Marine Emission Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428532 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Marine Emission Control Systems Market Size

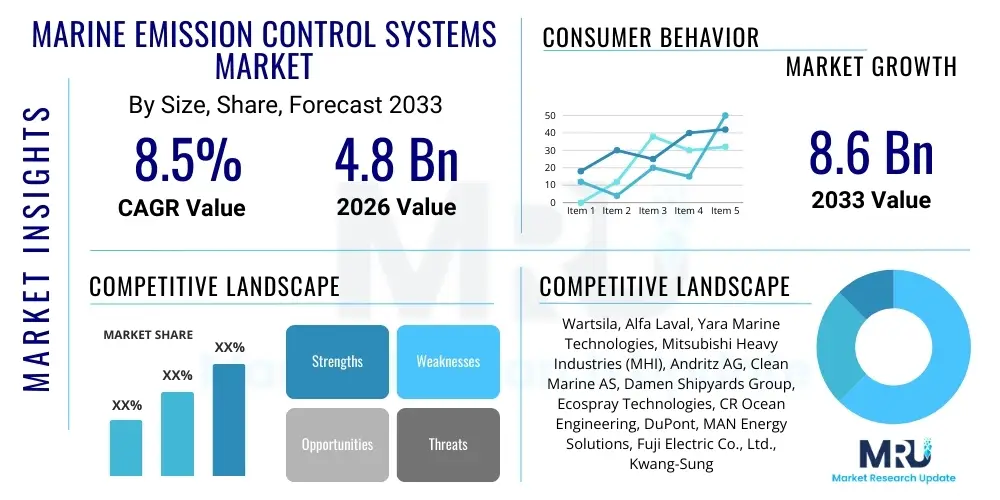

The Marine Emission Control Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2032.

Marine Emission Control Systems Market introduction

The Marine Emission Control Systems market encompasses technologies and solutions designed to reduce harmful pollutants from marine vessel exhausts, addressing growing environmental concerns and stringent regulatory frameworks. These systems are crucial for compliance with international and national emissions standards, such as those set by the International Maritime Organization (IMO). Products within this market include exhaust gas scrubbers, Selective Catalytic Reduction (SCR) systems, Exhaust Gas Recirculation (EGR) units, and various alternative fuel systems, each offering distinct methods to mitigate sulfur oxides (SOx), nitrogen oxides (NOx), particulate matter (PM), and greenhouse gases (GHGs).

Major applications for these sophisticated systems span across the entire maritime industry, from large cargo vessels and oil tankers to passenger cruise ships, ferries, and offshore support vessels. The primary benefits derived from adopting marine emission control technologies extend beyond regulatory compliance, encompassing improved air quality in coastal areas and port cities, enhanced corporate social responsibility, and in some cases, potential fuel efficiency gains. The driving factors for market expansion are primarily anchored in the global push for decarbonization and cleaner shipping, coupled with continuous technological advancements that make these systems more efficient, compact, and cost-effective for newbuilds and retrofits alike.

Marine Emission Control Systems Market Executive Summary

The Marine Emission Control Systems Market is currently experiencing robust growth, driven by an accelerating global focus on environmental sustainability within the shipping industry. Key business trends include a significant rise in demand for retrofit installations as older fleets comply with updated IMO 2020 sulfur cap regulations and upcoming EEXI/CII requirements. Manufacturers are investing heavily in research and development to create more compact, energy-efficient, and versatile solutions, including hybrid scrubbers and advanced SCR technologies, alongside expanding offerings in alternative fuel systems like LNG, methanol, and ammonia propulsion. Strategic partnerships and mergers are common as companies seek to expand product portfolios and geographical reach, consolidating market expertise to meet complex customer demands.

Regionally, Asia Pacific dominates the market, largely due to its extensive shipbuilding industry and high volume of maritime trade originating from the region. Europe and North America are pivotal in driving technological innovation and adopting stricter regional Emission Control Areas (ECAs), fostering demand for advanced compliance solutions. Latin America, the Middle East, and Africa are emerging growth markets, propelled by increasing maritime activity and gradual implementation of international environmental standards. These regions represent significant opportunities for new installations and retrofits, particularly as their shipping infrastructure expands and modernizes.

In terms of segmentation, exhaust gas scrubbers remain a popular choice, especially closed-loop and hybrid systems, due to their effectiveness in SOx reduction and the ability to continue using heavy fuel oil. Selective Catalytic Reduction (SCR) systems are gaining traction for NOx reduction, particularly in designated NOx Emission Control Areas (NECAs). Furthermore, a distinct upward trend exists in the adoption of alternative fuel systems, particularly Liquefied Natural Gas (LNG) propulsion, with methanol and ammonia technologies showing promising long-term growth as the industry explores pathways to zero-emission shipping. The retrofit segment demonstrates strong immediate demand, while newbuilds increasingly integrate advanced emission control from the design phase, indicating proactive compliance.

AI Impact Analysis on Marine Emission Control Systems Market

User questions frequently revolve around how artificial intelligence can optimize the performance and maintenance of marine emission control systems, enhance regulatory compliance, and contribute to overall vessel efficiency. There is significant interest in AI's role in predictive analytics for system failures, real-time emission monitoring, and adaptive control mechanisms that can adjust system operations based on dynamic environmental conditions or varying engine loads. Users also inquire about AI's potential in route optimization to minimize fuel consumption and emissions, and its capacity to integrate complex data streams from multiple onboard systems to provide holistic operational insights, ultimately leading to more sustainable and cost-effective maritime operations.

- AI-driven predictive maintenance for emission control components, reducing downtime and operational costs.

- Real-time optimization of scrubber and SCR system performance based on sensor data and environmental conditions.

- Enhanced compliance monitoring and reporting through automated data collection and analysis of emission levels.

- Fuel efficiency improvements by integrating emission control data with voyage planning and route optimization algorithms.

- Development of autonomous control systems for emission reduction, adapting to varying engine loads and fuel types.

- Advanced diagnostics for identifying potential issues before they escalate, improving system reliability and longevity.

- Integration with digital twins for simulation and testing of emission control strategies in virtual environments.

DRO & Impact Forces Of Marine Emission Control Systems Market

The Marine Emission Control Systems Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, shaped by various impact forces. Primary drivers include increasingly stringent global and regional environmental regulations, particularly from the International Maritime Organization (IMO) concerning SOx, NOx, and GHG emissions. Expanding global maritime trade volume translates to more vessels needing compliance, stimulating market growth. Growing corporate and consumer demand for sustainable shipping also pushes investment in cleaner technologies. Continuous advancements in emission control technologies, making them more efficient and economically viable, act as a strong market driver.

Conversely, several restraints impede faster market adoption. High upfront capital expenditure required for installing and retrofitting these systems presents a significant barrier, especially for smaller operators. Operational complexities associated with system maintenance, including waste disposal for scrubbers and urea management for SCRs, add to ongoing costs and logistical challenges. Furthermore, uncertainty surrounding future regulatory landscapes, particularly the long-term viability of compliance pathways versus a complete transition to alternative fuels, can create investment hesitation. Supply chain disruptions and skilled labor shortages for installation and maintenance also pose considerable challenges.

Despite these restraints, substantial opportunities exist within the market. Development of hybrid and multi-functional emission control systems addressing multiple pollutants simultaneously, or systems compatible with various fuel types, offers significant growth potential. The accelerating shift towards alternative and low-carbon fuels such as LNG, methanol, ammonia, and hydrogen presents a vast new market segment for compatible emission control and propulsion systems. Growing emphasis on digital integration, IoT, and data analytics for performance monitoring, predictive maintenance, and optimized operation opens new avenues for innovation. Retrofitting existing global fleets with advanced emission control solutions represents a consistent and substantial market opportunity, ensuring sustained demand.

Segmentation Analysis

The Marine Emission Control Systems market is comprehensively segmented to provide a detailed understanding of its diverse components and growth trajectories. This segmentation allows for precise analysis of market trends, technological preferences, and regional adoption patterns, aiding stakeholders in strategic decision-making. The market can be dissected based on the type of emission control technology employed, the application scenario (newbuilds versus retrofits), the specific fuel type used by vessels, and the end-user vessel category, each exhibiting unique market dynamics and growth drivers.

- By Technology Type:

- Exhaust Gas Scrubbers (EGCS)

- Open Loop Scrubbers

- Closed Loop Scrubbers

- Hybrid Scrubbers

- Selective Catalytic Reduction (SCR) Systems

- Exhaust Gas Recirculation (EGR) Systems

- Alternative Fuel Systems

- LNG (Liquefied Natural Gas) Fuel Systems

- Methanol Fuel Systems

- Ammonia Fuel Systems

- Hydrogen Fuel Systems

- Fuel Emulsification Systems

- Shore Power (Cold Ironing)

- Exhaust Gas Scrubbers (EGCS)

- By Application:

- Newbuild Vessels

- Retrofit Installations

- By Fuel Type:

- Heavy Fuel Oil (HFO)

- Marine Gas Oil (MGO)

- Liquefied Natural Gas (LNG)

- Methanol

- Ammonia

- Hydrogen

- By End User:

- Cargo Vessels (Container Ships, Bulk Carriers, General Cargo Ships)

- Tankers (Oil Tankers, Chemical Tankers, Gas Tankers)

- Passenger Vessels (Cruise Ships, Ferries, RoPax)

- Offshore Vessels (Supply Vessels, PSVs, AHTS, OSVs)

- Naval Vessels

- Specialized Vessels (Tugs, Dredgers, Fishing Vessels)

Value Chain Analysis For Marine Emission Control Systems Market

The value chain for the Marine Emission Control Systems market begins with upstream activities involving the sourcing and processing of raw materials and the manufacturing of specialized components. This stage includes suppliers of high-grade steel and alloys for scrubber fabrication, chemical providers for sorbents or urea (for SCR systems), and manufacturers of intricate components such as pumps, valves, sensors, control units, and advanced filtration systems. Research and development institutions also play a crucial upstream role, innovating new technologies and improving existing ones to meet evolving regulatory demands and performance benchmarks. These upstream players form the foundational basis for the entire ecosystem, ensuring the availability of necessary inputs for complex system assembly.

Midstream operations involve the core manufacturing and integration of the emission control systems. This includes specialized engineering firms that design bespoke systems for different vessel types, system integrators who assemble the various components into a cohesive unit, and shipyards that perform the actual installation, whether for newbuild vessels or as retrofits for existing fleets. Testing and certification bodies are also integral at this stage, ensuring compliance with international standards and verifying operational efficiency. The downstream segment of the value chain focuses on the distribution, sales, and aftermarket support of these systems. This involves direct sales channels from manufacturers to shipowners and shipyards, as well as an extensive network of distributors, agents, and service providers.

The distribution channels are typically a mix of direct and indirect approaches. Direct sales are common for large-scale projects or complex custom installations where manufacturers engage directly with major shipping companies, shipyards, or naval clients, often involving extensive consultation and project management. Indirect channels leverage a network of regional distributors, certified installers, and service partners who provide local support, maintenance, and spare parts. Aftermarket services, including routine maintenance, spare parts supply, system upgrades, and technical support, represent a significant part of the value chain, ensuring the long-term operational efficiency and compliance of installed systems. This comprehensive value chain ensures that marine emission control solutions are designed, built, installed, and maintained effectively throughout their lifecycle, serving the global maritime industry.

Marine Emission Control Systems Market Potential Customers

The primary potential customers and end-users of Marine Emission Control Systems are diverse entities within the global maritime industry, all operating vessels that fall under international and regional emission regulations. This broad category includes major international shipping companies, which operate vast fleets of cargo vessels such as container ships, bulk carriers, and general cargo ships, requiring robust solutions to maintain global compliance. Similarly, tanker operators, managing fleets of oil, chemical, and gas tankers, represent a significant customer base given the stringent safety and environmental protocols governing their operations. The substantial number of vessels in these segments means continuous demand for both new installations and retrofitting projects.

Furthermore, the passenger vessel segment, encompassing cruise lines and ferry operators, is a crucial customer group. These companies face immense public and regulatory pressure to minimize their environmental footprint, particularly in ecologically sensitive areas and port communities. Their operations often involve frequent port calls, necessitating advanced emission control to meet local air quality standards. Offshore vessel operators, including those managing supply vessels, anchor handling tug supply (AHTS) vessels, and platform support vessels (PSVs) serving the oil and gas industry, also constitute significant buyers, driven by regulations in coastal waters and increasingly by corporate sustainability mandates.

Beyond these commercial segments, governmental entities like navies and coast guards, as well as operators of specialized vessels such as tugboats, dredgers, and fishing vessels, are increasingly adopting emission control technologies. While their primary drivers might include national defense or specific operational mandates, compliance with environmental regulations and a commitment to reducing their ecological impact are becoming paramount. Ultimately, any organization owning or operating a marine vessel subject to international or regional emission limits is a potential customer, seeking effective, reliable, and cost-efficient solutions to navigate the complex landscape of environmental compliance and achieve operational sustainability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wartsila Corporation, Alfa Laval AB, Mitsubishi Shipbuilding Co. Ltd., Yanmar Co. Ltd., CR Ocean Engineering, Inc., Pureteq A/S, Ecospray Technologies S.r.l., Fuji Electric Co., Ltd., Value Maritime, Langh Tech Oy Ab, Clean Marine AS, Yara Marine Technologies, ME Production A/S, H+H Marine Inc., Damen Shipyards Group, Kongsberg Maritime, Schottel GmbH, MAN Energy Solutions, Hyundai Heavy Industries Co., Ltd., Caterpillar Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Emission Control Systems Market Key Technology Landscape

The marine emission control systems market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of lower emissions and greater operational efficiency. Exhaust gas cleaning systems, commonly known as scrubbers, remain a cornerstone, primarily categorized into open-loop, closed-loop, and hybrid variants. Open-loop systems use seawater for scrubbing and discharge washwater; closed-loop systems recirculate and treat washwater onboard, suitable for environmentally sensitive areas. Hybrid systems offer the flexibility to switch between open and closed modes, adapting to various operational requirements and regulatory zones. These systems are crucial for reducing sulfur oxide (SOx) emissions, allowing vessels to continue using heavy fuel oil (HFO) while complying with the IMO 2020 sulfur cap.

Beyond scrubbers, Selective Catalytic Reduction (SCR) systems are paramount for nitrogen oxide (NOx) emission reduction, particularly in designated NOx Emission Control Areas (NECAs). SCR technology involves injecting a reducing agent, typically urea, into the exhaust gas stream, which then reacts with NOx over a catalyst to convert it into harmless nitrogen and water. Exhaust Gas Recirculation (EGR) systems offer another method for NOx abatement by recirculating a portion of the exhaust gas back into the engine cylinders, lowering combustion temperatures and thereby reducing NOx formation. The integration of these technologies, sometimes in combination, is common to address multiple pollutant types comprehensively.

A significant and growing part of the technological landscape involves alternative fuel systems, representing a paradigm shift towards decarbonization. Liquefied Natural Gas (LNG) propulsion systems are currently the most mature and widely adopted low-carbon alternative, offering substantial reductions in SOx, NOx, particulate matter, and CO2 emissions. Emerging technologies include methanol, ammonia, and hydrogen fuel systems, which are currently undergoing extensive research, development, and pilot projects to address their unique challenges in terms of storage, bunkering infrastructure, and safety. Furthermore, digital technologies such as IoT sensors, advanced control systems, data analytics platforms, and AI-powered predictive maintenance solutions are increasingly integrated into emission control systems, enabling real-time monitoring, performance optimization, and enhanced regulatory compliance reporting, propelling the industry towards smarter and more sustainable maritime operations.

Regional Highlights

- Asia Pacific (APAC): This region dominates the marine emission control systems market, primarily driven by its extensive shipbuilding industry in countries like China, South Korea, and Japan. The burgeoning maritime trade routes across Asia and the increasing implementation of international and national emission regulations also contribute significantly to market expansion. APAC is a key hub for both newbuild installations and a growing retrofit market as existing fleets are updated to comply with global standards.

- Europe: Europe represents a mature market for marine emission control systems, characterized by stringent environmental regulations, particularly within its Emission Control Areas (ECAs) such as the Baltic Sea and North Sea. Countries like Germany, Norway, Denmark, and the Netherlands are at the forefront of adopting advanced technologies, including hybrid scrubbers, SCR systems, and early adoption of alternative fuel solutions. The region's strong focus on green shipping initiatives and decarbonization targets ensures continuous innovation and investment in cleaner maritime technologies.

- North America: The North American market is steadily growing, influenced by the robust regulations from the U.S. Environmental Protection Agency (EPA) and the Canadian government, especially concerning coastal and inland waterways. Demand is driven by cruise lines, cargo vessels operating along the coasts, and significant activity in the offshore oil and gas sector. Investment in sustainable port infrastructure and cold ironing solutions also contributes to the market's development.

- Latin America: This region is an emerging market for marine emission control systems. Growth is spurred by increasing maritime trade volumes, expanding port infrastructure, and a gradual alignment with international environmental standards. While currently focused on basic compliance solutions, there is rising interest in more advanced systems as economic development and environmental awareness improve.

- Middle East and Africa (MEA): The MEA region is witnessing growth due to its strategic position in global shipping lanes and significant oil and gas exports, leading to increased maritime traffic. Countries within the Gulf Cooperation Council (GCC) are investing in modernizing their fleets and ports, leading to a rising adoption of emission control technologies. Environmental regulations are becoming stricter, particularly in coastal zones and around major shipping hubs, driving demand for compliance solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Emission Control Systems Market.- Wartsila Corporation

- Alfa Laval AB

- Mitsubishi Shipbuilding Co. Ltd.

- Yanmar Co. Ltd.

- CR Ocean Engineering, Inc.

- Pureteq A/S

- Ecospray Technologies S.r.l.

- Fuji Electric Co., Ltd.

- Value Maritime

- Langh Tech Oy Ab

- Clean Marine AS

- Yara Marine Technologies

- ME Production A/S

- H+H Marine Inc.

- Damen Shipyards Group

- Kongsberg Maritime

- Schottel GmbH

- MAN Energy Solutions

- Hyundai Heavy Industries Co., Ltd.

- Caterpillar Inc.

Frequently Asked Questions

What are the primary types of marine emission control systems?

The primary types include Exhaust Gas Scrubbers (for SOx reduction), Selective Catalytic Reduction (SCR) systems (for NOx reduction), Exhaust Gas Recirculation (EGR) systems (also for NOx reduction), and alternative fuel systems like LNG, methanol, or ammonia propulsion, which reduce a range of pollutants.

How do international regulations impact the Marine Emission Control Systems Market?

International regulations, particularly those from the IMO (e.g., IMO 2020 sulfur cap, EEXI/CII), are the main drivers of market growth. They mandate specific emission limits, forcing vessel owners to adopt emission control technologies or switch to compliant fuels, thereby creating significant demand for these systems.

What is the role of AI in optimizing marine emission control?

AI plays a crucial role in optimizing marine emission control by enabling predictive maintenance for system components, real-time adjustments to system operations for peak efficiency, enhanced data-driven compliance monitoring, and integration with voyage planning for overall fuel and emission reduction.

Which regions are leading in the adoption of marine emission control systems?

Asia Pacific, particularly countries with major shipbuilding industries like China, South Korea, and Japan, currently leads in market size due to high maritime activity. Europe is also a key region, known for stringent regulations and early adoption of advanced green shipping technologies.

What are the main challenges facing the adoption of these systems?

Key challenges include the high upfront capital expenditure for installation and retrofitting, operational complexities and maintenance costs, uncertainty regarding future regulatory frameworks, and the need for skilled personnel for installation and ongoing support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Marine Emission Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Commercial Marine Emission Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Recreational Marine Emission Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Offshore Marine Emission Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager