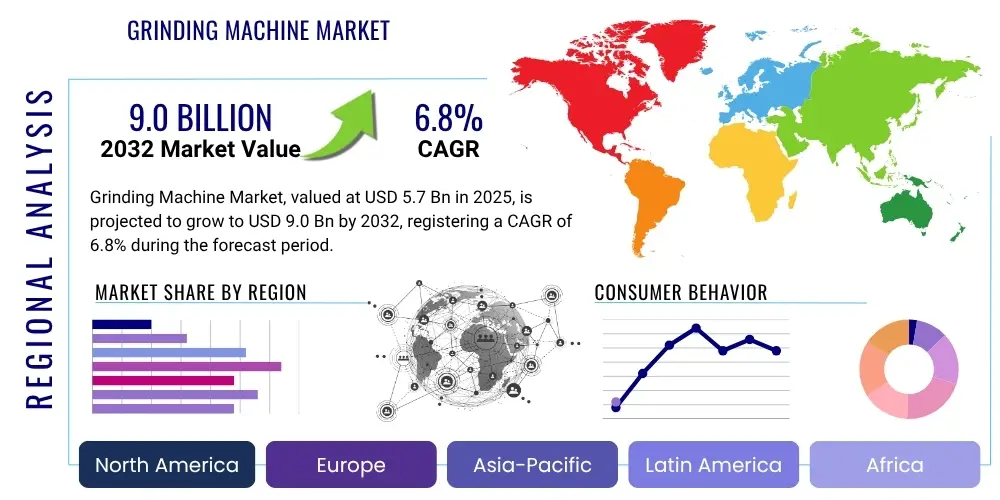

Grinding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429461 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Grinding Machine Market Size

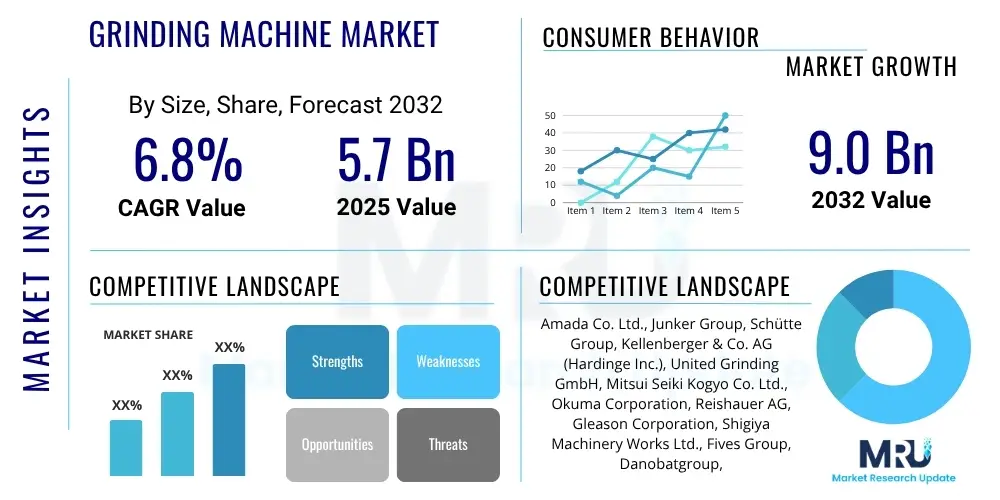

The Grinding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 5.7 Billion in 2025 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2032.

Grinding Machine Market introduction

The grinding machine market encompasses a critical segment of the manufacturing sector, providing essential tools for achieving high precision, superior surface finishes, and specific material removal in various industrial applications. These machines are designed to remove material from a workpiece using an abrasive wheel as the cutting tool, offering unparalleled accuracy compared to other machining processes. Major applications span across the automotive, aerospace, medical device, and general manufacturing industries, where the demand for components with tight tolerances and exceptional surface quality is paramount. The primary benefits derived from grinding machines include enhanced product performance, extended component lifespan, and reduced production waste, all contributing to increased operational efficiency. The market's growth is predominantly driven by the escalating demand for advanced manufacturing processes, rapid industrialization, and the continuous need for precision components in high-tech sectors globally.

Grinding machines are indispensable in modern manufacturing due to their capability to perform ultra-fine finishing operations. They utilize various types of abrasive wheels, ranging from conventional aluminum oxide and silicon carbide to superabrasives like cubic boron nitride (CBN) and diamond, each selected based on the material being processed and the desired outcome. The product portfolio includes surface grinders for flat surfaces, cylindrical grinders for external and internal diameters, centerless grinders for high-volume production of cylindrical parts, and specialized tool and cutter grinders for sharpening cutting tools. These machines are crucial for post-machining operations, refining parts to meet stringent specifications often required in critical applications such as engine components, turbine blades, medical implants, and optical lenses.

The ongoing evolution of manufacturing technologies further amplifies the significance of grinding machines. With the advent of new materials like composites, superalloys, and ceramics, conventional machining methods often fall short in achieving the desired precision and surface integrity. Grinding machines, especially those equipped with advanced controls and specialized abrasive tools, offer effective solutions for processing these challenging materials. The benefits extend beyond precision, including improved material hardness, resistance to wear, and reduced friction, which are vital for the durability and reliability of manufactured goods. Furthermore, the increasing focus on automation and integration within production lines drives innovation in grinding technology, leading to more efficient, automated, and intelligent grinding solutions that cater to the evolving needs of various industries, thereby acting as a significant market driver.

Grinding Machine Market Executive Summary

The Grinding Machine Market is experiencing robust growth fueled by several key business, regional, and segment trends that highlight its evolving landscape and future potential. Business trends are characterized by a strong emphasis on automation, the adoption of advanced manufacturing techniques such as Industry 4.0, and a growing consolidation among market players seeking to expand their technological capabilities and global reach. Regional trends indicate significant market expansion in emerging economies, particularly across the Asia Pacific, driven by rapid industrialization and governmental support for manufacturing sectors, while mature markets in North America and Europe continue to focus on technological upgrades and specialized high-precision applications. Segment-wise, the market is seeing a notable shift towards Computer Numerical Control (CNC) grinding machines, which offer superior precision and efficiency, alongside increasing demand from critical end-use industries like automotive, aerospace, and medical, all requiring components with exacting specifications and flawless finishes.

In terms of business dynamics, the competitive landscape is marked by continuous innovation, with companies investing heavily in research and development to introduce machines capable of processing new and challenging materials, while also integrating smart manufacturing features. Manufacturers are increasingly offering holistic solutions, encompassing not just the grinding machine but also automation systems, software for process optimization, and comprehensive after-sales services. This integrated approach aims to enhance operational efficiency for end-users and address the growing complexity of modern production environments. The global push for sustainability also influences business strategies, prompting manufacturers to develop energy-efficient grinding solutions and reduce waste, aligning with environmental regulations and corporate social responsibility initiatives, thus fostering innovation in sustainable manufacturing practices.

From a regional perspective, the Asia Pacific region stands out as a dominant force, owing to its robust manufacturing base, particularly in countries like China, India, and Japan, which are major producers of automotive components, electronics, and heavy machinery. Investments in infrastructure and manufacturing capacity in these regions are significantly boosting the demand for grinding machines. In contrast, North America and Europe, while having a slower growth rate, are characterized by a demand for highly specialized and technologically advanced grinding solutions, serving niche applications in aerospace, defense, and medical sectors. Latin America and the Middle East and Africa represent emerging markets with considerable potential, driven by industrialization initiatives, albeit facing challenges related to technological adoption and economic stability. These regional disparities create diverse opportunities and challenges for market participants, necessitating tailored strategies for market penetration and expansion.

AI Impact Analysis on Grinding Machine Market

User inquiries regarding the impact of Artificial Intelligence on the Grinding Machine Market frequently revolve around how AI can enhance precision, reduce operational costs, optimize maintenance schedules, and improve overall productivity. There is considerable interest in AI's role in predictive analytics for machine performance and lifespan, intelligent process control for adaptive grinding, and automation capabilities that minimize human intervention while maintaining high quality. Concerns often include the initial investment required for AI integration, the complexity of implementation, data security, and the necessity for a skilled workforce to manage and leverage AI-driven systems. Users anticipate that AI will fundamentally transform grinding operations by enabling more autonomous, efficient, and higher-quality production, addressing current manufacturing challenges such as material variability and tool wear with unprecedented accuracy.

- Enhanced Precision and Quality: AI algorithms analyze sensor data (vibration, acoustic, force) in real-time to adjust grinding parameters, optimizing material removal and achieving tighter tolerances and superior surface finishes.

- Predictive Maintenance: AI models forecast potential machine failures or component wear based on operational data, enabling proactive maintenance, minimizing downtime, and extending machine lifespan.

- Process Optimization: Machine learning algorithms learn from past grinding cycles to recommend optimal speeds, feeds, and coolant usage for different materials and geometries, reducing cycle times and improving efficiency.

- Adaptive Control: AI-driven systems can dynamically adapt grinding strategies to compensate for variations in workpiece material, tool wear, or environmental conditions, ensuring consistent quality across batches.

- Reduced Waste and Rework: By maintaining optimal conditions and detecting anomalies early, AI significantly reduces scrap rates and the need for rework, leading to substantial cost savings.

- Automated Inspection and Quality Control: AI-powered vision systems can perform rapid, accurate inspection of ground parts for defects, ensuring compliance with quality standards without manual intervention.

- Energy Efficiency: AI can optimize machine operation and power consumption by analyzing usage patterns and load requirements, contributing to more sustainable manufacturing.

- Augmented Operator Assistance: AI can provide real-time guidance and insights to human operators, enhancing their decision-making and productivity, especially for complex grinding tasks.

- Skill Gap Mitigation: By automating complex decisions and tasks, AI systems can help mitigate the impact of skilled labor shortages in precision grinding operations.

- Integration with Smart Manufacturing: AI facilitates seamless integration of grinding machines into broader Industry 4.0 ecosystems, enabling data exchange and synchronized operations with other production units.

DRO & Impact Forces Of Grinding Machine Market

The Grinding Machine Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), alongside various Impact Forces that shape its trajectory. Key drivers include the ever-increasing demand for high-precision components across diverse industries such as automotive, aerospace, and medical, coupled with the global push towards automation and smart manufacturing practices. However, the market faces restraints such as the high initial investment cost associated with advanced grinding machines, the scarcity of skilled labor capable of operating and maintaining these sophisticated systems, and the cyclical nature of industrial manufacturing which can lead to fluctuating demand. Opportunities for growth are abundant in emerging economies, the adoption of sustainable grinding processes, and the integration of cutting-edge technologies like AI and IoT. These elements are constantly modulated by impact forces such as macroeconomic conditions, rapid technological advancements, evolving environmental regulations, and global supply chain disruptions, all of which contribute to the market's complex operational environment and strategic considerations for stakeholders.

Driving factors for the grinding machine market are deeply rooted in the fundamental needs of modern industrial production. The automotive industry's continuous innovation in engine parts, transmission components, and electric vehicle parts, all requiring stringent precision and surface integrity, significantly boosts demand. Similarly, the aerospace and defense sectors, with their zero-tolerance policies for critical components like turbine blades, landing gear, and structural parts, rely heavily on advanced grinding solutions. The proliferation of complex and hard-to-machine materials, including superalloys, ceramics, and composites, necessitates sophisticated grinding capabilities, further expanding the market. Moreover, the global trend towards automation, supported by government initiatives and industry investments, encourages the adoption of automated grinding solutions, which enhance productivity, consistency, and worker safety, making them crucial for achieving efficiency targets and competitive advantages in manufacturing.

Conversely, several restraints pose challenges to market expansion. The substantial capital expenditure required to acquire high-end, precision grinding machines can be a significant barrier for smaller and medium-sized enterprises (SMEs), limiting their ability to upgrade or invest in new technology. This is exacerbated by the need for highly skilled operators and maintenance personnel who are increasingly difficult to find, creating a notable skill gap within the industry. Economic downturns and geopolitical uncertainties can also dampen investment in capital equipment, leading to market volatility. Furthermore, the complexity of machine setup, programming, and specialized tooling for diverse applications can increase operational costs and learning curves. Despite these challenges, the market continues to evolve, presenting numerous opportunities. The growing industrialization in developing countries offers untapped potential for market penetration. Innovations in abrasive materials, such as advanced ceramics and superabrasives, are improving grinding efficiency and tool life. The integration of Industry 4.0 technologies, including IoT for real-time monitoring and AI for predictive maintenance, opens new avenues for optimized performance and reduced operational costs. The increasing demand for customization and niche product manufacturing also provides fertile ground for specialized grinding solutions, demonstrating the market's adaptability and resilience in navigating its inherent complexities.

Segmentation Analysis

The Grinding Machine Market is comprehensively segmented to provide a detailed understanding of its diverse components and the distinct dynamics influencing each sub-market. This segmentation allows for precise market analysis, identifying key growth areas, competitive landscapes, and strategic opportunities. The primary segmentation categories typically include classification by product type, which differentiates machines based on their design and primary application; by operation, reflecting the level of automation and control; and by end-use industry, highlighting the diverse sectors that rely on grinding technologies for their manufacturing processes. Understanding these segments is crucial for manufacturers to tailor their product offerings, for investors to identify lucrative ventures, and for end-users to select the most appropriate grinding solutions for their specific operational needs and material requirements, thus driving targeted market strategies.

- By Product Type:

- Surface Grinders: Used for producing precise flat surfaces.

- Cylindrical Grinders: For achieving high-precision external and internal cylindrical surfaces.

- Centerless Grinders: Ideal for high-volume production of cylindrical parts without needing centers.

- Tool and Cutter Grinders: Specialized for sharpening and fabricating cutting tools.

- Internal Grinders: Designed for grinding internal bores and holes.

- Special Purpose Grinders: Tailored for specific applications or complex geometries, such as gear grinding or cam grinding.

- By Operation:

- Manual Grinding Machines: Operated directly by human intervention, suitable for low-volume or specialized tasks.

- Semi-Automatic Grinding Machines: Incorporate some automated features but require operator oversight for setup and adjustments.

- Automatic/CNC Grinding Machines: Computer Numerical Control (CNC) systems automate most operations, offering high precision, repeatability, and efficiency for complex parts.

- By End-Use Industry:

- Automotive Industry: For engine components, crankshafts, camshafts, gears, and transmission parts.

- Aerospace and Defense Industry: Precision components for aircraft engines, landing gear, and structural parts.

- General Manufacturing: Diverse applications in job shops, mold and die manufacturing, and fabrication.

- Electrical and Electronics Industry: Components for semiconductors, electronic devices, and precision instruments.

- Medical Industry: Manufacturing of surgical instruments, implants, and prosthetic devices.

- Construction Industry: Tool sharpening, repair, and component fabrication for heavy machinery.

- Heavy Machinery Industry: Grinding large components for industrial equipment, turbines, and agricultural machinery.

Value Chain Analysis For Grinding Machine Market

The value chain for the Grinding Machine Market is a complex network involving several interdependent stages, from the sourcing of raw materials to the final distribution and post-sales support, each contributing significantly to the overall market dynamics and product value. Upstream activities involve the procurement of critical components and raw materials necessary for machine manufacturing, while downstream operations focus on delivering the finished products to end-users through various distribution channels, both direct and indirect. This intricate process ensures that high-quality grinding machines reach diverse industrial applications, maintaining operational efficiency and technological advancement across the supply chain. Understanding the interactions within this value chain is paramount for identifying cost-saving opportunities, enhancing efficiency, and gaining a competitive edge in the global market, allowing stakeholders to optimize their strategies from component sourcing to customer delivery and after-sales service.

Upstream analysis in the grinding machine market involves the sourcing and processing of essential raw materials and sophisticated components. This includes high-grade steels and cast iron for machine bases and structural elements, specialized alloys for spindles and precision bearings, and advanced electronic components for control systems, particularly for CNC machines. Key suppliers include manufacturers of electric motors, servo drives, hydraulic and pneumatic systems, and abrasive wheel producers who provide the core cutting tools. The quality and availability of these upstream inputs directly influence the performance, reliability, and cost-effectiveness of the final grinding machines. Therefore, strong relationships with reliable suppliers and efficient supply chain management are critical for maintaining production schedules and ensuring the consistent quality of the manufactured equipment. Manufacturers must often collaborate closely with these suppliers to integrate new technologies and ensure component compatibility, which is vital for developing innovative grinding solutions.

Downstream analysis encompasses the distribution, sales, and post-sales service aspects of the grinding machine market. Distribution channels vary, including direct sales from manufacturers to large industrial clients, and indirect channels through a network of distributors, dealers, and agents who cater to a broader range of customers, especially small and medium-sized enterprises (SMEs). Direct sales allow for closer customer relationships, customization, and specialized support, while indirect channels provide wider market reach and localized service. Post-sales services, such as installation, training, maintenance, and spare parts supply, are crucial for customer satisfaction and long-term relationships, contributing significantly to the total cost of ownership and perceived value of the machine. The effectiveness of these distribution and service networks directly impacts market penetration and customer loyalty. Strategic partnerships with regional distributors are essential for navigating local market conditions, complying with regulations, and providing timely technical support, thereby completing the cycle of value delivery within the grinding machine industry.

Grinding Machine Market Potential Customers

The Grinding Machine Market serves a wide array of industrial sectors, with potential customers primarily comprising end-users and buyers who require precision machining capabilities for their production processes. These customers span across industries where accuracy, surface finish, and material integrity are non-negotiable, often dealing with hard-to-machine materials or components that demand extremely tight tolerances. The diverse applications range from high-volume automotive part manufacturing to highly specialized aerospace components and intricate medical devices. Identifying and understanding the specific needs, production volumes, and technical requirements of these varied end-users is crucial for grinding machine manufacturers to tailor their product offerings, develop targeted marketing strategies, and provide appropriate technical support. The extensive demand from these sectors ensures a consistently robust customer base, driving innovation and expansion within the grinding machine industry globally.

A significant segment of potential customers includes the automotive industry, which relies heavily on grinding machines for producing critical components such as crankshafts, camshafts, gearbox shafts, engine valves, and fuel injectors. The demand for enhanced fuel efficiency, reduced emissions, and improved vehicle performance drives the need for highly precise and durable parts, making advanced grinding solutions indispensable. Similarly, the aerospace and defense sectors represent another crucial customer base. Manufacturers in these industries require grinding machines for fabricating high-performance components like turbine blades, landing gear, engine shafts, and structural elements from superalloys, titanium, and other exotic materials, where absolute precision and flawless surface integrity are paramount for safety and operational reliability. These industries consistently invest in cutting-edge grinding technologies to meet stringent quality and regulatory standards, making them key drivers for advanced grinding machine sales and technological innovation.

Beyond the automotive and aerospace giants, the grinding machine market finds a substantial customer base in general manufacturing and specialized industries. This includes mold and die makers, tool and cutter manufacturers, and job shops that produce custom components for various applications. The medical device industry is also a rapidly growing segment, utilizing grinding machines for manufacturing precision surgical instruments, implants (e.g., knee and hip joints), prosthetics, and dental components, where biocompatibility and smooth surface finishes are critical. Furthermore, the electrical and electronics sector demands grinding for components in semiconductors, optical lenses, and high-precision electronic parts. Even the heavy machinery and construction industries use grinding machines for tool maintenance, fabricating large industrial components, and repairing parts. This broad spectrum of end-users underscores the versatility and essential role of grinding machines across the entire industrial landscape, ensuring a steady and diversified demand for these precision tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.7 Billion |

| Market Forecast in 2032 | USD 9.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amada Co. Ltd., Junker Group, Schütte Group, Kellenberger & Co. AG (Hardinge Inc.), United Grinding GmbH, Mitsui Seiki Kogyo Co. Ltd., Okuma Corporation, Reishauer AG, Gleason Corporation, Shigiya Machinery Works Ltd., Fives Group, Danobatgroup, Makino Milling Machine Co. Ltd., Haas Automation Inc., Sumitomo Heavy Industries Ltd., Komatsu Ltd., ANCA Pty Ltd., Falcon Machine Tools Co. Ltd., Grinding Technologies Inc., ELB-Schliff Werkzeugmaschinen GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grinding Machine Market Key Technology Landscape

The Grinding Machine Market is characterized by a rapidly evolving technology landscape, where innovation is continuously driven by the demand for higher precision, efficiency, and automation in manufacturing processes. Key technological advancements include the pervasive integration of Computer Numerical Control (CNC) systems, which offer unparalleled control over grinding parameters and enable the production of complex geometries with extreme accuracy. Furthermore, the incorporation of advanced automation solutions, such as robotic loading and unloading systems, and the application of Artificial Intelligence (AI) and the Internet of Things (IoT), are transforming grinding operations into smart, interconnected, and highly optimized processes. These technological adoptions are critical for addressing the challenges of machining new materials, meeting stringent quality requirements, and improving overall productivity and cost-effectiveness across diverse industrial applications, thus reshaping the competitive dynamics of the market.

The core of modern grinding technology lies in sophisticated CNC systems that allow for multi-axis simultaneous control, enabling complex contour grinding and significantly reducing setup times. These systems are complemented by advanced sensing and feedback mechanisms, including acoustic emission sensors, force sensors, and high-resolution encoders, which provide real-time data on the grinding process. This data is critical for monitoring wheel wear, detecting chatter, and ensuring optimal material removal rates, contributing to superior surface finishes and extended tool life. Furthermore, the development of specialized abrasive materials, such as CBN and diamond, has revolutionized the grinding of superalloys, ceramics, and hardened steels, offering increased efficiency and performance compared to conventional abrasives. Innovations in cooling and lubrication systems also play a vital role, minimizing thermal distortion and improving chip evacuation, which are crucial for maintaining workpiece integrity and enhancing process stability, especially during high-speed grinding operations.

Beyond precision and material capabilities, the current technology landscape emphasizes smart manufacturing principles. The integration of IoT allows grinding machines to be connected to broader production networks, enabling remote monitoring, data analytics, and predictive maintenance. AI algorithms are increasingly being employed for process optimization, learning from operational data to adapt grinding parameters dynamically, anticipate tool wear, and prevent defects, thereby minimizing downtime and improving overall equipment effectiveness (OEE). Robotics are utilized not only for material handling but also for automated deburring and polishing tasks, further enhancing automation. The confluence of these technologies is leading to the development of self-optimizing grinding systems that can operate with minimal human intervention, offering significant benefits in terms of productivity, quality consistency, and operational flexibility. This continuous technological evolution ensures that grinding machines remain at the forefront of precision manufacturing, capable of meeting the ever-increasing demands of industries striving for higher standards of product quality and manufacturing efficiency.

Regional Highlights

The global Grinding Machine Market exhibits distinct regional dynamics, influenced by varying levels of industrialization, technological adoption, and economic development. North America, characterized by its mature manufacturing sector and strong emphasis on high-precision engineering, continues to be a significant market, particularly in aerospace, defense, and medical device manufacturing. Europe, with its robust automotive industry and tradition of precision engineering in countries like Germany, Switzerland, and Italy, also represents a major market, driving demand for advanced and specialized grinding solutions. The Asia Pacific (APAC) region, however, stands out as the fastest-growing market, propelled by rapid industrialization, massive investments in manufacturing infrastructure, and the expansion of key end-use industries in countries such as China, India, Japan, and South Korea, positioning it as a global manufacturing hub. These regional differences necessitate tailored market strategies for manufacturers seeking to capitalize on diverse growth opportunities and address specific market needs across the globe.

In North America, the market for grinding machines is driven by a focus on innovation, automation, and the production of high-value, complex components. Manufacturers in this region prioritize machines that offer advanced features such as multi-axis CNC capabilities, integration with robotics, and sophisticated metrology systems to meet stringent quality standards. The aerospace sector's demand for grinding superalloys and titanium parts, coupled with the medical industry's need for precision instruments and implants, ensures a steady demand for high-end grinding solutions. Economic stability and ongoing technological upgrades in existing facilities further support market growth, though the mature nature of the market means growth is often driven by replacement and technology adoption rather than entirely new capacity expansion. This emphasis on technological sophistication and operational efficiency makes North America a key region for showcasing advanced grinding innovations.

The Asia Pacific region's dominance in the grinding machine market is attributable to several factors, including the large-scale manufacturing output across various sectors, government initiatives promoting industrial growth, and the availability of a vast labor force. Countries like China and India are experiencing significant growth in automotive, electronics, and general manufacturing, driving substantial demand for both conventional and advanced grinding machines. Japan and South Korea, known for their technological prowess, contribute to the market through the production of high-precision grinding machines and their integration into advanced manufacturing ecosystems. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets with considerable potential. Industrialization efforts, infrastructure development projects, and the expansion of oil and gas sectors are stimulating demand in these regions, albeit from a lower base. While these regions may face challenges related to economic volatility and technological penetration, they offer long-term growth prospects as their manufacturing capabilities mature and their industrial bases expand, making them important targets for future market development.

- North America: Focus on high-precision components in aerospace, defense, and medical sectors; strong adoption of advanced CNC and automated grinding systems.

- Europe: Driven by strong automotive industry, high-end machine tool manufacturing, and emphasis on precision engineering in Germany, Switzerland, and Italy.

- Asia Pacific (APAC): Largest and fastest-growing market due to rapid industrialization, automotive and electronics manufacturing expansion in China, India, Japan, and South Korea.

- Latin America: Emerging market with growing industrial base, particularly in automotive and infrastructure, presenting opportunities for new installations.

- Middle East and Africa (MEA): Developing manufacturing sector, increasing investments in infrastructure and industrialization driving demand for grinding machines for maintenance and component production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grinding Machine Market.- Amada Co. Ltd.

- Junker Group

- Schütte Group

- Kellenberger & Co. AG (Hardinge Inc.)

- United Grinding GmbH

- Mitsui Seiki Kogyo Co. Ltd.

- Okuma Corporation

- Reishauer AG

- Gleason Corporation

- Shigiya Machinery Works Ltd.

- Fives Group

- Danobatgroup

- Makino Milling Machine Co. Ltd.

- Haas Automation Inc.

- Sumitomo Heavy Industries Ltd.

- Komatsu Ltd.

- ANCA Pty Ltd.

- Falcon Machine Tools Co. Ltd.

- Grinding Technologies Inc.

- ELB-Schliff Werkzeugmaschinen GmbH

Frequently Asked Questions

What are the primary types of grinding machines?

Grinding machines are categorized by their application and design, with primary types including surface grinders for flat surfaces, cylindrical grinders for external and internal diameters, centerless grinders for high-volume cylindrical parts, and specialized tool and cutter grinders for sharpening cutting tools. Each type offers distinct advantages for achieving specific geometries and surface finishes required across various manufacturing processes.

How does automation influence the grinding machine market?

Automation significantly influences the grinding machine market by enhancing productivity, precision, and operational safety. Automated systems, including robotic loaders, integrated inspection, and CNC controls, reduce human intervention, minimize errors, and allow for continuous operation. This shift towards automation addresses labor shortages, improves consistency, and enables higher production volumes, making grinding processes more efficient and cost-effective for manufacturers.

Which industries are the largest consumers of grinding machines?

The largest consumers of grinding machines are industries requiring high precision and superior surface finishes for their components. These primarily include the automotive industry for engine and transmission parts, the aerospace and defense sectors for critical turbine and structural components, and the medical device industry for implants and surgical instruments. General manufacturing, electronics, and heavy machinery also represent substantial consumer bases due to their needs for precise tooling and component fabrication.

What are the key technological advancements in grinding machines?

Key technological advancements in grinding machines revolve around increased automation and intelligent control. This includes the widespread adoption of multi-axis CNC systems for complex geometries, integration of AI and IoT for predictive maintenance and process optimization, development of advanced abrasive materials like CBN and diamond, and sophisticated in-process measurement and adaptive control systems. These innovations aim to enhance precision, efficiency, and adaptability in grinding operations.

What are the main challenges faced by the grinding machine market?

The grinding machine market faces several key challenges, including the high initial capital investment required for advanced machinery, which can be prohibitive for smaller enterprises. A significant shortage of skilled labor capable of operating and maintaining complex grinding equipment also poses a substantial hurdle. Additionally, economic volatility and the cyclical nature of industrial demand can lead to market fluctuations, while intense competition drives continuous pressure for technological innovation and cost efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Concrete Floor Grinding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Roll Grinding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- CNC Fine Grinding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Centerless Grinding Machine Market Size Report By Type (Universal type, Special type, Precise type, Others), By Application (Automobile Industry, Aerospace Industry, Engineering Machinery Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Grinding Machine Market Size Report By Type (Internal Gear Grinding Machine, Universal Gear Grinding Machine, Others), By Application (Vehicle Industry, General Mechanical Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager