uniform application to site-specific management, leading to improved yields and reduced environmental impact.

Another crucial technological advancement is the development of controlled-release (CRF) and slow-release fertilizers (SRF). These formulations are designed to release nutrients gradually over an extended period, matching the nutrient uptake patterns of crops. This not only minimizes nutrient loss through leaching or volatilization but also reduces the frequency of application, saving labor and fuel costs. Furthermore, advancements in biotechnology are leading to the proliferation of bio-fertilizers, which utilize beneficial microorganisms to enhance nutrient availability and uptake by plants. These biological solutions offer a promising avenue for reducing reliance on synthetic chemical fertilizers and promoting ecological soil health.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly reshaping the fertilizer landscape. AI-powered analytics can process vast amounts of agricultural data to predict crop needs, optimize fertilization schedules, and identify potential issues like nutrient deficiencies or disease outbreaks. Internet of Things (IoT) devices, such as soil moisture sensors and nutrient probes, provide real-time data crucial for these AI systems. Moreover, advancements in drone technology for spraying and monitoring, along with autonomous machinery for planting and fertilizer application, are contributing to increased operational efficiency and accuracy, marking a new era of intelligent nutrient management in agriculture.

Regional Highlights

- Asia Pacific: This region holds the largest share in the global fertilizer market, driven by its enormous agricultural land base, high population density, and persistent demand for food production, particularly in countries like China, India, and Indonesia. Government initiatives to boost agricultural output and subsidies for fertilizer use further fuel market growth. The region is also a major producer and consumer of all major fertilizer types.

- North America: Characterized by highly advanced farming practices and widespread adoption of precision agriculture, North America is a significant market for specialty and high-efficiency fertilizers. The region focuses on optimizing nutrient use, reducing environmental impact, and leveraging technological innovations for sustainable crop production, particularly for corn, soybean, and wheat.

- Europe: European countries exhibit a strong inclination towards sustainable agricultural practices and stringent environmental regulations concerning fertilizer application. This has led to a growing demand for bio-fertilizers, organic fertilizers, and slow-release formulations. Innovation in nutrient management and a focus on reducing carbon footprint are key trends in this mature market.

- Latin America: This region is experiencing rapid growth in the fertilizer market, primarily due to the expansion of commercial agriculture, especially for crops like soybean, corn, and sugarcane. Countries like Brazil and Argentina are major contributors, driven by increasing export demand for agricultural commodities and improvements in farming technologies.

- Middle East and Africa (MEA): The MEA region presents substantial long-term growth potential, fueled by efforts to enhance food security, expand irrigated agricultural areas, and modernize farming practices. While challenges exist regarding infrastructure and capital investment, increasing government support and foreign investment in agriculture are expected to drive fertilizer demand, particularly for phosphate and nitrogenous types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fertilizer Market.- Nutrien Ltd.

- Yara International ASA

- The Mosaic Company

- CF Industries Holdings Inc.

- ICL Group Ltd.

- EuroChem Group AG

- OCP Group

- K S AG

- Uralkali PJSC

- Sinofert Holdings Limited

- Coromandel International Limited

- Gujarat State Fertilizers and Chemicals Limited (GSFC)

- Zuari Agro Chemicals Ltd.

- Haifa Group

- Koch Industries Inc.

- SQM (Sociedad Quimica y Minera de Chile)

- PhosAgro

- Indorama Corporation

- Bayer AG

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

What are the primary drivers of the Fertilizer Market growth?

The Fertilizer Market is primarily driven by global population growth, which fuels increasing food demand, coupled with shrinking arable land necessitating higher crop yields per hectare. Government support for agriculture, technological advancements in nutrient management, and rising awareness of soil health also significantly propel market expansion.

What are the main types of fertilizers and their applications?

The main types include nitrogenous (for vegetative growth, e.g., urea), phosphatic (for root and flower development, e.g., DAP), and potassic (for overall plant health and disease resistance, e.g., MOP). Secondary nutrients like sulfur and micronutrients such as zinc are also crucial for specific plant functions and overall crop quality.

How does precision agriculture impact fertilizer consumption?

Precision agriculture significantly impacts fertilizer consumption by enabling highly targeted application based on real-time soil and crop data, utilizing technologies like GPS, sensors, and drones. This optimizes nutrient delivery, reduces waste from over-application, and leads to more efficient use of resources, thereby potentially lowering overall consumption while maximizing yields.

What are the key environmental concerns associated with fertilizer use?

Key environmental concerns include nutrient runoff into water bodies, leading to eutrophication and algal blooms, which harm aquatic ecosystems. Additionally, the production and application of certain fertilizers, particularly nitrogenous ones, can contribute to greenhouse gas emissions, exacerbating climate change. Sustainable practices and advanced formulations aim to mitigate these impacts.

What is the future outlook for the Fertilizer Market, considering sustainability trends?

The future outlook for the Fertilizer Market is positive, with a strong shift towards sustainable and eco-friendly solutions. This includes a growing emphasis on bio-fertilizers, slow-release and controlled-release fertilizers, and integrated nutrient management systems. Technological innovations like AI and IoT will further enhance efficiency and reduce environmental footprints, ensuring long-term market resilience and growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fertilizer Gun Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fertilizer Storage Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Amino Acid Fertilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Silicon Fertilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Liquid Fertilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager